Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-195387

PROSPECTUS SUPPLEMENT

(to the prospectus dated May 12, 2014)

ONCOSEC MEDICAL INCORPORATED

22,535,212

Shares of Common Stock

Warrants to Purchase

9,239,438

Shares of Common Stock

9,239,438

Shares of Common Stock Underlying Warrants

We are offering up to 22,535,212 shares of our common stock and warrants to purchase up to 7,887,325 shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants) pursuant to a securities purchase agreement, dated June 3, 2014. Each share of common stock we sell in this offering will be accompanied by a warrant to purchase up to 0.35 shares of common stock at an exercise price of $0.90 per full share. Each share of common stock and accompanying warrant will be sold at a negotiated price of $0.71. The shares of common stock and warrants will be issued separately but can only be purchased together in this offering.

We are also registering warrants to purchase up to 1,352,113 shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants) issuable to the placement agent and the financial advisors in the offering under the registration statement of which this prospectus supplement forms a part.

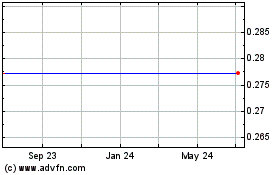

Our common stock is quoted for trading on the OTC Markets Group Inc.’s OTCQB tier (“OTCQB”) under the symbol “ONCS”.

We do not intend to apply for any listing of the warrants on any securities exchange and we do not expect that the warrants will be quoted on the OTCQB marketplace. On

June 3, 2014

, the closing price of our common stock on the OTCQB marketplace was $

0.79

per share.

|

|

|

Per Share (1)

|

|

Total

|

|

|

Offering Price

|

|

$

|

0.71

|

|

$

|

16,000,000

|

|

|

Placement Agent’s Fees (2)

|

|

$

|

0.04

|

|

$

|

960,000

|

|

|

Offering Proceeds, Before Expenses, to us

|

|

$

|

0.67

|

|

$

|

15,040,000

|

|

(1)

Per share price represents the offering price for a share of common stock and a warrant to purchase

0.35

of a share of common stock.

(2)

In addition, we have agreed to issue to the placement agent warrants to purchase up to an aggregate of

6

% of the aggregate number of shares of common stock sold in this offering and to pay to the placement agent a non-accountable expense allowance equal to

1

% of the aggregate gross proceeds raised in the offering and to reimburse certain legal expenses of the placement agent as described in the “Plan of Distribution” section herein.

H.C. Wainwright & Co., LLC has agreed to act as our placement agent in this offering. The placement agent is not purchasing any of the securities offered by us, and is not required to sell any specific number or dollar amount of securities, but will use its best efforts to sell the securities offered. We have agreed to pay the placement agent a placement fee equal to 6% of the aggregate gross proceeds to us from the sale of the common stock in the offering and to issue to the placement agent warrants to purchase up to an aggregate of 6% of the aggregate number of shares of common stock sold in the offering, provided that we may choose to pay up to 45% of the amount of the cash fee and issue up to 45% of the placement agent warrants directly to one or more other broker-dealers acting as financial advisors in the offering. We have engaged Maxim Group LLC (“Maxim”) and Noble Financial Capital Markets (“Noble”) as financial advisors with respect to the offering, and have agreed to pay 22.5% of the placement agent fee and issue 22.5% of the placement agent warrants to each of Maxim and Noble in consideration for their financial advisory services. We estimate total expenses of this offering, excluding the placement agent fees, will be approximately $65,000. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. See “Plan of Distribution” beginning on page S-20 of this prospectus for more information on this offering and the placement agent arrangements.

Delivery of the shares of common stock and warrants is expected to be made on or about

June 6

, 2014, subject to customary closing conditions.

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should review carefully the risks and uncertainties described under the heading “Risk Factors” on page S-6 of this

prospectus supplement. This prospectus supplement should be read in conjunction with and may not be delivered or utilized without the prospectus dated May 12, 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is

June 5

, 2014.

Table of Contents

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You must not rely on any unauthorized information or representations. This prospectus supplement and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”), utilizing a “shelf” registration process. Each time we sell securities under the accompanying base prospectus we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the price, the amount of securities being offered and the plan of distribution. The shelf registration statement was initially filed with the SEC on April 18, 2014, and was declared effective by the SEC on May 12, 2014. This prospectus supplement describes the specific details regarding this offering and may add, update or change information contained in the accompanying prospectus. The accompanying base prospectus provides general information about us, some of which, such as the section entitled “Plan of Distribution,” may not apply to this offering.

If information in this prospectus supplement is inconsistent with the accompanying base prospectus or the information incorporated by reference, you should rely on this prospectus supplement. This prospectus supplement, together with the base prospectus and the documents incorporated by reference into this prospectus supplement and the base prospectus, includes all material information relating to this offering. We have not authorized anyone to provide you with different or additional information. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should carefully read this prospectus supplement, the base prospectus, the information and documents incorporated herein by reference and the additional information under the heading “Where You Can Find More Information” before making an investment decision

.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus to “our Company,” “we,” “us,” “our” and “OncoSec” refer to OncoSec Medical Incorporated, a Nevada corporation.

S-1

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus supplement and the accompanying base prospectus carefully, including the section entitled “Risk Factors” beginning on page S-

6

and our consolidated financial statements and the related notes and the other information incorporated by reference into this prospectus supplement and the accompanying prospectus before making an investment decision.

Our Company

We are an emerging drug-medical device and therapeutic company focused on designing, developing and commercializing innovative and proprietary medical approaches for the treatment of solid tumors where currently approved therapies are inadequate based on their efficacy or side-effects. Our Company was incorporated under the laws of Nevada on February 8, 2008 under the name “Netventory Solutions Inc.” Initially, we provided online inventory services to small and medium sized companies. On March 1, 2011, we changed our name to “OncoSec Medical Incorporated.” In March 2011, we acquired from Inovio Pharmaceuticals, Inc. (“Inovio”) certain assets related to the use of drug-medical device combination products for the treatment of various cancers. With this acquisition, we have abandoned our efforts in the online inventory services industry and are focusing our efforts in the biomedical industry.

As a biopharmaceutical company focused on discovering and developing novel immunotherapeutic products to improve cancer treatment options for patients and physicians, our portfolio includes biologic immunotherapy product candidates intended to treat a wide range of oncology indications. Our technology includes intellectual property relating to certain delivery technologies, which we refer to as ImmunoPulse (“ImmunoPulse”), a therapeutic approach that is based on the use of an electroporation delivery device in combination with a DNA-based cytokine to treat solid tumors. In addition, our portfolio also includes an asset that utilizes electroporation delivery with an approved chemotherapeutic drug, which we refer to as NeoPulse (“NeoPulse”). These two different approaches represent unique therapeutic modalities. Our ImmunoPulse approach is based on the use of electroporation to enhance the local delivery of DNA plasmids encoding for different targets which, upon uptake into cells, direct the production of immunostimulatory cytokines to generate a local, regional and systemic immune response for the treatment of various cutaneous cancers. Our NeoPulse approach utilizes our electroporation technologies for the local delivery of the chemotherapeutic drug bleomycin to treat solid tumors. Our electroporation devices which are referred to as the OncoSec Medical System (“OMS”) consists of an electrical pulse generator console and various disposable applicators specific to the individual tumor size, type and location and is designed to increase the permeability of cancer cell membranes and, as a result, increases the intracellular delivery of selected therapeutic agents. Using either ImmunoPulse, a DNA-based immunotherapy or NeoPulse, therapies to treat solid tumors, our mission is to enable people with cancer to live longer with a better quality of life than otherwise possible or available with existing therapies.

Immunotherapy, a process which uses the patient’s own immune system to treat cancer, may have advantages over surgery, radiation, and chemotherapy. Many cancers appear to have developed the ability to “hide” from the immune system. A treatment that can augment the immune response against tumor cells by making the cancer more “visible” to the immune system would likely represent a significant improvement in cancer therapy. Immune-enhancing proteins such as interleukin-2, or IL-2, and interferon-alpha, or IFN-

a

, have shown encouraging results. However, these agents often require frequent doses that may result in severe side effects.

Our lead product candidate, OMS-I100 an immunotherapy for metastatic melanoma, is being studied in a Phase 2 open label clinical trial. This 30 patient trial was recently expanded with a protocol addendum which will allow for the assessment of the safety and efficacy of an increased dose frequency of a six-week treatment cycle with ImmunoPulse in up to 21 additional melanoma patients. Our ImmunoPulse melanoma program is designed with an objective to harness multiple components of the immune system to combat cancer, either as a monotherapy or in combination with current treatment regimens without incremental toxicity. A Phase 2b study is planned for OMS I100 in combination with anti-PD-1/PDL-1 therapy to evaluate the effectiveness of OMS-I100 to potentially improve the outcome of patients that may not respond to the expected new front line immunotherapy for advanced

S-2

Table of Contents

metastatic melanoma. Initiation of the study is dependent on several factors including accessing the PD1/PDL-1 antibody and United States Food and Drug Administration, or FDA, approval. We have expanded our development effort for melanoma based on encouraging Phase 2 data to date that suggests improvement in both overall response and disease-free and overall survival. Our additional ImmunoPulse product candidates in clinical development include our OMS-I110 Merkel Cell Carcinoma and OMS-I120 Cutaneous T-Cell Lymphoma studies. To date, our ImmunoPulse product candidates have been dosed in more than 65 cancer patients, as a monotherapy, and have demonstrated a favorable safety profile.

Our ImmunoPulse product candidates are based on our proprietary DNA based immunotherapy technology, which is designed to stimulate the human immune system. Our ImmunoPulse product candidates use synthetic cytokines from previously established cell lines rather than cells derived from the patient. We believe our approach enables a simpler, more consistent and scalable manufacturing process than therapies based on patient specific tissues or cells. Our product candidates are designed with an objective to harness multiple components of the immune system to combat cancer, either as a monotherapy or in combination with current treatment regimens without incremental toxicity. Our rationale for combination based immunotherapy is connected to the question of why certain patients may respond to immunotherapy while others may not respond. The responder versus non-responder phenotype of a solid tumor may be linked to solid tumors requiring certain characteristics of a highly tumorigenic environment that may correlate with efficacy of therapies. Specifically, in order for immunotherapy to be effective it is important for the presence of immune stimulatory cytokines and chemokines, the presence of co-stimulatory molecules, the presence of tumor antigens with normal MHC presentation, a low engagement of inhibitory molecules, and normal cell adhesion and trafficking. All of these factors converge to create an environment that is high in TIL infiltration, and TIL infiltration can be a biomarker correlated with the efficacy of immunotherapies. The opposite environment is characteristic of poor immunogenicity and potentially lack of response to an immunotherapy. Lack of immune stimulatory cytokines and chemokines, lack of costimulatory molecules, lack of tumor antigens or inadequate MHC presentation, a high engagement of inhibitory molecules, and aberrant cell adhesion or trafficking can lead to a low TIL infiltration which is associated with poor response to therapies. We believe ImmunoPulse, specifically, DNA based IL-12 delivered intratumorally may have the characteristics to have the ability to have a programmatic change in the microtumor environment and systemically to allow for potentially higher effectiveness of other immunotherapies.

We are also conducting research and development on other targets with an aim to produce new drugs capable of breaking the immune system’s tolerance to cancer through the basis that several of the components of a highly immunogenic environment are lost in cancer. At OncoSec, we have the opportunity to bring these back via plasmid expression with electroporation. We can introduce, for example, pro-inflammatory cytokines and chemokines, immune stimulatory receptors, co-stimulatory molecules, adhesion molecules, tumor suppressor genes and T-cell engagement molecules. Expression of these molecules can bring back the immune stimulatory components, block inhibitory molecules, and normalize cell adhesion and trafficking, all of which can increase TIL infiltration and lead to a more highly immunogenic environment.

We are also conducting small-molecule based research and development with an aim to produce new drugs capable of breaking the immune system’s tolerance to cancer through inhibition of the indoleamine-(2,3)-dioxygenase, or IDO, pathway. We are currently studying our lead IDO pathway inhibitor product candidate, d-1-methyltryptophan or indoximod, in collaboration with the National Cancer Institute, or NCI. We believe that our immunotherapeutic technologies will enable us to discover, develop and commercialize multiple product candidates that can be used either alone or in combination to enhance or potentially replace current therapies.

Two drugs for metastatic melanoma were approved in 2011, both on the basis of increased survival. Yervoy ®, a monoclonal antibody marketed by Bristol-Myers Squibb Co., increases the effectiveness of T-cells that can seek out and destroy melanoma cells. Zelboraf ®, a B-Raf inhibitor marketed by Genentech, a member of the Roche Group, interrupts a key process in melanoma growth in patients with a particular melanoma mutation. Both drugs are associated with significant side effects, and neither is considered a cure for melanoma.

In May 2013, two new drugs for metastatic melanoma were approved. Tafinlar® and Mekinist™ are single-agent oral treatments for the treatment of unresectable metastatic melanoma marketed by GlaxoSmithKline. Like Zelboraf®, both of these new agents interrupt a key process in melanoma growth by inhibiting the MAP

Kinase signaling pathway. Also, like Zelboraf, these agents can cause significant side effects and long-term use may lead to drug resistance by tumor cells.

S-3

Table of Contents

Our goal is to improve the lives of people suffering from the life-altering effects of cancer through the development of our novel treatment approaches. In pursuit of our goal, we have initiated three Phase II clinical trials for the use of our therapies to treat metastatic melanoma, Merkel cell carcinoma and cutaneous T-cell lymphoma. We also continue to investigate collaboration opportunities that will enable us to identify combinations with current standards of care, using immune-modulating checkpoint inhibitors (i.e. anti-CTLA-4 or anti-PD-1) that may improve the efficacy of standard of care.

We may seek regulatory approvals to initiate specific studies in target markets to collect clinical, reimbursement, and pharmacoeconomic data in order to advance a commercialization strategy. Our clinical development strategy includes completing the necessary additional clinical trials in accordance with FDA guidelines for cutaneous cancers including select rare cancers that have limited, adverse or no therapeutic alternatives. Our strategy also includes expanding the applications of our technologies through strategic collaborations or evaluation of other opportunities such as in-licensing and strategic acquisitions. We may collaborate with major pharmaceutical and biotechnology companies and government agencies, providing us access to complementary technologies or greater resources. These business activities are intended to provide us with mutually beneficial opportunities to expand or advance our product pipeline and serve significant unmet medical needs. We may license our intellectual property to other companies to leverage our technologies for applications that may not be appropriate for our independent product development.

Corporate Information

We were incorporated under the laws of the State of Nevada on February 8, 2008 under the name Netventory Solutions Inc. to pursue the business of inventory management solutions. Effective March 1, 2011, we completed a merger with our subsidiary, OncoSec Medical Incorporated, a Nevada corporation which was incorporated solely to effect a change in our name. As a result, we have changed our name from “Netventory Solutions Inc.” to “OncoSec Medical Incorporated”. Our principal executive offices are located at 9810 Summers Ridge Road, Suite 110, San Diego, California 92121. The telephone number at our principal executive office is (855) 662-6732. Our website address is www.oncosec.com. Information contained on our website is not deemed part of this prospectus supplement.

Risk Factors

Our business is subject to substantial risk. Please carefully consider the “Risk Factors” beginning on page S-6 of this prospectus supplement and other information included and incorporated by reference in this prospectus supplement for a discussion of the factors you should consider carefully before deciding to purchase the securities offered by this prospectus supplement. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. You should be able to bear a complete loss of your investment.

S-4

Table of Contents

The Offering

The following is a brief summary of some of the terms of the offering and is qualified in its entirety by reference to the more detailed information appearing elsewhere in this prospectus supplement and the accompanying prospectus. For a more complete description of the terms of our common stock, see the “Description of Securities We Are Offering” section in this prospectus supplement.

|

Securities offered by us in this offering

|

|

22,535,212

shares of our common stock, par value $0.0001 per share.

Warrants to purchase up to

7,887,325

shares of common stock, with an exercise price equal to $

0.90

per share.

7,887,325

shares of common stock issuable upon exercise of the warrants.

|

|

|

|

|

|

Offering price

|

|

$

0.71

per share of common stock and accompanying warrant to purchase 0.35 shares of our common stock.

|

|

|

|

|

|

Common stock outstanding immediately before this offering

|

|

221,853,215

shares.

|

|

|

|

|

|

Common stock to be outstanding immediately after this offering

|

|

244,388,427

shares (assuming the sale of all shares covered by this prospectus and assuming no exercise of any of the warrants offered hereby).

|

|

|

|

|

|

Use of proceeds

|

|

We expect to use the proceeds received from the offering to fund our clinical trials and for other working capital and general corporate purposes. See “Use of Proceeds” on page S-

22

.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” and other information included in this prospectus supplement or incorporated herein by reference for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

|

|

|

|

OTCQB symbol

|

|

ONCS. There is no established trading market for the warrants and we do not expect a market to develop.

|

The number of shares of our common stock outstanding immediately before and immediately after this offering excludes:

·

7,887,325 shares of common stock issuable upon exercise of the warrants being offered in this offering;

·

1,352,113 shares of common stock issuable upon exercise of warrants issuable to the placement agent and the financial advisors in connection with this offering;

·

13,142,500

shares of common stock issuable upon exercise of options outstanding as of

June 3, 2014

, of which approximately

7,200,000

shares are exercisable as of

June 3, 2014

;

·

897,625

shares of common stock reserved for issuance and available for future grant under our 2011 Stock Incentive Plan, as amended (the “2011 Plan”), as of

June 3

, 2014

; and

·

28,886,272

shares of common stock issuable upon exercise of warrants outstanding as of

June 3

, 2014, which have exercise prices ranging from $

0.26

to $

1.20

per share.

|

Placement agent warrants

|

|

We are also registering warrants to purchase up to 1,352,113 shares of our common stock (and the shares of common stock issuable from time to time upon exercise of these warrants) issuable to the placement agent and the financial advisors in the offering under the registration statement of which this prospectus supplement forms a part. The placement agent warrants shall have substantially the same terms as the warrants offered in this offering, except that the expiration date shall be five years from the effective date of the registration statement of which this prospectus forms a part.

|

S-5

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before purchasing our common stock, you should carefully consider the following risk factors as well as all other information contained in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference, including our consolidated financial statements and the related notes. Each of these risk factors, either alone or taken together, could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our common stock. There may be additional risks that we do not presently know of or that we currently believe are immaterial which could also impair our business and financial position. If any of the events described below were to occur, our financial condition, our ability to access capital resources, our results of operations and/or our future growth prospects could be materially and adversely affected and the market price of our common stock could decline. As a result, you could lose some or all of any investment you may have made or may make in our common stock.

Risks Related to this Offering and Our Common Stock

You will experience immediate dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered is substantially higher than the book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on an assumed offering price to the public of $

0.71

per share, if you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of $

0.56

per share in the net tangible book value of the common stock. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

Our management will have broad discretion over the use of the net proceeds from this offering.

We currently anticipate using the net proceeds from this offering for working capital and general corporate purposes, including funding our clinical trials. We have not reserved or allocated specific amounts for these purposes and we cannot specify with certainty how we will use the net proceeds. Accordingly, our management will have considerable discretion in the application of the net proceeds and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or market value. Until the net proceeds are used, they may be placed in investments that do not produce income or that lose value.

The warrants are a new issue of securities with no established trading market.

The warrants are a new issue of securities with no established trading market. The warrants will not be listed on any securities exchange and we do not expect them to be quoted on any quotation system. A trading market for the warrants is not expected to develop, and even if a market develops it may not provide meaningful liquidity. The absence of a trading market or liquidity for the warrants may adversely affect their value.

If we issue additional shares in the future, our existing stockholders will be diluted.

Our articles of incorporation authorize the issuance of up to 3,200,000,000 shares of common stock with a par value of $0.0001 per share. In addition to capital raising activities, other possible business and financial uses for our authorized common stock include, without limitation, future stock splits, acquiring other companies, businesses or products in exchange for shares of common stock, issuing shares of our common stock to partners in connection with strategic alliances, attracting and retaining employees by the issuance of additional securities under our various equity compensation plans, or other transactions and corporate purposes that our Board of Directors deems are in the Company’s best interest. Additionally, shares of common stock could be used for anti-takeover purposes or to delay or prevent changes in control or management of the Company. We cannot provide assurances that any issuances of common stock will be consummated on favorable terms or at all, that they will enhance stockholder value, or that they will not adversely affect our business or the trading price of our common stock. The issuance of any such shares will reduce the book value per share and may contribute to a reduction in the market price of the outstanding

shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current stockholders. Further, such issuance may result in a change of control of our corporation.

S-6

Table of Contents

Sales of common stock by our stockholders, or the perception that such sales may occur, could depress our stock price.

The market price of our common stock could decline as a result of sales by, or the perceived possibility of sales by, our existing stockholders. Since March 2011, we have completed a number of offerings of our common stock and warrants and as of

June 3

, 2014, have issued an aggregate of

221,853,215

shares of our common stock, including common stock underlying warrants. Future sales of common stock by significant stockholders, including by those who acquired their shares in our prior offerings or who are affiliates, or the perception that such sales may occur, could depress the price of our common stock.

If outstanding options and warrants to purchase shares of our common stock are exercised, the interests of our stockholders could be diluted.

We have issued a total of 23,367,417 shares of our common stock as a result of warrant exercises during the six month period ended January 31, 2014, and we have issued an additional 31,129,574 shares of our common stock as a result of warrant and stock option exercises that occurred between February 1, 2014 and

June 3

, 2014. Following such exercises, we have a total of

221,853,215

shares of common stock issued and outstanding as of

June 3

, 2014. In addition, we currently have

14,700,000

shares reserved for issuance under the 2011 Plan and pursuant to non-plan awards for vested and unvested stock options, and we have an additional

28,886,272

shares reserved for issuance following the exercise of outstanding warrants as of such date. The exercise of options and warrants, and the sale of shares underlying such options or warrants, could have an adverse effect on the market for our common stock, including the price that an investor could obtain for their shares. Investors may experience dilution in the net tangible book value of their investment upon the exercise of outstanding options and warrants granted under our stock option plans, and options and warrants that may be granted or issued in the future. In future periods, we may elect to reduce the exercise price of outstanding warrants as a means of providing additional financing to us.

Trading of our stock is restricted by the SEC’s “penny stock” regulations and certain FINRA rules, which may limit a stockholder’s ability to buy and sell our common stock.

Our securities are covered by certain “penny stock” rules, which impose additional sales practice requirements on broker-dealers who sell low-priced securities to persons other than established customers and accredited investors. For transactions covered by these rules, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale, among other things. In addition, the penny stock rules require a broker-dealer, before effecting a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing before effecting the transaction, and must be given to the customer in writing before or with the customer’s confirmation. These rules may affect the ability of broker-dealers and holders to sell our common stock and may negatively impact the level of trading activity for our common stock. To the extent our common stock remains subject to the penny stock regulations, such regulations may discourage investor interest in and adversely affect the market liquidity of our common stock.

The Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some

customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit stockholder’s ability to buy and sell our stock and have an adverse effect on the market for our shares.

S-7

Table of Contents

Our common stock is illiquid and subject to volatility and the price of our common stock may be negatively impacted by factors which are unrelated to our operations.

Our common stock is quoted for trading on the OTCQB. Trading of securities quoted on OTCQB is frequently highly volatile, with low trading volume. Since our common stock became available for trading on the OTCQB, we have experienced significant fluctuations in the stock price and trading volume of our common stock. There is no assurance that a sufficient market will develop in our stock, in which case it could be difficult for stockholders to sell their stock. The market price of our common stock could continue to fluctuate substantially.

Factors affecting the trading price of our common stock may include:

·

adverse research and development or clinical trial results;

·

conducting open-ended clinical trials which could lead to results (success or setbacks) being obtained by the public prior to a formal announcement by us;

·

our inability to obtain additional capital;

·

announcement that the FDA denied our request to approve our products for commercialization in the United States, or similar denial by other regulatory bodies which make independent decisions outside the United States;

·

potential negative market reaction to the terms or volume of any issuance of shares of our stock to new investors or service providers;

·

sales of substantial amounts of our common stock, or the perception that substantial amounts of our common stock will be sold, by our stockholders in the public market;

·

declining working capital to fund operations, or other signs of apparent financial uncertainty;

·

significant advances made by competitors that adversely affect our potential market position; and

·

the loss of key personnel and the inability to attract and retain additional highly-skilled personnel.

We have never paid dividends on our capital stock, and we do not anticipate paying any cash dividends in the foreseeable future.

The continued operation and expansion of our business will require substantial funding. Investors seeking cash dividends in the foreseeable future should not purchase our common stock. We have paid no cash dividends on any of our capital stock to date and we currently intend to retain our available cash to fund the development and growth of our business. Any determination to pay dividends in the future will be at the discretion of our Board of Directors and will depend upon results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our Board of Directors deems relevant. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Any return to stockholders will therefore be limited to the appreciation of their stock, which may never occur.

S-8

Table of Contents

Risks Related to our Business

We will need to raise additional capital in future periods to continue operating our business, and such additional funds may not be available on acceptable terms or at all.

We do not generate, and may never generate, any cash from operations and must raise additional funds in order to continue operating our business. We estimate our aggregate cash requirements for our current fiscal year ending July 31, 2014 to be approximately $10.9 million, which is inclusive of our approximate $4.8 million in cash outflows for the six month period ended January 31, 2014. As of January 31, 2014, we had cash and cash equivalents of approximately $18.5 million.

We have a history of raising funds through offerings of our common stock, and we may in the future raise additional funds through public or private equity offerings, debt financings or corporate collaborations and licensing arrangements. We expect to continue to fund our operations primarily through equity and debt financings in the future. If additional capital is not available, we may not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely. We will require additional financing to fund our planned operations, including developing and commercializing our intellectual property, seeking to license or acquire new assets, researching and developing any potential patents, related compounds and other intellectual property, funding potential acquisitions, and supporting clinical trials and seeking regulatory approval relating to our assets and any assets we may acquire in the future. Additional financing may not be available to us when needed or, if available, may not be available on commercially reasonable terms. If we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience substantial dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses. Obtaining commercial loans, assuming those loans would be available, would increase our liabilities and future cash commitments.

We may not be able to obtain additional financing if the volatile conditions in the capital and financial markets, and more particularly the market for early development stage biomedical company stocks, persist. Weak economic and capital markets conditions could result in increased difficulties in raising capital for our operations. We may not be able to raise money through the sale of our equity securities or through borrowing funds on terms we find acceptable. If we cannot raise the funds that we need, we will be unable to continue our operations, and our stockholders could lose their entire investment in our company.

We have never generated revenue from our operations.

We have not generated any revenue from operations since our inception. During the six month period ended January 31, 2014, we incurred a net loss of approximately $4.7 million. From our inception through January 31, 2014, we have incurred an aggregate loss of approximately $18.0 million. We expect that our operating expenses will continue to increase as we expand our current headcount, further our development activities and continue to pursue FDA approval for our product candidates.

We are an early-stage company with a limited operating history, which may hinder our ability to successfully meet our objectives.

We are an early-stage company with only a limited operating history upon which to base an evaluation of our current business and future prospects and how we will respond to competitive, financial or technological challenges. Only recently have we explored opportunities in the biomedical industry. As a result, the revenue and income potential of our business is unproven. In addition, because of our limited operating history, we have limited insight into trends that may emerge and affect our business. Errors may be made in predicting and reacting to relevant business trends and we will be subject to the risks, uncertainties and difficulties frequently encountered by early-stage companies in evolving markets. We may not be able to successfully address any or all of these risks and uncertainties. Failure to adequately do so could cause our business, results of operations and financial condition to suffer or fail.

We have not commercialized any of our potential product candidates and we cannot predict if or when we will become profitable.

We have not commercialized any product candidate relating to our current assets in the biomedical industry. Our ability to generate revenues from any of our product candidates will depend on a number of factors, including our ability to successfully complete clinical trials, obtain necessary regulatory approvals and negotiate arrangements

with third parties to help finance the development of, and market and distribute, any product candidate that receives regulatory approval. In addition, we will be subject to the risk that the marketplace will not accept our products.

S-9

Table of Contents

Because of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to predict the extent of our future losses or when or if we will become profitable, and it is possible we will never commercialize any of our product candidates or become profitable. Our failure to obtain regulatory approval and successfully commercialize any of our product candidates would have a material adverse effect on our business, results of operations, financial condition and prospects and could result in our inability to continue operations.

If we are unable to successfully recruit and retain qualified personnel, we may not be able to continue our operations.

In order to successfully implement and manage our business plan, we will depend upon, among other things, successfully recruiting and retaining qualified personnel having experience in the biomedical industry. Competition for qualified individuals is intense. If we are not able to find, attract and retain qualified personnel on acceptable terms, our business operations could suffer.

Additionally, although we have employment agreements with each of our executive officers, these agreements are terminable by them at will and we may not be able to retain their services. The loss of the services of any members of our senior management team could delay or prevent the development and commercialization of any other product candidates and our business could be harmed to the extent that we are not able to find suitable replacements.

Future growth could strain our resources, and if we are unable to manage our growth, we may not be able to successfully implement our business plan.

We hope to experience rapid growth in our operations, which will place a significant strain on our management, administrative, operational and financial infrastructure. Our future success will depend in part upon the ability of our executive officers to manage growth effectively. This will require that we hire and train additional personnel to manage our expanding operations. In addition, we must continue to improve our operational, financial and management controls and our reporting systems and procedures. If we fail to successfully manage our growth, we may be unable to execute upon our business plan.

We may be unable to successfully develop and commercialize the assets we have acquired, or acquire, or develop and commercialize new assets and product candidates.

Our future results of operations will depend to a significant extent upon our ability to successfully develop and commercialize in a timely manner the assets we acquired from Inovio related to certain non-DNA vaccine technology and intellectual property relating to selective electrochemical tumor ablation, which we refer to as the OMS. In addition, we may acquire new assets or product candidates in the future. There are numerous difficulties inherent in acquiring, developing and commercializing new products and product candidates, including difficulties related to:

·

successfully identifying potential product candidates;

·

developing potential product candidates;

·

difficulties in conducting or completing clinical trials, including receiving incomplete, unconvincing or equivocal clinical trials data;

·

obtaining requisite regulatory approvals for such products in a timely manner or at all;

·

acquiring, developing, testing and manufacturing products in compliance with regulatory standards in a timely manner or at all;

S-10

Table of Contents

·

being subject to legal actions brought by our competitors, which may delay or prevent the development and commercialization of new products;

·

delays or unanticipated costs; and

·

significant and unpredictable changes in the payer landscape, coverage and reimbursement for any products we develop.

As a result of these and other difficulties, we may be unable to develop potential product candidates using our intellectual property, and potential products in development by us may not receive timely regulatory approvals, or approvals at all, necessary for marketing by us or our third-party partners. If we do not acquire or develop product candidates, any of our product candidates are not approved in a timely fashion or at all or, when acquired or developed and approved, cannot be successfully manufactured and commercialized, our operating results would be adversely affected. In addition, we may not recoup our investment in developing products, even if we are successful in commercializing those products. Our business expenditures may not result in the successful acquisition, development or commercialization of products that will prove to be commercially successful or result in the long-term profitability of our business.

Certain of our intellectual property is licensed from Inovio pursuant to a non-exclusive license.

We have acquired certain technology and related assets from Inovio pursuant to an asset purchase agreement. In connection with the closing of the asset purchase agreement, we entered into a cross-license agreement with Inovio. Under the terms of the cross-license agreement, Inovio granted to us a non-exclusive, worldwide license to certain non-SECTA technology patents held by Inovio, and we granted to Inovio a limited, exclusive license to our acquired SECTA technology. While we do not currently rely on the intellectual property we have licensed from Inovio pursuant to this non-exclusive license, our product candidates may in the future utilize this intellectual property. Because the license is non-exclusive, Inovio may use its technology to compete with us. In addition, there are no restrictions on Inovio’s ability to license their technology to others. As a result Inovio could license to others, including our competitors, the intellectual property rights covered by their license to us, including any of our improvements to the licensed intellectual property. In addition, either party may terminate the cross-license agreement with 30 days’ notice if they no longer utilize or sublicense the patent rights they have acquired pursuant to the cross-license. If either party were to terminate the cross-license agreement, they would no longer have the right to use intellectual property that is subject to the cross license.

Regulatory authorities may not approve our product candidates or the approvals we secure may be too limited for us to earn sufficient revenues.

The FDA and other foreign regulatory agencies can delay approval of or refuse to approve our product candidates for a variety of reasons, including failure to meet safety and efficacy endpoints in our clinical trials. Our product candidates may not be approved even if they achieve their endpoints in clinical trials. Regulatory agencies, including the FDA, may disagree with our trial design and our interpretation of data from preclinical studies and clinical trials. Clinical trials of our product candidates may not demonstrate that they are safe and effective to the extent necessary to obtain regulatory approvals. We have initiated three Phase II clinical trials to assess our ImmunoPulse technology in patients with metastatic melanoma, Merkel cell carcinoma and cutaneous T-cell lymphoma. If we cannot adequately demonstrate through the clinical trial process that a therapeutic product we are developing is safe and effective, regulatory approval of that product would be delayed or prevented, which would impair our reputation, increase our costs and prevent us from earning revenues. Even if a product candidate is approved, it may be approved for fewer or more limited indications than requested or the approval may be subject to the performance of significant post-marketing studies. In addition, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our product candidates. Any limitation, condition or denial of approval would have an adverse effect on our business, reputation and results of operations.

S-11

Table of Contents

Our acquisition of the OMS technology included an extensive clinical database from existing clinical trials utilizing the NeoPulse technology. We must initiate or complete new pivotal clinical studies to support or expand

upon our clinical database for our NeoPulse technology, either internally or in collaboration with a strategic partner, in order to commercialize the NeoPulse technology. We or any strategic partner that we engage may not be successful in initiating or completing any such new pivotal clinical studies.

Delays in the commencement or completion of clinical testing for product candidates based on our OMS technology could result in increased costs to us and delay or limit our ability to pursue regulatory approval or generate revenues.

Clinical trials are very expensive, time consuming and difficult to design and implement. Even if the results of our proposed clinical trials are favorable, clinical trials for product candidates based on our OMS technology will continue for several years and may take significantly longer than expected to complete. Delays in the commencement or completion of clinical testing could significantly affect our product development costs and business plan. We do not know whether our Phase II clinical trials will be completed on schedule, if at all. In addition, we do not know whether any other pre-clinical or clinical trials will begin on time or be completed on schedule, if at all. The commencement and completion of clinical trials can be delayed for a number of reasons, including delays related to:

·

obtaining clearance from the FDA or respective international regulatory equivalent to commence a clinical trial;

·

reaching agreement on acceptable terms with prospective clinical research organizations (“CROs”) clinical investigators and trial sites;

·

obtaining institutional review board (“IRB”) approval to initiate and conduct a clinical trial at a prospective site;

·

identifying, recruiting and training suitable clinical investigators;

·

identifying, recruiting and enrolling subjects to participate in clinical trials for a variety of reasons, including competition from other clinical trial programs for similar indications; and

·

retaining patients who have initiated a clinical trial but may be prone to withdraw due to side effects from the therapy, lack of efficacy, personal issues, or for any other reason they choose, or who are lost to further follow-up.

We believe that we have planned and designed an adequate clinical trial program for our product candidates based on our OMS technology. However, the FDA could determine that it is not satisfied with our plan or the details of our pivotal clinical trial protocols and designs.

Additionally, changes in applicable regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for reexamination, which may impact the costs, timing or successful completion of a clinical trial. If we experience delays in completion of, or if we terminate, any of our clinical trials, the commercial prospects for our product candidates may be harmed, which may have a material adverse effect on our business, results of operations, financial condition and prospects.

We must rely on third parties to conduct our clinical trials. If these third parties do not successfully carry out their duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our product candidates and our business could be substantially harmed.

We expect to enter into agreements with third-party CROs to conduct our planned clinical trials and anticipate that we may enter into other such agreements in the future regarding any future product candidates. We currently rely on these parties for the execution of our clinical and pre-clinical studies, and control only certain aspects of their activities. We, and our CROs, are required to comply with the current FDA Code of Federal Regulations for Conducting Clinical Trials and good clinical practice (“GCP”) and International Conference on

S-12

Table of Contents

Harmonization (“ICH”) guidelines. The FDA enforces these GCP regulations through periodic inspections of trial sponsors, principal investigators, CRO trial sites, laboratories, and any entity having to do with the completion of the study protocol and processing of data. If we, or our CROs, fail to comply with applicable GCP regulations, the data generated in our clinical trials may be deemed unreliable and the FDA may require us to perform additional clinical trials before approving our marketing applications. Upon inspection, the FDA and similar foreign regulators may determine that our clinical trials are not compliant with GCP regulations. Our failure to comply with these regulations may require us to repeat clinical trials, which would delay the regulatory approval process.

If any of our relationships with third-party CROs terminate, we may not be able to enter into arrangements with alternative CROs on commercially reasonable terms, or at all. If CROs do not successfully carry out their contractual duties or obligations or meet expected deadlines, if they need to be replaced or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons, our clinical trials may be extended, delayed or terminated and we may not be able to obtain regulatory approval for or successfully commercialize our product candidates. As a result, our results of operations and the commercial prospects for our product candidates could be harmed, our costs could increase and our ability to generate additional revenues could be delayed.

We may participate in clinical trials conducted under an approved investigator sponsored investigational new drug application and correspondence and communication with the FDA pertaining to these trials will strictly be between the investigator and the FDA.

We have in the past, and may in the future, participate in clinical trials conducted under an approved investigator sponsored investigational new drug (“IND”) application. Regulations and guidelines imposed by the FDA with respect to IND applications include a requirement that the sponsor of a clinical trial provide ongoing communication with the agency as it pertains to safety of the treatment. This communication can be relayed to the agency in the form of safety reports, annual reports or verbal communication at the request of the FDA. Accordingly, it is the responsibility of each investigator (as the sponsor of the trial) to be the point of contact with the FDA. The communication and information provided by the investigator may not be appropriate and accurate, and the investigator has the ultimate responsibility and final decision-making authority with respect to submissions to the FDA. This may result in reviews, audits, delays or clinical holds by the FDA ultimately affecting the timelines for these studies and potentially risking the completion of these trials.

We may incur liability if our promotions of product candidates are determined, or are perceived, to be inconsistent with regulatory guidelines.

The FDA provides guidelines with respect to appropriate product promotion and continuing medical and health education activities. Although we endeavor to follow these guidelines, the FDA or the Office of the Inspector General: U.S. Department of Health and Human Services may disagree, and we may be subject to significant liability, including civil and administrative remedies as well as criminal sanctions. In addition, management’s attention could be diverted and our reputation could be damaged.

If we and the contract manufacturers upon whom we rely fail to produce our systems and product candidates in the volumes that we require on a timely basis, or fail to comply with stringent regulations, we may face delays in the development and commercialization of our electroporation equipment and product candidates.

We currently assemble certain components of our electroporation systems and utilize the services of contract manufacturers to manufacture the remaining components of these systems and our product supplies for clinical trials. We expect to increase our reliance on third party manufacturers if and when we commercialize our products and systems. The manufacture of our systems and product supplies requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Manufacturers often encounter difficulties in production, particularly in scaling up for commercial production. These problems include difficulties with production costs and yields, quality control, including stability of the equipment and product candidates and quality assurance testing, shortages of qualified personnel, as well as compliance with strictly enforced federal, state and foreign regulations. If we or our manufacturers were to encounter any of these difficulties or our manufacturers otherwise fail to comply with their obligations to us, our ability to provide our electroporation equipment to our partners and products to patients in our clinical trials or to

commercially launch a product would be jeopardized. Any delay or interruption in the supply of clinical trial supplies could delay the completion of our clinical trials, increase the costs associated with maintaining our clinical trial program and, depending upon the period of delay, require us to commence new trials at significant additional expense or terminate the trials completely.

S-13

Table of Contents

In addition, all manufacturers of our products must comply with current good manufacturing practice (“cGMP”) requirements enforced by the FDA through its facilities inspection program. These requirements include, among other things, quality control, quality assurance and the generation and maintenance of records and documentation. Manufacturers of our products may be unable to comply with these cGMP requirements and with other FDA, state and foreign regulatory requirements. We have little control over our manufacturers’ compliance with these regulations and standards. A failure to comply with these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval. If the safety of any product is compromised due to our or our manufacturers’ failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize our products, and we may be held liable for any injuries sustained as a result. Any of these factors could cause a delay of clinical trials, regulatory submissions, approvals or commercialization of our products, entail higher costs or result in our being unable to effectively commercialize our products. Furthermore, if our manufacturers fail to deliver the required commercial quantities on a timely basis, pursuant to provided specifications and at commercially reasonable prices, we may be unable to meet demand for our products and would lose potential revenues.

If any product candidate for which we receive regulatory approval does not achieve broad market acceptance or coverage by third-party payors, our revenues may be limited.

The commercial success of any potential product candidates for which we obtain marketing approval from the FDA or other regulatory authorities will depend upon the acceptance of these products by physicians, patients, healthcare payors and the medical community. Coverage and reimbursement of our approved product by third-party payors is also necessary for commercial success. The degree of market acceptance of any potential product candidates for which we may receive regulatory approval will depend on a number of factors, including:

·

our ability to provide acceptable evidence of safety and efficacy;

·

acceptance by physicians and patients of the product as a safe and effective treatment;

·

the prevalence and severity of adverse side effects;

·

limitations or warnings contained in a product’s FDA-approved labeling;

·

the clinical indications for which the product is approved;

·

availability and perceived advantages of alternative treatments;

·

any negative publicity related to our or our competitors’ products;

·

the effectiveness of our or any current or future collaborators’ sales, marketing and distribution strategies;

·

pricing and cost effectiveness;

·

our ability to obtain sufficient third-party payor coverage or reimbursement; and

·

the willingness of patients to pay out of pocket in the absence of third-party payor coverage.

Our efforts to educate the medical community and third-party payors on the benefits of any of our potential product candidates for which we obtain marketing approval from the FDA or other regulatory authorities may require significant resources and may never be successful. If our potential products do not achieve an adequate level

of acceptance by physicians, third-party payors and patients, we may not generate sufficient revenue from these products to become or remain profitable.

S-14

Table of Contents

We may not be successful in executing our strategy for the commercialization of our product candidates. If we are unable to successfully execute our commercialization strategy, we may not be able to generate significant revenue.

We intend to advance a commercialization strategy that leverages previous in-depth clinical experiences, previous CE (Conformité Européene) approvals for the electroporation-based devices and late stage clinical studies in the United States. This strategy would include seeking approval from the FDA to initiate pivotal registration studies in the United States for select rare cancers that have limited, adverse or no therapeutic alternatives. This strategy also would include expanding the addressable markets for the OMS therapies through the addition of relevant indications. Our commercialization plan also would include partnering and/or co-developing OMS in developing geographic locations, such as Eastern Europe and Asia, where local resources are best leveraged and appropriate collaborators can be secured.

We may not be able to implement a commercialization strategy as we have planned. Further, we have little experience and have not proven our ability to succeed in the biomedical industry and are not certain that our implementation strategy, if implemented correctly, would lead to significant revenue. If we are unable to successfully implement our commercialization plans and drive adoption by patients and physicians of our potential future products through our sales, marketing and commercialization efforts, then we will not be able to generate significant revenue which will have a material adverse effect on our business, results of operations, financial condition and prospects.

In order to market our proprietary products, we may choose to establish our own sales, marketing and distribution capabilities. We have no experience in these areas, and if we have problems establishing these capabilities, the commercialization of our products would be impaired.

We may choose to establish our own sales, marketing and distribution capabilities to market products to our target markets. We have no experience in these areas, and developing these capabilities will require significant expenditures on personnel and infrastructure. While we intend to market products that are aimed at a small patient population, we may not be able to create an effective sales force around even a niche market. In addition, some of our product candidates may require a large sales force to call on, educate and support physicians and patients. We may desire in the future to enter into collaborations with one or more pharmaceutical companies to sell, market and distribute such products, but we may not be able to enter into any such arrangement on acceptable terms, if at all. Any collaboration we do enter into may not be effective in generating meaningful product royalties or other revenues for us.

Our success depends in part on our ability to protect our intellectual property. Because of the difficulties of protecting our proprietary rights and technology, we may not be able to ensure their protection.

Our commercial success will depend in large part on obtaining and maintaining patent, trademark and trade secret protection of our product candidates and their respective components, formulations, manufacturing methods and methods of treatment, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell or importing our product candidates is dependent upon the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities.

The coverage claimed in a patent application typically is significantly reduced before a patent is issued, either in the United States or abroad. Consequently, any of our pending or future patent applications may not result in the issuance of patents and any patents issued may be subjected to further proceedings limiting their scope and may in any event not contain claims broad enough to provide meaningful protection. Any patents that are issued to us or our future collaborators may not provide significant proprietary protection or competitive advantage, and may be circumvented or invalidated. In addition, unpatented proprietary rights, including trade secrets and know-how, can be difficult to protect and may lose their value if they are independently developed by a third party or if their secrecy is lost. Further, because development and commercialization of our potential product candidates can be

S-15

Table of Contents

subject to substantial delays, our patents may expire and provide only a short period of protection, if any, following any future commercialization of products. Moreover, obtaining and maintaining patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by government patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. If any of our patents are found to be invalid or unenforceable, or if we are otherwise unable to adequately protect our rights, it could have a material adverse impact on our business and our ability to commercialize or license our technology and products.

We may incur substantial costs as a result of litigation or other proceedings relating to protection of our patent and other intellectual property rights, and we may be unable to successfully protect our rights to our potential products and technology.

If we choose to go to court to stop a third party from using the inventions claimed by our patents, that third party may ask the court to rule that the patents are invalid and/or should not be enforced. These lawsuits are expensive and could consume time and other resources even if we were successful in stopping the infringing activity. In addition, the court could decide that our patents are not valid and that we do not have the right to stop others from using the inventions claimed by the patents.

Additionally, even if the validity of these patents is upheld, the court could refuse to stop a third party’s infringing activity on the ground that such activities do not infringe our patents. The U.S. Supreme Court has recently revised certain tests regarding granting patents and assessing the validity of patents to make it more difficult to obtain patents. As a consequence, issued patents may be found to contain invalid claims according to the newly revised standards. Some of our patents may be subject to challenge and subsequent invalidation or significant narrowing of claim scope in a reexamination proceeding, or during litigation, under the revised criteria.

Third parties may claim that we infringe their proprietary rights and may prevent us from manufacturing and selling some of our products.

The manufacture, use and sale of new products that are the subject of conflicting patent rights have been the subject of substantial litigation in the biomedical industry. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. Litigation may be costly and time-consuming, and could divert the attention of our management and technical personnel. In addition, if we infringe on the rights of others, we could lose our right to develop, manufacture or market products or could be required to pay monetary damages or royalties to license proprietary rights from third parties. Although the parties to patent and intellectual property disputes in the biomedical industry have often settled their disputes through licensing or similar arrangements, the costs associated with these arrangements may be substantial and could include ongoing royalties. Furthermore, we cannot be certain that the necessary licenses would be available to us on commercially reasonable terms or at all. As a result, an adverse determination in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent us from manufacturing and selling our products, and could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Extensive industry regulation has had, and will continue to have, a significant impact on our business, especially our product development, manufacturing and distribution capabilities.

All biomedical companies are subject to extensive, complex, costly and evolving government regulation. For the U.S., these regulations are principally administered by the FDA and to a lesser extent by the United States Drug Enforcement Agency (the “DEA”) and state government agencies, as well as by various regulatory agencies in foreign countries where products or product candidates are being manufactured and/or marketed. The Federal Food, Drug and Cosmetic Act, the Controlled Substances Act and other federal statutes and regulations, and similar foreign statutes and regulations, govern or influence the testing, manufacturing, packing, labeling, storing, record keeping, safety, approval, advertising, promotion, sale and distribution of our products. Under these regulations, we may become subject to periodic inspection of our facilities, procedures and operations and/or the testing of our product candidates and products by the FDA, the DEA and other authorities, which conduct periodic inspections to confirm that we are in compliance with all applicable regulations. In addition, the FDA and foreign regulatory agencies conduct pre-approval and post-approval reviews and plant inspections to determine whether our systems and processes are in compliance with cGMP and other regulations. Following such inspections, the FDA or other

S-16

Table of Contents

agency may issue observations, notices, citations and/or warning letters that could cause us to modify certain activities identified during the inspection. To the extent that we successfully commercialize any product, we may also be subject to ongoing FDA obligations and continued regulatory review with respect to manufacturing, processing, labeling, packaging, distribution, storage, advertising, promotion and recordkeeping for the product. Additionally, we may be required to conduct potentially costly post-approval studies and report adverse events associated with our products to the FDA and other regulatory authorities. Unexpected or serious health or safety concerns would result in labeling changes, recalls, market withdrawals or other regulatory actions.

The range of possible sanctions includes, among others, FDA issuance of adverse publicity, product recalls or seizures, fines, total or partial suspension of production and/or distribution, suspension of the FDA’s review of product applications, enforcement actions, injunctions, and civil or criminal prosecution. Any such sanctions, if imposed, could have a material adverse effect on our business, operating results, financial condition and cash flows. Under certain circumstances, the FDA also has the authority to revoke previously granted drug approvals. Similar sanctions as detailed above may be available to the FDA under a consent decree, depending upon the actual terms of such decree. If internal compliance programs do not meet regulatory agency standards or if compliance is deemed deficient in any significant way, it could materially harm our business.