THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the first quarter of 2014. Revenue

this quarter was $3.2 million, 87 per cent higher than the first quarter of

2013, mainly due to higher sales activity in Canada. The Company reported a 92

per cent improvement in profit at $801,750(2) ($0.032 per basic share) for the

three months ended March 31, 2014 compared to a profit of $417,084 ($0.017 per

basic share) for the same three-month period of the prior year.

The increase in profit was due primarily to higher revenues arising out of the

increased volume of incinerators sold. Also contributing to the increase were

higher revenues from Incinerator and combustion services while lower Incinerator

rental income, higher average cost of sales and administrative expense and

higher income tax expense partially offset the impact on earnings of the

increased sales revenues. Higher net foreign exchange gains recorded in the

first quarter of 2014 compared to the same period of 2013 also contributed to

the the Company's overall improved performance.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except shares outstanding)

Increase

For the three months ended March 31 2014 2013 (decrease)

----------------------------------------------------------------------------

Revenue 3,214,437 1,719,577 1,495,860

Gross profit(1) 1,442,541 890,441 552,100

EBITDA(1) 1,154,868 656,220 468,648

Profit for the period(1)(2) 801,750 417,084 384,666

Cost of sales as a percent of

revenue(1) 55.1% 48.2% 6.9%

Funds flow from operations before

movements in non-cash working

capital(1) 1,255,065 662,405 592,660

Earnings per share

- Basic 0.032 0.017 0.015

- Diluted 0.031 0.017 0.014

----------------------------------------------------------------------------

March 31, December 31, Increase

As at 2014 2013 (decrease)

----------------------------------------------------------------------------

Total assets 14,794,863 14,029,829 765,034

Non-current liabilities 152,906 175,130 (22,224)

Shares outstanding(3)

Basic 25,282,370 25,102,265 180,105

Diluted 26,117,133 25,939,888 177,245

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of Questor's Management's Discussion and

Analysis for the year ended December 31, 2013.

(2) Before Other comprehensive income (loss).

(3) Weighted average.

The Company has received confirmed incinerator sales orders for $3.8 million

since the start of the year. The units are expected to be delivered in the

second and third quarter of 2014 and the associated revenue recorded at that

time. Management is in discussions with several companies in Canada and the U.S.

with respect to terms and conditions on additional incinerator orders, the

revenue for which will be recorded at the time the units are fabricated and

ready for delivery in the third and fourth quarters of 2014. For certain sizes

of units, the inventory that management built up over the latter half of 2013

will ensure that the Company is able to provide clients with short delivery

times on their orders.

At present, Questor has approximately 90 percent of the available rental

incinerator capacity committed under term contracts and is operating in the

traditional Western Canada markets as well as new markets in the United States.

Management expects to continue to issue orders for fabrication of additional

units for completion in the third and fourth quarters to add to the rental

fleet.

"The heightened environmental focus on emissions from flaring, climate change

and the health concerns arising from the impacts of poor air quality has created

a significant and growing market opportunity for Questor both domestically and

internationally. It has become essential for our clients to address these issues

to obtain approval for projects and the social license to operate," said Ms.

Audrey Mascarenhas, Questor's President and CEO. "As the U.S. adopts the new EPA

rules, the demand for our products continues to develop in both the sales and

rental businesses," she continued. "We have an inventory of units available and

have fabrication partners with sufficient capacity to meet new orders."

Questor's product quality and combustion expertise are becoming more recognized

on a daily basis globally. Our incineration technology is unique in its ability

to allay public concerns regarding air quality and is capable of meeting

emissions standards across a broad range of applications. Emissions legislation

introduced in the United States and Europe is expected to continue to increase

interest in our technology as companies look for solutions to flaring and

emissions control."

On January 31, 2014, Questor acquired 100% of the outstanding shares of

ClearPower Systems Inc., ("ClearPower") a company incorporated in 2010 under the

laws of the state of Delaware. ClearPower has developed technology that will

translate waste heat from any source into power. The integration of waste heat

from Questor's incineration process with the power generation capability of the

ClearPower technology is expected to present a valued solution for many of its

customers. "We are planning to commission a demonstration of this integration in

the fourth quarter of 2014 at an oil and gas facitlity in close proximity to

Calgary," said Ms Mascarenhas. "In addition we continue to evaluate the

substantial waste heat market that the ClearPower technology can be applied

directly to. These two large waste heat areas present opportunities that Questor

continues to prepare for and we anticipate revenue generation in 2015."

"We are focused and committed to providing continued excellence in combustion

products and services while we select our next steps in respect of introducing

Clearpower as a complementary technology to the enormous waste heat markets. Our

planning around fabrication has us well positioned to pursue growth

opportunities in North America and Europe over the remainder of this year and

into 2015," concluded Ms. Mascarenhas.

Ms. Mascarenhas was invited to join the Alberta Small Medium Enterprise ("SME")

Export Council whose mission is to provide advice to the provincial Minister of

International and Intergovernmental relations on measures to expand, encourage

and facilitate access of Alberta SMEs to foreign markets. The Council met for

the first time in Edmonton on April 29, 2014.

She also spoke as a member of the Society of Professional Engineers at their

Environmental Impact Workshop in Halifax, Nova Scotia on May 14, 2014 on the

topic of Economic Implications of Compliance.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Tuesday, June 24, 2014 at 3:00 p.m. MDT in the Company's Corporate

Offices at 1121, 940 - 6th Avenue S.W, Calgary, Alberta. In addition to the

formal business items, management will be presenting an overview of Questor's

results for the financial year ended December 31, 2013 and first quarter ended

March 31, 2014 and discussing the Company's strategic initiatives for 2014.

Questor's unaudited condensed consolidated financial statements and notes

thereto and management's discussion and analysis for the three months ended

March 31, 2014 will be available shortly on the Company's website at

www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield services provider founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which enables regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

The technology creates an opportunity to utilize the heat generated from

efficient combustion which can be been used for water vaporization, process heat

and power generation, through ClearPower Solutions (a subsidiary of Questor).

While Questor's current customer base operates primarily in the crude oil and

natural gas industry, this technology is applicable to other industries such as

landfills, water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

Unaudited

March 31 December 31

As at 2014 2013

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 6,023,026 $ 7,323,303

Trade and other receivables 3,879,578 2,863,257

Inventories 2,347,975 2,359,276

Prepaid expenses and deposits 93,048 124,163

Current tax assets - 77,849

----------------------------------------------------------------------------

Total current assets $ 12,343,627 12,747,848

----------------------------------------------------------------------------

Non-current assets

Property and equipment 1,533,329 1,256,066

Intangible assets 230,509 25,915

Goodwill 687,398 -

----------------------------------------------------------------------------

Total non-current assets 2,451,236 1,281,981

----------------------------------------------------------------------------

Total assets $ 14,794,863 $ 14,029,829

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities,

provisions $ 1,768,737 $ 1,746,259

Deferred revenue and deposits 450,238 252,356

Current portion of lease inducement 52,002 52,002

Current tax liabilities 371,864 638,527

----------------------------------------------------------------------------

Total current liabilities 2,642,841 $ 2,689,143

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 44,570 53,793

Lease inducement 108,336 121,337

----------------------------------------------------------------------------

Total non-current liabilities 152,906 175,130

----------------------------------------------------------------------------

Total liabilities 2,795,747 $ 2,864,274

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,680,655 5,636,119

Reserves 692,081 703,156

Retained earnings 5,628,030 4,826,280

Cumulative translation adjustment (1,650) -

----------------------------------------------------------------------------

Total equity 11,999,116 11,165,555

----------------------------------------------------------------------------

Total liabilities and equity $ 14,794,863 $ 14,029,829

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

Unaudited

For the three months ended March 31 2014 2013

----------------------------------------------------------------------------

Revenue $ 3,215,437 $ 1,719,577

Cost of sales (1,772,896) (829,136)

----------------------------------------------------------------------------

Gross profit 1,442,541 890,441

Administration expenses (487,156) (353,550)

Net foreign exchange gains (losses) 143,153 44,997

Depreciation of property and equipment (11,965) (10,740)

Amortization of intangible assets (305) (305)

Other income 2,700 4,675

----------------------------------------------------------------------------

Profit before tax 1,088,968 575,518

Income tax expense (287,218) (158,434)

----------------------------------------------------------------------------

Profit for the period $ 801,750 $ 417,084

----------------------------------------------------------------------------

Other comprehensive (loss) income, net of

income tax

Exchange differences on translating foreign

operations (1,650) -

----------------------------------------------------------------------------

Total comprehensive income for the period $ 800,100 $ 417,084

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share, Profit for the period

Basic $ 0.032 $ 0.017

Diluted $ 0.031 $ 0.017

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Unaudited

Cumulative

Issued Retained Translation

Capital Reserves Earnings Adjustment Total Equity

----------------------------------------------------------------------------

Balance at

January 1, 2014 $5,636,119 $ 703,156 $4,826,280 $ - $11,165,555

Profit for the

period - - 801, 750 - 801,750

Recognition of

share-based

payments - 16,711 - - 16,711

Issue of ordinary

shares under

employee share

option plan 44,536 (27,786) - - 16,750

Translation of

foreign

operations - - - (1,650) (1,650)

-----------------------------------------------------------

Balance at March

31, 2014 $5,680,655 $ 692,081 $5,628,030 $ (1,650) $11,999,116

-----------------------------------------------------------

Cumulative

Issued Retained Translation Total

Capital Reserves Earnings Adjustment Equity

----------------------------------------------------------------------------

Balance at

January 1, 2013 $5,521,001 $ 676,834 $2,282,231 $ - $ 8,480,066

Profit and total

comprehensive

income - 417,084 - 417,084

Recognition of

share-based

payments - 18,796 - - 18,796

Issue of ordinary

shares under

employee share

option plan - - - -

-----------------------------------------------------------

Balance at March

31, 2013 $5,521,001 $ 695,630 $2,699,315 $ - $ 8,915,946

-----------------------------------------------------------

The accompanying notes are an integral part of these unaudited condensed

consolidated financial statements.

---------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

Unaudited

For the three months ended March 31 2014 2013

----------------------------------------------------------------------------

Cash flows from operating activities

Profit and total comprehensive income $ 800,100 $ 417,084

Adjustments for:

Income tax expense 287,218 158,434

Depreciation of property and equipment 65,596 80,397

Amortization of intangible assets 305 305

Net unrealized foreign exchange (gains)

losses 85,136 (12,611)

Expense recognized in respect of equity-

settled share-based payments 16,711 18,796

----------------------------------------------------------------------------

1,255,065 662,405

Movements in non-cash working capital (891,550) (156,651)

----------------------------------------------------------------------------

Cash generated from operations 363,515 505,754

Income taxes paid (583,871) -

----------------------------------------------------------------------------

Net cash (used in) generated from operating

activities (220,356) 505,754

----------------------------------------------------------------------------

Cash flows used in investing activities

Payments for property and equipment (46,776) (90,355)

Payments for intangible assets (50,858) -

Acquisition of a business (1,000,710) -

----------------------------------------------------------------------------

Net cash used in investing activities (1,098,344) (90,355)

----------------------------------------------------------------------------

Cash flows from financing activities

Proceeds from issue of ordinary shares

under employee share option plan 16,750 -

----------------------------------------------------------------------------

Net cash generated from financing activities 16,750 -

----------------------------------------------------------------------------

Net (decrease) increase in cash (1,301,950) 415,399

Cash and cash equivalents at beginning of

the period 7,323,303 4,405,624

Effects of translation of foreign currency

items 1,673 6,246

----------------------------------------------------------------------------

Cash and cash equivalents at end of the

period $ 6,023,026 $ 4,827,269

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Questor Technology Inc.

Audrey Mascarenhas

President and Chief Executive Officer

(403) 571-1530

(403) 571-1539 (FAX)

amascarenhas@questortech.com

www.questortech.com

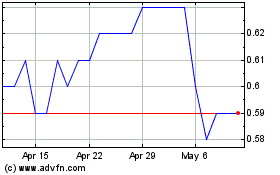

Questor Technology (TSXV:QST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2023 to Apr 2024