UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2014

ODYSSEY MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Nevada |

|

001-31895 |

|

84-1018684 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5215 West Laurel Street

Tampa, Florida 33607

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (813) 876-1776

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

Odyssey Marine Exploration, Inc.

(“Odyssey”) is holding its Annual Meeting of Stockholders (the “Annual Meeting”) on June 4, 2014, beginning at 9:30 a.m. (Eastern time). Attached as Exhibit 99.1 to this Current Report on Form 8-K is an excerpt from the

script of the presentation to be made by Gregory P. Stemm, Odyssey’s Chief Executive Officer, at the Annual Meeting.

The information

in this Item 7.01, including Exhibit 99.1, will not be treated as filed for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. This information will not be

incorporated by reference into a filing under the Securities Act of 1933, or into another filing under the Securities Exchange Act of 1934, unless that filing expressly refers to specific information in this report. The furnishing of the information

in this Item 7.01 of this report is not intended to and does not, constitute a representation that such furnishing is required by Regulation FD or that the information in this Item 7.01 is material investor information that is not

otherwise publicly available.

Forward Looking Information

Odyssey believes the information set forth in this Item 7.01, including Exhibit 99.1, may include “forward looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. Certain factors that could cause results to differ materially from those

projected in the forward-looking statements are set forth in “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the Securities and

Exchange Commission (the “SEC”) on March 17, 2014. The financial and operating projections as well as estimates of mining assets are based solely on the assumptions developed by Odyssey that it believes are reasonable based upon

information available to Odyssey as of the date of this report. All projections and estimates are subject to material uncertainties, and should not be viewed as a prediction or an assurance of actual future performance. The validity and accuracy of

Odyssey’s projections will depend upon unpredictable future events, many of which are beyond Odyssey’s control and, accordingly, no assurance can be given that Odyssey’s assumptions will prove true or that its projected results will

be achieved.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

(a) |

Financial Statements of Businesses Acquired. |

Not applicable.

| |

(b) |

Pro Forma Financial Information. |

Not applicable.

| |

(c) |

Shell Company Transactions. |

Not applicable.

99.1 Excerpt from script of presentation of Gregory

P. Stemm.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ODYSSEY MARINE EXPLORATION, INC. |

|

|

|

| Dated: June 4, 2014 |

|

By: |

|

/s/ Gregory P. Stemm |

|

|

|

|

Gregory P. Stemm |

|

|

|

|

Chief Executive Officer |

Exhibit 99.1

Operational Update

During the past year, we completed the

second phase of Gairsoppa silver recovery operations, breaking our own record for the deepest and heaviest recovery of precious metal from a shipwreck site in history. We recovered over 61 tons of silver last year, which brought the total

recovery to approximately 110 tons of silver, all of which has already been monetized. This was no easy feat and once again proves that Odyssey has unique deep ocean capabilities that are unmatched throughout the world.

The successful Gairsoppa operation helped us deliver record revenues of $17.2 million and net profit of $10.8 million for the 4th quarter of last year. This project was a wonderful proving ground and has set the stage for future commodity shipwrecks.

We are constantly improving our capabilities and we have just taken delivery of a unique new deep multi-beam side scan that will be used for locating and

providing high-resolution 3D maps of shipwrecks to depths of 6000 meters. We have also successfully tested our new 6,000 meter ROV system that will be used for confirming shipwreck identities and conducting salvage planning missions. We have

negotiated rights to salvage commodity shipwrecks with well-documented valuable cargoes and have identified many other commodity shipwreck targets that we believe will provide recurring streams of revenue from shipwreck recovery for years to come.

While we intended to be working on our commodity program right now, our Central America project was inserted this year. In some respects this project

could well produce the type of results we intended to derive from our commodity wreck recovery program. Our compensation rights are secured by a contract already approved by the State Court. We were pleased to be selected for this project, but under

the contract, we were required to comply with the specified performance period which had the effect of pushing some of our other schedules further into the future.

We have the capabilities in house for search, verification and documentation of commodity shipwrecks, but for many of these projects that require recovering

thousands of tons of cargo or which are at extreme depths, we will need a specialized recovery vessel. We have identified several potential vessels and we are evaluating which financial arrangements will best suit the multi-year commodity shipwreck

program. Our pipeline of commodity projects includes both smaller-tonnage gold/silver bullion-type shipwrecks and larger tonnage shipwrecks that were carrying metals such as tin or nickel. We may focus on the lower tonnage, high value cargo

commodity shipwrecks in the near term while we work on securing the optimal longer-term recovery vessel.

We are also looking at an opportunity presented

by one of the fastest growing deep ocean service companies to jointly develop a state of the art new-build ship that could provide us with the capability to conduct extreme deep ocean recovery operations and

access to every deep target in our file. This ship features extremely fuel efficient new technologies which will provide dramatic cost-savings as well as advanced capabilities on a huge stable

platform with a large cargo capacity and extended offshore duration for remote locations. It would also be extremely useful in expanding our seafloor mineral resource assessment and drilling capabilities, so it is an opportunity we are considering

very seriously.

Speaking of ocean minerals, this is a very interesting time in that aspect of our business. The last year has been challenging for the

exploration of Seafloor Massive Sulfides, because Nautilus Minerals, the Canadian company who has been the most visible player in this field, stumbled when the Papua New Guinea Government suspended their mining permit which put a stop to their plans

to mine copper-rich SMS deposits off PNG.

This challenging situation regrettably but understandably gave everyone, including Neptune Minerals investors,

a cause for concern about the future of SMS mining projects, especially in the South Pacific. During recent weeks, however, this situation turned around 180 degrees – with the PNG Government now getting solidly behind the project and agreeing

to invest over $100 million in the deep ocean mining project out of the government’s own coffers – which is the best possible guarantee that this project will move forward.

Not only is this good news for Nautilus investors, but it also bodes well for Neptune Minerals and other seafloor mineral projects and companies, and we now

see renewed interest in this space. We wish the management and shareholders of Nautilus much success with their project in PNG and elsewhere in the region, where they hold concessions in many of the same jurisdictions as Neptune. As we like to say,

a rising tide lifts all ships – and the success of Nautilus on their SMS projects in the South Pacific should bode well for the offshore mining industry.

As I have stated previously, I have no doubt that ocean mining will follow the path of the offshore oil and gas industry - and will grow into a huge industry.

We intend to continue performing exploration services for mineral rights holders for a combination of cash and equity in projects, and we are also originating and developing projects in which we maintain an ownership interest.

Oceanica is an example of a project that we were instrumental in developing, and as a result, now own a controlling interest in the deposit. After completing

work for Chatham Rock Phosphate and becoming familiar with the strategic importance and economic value of ocean phosphates, we determined that an ocean phosphate deposit off the coast of North America could be a game-changer for us. We embarked on

an exhaustive research project, and our geologists found documentary evidence in decades’ old scientific papers of a large potential phosphate deposit in the Pacific

Ocean. Through focused application of our resources and with the help of our partners, a 50-year exclusive mining license was granted for the area that our geologists told us could hold billions

of dollars’ worth of easily accessible, high quality phosphate reserves.

I’d like to spend a little time talking about this project, because

the further we get down the path, the more exciting it gets – and the more apparent it’s become that this project can be a true game-changer for Odyssey. As we talk about all the work we have put into this project, it’s important to

keep in mind that our work to date on this phosphate deposit has been cash flow positive for Odyssey, since we have received $27.5 million to date from our sales of Oceanica equity.

Hopefully you have had a chance to review our press release of March 11 which featured specific information on the deposit. This information was taken

from the NI 43-101 compliant preliminary assessment technical report which was prepared by an independent qualified person (QP) who is one of the industry’s most experienced phosphate mining and processing engineers. The hundreds of core

samples were tested and evaluated by the Florida Institute of Phosphate Research (FIPR), a highly respected, independent, not-for-profit phosphate laboratory based in the United States. Many of the core samples were also submitted to a second lab to

confirm the outstanding results.

The key takeaway from the technical report and the extensive testing is that the size of the deposit and the

concentrations of the phosphate in the mineralized deposits make this project potentially one of the largest and most important new phosphate projects in the world.

The deposit is centered approximately 40 kilometers off-shore, well away from coastal fishing areas or areas of environmental concern and is located at a

depth of 70 to 90 meters. The relatively shallow depth of the deposit with minimal to no overburden will allow the use of existing standard dredging ships and equipment. We are currently working on developing a cooperative venture with Royal

Boskalis Westminster, the world’s largest dredging company with over $4 billion in Revenues, who operate over 1,000 ships around the world, including several ships which are suitable for mining the Oceanica phosphates. We have held a number of

detailed strategic planning and technical sessions with Boskalis management, senior technicians and engineers both in Tampa and at their headquarters in the Netherlands. Our own Odyssey and Oceanica team members have spent months at Boskalis’

offices working closely with their engineers to plan and develop budgets for the dredging, mineral extraction and processing of phosphates from the Oceanica deposit.

Based on the extensive engineering work completed to date by a combination of Boskalis’ engineers and our own technical consultants, we expect to be able

to produce high grade rock phosphate at a cost that we believe will be lower than most of the world’s new proposed mines, and competitive with the world’s lowest-cost existing producers, especially when transport costs are taken into

account.

The next step in this project will be the submission of the Environmental Impact Assessment. I am pleased to

report that this filing - all 1,200 pages of it – is completed and ready to be filed shortly.

This exhaustive environmental assessment includes the

results of extensive environmental sampling, plume modeling, ecotoxicology and acoustic studies as well as other scientific reports from leading independent laboratories, scientists, biologists and subject matter experts from around the world.

Our timing on this project could not have been better. President Peña Nieto of Mexico recently announced that the Mexican National Oil company, Pemex,

would be investing heavily in the development of the fertilizer industry in Mexico. The vast majority of the country is under fertilized and relies on imports for these critical resources so the Oceanica project is perfectly positioned to provide a

long term solution for this challenge in the Mexican agricultural industry.

In addition to the obviously significant economic impact this project can

have for Odyssey – we are proud to be involved with the discovery of a strategic deposit which can contribute to supporting North America’s agricultural industries for the next century. This is important when you consider that North

America is fast running out of this critical irreplaceable component of fertilizer, and the Oceanica deposit will help insulate the agricultural industry in Mexico and the rest of the region from potential disruption of supplies from the major

producers in North Africa as happened in 2008, when phosphate fertilizer prices spiked over 500%.

As we have mentioned previously, JP Morgan is

representing this project for us with potential strategic investors and the development of a plan for maximizing shareholder value on the property. Rodney Miller, a Managing Director in JP Morgan’s Mergers and Acquisitions Group and Jeffrey

Price, Managing Director of their Chemical and Fertilizers Group in New York are representing the project and have been very helpful in developing our ongoing strategy for Oceanica.

===

Turning our attention to the shipwreck side of our

business, we have now embarked on the next chapter of the SS Central America shipwreck project. The shipwreck was discovered in 1988, and at the time, it was one of the first deep-ocean robotic recoveries ever performed, but only a small

percentage - about 5% - of the main shipwreck hull area was investigated.

We first visited the site in April, and as has already been announced publicly, we recovered gold during the

first reconnaissance dive. That certainly answered the assertions of many naysayers who said we wouldn’t find any gold there.

Things are going

exceptionally well on the project – our equipment is all performing beautifully, the pre-disturbance survey has been completed and the archaeological excavation is proceeding very smoothly. While there are some issues being resolved between the

Court-appointed Receiver for RLP and CADG, Odyssey is not a party to these proceedings and we have our recovery contract in place with the Receiver which has been approved by the Ohio State Court. The Federal Judge who has jurisdiction over the site

has found that Odyssey is qualified to conduct the archaeological recovery and that it is in the public interest for us to continue recovery operations.

As for the site itself, there is one thing that I can tell you without any qualification – and that is that anyone who thought that the previous

operations twenty years ago recovered all the gold and valuables from the site was clearly mistaken. Nearly every day of seafloor operations produces new discoveries and recoveries of gold in a dazzling array of different forms.

Early recovery results are well beyond our expectations. We’ve already recovered over $100,000 in 1857 face value of ingots and other gold including rare

natural nuggets, jewelry and a wide array of different coins. The collection we have recovered to date represents an amazing cross section of the type of wealth that resulted from the California gold rush, and coupled with the excellent methodical

archaeological work our team is conducting, will contribute a great deal to the historical record.

Based on estimates provided by the independent expert

hired by the court-appointed Receiver, this gold recovered to date represents a small fraction of his best estimate of what remained on the site. Now that we’ve completed recovery of most of the gold and valuable artifacts on the surface

outside the hull structure, we’re starting on the excavation inside the hull itself. Ingots, gold nuggets, dust and coins have been coming up from this new excavation area daily, so we are off to a great start on this project.

In every respect, we are very pleased with the progress we’ve been making, and we’d like to thank the Receiver for choosing Odyssey to be the

archaeological contractor on this historically and economically important expedition. The Receiver and his team, including Craig Mullen and Bob Evans who are on the Odyssey Explorer observing and monitoring our progress on the site, have been great

to work with. We look forward to collaborating with them to write the next chapter of the SS Central America and to bring the amazing story of this shipwreck to life.

What does 2014 hold in store for the shipwreck of HMS Victory? We remain the archaeological contractor to

the Maritime Heritage Foundation in the UK, which is the owner of the Victory shipwreck, and we are patiently awaiting instructions from the Foundation to continue work on the site. There have been several meetings recently with UK ministers

and government representatives to discuss moving forward on the project, and based on reports we have received we believe that the Foundation will get the green light to move ahead on the project soon. I know that the delays on this project have

been very frustrating for our shareholders, but I am confident that our patience will be rewarded.

I have just mentioned the three projects which I

believe will potentially be major catalysts in 2014. I believe that this year will see us building on the past two years’ success in the shipwreck business and realizing the fruits of our significant investment in the future of ocean mining.

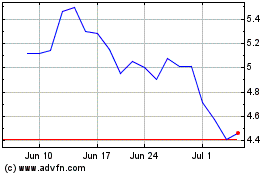

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

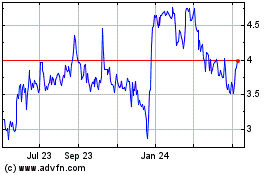

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024