Current Report Filing (8-k)

May 13 2014 - 10:08AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 13, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 13, 2014

B&G Foods, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

001-32316 |

|

13-3918742 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of Incorporation) |

|

File Number) |

|

Identification No.) |

|

Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (973) 401-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 13, 2014, B&G Foods, Inc. entered into an amendment to its employment agreement with Michael Sands, B&G Foods’ Executive Vice President of Snacks. The amendment eliminates the provision from the employment agreement granting Mr. Sands a tax gross up for any excise tax imposed by Internal Revenue Code Section 4999 on severance payments and other benefits upon a change of control of B&G Foods.

These gross up payments would have been made only if Mr. Sands received “excess parachute payments” within the meaning of Internal Revenue Code Section 280G.

As amended, the employment agreement now provides that, if an excise tax would be due, severance payments and/or benefits under the employment agreement or otherwise upon a change of control will be reduced if, and to the extent, such a reduction would result in a greater after-tax return to Mr. Sands than his receiving all of the severance payments and benefits and paying the resulting excise tax.

Under the amended employment agreement, in no event will B&G Foods be required to pay an excise tax gross up to Mr. Sands.

The amendment is filed as Exhibit 10.1 to this report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

10.1 |

|

First Amendment to Employment Agreement, dated May 13, 2014, between B&G Foods and Michael Sands. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

B&G FOODS, INC. |

|

|

|

|

|

|

|

|

|

Dated: May 13, 2014 |

By: |

/s/ Scott E. Lerner |

|

|

|

Scott E. Lerner |

|

|

|

Executive Vice President,

General Counsel and Secretary |

3

Exhibit 10.1

FIRST AMENDMENT TO EMPLOYMENT AGREEMENT

FIRST AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of May 13, 2014, by and between B&G Foods, Inc., a Delaware corporation (the “Corporation”) and Michael Sands (“Sands”).

PRELIMINARY STATEMENTS

WHEREAS, the Corporation and Sands are parties to an Employment Agreement, dated as of March 11, 2014 (the “Agreement”);

WHEREAS, the Corporation and Sands each desire to amend the Agreement as set forth in this Amendment.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Defined Terms. Except as otherwise set forth herein, capitalized terms used but not defined herein shall have the respective meanings assigned to such terms in the Agreement.

2. Amendments to the Agreement.

(a) Section 7(g) of the Agreement is hereby amended and restated in its entirety to read as follows:

“(g) Notwithstanding any other provision of this Agreement, in the event that the amount of payments or other benefits payable to Sands under this Agreement (including, without limitation, the acceleration of any payment or the accelerated vesting of any payment or other benefit), together with any payments, awards or benefits payable under any other plan, program, arrangement or agreement maintained by the Corporation or one of its Subsidiaries or other Affiliates, would constitute an “excess parachute payment” (within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”)), such payments and benefits shall be reduced (by the minimum possible amounts) in the order set forth below until no amount payable to Sands under this Agreement or otherwise constitutes an “excess parachute payment” (within the meaning of Section 280G of the Code); provided, however, that no such reduction shall be made if the net after-tax amount (after taking into account federal, state, local or other income, employment and excise taxes) to which Sands would otherwise be entitled without such reduction would be greater than the net after-tax amount (after taking into account federal, state, local or other income, employment and excise taxes) to Sands resulting from the receipt of such payments and benefits with such reduction. If any payments or benefits payable to Sands are required to be reduced pursuant to this Section, such payments and/or benefits to Sands shall be reduced in the following order: first, payments that are payable in cash, with amounts that are payable last reduced first; second, payments due in respect of any equity or equity derivatives included at their full value under Section 280G (rather than their accelerated value); third, payments due in respect of any equity or equity derivatives valued at accelerated value under Section 280G, with the highest values reduced first (as such values are determined under Treasury Regulation Section 1.280G-1, Q&A 24); and fourth, all other non-cash benefits.

All determinations required to be made under this Section 7(g), including whether a payment would result in an “excess parachute payment” and the assumptions to be utilized in arriving at such determinations, shall be made by an accounting firm designated by the Corporation (the “Accounting Firm”) which shall provide detailed supporting calculations both to the Corporation and

Sands as requested by the Corporation or Sands. All fees and expenses of the Accounting Firm shall be borne solely by the Corporation and shall be paid by the Corporation. Absent manifest error, all determinations made by the Accounting Firm under this Section 7(g) shall be final and binding upon the Corporation and Sands.”

3. Reference to and Effect on the Agreement.

(a) On and after the date hereof each reference in the Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import, shall mean and be a reference to the Agreement as amended hereby.

(b) Except as specifically amended hereby, the Agreement shall continue to be in full force and effect and is hereby in all respects ratified and confirmed.

(c) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of either party under the Agreement.

4. Counterparts. This Amendment may be executed in counterparts, and any party hereto may execute any such counterpart, each of which when executed and delivered shall be deemed to be an original and all of which counterparts taken together shall constitute but one and the same instrument. This Amendment shall become effective when each party hereto shall have received a counterpart hereof signed by the other party hereto. The parties agree that the delivery of this Amendment may be effected by means of an exchange of facsimile or pdf signatures.

5. Governing Law. This Amendment and any claim, controversy or dispute arising under or related to this Amendment, the relationship of the parties, and/or the interpretation and enforcement of the rights and duties of the parties shall be construed and enforced under and in accordance with the laws of the State of New Jersey, without regard to conflicts of law principles.

IN WITNESS WHEREOF, the parties have caused this Amendment to be duly executed and delivered by their proper and duly authorized officers as of the day and year first above written.

|

|

B&G FOODS, INC. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Scott E. Lerner |

|

|

|

Name: Scott E. Lerner |

|

|

|

Title: Executive Vice President |

|

|

|

|

|

|

|

|

|

|

MICHAEL SANDS |

|

|

|

|

|

|

|

|

|

|

/s/ Michael Sands |

2

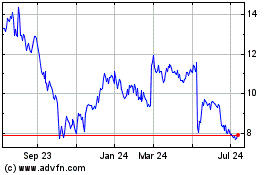

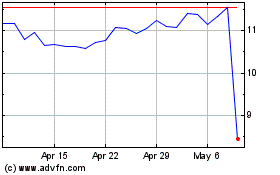

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024