After driving earnings for many quarters, the financial sector has

been a major drag on total Q1 earnings growth. This is especially

true as financials is the second-worst performing sector this

earnings season, trailing autos.

Total earnings for 100% of the sector’s total market capitalization

are down 7% with a lower beat ratio of 64.6%. Revenues are also

down 14% year over year with a beat ratio of 54.4%. The weakness

can mostly be blamed on sluggish results from big U.S. banks (read:

3 ETF Winners from Earnings Season).

Despite disappointing earnings, one corner of the broader financial

segment – insurance – is performing quite well than the others.

Most of the insurers reported gloomy revenue numbers missing our

estimate, while earnings seem quite inspiring. This is primarily

thanks to a string of earnings beat by some of popular names such

as American International (AIG), Prudential Financial (PRU), Aflac

Inc. (AFL) and Travelers (TRV).

However, MetLife (MET) and Allstate (ALL) reported lackluster

earnings and Chubb Corp (CB) met earnings estimate.

Insurance Earnings in Focus

MetLife, the U.S. life insurer behemoth, missed

the Zacks Consensus Estimate by 3 cents and deteriorated 7% from

the year-ago quarter. On the other hand,

PRU, the

second-largest U.S. life insurer, surprised the market with a

strong earnings beat of 13 cents and 5.7% year over year

improvement.

Aflac, the seller of supplement health insurance,

topped our earnings estimate by a penny and saw no change from the

year-ago earnings. The largest commercial insurer in the U.S. and

Canada –

AIG – also reported strong earnings.

Though earnings per share of $1.21 surpassed the Zacks Consensus

Estimate of $1.08, the figure was below the year-ago earnings of

$1.34 (read: 3 ETFs to Profit from the Hot Insurance Industry).

One of the largest property and casualty insurers and an industry

bellwether,

Travelers, posted record earnings of

$2.95 per share, strongly beating Zacks Consensus Estimate of $2.13

and improving from the year-ago earnings of $2.33.

Though earnings at another property and casualty insurer –

Chubb - managed to meet our estimate of $1.50, the

figure showed a 30% year-over-year decline thanks to severe winter.

Allstate, personal property and casualty insurer,

lagged the Zacks Consensus Estimate by 14 cents and the year-ago

earnings by a nickel.

Insurance ETFs in Focus

Based on decent earnings, insurance ETFs are leading the financial

ETF space in the trailing one-month period. Investors looking to

gain exposure to this corner of the market segment in a diversified

way may consider the following ETFs (see: all the Financial ETFs

here).

SPDR S&P Insurance ETF (KIE)

This fund follows the S&P Insurance Select Industry Index and

offers equal weight exposure across 51 stocks, suggesting no

concentration risk. None of the securities holds more than 2.39% of

total assets. About two-fifths of the portfolio is allocated to the

property and casualty insurance sector while life & health

insurance accounts for another one-fifth share.

The ETF has managed $271 million in its asset base so far and

trades in good average daily volume of 136,000 shares. The product

has an expense ratio of 0.35% and added about 2.9% over the past

one month. The ETF has a Zacks Rank of 2 or ‘Buy’ rating with

Medium risk outlook.

iShares U.S. Insurance ETF (IAK)

With AUM of $152.8 million, this product tracks the Dow Jones U.S.

Select Insurance Index and charges 45 bps in annual fees. Volume is

light, trading in about 28,000 shares per day. In total, the fund

holds 66 securities in its basket with the largest allocation to

American International at 12.25%, closely followed by Metlife at

9.27%. Other firms do not hold more than 6.39% of assets.

Here again, property and casualty insurance takes the top spot,

accounting for half of the asset base. Life insurance and full time

insurance take the remaining portion in the basket. The fund moved

up nearly 3% over the trailing one month and has a Zacks Rank of 1

or ‘Strong Buy’ rating with Medium risk outlook (read: Should You

Buy Insurance ETFs Now?).

PowerShares KBW Property & Casualty Insurance Fund

(KBWP)

This overlooked ETF provides targeted exposure to the property and

casualty insurers by tracking the KBW Property & Casualty

Index. Holding 24 securities, the fund has a slight tilt toward

Allstate, Travelers and Chubb that collectively make up for 24.19%

of total assets.

Though property and casualty insurance accounts for 66% share,

reinsurance and multiline insurance also receive double-digit

exposure in the basket. The product has amassed just $9.6 million

in AUM and trades in small volumes of just 4,000 shares per day on

average. The ETF charges an annual fee of 35 bps and returned

nearly 4.5% in the last one-month period. KBWP has a Zacks Rank of

2 with Medium risk outlook.

Bottom Line

Investors should note that these products have clearly outpaced the

broad sector fund (XLF) and the market fund (SPY) by a wide margin.

This outperformance is expected to continue in the coming months on

concerns over rising interest rates, which would enable them to

earn more premium on their investment portfolio (read: Play Rising

Rates with These ETFs).

Further, recovering economic health and an improving labor market

are driving higher demand for all types of insurance services,

leading to strength in this segment. Moreover, upside to the sector

could be confirmed by the Zacks Industry Rank, as four out of five

insurance industries have a solid rank (in the top 42%) at the time

of writing.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ISHARS-US INSUR (IAK): ETF Research Reports

PWRSH-K P&C INS (KBWP): ETF Research Reports

SPDR-KBW INSUR (KIE): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

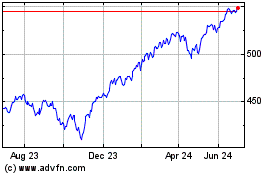

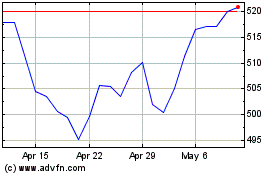

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024