Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-191704

PROSPECTUS SUPPLEMENT

(To the Prospectus dated November 1, 2013)

Document

Security Systems, Inc.

209,700

Shares of Common Stock

209,700

Overallotment Shares of Common Stock

We are offering directly to an institutional

investor 209,700 shares of our common stock at a price of $1.44 per share. We also are offering 209,700 shares of our common stock

at a price of $1.60 per share pursuant to an overallotment right granted to the investor for a period of ninety days from the date

of the closing of the sale of the initial 209,700 shares offered hereby.

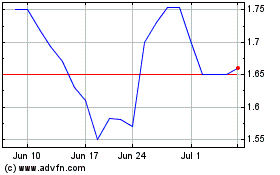

Our common stock is listed on the NYSE MKT

under the symbol “DSS”. On June 11, 2014, the closing sale price of our common stock was $1.60 per share.

Investing in our securities involves

a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 4 of the

accompanying prospectus and the documents incorporated by reference herein for a discussion of information that should be considered

in connection with an investment in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus supplement

or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

1.44

|

|

|

$

|

301,968

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.44

|

|

|

$

|

301,968

|

|

We expect to deliver the shares of common

stock being offered pursuant to this prospectus supplement to the investor on or about June 13, 2014.

The aggregate market value of our outstanding

common stock held by non-affiliates is approximately $67,880,000, based on 49,503,954 shares of outstanding common stock and 6,170,948

shares held by affiliates, and a price of $1.43 per share, which was the closing sales price of our common stock as quoted on the

NYSE MKT on June 5, 2014. Pursuant to General Instruction I.B.6 of Form S-3, in no event during the period of

twelve calendar months immediately prior to, and including, the sales under this prospectus supplement, will we sell our common

stock in a public primary offering with a value exceeding more than one-third of the aggregate market value of the common stock

held by non-affiliates so long as our public float remains below $75 million. We have offered and sold no securities pursuant

to General Instruction I.B.6 of Form S-3 during the twelve calendar months prior to and including the date of this prospectus supplement.

The date of this prospectus supplement

is June 12, 2014.

TABLE OF CONTENTS

Prospectus Supplement

|

|

Page

|

|

About this Prospectus Supplement

|

ii

|

|

Cautionary Statement Regarding Forward-Looking Statements

|

iii

|

|

Prospectus Supplement Summary

|

S-

1

|

|

Risk Factors

|

S-4

|

|

Use of Proceeds

|

S-

15

|

|

Dividend Policy

|

S-

15

|

|

Dilution

|

S-

16

|

|

Description of Common Stock

|

S-17

|

|

Plan of Distribution

|

S-18

|

|

Legal Matters

|

S-19

|

|

Experts

|

S-19

|

|

Where You Can Find More Information

|

S-

19

|

|

Incorporation of Certain Information By Reference

|

S-

20

|

Prospectus

|

About This Prospectus

|

1

|

|

Our

Business

|

1

|

|

Risk Factors

|

4

|

|

Disclosure Regarding Forward-Looking Statements

|

20

|

|

Use of Proceeds

|

21

|

|

The Securities We May Offer

|

22

|

|

Description of Common Stock

|

23

|

|

Description of Warrants

|

24

|

|

Plan of Distribution

|

26

|

|

Legal Matters

|

28

|

|

Experts

|

28

|

|

Where You Can Find More Information

|

28

|

|

Incorporation of Certain Documents by Reference

|

28

|

ABOUT THIS PROSPECTUS SUPPLEMENT

On October 11, 2013, we filed with the

Securities and Exchange Commission, or SEC, a registration statement on Form S-3 (File No. 333-191704) utilizing a shelf registration

process relating to the securities described in this prospectus supplement, which registration statement, as amended, was declared

effective on November 1, 2013. Under this shelf registration process, we may, from time to time, sell up to 15,000,000 shares of

our common stock and/or warrants to purchase common stock.

This prospectus supplement describes the

specific terms of an offering of our securities and also adds to and updates information contained in the accompanying prospectus

and the documents incorporated by reference into the accompanying prospectus. The second part, the accompanying prospectus, provides

more general information. If the information in this prospectus supplement is inconsistent with the accompanying prospectus or

any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information

in this prospectus supplement.

In making your investment decision, you

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus

and any relevant free writing prospectus. We have not authorized anyone to provide you with any other information. If you receive

any information not authorized by us, you should not rely on it. We are not making an offer to sell the securities in any jurisdiction

where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in

this prospectus supplement or the accompanying prospectus or any relevant free writing prospectus is accurate as of any date other

than its respective date.

It is important for you to read and consider

all of the information contained in this prospectus supplement and the accompanying prospectus in making your investment decision.

We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where

you can find additional related discussions. The table of contents in this prospectus supplement provides the pages on which these

captions are located. You should read both this prospectus supplement and the accompanying prospectus, together with the additional

information described in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference” of this prospectus supplement, before investing in our securities.

We are offering to sell, and seeking offers

to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement

and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves

about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement

and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this

prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

Unless the context otherwise requires,

“Document Security Systems”, “Document Security,” “DSS,” “we,” “us,”

“our” or “Company” and similar names refer to Document Security Systems, Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The SEC encourages companies to disclose

forward-looking information so that investors can better understand a company’s future prospects and make informed investment

decisions. This prospectus supplement, the accompanying prospectus and the documents we have filed with the SEC that are incorporated

herein and therein by reference contain such “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995.

Words such as “may,” “might,”

“should,” “anticipate,” “estimate,” “expect,” “projects,” “intends,”

“plans,” “believes” and words and terms of similar substance used in connection with any discussion of

future operating or financial performance, identify forward-looking statements. Forward-looking statements represent management’s

current judgment regarding future events and are subject to a number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking statements. Please see the discussion of risks and uncertainties

under “Risk Factors” below, and contained in the accompanying prospectus and otherwise incorporated by reference herein,

and in our most recent annual report on Form 10-K, as may be revised or supplemented by our most recent quarterly report on

Form 10-Q, as well as any amendments thereto, as filed with the SEC and which are incorporated herein by reference.

In light of these assumptions, risks and

uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus supplement, the

accompanying prospectus or in any document incorporated herein or therein by reference might not occur. Investors are cautioned

not to place undue reliance on the forward-looking statements, which speak only as of the respective dates of this prospectus supplement,

the accompanying prospectus or the date of the document incorporated by reference in this prospectus supplement or the accompanying

prospectus. We expressly disclaim any obligation to update or alter any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by federal securities laws.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary is qualified in

its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto

appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. Before you decide

to invest in our securities, you should read the entire prospectus supplement and the accompanying prospectus carefully, including

the risk factors and the financial statements and related notes included or incorporated by reference in this prospectus supplement

and the accompanying prospectus

.

Overview

Document Security Systems, Inc. (referred

to in this prospectus supplement as “Document Security Systems”, “DSS”, “we”, “us”,

“our” or “Company”) was formed in New York in 1984. We specialize in fraud and counterfeit protection for

all forms of printed documents and digital information. We hold numerous patents for optical deterrent technologies that provide

protection of printed information from unauthorized scanning and copying. We operate two production facilities, a combined security

and commercial printing and packaging facility, and a plastic card facility where we produce secure and non-secure documents for

our customers. We license our anti-counterfeiting technologies to printers and brand-owners. In addition, we have a digital division

which provides cloud computing services for our customers, including disaster recovery, back-up and data security services.

Prior to 2006, our primary revenue source

in our document security division was derived from the licensing of our technology. In 2006, we began a series of acquisitions

designed to expand our ability to produce products for end-user customers. In 2006, we acquired Plastic Printing Professionals,

Inc. (“P3”), a privately held plastic cards manufacturer located in the San Francisco, California area. P3 is also

referred to herein as the “DSS Plastics Group”. In 2008, we acquired substantially all of the assets of DPI of Rochester,

LLC, a privately held commercial printer located in Rochester, New York, referred to herein as “Secuprint” or “DSS

Printing Group”. In 2010, we acquired Premier Packaging Corporation (“Premier Packaging”), a privately held packaging

company located in the Rochester, New York area. Premier Packaging is also referred to herein as the DSS Packaging Group. In May

2011, we acquired all of the capital stock of ExtraDev, Inc. (“ExtraDev”), a privately held information technology

and cloud computing company located in the Rochester, New York area. ExtraDev is also referred to herein as the “DSS Digital

Group”.

On July 1, 2013, we merged with DSS Technology

Management, Inc. (formerly known as Lexington Technology Group, Inc.), a private intellectual property monetization company. DSS

Technology Management is focused on extracting the economic benefits of intellectual property assets through acquiring or internally

developing patents or other intellectual property assets (or interests therein) and then monetizing such assets through a variety

of value enhancing initiatives, including, but not limited to:

|

|

·

|

customized technology solutions (such as applications for medical

electronic health records),

|

|

|

·

|

strategic partnerships, and

|

On October 3, 2012, DSS Technology Management,

through its wholly-owned subsidiary, Bascom Research, initiated patent infringement lawsuits in the United States District Court

for the Eastern District of Virginia against five companies, including Facebook, Inc. and LinkedIn Corporation, for unlawfully

using systems that incorporate features claimed in patents owned by Bascom Research. The patents included in the lawsuit relate

to the data structure used by social and business networking web sites and Web 2.0 corporate intranets. On December 12, 2012, the

lawsuits were transferred to the United States District Court for the Northern District of California.

On July 8, 2013, DSS Technology Management

purchased two patents for $500,000 covering certain methods and processes related to Bluetooth devices (the “Bluetooth Patents”).

In conjunction with the patent purchases, DSS Technology Management entered into a Proceed Right Agreement with certain investors

whereby DSS Technology Management initially received $250,000 of a total of $750,000 it will ultimately receive thereunder, subject

to certain payment milestones, in exchange for 40% of the proceeds, if any, from the use, sale or licensing of the two patents.

On November 26, 2013, DSS Technology Management filed suit against Apple, Inc. (“Apple”) in the United States District

Court for the Eastern District of Texas, for patent infringement involving the Bluetooth Patents (the “Apple Litigation”).

DSS Technology Management is seeking a judgment for infringement, injunctive relief, and money damages from Apple in connection

with the Apple Litigation.

On September 27, 2013, DSS Technology Management

purchased 10 patents covering certain methods and processes in the semiconductor industry for $2,000,000 (the “Semiconductor

Patents”). On March 10, 2014, DSS Technology Management filed suit in the United States District Court for the Eastern District

of Texas against Taiwan Semiconductor Manufacturing Company, TSMC North America, TSMC Development, Inc., Samsung Electronics Co.,

Ltd., Samsung Electronics America, Inc., Samsung Telecommunications America L.L.C., Samsung Semiconductor, Inc., Samsung Austin

Semiconductor LLC, and NEC Corporation of America, for patent infringement involving one of its Semiconductor Patents. In this

case, DSS Technology Management is seeking a judgment for infringement, injunctive relief, and money damages from each of the named

defendants.

On February 13, 2014, DSS Technology Management

entered into an agreement with investors to receive a series of advances up to $4,500,000 from the investors in exchange for promissory

notes, fixed return interests and contingent interests collateralized by certain of DSS Technology Management’s intellectual

property. On February 13, 2014, we received $2,000,000 under the agreement and on March 27, 2014, we received an additional $1,000,000

under the agreement.

In January and February 2014, DSS Technology

Management made investments of $100,000 and $400,000, respectively, to purchase an aggregate of 594,530 shares of common stock

of Express Mobile, Inc. (“Express Mobile”), which represented approximately 6% of the outstanding common stock of Express

Mobile at the time of investment. Express Mobile is a developer of custom mobile applications and websites.

On April 30, 2014, DSS Technology Management,

contracted to purchase a portfolio of 115 patents for an aggregate cash purchase price of $1,150,000. This pending patent acquisition

is expected to be completed during the second quarter of 2014.

We do business in four operating segments

as follows:

DSS Packaging and Printing Group

— Produces

custom paperboard packaging serving clients in the pharmaceutical, beverage, photo packaging, toy, specialty foods and direct marketing

industries, among others. The group also provides secure and commercial printing services for end-user customers along with technical

support for our technology licensees. The division produces a wide array of printed materials such as security paper, vital records,

prescription paper, birth certificates, receipts, manuals, identification materials, entertainment tickets, secure coupons, parts

tracking forms, brochures, direct mailing pieces, catalogs, business cards, etc. The division also provides the basis of research

and development for our security printing technologies.

DSS Plastics Group

— Manufactures

laminated and surface printed cards which can include magnetic stripes, bar codes, holograms, signature panels, invisible ink,

micro fine printing, guilloche patterns, biometric, radio frequency identification (RFID) and watermarks for printed plastic documents

such as ID cards, event badges, and driver’s licenses.

DSS Digital Group

— Provides

data center centric solutions to businesses and governments delivered via the “cloud”. This division developed an iPhone

based application that integrates some of the our traditional optical deterrent technologies into proprietary digital data security

based solutions for brand protection and product diversion prevention.

DSS Technology Management

— Acquires

or internally develops patented technology or intellectual property assets (or interests therein), with the purpose of monetizing

these assets through a variety of value-enhancing initiatives, including, but not limited to, investments in the development and

commercialization of patented technologies, licensing, strategic partnerships and commercial litigation.

Corporate History and Information

We are a New York corporation formed in

1984. On July 1, 2013, our wholly-owned subsidiary, DSSIP, Inc., a Delaware corporation, merged with and into Lexington Technology

Group, Inc., a Delaware corporation which, on August 2, 2013, changed its name to DSS Technology Management, Inc. We refer to the

merger of DSSIP and Lexington Technology Group as the “Merger.”

Our executive offices are located at First

Federal Plaza, 28 East Main Street, Suite 1525, Rochester, New York 14614. Our telephone number is (585) 325-3610. Our website

address is www.dsssecure.com. Information contained in, or accessible through, our website does not constitute part of this prospectus

supplement or the accompanying prospectus.

The Offering

|

Common stock offered by us pursuant to this prospectus supplement

|

|

209,700 shares of common stock.

|

|

|

|

|

|

Share price

|

|

$1.44 per share

|

|

|

|

|

|

Overallotment right

|

|

We have granted the investor an overallotment right to purchase up to 209,700 additional shares of common stock at a price of $1.60 per share. The overallotment right runs for 90 days from the date of the closing of the sale of the initial shares. The term of the overallotment right will be extended by the number of days, if any, during the overallotment right term that a registration statement covering the sale of the overallotment shares is not effective.

|

|

|

|

|

|

Common stock to be outstanding

after this offering

|

|

49,713,654 shares of our common stock or 49,923,354 shares of our common stock if the overallotment shares are exercised in full.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-15.

|

|

|

|

|

|

Dividend policy

|

|

We do not anticipate paying any cash dividends on our common stock in the foreseeable future.

|

|

|

|

|

|

NYSE MKT listing

|

|

Our common stock is listed on the NYSE MKT under the symbol “DSS.”

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 4 of the accompanying prospectus and the documents incorporated by reference herein for a discussion of factors you should carefully consider before investing in our securities.

|

The number of shares of our common stock

to be outstanding immediately after this offering is based on 49,503,954 shares outstanding as of March 31, 2014, including 7,500,000

shares held in escrow, and does not include, as of that date:

|

|

•

|

6,794,941 shares of our common stock that have been reserved for issuance upon exercise of outstanding warrants with a weighted

average exercise price of $4.66 per share;

|

|

|

•

|

5,022,595 shares of our common stock subject to outstanding options with a weighted average exercise price of $2.50 per share;

|

|

|

•

|

260,180 shares of our common stock reserved for issuance upon the conversion of an outstanding convertible promissory note

dated December 30, 2011; and

|

|

|

•

|

936,229 shares of our common stock reserved for issuance in connection with future awards under our 2013 Employee, Director

and Consultant Equity Incentive Plan.

|

Unless otherwise indicated, the information

contained in this prospectus supplement assumes no exercise by the investor of its overallotment right to purchase up to an additional

209,700 shares of common stock.

RISK FACTORS

Investing in our common stock involves

risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described

below. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors”

included in our most recent annual report on Form 10-K which is on file with the SEC and is incorporated herein by reference, and

which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. There may

be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse

effects on our future results. If any of these risks actually occurs, our business, business prospects, financial condition

or results of operations could be seriously harmed. This could cause the trading price of our common stock to decline, resulting

in a loss of all or part of your investment. Please also read carefully the section above entitled “Cautionary Statement

Regarding Forward-Looking Statements.”

Risks Relating to our Business, including the Merger of Document

Security Systems and Lexington Technology Group

We have identified the following risks

and uncertainties that may have a material adverse effect on our business, financial condition or results of operations in the

future. References to the “combined company” relate to the Merger, effective on July 1, 2013, of Document Security

Systems and Lexington Technology Group, Inc. whereby Lexington Technology Group became a wholly-owned subsidiary of Document Security

Systems. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our

business operations. If any of these risks occur, our business, results of operations or financial condition could suffer,

the market price of our common stock could decline and you could lose all or part of your investment in our common stock.

The failure to integrate successfully our businesses and

Lexington Technology Group in the expected timeframe could adversely affect the combined company’s future results.

The success of the Merger will depend, in

large part, on the ability of the combined company to realize the anticipated benefits from combining our businesses and that of

Lexington Technology Group.

The failure to integrate successfully and

to manage successfully the challenges presented by the integration process may result in the combined company’s failure to

achieve some or all of the anticipated benefits of the Merger.

Potential difficulties that may be encountered

in the integration process include the following:

|

|

•

|

using the combined company’s cash and other assets efficiently to develop the business of the combined company;

|

|

|

•

|

appropriately managing the liabilities of the combined company;

|

|

|

•

|

potential unknown or currently unquantifiable liabilities associated with the Merger and the operations of the combined company;

|

|

|

•

|

potential unknown and unforeseen expenses, delays or regulatory conditions associated with the Merger; and

|

|

|

•

|

performance shortfalls resulting from diversion of management’s attention to the task of efficiently

integrating the companies’ operations.

|

We may not realize the potential

value and benefits created by the Merger.

The success of the Merger will depend, in

part, on our ability to realize the expected potential value and benefits created from integrating our existing business with Lexington

Technology Group’s business, which includes the maximization of the economic benefits of the combined company’s intellectual

property portfolio. The integration process may be complex, costly, and time-consuming. The difficulties of integrating the operations

of our businesses could include, among others:

|

|

•

|

failure to effectively implement the business plan for the combined business;

|

|

|

•

|

unanticipated issues in integrating the business of both companies;

|

|

|

•

|

potential lost sales and customers if any of our customers decide not to do business with us after the Merger;

|

|

|

•

|

loss of key employees with knowledge of our historical business and operations;

|

|

|

•

|

unanticipated changes in applicable laws and regulations; and

|

|

|

•

|

other unanticipated issues, expenses, or liabilities that could impact, among other things, our ability to realize any expected

benefits on a timely basis, or at all.

|

We may not accomplish the integration of

Lexington Technology Group’s business smoothly, successfully, or within the anticipated costs or time frame. The diversion

of the attention of management from our operations to the integration effort and any difficulties encountered in combining businesses

could prevent us from realizing the full expected potential value and benefits to result from the Merger and could adversely affect

our business. In addition, the integration efforts could divert the focus and resources of the management of the combined companies

from other strategic opportunities and operational matters during the integration process.

If the Merger does not qualify as a “reorganization”

under Section 368(a) of the Internal Revenue Code (the “Code”), the stockholders of Lexington Technology Group may

be required to pay substantial United States federal income taxes as a result of the Merger.

The Merger was intended to qualify as a

“reorganization” under Section 368(a) of the Code and that the United States holders of shares of Lexington Technology

Group capital stock generally should not recognize taxable gain or loss as a result of the Merger. However, neither company has

requested, or intends to request, a ruling from the IRS with respect to the tax consequences of the Merger, and there can be no

assurance that the companies’ position would be sustained if challenged by the IRS. Accordingly, if there is a final determination

that the Merger does not qualify as a “reorganization” under Section 368(a) of the Code and is taxable for United States

federal income tax purposes, Lexington Technology Group stockholders generally would recognize taxable gain or loss on their receipt

of equity securities of Document Security Systems in connection with the Merger equal to the difference between such stockholder’s

adjusted tax basis in their shares of Lexington Technology Group capital stock and the fair market value of the equity securities

of Document Security Systems.

We have a history of losses.

We have a history of losses. While we had

net income in 2013 due to a one-time deferred tax benefit of approximately $11.0 million, we had losses for the fiscal years of

2012, 2011, and 2010, of approximately $4.3 million, $3.2 million, and $3.5 million, respectively, and a loss of approximately

$3.1 million for the three months ended March 31, 2014. Our results of operations in the future will depend on many factors, but

largely on our ability to successfully market our anti-counterfeiting products, technologies and services and successfully monetize

our IP assets. Failure to achieve profitability in the future could adversely affect the trading price of our common stock and

our ability to raise additional capital and, accordingly, our ability to continue to grow our business. There can be no assurance

that we will succeed in addressing any or all of these risks, and the failure to do so could have a material adverse effect on

our business, financial condition and operating results.

We have a significant amount of indebtedness, some of

which is secured by our assets, and we may be unable to satisfy our obligations to pay interest and principal thereon when due.

As of March 31, 2014, we had the following

significant amounts of outstanding indebtedness:

|

|

(i)

|

$575,000 convertible promissory note bearing interest at 10% per annum due in full on December 29, 2015, or convertible into

up to 260,180 shares of DSS common stock, secured by the assets of our wholly-owned subsidiary, Secuprint. Interest is due quarterly.

|

|

|

(ii)

|

$275,000 due under a term loan with Citizens Bank which matures February 1, 2015 and is payable in monthly payments of $25,000

plus interest. Interest accrues at 1 Month LIBOR plus 3.75%. We subsequently entered into an interest rate swap agreement to lock

into a 5.7% effective interest rate over the life of the term loan.

|

|

|

(iii)

|

Up to $1,000,000 in a revolving line of credit with Citizens Bank available for use by Premier Packaging, subject to certain

limitations, payable in monthly installments of interest only. Interest accrues at 1 Month LIBOR plus 3.75%. As of March 31, 2014,

there was no indebtedness outstanding on the line.

|

|

|

(iv)

|

$1,119,000 due under a promissory note with Citizens Bank used to purchase our packaging division facility. We are required

to pay monthly installments of $7,658 plus interest until August 2021 at which time a balloon payment of the remaining principal

balance of $919,677 is due. We entered into an interest rate swap agreement to lock into a 5.865% effective interest rate over

the life of the term loan. The promissory note is secured by a first mortgage on our packaging division facility.

|

|

|

(v)

|

$850,000 promissory note bearing interest at 9% per annum due in full on May 24, 2015 secured by certain equipment and the

assets of our wholly-owned subsidiary, Secuprint. Interest is due quarterly.

|

|

|

(vi)

|

$1,246,000 under an equipment note entered into by our subsidiary, Premier Packaging, with Peoples Capital. The

note is secured by the equipment, bears interest at 4.84%, and is repayable over a 60-month period in monthly payments of $24,511

commencing January 2014.

|

|

|

(vii)

|

$450,000 under a construction loan entered into by our subsidiary, Premier Packaging, with Citizen’s pursuant to which

Premier Packaging is making improvements and additions to its production facility. The construction loan will be converted

to a promissory note as soon as the construction is completed, which is expected in the first half of 2014. The

promissory note will be payable in monthly installments over a 15 year period at an interest to be determined at the date of conversion,

at which time borrower may elect either a fixed rate of 3.89% or variable rate based on the then applicable LIBOR rate. The

construction loan and promissory note are secured by the assets of our packaging facility.

|

|

|

(viii)

|

An aggregate of $2,691,000 outstanding under a promissory notes with Fortress Credit Corp collateralized by certain of our

intellectual property, bearing interest at 1.95% payable in cash or in kind in our discretion and payable in February 2018.

|

The Citizens Bank obligations are secured

by all of the assets of Premier Packaging and are also secured through cross guarantees by us and our other wholly-owned subsidiaries,

P3 and Secuprint. Under the Citizens Bank credit facilities, our subsidiary, Premier Packaging Corporation is subject to various

covenants including fixed charge coverage ratio, tangible net worth and current ratio covenants. In March 2014, Premier Packaging

was notified that it was not in compliance with the required fixed charge coverage ratio as of December 31, 2013. In March 2014,

we received a waiver as of December 31, 2013 from Citizens Bank, relating to the above-mentioned financial covenant. If we were

to default on any of the above indebtedness and not receive a waiver from the creditors and the creditors were to foreclose on

secured assets, this could have a material adverse effect on our business, financial condition and operating results.

Certain of our recently developed

products are not yet commercially accepted and there can be no assurance that those products will be accepted, which would adversely

affect our financial results.

Over the past several years, we have spent

significant funds and time to create new products by applying its technologies onto media other than paper, including plastic and

cardboard packaging, and delivery of our technologies digitally. We have had limited success to date in selling its products that

are on cardboard packaging and those that are delivered digitally. Our business plan includes plans to incur significant marketing,

intellectual property development and sales costs for these newer products, particularly the digitally delivered products. If we

are not able to sell these new products, our financial results will be adversely affected.

The results of our research and development efforts are

uncertain and there can be no assurance of the commercial success of our products.

We believe that we will need to continue

to incur research and development expenditures to remain competitive. The products we are currently developing or may develop in

the future may not be technologically successful. In addition, the length of our product development cycle may be greater than

we originally expected and we may experience delays in future product development. If our resulting products are not technologically

successful, they may not achieve market acceptance or compete effectively with our competitors’ products.

Changes in document security technology and standards

could render our applications and services obsolete.

The market for document security products,

applications, and services is fast moving and evolving. Identification and authentication technology is constantly changing as

we and our competitors introduce new products, applications, and services, and retire old ones as customer requirements quickly

develop and change. In addition, the standards for document security are continuing to evolve. If any segments of our market adopt

technologies or standards that are inconsistent with our applications and technology, sales to those market segments could decline,

which could have a material adverse effect on us and our financial condition.

The market in which we operate is highly competitive,

and we may not be able to compete effectively, especially against established industry competitors with greater market presence

and financial resources.

Our market is highly competitive and characterized

by rapid technological change and product innovations. Our competitors may have advantages over us because of their longer operating

histories, more established products, greater name recognition, larger customer bases, and greater financial, technical and marketing

resources. As a result, they may be able to adapt more quickly to new or emerging technologies and changes in customer requirements,

and devote greater resources to the promotion and sale of their products. Competition may also force us to decrease the price of

our products and services. We cannot assure you that we will be successful in developing and introducing new technology on a timely

basis, new products with enhanced features, or that these products, if introduced, will enable us to establish selling prices and

gross margins at profitable levels.

Our growth strategy depends, in part,

on us acquiring complementary businesses and assets and expanding our existing operations to include manufacturing capabilities,

which we may be unable to do.

Our growth strategy is based, in part, on

our ability to acquire businesses and assets that are complementary to our existing operations and expanding our operations to

include manufacturing capabilities. We may also seek to acquire other businesses. The success of this acquisition strategy will

depend, in part, on our ability to accomplish the following:

|

|

•

|

identify suitable businesses or assets to buy;

|

|

|

•

|

complete the purchase of those businesses on terms acceptable to us;

|

|

|

•

|

complete the acquisition in the time frame we expect; and

|

|

|

•

|

improve the results of operations of the businesses that we buy and successfully integrate their operations into ours.

|

Although we have been able to make acquisitions

in the past, there can be no assurance that we will be successful in pursuing any or all of these steps on future transactions.

Our failure to implement our acquisition strategy could have an adverse effect on other aspects of our business strategy and our

business in general. We may not be able to find appropriate acquisition candidates, acquire those candidates that we find or integrate

acquired businesses effectively or profitably.

We have in the past used, and may continue

to use, our common stock as payment for all or a portion of the purchase price for acquisitions. If we issue significant amounts

of our common stock for such acquisitions, this could result in substantial dilution of the equity interests of our stockholders.

If we fail to retain certain of our key personnel and

attract and retain additional qualified personnel, we might not be able to pursue our growth strategy.

Our future success depends upon the continued

service of certain of our executive officers and other key sales and research personnel who possess longstanding industry relationships

and technical knowledge of our products and operations. Although we believe that our relationship with these individuals is positive,

there can be no assurance that the services of these individuals will continue to be available to us in the future. There can be

no assurance that these persons will agree to continue to be employed by us after the expiration dates of their current contracts.

If we do not successfully expand our sales force, we may

be unable to increase our revenues.

We must expand the size of our marketing

activities and sales force to increase revenues. We continue to evaluate various methods of expanding our marketing activities,

including the use of outside marketing consultants and representatives and expanding our in-house marketing capabilities. If we

are unable to hire or retain qualified sales personnel or if newly hired personnel fail to develop the necessary skills to be productive,

or if they reach productivity more slowly than anticipated, our ability to increase our revenues and grow could be compromised.

The challenge of attracting, training and retaining qualified candidates may make it difficult to meet our sales growth targets.

Further, we may not generate sufficient sales to offset the increased expense resulting from expanding our sales force or we may

be unable to manage a larger sales force.

Future growth in our business could make it difficult

to manage our resources.

Our anticipated business expansion could

place a significant strain on our management, administrative and financial resources. Significant growth in our business may require

us to implement additional operating, product development and financial controls, improve coordination among marketing, product

development and finance functions, increase capital expenditures and hire additional personnel. There can be no assurance that

we will be able to successfully manage any substantial expansion of our business, including attracting and retaining qualified

personnel. Any failure to properly manage our future growth could negatively impact our business and operating results.

We cannot predict our future capital needs and we may

not be able to secure additional financing.

We may need to raise additional funds in

the future to fund our working capital needs, to fund more aggressive expansion of our business, to complete development, testing

and marketing of our products and technologies, or to make strategic acquisitions or investments. We may require additional equity

or debt financings, collaborative arrangements with corporate partners or funds from other sources for these purposes. No assurance

can be given that necessary funds will be available for us to finance our development on acceptable terms, if at all. Furthermore,

such additional financings may involve substantial dilution of our stockholders or may require that we relinquish rights to certain

of our technologies or products. In addition, we may experience operational difficulties and delays due to working capital restrictions.

If adequate funds are not available from operations or additional sources of financing, we may have to delay or scale back our

growth plans.

If we are unable to respond to regulatory or industry

standards effectively, our growth and development could be delayed or limited.

Our future success will depend in part on

our ability to enhance and improve the functionality and features of our products and services in accordance with regulatory or

industry standards. our ability to compete effectively will depend in part on our ability to influence and respond to emerging

industry governmental standards in a timely and cost-effective manner. If we are unable to influence these or other standards or

respond to these or other standards effectively, our growth and development of various products and services could be delayed or

limited.

Changes in the laws and regulations to which we are subject

may increase our costs.

We are subject to numerous laws and regulations,

including, but not limited to, environmental and health and welfare benefit regulations, as well as those associated with being

a public company. These rules and regulations may be changed by local, state, provincial, national or foreign governments or agencies.

Such changes may result in significant increases in our compliance costs. Compliance with changes in rules and regulations could

require increases to our workforce, and could result in increased costs for services, compensation and benefits, and investment

in new or upgraded equipment.

Declines in general economic conditions or acts of war

and terrorism may adversely impact our business.

Demand for printing services is typically

correlated with general economic conditions. The recent declines in United States economic conditions have adversely impacted our

business and results of operations, and may continue to do so for the foreseeable future. The overall business climate of our industry

may also be impacted by domestic and foreign wars or acts of terrorism, which events may have sudden and unpredictable adverse

impacts on demand for our products and services.

We have a large number of authorized but unissued shares

of common stock, which our management may issue without further stockholder approval, thereby causing dilution of your holdings

of our common stock.

As of March 31, 2014, we had approximately

151 million authorized but unissued shares of our common stock. Our management continues to have broad discretion to issue shares

of our common stock in a range of transactions, including capital-raising transactions, mergers, acquisitions, for anti-takeover

purposes, and in other transactions, without obtaining stockholder approval, unless stockholder approval is required for a particular

transaction under the rules of the NYSE MKT, state and federal law, or other applicable laws. If our board of directors determines

to issue additional shares of our common stock from the large pool of authorized but unissued shares for any purpose in the future

without obtaining stockholder approval, your ownership position would be diluted without your further ability to vote on such transaction.

The exercise of our outstanding options and warrants,

vesting of restricted stock awards and conversion of debt securities may depress our stock price.

As of March 31, 2014 there were 19,618,892

of common stock share equivalents potentially issuable under convertible debt agreements, employment agreements, options, warrants,

and restricted stock agreements, including common shares being held in escrow pursuant to the Merger completed in July 2013, that

could potentially dilute basic earnings per share in the future. Sales of these securities in the public market, or the perception

that future sales of these securities could occur, could have the effect of lowering the market price of our common stock below

current levels and make it more difficult for us and our stockholders to sell our equity securities in the future. Sale or the

availability for sale of shares of common stock by stockholders could cause the market price of our common stock to decline and

could impair our ability to raise capital through an offering of additional equity securities.

We do not intend to pay cash dividends.

We do not intend to declare or pay cash

dividends on our common stock in the foreseeable future. We anticipate that we will retain any earnings and other cash resources

for investment in our business. The payment of dividends on our common stock is subject to the discretion of our board of directors

and will depend on our operations, financial position, financial requirements, general business conditions, restrictions imposed

by financing arrangements, if any, legal restrictions on the payment of dividends and other factors that our board of directors

deems relevant.

We have material weaknesses in our internal control over

financial reporting structure, which, until remedied, may cause errors in our financial statements that could require restatements

of our financial statements and investors may lose confidence in our reported financial information, which could lead to a decline

in Our stock price.

Section 404 of the Sarbanes-Oxley Act of

2002 requires us to evaluate the effectiveness of our internal control over financial reporting as of the end of each year, and

to include a management report assessing the effectiveness of our internal control over financial reporting in each Annual Report

on Form 10-K. We identified one material weakness in our internal control over financial reporting in our annual assessment of

internal controls over financial reporting that management performed for the year ended December 31, 2013. The identified material

weakness remains as of the date of this prospectus supplement. Management has concluded that we did not maintain a sufficient complement

of qualified accounting personnel and controls associated with segregation of duties, and that the foregoing represented material

weakness in our internal control over financial reporting. We are uncertain at this time of the costs to remediate the material

weakness, however, we anticipate the cost to be in the range of $200,000 to $400,000 (including the cost of hiring additional qualified

accounting personnel to eliminate segregation of duties issues and using the services of accounting consultants for complex and

non-routine transactions if and when they arise). We cannot guarantee that the actual costs to remediate the deficiency will not

exceed this amount. If our internal control over financial reporting or disclosure controls and procedures are not effective, there

may be errors in our financial statements and in our disclosure that could require restatements. Investors may lose confidence

in our reported financial information and in our disclosure, which could lead to a decline in our stock price.

The value of our intangible assets and investments may

not be equal to their carrying values.

As of March 31, 2014, we had approximately

$43.5 million of net intangible assets. We are required to evaluate the carrying value of such intangibles. Whenever events or

changes in circumstances indicate that the carrying value of an intangible asset, including goodwill, and investment may not be

recoverable, we will have to determine whether there has been impairment by comparing the anticipated undiscounted cash flows (discounted

cash flows for goodwill) from the operation and eventual disposition of the product line or asset with our carrying value. If any

of our intangible assets are deemed to be impaired then it will result in a significant reduction of the operating results in such

period.

If we are unable to adequately protect our intellectual

property, our competitive advantage may disappear.

Our success will be determined in part by

our ability to obtain United States and foreign patent protection for our technology and to preserve our trade secrets. Because

of the substantial length of time and expense associated with developing new document security technology, we place considerable

importance on patent and trade secret protection. We intend to continue to rely primarily on a combination of patent protection,

trade secrets, technical measures, copyright protection and nondisclosure agreements with our employees and customers to establish

and protect the ideas, concepts and documentation of software and trade secrets developed by us. Our ability to compete and the

ability of our business to grow could suffer if these intellectual property rights are not adequately protected. There can be no

assurance that our patent applications will result in patents being issued or that current or additional patents will afford protection

against competitors. Failure of Our patents, copyrights, trademarks and trade secret protection, non-disclosure agreements and

other measures to provide protection of our technology and our intellectual property rights could enable our competitors to more

effectively compete with us and have an adverse effect on our business, financial condition and results of operations. In addition,

our trade secrets and proprietary know-how may otherwise become known or be independently discovered by others. No guarantee can

be given that others will not independently develop substantially equivalent proprietary information or techniques, or otherwise

gain access to Our proprietary technology.

In addition, we may be required to litigate

in the future to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of

the proprietary rights of others, or to defend against claims of infringement or invalidity. Any such litigation could result in

substantial costs and diversion of resources and could have a material adverse effect on our business, financial condition or results

of operations, and there can be no assurances of the success of any such litigation.

We may face intellectual property

infringement or other claims against us, our customers or our intellectual property that could be costly to defend and result in

our loss of significant rights.

Although we have received patents with respect

to certain of our technologies, there can be no assurance that these patents will afford us any meaningful protection. Although

we believe that our use of the technology and products we have developed and other trade secrets used in our operations do not

infringe upon the rights of others, our use of the technology and trade secrets we developed may infringe upon the patents or intellectual

property rights of others. In the event of infringement, we could, under certain circumstances, be required to obtain a license

or modify aspects of the technology and trade secrets we developed or refrain from using the same. We may not have the necessary

financial resources to defend an infringement claim made against us or be able to successfully terminate any infringement in a

timely manner, upon acceptable terms and conditions or at all. Failure to do any of the foregoing could have a material adverse

effect on us and our financial condition. Moreover, if the patents, technology or trade secrets we developed or use in our business

are deemed to infringe upon the rights of others, we could, under certain circumstances, become liable for damages, which could

have a material adverse effect on DSS and our financial condition. As we continue to market our products, we could encounter patent

barriers that are not known today. A patent search may not disclose all related applications that are currently pending in the

United States Patent Office, and there may be one or more such pending applications that would take precedence over any or all

of our applications.

Furthermore, third parties may assert that

our intellectual property rights are invalid, which could result in significant expenditures by us to refute such assertions. If

we become involved in litigation, we could lose our proprietary rights, be subject to damages and incur substantial unexpected

operating expenses. Intellectual property litigation is expensive and time-consuming, even if the claims are subsequently proven

unfounded, and could divert management’s attention from our business. If there is a successful claim of infringement, we

may not be able to develop non-infringing technology or enter into royalty or license agreements on acceptable terms, if at all.

If we are unsuccessful in defending claims that our intellectual property rights are invalid, we may not be able to enter into

royalty or license agreements on acceptable terms, if at all. This could prohibit us from providing our products and services to

customers, which could have a material adverse effect on us and our financial condition.

We have commenced legal proceedings against numerous companies,

including Facebook, Inc., LinkedIn Corporation, Apple, Inc, Samsung, and NEC, among others, and we expect such litigation to be

time-consuming and costly, which may adversely affect our financial condition and our ability to operate our business.

To monetize our patent assets, we have commenced

legal proceedings against numerous companies, including Facebook, Inc., LinkedIn Corporation, Apple, Inc, Samsung, and NEC, among

others alleging infringement of our patents. Our viability is partially dependent on the outcome of this litigation, and there

is a risk that we may be unable to achieve the results we desire from such litigation, which failure could significantly harm our

business. In addition, the defendants in this litigation are much larger than us and have substantially more resources than us,

which could make our litigation efforts more difficult.

These legal proceedings may continue for

several years and may require significant expenditures for legal fees and other expenses. Disputes regarding the assertion of patents

and other intellectual property rights are highly complex and technical. Once initiated, we may be forced to litigate against others

to enforce or defend our intellectual property rights or to determine the validity and scope of other parties’ proprietary

rights. The defendants or other third parties involved in the lawsuits in which we are involved may allege defenses and/or file

counterclaims in an effort to avoid or limit liability and damages for patent infringement. If such defenses or counterclaims are

successful, they may have a great impact on the value of the patents and preclude our ability to derive licensing revenue from

the patents. Therefore, a negative outcome of any such litigation, or one or more claims contained within any such litigation,

could materially and adversely impact our business.

While we believe that certain of our patents are being

infringed by the defendants named in our various litigation matters, there is a risk that a court will find the patents invalid,

not infringed or unenforceable and/or that the US Patent and Trademark Office (USPTO) will either invalidate the patents or materially

narrow the scope of their claims during the course of a re-examination. In addition, even with a positive trial court verdict,

the patents may be invalidated, found not infringed or rendered unenforceable on appeal. This risk may occur either presently in

our current litigation or from time to time in connection with future litigation we may bring. If this were to occur, it would

have a material adverse effect on our viability and operations.

Patent litigation is inherently risky and

the outcome is uncertain. Some of the parties we believe are infringing on our patents are large and well-financed companies with

substantially greater resources than ours. We believe that parties will devote a substantial amount of resources in an attempt

to avoid or limit a finding that they are liable for infringing our patents or, in the event liability is found, to avoid or limit

the amount of associated damages. In addition, there is a risk that these parties may file re-examinations or other proceedings

with the USPTO or other government agencies in an attempt to invalidate, narrow the scope or render unenforceable our patents.

It is also possible that a court may rule that we have violated statutory authority, regulatory authority, federal rules, local

court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event,

a court may issue monetary sanctions against us or award attorneys’ fees and/or expenses to one or more defendants, which

could be material, and if we are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could

materially harm our operating results and our financial position.

In addition, it is difficult in general

to predict the outcome of patent enforcement litigation at the trial level. There is a higher rate of appeals in patent enforcement

litigation than more standard business litigation. Such appeals are expensive and time-consuming, and the outcomes of such appeals

are sometimes unpredictable, resulting in increased costs and reduced or delayed revenue.

We may be unable to retain key advisors and legal counsel

to represent us in our patent infringement litigation.

The success of our pending legal proceedings

and future legal proceedings depends in part upon our ability to retain key advisors and legal counsel to represent us in such

litigation. The retention of such key advisors and legal counsel is likely to be expensive and we may not be able to retain such

key advisors and legal counsel on favorable economic terms. Therefore, an inability to retain key advisors and legal counsel to

represent us in our litigation could have a material adverse effect on our business.

We may seek to internally develop additional new inventions

and intellectual property, which would take time and would be costly. Moreover, the failure to obtain or maintain intellectual

property rights for such inventions would lead to the loss of our investments in such activities.

Members of our management team have significant

experience as inventors. As such, part of our business may include the internal development of new inventions and intellectual

property that we will seek to monetize. However, this aspect of our business would likely require significant capital and would

take time to achieve. Such activities could also distract our management team from our present business initiatives, which could

have a material and adverse effect on our business. There is also the risk that these initiatives would not yield any viable new

inventions or technology, which would lead to a loss our investments in time and resources in such activities.

In addition, even if we are able to internally

develop new inventions, in order for those inventions to be viable and to compete effectively, we would need to develop and maintain,

and we would heavily rely on, a proprietary position with respect to such inventions and intellectual property. However, there

are significant risks associated with any such intellectual property we may develop principally including the following:

|

|

•

|

patent applications we may file may not result in issued patents or may take longer than we expect to result in issued patents;

|

|

|

•

|

we may be subject to interference proceedings;

|

|

|

•

|

we may be subject to opposition proceedings in the U.S. or foreign countries;

|

|

|

•

|

any patents that are issued to us may not provide meaningful protection;

|

|

|

•

|

we may not be able to develop additional proprietary technologies that are patentable;

|

|

|

•

|

other companies may challenge patents issued to us;

|

|

|

•

|

other companies may design around technologies we have developed; and

|

|

|

•

|

enforcement of our patents would be complex, uncertain and very expensive.

|

We cannot be certain that patents will be

issued as a result of any future applications, or that any of our patents, once issued, will provide us with adequate protection

from competing products. For example, issued patents may be circumvented or challenged, declared invalid or unenforceable, or narrowed

in scope. In addition, since publication of discoveries in scientific or patent literature often lags behind actual discoveries,

we cannot be certain that it will be the first to make our additional new inventions or to file patent applications covering those

inventions. It is also possible that others may have or may obtain issued patents that could prevent us from commercializing our

products or require us to obtain licenses requiring the payment of significant fees or royalties in order to enable us to conduct

our business. As to those patents that we may license or otherwise monetize, our rights will depend on maintaining our obligations

to the licensor under the applicable license agreement, and we may be unable to do so. Our failure to obtain or maintain intellectual

property rights for our inventions would lead to the loss of our investments in such activities, which would have a material and

adverse effect on our business.

Moreover, patent application delays could

cause delays in recognizing revenue from our internally generated patents and could cause us to miss opportunities to license patents

before other competing technologies are developed or introduced into the market.

New legislation, regulations or rules related to obtaining

patents or enforcing patents could significantly increase our operating costs and decrease our revenue.

We expect to spend a significant amount

of resources to enforce our patents. If new legislation, regulations or rules are implemented either by Congress, the U.S. Patent

and Trademark Office (the “USPTO”), any state or the courts that impact the patent application process, the patent

enforcement process or the rights of patent holders, these changes could negatively affect our expenses and revenue and any reductions

in the funding of the USPTO could negatively impact the value of our assets. United States patent laws have been amended by the

Leahy-Smith America Invents Act, or the America Invents Act. The America Invents Act includes a number of significant changes to

U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and the increase

in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the America Invents

Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that such actions will

need to be brought against individual parties allegedly infringing by their respective individual actions or activities. At this

time, it is not clear what, if any, impact the America Invents Act will have on the operation of our enforcement business. However,

the America Invents Act and its implementation could increase the uncertainties and costs surrounding the enforcement of our patented

technologies, which could have a material adverse effect on our business and financial condition.

A number of states have adopted or are considering

legislation to make the patent enforcement process more difficult for non-practicing entities, such as allowing such entities to

be sued in state court and setting higher standards of proof for infringement claims. We cannot predict what, if any, impact these

state initiatives will have on the operation of our enforcement business. However, such legislation could increase the uncertainties

and costs surrounding the enforcement of our patented technologies, which could have a material adverse effect on our business

and financial condition.

In addition, the U.S. Department of Justice

(“DOJ”) has conducted reviews of the patent system to evaluate the impact of patent assertion entities on industries

in which those patents relate. It is possible that the findings and recommendations of the DOJ could impact the ability to

effectively license and enforce standards-essential patents and could increase the uncertainties and costs surrounding the enforcement

of any such patented technologies.

Finally, new rules regarding the burden

of proof in patent enforcement actions could significantly increase the cost of our enforcement actions, and new standards or limitations

on liability for patent infringement could negatively impact our revenue derived from such enforcement actions.

Our acquisitions of patent assets

may be time consuming, complex and costly, which could adversely affect our operating results.

Acquisitions of patent or other intellectual

property assets, which are and will be critical to our business plan, are often time consuming, complex and costly to consummate.

We may utilize many different transaction structures in our acquisitions and the terms of such acquisition agreements tend to be

heavily negotiated. As a result, we expect to incur significant operating expenses and will likely be required to raise capital

during the negotiations even if the acquisition is ultimately not consummated. Even if we are able to acquire particular patent

assets, there is no guarantee that we will generate sufficient revenue related to those patent assets to offset the acquisition

costs. While we will seek to conduct confirmatory due diligence on the patent assets we are considering for acquisition, we may

acquire patent assets from a seller who does not have proper title to those assets. In those cases, we may be required to spend

significant resources to defend our interest in the patent assets and, if we are not successful, our acquisition may be invalid,

in which case we could lose part or all of our investment in the assets.

In addition, we may acquire patents and

technologies that are in the early stages of adoption in the commercial, industrial and consumer markets. Demand for some of these

technologies will likely be untested and may be subject to fluctuation based upon the rate at which licensees will adopt these

patents and technologies in their products and services. As a result, there can be no assurance as to whether technologies we acquire

or develop will have value that we can monetize.

In certain acquisitions of patent

assets, we may seek to defer payment or finance a portion of the acquisition price. This approach may put us at a competitive disadvantage

and could result in harm to our business.

We have limited capital and may seek to

negotiate acquisitions of patent or other intellectual property assets where we can defer payments or finance a portion of the

acquisition price. These types of debt financing or deferred payment arrangements may not be as attractive to sellers of patent

assets as receiving the full purchase price for those assets in cash at the closing of the acquisition. As a result, we might not

compete effectively against other companies in the market for acquiring patent assets, many of whom have greater cash resources

than we have.

We may not be able to capitalize

on potential market opportunities related to our licensing strategy or patent portfolio.

In order to capitalize on our patent portfolio,

we intend to enter into licensing relationships. However, there can be no assurance that we will be able to capitalize on our patent

portfolio or any potential market opportunity in the foreseeable future. Our inability to generate licensing revenues associated

with potential market opportunities could result from a number of factors, including, but not limited to:

|

|

•

|

We may not be successful in entering into licensing relationships on commercially acceptable terms; and

|

|

|

•

|

Challenges from third parties as to the validity of our patents underlying licensing opportunities.

|

Weak global economic conditions may

cause infringing parties to delay entering into licensing agreements, which could prolong our litigation and adversely affect our

financial condition and operating results

.

Our business plan depends significantly

on worldwide economic conditions, and the United States and world economies have recently experienced weak economic conditions.

Uncertainty about global economic conditions poses a risk as businesses may postpone spending in response to tighter credit, negative

financial news and declines in income or asset values. This response could have a material negative effect on the willingness of

parties infringing on our assets to enter into licensing or other revenue generating agreements voluntarily. Entering into such

agreements is critical to our business plan, and failure to do so could cause material harm to our business.

Risks Related to This Offering

Our management will have broad discretion

over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree or which do

not produce beneficial results.

We currently intend to use the net proceeds

from this offering for working capital and general corporate purposes. We have not allocated specific amounts of the net proceeds

from this offering for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility

in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of

these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or

any, return for us or our stockholders. The failure of our management to use such funds effectively could have a material adverse

effect on our business, prospects, financial condition, and results of operations.

A substantial number of shares of

common stock may be sold in the market following this offering, which may depress the market price for our common stock.

Sales of a substantial number of shares

of our common stock in the public market following this offering could cause the market price of our common stock to decline. A

substantial majority of the outstanding shares of our common stock are, and the shares of common stock sold in this offering upon

issuance will be, freely tradable without restriction or further registration under the Securities Act. In addition, as of March

31, 2014, an aggregate of 12,077,716 shares of our common stock are issuable upon exercise of outstanding options and warrants

and a convertible promissory note.

You will experience immediate dilution in the book value

per share of the securities you purchase in this offering.

Because the price per share of our common

stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial

dilution in the net tangible book value of the common stock you purchase in this offering. Based on an offering price of $1.44