Current Report Filing (8-k)

May 28 2014 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2014

LifeVantage Corporation

(Exact name of registrant as specified in its charter)

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

9785 S. Monroe Street, Suite 300, Sandy, UT | | 84070 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (801) 432-9000

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02(e) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Fiscal Year 2015 Annual Incentive Plan

On May 21, 2014, our board of directors, upon the recommendation of the Compensation Committee, adopted a fiscal year 2015 annual incentive plan (the “FY2015 Annual Incentive Plan”). The FY2015 Annual Incentive Plan is intended to reward certain full time employees who have been selected by the Compensation Committee for participation in the plan for their performance in meeting corporate and personal goals. Participants in our FY2015 Sales Plan, which is described below, are not eligible to participate in the FY2015 Annual Incentive Plan. Our President and Chief Executive Officer and two of our other named executive officers are eligible to participate under the FY2015 Annual Incentive Plan.

Under the terms of the FY2015 Annual Incentive Plan, our President and Chief Executive Officer and other eligible named executive officers will receive bonuses if our company meets certain corporate goals and the eligible named executive officers meet certain personal goals. The relative weight assigned to corporate goals and personal goals is 70% and 30%, respectively. The corporate goals relate to our revenue and our earnings before interest, taxes, depreciation and amortization, or EBITDA. The amount of any bonuses payable with respect to the achievement of corporate goals and personal goals will vary depending upon the percent of the respective goals that are achieved. The target bonus amount for our President and Chief Executive Officer is 72% of his base salary and for each other eligible named executive officer is 50% of their respective base salary and the maximum bonus amount for our President and Chief Executive Officer is 90% of his base salary and for each other eligible named executive officer is 62.5% of their respective base salary. The table below describes the target bonus amount and maximum bonus amount for our President and Chief Executive Officer and for each other eligible named executive officer based on their current base salaries:

|

| | | | | | | | | | |

Named Executive Officer | | Title | | Target Bonus Amount | | Maximum Eligible Bonus Amount |

Douglas C. Robinson | | President and Chief Executive Officer | | $ | 406,800 |

| | $ | 508,500 |

|

David S. Colbert | | Chief Financial Officer | | $ | 162,500 |

| | $ | 203,125 |

|

Robert M. Urban | | Chief Operating Officer | | $ | 185,000 |

| | $ | 231,250 |

|

Robert H. Cutler | | General Counsel and Corporate Secretary | | $ | 176,000 |

| | $ | 220,000 |

|

None of our named executive officers received any bonus payments under our fiscal year 2014 annual incentive plan.

Fiscal Year 2015 Sales Incentive Plan

On May 21, 2014, our board of directors, upon the recommendation of the Compensation Committee, adopted the fiscal year 2015 Sales Incentive Plan (“FY2015 Sales Plan”). The FY2015 Sales Plan is intended to align our sales personnel with our business strategy and key objectives and to reward them for their efforts in fiscal year 2015. Personnel who are responsible for sales targets within our sales organization and whose position is that of an account manager or sales manager or above (and who do not participate in our FY2015 Annual Incentive Plan) are eligible to participate in the FY2015 Sales Plan. One of our named executive officers, Ryan Thompson (Senior Vice President of Global Sales), will be eligible to participate in the FY2015 Sales Plan. Under the FY2015 Sales Plan, participants are eligible to earn and receive quarterly discretionary bonuses based upon the degree of achievement of specified performance metrics. Our President and Chief Executive Officer will generally serve as the FY2015 Sales Plan “Committee” which is responsible for administering the plan.

The three performance metrics upon which a participant's performance will be evaluated are revenue, enrollment and distributor attrition rate. For each FY2015 Sales Plan participant, the Committee will establish quarterly target quantitative goals for each of the three performance metrics and each of the three metrics will have a relative percentage weight assigned to it (such that the sum of the three percentage weights equals 100%). The degree of achievement for each of the performance metrics will be separately evaluated by the Committee after each quarter in fiscal year 2015. A participant's potential annual target bonus for a performance metric would generally be the product of his/her annual base salary on July 1, 2014 multiplied by the relative percentage weight assigned to the performance

metric multiplied by a percentage based on the participant's job level. Mr. Thompson's job level percentage is 50% and his current annual base salary is $265,600.

A participant will be eligible to receive a quarterly cash bonus based upon his/her degree of achievement of the performance metrics for the prior quarter. Achievement of less than 90% of the target goal will generally mean that a participant cannot receive a quarterly payment with respect to that performance metric. However, it is possible that a participant may receive an additional year-end bonus payment for a performance metric if overall annual performance was exceeded but performance in one or more quarters was below the 90% threshold performance level. Performance between 90% and 100% of the target goal can result in a bonus payment that is proportionately scaled between 30% and 100% of the target bonus amount. Performance in excess of the target goal can result in a bonus payment that will increase by four percent of the target bonus amount for each one percent that the target goals were exceeded. Notwithstanding the degree of achievement, the Committee may in its discretion reduce or eliminate any participant's bonus amount. Bonus payments for the first three quarters of fiscal 2015 will generally be made within 45 days after the end of the quarter and bonus payments for the fourth quarter will generally be made within 2 ½ months after the end of fiscal 2015.

In the event of any discrepancies or conflicts between the foregoing summaries and the terms of the FY2015 Sales Plan, the terms of the FY2015 Sales Plan shall prevail and govern.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

| LifeVantage Corporation |

| |

Dated: May 28, 2014 | By:/s/ Rob Cutler Rob Cutler General Counsel |

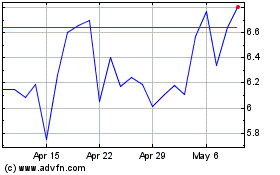

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

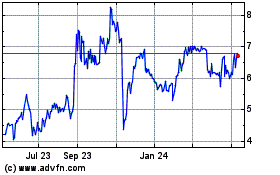

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024