Amended Current Report Filing (8-k/a)

June 16 2014 - 4:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

Amendment

No. 1

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 10, 2012

CORTEX

PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S

Employer

Identification No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

2.01 Completion of Acquisition or Disposition of Assets.

Pursuant

to an Agreement and Plan of Merger dated August 10, 2012 (the “

Merger Agreement

”) by and among Cortex Pharmaceuticals,

Inc., a Delaware corporation (the “

Company

”), Pier Acquisition Corp., a Delaware corporation (“

Merger

Sub

”) and wholly-owned subsidiary of the Company, and Pier Pharmaceuticals, Inc., a Delaware corporation (“

Pier

”),

Merger Sub merged with and into Pier (the “

Merger

”) and Pier became a wholly-owned subsidiary of the Company.

The Merger closed and became effective on August 10, 2012. Pursuant to the Merger and in exchange for each outstanding share of

Pier capital stock and the cancellation of certain liabilities, the former security holders and certain vendors of Pier obtained

the right to receive an aggregate of 58,417,895 shares of the Company’s common stock (the “

Common Shares

”)

as set forth in the Merger Agreement, which represented approximately 41% of the outstanding shares of the Company immediately

following the Merger. Pursuant to the Merger, the Company acquired all of Pier’s assets, including Pier’s exclusive

license of its dronabinol technology from the University of Illinois, as well as issued method-of-use patents and pending formulation

patents, and assumed certain liabilities of Pier.

On

August 16, 2012 the Company filed a Current Report on Form 8-K reporting the acquisition of Pier. At that time, the Company did

not file financial statements or pro forma financial information regarding Pier as required under Item 9.01. This Amendment No.

1 to the previously filed Current Report on Form 8-K contains the required financial statements and pro forma financial information.

The

description of the acquisition of Pier contained in this Item 2.01 is qualified in its entirety by reference to the full text

of the Merger Agreement, which was filed as Exhibit 2.01 to the previously filed Current Report on Form 8-K and is incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits

(a)

Audited

financial statements of Pier (formerly SteadySleep Rx Co.) for the years ended December 31, 2011 and 2010, and for the period

from June 25, 2007 (inception) to December 31, 2011 (cumulative), and the notes related thereto, are attached as Exhibit 99.2

to this Current Report on Form 8-K/A and incorporated herein by reference.

Unaudited

financial statements of Pier (formerly SteadySleep Rx Co.) for the six months ended June 30, 2012 and 2011, and for the

period from June 25, 2007 (inception) to June 30, 2012 (cumulative), and the notes related thereto, are attached as Exhibit

99.3 to this Current Report on Form 8-K/A and incorporated herein by reference.

(b)

Unaudited

pro forma condensed consolidated balance sheet as of June 30, 2012, is attached as Exhibit 99.4 to this Current Report on Form

8-K/A and incorporated herein by reference.

Unaudited

pro forma condensed consolidated statements of operations for the year ended December 31, 2011 and for the six months ended June

30, 2012, are attached as Exhibit 99.5 to this Current Report on Form 8-K/A and incorporated herein by reference.

(d)

Exhibits.

A

list of exhibits required to be filed as part of this report is set forth in the Exhibit Index, which is presented elsewhere in

this document, and is incorporated herein by reference.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date: June 16, 2014

|

CORTEX

PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Arnold S. Lippa

|

|

|

|

Arnold

S. Lippa

President

and Chief Executive Officer

|

EXHIBIT

INDEX

|

Exhibit

Number

|

|

Exhibit

Description

|

|

|

|

|

|

2.1*

|

|

Agreement and

Plan of Merger, dated as of August 10, 2012, by and among Cortex Pharmaceuticals, Inc., Pier Acquisition Corp. and Pier Pharmaceuticals,

Inc.**

|

|

|

|

|

|

99.1*

|

|

Press Release

dated August 14, 2012.

|

|

|

|

|

|

99.2

|

|

Audited financial

statements of Pier (formerly SteadySleep Rx Co.) for the years ended December 31, 2011 and 2010, and for the period from June

25, 2007 (inception) to December 31, 2011 (cumulative), and the notes related thereto.

|

|

|

|

|

|

99.3

|

|

Unaudited financial

statements of Pier (formerly SteadySleep Rx Co.) for the years ended June 30, 2012 and 2011, and for the period from June

25, 2007 (inception) to June 30, 2012 (cumulative), and the notes related thereto.

|

|

|

|

|

|

99.4

|

|

Unaudited pro

forma condensed consolidated balance sheet as of June 30, 2012.

|

|

|

|

|

|

99.5

|

|

Unaudited pro

forma condensed consolidated statements of operations for the year ended December 31, 2011 and for the six months ended June

30, 2012.

|

*

Previously filed

**

Schedules omitted pursuant to Item 601(b)(2) of Regulation S-K. Cortex Pharmaceuticals, Inc. agrees to furnish

supplementally a copy of such schedules, or any section thereof, to the SEC upon request.

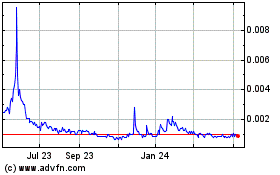

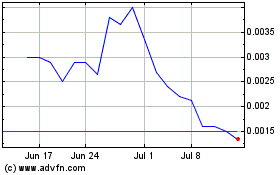

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

RespireRx Pharmaceuticals (PK) (USOTC:RSPI)

Historical Stock Chart

From Apr 2023 to Apr 2024