UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 29, 2014

El Paso Electric Company

(Exact name of registrant as specified in its charter)

|

| | |

Texas | 001-14206 | 74-0607870 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

Stanton Tower, 100 North Stanton, El Paso, Texas | | 79901 |

(Address of principal executive offices) | | (Zip Code) |

(915) 543-5711

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 29, 2014, the Company’s shareholders approved the El Paso Electric Company Amended and Restated 2007 Long-Term Incentive Plan (the “Plan”). A description of the Plan is set forth in the Company’s Proxy Statement filed with the Securities Exchange Commission on April 18, 2014.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its annual meeting of shareholders on May 29, 2014. As of the close of business on the record date, March 31, 2014, the Company had a total of 40,303,763 shares of common stock outstanding and entitled to vote at the annual meeting, of which 39,217,261 shares were represented at the meeting in person or by proxy. The primary purpose of the annual meeting was to give our shareholders the opportunity to vote on four matters: (i) the election of Class II directors; (ii) to consider and act upon the recommendation of the Board to approve the Company’s Amended and Restated 2007 Long-Term Incentive Plan, (iii) the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; and (iv) a non-binding advisory vote on the compensation paid to the Company’s named executive officers, commonly referred to as a “say on pay” vote. A detailed discussion of each of these proposals can be found in our definitive Proxy Statement filed with the Securities and Exchange Commission (the “SEC”) on April 18, 2014.

Proposal 1: Election of Class II Directors

At the annual meeting, our shareholders elected the following persons to serve as Class II directors to hold office for a three-year term expiring at our annual meeting of shareholders to be held in 2017:

|

| | | |

Director | Votes For | Votes Withheld | Broker Non-Votes |

Catherine A. Allen | 37,854,255 | 243,027 | 1,119,979 |

Edward Escudero | 37,940,837 | 156,445 | 1,119,979 |

Michael K. Parks | 37,774,140 | 323,142 | 1,119,979 |

Eric B. Siegel | 37,764,346 | 332,936 | 1,119,979 |

In addition to the Class II directors listed above, the following individuals continue to serve as Class I and Class III directors following the meeting: John Robert Brown, James W. Cicconi, James W. Harris, Patricia Z. Holland-Branch, Woodley L. Hunt, Thomas V. Shockley, III, Stephen N. Wertheimer, and Charles A. Yamarone.

Proposal 2: Approval of the Company’s Amended and Restated 2007 Long Term Incentive Plan

At the annual meeting, our shareholders approved the Company’s Amended and Restated 2007 Long-Term Incentive Plan.

|

| |

Description | Number of Votes |

FOR | 33,393,937 |

AGAINST | 4,683,385 |

ABSTAIN | 19,960 |

BROKER NON-VOTES | 1,119,979 |

Proposal 3: Appointment of Independent Registered Public Accounting Firm

At the annual meeting, our shareholders ratified the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 by the following vote:

|

| |

Description | Number of Votes |

FOR | 39,055,454 |

AGAINST | 142,739 |

ABSTAIN | 19,068 |

Proposal 4: Advisory Vote on the Company’s Executive Compensation

At the annual meeting, our shareholder approved an advisory vote on the Company’s executive compensation “say on pay” for our named executive officers by the following vote:

|

| |

Description | Number of Votes |

FOR | 36,477,300 |

AGAINST | 1,596,071 |

ABSTAIN | 23,911 |

BROKER NON-VOTES | 1,119,979 |

Item 8.01. Other Events.

On May 29, 2014, El Paso Electric Company (the “Company”) announced that the Board of Directors approved an increase to the quarterly cash dividend to $0.28 per share of common stock from its current quarterly rate of $0.265 per share, commencing with the June 30, 2014 dividend payment, which will be payable to shareholders of record on June 13, 2014.

The Company’s press release announcing the dividend increase is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| |

Exhibit Number | Description of Exhibit |

99.1 | Press Release Dated May 29, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EL PASO ELECTRIC COMPANY

(Registrant)

By: /s/ Nathan T. Hirschi

Name: Nathan T. Hirschi

Title: Senior Vice President - Chief Financial Officer

Dated: May 29, 2014

EXHIBIT INDEX

|

| | |

Exhibit Number | Description of Exhibit | |

99.1 | Press Release Dated May 29, 2014 | |

www.epelectric.com

May 29, 2014

El Paso Electric Announces an Increase in the Quarterly Dividend

El Paso, TX - The Board of Directors of El Paso Electric (NYSE:EE) has declared a regular quarterly cash dividend on its common stock of $0.28 per share. The dividend was declared on May 29, 2014 and is payable on June 30, 2014 to shareholders of record on June 13, 2014. At the new rate, the indicated annualized cash dividend would be $1.12 per share for the following year, up from $1.06 paid in the last four quarters.

El Paso Electric is a regional electric utility providing generation, transmission, and distribution service to approximately 395,000 retail and wholesale customers in a 10,000 square mile area of the Rio Grande valley in west Texas and southern New Mexico. El Paso Electric has a net dependable generating capability of 1,872 MW. El Paso Electric's common stock trades on the New York Stock Exchange under the symbol EE.

Safe Harbor

This news release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: (i) increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates; (ii) recovery of capital investments and operating costs through rates in Texas and New Mexico; (iii) uncertainties and instability in the general economy and the resulting impact on EE's sales and profitability; (iv) changes in customers’ demand for electricity as a result of energy initiatives and emerging competing services and technologies; (v) unanticipated increased costs associated with scheduled and unscheduled outages of generating plant; (vi) the size of our construction program and our ability to complete construction on budget; (vii) potential delays in our construction schedule due to legal challenges or other reasons; (viii) costs at Palo Verde; (ix) deregulation and competition in the electric utility industry; (x) possible increased costs of compliance with environmental or other laws, regulations and policies; (xi) possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities; (xii) uncertainties and instability in the financial markets and the resulting impact on EE's ability to access the capital and credit markets; and (xiii) other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE's filings are available from the Securities and Exchange Commission or may be obtained through EE's website, http://www.epelectric.com. Any such forward-looking statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. EE does not undertake to update any forward-looking statement that may be made from time to time by or on behalf of EE except as required by law.

###

|

| |

Public Relations Eddie Gutierrez | (915) 543.5763 eduardo.gutierrez@epelectric.com | Investor Relations Lisa Budtke | (915) 543.5947 lisa.budtke@epelectric.com |

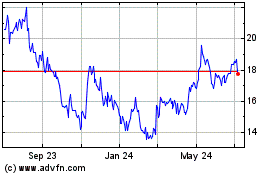

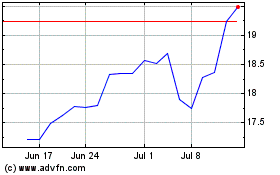

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024