UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2014

SPANISH BROADCASTING SYSTEM, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-27823 |

|

13-3827791 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 7007 N.W. 77th Avenue, Miami, Florida |

|

33166 |

| (Address of principal executive offices) |

|

(Zip Code) |

(305) 441-6901

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement

On June 5, 2014, Spanish Broadcasting System, Inc. (the “Company”) entered into an employment agreement (the “Employment Agreement”)

with Raul Alarcon, its Chairman of the Board, Chief Executive Officer and President. The Employment Agreement replaces and supersedes an employment agreement between the Company and Mr. Alarcon that was entered into on October 25, 1999.

Under the Employment Agreement, Mr. Alarcon shall continue to serve as Chairman of the Board, Chief Executive Officer and President. The Employment

Agreement is deemed to be effective as of May 1, 2014 and continues through December 31, 2018. The Employment Agreement automatically renews for one successive three-year term until December 31, 2021 unless either party notifies the

other that it will not renew the Employment Agreement. After December 31, 2021, the Employment Agreement automatically renews for successive one-year terms unless sooner terminated pursuant to the terms of the Employment Agreement.

Under the Employment Agreement, Mr. Alarcon is entitled to receive an annual base salary of $1,750,000. Mr. Alarcon can also earn an annual

performance bonus of up to $750,000 based on the Company’s achieving a certain level of EBITDA and a discretionary bonus as determined by the Compensation Committee of the Board of Directors of the Company. The Employment Agreement also

provides for a Retention Bonus equal to $1,616,668, payable $216,668 upon execution of the Employment Agreement and $50,000 per month for 28 months. Mr. Alarcon is also entitled to participate in all employee benefit plans and arrangements of

the Company, including without limitation, all life, group insurance and health insurance plans and all disability, retirement, stock option and other employee benefit plans of the Company.

Mr. Alarcon is also entitled to the use of one automobile and the services of a driver at the expense of the Company and reimbursement from the Company

for insurance, maintenance and fuel expenses related thereto. Mr. Alarcon is also entitled to life insurance and reimbursement for personal tax and accounting services and certain legal expenses.

Mr. Alarcon’s employment under the Employment Agreement shall terminate: (a) for Cause or (b) by reason of Mr. Alarcon’s death

or disability. If Mr. Alarcon’s employment is terminated for Cause, the Company will pay his accrued base salary and all other benefits accrued through the date of termination. If Mr. Alarcon’s employment is terminated due to his

death or disability, the Company will pay his accrued base salary and all other benefits accrued through the date of termination and all non-vested options immediately vest.

Under the terms of the Employment Agreement, Mr. Alarcon has agreed not to disclose any confidential information concerning the Company’s business.

In addition, Mr. Alarcon has agreed not to solicit or to interfere with the Company’s relationship with any of the Company’s employees or independent contractors or to interfere with the Company’s relationship with any person or

entity with which the Company had any contractual or business relationship until 12 months following termination of his employment. Furthermore, Mr. Alarcon has entered into a noncompetition agreement pursuant to which he has agreed not to

provide competing services until 12 months following termination of his employment.

The description of the amended and restated employment agreement

set forth above is qualified in its entirety by reference to the full text of the Employment Agreement, which is attached as Exhibit 10.1 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

The information contained in Item 1.01 above regarding the Employment Agreement is hereby incorporated by reference into this

Item 5.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Employment Agreement, dated June 5, 2014, by and between the Company and Raul Alarcon. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SPANISH BROADCASTING SYSTEM, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

| June 11, 2014 |

|

|

|

By: |

|

/s/ Joseph A. García |

|

|

|

|

|

|

Joseph A. García |

|

|

|

|

|

|

Chief Financial Officer, Chief Administrative Officer, Senior Executive Vice President and Secretary |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Employment Agreement, dated June 5, 2014, by and between the Company and Raul Alarcon. |

Exhibit 10.1

EMPLOYMENT AGREEMENT

EMPLOYMENT AGREEMENT dated as of June 5th, 2014 by and between Spanish Broadcasting System, Inc., a Delaware corporation (the

“Company”) and Raúl Alarcón (the “Executive”).

WHEREAS, the Company and the Executive are

parties to an Employment Agreement, dated October 25, 1999 (the “1999 Agreement”);

WHEREAS, the Company and the

Executive desire to enter into a new employment agreement (the “Agreement”) and to terminate the 1999 Agreement as hereinafter provided; and

WHEREAS, the Executive has served as President of the Company since 1985, Chief Executive Officer of the Company since 1994, and

Chairman of the Board of Directors since 1999, and the Company desires to assure itself of the continued availability of the Executive’s services in such capacities;

NOW, THEREFORE, the Company and the Executive agree as follows:

1. Employment. The Company shall employ the Executive and the Executive shall be employed by the Company as Chairman of the Board of

Directors, Chief Executive Officer and President of the Company and its subsidiaries, affiliates and related companies (collectively, the “Subsidiaries”) for the term of this Agreement.

2. Term. The term of the Executive’s employment pursuant to this Agreement shall commence on May 1, 2014 (the “Effective

Date”) and continue until December 31, 2018 (the “Initial Term”). Unless either party notifies the other party in writing at least 90 days prior to December 31, 2018 that such party desires to terminate the agreement, the

term shall be automatically renewed for a successive three-year term until December 31, 2021 (the “Renewal Term”). Unless either party notifies the other party in writing at least 90 days prior to December 31, 2021 or any

succeeding December 31, such term shall be automatically renewed for successive one-year terms unless sooner terminated pursuant to the terms of this Agreement (collectively, the Initial Term, Renewal Term and any successive one-year terms

shall be referred to as the “Employment Term”).

3. Duties. The Executive shall, subject to overall direction consistent

with the legal authority of the Board of Directors of the Company (the “Board”), serve as, and have all power and authority inherent in the offices of, Chairman of the Board, Chief Executive Officer and President of the Company and its

subsidiaries during the Employment Term and, as such, shall have all authority and responsibility commensurate with the titles of Chairman, Chief Executive Officer and President, including ultimate responsibility for and authority over all

day-to-day business affairs and operations of the Company and its subsidiaries and their personnel and have such other executive powers and duties as may from time to time be prescribed by the Board. The Executive shall also serve as a member of the

Board during the Employment Term. The Executive shall devote his business time and efforts to the business of the Company and its Subsidiaries.

4. Compensation and Other Provisions.

(a) Base Salary. The Company shall pay to the Executive a base salary at a rate of not less than $1,750,000.00 per annum effective as of

the Effective Date for each year during the Employment Term, payable in substantially equal semi-monthly installments (the “Base Salary”).

(b) Retention Bonus. As consideration for entering into this new Agreement, in recognition of the Executive’s service to the

Company since 1983, his service as President of the Company since 1985, his service as Chief Executive Officer since 1994, his service as the Chairman of the Board of Directors since 1999 and to incentivize Mr. Alarcón’s future

performance, the Executive shall receive a retention bonus of $1,616,668.00 payable in the following manner: $216,668.00 to be paid upon execution and $50,000.00 to be paid by the fifteenth day of each month beginning in June 2014 for 28 months.

(c) Annual Bonus. For each year during the Employment Term, Executive shall receive a performance bonus of $750,000.00 if the

performance criteria for the year is achieved or exceeded (the “Performance Bonus”). Additionally, the Compensation Committee may exercise its discretion and award a bonus in such amount as it deems appropriate based on such factors as the

Compensation Committee may determine either in addition to the Performance Bonus earned or in the event that no Performance Bonus is earned (the “Discretionary Bonus”). It is expected that the annual performance criteria for the

Performance Bonus will be based on a financial or operational goal or goals and will be determined annually by the Compensation Committee in consultation with the Executive, and may be determined at any point during the fiscal year (it being

intended that such criteria will be established during the Company’s annual budgeting process). For the first fiscal year during the Employment Term and each year thereafter unless modified by the Compensation Committee and Board of Directors,

the performance criteria shall consist of achieving a certain minimum dollar amount of earnings before interest, taxes, depreciation and amortization (“EBITDA”), as such non-GAAP measure is customarily defined and calculated by the Company

and other companies in its same industry.

(d) Participation in Benefit Plans. During the Employment Term, the Executive shall be

eligible to participate in all employee benefit plans and arrangements now in effect or which may hereafter be established which are generally applicable to the other senior executives of the Company or any of its subsidiaries, including without

limitation, all life, group insurance and health insurance plans and all disability, retirement, stock option and other employee benefit plans of the Company or any of its subsidiaries.

(e) Other Benefits. The Executive shall be entitled to the same vacation benefits as are generally available to other senior executives

of the Company, but which in no event shall be less than six (6) weeks per year. The Executive shall be reimbursed for all reasonable expenses incurred by him in the discharge of his duties, including but not limited to expenses for

entertainment and travel. The Executive shall account to the Company for all such expenses. The Executive shall be entitled to the use of one automobile substantially similar to the automobile of the type presently used by the Executive, and the

services of a driver or similarly-related personnel provided at the expense of the Company and reimbursement from the Company for insurance, maintenance and fuel expenses. The Executive shall be entitled to life insurance on the life of the

Executive payable to beneficiaries designated by the Executive in a face amount of not less than $5,000,000. The Executive shall be entitled to reimbursement for reasonable personal tax and accounting services to be performed by an accountant of the

Executive’s choosing. The Executive shall also be entitled to reimbursement for reasonable legal services in circumstances where: (a) the Executive is either named as a co-defendant or co-plaintiff along with the Company; and (b) the

Executive needs to retain separate counsel in connection with Company related matters as long as the Executive’s interest in such matters are not directly adverse to the Company.

2

5. Termination. The Executive’s employment hereunder shall terminate as a result of

any of the following events:

(a) the Executive’s death;

(b) upon the election of the Board of Directors of the Company in the event the Executive shall have been unable to substantially perform his

duties hereunder by reason of illness, accident or other physical or mental disability for a continuous period of at least ninety (90) days or an aggregate of ninety (90) days during any continuous twelve-month period

(“Disability”);

(c) for cause, where “Cause” shall mean that (i) the Executive has been convicted of fraud, theft

or embezzlement against the Company or any Subsidiary or has entered a plea of nolo contendere in connection with such charges, (ii) the Executive has been convicted of a felony or a crime involving moral turpitude or has entered a plea

of nolo contendere in connection with such charges, or (iii) an independent third-party has determined that (x) the Executive has breached any non-competition, confidentiality or non-solicitation agreement with the Company or any

Subsidiary, (y) the Executive has materially breached any of the terms of this Agreement and has failed to cure such breach within 45 days after the receipt of written notice of such breach from the Company, or (z) the Executive has

engaged in gross negligence or willful misconduct that causes calculable harm to the business and operations of the Company or a Subsidiary. In connection with sub-paragraph (iii)(x)-(z), the parties agree that whether any perceived breach or

violation is viable grounds for a Cause termination is to be determined by a mutually acceptable, independent third-party (e.g., a retired judge, an arbitrator, etc.) on an expedited basis, but in no event later than ninety days. The independent

third-party’s decision shall govern, though the parties expressly reserve all rights of appeal.

Any termination pursuant to

subparagraph (b) or (c) of this section shall be communicated by a written notice (“Notice of Termination”) which shall indicate the specific termination provision in this Agreement which is being relied upon and shall set forth

in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under such provision.

The Executive’s employment under this Agreement shall be deemed to have terminated as follows: (i) if the Executive’s

employment is terminated pursuant to subparagraph (a) above, on the date of his death; and (ii) if the Executive’s employment is terminated pursuant to subparagraph (b) or (c) above, on the date on which Notice of

Termination is given. The date on which termination is deemed to have occurred pursuant to this paragraph is hereinafter referred to as the “Date of Termination.”

3

6. Payments on Termination.

(a) Cause. If the Company shall terminate the Executive’s employment under subparagraph 5(c) for Cause, then, the Company shall pay

to the Executive the sum of the accrued Base Salary to which he is entitled through the Date of Termination together with all benefits, bonuses, accrued, unused vacation, incentive compensation and any other compensation accrued through such date,

as well as all reimbursements for reasonable and necessary business expenses incurred by Executive through the Date of Termination. Upon termination for Cause, all Non-Vested Options shall terminate. The Executive shall not be required to mitigate

the amount of any payment provided for in this subparagraph by seeking other employment or otherwise, nor shall the amount of any payment or benefit provided for in this subparagraph (a) be reduced by any compensation or retirement benefits

heretofore or hereafter earned by the Executive as the result of employment by any other person, firm or corporation.

(b) Death or

Disability. Upon termination pursuant to subparagraph 5(a) or 5(b) hereof, the Company shall pay the Executive’s estate or the Executive (or his guardian), as applicable, in a lump sum on the 30th day following the Date of Termination, the

sum of the accrued Base Salary to which the Executive is entitled through the Date of Termination together with all benefits, bonuses, incentive compensation and any other compensation accrued through such date. Upon termination pursuant to

subparagraph 5(a) or 5(b) hereof, all Non-Vested Options shall immediately vest and remain exercisable until the later of (i) two years from the Executive’s death or disability and (ii) the remaining term of the Option.

(c) Retention of Life Insurance. In the event of the termination of the Executive’s employment for any reason, then the Executive

shall have the option for a period of 90 days following the Date of Termination, upon written notice delivered to the Company during such 90-day period, to require that the Company, at the Company’s expense, transfer to him or any other entity

designated by the Executive the insurance policy on the life of the Executive required to be retained by the Company under Section 4(e) of this Agreement; provided, however, that commencing with the effective date of the transfer of such

insurance policy on the life of the Executive, the Executive shall be responsible for payment of any future premiums connected therewith.

7. Life Insurance. If requested by the Company, the Executive shall submit to such physical examinations and otherwise take such actions

and execute and deliver such documents as may be reasonably necessary to enable the Company to obtain life insurance on the life of the Executive.

8. Representations and Warranties.

(a) The Executive represents and warrants to the Company that the Executive is under no contractual or other restriction or obligation which

would prevent the performance of his duties hereunder, or interfere with the rights of the Company hereunder.

4

(b) The Company represents and warrants to the Executive that (i) it has all requisite power

and authority to execute, deliver, and perform this Agreement, (ii) all necessary corporate proceedings of the Company have been duly taken to authorize the execution, delivery, and performance of this Agreement, and (iii) this Agreement

has been duly authorized, executed, and delivered by the Company, is the legal, valid and binding obligation of the Company, and is enforceable as to the Company in accordance with its terms.

9. Confidential Information. All confidential or proprietary information which the Executive may obtain during the Employment

Term relating to the business or affairs of the Company or any affiliate of the Company (the “Confidential Information”) shall not be published, disclosed, or made accessible by him to any other person, firm, or corporation except in the

business and for the benefit of the Company. The provisions of this Section 9 shall not apply to any information which: (a) is or becomes publicly available otherwise than by breach of this Section 9 or (b) is required by law or

an order of any court, agency or proceeding to be disclosed (but only for the purposes of and to the minimum extent required by such compelled disclosure) provided that the Executive promptly notifies the Company of such requirement.

10. Non-Competition. During the Employment Term and for a period of one year thereafter, Executive shall not, without the express

written consent of the Company, directly or indirectly, own or control any “Competing Business” (as defined below) in any “Competing Market” (as defined below); provided, however, that, notwithstanding the foregoing,

Executive may invest in securities of any entity, solely for investment purposes and without participating in the business thereof, if (A) such securities are traded on any national securities exchange or automated quotation system or

equivalent non-U.S. securities exchange, (B) Executive is not a controlling person of, or a member of a group which controls, such entity and (C) Executive does not, directly or indirectly, own five percent (5%) or more of any class

of securities of such entity. For purposes of this section, a “Competing Business” is any enterprise engaged in the production, sale or distribution of content via radio, television, the world wide web, or other media used by the Company

as of the Date of Termination to distribute content as well as live concerts and events that (i) principally targets U.S. Hispanic audiences or (ii) creates, maintains or operates entertainment aimed at U.S. Hispanic consumers or users. A

division or subsidiary of a diversified business will be treated as a Competing Business only if (i) the diversified business falls within the preceding sentence and (ii) the Executive directly provides services to that division or

subsidiary as his primary employment within the diversified business. A “Competing Market” is a geographic market in which the Company or any affiliate has, on or before the Date of Termination, (i) commenced material operations or

(ii) determined before such date to commence such material operations. Notwithstanding anything to the contrary contained herein, the parties agree that Executive’s controlling interest in South Broadcasting System, Inc. shall not be

deemed a breach of this Agreement. Additionally, the Board of Directors shall have the authority to review: (a) the Executive’s potential ownership of a controlling equity interest in another entity or enterprise in a Competing

Business, as well as (b) the Executive’s potential engagement as a consultant to another entity or enterprise in a Competing Business, with such activities being approved if, in the discretion of the Board of Directors, such ownership

interest or consulting role either advances the interests of the Company, or is deemed to have either a neutral impact or no impact on the Company. Any controlling equity interest or consulting role approved in accordance with the preceding sentence

shall not be deemed a breach of this Agreement.

5

11. Non-Solicitation. During the Employment Term and for a period of one year thereafter,

Executive shall not, without the Company’s prior written consent, directly or indirectly, (i) knowingly solicit or knowingly encourage to leave the employment or independent contractor service of the Company, any person employed or

otherwise engaged as an independent contractor by the Company at the time of the termination thereof; or (ii) whether for Executive’s own account or for the account of any other person, firm, corporation or other business organization,

intentionally interfere with the Company’s relationship with, or divert or attempt to divert away from the Company, any person or entity who during Executive’s employment with the Company had any contractual or business relationship with

the Company or engaged in negotiations toward such a contract with the Company. Notwithstanding the above, nothing shall prevent Executive from soliciting loans, investment capital, management services or vendor services from third parties engaged

in the Business if the activities of Executive facilitated thereby do not otherwise adversely interfere with the operations of the Business.

12. Reasonableness of Restrictive Covenants. Executive has carefully read and considered the promises made in this Agreement. Executive

agrees that the promises made in this Agreement are reasonable and necessary for protection of the Company’s legitimate business interests, including but not limited, to its Confidential Information; existing and specific prospective customer

relationships; productive and competent workforce; and undisrupted workplace. Executive further agrees that prior to signing this Agreement, he has been provided a reasonable time to review the Agreement and an opportunity to consult separate

counsel concerning the terms of this Agreement.

13. No Geographic Restriction—Savings Clause. Executive acknowledges that, in

certain instances, there are no geographic restrictions stated in this Agreement. Instead, in those instances, this Agreement provides for employee- and customer-based restrictions that are reasonable and necessary for the protection of the

Company’s legitimate business interests. Notwithstanding, if a court of competent jurisdiction finds any of the foregoing covenants invalid for an unreasonable geographic restriction or lack of a geographic restriction, Executive agrees that

the applicable geographic restriction shall be the State of Florida, Miami-Dade County; State of California, Los Angeles County and Santa Clara County; State of Illinois, Cook County; State of New York, New York County, the Commonwealth of Puerto

Rico, Guaynabo County; and State of Texas, Harris County, or such greater or lesser geographic areas which the Court deems proper.

14.

Non-Disparagement. Executive will not during employment or at any time thereafter, criticize, ridicule, or make any statement which disparages or is derogatory of the Company, or any of its related companies, officers, directors, members,

agents, employees, contractors, customers, clients, vendors, suppliers, or licensees. The Company will not during the Executive’s employment or at any time thereafter, criticize, ridicule, or make any statement which disparages or is derogatory

of the Executive.

15. Tax Code Section 409A. This Agreement and the amounts payable and other benefits hereunder are intended

to comply with, or otherwise be exempt from, Section 409A (“Section 409A”) of the Internal Revenue Code of 1986, as amended (the “Tax Code”). This Agreement shall be administered, interpreted and construed in a manner

consistent with Section 409A. If any provision of this Agreement is found not to comply with, or otherwise not to be exempt from, the provisions of Section 409A, it shall be modified and given effect, in the sole discretion of the Company and

without requiring Executive’s consent, in such manner as the Company determines to be necessary or appropriate to comply with, or to effectuate an exemption from, Section 409A. Each payment under this Agreement shall be treated as a

separate identified payment for purposes of Section 409A. The preceding provisions shall not be construed as a guarantee by the Company of any particular tax effect to Executive of the payments and other benefits under this Agreement. The

Company shall not have any obligation to indemnify and/or hold harmless any person with respect to taxes, penalties and/or interest under Section 409A.

6

With respect to any reimbursement of expenses of, or any provision of in-kind benefits to, Executive, as

specified under this Agreement, such reimbursement of expenses or provision of in-kind benefits shall be subject to the following conditions: (a) the expenses eligible for reimbursement or the amount of in-kind benefits provided in one taxable

year shall not affect the expenses eligible for reimbursement or the amount of in-kind benefits provided in any other taxable year, except for any medical reimbursement arrangement providing for the reimbursement of expenses referred to in

Section 105(b) of the Tax Code; (b) the reimbursement of an eligible expense shall be made no later than the end of the year after the year in which such expense was incurred; and (c) the right to reimbursement or in-kind benefits

shall not be subject to liquidation or exchange for another benefit.

If and to the extent required to comply with Section 409A of the Tax Code, any

payment or benefit required to be paid hereunder on account of termination of Executive’s employment or service (or any other similar term) shall be made only in connection with a “separation from service” with respect to Executive

within the meaning of Section 409A of the Tax Code.

If a payment obligation under this Agreement arises on account of Executive’s separation

from service while Executive is a “specified employee” (as defined under Section 409A of the Tax Code and determined in good faith by the Company), any payment of “deferred compensation” (as defined under Treasury Regulation

Section 1.409A-1(b)(1), after giving effect to the exemptions in Treasury Regulation Sections 1.409A-1(b)(3) through (b)(12)) that is scheduled to be paid within six months after such separation from service shall accrue without interest and

shall be paid on the first day of the seventh month beginning after the date of Executive’s separation from service or, if earlier, upon the death of Executive.

16. Tax Code Sections 280G and 4999. Notwithstanding anything in this Agreement to the contrary, in the event that any payment or

benefit received or to be received by Executive (including any payment or benefit received in connection with a Change in Control or the termination of Executive’s employment, whether pursuant to the terms of this Agreement or any other plan,

arrangement or agreement) all such payments and benefits being hereinafter referred to as the “Total Payments” would not be deductible (in whole or part) by the Company as a result of section 280G of the Tax Code, then, to the extent

necessary to make the maximum amount of the Total Payments deductible, the portion of the Total Payments that does not constitute deferred compensation within the meaning of Section 409A of the Tax Code shall first be reduced (if necessary, to

zero), and all other Total Payments shall thereafter be reduced (if necessary, to zero), with cash payments being reduced before non-cash payments, and payments to be paid last being reduced first; provided, however, that such

reduction shall only be made if (i) the amount of such Total Payments, as so reduced (and after subtracting the net amount of federal, state and local income taxes on such reduced Total Payments) is greater than or equal to (ii) the amount

of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income taxes on such Total Payments and the amount of the excise tax imposed under Section 4999 of the Tax Code on such unreduced

Total Payments).

7

17. Survival. The covenants, agreements, representations and warranties contained in or

made pursuant to this Agreement shall survive the Executive’s termination of employment, irrespective of any investigation made by or on behalf of any party.

18. Entire Agreement; Modification. This Agreement sets forth the entire understanding of the parties with respect to the subject matter

hereof, supersedes all existing agreements and undertakings, whether written or oral between them regarding the Executive’s employment and compensation, and may be modified only by a written instrument duly executed by each party.

19. Notices. Any notice or other communication required or permitted to be given hereunder shall be in writing and shall be mailed by

certified mail, return receipt requested, or delivered against receipt to the party to whom it is to be given at the address of such party set forth below (or to such other address as the party shall have furnished in writing in accordance with the

provisions of this Section 19). Notice to the estate of the Executive shall be sufficient if addressed to the Executive as provided in this Section 19. Any notice or other communication given by certified mail shall be deemed given at the

time of certification thereof, except for a notice changing a party’s address which shall be deemed given at the time of receipt thereof.

[Intentionally omitted]

If to the Company:

7007

N.W. 77th Avenue

Miami, Florida 33166

20. Waiver. Any waiver by either party of a breach of any provision of this Agreement shall not operate as or be construed to be a

waiver of any other breach of such provision or of any breach of any other provision of this Agreement. The failure of a party to insist upon strict adherence to any term of this Agreement on one or more occasions shall not be considered a waiver or

deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement. Any waiver must be in writing.

21. Binding Effect. The Executive’s rights and obligations under this Agreement shall not be transferable by assignment or

otherwise, and any attempt to do any of the foregoing shall be void. The provisions of this Agreement shall be binding upon and inure to the benefit of each of the Company, its successors and assigns.

8

22. No Third Party Beneficiaries. This Agreement does not create, and shall not be

construed as creating, any rights enforceable by any person not a party to this Agreement; provided, however that Executive may designate one or more beneficiaries to receive any amounts that would otherwise be payable hereunder to Executive’s

estate or pursuant to the life insurance policy described in Section 4(e).

23. Headings. The headings in this Agreement are

solely for convenience of reference and shall be given no effect in the construction or interpretation of this Agreement.

24. Governing

Law. This Agreement shall be governed by the laws of the State of Florida, without regard to any conflicts of laws principles thereof that would call for the application of the laws of any other jurisdiction. The parties hereby agree that the

jurisdiction of, or the venue of, any action brought by either party shall be in a state or federal district court sitting in Miami Dade County, Florida and both Parties hereby agree to waive any right to contest such jurisdiction and venue.

25. Invalidity. The invalidity or unenforceability of any term of this Agreement shall not invalidate, make unenforceable or otherwise

affect any other term of this Agreement, which shall remain in full force and effect.

9

IN WITNESS WHEREOF, the parties have executed this Employment Agreement as of the date

first hereinabove written.

|

|

|

| SPANISH BROADCASTING SYSTEM, INC. |

|

|

| By: |

|

/s/ Joseph A. Garcia |

|

| EXECUTIVE: |

|

| /s/ Raúl Alarcón |

| Name: Raúl Alarcón |

10

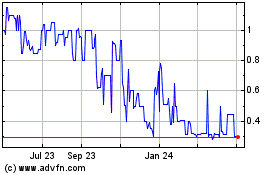

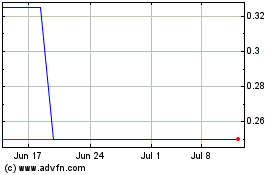

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Apr 2023 to Apr 2024