UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

|

ý

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

|

|

¨

|

Definitive Information Statement

|

JBI, INC.

(Name of Registrant As Specified In Charter)

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No:

(3) Filing Party:

(4) Date Filed:

JBI, INC.

20 Iroquois Street

Niagara Falls, New York 14303

Dear Stockholders:

We are writing to advise you that the stockholders of JBI, Inc., a Nevada corporation (the “Company,” “we” or “us”), holding a majority of the voting power of our outstanding common stock and preferred stock, voting together as a single class, executed a written consent in lieu of a special meeting dated May 16, 2014, authorizing an amendment to our Articles of Incorporation (the “Charter Amendment”) to (i) change our name to “Plastic2Oil, Inc.” and (ii) increase the total number of authorized shares of common stock, par value $0.001 per share, of our Company from 150,000,000 shares to 250,000,000 shares. Our board of directors (the “Board of Directors”) also approved the proposed Charter Amendment on May 16, 2014.

Our Board of Directors has fixed the close of business on May 16, 2014 (the “Record Date”), as the Record Date for the determination of stockholders entitled to notice of the action by written consent. Pursuant to Rule 14c-2 under the Securities and Exchange Act, of 1934, as amended (the “Exchange Act”), the Charter Amendment will not be implemented until at least twenty (20) calendar days after the mailing of this Information Statement to our stockholders. This Information Statement will be mailed on or about May __, 2014, to our stockholders as of the close of business on the Record Date

.

No action is required by you to effectuate this action. The accompanying Information Statement is furnished only to inform our stockholders in accordance with Rule 14c-2 promulgated under the Exchange Act of the action described above before it takes effect. This letter is the notice required by Section 78.390 of the Revised Statutes of the State of Nevada.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF THE VOTING POWER OF OUR OUTSTANDING COMMON STOCK AND PREFERRED STOCK, VOTING TOGETHER AS A SINGLE CLASS, HAVE VOTED TO AUTHORIZE THE CHARTER AMENDMENT. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

Please feel free to call us at (716) 278-0015 should you have any questions regarding the enclosed Information Statement.

|

|

For the Board of Directors of

|

|

|

Date: May __, 2014

|

|

|

|

|

JBI, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Richard Heddle

|

|

|

|

|

Richard Heddle

|

|

|

|

|

Chief Executive Officer

|

|

THIS INFORMATION STATEMENT IS BEING PROVIDED TO

YOU BY THE BOARD OF DIRECTORS OF THE COMPANY

JBI, INC.

20 Iroquois Street

Niagara Falls, New York 14303

INFORMATION STATEMENT

(Preliminary)

May __, 2014

GENERAL INFORMATION

JBI, Inc. (the “Company,” “we” or “us”) is furnishing this Information Statement to you to provide a description of actions taken by our board of directors (the “Board of Directors”) on May 16, 2014, and by the holders of a majority of the voting power of our outstanding shares of common stock, par value $0.001 per share (“Common Stock”), and our outstanding shares of preferred stock, par value $0.001 per share (“Preferred Stock”), voting together as a single class (the “Majority Stockholders”), in accordance with the relevant sections of the Revised Statutes of the State of Nevada (the “NRS”).

This Information Statement is being mailed on or about May __, 2014, to stockholders of record on May 16, 2014 (the “Record Date”). This Information Statement is being delivered only to inform you of the corporate action described herein in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), before such action takes effect. No action is requested or required on your part

.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS' MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF THE VOTING POWER OF OUR OUTSTANDING COMMON STOCK AND PREFERRED STOCK, VOTING TOGETHER AS A SINGLE CLASS, HAVE VOTED TO AUTHORIZE THE CHARTER AMENDMENT. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND CONSEQUENTLY NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THIS MATTER.

General Description of Corporate Action

On May 16, 2014, the Majority Stockholders delivered an executed written consent in lieu of a special meeting authorizing and approving an amendment to our Articles of Incorporation, in the form attached hereto as

Appendix A

(the “Charter Amendment”), to (i) change our name to “Plastic2Oil, Inc.” (the “Name Change”) and (ii) increase the total number of authorized shares of Common Stock from 150,000,000 shares to 250,000,000 shares (the “Share Increase”). The Majority Stockholders held on the Record Date an aggregate of approximately 53.7% of the outstanding voting power of our Common Stock and Preferred Stock voting together as a single class that were entitled to give such consent. The Majority Stockholders consist of Mr. Richard Heddle, our Chief Executive Officer, and Mr. John Bordynuik, our Chief of Technology. For further information on our voting securities and the securities owned by the Majority Stockholders, see the sections below entitled “Outstanding Voting Securities” and “Principal Stockholders.”

On May 16, 2014, the Board of Directors unanimously approved the Charter Amendment. The Board of Directors will effect the Name Change and the Share Increase by filing the Charter Amendment with the Nevada Secretary of State, which will occur no sooner than 20 calendar days after the date this Information Statement has been mailed to stockholders. No further action on the part of our stockholders is required to authorize or effectuate the Charter Amendment

.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors believes that the Name Change and the Share Increase are in the best interest of our Company and our stockholders for the reasons described herein. No assurance can be given that any of the reasons cited in this Information Statement will ultimately be proven to be correct

.

This Information Statement contains a brief summary of the material aspects of the Charter Amendment.

ACTION 1

APPROVAL OF AMENDMENT TO OUR ARTICLES OF INCORPORATION TO CHANGE OUR NAME

The following description of the Name Change is intended to be a summary only and is qualified in its entirety by the terms of the Charter Amendment, a copy of which is attached hereto as

Appendix A

.

Reasons for Approving the Name Change

The current name of the Company reflects the personal initials of our founder and former Chief Executive Officer, President and Chairman, Mr. John Bordynuik. At the time the name was selected, we were engaged in several business lines founded by Mr. Bordynuik. More recently, however, we (as previously reported) have focused our efforts on the development of our Plastic2Oil, or P2O® business. Additionally, in May 2012, Mr. Bordynuik resigned from his position as an officer and director of the Company, but remains in the employ of the Company as our Chief of Technology. The Board of Directors believes that the proposed change to “Plastic2Oil, Inc.” provides more information to the public regarding the business in which we are primarily engaged.

Principal Effects of the Name Change

Changing our name will not have any effect on our corporate status, the rights of stockholders, or the transferability of outstanding stock certificates. There are no material U.S. Federal Income Tax consequences to either the Company or our stockholders.

If a holder of Common Stock wishes to exchange his certificate for a certificate reciting the name “Plastic2Oil, Inc.” after the effective date of the Name Change, he may do so by surrendering his certificate to the Company’s transfer agent with a request for a replacement certificate and the appropriate stock transfer fee. Our transfer agent is:

Pacific Stock Transfer Company

4045 South Spencer Street, Suite 403

Las Vegas, Nevada 89119

Phone: (702) 361-3033

Fax: (702) 433-1979

In connection with the Name Change, the trading symbol and CUSIP number of our Common Stock will also be changed. We will apply to FINRA for a new trading symbol and to the CUSIP bureau for a new CUSIP number and subsequently the Common Stock will be assigned a new trading symbol and a new CUSIP number.

ACTION 2

APPROVAL OF AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE OUR AUTHORIZED COMMON STOCK

The following description of the Share Increase is intended to be a summary only and is qualified in its entirety by the terms of the Charter Amendment, a copy of which is attached hereto as

Appendix A

.

.

Reasons for the Increase in Authorized Common Stock

Currently, the Company is authorized to issue 150,000,000 shares of Common Stock. Of the 150,000,000 shares of Common Stock authorized, as of the Record Date, there were 98,002,772 shares of Common Stock issued and outstanding, and 13,770,449 shares of Common Stock reserved for issuance upon the conversion of the outstanding Series B Preferred Stock and 16,627,817 shares of Common Stock reserved for issuance upon the exercise of outstanding warrants and options, including, without limitation, options issued pursuant to the Company’s 2012 Long Term Incentive Plan. Consequently, as of the Record Date, the Company had 21,398,962 shares of Common Stock available for general corporate purposes.

As a general matter, the Board of Directors does not believe the currently available number of authorized but unissued shares of Common Stock is an adequate number of shares to assure that there will be sufficient shares available for issuance in connection with the exercise or conversion of the outstanding Series B Preferred Stock, warrants and options as well as possible equity and equity-based financings, future acquisitions, possible future awards under employee benefit plans, stock dividends, stock splits, and other corporate purposes. Therefore, the Board of Directors approved the increase in

authorized shares of

Common Stock to 250,000,000 as a means of providing us with the flexibility to act with respect to the issuance of Common Stock or securities exercisable for, or convertible into, Common Stock in circumstances which we believe will advance the interests of the Company and our stockholders without the delay of seeking an amendment to the Articles of Incorporation at that time.

The Board of Directors is considering, and will continue to consider, various financing options, including the issuance of Common Stock or securities convertible into Common Stock from time-to-time to raise additional capital necessary to support operations and future growth of the Company. As a result of the Share Increase, the Board of Directors will have more flexibility to pursue opportunities to engage in possible future capital market transactions involving Common Stock or securities convertible into Common Stock, including, without limitation, public offerings or private placements of such Common Stock or securities convertible into Common Stock. There are no specific financing transactions under consideration at this time that would require the issuance of the additional authorized shares of Common Stock included in the Charter Amendment.

In addition, our growth strategy may include the pursuit of selective acquisitions to execute our business plan. We could also use the additional Common Stock for potential strategic transactions, including, among other things, acquisitions, spin-offs, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and investments. There are no specific acquisitions under consideration at this time that would require the issuance of the additional authorized shares of Common Stock included in the Charter Amendment.

PLEASE NOTE THAT THE INCREASE IN OUR AUTHORIZED COMMON STOCK WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTERESTS IN OUR COMPANY. HOWEVER, ISSUANCES OF SIGNIFICANT NUMBERS OF ADDITIONAL SHARES OF COMMON STOCK IN THE FUTURE WILL DILUTE STOCKHOLDERS’ PERCENTAGE OWNERSHIP OF THE COMPANY AND, IF SUCH SHARES ARE ISSUED AT PRICES BELOW WHAT CURRENT STOCKHOLDERS PAID FOR THEIR SHARES, MAY DILUTE THE VALUE OF CURRENT STOCKHOLDERS’ SHARES

.

Additional Information

Ability of the Board of Directors to Issue Stock; Certain Issuances Requiring Stockholder Approval

The additional shares of Common Stock authorized by the Charter Amendment may be issued for any proper purpose from time-to-time upon authorization by the Board of Directors, without further approval by the stockholders unless required by applicable law, rule or regulation, including, without limitation, rules of any trading market that the Common Stock may trade on at that time. Shares may be issued for such consideration as the Board of Directors may determine and as may be permitted by applicable law.

Interest of the Directors and Officers of the Company in the Share Increase

The current officers and directors of the Company and the officers and directors of the Company when the Share Increase was approved by the Board of Directors do not have any substantial interest, direct or indirect, in the approval of the Charter Amendment, other than as stockholders of the Company and as employees of the Company that are eligible for equity awards under the Company’s employee benefit plans, including the Company’s 2012 Long Term Incentive Plan

.

Effects of the Share Increase

The Share Increase was not approved by the Board of Directors as a means of preventing or dissuading a change in control or takeover of the Company. However, use of these shares for such a purpose is possible. Authorized but unissued or unreserved shares of Common Stock, for example, could be issued in an effort to dilute the stock ownership and voting power of persons seeking to obtain control of the Company or could be issued to purchasers who would support the Board of Directors in opposing a takeover proposal. In addition, they

may have the effect of discouraging a challenge for control or make it less likely that such a challenge, if attempted, would be successful. The Board of Directors and executive officers of the Company have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

The holders of Common Stock are not entitled to preemptive rights with respect to the issuance of additional Common Stock or securities convertible into or exercisable for Common Stock. Accordingly, the issuance of additional shares of Common Stock or such other securities might dilute the ownership and voting rights of stockholders.

The holders of Common Stock will not realize any dilution in their percentage of ownership of the Company or their voting rights as a result of the Share Increase. However, issuances of significant numbers of additional shares of Common Stock in the future (i) will dilute stockholders’ percentage ownership of the Company and (ii) if such shares are issued at prices below what current stockholders paid for their shares, may dilute the value of current stockholders’ shares.

The Share Increase will not change the terms of the Common Stock. The additional shares of Common Stock for which authorization is sought will have the same voting rights and liquidation rights, the same rights to dividends and distributions and will be identical in all other respects to the Common Stock now authorized.

Summary of the Share Increase

Below is a brief summary of the Share Increase

:

|

|

·

|

The authorized Common Stock of the Company will be increased from 150,000,000 shares to 250,000,000 shares.

|

|

|

·

|

The par value of the Common Stock will not change.

|

|

|

·

|

The Share Increase will not affect the number of outstanding shares of Preferred Stock or the proportionate equity interests of the holders of Preferred Stock.

|

|

|

·

|

The Share Increase has been approved by the Board of Directors and the written consent of the Majority Stockholders.

|

NO APPRAISAL RIGHTS

Under the NRS, stockholders are not entitled to appraisal rights with respect to the Charter Amendment and we will not independently provide stockholders with any such right.

EFFECTIVE DATE OF CHARTER AMENDMENT

The Board of Directors will effectuate both the Name Change and the Share Increase by filing the Charter Amendment with the Nevada Secretary of State, which will occur no sooner than 20 calendar days after the date this Information Statement has been mailed to stockholders. After such 20-day period, the Board of Directors has the authority to file the Charter Amendment

.

OUTSTANDING VOTING SECURITIES

Our authorized capital stock consists of 150,000,000 shares of Common Stock and 5,000,000 shares of Preferred Stock. As of the Record Date, we had issued and outstanding:

|

|

·

|

98,002,772 shares of Common Stock;

|

|

|

·

|

1,000,000 shares of our Series A Super Voting Preferred Stock; and

|

|

|

·

|

1,967,207 shares of our Series B Convertible Preferred Stock.

|

The number of voting shares outstanding excludes shares of Common Stock subject to stock purchase warrants outstanding and shares of Common Stock reserved for issuance pursuant to our 2012 Long Term Incentive Plan.

On or about May 16, 2014, the Majority Stockholders, which stockholders are the holders of approximately 53.7% of the outstanding voting power of our outstanding shares of Common Stock and Preferred Stock, voting together as a single class, executed and delivered to us a written consent approving the Charter Amendment. As the Charter Amendment was approved by the Majority Stockholders, no proxies are being solicited with this Information Statement

.

The NRS provides in substance that unless our Articles of Incorporation provides otherwise, stockholders may take action without a meeting of stockholders and without prior notice if a consent or consents in writing, setting forth the action so taken, is signed by the stockholders having not less than the minimum number of votes that would be necessary to take such action at a meeting at which all shares entitled to vote thereon were present.

Common Stock

The holders of our Common Stock, $0.001 par value per share, are entitled to one vote per share on all matters to be voted upon by stockholders. Holders of our Common Stock are entitled, among other things, (i) to share ratably in dividends if, when and as declared by the Board of Directors out of funds legally available therefore and (ii) in the event of liquidation, dissolution or winding-up of our Company, to share ratably in the distribution of assets legally available therefore, after payment of debts and expenses. Holders of our Common Stock have no subscription, redemption or conversion rights. The holders of our Common Stock do not have cumulative voting rights and have no preemptive rights to subscribe for additional shares of our capital stock. The rights, preferences and privileges of holders of our Common Stock are subject to the terms of any series of Preferred Stock that may be issued and outstanding from time-to-time. A vote of the holders of a majority of our Common Stock is generally required to take action under our Articles of Incorporation and Bylaws

.

Preferred Stock

Under our Articles of Incorporation, the Board of Directors can issue up to 5,000,000 shares of Preferred Stock from time-to-time in one or more series. Our Board of Directors is authorized to fix by resolution as to any series the designation and number of shares of the series, the voting rights, the dividend rights, the redemption price, the amount payable upon liquidation or dissolution, the conversion rights, and any other designations, preferences or special rights or restrictions as may be permitted by law. Unless the nature of a particular transaction and the rules of law applicable thereto require such approval, the Board of Directors has the authority to issue these shares of Preferred Stock without stockholder approval. As of the Record Date, the Board of Directors has designated the following series of Preferred Stock:

Series A Super Voting Preferred Stock

. The Board of Directors designated 1,000,000 shares of Series A Super Voting Preferred Stock, par value $0.001 per shares (the “Series A Preferred Stock”), of which 1,000,000 shares are currently issued and outstanding. Each share of the Series A Preferred Stock is entitled to one hundred (100) votes on all matters to be voted upon by our stockholders. Mr. John Bordynuik, our founder and Chief of Technology, is the holder of all outstanding shares of Series A Preferred Stock.

Mr. Bordynuik was a party to a letter agreement (the “Letter Agreement”) with certain investors (the “Investors”) in our May 2012 private placement, which Letter Agreement contained certain restrictions on Mr. Bordynuik’s ability to vote his shares of Series A Preferred Stock. Prior to the filing of this Information Statement, the Letter Agreement was terminated upon the receipt of waiver/rescission notices from the requisite number of Investors required under the Letter Agreement’s terms. Upon effectiveness of the Charter Amendment, Mr. Bordynuik has agreed with us to return all his shares of Series A Preferred Stock to the Company for cancellation

.

Series B Convertible Preferred Stock

. The Board of Directors designated 2,300,000 shares of Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”), of which 1,967,207 are currently outstanding. Holders of our Series B Preferred Stock are entitled to vote on an as-converted basis on all matters to be voted upon by stockholders. Currently, each share of Series B Preferred Stock is convertible into seven (7) shares of Common Stock.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of our Common Stock and Series A Preferred Stock as of the Record Date by:

|

|

·

|

each person known by us to be a beneficial owner of more than 5% of our outstanding Common Stock and Series A Preferred Stock;

|

|

|

·

|

each of our named executive officers; and

|

|

|

·

|

all directors and executive officers as a group.

|

Our outstanding shares of Series B Preferred Stock are reflected on an as-converted basis with our Common Stock. The amounts and percentages of Common Stock and Series A Preferred Stock beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days after, the Record Date. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed a beneficial owner of securities as to which he has no economic interest. Except as indicated by footnote, to our knowledge, the persons named in the table below have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

In the table below, the percentage of ownership of our Common Stock is based on 98,002,772 shares of Common Stock outstanding as of the Record Date. Unless otherwise noted below, the address of the persons listed on the table is c/o JBI, Inc., 20 Iroquois Street, Niagara Falls, New York 14303.

|

|

|

Common Stock

Beneficially Owned

|

|

|

Series A Preferred Stock

Beneficially Owned

|

|

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percentage

|

|

|

Number

|

|

|

Percentage

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard Heddle,

Chief Executive Officer and Director

|

|

|

6,000,000

|

(1)

|

|

|

6.14

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rahoul Banerjea,

Chief Financial Officer

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip J. Bradley

, Director

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All named executive officers and directors as a group

|

|

|

6,000,000

|

|

|

|

6.14

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% or More Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Bordynuik

|

|

|

4,801,846

|

(2)

|

|

|

4.8

|

%

|

|

|

1,000,000

|

|

|

|

100

|

%

|

___________

|

|

Includes warrants to purchase 3,000,000 shares of Common Stock.

|

|

(2)

|

Includes

1,400,000

shares of common stock issuable upon the exercise of outstanding stock options that are exercisable within 60 days.

|

FORWARD-LOOKING STATEMENTS

This Information Statement may contain certain “forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs regarding our Company. These forward-looking statements include, but are not limited to, statements regarding our business, anticipated financial or operational results, our objectives, the amount and timing of the contemplated initial public offering of our Common Stock. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including factors discussed in this and other filings of ours with the SEC.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Exchange Act and in accordance therewith file reports, proxy statements and other information, including annual and quarterly reports on Form 10-K and 10-Q (the “1934 Act Filings”), with the SEC. Reports and other information we file with the SEC can be inspected and copied at the public reference facilities maintained at the SEC at Room 1024, 450 Fifth Street, N.W., Washington, DC 20549. Copies of such material can be obtained upon written request addressed to the SEC, Public Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. The SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

We may send only one Information Statement and other corporate mailings to stockholders who share a single address unless we have received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, we will deliver promptly upon written or oral request a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which we should direct the additional copy of this Information Statement, to us at 20 Iroquois Street, Niagara Falls, New York 14303, telephone: (716) 278-0015.

If multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer us to mail each stockholder a separate copy of future mailings, you may mail notification to, or call us at, our principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer us to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to our principal executive offices.

This Information Statement is provided to the holders of Common Stock only for information purposes in connection with the actions, pursuant to and in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information Statement.

MISCELLANEOUS MATTERS

We will bear the entire cost of furnishing this Information Statement. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

This Information Statement is being mailed on or about May __, 2014, to all stockholders of record as of the Record Date. You are being provided with this Information Statement pursuant to Section 14C of the Exchange Act and Regulation 14C and Schedule 14C thereunder, and, in accordance therewith, the Charter Amendment will not be filed with the Secretary of State of the State of Nevada and will not become effective until at least 20 calendar days after the mailing of this Information Statement to our stockholders as of the Record Date.

|

Date: May __, 2014

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

JBI, INC.

|

|

|

|

|

|

|

|

|

/s/ Richard Heddle

|

|

|

|

Richard Heddle

|

|

|

|

Chief Executive Officer

|

|

APPENDIX A

FORM OF

CERTIFICATE OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

JBI, INC.

|

|

|

|

|

|

|

|

|

*090203*

|

|

|

ROSS MILLER

Secretary of State

204 North Carson Street, Suite 1

Carson City, Nevada 89701-4520

(775) 684-5708

Website:

www.nvsos.gov

|

|

|

|

|

|

|

Certificate of Amendment

(PURSUANT TO NRS 78.385 AND 78.390)

|

|

|

|

|

|

|

|

USE BLACK INK ONLY

-

DO NOT HIGHLIGHT

|

ABOVE SPACE IS FOR OFFICE USE ONLY

|

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

1.

Name

of corporation:

JBI, Inc.

2.

The

articles

have been amended as follows:

(provide article numbers, if available)

Article 1 is hereby amended to change the name of the corporation to: Plastic2Oil, Inc.

Article 4 is amended to increase the number of authorized shares of common stock as follows:

The aggregate number of shares which the corporation shall have authority to issue shall consist of 250,000,000 shares of Common Stock, $0.001 par value per share, and 5,000,000 shares of Preferred Stock, $0.001 par value per share

.

3.

The vote by which the

stockholders

holding

shares

in

the corporation entitling them

to

exercise

at

least

a

majority

of the

voting

power, or such

greater proportion

of the voting power as may be required in the case of a

vote

by classes or series, or as may be required by the provisions of the

articles of incorporation* have voted in favor of the amendment is: 53.7%

|

4.

Effective date and time of

filing: (optional)

|

Date:

|

Time:

|

|

|

(must not be later than 90 days after the certificate is filed)

|

5.

Signature: (required)

*If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT:

Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

|

|

Nevada Secretary of State Amend Profit-After

|

|

This form must be accompanied by appropriate fees.

|

Revised: 11-27-13

|

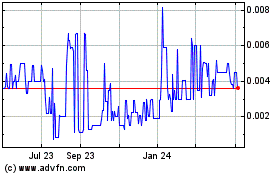

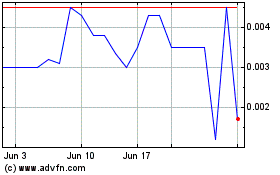

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Apr 2023 to Apr 2024