Current Report Filing (8-k)

May 21 2014 - 11:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 21, 2014

Great China Mania Holdings, Inc.

(Exact name of registrant as specified in charter)

Florida

(State or other jurisdiction of incorporation)

|

333-139008

|

|

59-2318378

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

Room 1902, 19/F, Kodak House 2, Java Road,

North Point, Hong Kong

|

|

| |

|

|

| |

(Address of Principal Executive Offices)

|

|

| |

|

|

| |

(852) 3543-1208

|

|

| |

(Registrant’s Telephone Number, Including Area Code)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement.

On May 21, 2014, Great China Mania Holdings, Inc. (the “Company”) entered into a binding letter of intent with Concept X Limited (“Concept X”) for the proposed acquisition of 100% equity interest in Concept X (the “Letter of Intent”). Pursuant to the Letter of Intent, the Company will purchase 100% equity interest of Concept X from its shareholders Lee Wor Kuen and Lee Ho Shok Fong for an aggregate consideration of 500,000 shares of restricted common stock of the Company (the “Consideration Shares”). The Consideration Shares will remain restricted and will be locked up for a period of 12 months from the date of completion of the acquisition (the “Restriction Period). The parties have agreed that the Company will have the first right of refusal to purchase the Consideration Shares from Lee Wor Kuen and Lee Ho Shok Fong after the Restriction Period for consideration of USD $1.00 per share.

In the Letter of Intent, the parties have agreed that Lee Wor Kuen and Lee Ho Shok Fong shall assume the liabilities of all existing unsettled loans owed to third parties and financial institutions by Concept X, cancel all payables and loans owed to related parties by Concept X (specifically those loans from Lee Wor Kuen, Lee Ho Shok Fong and Chee Yan Label Weaving & Press Printing Co., Limited) and assume the liabilities of the net trade payables (defined as trade payables minus trade receivables) as of the date of completion of acquisition of Concept X.

After the consummation of the definitive agreements, and after the Restriction Period, if Lee Wor Kuen and Lee Ho Shok Fong elect to sell the Consideration Shares, they agree they will apply the proceeds from the sale to pay down the balance of unsettled loans owed to third parties and financial institutions after the Restriction Period and to deliver an amount equal to HKD 1,500,000 to the bank account of Concept X to settle the net trade payables of Concept X at the date of completion of acquisition.

The Company will have one week from the date of the Letter of Intent to conduct all due diligence procedures concerning Concept X. If the Company determines after performing the due diligence that it does not want to enter into a definitive agreement with Concept X, they must notify Concept X in writing of the cancellation of the transactions set forth in the Letter of Intent. The Closing Date for the acquisition will be the earlier to occur of (1) the Company agreeing that they are satisfied with their due diligence; or (2) one week following the date of the Letter of Intent. At Closing, the parties shall also enter into a definitive acquisition agreement that will more specifically define the transaction as well as the roles of the respective parties on a going forward basis.

Item 9.01 Financial Statements and Exhibits.

|

|

|

| |

|

|

|

Letter of Intent dated May 21, 2014.

|

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GREAT CHINA MANIA HOLDINGS, INC.

|

|

| |

|

|

|

|

May 21, 2014

|

By:

|

/s/Kwan Yin Roy Kwong

|

|

| |

|

Kwan Yin Roy Kwong

|

|

| |

|

Chief Executive Officer and Director

|

|

Exhibit 1.1

GREAT CHINA MANIA HOLDINGS, INC.

Flat 1902, 19/F, Kodak House 2

Java Road

North Point, Hong Kong

May 21, 2014

CONFIDENTIAL

CONCEPT X LIMITED

Flat 1816, Tsuen Wan Industrial Centre

220-248 Texaco Road

Tsuen Wan, New Territories

Hong Kong

To: Mr. Lee Wor Kuen/ Ms. Lee Ho Shok Fong

Flat 1816, Tsuen Wan Industrial Centre

220-248 Texaco Road

Tsuen Wan, New Territories

Hong Kong

Dear Sirs:

|

Re:

|

Binding Letter of Intent for the Proposed Acquisition of 100% Equity Interest of Concept X Limited (“Concept X”)

|

This letter agreement (this “Agreement”) sets out the terms upon which Great China Mania Holdings, Inc. (“GMEC”) and Concept X have agreed.

GMEC is a fully-reporting smaller reporting company trading on the OTC Bulletin Board with approximately 25,000,000 shares issued and oustdanding and reported revenues of approximately $2.3 million for the year ended December 31, 2013.

Concept X is a Hong Kong registered company that specializes in media production in Hong Kong. Concept X has reported approximately $1.4 million revenues for year ended March 31, 2014.

GMEC and Concept X agree as follows:

GMEC will purchase 100% equity interest of Concept X from Lee Wor Kuen and Lee Ho Shok Fong at an aggregate consideration of 500,000 shares of restricted common stock of GMEC (“Consideration Shares”). It is the intention of GMEC, Lee Wor Kuen and Lee Ho Shok Fong to restrict the Consideration Shares for a period of 12 months from the date of completion of the acquisition (“Restriction Period). Furthermore, GMEC shall have the first right of refusal to purchase the Consideration Shares from Lee Wor Kuen and Lee Ho Shok Fong after the Restriction Period at a consideration of $1 per share.

In conjunction to the purchase of Concept X by GMEC, Lee Wor Kuen and Lee Ho Shok Fong agree to execute all necessary documents in order to jointly undertake the followings:

|

|

1.

|

Assume the ultimate liabilities of all existing unsettled loans owed to third parties and financial institutes

|

|

|

2.

|

Cancel all payables and loans owed to related parties, e.g., loans from Lee Wor Kuen, Lee Ho Shok Fong and Chee Yan Label Weaving & Press Printing Co., Limited (Company controlled by Lee Wor Kuen).

|

|

|

3.

|

Assume the ultimate liabilities of the net trade payables (trade payables minus trade receivables) as of the date of completion of acquisition

|

Lee Wor Kuen and Lee Ho Shok Fong hereby undertake to apply the proceed from the sales of the Consideration Shares (If they have sold part or whole of the Consideration Shares after the Restriction Period) to settle the followings in the priority of:

|

|

1.

|

The balance of unsettled loans owed to third parties and financial institutes after the Restriction Period

|

|

|

2.

|

An amount equal to HKD 1,500,000 to be transferred to the bank account of Concept X to settle the net trade payables of Concept X at the date of completion of acquisition

|

Further details as well as all contractual arrangements and specific business transfer procedures shall be determined and conducted as appropriate. All parties hereto shall cooperate with each other to accomplish these items with the objective of expeditiously completing the transaction.

GMEC shall have one week from the date hereof to conduct all due diligence procedures concerning Concept X.

At the Closing (defined as below), the parties shall also enter into a definitive acquisition agreement that will more specifically define the transaction as well as the roles of the respective parties hereto on a going forward basis.

Closing conditions:

|

|

a.

|

GMEC management completes their due diligence procedures relating to Concept X and is satisfied with the results thereof.

|

|

|

b.

|

In the event that GMEC is not satisfied with the due diligence in any fashion, GMEC will send written notification to Concept X explaining the circumstances and the reasoning of such dissatisfaction. In the event that no such written notice is provided, due diligence will be deemed to have been satisfactory in all material respects.

|

|

|

c.

|

The Closing Date (“Closing”) shall be the earlier to occur of (1) GMEC agreeing that they are satisfied with their due diligence; or (2) one week from the date hereof

|

1. Confidentiality

GMEC and Concept X acknowledge that each will be providing to the other information that is non-public, confidential, and proprietary in nature (the "Confidential Information"). Each, and their respective affiliates, representative, agents and employees, will keep the Confidential Information confidential and will not, except as otherwise provided below, disclose such information or use such information for any purpose other than for negotiation of the Definitive Agreements and the evaluation and consummation of the transactions described herein, provided however that this provision will not apply to information that:

|

|

(a)

|

becomes generally available to the public absent any breach of this provision;

|

|

|

(b)

|

was available on a non-confidential basis to a Party prior to its disclosure pursuant to this Agreement; or

|

|

|

(c)

|

becomes available on a non-confidential basis from a third party who is not bound to keep such information confidential

|

Each Party hereto agrees that it will not make any public disclosure of the existence of this Agreement or of any of its terms without first advising the other party of the proposed disclosure, unless such disclosure is required by applicable law or regulation and in any event the Party contemplating disclosure will inform the other Party of and obtain its consent to the form and content of such disclosure, which consent will not be unreasonably withheld or delayed.

Each Party hereto agrees that immediately upon any discontinuance of activities by either party such that the Transaction will not be consummated, each Party will return to the other all Confidential Information.

2. Definitive Agreement

Upon execution of this Agreement, the Parties agree to negotiate in good faith and to enter into a Definitive Agreement as quickly as practicable. Such Definitive Agreement will more specifically describe the manner in which the acquisition shall be completed.

GMEC will be responsible for the legal fees and other expenses related to this proposed transaction, except as otherwise agreed in the Definitive Agreement.

GMEC may make a press release or other public announcement as well as filing a current report to the United States Securities and Exchange Commission. Concept X acknowledges that GMEC may be obligated under applicable securities laws to file, and hereby consents to GMEC filing, a copy of this Agreement with the United States Securities and Exchange Commission.

4. Binding Nature of Letter of Intent

This letter is intended to be a legally binding commitment by any of the parties hereto with respect to the subject matter herein.

5. Governing Law

This Agreement shall be governed by the laws of the State of Florida. Any legal action or other legal proceeding relating to this Agreement or its enforcement shall be brought in any state or federal court in the State of Florida.

GMEC looks forward to pursuing the transactions set out in this Agreement with Concept X. Please indicate your agreement to this Agreement by signing and returning a copy to the undersigned no later than May 21, 2014.

Yours truly,

GREAT CHINA MANIA HOLDINGS, INC.

/s/

Kwan Yin Roy Kwong, CEO

The undersigned hereby accepts the foregoing this 21st day of April, 2014

Concept X Limited

Per:

/s/

(Director)

Concept X Limited

/s/

Lee Wor Kuen, Shareholder

Concept X Limited

______________________________

Lee Ho Shok Fong, Shareholder

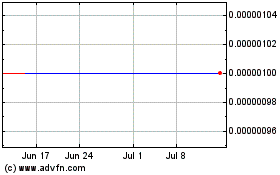

GME Innotainment (CE) (USOTC:GMEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

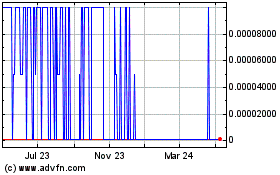

GME Innotainment (CE) (USOTC:GMEV)

Historical Stock Chart

From Apr 2023 to Apr 2024