VirTra Releases 2014 First Quarter Financial Results

May 15 2014 - 8:00AM

Marketwired

VirTra Releases 2014 First Quarter Financial Results

TEMPE, AZ--(Marketwired - May 15, 2014) - VirTra Systems

(PINKSHEETS: VTSI), a leading provider of firearms simulators to

military, law enforcement agencies and other organizations, today

announced the release of its unaudited 2014 first quarter financial

statements. The financial statements are available on VirTra's

website and here.

Financial Summary:

- Net Sales were $2.0 million for the quarter ending March 31,

2014, a decrease of $0.5 million, or 20%, compared to the previous

year's first quarter sales of $2.5 million. The decrease is

consistent with the volatility between quarters.

- Gross margin for the first quarter 2014 was 62% of Net Sales,

compared to 70% last year. The drivers for the decrease are

primarily due to timing of product shipments in the pipeline to

customers and corresponding leverage of fixed overhead.

- Sales, general and administrative (SG&A) expenses of $1.0

million in Q1 2014 decreased 20%, from $1.2 million in Q1 2013. As

a percent of revenue, SG&A was 50% for Q1 2014 compared to 48%

in Q1 2013.

- Income from operations were $0.2 million for the quarter ending

March 31, 2014, a decrease of $0.3 million, compared to income from

operations of $0.5 million in Q1 2013.

- Throughout Q1 2014, the Company used $0.7 million in cash from

operating activities by fulfilling orders secured by deposits. Cash

and cash equivalents were $1.6 million at the end of Q1 2014, down

from $2.4 million at December 31, 2013.

- The Company has no draw upon the line of credit as of March 31,

2014.

Bob Ferris, Chief Executive Officer of VirTra, commented, "The

first quarter 2014 results of $2 million in sales and $238,000 of

net income are positive and in-line with quarterly fluctuations.

Our management team has worked extremely hard to position the

Company for continued growth as an industry leader in firearms

simulators."

About VirTra Systems

VirTra is a global leading provider of the world's most

realistic and effective shooting simulators. VirTra is the higher

standard in firearms training simulators, offering a variety of

simulator platforms, powerful gas-powered recoil kits and the

patented Threat-Fire™ simulated hostile return fire system.

VirTra's products provide the very best simulation training

available for personnel that are entrusted with lethal force and

critical missions. The Company's common stock is not registered

under the Securities Exchange Act of 1934 and the Company does not

currently file periodic or other reports with the Securities and

Exchange Commission.

www.VirTra.com

Forward-looking Statements

This news release includes certain information that may

constitute forward-looking statements made pursuant to the safe

harbor provision of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are typically identified by

terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates," "proposed," "planned,"

"potential" and similar expressions, or are those, which, by their

nature, refer to future events. All statements, other than

statements of historical fact, included herein, including

statements about VirTra's beliefs and expectations, are

forward-looking statements. Forward-looking information is

necessarily based upon a number of assumptions that, while

considered reasonable, are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results

and future events to differ materially from those expressed or

implied by such forward-looking information. Although VirTra

believes that such statements are reasonable, it can give no

assurance that such forward-looking information will prove to be

accurate. VirTra cautions investors that any forward-looking

statements by the Company are not guarantees of future results or

performance, and that actual results may differ materially from

those in forward-looking statements as a result of various factors.

Accordingly, due to the risks, uncertainties and assumptions

inherent in forward-looking information, readers and prospective

investors in the Company's securities should not place undue

reliance on forward-looking information. All forward-looking

information contained in this press release is given as of the date

hereof, is based upon the opinions and estimates of management and

information available to management as at the date hereof and is

subject to change. The Company assumes no obligation to revise or

update forward-looking information to reflect new circumstances,

whether as a result of new information, future events or otherwise,

except as required by law.

- - - -FINANCIALS FOLLOWING- - -

-

VIRTRA SYSTEMS, INC.

BALANCE SHEETS as of:

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

March 31, 2014 |

|

|

December 31, 2013 |

|

| |

|

(unaudited) |

|

|

(audited) |

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

1,605,084 |

|

|

$ |

2,358,955 |

|

| |

Accounts receivable |

|

|

651,734 |

|

|

|

786,877 |

|

| |

Inventory |

|

|

572,356 |

|

|

|

407,434 |

|

| |

Prepaid expenses and other current assets |

|

|

107,734 |

|

|

|

44,902 |

|

| |

Total current assets |

|

|

2,936,908 |

|

|

|

3,598,168 |

|

| Property and equipment, net |

|

|

423,489 |

|

|

|

460,513 |

|

| Total assets |

|

$ |

3,360,397 |

|

|

$ |

4,058,681 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

282,897 |

|

|

$ |

289,820 |

|

| |

Accrued compensation and related costs |

|

|

317,020 |

|

|

|

588,097 |

|

| |

Accrued expenses and other current liabilities |

|

|

159,108 |

|

|

|

153,875 |

|

| |

Deferred revenue |

|

|

839,863 |

|

|

|

1,516,792 |

|

| |

Total current liabilities |

|

|

1,598,888 |

|

|

|

2,548,584 |

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

| |

Accrued rent liability - long-term |

|

|

132,586 |

|

|

|

144,990 |

|

| Total liabilities |

|

|

1,731,474 |

|

|

|

2,693,574 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

| |

Preferred stock $0.005 par value; 2,000,000 shares authorized; no

shares issued or outstanding as of December 31, 2013 and 2012 |

|

|

- |

|

|

|

- |

|

| |

Common stock $0.005 par value; 500,000,000 shares authorized;

158,328,245 shares issued and 158,285,045 shares outstanding as of

December 31, 2013 and 2012, respectively |

|

|

791,641 |

|

|

|

791,641 |

|

| |

Additional paid-in capital |

|

|

13,169,477 |

|

|

|

13,144,044 |

|

| |

Treasury stock at cost, 43,200 common shares as ofDecember 31, 2013

and 2012, respectively |

|

|

(2,981 |

) |

|

|

(2,981 |

) |

| |

Accumulated deficit |

|

|

(12,329,214 |

) |

|

|

(12,567,597 |

) |

| |

Total stockholders' equity |

|

|

1,628,923 |

|

|

|

1,365,107 |

|

| Total liabilities and stockholders' equity |

|

$ |

3,360,397 |

|

|

$ |

4,058,681 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

VIRTRA SYSTEMS, INC.

STATEMENTS OF OPERATIONS for the period:

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

2014 |

|

2013 |

|

| |

|

|

|

|

|

|

|

| Net revenues |

|

$ |

1,961,650 |

|

$ |

2,489,666 |

|

| Cost of products sold |

|

|

751,192 |

|

|

752,427 |

|

| Gross margin |

|

|

1,210,458 |

|

|

1,737,239 |

|

| General and administrative expenses |

|

|

972,882 |

|

|

1,203,879 |

|

| Income from operations |

|

|

237,576 |

|

|

533,360 |

|

| Other income/(expense): |

|

|

|

|

|

|

|

| |

Other income |

|

|

807 |

|

|

28 |

|

| |

Other expense |

|

|

- |

|

|

(3,411 |

) |

| Net other income/(expense) |

|

|

807 |

|

|

(3,383 |

) |

| Income before income taxes |

|

|

238,383 |

|

|

529,977 |

|

| Income tax expense/(benefit) |

|

|

- |

|

|

- |

|

| Net income |

|

$ |

238,383 |

|

$ |

529,977 |

|

| Weighted average of common and common equivalent shares

outstanding: |

|

|

|

|

|

|

|

| |

-Basic |

|

|

158,285,045 |

|

|

158,285,045 |

|

| Net income per common and common equivalent share: |

|

|

|

|

|

|

|

| |

-Basic |

|

$ |

0.00 |

|

$ |

0.00 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

VIRTRA SYSTEMS, INC.

STATEMENTS OF STOCKHOLDERS' (DEFICIT)/EQUITY for the

period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Treasury |

|

|

Accumulated |

|

|

|

|

|

|

|

Shares |

|

Amount |

|

paid-in capital |

|

Stock |

|

|

Deficit |

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2013 |

|

158,285,045 |

|

$ |

791,641 |

|

$ |

13,032,498 |

|

$ |

(2,981 |

) |

|

$ |

(14,148,373 |

) |

|

$ |

(327,215 |

) |

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

1,580,776 |

|

|

|

1,580,776 |

|

|

Stock-based compensation |

|

- |

|

|

- |

|

|

111,546 |

|

|

- |

|

|

|

- |

|

|

|

111,546 |

|

|

Balance at December 31, 2013 |

|

158,285,045 |

|

|

791,641 |

|

|

13,144,044 |

|

|

(2,981 |

) |

|

|

(12,567,597 |

) |

|

|

1,365,107 |

|

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

238,383 |

|

|

|

238,383 |

|

|

Stock-based compensation |

|

- |

|

|

- |

|

|

25,433 |

|

|

- |

|

|

|

- |

|

|

|

25,433 |

|

|

Balance at March 31, 2014 |

|

158,285,045 |

|

$ |

791,641 |

|

$ |

13,169,477 |

|

$ |

(2,981 |

) |

|

$ |

(12,329,214 |

) |

|

$ |

1,628,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VIRTRA SYSTEMS, INC.

STATEMENTS OF CASH FLOWS for the period:

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three months ended March 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

238,383 |

|

|

$ |

529,977 |

|

| Adjustments to reconcile net income to net cashprovided

by operating activities: |

|

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

|

52,024 |

|

|

|

56,067 |

|

| |

Stock-based compensation |

|

|

25,433 |

|

|

|

26,598 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| |

Accounts receivable |

|

|

135,143 |

|

|

|

(263,673 |

) |

| |

Inventory |

|

|

(164,922 |

) |

|

|

(12,715 |

) |

| |

Prepaid expenses and other assets |

|

|

(62,832 |

) |

|

|

791 |

|

| |

Accounts payable and other accrued expenses |

|

|

(285,171 |

) |

|

|

30,434 |

|

| |

Deferred revenue |

|

|

(676,929 |

) |

|

|

(551,119 |

) |

| Net cash provided by operating activities |

|

|

(738,871 |

) |

|

|

(183,640 |

) |

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| |

Purchase of property and equipment |

|

|

(15,000 |

) |

|

|

(970 |

) |

| Net cash used in investing activities |

|

|

(15,000 |

) |

|

|

(970 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| |

Draws on line of credit |

|

|

- |

|

|

|

150,000 |

|

| |

Repayments of line of credit |

|

|

- |

|

|

|

(150,000 |

) |

| |

Payments on term loan |

|

|

- |

|

|

|

(19,843 |

) |

| Net cash provided by/(used in) financing

activities |

|

|

- |

|

|

|

(19,843 |

) |

| Increase/(decrease) in cash and cash equivalents |

|

|

(753,871 |

) |

|

|

(204,453 |

) |

| Cash and cash equivalents, beginning of period |

|

|

2,358,955 |

|

|

|

372,119 |

|

| Cash and cash equivalents, end of period |

|

$ |

1,605,084 |

|

|

$ |

167,666 |

|

| Cash paid during the period for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

7,738 |

|

|

$ |

2,668 |

|

| Taxes |

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Investor Relations Counsel Rudy R. Miller Chairman, President

& CEO The Miller Group www.themillergroup.net tel: 602.225.0505 email:

virtra@themillergroup.net

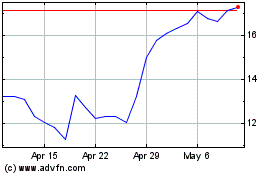

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024