UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2014

ORGANOVO HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Commission

File Number: 001-35996

|

|

|

| Delaware |

|

27-1488943 |

| (State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

6275 Nancy Ridge Dr.,

San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 550-9994

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On June 12, 2014, Organovo Holdings, Inc. (the “Company”) issued a press release announcing financial results for its fiscal year ended

March 31, 2014 and provided a business update. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this

Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02

shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

|

|

|

| 99.1 |

|

Press Release, dated June 12, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

|

|

ORGANOVO HOLDINGS, INC. |

|

|

|

|

| Date June 12, 2014 |

|

|

|

|

|

/s/ Keith Murphy |

|

|

|

|

|

|

Keith Murphy |

|

|

|

|

|

|

Chief Executive Officer |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated June 12, 2014. |

Exhibit 99.1

Organovo Reports Fiscal 2014 Financial Results

SAN

DIEGO, June 12, 2014 – Organovo Holdings, Inc. (NYSE MKT: ONVO) (“Organovo”), a three-dimensional biology company focused on delivering breakthrough 3D bioprinting technology, has reported its financial results for the fiscal

year ended March 31, 2014. The Company also reported on its corporate highlights during fiscal 2014.

FY 2014 Corporate Highlights:

| |

• |

|

Expanded independent Board membership with the addition of Tamar D. Howson and Richard A. Heyman, Ph.D.; |

| |

• |

|

Common stock was approved to list on the NYSE MKT and began trading on the New York Stock Exchange MKT on July 11, 2013; |

| |

• |

|

Raised $46.6 Million via a fully underwritten public offering of Common Stock, in which Lazard Capital Markets LLC and Oppenheimer & Co. Inc. acted as joint book-runners for the offering;

|

| |

• |

|

Presented data demonstrating retention of key liver functions in bioprinted tissues for up to 40 days, and demonstrated that Organovo’s 3D liver tissues exhibit dose-dependent responses to known liver

toxicants, and that the toxic effects can be assessed using both standard screening assays and histopathological assessment of the treated tissue; |

| |

• |

|

Performed its first 3D Liver tissue delivery, marking the delivery of Organovo’s 3D Liver tissue to a laboratory outside of the company to a key opinion leader (KOL) for experimentation;

|

| |

• |

|

Initiated contracting for toxicity testing using its 3D Human Liver Tissue for selected clients prior to full release; |

| |

• |

|

Announced collaboration with the National Center for Advancing Translational Sciences (NCATS) and the National Eye Institute (NEI) to help scientists develop more reliable tools for bringing safer, more effective

treatments to patients on a faster timeline; |

| |

• |

|

Doubled office and laboratory space to 30,000 sq. feet to accommodate the capacity requirements of recent partnerships and the near-term commercial product launch; |

| |

• |

|

Celebrated a profile of the company and the 3D bioprinting space as the cover story in the Economist’s Technology Quarterly. |

“Organovo was able to continue our achievement of strong results in fiscal 2014,” stated Keith Murphy, chief executive officer of Organovo. “We

demonstrated the viability and utility of our 3D liver tissues and breast tumor disease model, expanded our partnerships, uplisted our common stock to the NYSE MKT, raised significant financing, and saw tremendous scientific results from our

bioprinting efforts in a variety of tissue types. We will continue to focus in fiscal 2015 on executing our business plan and on striving to deliver long-term shareholder value.”

Financial Results:

Comparison of the years ended March 31, 2014 and December 31, 2012

Revenues

Revenues of $0.4 million for the

year ended March 31, 2014 decreased approximately $0.8 million, or 67%, over revenues of $1.2 million for the year ended December 31, 2012. This decrease reflects the completion or declining activity under two collaborative research

agreements since 2012, partially offset by increasing revenue contributions from three new collaborative research agreements.

Operating Expenses

Operating expenses increased approximately $10.5 million, or 100%, from $10.5 million for the year ended December 31, 2012

to $21.0 million for the year ended March 31, 2014. Of this increase, $5.9 million is related to increased selling, general and administrative expense, while the other $4.6 million relates to increased investment in research and development

expense. Those increases are attributed to the Company’s continued implementation of its business plan, including hiring additional staff to support its research and development initiatives, incremental investment associated with

commercialization project initiatives, expenses related to operating as a publicly traded corporation, expansion to a larger facility, and increased stock compensation expense relative to employees and certain consulting services.

Research and Development Expenses

Research and development expense increased $4.6 million, or 135%, from approximately $3.4 million for the year ended December 31, 2012 to

approximately $8.0 million for the year ended March 31, 2014 as the Company significantly increased its research staff to support its obligations under certain collaborative research agreements and grants, and to expand product development

efforts in preparation for commercial revenues. Full-time research and development staffing increased from nineteen full-time employees as of December 31, 2012 to thirty-two full-time employees as of March 31, 2014. In addition to the

incremental payroll, benefits and stock-based compensation resulting from increased staffing levels, the Company increased its facility space to accommodate its growing research staff, and increased its spending on lab equipment and supplies in

proportion to its increased research activities.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased approximately $5.9 million, or 83%, from $7.1 million for the year ended

December 31, 2012 to $13.0 million for the year ended March 31, 2014. Increased staffing expenses of approximately $1.5 million was due to the headcount increase from ten full-time employees as of December 31, 2012 to thirteen

full-time employees as of March 31, 2014, to provide strategic infrastructure in developing collaborative relationships and preparing for commercialization of products and services, and to address the additional compliance requirements of

operating as a publicly traded corporation. In addition, the year ended March 31, 2014 includes $1.2 million more in payroll taxes related to the vesting of restricted stock units the Company previously granted to certain of its executives.

Stock-based compensation costs also increased approximately $2.9 million due to additional grants to employees and consultants as well as an overall increase in the Company’s stock price. The remainder of the increase is primarily due to

non-recurring external fees and expenses incurred during the year ended March 31, 2014 related to the Company’s up-listing to the NYSE MKT and its completion of a secondary public offering during the year.

Other Income (Expense)

The $29.0 million decrease in other expenses as compared to the year ended December 31, 2012 was primarily due to the inclusion of

one-time non-cash transaction costs associated with the Merger and 2012 Private Placements in other expense during 2012, including approximately $19.0 million of expense for the excess of the fair value of warrant liabilities over proceeds received,

$2.1 million of financing costs in excess of proceeds received and $1.0 million in interest expense from the accretion of debt discount and amortization of deferred financing costs related to the 2011 Private Placement, the Merger and the 2012

Private Placement. In addition, $1.9 million of expense was recorded in 2012 for the loss on inducement to exercise warrants under a tender offer completed during the year. Finally, non-cash expense related to the change in fair value of warrant

liabilities decreased by approximately $4.8 million, due to fewer warrants outstanding as of March 31, 2014.

Various factors are

considered in the pricing models we use to value the warrants, including the Company’s current stock price, the remaining life of the warrants, the volatility of the Company’s stock price, and the risk free interest rate. Future changes in

these factors may have a significant impact on the computed fair value of the warrant liability. As such, we expect future changes in the fair value of the warrants to continue to vary significantly from quarter to quarter.

Financial Condition, Liquidity and Capital Resources

At March 31, 2014, we had total current assets of $49.2 million and current liabilities of $1.9 million, resulting in working capital of

$47.3 million. At March 31, 2013, we had total current assets of $16.1 million and current liabilities of $8.4 million, resulting in working capital of $7.7 million. At December 31, 2012, we had total current assets of $15.9 million and

current liabilities of $22.0 million, resulting in a working capital deficit of $6.1 million.

Net cash used in investing activities was

approximately $0.3 million, $0.2 million, less than $0.1million, $0.4 million, and $0.1 million for the year ended March 31, 2014, the three months ended March 31, 2013 and March 31, 2012, and the years ended December 31, 2012

and December 31, 2011, respectively. The majority of net cash used in investing activities from inception to date has been for the purchases of equipment for the research lab.

Net cash provided by financing activities was approximately $48.4 million, $3.7 million, $13.6 million, $24.6 million and $2.1 million for the

year ended March 31, 2014, the three months ended March 31, 2013 and March 31, 2012, and the years ended December 31, 2012 and December 31, 2011, respectively.

During the year ended March 31, 2014, we raised net proceeds of approximately $43.4 million through the sale of 10,350,000 shares of our

common stock in a public offering. In addition, we raised net proceeds of approximately $3.5 million from an at-the-market follow-on offering, $1.0 million from the exercise of warrants, and $0.4 million from stock option exercises during the year

ended March 31, 2014.

About Organovo Holdings, Inc.

Organovo designs and creates functional, three-dimensional human tissues for medical research and therapeutic applications. The Company is collaborating

with pharmaceutical and academic partners to develop human biological disease models in three dimensions. These 3D human tissues have the potential to accelerate the drug discovery process, enabling treatments to be developed faster and at lower

cost. In addition to numerous scientific publications, the Company’s technology has been featured in The Wall Street Journal, Time Magazine, The Economist, and numerous others. Organovo is changing the shape of medical

research and practice. Learn more at www.organovo.com.

Safe Harbor Statement

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements as that term is defined in the

Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. The factors that could cause actual future results to differ

materially from current expectations include, but are not limited to, risks and uncertainties relating to the Company’s ability to develop, market and sell products based on its technology; the expected benefits and efficacy of the

Company’s products and technology; the market acceptance of the Company’s products; and the Company’s business, research, product development, regulatory approval, marketing and distribution plans and strategies. These and other

factors are identified and described in more detail in our filings with the SEC, including our annual report on Form 10-K filed with the SEC on June 10, 2014 as well as our other filings with the Securities and Exchange

Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that we

may issue in the future. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later

events or circumstances or to reflect the occurrence of unanticipated events.

SOURCE Organovo Holdings, Inc.

Investor Contact, Barry Michaels, Chief Financial Officer, 858-224-1000, ext. 3, IR@organovo.com, or

Gerry Amato, Booke & Company Investor Relations, admin@bookeandco.com;

Media Contact, Mike Renard, EVP, Commercial Operations, 858-224-1006, mrenard@organovo.com

ORGANOVO HOLDINGS, INC.

(A development stage company)

CONSOLIDATED BALANCE SHEETS

(in thousands except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2014 |

|

|

March 31, 2013 |

|

|

December 31, 2012 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

48,167 |

|

|

$ |

15,628 |

|

|

$ |

14,817 |

|

| Grant receivable |

|

|

— |

|

|

|

101 |

|

|

|

162 |

|

| Inventory |

|

|

63 |

|

|

|

88 |

|

|

|

360 |

|

| Deferred financing costs |

|

|

40 |

|

|

|

— |

|

|

|

— |

|

| Prepaid expenses and other current assets |

|

|

891 |

|

|

|

327 |

|

|

|

527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

49,161 |

|

|

|

16,144 |

|

|

|

15,866 |

|

| Fixed assets, net |

|

|

857 |

|

|

|

1,045 |

|

|

|

714 |

|

| Restricted cash |

|

|

79 |

|

|

|

88 |

|

|

|

88 |

|

| Other assets, net |

|

|

89 |

|

|

|

98 |

|

|

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

50,186 |

|

|

$ |

17,375 |

|

|

$ |

16,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

326 |

|

|

$ |

641 |

|

|

$ |

425 |

|

| Accrued expenses |

|

|

1,167 |

|

|

|

780 |

|

|

|

981 |

|

| Deferred revenue |

|

|

13 |

|

|

|

53 |

|

|

|

— |

|

| Current portion of capital lease obligation |

|

|

10 |

|

|

|

10 |

|

|

|

10 |

|

| Warrant liabilities |

|

|

377 |

|

|

|

6,898 |

|

|

|

20,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,893 |

|

|

|

8,382 |

|

|

|

22,035 |

|

| Deferred revenue, net of current portion |

|

|

4 |

|

|

|

9 |

|

|

|

— |

|

| Capital lease obligation, net of current portion |

|

|

5 |

|

|

|

15 |

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

$ |

1,902 |

|

|

$ |

8,406 |

|

|

$ |

22,052 |

|

|

|

|

|

| Commitments and Contingencies (Note 8) |

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value; 150,000,000 shares authorized, 78,113,639, 64,686,919 and 58,535,411 shares issued and outstanding at

March 31, 2014, March 31, 2013, and December 31, 2012, respectively |

|

|

78 |

|

|

|

65 |

|

|

|

59 |

|

| Additional paid-in capital |

|

|

140,419 |

|

|

|

75,269 |

|

|

|

44,883 |

|

| Deficit accumulated during the development stage |

|

|

(92,213 |

) |

|

|

(66,365 |

) |

|

|

(50,245 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity (deficit) |

|

|

48,284 |

|

|

|

8,969 |

|

|

|

(5,303 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity (Deficit) |

|

$ |

50,186 |

|

|

$ |

17,375 |

|

|

$ |

16,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANOVO HOLDINGS, INC.

(A development stage company)

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended

March 31,

2014 |

|

|

Three Months Ended

March 31, |

|

|

Year ended

December 31,

2012 |

|

|

Year ended

December 31,

2011 |

|

|

Period from

April 19, 2007

Inception

Through

March 31, 2014 |

|

| |

|

|

2013 |

|

|

2012 |

|

|

|

|

| |

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

224 |

|

|

$ |

224 |

|

| Collaborations |

|

|

248 |

|

|

|

98 |

|

|

|

120 |

|

|

|

1,035 |

|

|

|

688 |

|

|

|

2,144 |

|

| Grants |

|

|

131 |

|

|

|

117 |

|

|

|

— |

|

|

|

162 |

|

|

|

57 |

|

|

|

1,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

379 |

|

|

|

215 |

|

|

|

120 |

|

|

|

1,197 |

|

|

|

969 |

|

|

|

3,442 |

|

| Cost of product revenue |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

121 |

|

|

|

134 |

|

| Selling, general, and administrative expenses |

|

|

13,054 |

|

|

|

2,792 |

|

|

|

902 |

|

|

|

7,080 |

|

|

|

1,733 |

|

|

|

25,593 |

|

| Research and development expenses |

|

|

7,974 |

|

|

|

1,448 |

|

|

|

547 |

|

|

|

3,436 |

|

|

|

1,420 |

|

|

|

16,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from Operations |

|

|

(20,649 |

) |

|

|

(4,025 |

) |

|

|

(1,329 |

) |

|

|

(9,319 |

) |

|

|

(2,305 |

) |

|

|

(38,341 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value of warrant liabilities in excess of proceeds received |

|

|

— |

|

|

|

— |

|

|

|

(19,019 |

) |

|

|

(19,019 |

) |

|

|

— |

|

|

|

(19,019 |

) |

| Change in fair value of warrant liabilities |

|

|

(5,120 |

) |

|

|

(12,034 |

) |

|

|

(13,506 |

) |

|

|

(9,931 |

) |

|

|

(7 |

) |

|

|

(27,092 |

) |

| Financing transaction costs in excess of proceeds received |

|

|

— |

|

|

|

— |

|

|

|

(2,130 |

) |

|

|

(2,130 |

) |

|

|

— |

|

|

|

(2,130 |

) |

| Loss on inducement to exercise warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,904 |

) |

|

|

— |

|

|

|

(1,904 |

) |

| Loss on disposal of fixed assets |

|

|

(84 |

) |

|

|

— |

|

|

|

— |

|

|

|

(158 |

) |

|

|

— |

|

|

|

(242 |

) |

| Interest expense |

|

|

(13 |

) |

|

|

(65 |

) |

|

|

(1,088 |

) |

|

|

(1,088 |

) |

|

|

(2,067 |

) |

|

|

(3,484 |

) |

| Interest income |

|

|

18 |

|

|

|

4 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

29 |

|

| Other expense |

|

|

— |

|

|

|

— |

|

|

|

(9 |

) |

|

|

(9 |

) |

|

|

(4 |

) |

|

|

(30 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Income (Expense) |

|

|

(5,199 |

) |

|

|

(12,095 |

) |

|

|

(35,752 |

) |

|

|

(34,234 |

) |

|

|

(2,078 |

) |

|

|

(53,872 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(25,848 |

) |

|

$ |

(16,120 |

) |

|

$ |

(37,081 |

) |

|

$ |

(43,553 |

) |

|

$ |

(4,383 |

) |

|

$ |

(92,213 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share — basic and diluted |

|

$ |

(0.35 |

) |

|

$ |

(0.26 |

) |

|

$ |

(1.17 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.19 |

) |

|

|

|

|

| Weighted average shares used in computing net loss per common share — basic and diluted |

|

|

73,139,618 |

|

|

|

61,750,157 |

|

|

|

31,591,663 |

|

|

|

43,149,657 |

|

|

|

22,925,694 |

|

|

|

|

|

ORGANOVO HOLDINGS, INC.

(A development stage company)

CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year

Ended

March 31,

2014 |

|

|

Three Months

Ended

March 31,

2013 |

|

|

Three Months

Ended

March 31,

2012 |

|

|

Year

Ended

December 31,

2012 |

|

|

Year

Ended

December 31,

2011 |

|

|

Period from

April 19,

2007

(Inception)

Through

March 31,

2014 |

|

| |

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(25,848 |

) |

|

$ |

(16,120 |

) |

|

$ |

(37,081 |

) |

|

$ |

(43,553 |

) |

|

$ |

(4,383 |

) |

|

$ |

(92,213 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of deferred financing costs |

|

|

— |

|

|

|

— |

|

|

|

319 |

|

|

|

319 |

|

|

|

119 |

|

|

|

438 |

|

| Amortization of warrants issued for services |

|

|

323 |

|

|

|

261 |

|

|

|

— |

|

|

|

556 |

|

|

|

— |

|

|

|

1,140 |

|

| Depreciation and amortization |

|

|

387 |

|

|

|

80 |

|

|

|

17 |

|

|

|

195 |

|

|

|

68 |

|

|

|

818 |

|

| Loss on disposal of fixed assets |

|

|

84 |

|

|

|

— |

|

|

|

— |

|

|

|

158 |

|

|

|

— |

|

|

|

242 |

|

| Amortization of debt discount |

|

|

— |

|

|

|

— |

|

|

|

896 |

|

|

|

896 |

|

|

|

1,188 |

|

|

|

2,084 |

|

| Interest accrued on convertible notes payable |

|

|

— |

|

|

|

— |

|

|

|

12 |

|

|

|

12 |

|

|

|

232 |

|

|

|

495 |

|

| Fair value of warrant liabilities in excess of proceeds |

|

|

— |

|

|

|

— |

|

|

|

19,019 |

|

|

|

19,019 |

|

|

|

— |

|

|

|

19,019 |

|

| Change in fair value of warrant liabilities |

|

|

5,120 |

|

|

|

12,034 |

|

|

|

13,506 |

|

|

|

9,931 |

|

|

|

7 |

|

|

|

27,092 |

|

| Loss on inducement to exercise warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,904 |

|

|

|

— |

|

|

|

1,904 |

|

| Expense associated with warrant modification |

|

|

12 |

|

|

|

65 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

77 |

|

| Stock-based compensation |

|

|

4,600 |

|

|

|

848 |

|

|

|

4 |

|

|

|

1,435 |

|

|

|

9 |

|

|

|

6,900 |

|

| Warrants issued in connection with exchange agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

528 |

|

|

|

528 |

|

| Increase (decrease) in cash resulting from changes in: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grants receivable |

|

|

101 |

|

|

|

61 |

|

|

|

— |

|

|

|

(162 |

) |

|

|

60 |

|

|

|

— |

|

| Inventory |

|

|

25 |

|

|

|

— |

|

|

|

(45 |

) |

|

|

(459 |

) |

|

|

(224 |

) |

|

|

(726 |

) |

| Prepaid expenses and other assets |

|

|

(392 |

) |

|

|

(61 |

) |

|

|

(65 |

) |

|

|

(101 |

) |

|

|

(69 |

) |

|

|

(647 |

) |

| Accounts payable |

|

|

(315 |

) |

|

|

216 |

|

|

|

(217 |

) |

|

|

(233 |

) |

|

|

373 |

|

|

|

326 |

|

| Accrued expenses |

|

|

387 |

|

|

|

(201 |

) |

|

|

(37 |

) |

|

|

543 |

|

|

|

132 |

|

|

|

1,167 |

|

| Deferred revenue |

|

|

(45 |

) |

|

|

62 |

|

|

|

116 |

|

|

|

(153 |

) |

|

|

46 |

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(15,561 |

) |

|

|

(2,755 |

) |

|

|

(3,556 |

) |

|

|

(9,693 |

) |

|

|

(1,914 |

) |

|

|

(31,339 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits released from restriction (restricted cash deposits) |

|

|

9 |

|

|

|

— |

|

|

|

(38 |

) |

|

|

(88 |

) |

|

|

— |

|

|

|

(79 |

) |

| Purchases of fixed assets |

|

|

(277 |

) |

|

|

(137 |

) |

|

|

(6 |

) |

|

|

(357 |

) |

|

|

(46 |

) |

|

|

(1,198 |

) |

| Purchases of intangible assets |

|

|

— |

|

|

|

(19 |

) |

|

|

— |

|

|

|

— |

|

|

|

(65 |

) |

|

|

(114 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(268 |

) |

|

|

(156 |

) |

|

|

(44 |

) |

|

|

(445 |

) |

|

|

(111 |

) |

|

|

(1,391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of convertible notes payable |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,543 |

|

|

|

4,630 |

|

| Proceeds from issuance of common stock and exercise of warrants, net |

|

|

48,016 |

|

|

|

3,724 |

|

|

|

13,723 |

|

|

|

24,714 |

|

|

|

— |

|

|

|

76,454 |

|

| Proceeds from exercise of stock options |

|

|

402 |

|

|

|

— |

|

|

|

— |

|

|

|

18 |

|

|

|

— |

|

|

|

420 |

|

| Proceeds from issuance of related party notes payable |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

225 |

|

|

|

250 |

|

| Principal payments on capital lease obligations |

|

|

(10 |

) |

|

|

(2 |

) |

|

|

— |

|

|

|

(7 |

) |

|

|

— |

|

|

|

(19 |

) |

| Repayment of related party notes payable |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(250 |

) |

|

|

(250 |

) |

| Repayment of convertible notes and interest payable |

|

|

— |

|

|

|

— |

|

|

|

(110 |

) |

|

|

(110 |

) |

|

|

— |

|

|

|

(110 |

) |

| Deferred financing costs |

|

|

(40 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(438 |

) |

|

|

(478 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

48,368 |

|

|

|

3,722 |

|

|

|

13,613 |

|

|

|

24,615 |

|

|

|

2,080 |

|

|

|

80,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Increase in Cash and Cash Equivalents |

|

|

32,539 |

|

|

|

811 |

|

|

|

10,013 |

|

|

|

14,477 |

|

|

|

55 |

|

|

|

48,167 |

|

| Cash and Cash Equivalents at Beginning of Period |

|

|

15,628 |

|

|

|

14,817 |

|

|

|

340 |

|

|

|

340 |

|

|

|

285 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents at End of Period |

|

$ |

48,167 |

|

|

$ |

15,628 |

|

|

$ |

10,353 |

|

|

$ |

14,817 |

|

|

$ |

340 |

|

|

$ |

48,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

10 |

|

|

$ |

10 |

|

|

$ |

— |

|

|

$ |

10 |

|

| Income Taxes |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

3 |

|

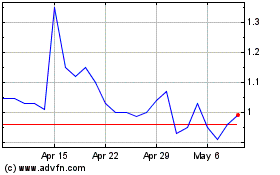

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

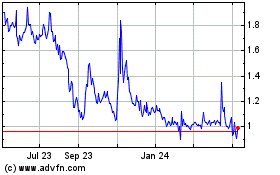

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024