Bloomin' Brands, Inc. (Nasdaq:BLMN) today reported financial

results for the thirteen weeks ended March 30, 2014.

Key highlights for the thirteen weeks ended March 30, 2014

include the following:

- Total revenues increased 6.0% to $1.2 billion and include the

impact of one less operating day due to the change in the Company's

fiscal year end from a calendar year ending on December 31 to a

52-53 week fiscal year

- Comparable sales for Company-owned core domestic concepts were

flat while traffic decreased 1.6% driven by an estimated (1.7%) of

aggregate impact from unfavorable weather and a shift in the timing

of holidays

- Adjusted operating income margin* was 8.4% versus 8.9% in the

first quarter of 2013 and U.S. GAAP operating income margin was

7.8% versus 8.9% in the first quarter of 2013

- Effective income tax rate of 24.8% versus 14.1% in the first

quarter of 2013

- Adjusted EBITDA* was $143.1 million versus $140.9 million in

the first quarter of 2013

- Adjusted net income* was $58.5 million versus $63.2 million in

the first quarter of 2013 and U.S. GAAP Net income attributable to

Bloomin' Brands was $53.7 million versus $63.2 million in the first

quarter of 2013

- Adjusted diluted earnings per share* were $0.46 per share, a

decrease of $0.04 from the first quarter of 2013, and GAAP Diluted

earnings per share were $0.42 per share, a decrease of $0.08 from

the first quarter of 2013

The following table reconciles Adjusted diluted earnings per

share to Diluted earnings per share for the periods as indicated

below:

| |

THIRTEEN |

THREE |

|

| |

WEEKS ENDED MARCH

30, 2014 |

MONTHS ENDED

MARCH 31, 2013 |

CHANGE |

| Adjusted diluted earnings per share* |

$ 0.46 |

$ 0.50 |

$ (0.04) |

| Adjustments* |

(0.04) |

— |

(0.04) |

| Diluted earnings per share |

$ 0.42 |

$ 0.50 |

$ (0.08) |

| |

|

|

|

| * Denoted items are

non-GAAP measurements, which include adjustments to the financial

results as determined under U.S. GAAP. See Reconciliations of

Non-GAAP Measures to U.S. GAAP Results included later in this

release. |

|

|

|

"Our brands held up well in a challenging environment and we

continued to gain share," said Elizabeth Smith, CEO. "First quarter

results were consistent with our expectations and we remain on

track to deliver our sales and earnings guidance for the year."

Financial Results

The following summarizes the Company's results for the thirteen

weeks ended March 30, 2014:

- Total revenues increased 6.0% to $1.2 billion. This

increase was primarily due to the consolidation of restaurant

sales generated by the formerly unconsolidated joint venture

restaurants in Brazil and additional revenues from opening new

restaurants. The increase in Total revenues was partially

offset by declines in average unit volumes in the Company's South

Korean restaurants, the loss of one operating day due to the the

Company's change to a 52-53 week fiscal year, the closing of

25 restaurants since March 31, 2013, and the removal of royalty

income related to the consolidation of the Company's Brazilian

operation.

- Comparable sales for Company-owned core domestic concepts were

flat as a result of increases in general menu prices offset by a

1.6% decline in customer traffic. Traffic was negatively

impacted by approximately 1.7% due to the combined impact of

unfavorable weather and a shift in the timing of holidays in

2014. In addition, comparable sales were negatively impacted

by a change in mix in the Company's product sales. Results by

concept were as follows:

| |

COMPANY- |

| THIRTEEN WEEKS ENDED

MARCH 30, 2014 |

OWNED |

| Domestic comparable restaurant sales (stores

open 18 months or more) |

|

| Outback Steakhouse |

0.8% |

| Carrabba's Italian Grill |

(1.8)% |

| Bonefish Grill |

(1.5)% |

| Fleming's Prime Steakhouse and

Wine Bar |

1.7% |

- Adjusted restaurant-level operating margin as a percentage of

Restaurant sales was 18.0% for the thirteen weeks ended March 30,

2014 versus 18.4% for the comparable period in 2013. This

decrease was primarily attributable to commodity inflation, costs

associated with lunch expansion, lower average unit volumes in the

Company's South Korean restaurants, higher advertising expenses,

and costs associated with the new menu rollout at Carrabba's

Italian Grill. The decrease was partially offset by

productivity savings, menu pricing and the operating margin benefit

from the consolidation of the formerly unconsolidated joint venture

restaurants in Brazil.

- Adjusted operating income as a percentage of Total revenues was

8.4% for the thirteen weeks ended March 30, 2014 versus 8.9%

for the comparable period in 2013. This decrease was driven

primarily by lower Adjusted restaurant-level operating margins and

higher Depreciation and amortization. This was partially

offset by lower expense associated with the timing of the Company's

annual managing partner conference.

- The Company opened 15 new system-wide locations: six Bonefish

Grill restaurants, two Carrabba's Italian Grill restaurants, one

Outback Steakhouse, one Fleming's Prime Steakhouse and Wine Bar and

five Company-owned international Outback Steakhouse restaurants,

three in Brazil and one each in South Korea and China.

Other Events

- The Company's fiscal first quarter adjusted results reflect the

following items:

- As previously announced, in the fourth quarter of 2013 the

Company completed an assessment of its restaurant base in advance

of capital and development planning for the 2014 fiscal

year. As a result of this assessment, the Company decided to

close 22 underperforming restaurants primarily within the Outback

Steakhouse concept. In connection with this initiative, the

Company incurred an aggregate $4.9 million for non-cancelable

operating lease liabilities and restaurant closing costs in the

thirteen weeks ended March 30, 2014.

- In connection with the Company's acquisition of a controlling

interest in its Brazilian joint venture, an adjustment of

approximately $1.5 million for pre-tax, non-cash amortization of

intangibles was recorded in the thirteen weeks ended March 30,

2014. This amount represents the Company's portion of the

amortization of reacquired franchise rights and favorable and

unfavorable leases.

- On March 10, 2014, certain stockholders of the Company

completed a secondary public offering of 20.7 million shares of the

Company's common stock at a public offering price

of $24.50 per share. All of the shares were offered

by certain stockholders of the Company, and the Company did not

receive any proceeds from the offering. After the completion

of this transaction, the Company no longer qualifies as a

"controlled company" within the meaning of the corporate governance

rules of Nasdaq. The Company incurred approximately $1.1

million of transaction-related expenses in the thirteen weeks ended

March 30, 2014, primarily related to this transaction.

- As previously reported, the Company's Board of Directors

approved a change in the Company's fiscal year end from a calendar

year ending on December 31 to a 52-53 week fiscal year ending on

the last Sunday in December, effective beginning with fiscal year

2014. The fiscal year change was made on a prospective basis

and the Company did not adjust operating results for prior

periods. For the thirteen weeks ended March 30, 2014, the

fiscal year end change had the following impact as compared to

prior year primarily because of one fewer operating day in the

current period:

- Total revenues were approximately $7.5 million lower;

- Adjusted net income and U.S. GAAP Net income were approximately

$1.5 million lower; and

- Adjusted diluted earnings per share and U.S. GAAP Diluted

earnings per share were approximately $0.01 lower.

- During the thirteen weeks ended March 30, 2014, the

Company's wholly-owned subsidiary, OSI Restaurant Partners,

LLC, ("OSI") made $10.0 million of voluntary prepayments

on its outstanding senior secured Term Loan B. The balance of

the Term Loan B as of March 30, 2014 was $925.0 million.

- In April 2014, the Company initiated a process to refinance its

outstanding senior secured credit facilities. At the time of

this release, the terms of the agreement are not final. Upon

completion of the refinancing, we expect total outstanding

indebtedness under the new credit facilities to be consistent with

the total amount outstanding under our current credit

facilities. If the refinancing is completed, the Company

anticipates lower interest expense in 2014.

Fiscal 2014 Financial Outlook

The Company is reaffirming its full-year guidance for blended

core domestic comparable restaurant sales growth of between 1.0% to

2.0% and Adjusted diluted earnings per share to be at

least $1.21 as previously communicated in its February 25,

2014 earnings release.

U.S. GAAP net income, U.S. GAAP diluted earnings per share and

General and Administrative expense may differ from guidance. This

is the result of expenses related to the Company's anticipated

refinancing of its senior secured credit facilities. These expenses

will be excluded from all adjusted metrics. All other elements

of the guidance included in the February 25, 2014 release

remain intact.

Conference Call

The Company will host a conference call today, May 9, 2014

at 9:00 AM ET. The conference call can be accessed live over

the telephone by dialing (877) 941-1427 or (480) 629-9664 for

international callers. A replay will be available beginning

two hours after the call and can be accessed by dialing (877)

870-5176 or (858) 384-5517 for international callers; the

conference ID is 4678154. The replay will be available through

Friday, May 16, 2014. The call will also be webcast live from

the Company's website at http://www.bloominbrands.com under the

Investors section. A replay of this webcast will be available

on the Company's website, after the call.

About Bloomin' Brands, Inc.

The Company is one of the largest casual dining restaurant

companies in the world with a portfolio of leading, differentiated

restaurant concepts. The Company has five founder-inspired brands:

Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill,

Fleming's Prime Steakhouse and Wine Bar and Roy's, with all except

Roy's considered core concepts. The Company operates more than

1,500 restaurants in 48 states, Puerto Rico, Guam and 21 countries,

some of which are franchise locations. For more information,

please visit www.bloominbrands.com.

Forward-Looking Statements

Certain statements contained herein, including statements under

the headings "Fiscal 2014 Financial Outlook" are not based on

historical fact and are "forward-looking statements" within the

meaning of applicable securities laws. Generally, these

statements can be identified by the use of words such as

"believes," "estimates," "anticipates," "expects," "on track,"

"feels," "forecasts," "seeks," "projects," "intends," "plans,"

"may," "will," "should," "could," "would" and similar expressions

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying

words. These forward-looking statements include all matters

that are not historical facts. By their nature,

forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from the Company's

forward-looking statements. These risks and uncertainties

include, but are not limited to: local, regional, national and

international economic conditions; consumer confidence and spending

patterns; price and availability of commodities, such as beef,

chicken, shrimp, pork, seafood, dairy, potatoes, onions and energy

supplies, which are subject to fluctuation and could increase or

decrease more than the Company expects; weather, acts of God and

other disasters; the seasonality of the Company's business;

inflation or deflation; increases in unemployment rates and taxes;

increases in labor and health insurance costs; competition and

changes in consumer tastes and the level of acceptance of the

Company's restaurant concepts (including consumer acceptance of

prices); consumer reaction to public health issues; consumer

perception of food safety; demographic trends; the cost of

advertising and media; government actions and policies; interest

rate changes, compliance with debt covenants and the Company's

ability to make debt payments; the availability of credit presently

arranged from the Company's revolving credit facilities; and the

cost and availability of credit for the proposed refinancing of the

Company's credit facilities including the possibility the

refinancing is not completed. Further information on potential

factors that could affect the financial results of the Company and

its forward-looking statements is included in its Form 10-K filed

with the Securities and Exchange Commission on March 3,

2014. The Company assumes no obligation to update any

forward-looking statement, except as may be required by

law. These forward-looking statements speak only as of the

date of this release. All forward-looking statements are

qualified in their entirety by this cautionary statement.

Note: Numerical figures included in this release have been

subject to rounding adjustments.

| BLOOMIN' BRANDS,

INC. |

| |

|

|

| CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE INCOME |

| (IN THOUSANDS, EXCEPT

PER SHARE DATA) |

| |

|

|

| |

THIRTEEN |

THREE |

| |

WEEKS ENDED MARCH

30, 2014 |

MONTHS ENDED

MARCH 31, 2013 |

| |

(unaudited) |

(unaudited) |

| Revenues |

|

|

| Restaurant sales |

$ 1,150,525 |

$ 1,082,356 |

| Other revenues |

7,334 |

9,894 |

| Total revenues |

1,157,859 |

1,092,250 |

| Costs and expenses |

|

|

| Cost of sales |

373,614 |

349,989 |

| Labor and other related |

311,418 |

299,867 |

| Other restaurant operating |

256,518 |

233,809 |

| Depreciation and

amortization |

46,165 |

40,196 |

| General and administrative |

74,054 |

72,491 |

| Provision for impaired assets

and restaurant closings |

6,064 |

1,896 |

| Income from operations of

unconsolidated affiliates |

— |

(2,858) |

| Total costs and expenses |

1,067,833 |

995,390 |

| Income from operations |

90,026 |

96,860 |

| Other expense, net |

(164) |

(217) |

| Interest expense, net |

(16,598) |

(20,880) |

| Income before provision for income taxes |

73,264 |

75,763 |

| Provision for income taxes |

18,164 |

10,707 |

| Net income |

55,100 |

65,056 |

| Less: net income attributable

to noncontrolling interests |

1,367 |

1,833 |

| Net income attributable to Bloomin'

Brands |

$ 53,733 |

$ 63,223 |

| |

|

|

| Net income |

$ 55,100 |

$ 65,056 |

| Other comprehensive income: |

|

|

| Foreign currency translation

adjustment |

(5,365) |

(4,532) |

| Comprehensive income |

49,735 |

60,524 |

| Less: comprehensive income

attributable to noncontrolling interests |

1,367 |

1,833 |

| Comprehensive income attributable to Bloomin'

Brands |

$ 48,368 |

$ 58,691 |

| |

|

|

| Earnings per share: |

|

|

| Basic |

$ 0.43 |

$ 0.52 |

| Diluted |

$ 0.42 |

$ 0.50 |

| Weighted average common shares

outstanding: |

|

|

| Basic |

124,542 |

121,238 |

| Diluted |

127,851 |

126,507 |

| |

|

|

Supplemental Balance Sheet Information (in thousands):

| |

March 30,

2014 |

December 31,

2013 |

| |

(unaudited) |

|

| Cash and cash equivalents (1) |

$ 172,604 |

$ 209,871 |

| Net working capital (deficit) (2) |

(226,345) |

(260,471) |

| Total assets |

3,208,790 |

3,274,174 |

| Total debt, net |

1,405,133 |

1,419,143 |

| Total stockholders' equity |

530,176 |

482,709 |

| |

|

|

| (1) |

Excludes restricted cash. |

| (2) |

The Company has, and in the future may

continue to have, negative working capital balances (as is common

for many restaurant companies). The Company operates successfully

with negative working capital because cash collected on Restaurant

sales is typically received before payment is due on its current

liabilities and its inventory turnover rates require relatively low

investment in inventories. Additionally, ongoing cash flows from

restaurant operations and gift card sales are used to service debt

obligations and to make capital expenditures. |

| |

|

Reconciliations of Non-GAAP Measures to

U.S. GAAP Results (unaudited)

In addition to the results provided in accordance with generally

accepted accounting principles in the United States ("U.S. GAAP"),

the Company provides non-GAAP measures which present operating

results on an adjusted basis. These are supplemental measures

of performance that are not required by or presented in accordance

with U.S. GAAP and include the following: (i) Adjusted

restaurant-level operating margins, (ii) Adjusted income from

operations and the corresponding margins, (iii) Adjusted net

income, (iv) Adjusted diluted earnings per share and (v) EBITDA and

Adjusted EBITDA. These non-GAAP measures are not measurements of

the Company's operating or financial performance under U.S. GAAP

and should not be considered as an alternative to performance

measures derived in accordance with U.S. GAAP or as an alternative

to cash flow from operating activities as measures of the Company's

liquidity. These non-GAAP measures may not be comparable to

similarly titled measures used by other companies and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with U.S. GAAP.

- Restaurant-level operating margins are calculated as Restaurant

sales after deduction of the main restaurant-level operating costs

(comprising Cost of sales, Labor and other related and Other

restaurant operating). Adjusted restaurant-level operating

margins are calculated by eliminating from Restaurant-level

operating margins the impact of items that are not considered

indicative of ongoing operations consistent with the other non-GAAP

measures discussed below. The Company provides this non-GAAP

measure because it believes it is useful for investors to assess

core restaurant operations without the effect of certain

adjustments. For the periods presented, Adjusted

restaurant-level operating margin includes the adjustment for the

deferred rent write-off associated with the fourth quarter of 2013

decision to close 22 underperforming locations. The write-off

of the deferred rent liability was recorded in Other restaurant

operating during the thirteen weeks ended March 30, 2014. No

adjustments impacted Restaurant-level operating margins during the

three months ended March 31, 2013.

- Adjusted income from operations, Adjusted net income and

Adjusted diluted earnings per share are calculated by eliminating

from Income from operations, Net income attributable to Bloomin'

Brands and Diluted earnings per share the impact of items that are

not considered indicative of ongoing operations. The Company

provides these non-GAAP measures because it believes they are

useful for investors to assess the operating performance of the

business without the effect of certain adjustments. For the periods

presented, the non-GAAP adjustments include transaction-related

expenses primarily attributable to costs associated with the

secondary offering of the Company's common stock in March 2014;

certain restaurant closing charges; purchased intangibles

amortization; and an adjustment to the Provision for income taxes

based on the statutory rate applicable to jurisdictions in which

the above non-GAAP adjustments relate.

- Earnings before interest, taxes and depreciation and

amortization ("EBITDA") and Adjusted EBITDA (calculated by

adjusting EBITDA to exclude certain stock-based compensation

expenses, non-cash expenses and other significant unusual items

that the Company does not consider representative of its underlying

business performance) are supplemental measures of operating

performance. The Company believes that EBITDA and Adjusted

EBITDA are useful measures for investors as they permit a

comparative assessment of its operating performance relative to its

performance based on its U.S. GAAP results, while isolating the

effects of some items that vary from period to period and to

facilitate company-to-company comparisons within the restaurant

industry by eliminating some of these foregoing

variations.

The use of these measures permits a comparative assessment of

the Company's operating performance relative to its performance

based on U.S. GAAP results, while isolating the effects of certain

items that vary from period to period without correlation to core

operating performance or that vary widely among similar

companies. However, the inclusion of these adjusted measures

should not be construed as an indication that future results will

be unaffected by unusual or infrequent items or that the items for

which the adjustments have been made are unusual or

infrequent. In the future, the Company may incur expenses or

generate income similar to the adjusted items. The Company

further believes that the disclosure of these non-GAAP measures is

useful to investors as they form the basis for how

the Company's management team and Board of Directors evaluate

the Company's performance including for achievement of objectives

under the Company's cash and equity compensation plans. By

disclosing these non-GAAP measures, the Company believes that it is

providing for investors the basis for a greater understanding of,

and an enhanced level of transparency into, the means by which the

management team operates the business.

Reconciliations of Non-GAAP Financial Measures - Adjusted

Restaurant-Level Operating Margin

The following tables show the percentages of certain operating

cost financial statement line items in relation to Restaurant sales

on both a U.S. GAAP basis and an adjusted basis, as indicated, for

the thirteen weeks ended March 30, 2014 and the three months ended

March 31, 2013:

| |

THIRTEEN WEEKS ENDED March 30, 2014 |

THREE MONTHS

ENDED MARCH 31, 2013 |

(UNFAVORABLE) FAVORABLE CHANGE IN

ADJUSTED 2014 |

| |

U.S.

GAAP |

ADJUSTED

(1) |

U.S. GAAP AND

ADJUSTED (2) |

VS. ADJUSTED

2013 |

| Restaurant sales |

100.0% |

100.0% |

100.0% |

|

| |

|

|

|

|

| Cost of sales |

32.5% |

32.5% |

32.3% |

(0.2)% |

| Labor and other related |

27.1% |

27.1% |

27.7% |

0.6% |

| Other restaurant operating |

22.3% |

22.5% |

21.6% |

(0.9)% |

| |

|

|

|

|

| Restaurant-level operating margin |

18.2% |

18.0% |

18.4% |

(0.4)% |

| |

|

|

|

|

| (1) |

Adjusted restaurant-level operating margins

include the adjustment for the deferred rent liability write-off

associated with the fourth quarter of 2013 decision to close 22

underperforming locations. The write-off of the deferred rent

liability was recorded in Other restaurant operating during the

thirteen weeks ended March 30, 2014. |

| (2) |

No adjustments impacted Restaurant-level

operating margins during the three months ended March 31,

2013. |

Reconciliations of Non-GAAP Financial Measures - Adjusted Income

from Operations, Adjusted Net Income, Adjusted Diluted Earnings Per

Share and Adjusted Diluted Earnings Per Share

The following table reconciles Adjusted income from operations

and the corresponding margins, Adjusted net income and Adjusted

diluted earnings per share, for the thirteen weeks ended March 30,

2014 and the three months ended March 31, 2013 to their respective

most comparable U.S. GAAP measures (in thousands, except per share

amounts):

| |

THIRTEEN |

THREE |

| |

WEEKS ENDED MARCH

30, 2014 |

MONTHS ENDED

MARCH 31, 2013 |

| Income from operations |

$ 90,026 |

$ 96,860 |

| Operating income margin |

7.8% |

8.9% |

| Adjustments: |

|

|

| Transaction-related expenses

(1) |

1,118 |

— |

| Other losses (2) |

4,929 |

— |

| Purchased intangibles

amortization (3) |

1,458 |

— |

| Adjusted income from operations |

$ 97,531 |

$ 96,860 |

| Adjusted operating income

margin |

8.4% |

8.9% |

| |

|

|

| Net income attributable to Bloomin'

Brands |

$ 53,733 |

$ 63,223 |

| Adjustments: |

|

|

| Transaction-related expenses

(1) |

1,118 |

— |

| Other losses (2) |

4,929 |

— |

| Purchased intangibles

amortization (3) |

1,458 |

— |

| Total adjustments, before income taxes |

7,505 |

— |

| Adjustment to provision for

income taxes (4) |

(2,695) |

— |

| Net adjustments |

4,810 |

— |

| Adjusted net income |

$ 58,543 |

$ 63,223 |

| |

|

|

| Diluted earnings per share |

$ 0.42 |

$ 0.50 |

| Adjusted diluted earnings per share |

$ 0.46 |

$ 0.50 |

| |

|

|

| Diluted weighted average common shares

outstanding |

127,851 |

126,507 |

| |

|

| (1) |

Transaction-related expenses primarily relate

to costs incurred with the secondary offering of the Company's

common stock completed in March 2014. |

| (2) |

During the thirteen weeks ended March 30,

2014, the Company incurred additional expenses for non-cancelable

operating lease liabilities and restaurant closing costs associated

with the fourth quarter of 2013 decision to close 22

underperforming locations. |

| (3) |

Represents the Company's proportional share

of non-cash amortization of intangibles recorded as a result of the

acquisition of a controlling ownership interest in the Company's

Brazilian operations and includes amortization for reacquired

franchise rights and favorable and unfavorable leases. |

| (4) |

Income tax effect of adjustments for the

thirteen weeks ended March 30, 2014 was calculated based on the

statutory rate applicable to jurisdictions in which the above

non-GAAP adjustments relate. |

| |

|

Reconciliations of Non-GAAP Financial Measures - EBITDA and

Adjusted EBITDA

The following table reconciles Net income attributable to

Bloomin' Brands to EBITDA and Adjusted EBITDA for the thirteen

weeks ended March 30, 2014 and the three months ended March 31,

2013 (in thousands):

| |

THIRTEEN |

THREE |

| |

WEEKS ENDED MARCH

30, 2014 |

MONTHS ENDED

MARCH 31, 2013 |

| Net income attributable to Bloomin'

Brands |

$ 53,733 |

$ 63,223 |

| Provision for income taxes |

18,164 |

10,707 |

| Interest expense, net |

16,598 |

20,880 |

| Depreciation and amortization |

46,165 |

40,196 |

| EBITDA |

134,660 |

135,006 |

| Impairments and disposals (1) |

399 |

876 |

| Transaction-related expenses (2) |

1,118 |

— |

| Stock-based compensation expense |

3,575 |

4,429 |

| Other losses (3) |

3,335 |

582 |

| Adjusted EBITDA |

$ 143,087 |

$ 140,893 |

| |

|

|

| (1) |

Represents the elimination of non-cash

impairment charges for fixed assets and intangible assets and net

gains or losses on the disposal of fixed assets. |

| (2) |

Transaction-related expenses primarily relate

to costs incurred with the secondary offering of the Company's

common stock completed in March 2014. |

| (3) |

Represents expenses incurred as a result of

(losses) gains on the Company's partner deferred compensation

participant investment accounts net of the loss (gain) on the

corporate-owned life insurance policies that are held for

settlement of the Company's obligations under these programs,

foreign currency loss (gain), the loss (gain) on the cash surrender

value of executive life insurance and additional expenses for

non-cancelable operating lease liabilities and restaurant closing

costs of approximately $4.9 million associated with the fourth

quarter of 2013 decision to close 22 underperforming

locations. |

| |

|

Comparative Store Information

The table below presents the number of the Company's restaurants

in operation at the end of the periods indicated:

| |

MARCH 30, |

MARCH 31, |

| |

2014 |

2013 |

| Number of restaurants (at end of the

period): |

|

|

| Outback Steakhouse |

|

|

| Company-owned—domestic |

650 |

663 |

| Company-owned—international (1)

(2) |

171 |

117 |

| Franchised—domestic |

104 |

106 |

| Franchised and joint

venture—international (1) |

51 |

89 |

| Total |

976 |

975 |

| Carrabba's Italian Grill |

|

|

| Company-owned |

240 |

234 |

| Franchised |

1 |

1 |

| Total |

241 |

235 |

| Bonefish Grill |

|

|

| Company-owned |

192 |

174 |

| Franchised |

5 |

7 |

| Total |

197 |

181 |

| Fleming's Prime Steakhouse and Wine Bar |

|

|

| Company-owned |

66 |

65 |

| Roy's |

|

|

| Company-owned |

20 |

22 |

| System-wide total |

1,500 |

1,478 |

| |

|

|

| (1) |

Effective November 1, 2013, the Company

acquired a controlling interest in its Brazilian operations

resulting in the consolidation and reporting of 47 restaurants (as

of the acquisition date) as Company-owned locations that are

reported as unconsolidated joint venture locations in the

historical period presented. |

| (2) |

The restaurant count for Brazil is reported

as of February 28, 2014 to correspond with the balance sheet date

of this subsidiary and, therefore, excludes one restaurant that

opened in March 2014. Restaurant counts for the Company's

Brazilian operations were reported as of March 31st in the

historical period presented. |

CONTACT: Chris Meyer

Vice President, Investor Relations & Treasurer

(813) 830-5311

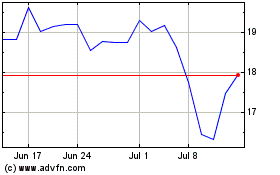

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

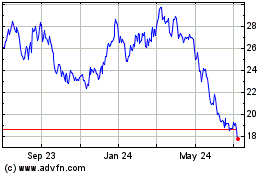

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024