|

|

|

|

|

Prospectus Supplement No. 20

(to

Prospectus dated May 30, 2013)

|

|

Filed pursuant to Rule 424 (b)(4)

Registration No. 333-187508

|

125,000 Shares of Series A Convertible Preferred Stock

12,500,000 Shares of Common Stock Underlying the Preferred Stock

Warrants to Purchase up to 6,250,000 Shares of Common Stock and

6,250,000 Shares of Common Stock Underlying the Warrants

ARCA biopharma, Inc.

This prospectus supplement supplements the prospectus dated May 30, 2013 (the “Prospectus”), as supplemented by that certain

Prospectus Supplement No. 1 dated July 17, 2013 (“Supplement No. 1”), by that certain Prospectus Supplement No. 2 dated July 19, 2013 (“Supplement No. 2”), by that certain Prospectus Supplement

No. 3 dated July 24, 2013 (“Supplement No. 3”), by that certain Prospectus Supplement No. 4 dated July 30, 2013 (“Supplement No. 4”), by that certain Prospectus Supplement No. 5 dated

August 6, 2013 (“Supplement No. 5”), by that certain Prospectus Supplement No. 6 dated September 4, 2013 (“Supplement No. 6”), by that certain Prospectus Supplement No. 7 dated September 23,

2013 (“Supplement No. 7”), by that certain Prospectus Supplement No. 8 dated October 29, 2013 (“Supplement No. 8”), by that certain Prospectus Supplement No. 9 dated November 6, 2013

(“Supplement No. 9”), by that certain Prospectus Supplement No. 10 dated November 13, 2013 (“Supplement No. 10”), by that certain Prospectus Supplement No. 11 dated November 21, 2013

(“Supplement No. 11”), by that certain Prospectus Supplement No. 12 dated December 5, 2013 (“Supplement No. 12”), by that certain Prospectus Supplement No. 13 dated January 8, 2014 (“Supplement

No. 13”), by that certain Prospectus Supplement No. 14 dated February 10, 2014 (“Supplement No. 14”), by that certain Prospectus Supplement No. 15 dated February 12, 2014 (“Supplement

No. 15”), by that certain Prospectus Supplement No. 16 dated February 18, 2014 (“Supplement No. 16”), by that certain Prospectus Supplement No. 17 dated March 3, 2014 (“Supplement No. 17”),

by that certain Prospectus Supplement No. 18 dated March 20, 2014 (“Supplement No. 18”), and by that certain Prospectus Supplement No. 19 dated May 13, 2014 (“Supplement No. 19”, and together with

Supplement No. 1, Supplement No. 2, Supplement No. 3, Supplement No. 4, Supplement No. 5, Supplement No. 6, Supplement No. 7, Supplement No. 8, Supplement No. 9, Supplement No. 10, Supplement

No. 11, Supplement No. 12, Supplement No. 13, Supplement No. 14, Supplement No. 15, Supplement No. 16, Supplement No. 17, and Supplement No. 18, the “Supplements”), which form a part of our

Registration Statement on Form S-1 (Registration No. 333-187508). This prospectus supplement is being filed to update and supplement the information in the Prospectus and the Supplements with the information contained in our current report on

Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on June 9, 2014 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus, the Supplements and this prospectus supplement relate to the offer and sale of up to 125,000 shares of Series A Convertible

Preferred Stock (“Preferred Stock”) which are convertible into 12,500,000 shares of Common Stock, warrants to purchase up to 6,250,000 shares of our Common Stock and 6,250,000 shares of Common Stock underlying the warrants.

This prospectus supplement should be read in conjunction with the Prospectus and the Supplements. This prospectus supplement updates and

supplements the information in the Prospectus and the Supplements. If there is any inconsistency between the information in the Prospectus, the Supplements and this prospectus supplement, you should rely on the information in this prospectus

supplement.

Our common stock is traded on the Nasdaq Global Market under the trading symbol “ABIO.”

On June 9, 2014, the last reported sale price of our common stock was $1.49 per share.

Investing in our securities involves a

high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of the Prospectus and beginning on page 25 of our quarterly report on Form 10-Q for the period

ended March 31, 2014 before you decide whether to invest in shares of our common stock.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 9, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

June 9, 2014 (June 5, 2014)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-22873

|

|

36-3855489

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.07 Submission of Matters to a Vote of Security Holders

On June 5, 2014, the Company held it’s 2014 Annual Meeting of Stockholders (the “2014 Annual Meeting”) at which the Company’s

stockholders voted upon (i) the election of Company nominees Dr. Michael R. Bristow and Mr. Robert E. Conway, to the Company’s Board of Directors (the “Board”) for a three-year term ending at the 2017 Annual

Meeting of Stockholders and (ii) the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

The stockholders elected both director nominees and ratified the selection of KPMG LLP as the Company’s independent registered public accounting firm for

the fiscal year ending December 31, 2014. The tabulation of votes cast with respect to each matter voted upon, as applicable, was as follows:

1. Election of Directors

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

Michael R. Bristow, M.D., Ph.D.

|

|

3,698,688

|

|

119,242

|

|

10,028,926

|

|

Robert E. Conway

|

|

3,707,261

|

|

110,669

|

|

10,028,926

|

2. Ratification of the selection of KPMG LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2014

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

13,763,868

|

|

72,354

|

|

10,634

|

|

—

|

Item 8.01 Other Events

Appointment of Robert E. Conway as Chairman of the Board of Directors

On June 5, 2014, the Board also appointed Mr. Conway as the Chairman of the Board of the Company. A copy of the press release relating to Mr.

Conway’s election is attached hereto as Exhibit 99.1

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release titled “Robert E. Conway Elected Chairman of ARCA biopharma Board of Directors” dated June 9, 2014.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: June 9, 2014

|

|

|

|

|

ARCA biopharma, Inc.

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Christopher D. Ozeroff

|

|

Name:

|

|

Christopher D. Ozeroff

|

|

Title:

|

|

Senior Vice President and General Counsel

|

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release titled “Robert E. Conway Elected Chairman of ARCA biopharma Board of Directors” dated June 9, 2014.

|

4

Exhibit 99.1

ROBERT E. CONWAY ELECTED CHAIRMAN OF ARCA BIOPHARMA

BOARD OF DIRECTORS

Westminster, CO,

June 9, 2014

– ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company developing genetically-targeted therapies for cardiovascular diseases, today announced that Robert E. Conway, has been elected Chairman of the

Company’s Board of Directors. He serves on the Audit and Compensation Committees of the Board of Directors.

Mr. Conway has over 30 years of

executive leadership experience in the pharmaceutical and biotechnology industries. Mr. Conway served as the Chief Executive Officer and member of the Board of Directors of Array BioPharma from 1999 to 2012. Array is a biopharmaceutical company

focused on the discovery, development and commercialization of targeted small molecule drugs to treat patients afflicted with cancer and inflammatory diseases. Prior to joining Array, Mr. Conway was the Chief Operating Officer and Executive

Vice President of Hill Top Research, Inc., a clinical research services company, from 1996 to 1999. He also held various executive positions for Corning Inc. including Corporate Vice President and General Manager of Corning Hazleton, Inc., a

contract research organization. Mr. Conway serves as the Chairman of Wall Family Enterprise, a leading library and education supplies company. He is on the Board of Directors of eResearch Technology, Inc. In addition, Mr. Conway is a

member of the Strategic Advisory Committee of Genstar Capital, LLC.

“Bob’s experience and leadership are a tremendous asset to ARCA,” said

Dr. Michael R. Bristow, President and Chief Executive Officer of ARCA. “With his significant experience in leading both drug development efforts and companies in the biopharmaceutical sector, Bob’s input and guidance will be

valuable to the ARCA Board as we continue the development of Gencaro and look to deliver value to our stockholders.”

“I am honored to accept

this role with the ARCA Board of Directors,” said Mr. Conway. “This is an exciting time for the organization with the GENETIC-AF trial under way. We believe there is an unmet medical need for new atrial fibrillation treatments. The

GENETIC-AF trial, conducted with the collaboration of Medtronic, will hopefully provide important new data for the atrial fibrillation community.”

About ARCA biopharma

ARCA biopharma is dedicated to

developing genetically-targeted therapies for cardiovascular diseases. The Company’s lead product candidate, Gencaro

TM

(bucindolol hydrochloride), is an investigational, pharmacologically

unique beta-blocker and mild vasodilator being developed for atrial fibrillation. ARCA has identified common genetic variations that it believes predict individual patient response to Gencaro, giving it the potential to be the first

genetically-targeted atrial fibrillation prevention treatment. ARCA has a collaboration with Medtronic, Inc. for support of the GENETIC-AF trial. For more information please visit

www.arcabiopharma.com

.

Safe Harbor Statement

This press release contains “forward-looking statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to, statements regarding, potential timing for patient enrollment in the GENETIC-AF trial, the sufficiency of the Company’s capital to support its operations, the potential for genetic

variations to predict individual patient response to Gencaro, Gencaro’s potential to treat atrial fibrillation, future treatment options for patients with atrial fibrillation, and the potential for Gencaro to be the first genetically-targeted

atrial fibrillation prevention treatment. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking

statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: the Company’s financial resources and whether they will be sufficient to meet the Company’s business objectives and

operational requirements; results of earlier clinical trials may not be confirmed in future trials, the protection and market exclusivity provided by the Company’s intellectual property; risks related to the drug discovery and the regulatory

approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the SEC, including without limitation the Company’s annual

report on Form 10-K for the year ended December 31, 2013, and subsequent filings. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabiopharma.com

###

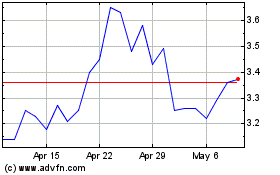

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

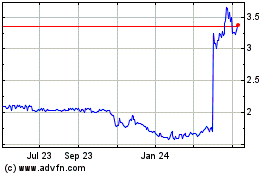

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2023 to Apr 2024