UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 2, 2014

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-16383 |

|

95-4352386 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 700 Milam Street

Suite 800 Houston,

Texas |

|

77002 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 375-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On June 2, 2014, Cheniere Energy, Inc. (the

“Company”) provided notice that it has decided to postpone the 2014 Annual Meeting of Stockholders of the Company, scheduled to be held at 9:00 a.m., Central Daylight Time, on Thursday, June 12, 2014, in light of a complaint that has

been filed in the Delaware Court of Chancery of the State of Delaware styled Jones v. Souki, et al., C.A. No. 9710-VCL (Del. Ch.) and plaintiff’s request to expedite proceedings before the June 12th Annual Meeting. The

2014 Annual Meeting will now take place on Thursday, September 11, 2014. A formal notice setting forth the exact location and time of the rescheduled meeting will be mailed to stockholders in due course. A copy of the complaint is attached as

Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference

The information included in this Item 7.01 of

this Current Report on Form 8-K shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as may

be expressly set forth by specific reference to this Item 7.01 in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Complaint in Jones v. Souki, et al., C.A. No. 9710-VCL (Del. Ch.). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CHENIERE ENERGY, INC. |

|

|

|

|

| Date: June 2, 2014 |

|

|

|

By: |

|

/s/ Michael J. Wortley |

|

|

|

|

Name: |

|

Michael J. Wortley |

|

|

|

|

Title: |

|

Senior Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Complaint in Jones v. Souki, et al., C.A. No. 9710-VCL (Del. Ch.). |

Exhibit 99.1

|

|

|

|

|

|

|

EFiled: May 29 2014 09:48AM EDT

Transaction ID 55512433 Case

No. 9710- |

|

|

IN THE COURT OF CHANCERY OF THE STATE OF

DELAWARE

|

|

|

| JAMES B. JONES, On Behalf of |

|

C.A. No. |

| Himself and All Other Similarly Situated |

|

|

| Stockholders, and Derivatively On |

|

|

| Behalf of CHENIERE ENERGY, INC., |

|

|

|

|

| Plaintiff,

v. |

|

|

| CHARIF SOUKI, H. DAVIS THAMES, MEG A. GENTLE,

R. KEITH |

|

|

| TEAGUE, GREG W. RAYFORD, JEAN |

|

|

| ABITEBOUL, VICKY A. BAILEY, G. ANDREA BOTTA,

NUNO BRANDOLINI, KEITH F. CARNEY, JOHN M. DEUTCH, DAVID I.

FOLEY, RANDY A. FOUTCH, PAUL J. HOENMANS, DAVID B.

KILPATRICK, WALTER L. |

|

|

| WILLIAMS, and CHENIERE ENERGY, INC., |

|

|

|

|

| Defendants, |

|

|

VERIFIED CLASS ACTION AND DERIVATIVE COMPLAINT

Plaintiff James B. Jones (“Plaintiff”), as a stockholder of Cheniere Energy Inc. (“Cheniere” or the “Company”),

and on behalf of defendant Cheniere, brings the following Verified Class Action and Derivative Complaint against the Company and the members of Cheniere’s board of directors. The allegations herein are based upon, inter alia, the

investigation made by and through their attorneys and review of publicly available information except as to those allegations that pertain to the Plaintiff himself, as follows:

NATURE OF THE ACTION

1. Plaintiff, on behalf of himself and all other similarly situated stockholders of Cheniere, brings this action both directly and

derivatively to recover 25 million shares of Cheniere stock that were improperly awarded to Cheniere’s employees, consultants and directors under the Cheniere Energy, Inc. 2011 Incentive Plan (the “2011 Plan”) despite the fact

that the stockholder vote to permit such awards did not receive the required majority vote. Defendants improperly failed to count abstentions as “no” votes, as was required by Delaware law, and as a result, Defendants falsely claimed the

vote passed with a majority vote. Beyond being wholly irrational and in contravention of Delaware law, the awarding of these restricted stock awards was an unauthorized act by the Board that exceeded the Company’s own authority under its own

bylaws and is thus ultra vires.

1

2. Plaintiff also brings this action for corrective disclosures to Cheniere’s

December 31, 2012 proxy statement filed in connection with the Special Meeting of Stockholders held on February 1, 2013 (“Special Meeting Proxy Statement”) and the February 4, 2013 Form 8-K (“2013 8-K”). The

Special Meeting Proxy Statement falsely told stockholders that abstentions are not “taken into account” with regard to the stockholder vote to increase the 2011 Plan share reserve by 25 million shares. Similarly, the 2013 8-K falsely

told stockholders that “stockholders voted in favor” of this 25 million share increase when in fact that vote did not receive the requisite majority as required by Cheniere’s bylaws and Delaware law.

2

3. This action is also being brought to invalidate a newly adopted bylaw that changes the way

Cheniere counts abstentions in stockholder votes. This new bylaw, adopted by the Board on April 3, 2014 (without stockholder input), would now allow Cheniere to not count abstentions at all in a new, upcoming vote scheduled for June 12,

2014 (the “Stockholder Vote”), to increase the number of shares of common stock available for issuance under the 2011 Plan by an additional 30 million shares. This new bylaw was approved for an improper purpose by Cheniere’s

Board because it demonstrates that the Company was aware the previous vote to increase the share reserve should have, but did not, count abstentions as “no” votes, and it seeks to decrease the voting power of “no” votes in the

upcoming vote without informing stockholders of this effect.

4. Finally, Plaintiff brings this action to enjoin the upcoming

June 12, 2014 stockholder vote to increase the 2011 Plan’s share reserve by 30 million shares until the Company makes corrective disclosures regarding the above allegations and until the improper April 3, 2014

“abstentions” bylaw is invalidated.

3

PARTIES

5. Plaintiff James B. Jones has been a stockholder of Cheniere since September 26, 2008, and has been such continuously since then.

6. Defendants Charif Souki, Vicky A. Bailey, G. Andrea Botta, Nuno Brandolini, Keith F. Carney, John M. Deutch, David I. Foley,

Randy A. Foutch, Paul J. Hoenmans, David B. Kilpatrick and Walter L. Williams constitute the Cheniere Board (collectively, the “Director Defendants”). In their capacities as directors, they are each responsible as fiduciaries to the

Company and its stockholders. The Director Defendants authorized or allowed their names to be used in the distribution of the Company’s Special Meeting Proxy Statement for the February 1, 2013 meeting of stockholders. The Director Defendants

also authorized or allowed their names to be used in the distribution of the Company’s 2014 Proxy Statement for the upcoming June 12, 2014 meeting of stockholders. Each of the Director Defendants has been awarded stock compensation under

the 2011 Plan that exceeds the shares properly-approved by the Cheniere stockholders.

7. Of these eleven directors, the 2014 Proxy

Statement claims that only nine meet the NYSE “independence” requirements. Defendant Souki is not independent because he is Chief Executive Officer and President of the Company. Defendant Foley is not independent because he is a Senior

Managing Director in the Private Equity Group of The Blackstone Group L.P., an investment and

4

advisory firm (“Blackstone”), and his appointment to the Board was made pursuant to an investor rights agreement that was entered into by the Company, Cheniere Partners GP, Blackstone

CQP Holdco, LP and various other related parties in connection with Blackstone Holdco’s purchase of Class B units in Cheniere Energy Partners, L.P.

8. Defendants Souki, H. Davis Thames, Meg A. Gentle, R. Keith Teague, Greg W. Rayford and Jean Abitebol (collectively, the “Executive

Defendants”) are the Company’s Named Executive Officers as defined in 17 C.F.R. § 229.402(a)(3), and Officers as defined in 10 Del. C. § 3114(b). Each of the Executive Defendants has been awarded stock compensation under the 2011

Plan that exceeds the shares properly-approved by the Cheniere stockholders.

9. Defendants Bailey, Carney, Foutch, Kilpatrick, and

Williams are all members of the compensation committee of the Company’s Board (the “Compensation Committee”). Defendant Kilpatrick serves as chair of the Compensation Committee. The members of the Compensation Committee approved the

excessive, improper awards received by the Executive Defendants and other employees of Cheniere under the 2011 Plan in violation of Cheniere’s bylaws and Delaware law. The Compensation Committee charter specifically requires compliance with the

bylaws.

5

10. Defendant Cheniere is a corporation organized under the laws of the State of Delaware. The

Company’s last fiscal year ended December 31, 2013. According to the 2014 Proxy Statement, as of April 15, 2014, there were 237,899,730 shares of common stock outstanding. This amount presumably includes stock awards granted based on the

illegal increase to the 2011 Plan share reserve of 25 million shares. As noted above, on June 12, 2014, the Director Defendants sought stockholder approval, based on a recent change in the manner by which abstentions are to be counted, to

increase the 2011 Plan share reserve by an additional 30 million shares. Together, these two defective votes potentially involve over 20% of the total outstanding Cheniere stock (55,000,000 million shares / 267,899,730 shares).

11. The Company’s stock is traded on the NYSE under the symbol “LNG.” Cheniere owns and operates the Sabine Pass liquefied

natural gas (“LNG”) receiving terminal and Creole Trail Pipeline in Louisiana through its partial ownership interest in and management agreements with Cheniere Energy Partners, L.P., which is a publicly traded partnership created in 2007.

Through its subsidiary, Cheniere Energy Partners, L.P., Cheniere is developing a liquefaction project adjacent to the Sabine Pass LNG terminal for up to six LNG trains with aggregate capacity of approximately 27 megatonnes per annum.

6

CLASS ACTION ALLEGATIONS

12. Plaintiff brings this action individually and as a class action, pursuant to Court of Chancery Rule 23, on behalf of all similarly

situated stockholders of Cheniere (the “Class”). Excluded from the Class are Defendants herein, and any person, firm, trust, corporation or other entity related to or affiliated with any of the Defendants.

13. This action is properly maintainable as a class action.

14. The Class is so numerous that joinder of all members is impracticable. As of April 15, 2014, there were 237,899,730 shares of

Cheniere common stock outstanding.

15. There are questions of law and fact which are common to the Class including, inter alia,

the following:

| |

(a) |

whether the Director Defendants breached their fiduciary duties to Plaintiff, the other members of the Class and the Company; and |

| |

(b) |

whether Plaintiff and the Class are entitled to declaratory relief, injunctive relief and/or damages. |

16. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature.

Plaintiff’s claims are typical of claims of the other members of the Class and Plaintiff has the same interests as the other members of the Class. Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately

protect the interests of the Class.

7

17. The prosecution of separate actions by individual members of the Class would create the risk

of inconsistent or varying adjudications with respect to individual members of the Class that would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class that would, as a

practical matter, be dispositive of the interests of the other members not party to the adjudications or substantially impair or impede their ability to protect their interests.

18. Defendants have acted, or refused to act, on grounds generally applicable to and causing injury to the Class, and therefore injunctive

relief and/or corresponding declaratory relief on behalf of the Class as a whole is appropriate.

WRONGFUL ACTS AND OMISSIONS

| |

I. |

The Extraordinary Restricted Stock Awards Granted to the Executive Defendants Under the 2011 Plan |

19. On April 29, 2014, it was reported that Cheniere’s CEO, Defendant Souki, received compensation of over $141 million in 2013, on

top of the $57 million he received in 2012, for total compensation exceeding $198 million for two years. The other five Executive Defendants received total compensation exceeding $130 million in the last two years. But these public disclosures do

not tell the full story.

8

20. The vast bulk of the compensation these employees have received has been through the issuance

of restricted stock awards under the 2011 Plan. Defendant Souki received 6 million restricted shares in 2013 under the 2011 Plan – the maximum permissible for any employee in one year under the terms of the plan1 – with a fair market value of $126,600,000 based on the market price on the date of grant, which was $21.10 per share. The other five Executive Defendants received awards totaling 3,840,000

restricted shares under the 2011 Plan in 2013 with a fair market value of $80,934,000 based on the market price on the date of grant.

21.

Defendant Souki received 3.5 million restricted shares in 2012 under the 2011 Plan with a fair market value of $49,210,000 based on the market price on the date of grant, which was $14.06 per share. The other five Executive Defendants received

awards totaling 2.2 million restricted shares under the 2011 Plan in 2012 with a fair market value of $30,932,000 based on the market price on the date of grant.

22. While these awards were excessive when made, this Complaint does not allege that they were wasteful simply

because they were extraordinary and, in

| 1 |

In fact, Defendant Souki received an additional 300,000 Cheniere restricted shares in 2013 (for a total of 6,300,000 shares), but because this award exceeded the maximum of the 2011 Plan for any one employee, these

shares were granted under a previous compensation plan – the Cheniere 2003 Incentive Compensation Plan (the “2003 Plan”). |

9

large part, unprecedented. Instead, this Complaint alleges that most of these awards should never have been

granted because the majority of Cheniere’s stockholders did not approve the increases to the 2011 Plan share reserve that supposedly support them. As of April 15, 2014, the Compensation Committee has thus far granted 27,197,536 shares

under the 2011 Plan to the Executive Defendants and other employees and consultants of Cheniere. However, 17,197,536 of these shares, should not have been awarded since Cheniere’s stockholders did not approve them.

| |

II. |

The 17,197,536 Restricted Stock Awards that Violated Cheniere’s Bylaws, Delaware Law and the Terms of the 2011 Plan |

23. The 2011 Plan was originally approved by a majority of Cheniere’s stockholders on June 16, 2011 with a share reserve of

10 million shares. This plan passed easily with the following votes recorded:

|

|

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 23,459,610 |

|

7,320,515 |

|

209,084 |

|

19,308,606 |

24. However, because, as noted above, Cheniere provided the Executive Defendants with such extraordinarily

high compensation under the 2011 Plan, on December 31, 2012 – less than one year after the 2011 Plan was originally approved by stockholders – only 100,000 shares remained of the 10 million shares originally approved for the 2011 Plan

share reserve.

10

25. On this same date, December 31, 2012, despite the fact that the share reserve was almost

completely depleted, the Compensation Committee approved an aggregate grant of 17.4 million shares of restricted stock under the 2011 Plan to all employees and 600,000 shares of restricted stock to a consultant of the Company. Since there were

almost no shares left in the 2011 Plan share reserve to cover these grants, it was necessary for the Company to request stockholder approval of an increase to the share reserve under the terms of the 2011 Plan.2

26. To gain such stockholder approval, on February 1, 2013, the Company convened a

special meeting and requested stockholder approval of an increase to the 2011 Plan share reserve of 25 million shares through the Special Meeting Proxy Statement. The stockholder vote on this increase was scheduled for February 1, 2013.

| 2 |

The February 1, 2013 stockholder vote was necessary to cover the Compensation Committee’s December 31, 2012 awards because, as the Special Meeting Proxy Statement explained, “Any amendment which

would constitute a “material revision” of the 2011 Plan (as that terms is used in the rules of the NYSE MKT LLC) or to the extent necessary to comply with the [tax] Code, including Sections 162(m) and 422 of the Code, is subject to

stockholder approval.” The first type of “material revision” of an “equity compensation plan” identified in the NYSE Listed Company Manual that requires “stockholders must be given the opportunity to vote,” is

“[a] material increase in the number of shares available under the plan….” |

11

27. The February 1, 2013 stockholder vote to nearly triple the 2011 Plan share reserve was

decidedly more contentious than the vote to originally approve the plan. The results of this vote were reported as:

|

|

|

|

|

|

|

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 77,011,739 |

|

57,907,345 |

|

36,252,581 |

|

0 |

28. As these vote totals demonstrate, it was only by not counting abstentions as part of the overall vote that

Defendants were able to claim that “stockholders voted in favor of Amendment No. 1 to the 2011 Plan” on the 2013 8- K reporting these results. But with regard to this vote, both Cheniere’s bylaws and Delaware law required that

abstentions be counted as “no” votes, meaning less than 45% of the vote was in favor of amendment. Thus, both the Special Meeting Proxy Statement and 2013 8-K were false or misleading.

| |

III. |

Cheniere’s Bylaws and Delaware Law Required the Stockholder Vote to Increase the 2011 Plan’s Share Reserves Counted Abstentions as “No” Votes |

29. On the date of the stockholder vote to increase the 2011 Plan share reserve by 25 million shares, February 1, 2013,

Cheniere’s bylaws § 2.7 read as follows:

Each Stockholder shall be entitled to one vote for each Share held of record by such

Stockholder. Except as otherwise provided by law or the Certificate of Incorporation, when a quorum is present at any meeting of Stockholders, the vote of the record holders of a majority of the Shares entitled to vote thereat, present in

person or by proxy, shall decide any question brought before such meeting.

12

(Emphasis added.)

30. This bylaw is essentially identical to the default rule in Delaware which provides that, unless the bylaws or certificate of incorporation

hold otherwise,

In all matters other than the election of directors, the affirmative vote of the majority of shares present in

person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders;

8 Del. C. §

216(2) (emphasis added).

31. In a case with a substantially similar bylaw provision, this Court has held that “[I]n determining

whether a [shareholder] proposal has passed in a circumstance where the vote is required ‘a majority of the shares present and entitled to vote on the subject matter,’ abstentions . . . are to be treated as shares present and

“entitled to vote on the subject matter.” Applying that standard, an abstention would be counted as a ‘no’ vote . . . .” Licht v. Storage Tech. Corp., C.A. No., 524-N, 2005 Del. Ch. LEXIS 64, at *1-2

(Del. Ch. May 6, 2005)(emphasis added).

13

32. Delaware law provides that when a company’s bylaws require the vote of

“a majority of the shares present and entitled to vote on the subject matter,” abstentions, but not broker non-votes, are to be

treated as shares present and “entitled to vote on the subject matter.” Applying that standard, an abstention would be counted as a “no” vote ….”

R. FRANKLIN BALOTTI & JESSE A. FINKLESTEIN, THE DELAWARE

LAW OF CORPORATIONS AND BUSINESS ORGANIZATIONS, § 7.25 (emphasis added).3

33. Another leading Delaware authority explains that

As a general rule, in the absence of charter, bylaw, or statutory provisions setting forth some other requirement, the vote

necessary for effective stockholder action upon a transaction is the affirmative vote of a majority of the voting power present and entitled to vote on the subject matter. Thus, abstentions are in effect negative votes. For

example, where a quorum of 100 votes is present, effective action occurs only where 51 votes are cast in its favor. A resolution receiving only 50 affirmative votes is defeated, no matter whether the remainder are negative votes or abstentions.

2 DAVID A. DREXLER, LEWIS S. BLACK & A. GILCHRIST SPARKS,

III, DELAWARE CORPORATION LAW AND PRACTICE, § 25.06 (emphasis added).

34. Countless additional authorities echo this rule. For example, Keith Paul Bishop of the National Law Review writes,

Under Section 216(2) of the Delaware General Corporation Law, the default required vote (in the absence of a specification in the

certificate of incorporation or bylaws) is the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of

| 3 |

See 8 Del. C. § 109(b) (“The bylaws may contain any provision, not inconsistent with law. . . .”). |

14

the stockholders. Under this standard, abstentions must be counted. Not counting abstentions is [also] at odds with the NYSE’s stockholder approval rule. The New York Stock

Exchange requires stockholder approval of specified matters. When stockholder approval is required, Rule 312.07 of the Listed Company Manual requires the approval of a majority of the votes ‘cast’. Oddly, the NYSE considers abstentions as

votes ‘cast’.

Keith Paul Bishop, On Closer Inspection, This CII (Council of Institutional Investors) ‘Best Practice’ May Be

Neither Good Nor Legal, National Law Review (Feb. 4, 2014) (emphasis added).

35. Gibson, Dunn & Crutcher LLP released an advisory

regarding changes to the NYSE Rules quorum requirement on July 19, 2013 that explained:

[F]or companies with a voting standard that

requires “approval from a majority of the shares, present in person or by proxy and entitled to vote” (the Delaware law default), the voting calculation will be the same under a company’s organizational documents and the NYSE rule.

In this case, abstentions count as votes against a proposal both for NYSE and state law purposes.

Gillian McPhee, Ronald Mueller, NYSE

Amends Rules on Matters Requiring Stockholder Approval Under NYSE Rules (July 19, 2013) (emphasis added).

36. Similarly, on

October 22, 2010, McDermott Will & Emery issued an advisory in the wake of the Dodd-Frank Act, explaining that companies should be aware of how their bylaws or charter documents deal with abstentions because

Unless bylaws or charter documents provide otherwise, at meetings of Delaware corporations, abstentions will effectively be

counted as de facto “against” votes because approval of the matter would require the vote of a majority of the shares present and entitled to vote.

SEC Proposes Rules on Executive Compensation Stockholder Votes Under Dodd- Frank (Oct. 22, 2010) (emphasis added).

15

37. Aside from this authority, the history behind Cheniere’s bylaw § 2.7 demonstrates

that until very recently, Cheniere has always regarded this bylaw as requiring that abstentions be counted as “no” votes with regard to every vote except for stockholder votes to appoint directors,4 i.e., the Delaware default standard. Indeed, after Cheniere’s bylaws were restated on January 29, 2004, they were amended only twice until they were completed restated on

April 3, 2014 (as discussed in detail below). The first of these two amendments dealt entirely with § 2.7 and this March 1, 2005 amendment tracks almost exactly what the Delaware default rule 8 Del. C. § 216(2) says, as

demonstrated above.

38. Indeed, while previous proxy statements varied in their explanations of how abstentions would be counted towards

a stockholder vote, after this March 1, 2005 change to § 2.7, every single proxy statement Cheniere filed until 2011 said that it counted abstentions as “no” votes on all votes that did not involve director elections.

39. Then, in 2011, Cheniere began reporting in its proxy statements that for other votes, not dealing with

director elections, “Abstentions and broker non-votes represented by submitted proxies will not be taken into account….” The

| 4 |

The Delaware default standard has an exception for director elections. 8 Del. C. § 216(2) (“In all matters other than the election of directors, the affirmative vote of the majority of shares

present in person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders.”) (emphasis added). |

16

reason for this 2011 decision is unclear, but Cheniere did not modify its bylaws before 2011 to allow for such

changes. The only obvious explanation for this decision is that in 2011 and afterwards Cheniere also began to falsely conflate abstentions with “broker non-votes” in its proxy statements, claiming in the 2011 proxy statement that:

“‘Abstentions’ and ‘broker non-votes’ occur when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting

power for that particular item and has not received instructions from the beneficial owner.”

40. This statement, found in

Cheniere’s 2011-2013 proxy statements, is untrue, as Cheniere demonstrated in its most recent 2014 Proxy Statement, which deletes “abstentions” from this definition: “Broker non-votes” occur when a bank, broker or other

holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.”

41. Indeed, Delaware authorities are clear that, unlike a broker non-vote, “an abstention is a voluntary decision not to

vote….” R. FRANKLIN BALOTTI & JESSE A. FINKLESTEIN, THE DELAWARE LAW OF CORPORATIONS

AND BUSINESS ORGANIZATIONS, § 7.25. This is why Delaware requires such votes be counted within the group “entitled to vote.”

17

42. In sum, the February 1, 2013 stockholder vote to increase the 2011 Plan share reserve by

25 million shares did not gain the requisite majority needed for passage. As such, all restricted share compensation dependant on this increase is in contravention of the terms of the plan, the Company’s bylaws, NYSE rules and Delaware

law.

43. As of April 15, 2014, the Company reports that it is has awarded 17,197,536 Restricted Stock Awards attributable to this

illegal increase. None of these shares are valid.

| |

IV. |

Defendants Are Aware That Cheniere’s Former Bylaws Required Counting Abstentions as “No” Votes |

44. After the illegal February 1, 2013 stockholder vote, Cheniere changed its bylaws regarding abstentions demonstrating that Defendants

were aware that the February 1, 2013 stockholder vote did not comply with Delaware law.

45. On April 3, 2014, Cheniere’s

Board entirely restated its bylaws for the first time since 2004. In the 8-K disclosing these changes filed with the SEC on April 9, 2014, the Company explained that one such change was made “to provide how abstentions and broker non-votes

will be treated.” Indeed, these revised bylaws entirely deleted the language from § 2.7 that directly tracked the Delaware default rule – 8 Del. C. § 216(2) – and which explained stockholder “voting.”

18

Now, § 2.8 of the bylaws explains stockholder “voting,” and it somewhat confusingly states:

SECTION 2.8. Voting. Except as otherwise provided by the Certificate of Incorporation, each stockholder entitled to vote at any meeting of

stockholders shall be entitled to one vote for each share held by such stockholder which has voting power upon the matter in question. On any matter where a minimum or other vote of stockholders is provided by the Certificate of Incorporation,

these Bylaws, the rules or regulations of any stock exchange applicable to the Corporation, or applicable law or pursuant to any regulation applicable to the Corporation or its securities, such minimum or other vote shall be the required

vote on such matter (with the effect of abstentions and broker non-votes to be determined based on the vote required). All other matters presented to the stockholders at a meeting at which a quorum is present for which no

minimum or other vote is called for by the Certificate of Incorporation, these Bylaws, the rules or regulations of any stock exchange applicable to the Corporation, or applicable law or pursuant to any regulation applicable to the Corporation or its

securities, other than for the election of Directors, shall be decided by the affirmative vote of the holders of a majority in voting power of the shares of stock entitled to vote on the matter, present in person or by proxy (with abstentions

counting as votes against the matter and broker non-votes not counting as shares entitled to vote on the matter).

Subject to the

rights of the holders of any series of preferred stock to elect Directors under specified circumstances, each Director shall be elected by the vote of a majority of votes cast with respect to that Director’s election at any meeting for the

election of Directors at which a quorum is present, provided that if, as of the tenth (10th) day preceding the date the Corporation first mails its notice of meeting for such meeting to the stockholders, the number of nominees exceeds the

number of Directors to be elected (a “Contested Election”), the Directors shall be elected by the vote of a plurality of the votes cast. For purposes of this Section 2.8, a “majority of votes cast” shall mean that the number

of votes cast “for” a Director’s election exceeds the number of votes cast “against” that Director’s election (with “abstentions” and “broker non-votes” not counted as votes cast

19

either “for” or “against” that Director’s election). In the event an incumbent Director fails to receive a majority of votes cast in an election that is not

a Contested Election, such incumbent Director shall submit to the Company, in accordance with Section 3.4 of these Bylaws, such director’s resignation from the Board, contingent on acceptance of that resignation by the Board. The

Governance and Nominating Committee shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent Director, or whether other action should be taken. The Board shall act on the resignation, taking into

account the Governance and Nominating Committee’s recommendation, and publicly disclose (by a press release and filing an appropriate disclosure with the Securities and Exchange Commission) its decision regarding the resignation (and, if such

resignation is rejected, the rationale behind the decision) within ninety (90) days following certification of the election results. The Director whose resignation is being considered shall not participate in the deliberations of the Governance

and Nominating Committee or the Board with respect to whether to accept such director’s resignation. If the Director’s resignation is not accepted by the Board, such Director shall continue to serve until his or her successor is duly

elected, or until his or her earlier resignation or removal. If the Board accepts a Director’s resignation pursuant to this Section 2.8, or if a nominee for Director is not elected and the nominee is not an incumbent Director, then the Board

may fill the resulting vacancy pursuant to Article III, Section 3.3 of these Bylaws.

(Emphasis added.)

46. While this new bylaw is far from clear, it appears to allow the Company, as of April 3, 2014, to not count abstentions as

“no” votes “[o]n any matter where a minimum or other vote of stockholders is provided by the Certificate of Incorporation, these Bylaws, the rules or regulations of any stock exchange applicable to the Corporation, or applicable law

or pursuant to any regulation applicable to the Corporation or its securities.” As noted in footnote 2

20

above, votes to increase the 2011 Plan share reserve are specifically required by the NYSE rules – a “stock exchange applicable to the Corporation.” As such, had these bylaws been

in effect before the February 1, 2013 vote, Cheniere could have conceivably chosen not to count abstentions toward the vote. On information and belief, therefore, this bylaw was created for an improper purpose – to disenfranchise

stockholders by making it far easier for the Company’s Board and management to gain approval of unpopular items such as increases to the 2011 Plan share reserve. It was also improper to change this bylaw given the fact that the Company has

never admitted the previous February 1, 2013 vote was faulty and that in the context of that vote, the Company should have counted abstentions as “no” votes, rendering that vote void.

47. Accompanying this change to the bylaws, less than a month after the Board made this change to Cheniere’s “abstention”

rules, on April 28, 2014, Cheniere’s management and Board proposed another increase to the 2011 Plan share reserve in the 2014 Proxy Statement. This proposal, Proposal 4, which has been submitted for a June 12, 2014 stockholder vote,

would increase the 2011 Plan share reserve by another 30 million shares. Proposal 3, which has been submitted for the same vote, requests a shareholder vote to approve the 2014-2018 Long- Term Incentive Compensation Program, is dependant on the

approval of Proposal 4 and the increase to the 2011 Plan share reserve.

21

48. Notably, however, the 2014 Proxy Statement also demonstrates that Defendants are aware that

the previous February 1, 2013 vote to increase the share reserve improperly failed to count abstentions as “no” votes. For example, as stated above, the 2014 Proxy Statement now corrects language that had in the previous proxy

statements incorrectly conflated abstentions with “broker non-votes.” In addition, the 2014 Proxy Statement now explains within the actual proposals (rather than simply in the introductory instructions to the proxy statement) that

“Abstentions and broker non-votes will not be taken into account in determining the outcome of [the increase to the share reserve.]” In the Special Meeting Proxy Statement, the proposal explained that the February 1, 2013 increase to the

2011 Plan share reserve required “the affirmative vote of at least a majority of the shares present in person or by proxy at the Meeting and entitled to vote on such matter.” In other words, the language in the actual proposal to increase

the 2011 Plan share reserve on February 1, 2013 tracked exactly with the language in the then-existing bylaws. No such language is contained in the new 2014 proposal.

| |

V. |

The 2014 Proxy Statement Is False and Misleading |

49. The 2014 Proxy Statement is false

and misleading for a number of reasons. First, it does not explain that the February 1, 2013 vote did not properly increase the 2011 Plan share reserve. Instead, it falsely reports that: (1) “The

22

stockholders approved an increase in the number of shares of common stock available for issuance under the 2011 Plan in February 2013”; (2) “The 2011 Plan was approved by our

stockholders in June 2011 and an amendment to the 2011 Plan was approved by our stockholders in February 2013”; and (3) “The 2011 Plan was amended in February 2013.”

50. Second, the 2014 Proxy Statement falsely reports the 2011 Plan share reserve as being far greater than the 10 million shares that were

originally approved by stockholders in 2011. It also falsely reports that shares remain available for issuance under the 2011 Plan: “As of April 15, 2014, there were 8,072,454 shares of common stock available for issuance under the 2011

Plan. An aggregate of 27,197,536 shares of restricted stock were granted under the 2011 Plan through the date of the filing of this Proxy Statement.”

51. Third, it never explains that the newly-adopted April 3, 2014 bylaws have fundamentally changed the way the Company will count

abstentions going forward for votes such as those to increase the 2011 Plan share reserve. Instead, it ignores this important change to stockholder rights – only mentioning the restated bylaws once in the 2014 Proxy Statement, and then only

with regard to their effect on director elections.

52. In sum, the 2014 Proxy Statement is false and misleading.

23

DEMAND FUTILITY ALLEGATIONS

53. Plaintiff has not made any demand on the Company’s Board to institute this action because none is required for a direct claim seeking

redress for wrongs to fair corporate suffrage. With regard to the derivative claims, the Director Defendants are interested in the improper increases to the 2011 Plan share reserve and their wrongful acts render any demand requirement as futile.

54. As of the date of filing, there are eleven members of Cheniere’s Board. As stated above, of these eleven directors, the 2014

Proxy Statement claims that only nine meet the NYSE “independence” requirements. Defendant Souki is not independent because he is Chief Executive Officer and President of the Company. Defendant Foley is not independent because he is a

Senior Managing Director in Blackstone, and his appointment to the Board was made pursuant to an investor rights agreement that was entered into by the Company, Cheniere Partners GP, Blackstone CQP Holdco, LP and various other related parties in

connection with Blackstone Holdco’s purchase of Class B units in Cheniere Energy Partners, L.P.

| |

I. |

The Entire Board Is Interested in the 2011 Plan Compensation That This Complaint Challenges |

55. In addition to Defendants Souki and Foley, the other nine members of the Board are interested in the stockholder votes concerning the 2011

Plan share reserve on February 1, 2013 and June 12, 2014 because they received the majority

24

of their compensation in restricted stock under the 2011 Plan, and this Complaint prays for an injunction declaring this compensation (and all other 2011 Plan compensation dependant on the

illegal February 1, 2013 vote and upcoming June 12, 2014) void. Indeed, the 2014 Proxy Statement reports that “[a]s of April 15, 2014, there were approximately 478 employees [including Souki], one consultant and ten non-employee

directors [including Foley] eligible to participate in the 2011 Plan.”

56. The 2014 Proxy

Statement also reports that the ten non-employee directors received the majority or all of their compensation in restricted stock5:

|

|

|

|

|

|

|

|

|

| Non-Employee Director |

|

Restricted Stock Comp. |

|

|

Total Comp. |

|

| Vicky A. Bailey |

|

$ |

90,020 |

|

|

$ |

175,020 |

|

| G. Andrea Botta |

|

$ |

100,016 |

|

|

$ |

195,016 |

|

| Nuno Brandolini |

|

$ |

90,020 |

|

|

$ |

175,020 |

|

| Keith F. Carney |

|

$ |

200,004 |

|

|

$ |

203,446 |

|

| John M. Deutch |

|

$ |

95,004 |

|

|

$ |

185,004 |

|

| David I. Foley |

|

$ |

180,012 |

|

|

$ |

180,012 |

|

| Randy A. Foutch |

|

$ |

158,016 |

|

|

$ |

158,016 |

|

| Paul J. Hoenmans |

|

$ |

90,020 |

|

|

$ |

135,020 |

|

| David B. Kilpatrick |

|

$ |

100,016 |

|

|

$ |

195,016 |

|

| Walter L. Williams |

|

$ |

90,020 |

|

|

$ |

186,815 |

|

| 5 |

Cheniere’s 2013 10-K reports restricted stock compensation has been awarded to directors under both the 2011 Plan and the earlier 2003 Plan. Although no Cheniere public disclosure makes this clear, it is very

likely that all of the restricted stock compensation described in the above chart comes from the 2011Plan because at the time the 2011 Plan was first approved by stockholders, it was intended to replace the 2003 Plan. The 2011 Proxy Statement

reported in this regard that “it is expected that the 2003 Plan will not have sufficient shares of common stock reserved for issuance necessary to cover future award programs.” And, in any event, the 2003 Plan expired in January 2014,

meaning all future grants will have to come from the 2011 Plan. |

25

57. In sum, each of the directors is interested in the compensation they have received and will

receive under the 2011 Plan based on the February 1, 2013 and June 12, 2014 stockholder votes to (ostensibly) increase the share reserve. The positive resolution of this action would require the return of this compensation to the Company

and new stockholder votes with corrective disclosures, putting all of this compensation in jeopardy. These allegations render all of the Defendant Directors incapable of making an impartial decision regarding pre-suit demand.

58. But even if each of the directors were not interested, demand would still be excused by virtue of conflicts involving a majority of board

members. In addition to Defendants Souki and Foley, who are admitted by the Company to be non-independent under NYSE rules, defendants Bailey, Carney, Foutch, Kilpatrick and Williams are all members of the Compensation Committee, which has direct

oversight of the illegal compensation that has been granted purportedly under the auspices of the 2013 stockholder vote. These five members of the Board, in addition to Souki and Foley, constitute seven of the eleven members of the current Board,

thereby providing an alternative basis for a finding that demand would be futile.

26

| |

II. |

The Violations of the 2011 Plan and Bylaws Are Not Protected by the Business Judgment Rule |

59. Delaware law excuses demand whenever the challenged act of the board is not the product of a valid exercise of business judgment,

regardless of whether a majority of the board is disinterested and independent.

60. The bylaws are a contract between the Company, the

stockholders, its directors and its officers, and none of these parties is permitted to violate this contract. Nonetheless, all of the Director Defendants knowingly violated the terms of Cheniere’s bylaws by failing to count abstentions as

“no” votes with regard to the February 1, 2013 stockholder vote to increase the 2011 Plan share reserve. This is demonstrated not only by the failure to follow the bylaws and the extensive authority explaining that such bylaws require

abstentions to be counted as “no” votes, but also by the fact that the Board has, for example, subsequently amended these bylaws “to provide how abstentions and broker non-votes will be treated” without remediating the conduct

that led to this change.

61. Moreover, as noted above, the five members of the Compensation Committee, Defendants Bailey, Carney, Foutch,

Kilpatrick, and Williams, have violated the terms of the 2011 Plan by awarding compensation under it in excess of the share reserve properly approved by the stockholders. They have also violated

27

the bylaws by failing to count abstentions as “no” votes with regard to the February 1, 2013 stockholder vote to increase the 2011 Plan share reserve. The Compensation Committee

charter specifically requires compliance with the bylaws.

62. All Director Defendants have also violated the 2011 Plan by accepting

compensation that was provided in excess of the share reserve properly approved by the stockholders in 2011.

63. In addition, when, for a

stockholder meeting, a corporate board solicits stockholders’ votes for an executive compensation plan, the Board owes the stockholders a statutory and fiduciary duty of full and fair disclosure, meaning that all material facts must be fully

and fairly disclosed and no material facts may be omitted. This duty of disclosure is separate and apart from other fiduciary duties governing how board members and corporate officers must deal with the business and property of the corporation.

Courts give deference to a corporate board of directors as to questions of management of the corporation’s business, but not as to questions of the board’s performance of its disclosure duties, and for three reasons. First, a board’s

decision, even if taken in good faith, to misstate or to omit a material fact cannot be defended on the grounds that reasonable persons could differ on the subject. Second, although courts may not be well suited to making business decisions, courts

are well suited to deciding questions concerning the

28

quality of, and circumstances surrounding, disclosures. Third, allegations that a proxy statement has materially false or misleading representations and omissions could raise issues as to the

honesty and good faith of the directors. The Director Defendants made or permitted their names to be used with regard to soliciting stockholder votes connected to the following misrepresentations:

a. The Special Meeting Proxy Statement contained materially false or misleading statements and omissions concerning the treatment of

abstentions.

b. The 2014 Proxy Statement fails to properly explain the effect of the changes to the bylaws for purposes of counting

abstentions.

c. The 2014 Proxy Statement also misrepresents the February 1, 2013 stockholder vote, claiming that a majority of the

stockholders voted in favor of the share reserve increase.

COUNT I

(Direct Claim for Breach of Contract Against All Defendants)

64. Paragraphs 1 through 52 state a direct claim for relief against all defendants under Delaware law for violations of Cheniere’s bylaws

and Delaware law.

65. The right to vote his or her shares and to have that vote properly counted in accordance with a Company’s

governing documents is fundamental to stockholders. The violation of this right provides for a direct claim.

29

66. A corporation’s bylaws are also a contract between the stockholders, the board of

directors, the officers and the Company. The failure of any of these parties to follow these bylaws is therefore a breach of contract.

67. Defendants violated Plaintiff Jones’ right to have his vote properly counted by failing to count abstentions as “no” votes

with regard to the February 1, 2013 stockholder vote. Defendants also violated the bylaws, which form a contract between all parties.

68. Stockholder-approved compensation plans, like all documents that determine how a company governs itself, are also contracts between the

stockholders, the board of directors, the officers and the Company. Defendants violated 2011 Plan by (1) increasing the 2011 Plan share reserve without acquiring a stockholder vote approving such an increase on February 1, 2013; and

(2) awarding more stock-based compensation than the stockholder-approved share reserve.

69. As a result of these actions, Plaintiff

has been and will be injured.

70. Plaintiff has no adequate remedy at law.

71. To ameliorate the injury, an equitable accounting with disgorgement and injunctive relief is required.

30

COUNT II

(Derivative Claim for Breach of Contract On Behalf of the Company Against

All Director Defendants and Executive Defendants)

72. Paragraphs 1 through 63 state a derivative claim for relief against all Director Defendants and Executive Defendants under Delaware Law.

73. Delaware law does not allow corporate fiduciaries to violate the terms of a Company’s bylaws or stockholder-approved plans. As

noted above, defendants violated these documents by miscounting the February 1, 2013 stockholder vote and paying out more stock-based compensation than the stockholder approved share reserve that was last properly approved by Cheniere’s

stockholders.

74. As a result, the Company has been and will continue to be injured because the terms of a stockholder-approved plan have

been violated to provide more compensation to defendants than the 2011 Plan allowed.

COUNT III

(Direct Claim for Breach of Contract Against All Defendants)

75. Paragraphs 1 through 52 state a direct claim for relief against all defendants under Delaware law for violations of Cheniere’s bylaws

and Delaware law.

76. The Director Defendants improperly approved a change to the bylaws on April 3, 2014 that fundamentally

redefines the way abstentions are to be treated going forward. This change was made to disenfranchise stockholders as a reaction to the February 1, 2013 stockholder vote that should have, but did not, count abstentions as “no” votes.

31

77. The fact that the reason for this change was never explained to stockholders and the fact

that it was made in reaction to a violation of the previous bylaws by the Defendants renders this change improper.

78. As a result of

these actions, Plaintiff has been and will be injured.

79. Plaintiff has no adequate remedy at law.

80. To ameliorate the injury, this bylaw should be suspended pending a vote by the stockholder to approve it with full disclosure of the

reasons why this change was implemented.

COUNT IV

(Derivative Claim for Breach of Contract On Behalf of the Company Against

All Director Defendants and Executive Defendants)

81. Paragraphs 1 through 63 state a derivative claim for relief against all Director Defendants under Delaware Law.

82. Delaware law does not allow corporate fiduciaries to change a Company’s bylaws for improper purposes. As noted above, the Director

Defendants restated Cheniere’s bylaws on April 3, 2014 in part to disenfranchise stockholders and as a reaction to the February 1, 2013 stockholder vote that should have, but did not, count abstentions as “no” votes.

83. As a result, the Company has been and will continue to be injured.

32

COUNT V

(Direct Claim for Breach of Fiduciary Duty Against All Defendants)

84. Paragraphs 1 through 52 state a direct claim for relief against all defendants under Delaware law for violations of Cheniere’s bylaws

and Delaware law.

85. Defendants caused materially false statements to be disseminated to the stockholders in the Special Meeting Proxy

Statement, the 2013 8-K, and the 2014 Proxy Statement.

86. The acts of Defendants have injured Plaintiff directly by providing materially

false information in connection with the upcoming stockholder vote.

87. As a result of these actions of the Director Defendants,

Plaintiff has been and will be injured.

88. Plaintiff has no adequate remedy at law.

89. To ameliorate the injury, injunctive relief is required in the form of corrective disclosures regarding Proposal 3 – to approve an

increase to the 2011 Plan share reserve – and Proposal 4 – to approve the 2014-2018 Long Term Incentive Compensation Program – at the June 12, 2014 meeting.

COUNT VI

(Derivative Claim for Breach of Fiduciary Duty On Behalf of the Company

Against All Director Defendants and Executive Defendants)

90. Paragraphs 1 through 63 state a derivative claim for relief against all Director Defendants and Executive Defendants under Delaware Law.

33

91. The acts of the Director Defendants in distributing the false or misleading Special Meeting

Proxy Statement, the 2013 8-K, and the 2014 Proxy Statement have injured the Company by interfering with proper governance on its behalf that follows the free and informed exercise of the stockholders’ right to vote for directors and for

compensation plans.

92. The acts of the Executive Defendants and the Director Defendants in distributing the false and misleading Proxy

Statement, including their names in it, authorizing the acceptance and the payment of compensation under the 2011 Plan and failing to seek informed stockholder approval of 2011 Plan share reserve constitute breaches of these Defendants’

respective duties of loyalty to and care for the Company and its stockholders.

93. As a result of these actions of the Director

Defendants and the Executive Defendants, the Company has been and will be injured.

COUNT VII

(Derivative Claim for Unjust Enrichment On Behalf of the Company

Against the Director Defendants and the Executive Defendants)

94. Paragraphs 1 through 63 state a derivative claim for relief against the Director Defendants and Executive Defendants under Delaware Law.

95. The Director Defendants and Executive Defendants have been or will be unjustly enriched as a result of their acceptance of stock

compensation under the 2011 Plan that exceeded the share reserve approved by Cheniere’s stockholders. These Defendants’ acceptance of such improperly paid compensation has or will constitute unjust enrichment.

34

96. As a result, the Company has been and will continue to be injured because the terms of a

stockholder-approved plan have been violated to provide more compensation to defendants than the 2011 Plan allowed.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff respectfully pray for the following relief:

A. Preliminary and permanently enjoining Defendants and their counsel, agents, employees and all persons acting under, in concert with, or for

them, from proceeding with the Stockholder Vote until Defendants disclose all material information and correct material misrepresentations in the Special Meeting Proxy Statement, the 2013 8-K, and the 2014 Proxy Statement;

B. Declaring the Company’s February 1, 2013 vote void that approved the increase in the Company’s 2011 Plan share reserve and

disgorge all compensation distributed as a result of this improper share increase;

F. An order requiring equitable accounting, with

disgorgement, in favor of the Company for the losses that it has and will sustain by virtue of the misconduct alleged herein;

G. Awarding

monetary relief, including but not limited to monetary damages to compensate for the dilution of Cheniere’s stock from February 1, 2013 to the present, in addition to or in substitution of the specific equitable relief herein requested;

35

I. Awarding Plaintiff the costs and disbursements of this action and a reasonable allowance for

fees and expenses for Plaintiff’s counsel and expert(s); and

J. Granting Plaintiff such other and further relief as the Court may

deem just and proper.

36

|

|

|

|

|

|

|

| Dated: May 29, 2014 |

|

|

|

ANDREWS & SPRINGER LLC |

|

|

|

|

By: |

|

/s/ Peter B. Andrews |

|

|

|

|

Peter B. Andrews (Del. Bar No. 4623) |

|

|

|

|

Craig J. Springer (Del. Bar No. 5529) |

|

|

|

|

3801 Kennett Pike, Building C, Suite 305 |

|

|

|

|

Wilmington, DE 19807 |

|

|

|

|

Tel.: (302) 504-4957 |

|

|

|

|

|

|

|

Counsel for Plaintiff James B. Jones |

|

|

|

|

| Of Counsel: |

|

|

|

|

|

|

BARRACK, RODOS & BACINE

Daniel E. Bacine

Jeffrey W. Golan

Julie B. Palley

Two Commerce Square

2001 Market Street, Suite 3300

Philadelphia, PA 19103

Tel.: (215) 963-0600

-and-

Alexander Arnold Gershon

Michael A. Toomey

425 Park Avenue, Suite 3100

New York, NY 10022

Tel.: (212) 688-0782

Counsel for Plaintiff James B.

Jones

37

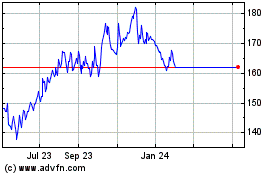

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024