CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

|

Amount to be

Registered (1)

|

|

|

Proposed maximum offering

price per share (2)

|

|

|

Proposed maximum

aggregate offering price (2)

|

|

|

Amount of

registration fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock,

$0.0001 par value per share

|

|

|

5,294,033

|

|

|

$

|

4.805

|

|

|

$

|

25,437,829

|

|

|

$

|

3,276.39

|

|

(1) Represents 2,935,058 shares of common stock and 2,358,975 shares of common stock which are issuable upon conversion of certain warrants. In addition to the shares of the Registrant’s common stock set forth in the table above, pursuant to Rule 416 under the Securities Act of 1933, as amended, the Registrant is registering an indeterminate number of shares of the Registrant’s common stock that may be issued with respect to the shares being registered hereunder in connection with stock splits, stock dividends, recapitalizations or similar events. No additional registration fee has been paid for such shares of our common stock.

(2) Estimated solely for the purposes of calculating the registration fee pursuant to Section 6(b) of the Securities Act and computed pursuant to Rule 457(c) promulgated under the Securities Act of 1933, as amended, based upon the average of the high and low prices of the Registrant’s common stock on May 29, 2014, as reported by the Nasdaq Capital Market.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDER MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND THE SELLING STOCKHOLDER IS NOT SOLICITING OFFERS TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED JUNE 2, 2014

PROSPECTUS

5,294,033 Shares of Common Stock

This prospectus relates to the resale, from time to time, of up to 5,294,033 shares of our common stock, par value $0.0001 per share, by the selling stockholder identified in this prospectus under “Selling Stockholder.” We are not selling any shares of our common stock under this prospectus and will not receive any proceeds from the sale of shares by the selling stockholder. The selling stockholder will bear all commissions and discounts, if any, attributable to the sale of the shares. We will bear all costs, expenses and fees in connection with the registration of the shares.

The selling stockholder may sell the shares of our common stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under “Plan of Distribution.” The prices at which the selling stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions.

Our common stock is currently listed on The NASDAQ Capital Market under the symbol “OXBT”. The last reported sale price of our common stock on The NASDAQ Capital Market on May 29, 2014 was $4.76 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus and in the documents we incorporate by reference in this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 2, 2014

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

|

1

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

1

|

|

SUMMARY

|

|

2

|

|

RISK FACTORS

|

|

5

|

|

USE OF PROCEEDS

|

|

5

|

|

SELLING STOCKHOLDER

|

|

5

|

|

PLAN OF DISTRIBUTION

|

|

6

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

7

|

|

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

|

|

7

|

|

LEGAL MATTERS

|

|

8

|

|

EXPERTS

|

|

8

|

ABOUT THIS PROSPECTUS

In this prospectus, the “Company,” “we,” “us,” and “our” and similar terms refer to Oxygen Biotherapeutics, Inc. References to our “common stock” refer to the common stock, par value $.0001 per share, of Oxygen Biotherapeutics, Inc.

You should read this prospectus together with additional information described under the headings “Where You Can Find More Information” and “Documents Incorporated by Reference.” If there is any inconsistency between the information in this prospectus and the documents incorporated by referenced herein, you should rely on the information in this prospectus.

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized any other person to provide information different from that contained in this prospectus and the documents incorporated by reference herein. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus is accurate as of the dates on the cover page, regardless of time of delivery of the prospectus or any sale of securities. Our business, financial condition, results of operation and prospects may have changed since those dates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this prospectus and the information it incorporates by reference may contain various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All information relative to future markets for our products and trends in and anticipated levels of revenue, gross margins and expenses, as well as other statements containing words such as “believe,” “project,” “may,” “will,” “anticipate,” “target,” “plan,” “estimate,” “expect” and “intend” and other similar expressions constitute forward-looking statements. These forward-looking statements are subject to business, economic and other risks and uncertainties, both known and unknown, and actual results may differ materially from those contained in the forward-looking statements. Examples of risks and uncertainties that could cause actual results to differ materially from historical performance and any forward-looking statements include, but are not limited to, the risks described under the heading “Risk Factors” on page 5 of this prospectus, in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, as well as any subsequent filings with the SEC. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made. You should read carefully this prospectus, any applicable prospectus supplement and any related free writing prospectuses that we have authorized for use in connection with this offering, together with the information incorporated herein or therein by reference as described under the heading “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify all of our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

SUMMARY

This summary is not complete and does not contain all of the information you should consider before investing in the securities offered by this prospectus. You should read this summary together with the entire prospectus, including our financial statements, the notes to those financial statements, and the other documents identified under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus, before making an investment decision. See the Risk Factors section of this prospectus on page 5 for a discussion of the risks involved in investing in our securities.

Oxygen Biotherapeutics, Inc.

Company Overview

We are a specialty pharmaceutical company focused on developing and commercializing drugs for critical care patients. Our principal business objective is to acquire, or discover, develop, and commercialize novel therapeutic products for disease indications that represent significant areas of clinical need and commercial opportunity. Our lead product is levosimendan, which was acquired in an asset purchase agreement with Phyxius Pharma, Inc. Levosimendan is a calcium sensitizer developed for intravenous use in hospitalized patients with acutely decompensated heart failure. The treatment is currently approved in more than 50 countries for this indication. The United States Food and Drug Administration, or FDA, has granted Fast Track status for levosimendan for the reduction of morbidity and mortality in cardiac surgery patients at risk for developing Low Cardiac Output Syndrome, or LCOS. In addition, the FDA has agreed to the Phase 3 protocol design under Special Protocol Assessment (SPA), and provided guidance that a single successful trial will be sufficient to support approval of levosimendan in this indication.

We are also developing Oxycyte®, a systemic perfluorocarbon, or PFC, product we believe is a safe and effective oxygen carrier for use in situations of acute ischemia. Oxycyte has been successful in two clinical trials and is currently being evaluated in a Phase II-b clinical trial for the treatment of traumatic brain injury, or TBI.

Strategy

Our current strategy is to:

|

●

|

Efficiently conduct clinical development to establish clinical proof of concept with our lead product candidates;

|

|

●

|

Advance the development of the PFC therapeutic modality and supporting capabilities;

|

|

●

|

Efficiently explore new high-potential therapeutic applications, leveraging third-party research collaborations and our results from related areas;

|

|

●

|

Continue to expand our intellectual property portfolio; and

|

|

●

|

Enter into licensing or product co-development arrangements in certain areas, while out-licensing opportunities in non-core areas.

|

We believe that this strategy will allow us to develop a portfolio of high quality product development opportunities, expand our clinical development and commercialization capabilities, and enhance our ability to generate value from our proprietary technologies.

Opportunities and Trends

We are moving forward with plans to initiate the phase 3 trial for levosimendan. Duke University’s Duke Clinical Research Institute, or DCRI, has been selected to conduct the Phase 3 trial. DCRI is the world’s largest academic clinical research organization, with substantial experience in conducting cardiac surgery trials. DCRI will serve as the coordinating center and Drs. John H. Alexander and Rajendra Mehta as lead investigators for the Phase 3 trial.

The Phase 3 trial will be conducted in approximately 50 major cardiac surgery centers in North America. The trial will enroll patients undergoing coronary artery bypass graph and/or mitral valve surgery who are at risk for developing LCOS. The trial will be a double blind, randomized, placebo controlled study seeking to enroll 760 patients. It is expected that enrollment will begin in the third quarter of 2014, and will take approximately 18 months to complete. We are currently in the planning phase of the program.

We continue to execute on our strategic plan, which calls for resuming our Phase II-B clinical trials for STOP-TBI (Safety and Tolerability of Oxycyte in Patients with Severe non-Penetrating Traumatic Brain Injury); supporting our collaborations to gather proof-of-concept data for additional therapeutic areas with unmet medical needs; and continuing our business development efforts to expand our product portfolio. We also continue to progress Oxycyte through the regulatory approval process by conducting a comprehensive group of preclinical studies to confirm the safety profile of our product. These studies are particularly focused on platelet activity and immunocompetence. We believe these actions position us well to drive future growth and create stockholder value.

As we focus on the development of our existing products and product candidates, we also continue to position ourselves to execute upon licensing and other partnering opportunities. In order to do so, we will need to continue to maintain our strategic direction, manage and deploy our available cash efficiently and strengthen our collaborative research development and partner relationships.

During fiscal year 2014 we are focused on the following four key initiatives:

|

●

|

Conducting well-designed studies early in the clinical development process to establish a robust foundation for subsequent development, partnership and expansion into complementary areas;

|

|

●

|

Working with collaborators and partners to accelerate product development, reduce our development costs, and broaden our commercialization capabilities;

|

|

●

|

Gaining regulatory approval for the continued development and commercialization of our products in the United States; and

|

|

●

|

Developing new intellectual property to enable us to file patent applications that cover new applications of our existing technologies and product candidates.

|

Corporate Information

Our principal executive offices are located at ONE Copley Parkway, Suite 490, Morrisville, North Carolina 27560, and our telephone number is (919) 855-2100. Our Internet address is

http://www.oxybiomed.com

. The information on our website is not incorporated by reference into this prospectus, and you should not consider it part of this prospectus.

Oxygen Biotherapeutics was originally formed as a New Jersey corporation in 1967 under the name Rudmer, David & Associates, Inc., and subsequently changed its name to Synthetic Blood International, Inc. Effective June 30, 2008, we changed the domiciliary state of the corporation to Delaware and changed the company name to Oxygen Biotherapeutics, Inc.

The Offering

|

Issuer

|

|

Oxygen Biotherapeutics, Inc.

|

|

|

|

|

|

Shares of common stock offered by us

|

|

None

|

|

|

|

|

|

Shares of common stock offered by the selling stockholder

|

|

5,294,033 shares

|

|

|

|

|

|

Shares of common stock outstanding before this offering

|

|

27,858,244 shares

|

|

|

|

|

|

Shares of common stock outstanding after completion of this offering, assuming the sale of all shares offered hereby

|

|

30,217,219 shares

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the resale of the common stock by the selling stockholder.

|

|

|

|

|

|

Risk Factors

|

|

Investing in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 5 and in the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our securities.

|

The number of shares of common stock outstanding before and after the offering is based on 27,858,244 shares outstanding as of May 29, 2014 and excludes:

|

●

|

2,762,466 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $4.28 per share;

|

|

●

|

3,647,858 shares of common stock issuable upon the exercise of outstanding options with a weighted average exercise price of $5.79 per share and 42,227 shares of common stock issuable upon the vesting of outstanding restricted stock grants;

|

|

●

|

155,437 shares of common stock reserved for future grants and awards under our equity incentive plans; and

|

|

●

|

6,652 shares of common stock issuable upon the conversion of outstanding convertible notes with a weighted average conversion price of $45.10.

|

RISK FACTORS

An investment in our securities is speculative and involves a high degree of risk. You should carefully consider the risks under the heading “Risk Factors” beginning on page 11 of our Annual Report on Form 10-K for the fiscal year ended April 30, 2013, filed with the SEC on June 26, 2013, and our Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2014, filed with the SEC on March 17, 2014, which information is incorporated by reference in this prospectus and other information in this prospectus and the documents incorporated by reference before deciding to invest in our securities. If any of the risks actually occur, our business, results of operations, financial condition and cash flows could be materially adversely affected, the trading price of our common stock could decline significantly, and you might lose all or part of your investment. Additional risks and uncertainties that we are unaware of or that we believe are not material at this time could also materially adversely affect our business, financial condition or results of operations. In any case, the value of our securities could decline, and you could lose all or part of your investment. You should also refer to our financial statements and the notes to those statements, which are incorporated by reference in this prospectus. For more information, see “Where You Can Find More Information.”

USE OF PROCEEDS

All proceeds from the resale of the shares of our common stock offered by this prospectus will belong to the selling stockholder identified in this prospectus under “Selling Stockholder.” We will not receive any proceeds from the resale of the shares of our common stock by the selling stockholder.

We will receive proceeds from any cash exercise of warrants held by the selling stockholder (the “Warrants”). We intend to use any net proceeds from any such exercise to further our clinical trials and efforts to obtain regulatory approval of Levosimendan and Oxycyte, develop our product candidates, support manufacturing of Levosimendan and Oxycyte, for research and development and for general corporate purposes, including working capital and potential acquisitions. We currently do not have any arrangements or agreements for any acquisitions. We cannot precisely estimate the allocation of the net proceeds from any exercise of the Warrants for cash. Accordingly, in the event the Warrants are exercised for cash, our management will have broad discretion in the application of the net proceeds of such exercises. Pending the use of net proceeds, we intend to invest the net proceeds of any Warrant for cash exercise in certificates of deposit or direct or guaranteed obligations of the U.S. government. There is no assurance that the Warrants will ever be exercised for cash.

SELLING STOCKHOLDER

|

|

|

Beneficial Ownership Before Offering

|

|

|

|

|

|

Beneficial Ownership After Offering(3)

|

|

|

|

|

Number of Shares Owned (2)

|

|

|

|

|

|

|

|

|

|

|

|

JP SPC 3 obo OXBT FUND, SP (1)

|

|

|

5,342,338

|

|

|

|

5,294,033

|

|

|

|

31,069

|

|

|

|

0.1

|

%

|

(1) As of May 29, 2014, JP SPC 3 obo OXBT FUND, SP (“OXBT Fund”) beneficially owns (i) 2,983,363 shares of our common stock and (ii) Warrants to purchase an aggregate of 2,358,975 shares of common stock. OXBT Fund has indicated to us that Mr. Gregory Pepin, one of our directors, has voting and investment power over the shares held by it. Mr. Pepin is a co-founder of EOS, an investment company, which serves as the Investment Manager and Managing Director for OXBT Fund, and consequently he may be deemed to be the beneficial owner of shares held by OXBT Fund. Mr. Pepin disclaims beneficial ownership of the shares held by OXBT Fund except to the extent of his pecuniary interest therein.

(2) Represents shares of common stock directly beneficially owned as of May 29, 2014, as well as shares of common stock issuable upon exercise of Warrants held by OXBT Fund.

(3) Represents shares of common stock directly beneficially owned as of May 29, 2014 (all of which are not being offered hereby). Amounts are calculated based on an aggregate of 30,217,219 shares of common stock outstanding after the offering.

PLAN OF DISTRIBUTION

The Selling Stockholder (the “Selling Stockholder”) of the securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholder may use any one or more of the following methods when selling securities:

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

●

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

●

|

privately negotiated transactions;

|

|

●

|

settlement of short sales;

|

|

●

|

in transactions through broker-dealers that agree with the Selling Stockholder to sell a specified number of such securities at a stipulated price per security;

|

|

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

●

|

a combination of any such methods of sale; or

|

|

●

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholder may also sell securities under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

The Company expects to pay certain fees and expenses incurred by the Company incident to the registration of the securities.

Because Selling Stockholder may be deemed to be an “underwriter” within the meaning of the Securities Act, the Selling Stockholder will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. The Selling Stockholder has advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale of the resale securities by the Selling Stockholder.

We expect to keep this prospectus effective until all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. We have been informed by the Selling Stockholder that (i) the resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws and (ii) in certain states, the resale securities covered hereby will not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the common stock by the Selling Stockholder or any other person. We will make copies of this prospectus available to the Selling Stockholder and have informed the Selling Stockholder of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

WHERE YOU CAN FIND MORE INFORMATION

We file annual reports, quarterly reports, current reports, and proxy and information statements and other information with the SEC. You may read and copy materials that we have filed with the SEC at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Copies of reports and other information from us are available on the SEC’s website at

http://www.sec.gov

. Such filings are also available at our website at

http://www.oxybiomed.com

. Website materials are not a part of this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” in this prospectus the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The following documents filed with the SEC are hereby incorporated by reference in this prospectus:

(a) Our Annual Report on Form 10-K for the fiscal year ended April 30, 2013, filed with the SEC on June 26, 2013;

(b) Our Quarterly Report on Form 10-Q for the quarterly period ended July 31, 2013, filed with the SEC on September 17, 2013, our Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2013, filed with the SEC on December 17, 2013, and our Quarterly Report on Form 10-Q for the quarterly period ended January 31, 2014, filed with the SEC on March 17, 2014;

(c) Our Current Reports on Form 8-K filed with the SEC on May 1, 2013, May 15, 2013, May 16, 2013, July 25, 2013, August 13, 2013, August 26, 2013, October 25, 2013, November 8, 2013, November 19, 2013, December 9, 2013, December 23, 2013, March 6, 2014, March 21, 2014 and April 4, 2014, and our Current Reports on Form 8-K/A filed with the SEC on July 31, 2013, December 20, 2013, and January 22, 2014; and

(d) The description of our Common Stock contained in our Registration Statement on Form 8-A filed on January 11, 2010, and any amendments or reports filed for the purpose of updating such description.

In addition, all documents subsequently filed by Oxygen Biotherapeutics pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, including prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this prospectus and to be a part hereof from the date of filing of such documents. However, any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the SEC, including without limitation any information furnished pursuant to Item 2.02 or 7.01 of Form 8-K or certain exhibits furnished pursuant to Item 9.01 of Form 8-K, shall not be deemed to be incorporated by reference in this prospectus

Any statement in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you, upon written or oral request, a copy of any or all of the documents incorporated by reference herein, other than exhibits to such documents that are not specifically incorporated by reference therein. All requests should be sent to the attention of Nancy Hecox, Vice President of Legal Affairs and General Counsel, Oxygen Biotherapeutics, Inc., ONE Copley Parkway, Suite 490, Morrisville, North Carolina 27560 or made via telephone at (919) 855-2100.

LEGAL MATTERS

The validity of our securities issuable hereunder has been passed upon for Oxygen Biotherapeutics by Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P., Raleigh, North Carolina.

EXPERTS

Cherry Bekaert LLP, our independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K, for the year ended April 30, 2013, filed on June 26, 2013, which is incorporated by reference in this prospectus. Our consolidated financial statements are incorporated by reference in reliance on their report given upon their authority as experts in accounting and auditing.

Common Stock

________________________________

PROSPECTUS

________________________________

June 2, 2014

P

art II Information Not Required in the Prospectus

|

Item 14

.

|

Other Expenses of Issuance and Distribution

|

The fees and expenses to be paid in connection with the distribution of the securities being registered hereby are estimated as follows:

|

SEC registration fee

|

|

$

|

3,276

|

|

|

Accounting fees and expenses

|

|

|

8,500

|

|

|

Legal fees and expenses

|

|

|

10,000

|

|

|

Printing expenses

|

|

|

2,500

|

|

|

Miscellaneous

|

|

$

|

1,500

|

|

|

Total

|

|

$

|

25,776

|

|

|

Item 15

.

|

Indemnification of Directors and Officers

|

Section 145 of the Delaware General Corporation Law provides that a corporation has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceeding to which he is or is threatened to be made a party by reason of such position, if such person shall have acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal proceeding, if such person had no reasonable cause to believe his conduct was unlawful; provided that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances.

Our Certificate of Incorporation and Bylaws provide that our directors and officers will be indemnified by us to the fullest extent authorized by Delaware General Corporation Law. In addition, the Certificate of Incorporation provides, as permitted by Section 102(b)(7) of the Delaware General Corporation Law, that our directors will not be liable for monetary damages to us for breaches of their fiduciary duty as directors, unless they (i) violated their duty of loyalty to us or our stockholders, (ii) acted, or failed to act, in good faith, (iii) acted with intentional misconduct, (iv) knowingly or intentionally violated the law, (v) authorized unlawful payments of dividends, unlawful stock purchases or unlawful redemptions, or (vi) derived an improper personal benefit from their actions as directors.

Our Bylaws also permit us to secure insurance on behalf of any officer, director or employee for any liability arising out of his or her actions, regardless of whether Delaware General Corporation Law would permit indemnification. We have purchased a policy of directors’ and officers’ liability insurance that insures our directors and officers.

The limitations of liability and indemnification provisions in our Certificate of Incorporation and Bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit our stockholders and us. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions. We believe that these provisions, the insurance and the indemnity agreements are necessary to attract and retain talented and experienced directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

|

|

|

Description

|

|

|

|

|

|

4.1

|

|

Specimen Stock Certificate (1)

|

|

|

|

|

|

|

|

Opinion of Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P.*

|

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Accounting Firm*

|

|

|

|

|

|

23.2

|

|

Consent of Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P.(2)

|

|

|

|

|

|

24.1

|

|

Power of Attorney (3)

|

|

(1)

|

This document was filed as Exhibit 4.1 to the annual report on Form 10-K filed by Oxygen Biotherapeutics with the SEC on July 23, 2010, and is incorporated herein by this reference.

|

|

(2)

|

Contained in Exhibit 5.1.

|

|

(3)

|

Contained on signature page.

|

|

*

|

Filed herewith.

|

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any acts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of a prospectus filed with the SEC pursuant to Rule 424(b) under the Securities Act if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided

,

however

, that subparagraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment by those subparagraphs is contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration, by means of a post-effective amendment, any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(5) That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrants, pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Town of Morrisville, State of North Carolina, on June 2, 2014.

|

|

OXYGEN BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

By:

|

/s/ John P. Kelley

|

|

|

|

|

John P. Kelley

|

|

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS that each individual whose signature appears below constitutes and appoints John P. Kelley and Michael B. Jebsen, and each of them, his true and lawful attorneys-in-fact and agents with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitutes, may lawfully do or cause to be done by virtue hereof

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer and Director

|

|

June 2, 2014

|

|

John P. Kelley

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

Michael B. Jebsen

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

|

Chairman and Director

|

|

|

|

Ronald Blanck, D.O.

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Gregory Pepin

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

William Chatfield

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Anthony DiTonno

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Chris Rallis

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Gerald T. Proehl

|

|

|

|

|

EXHIBIT INDEX

|

|

|

Description

|

|

|

|

|

|

4.1

|

|

Specimen Stock Certificate (1)

|

|

|

|

|

|

5.1

|

|

Opinion of Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P.*

|

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Accounting Firm*

|

|

|

|

|

|

23.2

|

|

Consent of Smith, Anderson, Blount, Dorsett, Mitchell & Jernigan, L.L.P.(2)

|

|

|

|

|

|

24.1

|

|

Power of Attorney (3)

|

|

(1)

|

This document was filed as Exhibit 4.1 to the annual report on Form 10-K filed by Oxygen Biotherapeutics with the SEC on July 23, 2010, and is incorporated herein by this reference.

|

|

(2)

|

Contained in Exhibit 5.1.

|

|

(3)

|

Contained on signature page.

|

|

*

|

Filed herewith.

|

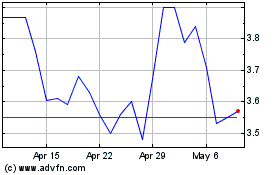

Tenax Therapeutics (NASDAQ:TENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tenax Therapeutics (NASDAQ:TENX)

Historical Stock Chart

From Apr 2023 to Apr 2024