Tonogold Resources Inc. (OTC:TNGL) (the "

Company")

is pleased to announce it has agreed terms with the owners of

Mil-ler Resources and Energy SA de CV ("

Mil-ler"),

owner of the Nevmex producing iron ore project located near

Hermosillo, Sonora in Mexico, to merge the companies in a non-cash

transaction as an alternative to the previous arrangements.

This new deal will result in the existing iron ore operations

being 100% owned by Tonogold upon the issue of 541 million Tonogold

shares to the shareholders of Mil-ler (subject to Tonogold

shareholders approving a 1 for 10 reverse share split and an

adjustment to the authorized capital to enable the shares to be

issued).

The shareholders of Mil-ler have mutually agreed to a

self-imposed trading restriction (in excess to those imposed by the

SEC) with 75% of the shares issued being subject to at least a

12-month hold period, 50% an 18-month hold, and 25% subject to a

24-month hold, reflecting the long-term investment strategy of the

current owners of Mil-ler.

On April 1, 2014, Tonogold announced that it had mandated EAS

Advisors, LLC ("EAS") to provide equity capital

market advice and through Merriman Capital Inc. to assist the

Company in its capital raising requirements in order to fund the

acquisition of Mil-ler.

EAS undertook a site visit to evaluate the Mil-ler operations

and meet with its stakeholders and subsequently recommended that

the companies merge in order to align shareholders' interests and

make the investment more attractive to US investors. EAS reviewed

the entire operations from the mine to port for the benefit of the

shareholders of the Company.

As a consequence of Tonogold securing 100% of Mil-ler, the

capital raising has increased from that previously announced (of $6

million) to $14 million to more rapidly advance the expansion and

exploration of the Nevmex projects. The Company and EAS have

received encouraging feedback in early discussions.

The increased offering will enable Tonogold to fund significant

opportunities that have been identified not only on the project's

135-square miles of prospective tenements but also to fund a number

of regional consolidation opportunities as part of Tonogold's

significant growth objectives. Tonogold has an initial target to

produce over 700,000 tonnes per year of Iron Ore within a 6-month

time frame.

Tonogold has recently completed a $600,000 short-term loan note,

convertible into shares at 5 cents per share or repaid (at the

holders election following completion of the capital raising) to

provide Tonogold with working capital in the short-term.

The Company expects to approve the issue of shares to Mil-ler

and complete the 1:10 reverse share split at a Meeting of

Shareholders in June 2014. Shareholders will be duly notified of

this meeting in accordance with Notice of Meetings

requirements.

The Company is continuing to work with its advisors in a bid to

become a fully reporting entity as soon as possible. Additionally,

we expect the reverse share split share price will provide Tonogold

the opportunity to list on secondary exchanges in the near-term, as

well attract a broader investor base.

The share structure contemplated following the completion of the

capital raising and acquisition (pre and post the proposed capital

re-structure) is provided in the table below:

| |

| |

Number of shares

(M's) |

|

| |

Pre |

Post |

% |

| Currently on issue |

195.0 |

19.5 |

19.0% |

| Short term Convertible Loan |

12.0 |

1.2 |

1.2% |

| Current raising |

280.0 |

28.0 |

27.2% |

| Shares for 100% of Mexico |

541.0 |

54.1 |

52.6% |

| Total |

1,028.0 |

102.8 |

100.0% |

Mr. Travis Miller, Mil-ler's largest shareholder and general

manager, will become Tonogold's largest shareholder with him

holding approximately 26% of the enlarged share capital of the

Company. Mr. Miller has agreed to join the board of Tonogold as an

executive director. Further details of Mr. Miller are provided as

an appendix to this announcement.

Mr. Ashley, Tonogold's CEO stated "The extremely professional

and positive discussions between Tonogold and Mil-ler over the past

months has provided increased confidence from both sides of the

significant benefits that will result in consolidating 100% of this

asset into Tonogold immediately. EAS's extremely professional and

diligent assessment of Tonogold and the project being acquired,

coupled with their understanding of the US capital markets,

particularly in the natural resource sector, has been invaluable

and the revised structure, I believe, establishes an extremely

sound foundation for Tonogold and paves the way for substantial

growth with significant and real shareholder returns in the future.

I am extremely happy with the relationship that has developed

between Tonogold and the management and owners of Mil-ler and

particularly look forward to working with Travis Miller and his

team to build Tonogold into a significant and highly profitable

iron ore producer."

Mr. Miller said "I am very excited to become an integral part of

Tonogold. I believe that the synergies of our asset base and

management team together with the experience and track record of

Tonogold's management in building substantial growth though

fundamentally driven objectives and strategies in the resource

sector will ensure that the full potential of our iron ore project

will be realized in a professional and timely manner for the

benefit of all shareholders."

Mr. Eddie Sugar (the principle of EAS) said, "Although we were

initially skeptical about the investment given the recent publicity

in Mexico regarding iron ore, we were very pleasantly surprised to

subsequently find a situation almost completely opposite of what we

expected. Not only are the Mil-ler and Tonogold teams extremely

professional and experienced, our understanding of Mexican iron ore

and our skepticism were completely unfounded. We found the

state of Sonora to be an extremely friendly place for mining and

the supporting infrastructure to be of great quality, which even

producers and developers in Australia and America would

envy. We are very excited to be part of Tonogold's future and

believe they are well on their way to creating a considerable

business with a combination of characteristics that are rare in

iron ore; strong cash flow generation off of a very small capital

expenditure base with the added benefit of very significant

production growth potential."

APPENDIX 1

Background of Mr. Travis

Miller

Mr. Miller is a US citizen but has lived in Mexico for the past

7 years and is fluent in Spanish. In 2008, Mr. Miller arranged the

consolidated of the tenement package that is now the Nevmex project

owned by Mil-Ler (a private Mexican entity). During 2011, through

Mil-ler, Mr. Miller funded an exploration program over two areas in

close proximity to the access road leading onto the tenements and

established the Ponderosa and Vito 3 deposits. In 2012 Mr. Miller

arranged for a large construction group in Mexico to take a 50%

equity interest in Mil-ler by providing the mining fleet and

process facilities to enable the commencement of production at

Ponderosa. Under Mr. Miller's management, production commenced in

early 2013. Subsequent drilling has resulted in Ponderosa becoming

much larger, with current expectations that it will provide the

feed necessary to sustain a production rate of 360,000 tonnes of

iron ore per annum for at least 5 years. Mr. Miller has significant

mining and Mexican business experience.

Safe Harbor Statement

This press release contains certain forward-looking information

about Tonogold Resources, Inc. ("Tonogold") which is intended to be

covered by the safe harbor for "forward-looking statements"

provided by the Private Securities Litigation Reform Act of

1995. Forward-looking statements are statements that are not

historical facts. Words such as "expect(s)," "feel(s),"

"believe(s)," "will," "may," "anticipate(s)," and similar

expressions are intended to identify forward-looking

statements. These statements include, but are not limited to,

financial projections and estimates and their underlying

assumptions; statements regarding plans, objectives and

expectations with respect to future operations, products and

services; and statements regarding future performance. Such

statements are subject to certain risks and uncertainties, many of

which are difficult to predict and generally beyond the control of

Tonogold Resources, Inc. that could cause actual results to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include: our lack of operating revenue and

earnings history, our need for additional capital to pursue our

business strategy, some of our managers lack formal training in the

mining business, the grade and quantity of minerals in our projects

may not be economic, we do not have fee title to our properties,

but derive our rights through leases and the Mining Law, changes to

the Mining Law may increase the cost of doing business, we are a

non-reporting company and as such do not make periodic filings with

the Securities and Exchange Commission, we trade on the Pink Sheets

and there can be no assurances that a liquid market will develop in

our securities, mining is subject to extensive environmental

regulations and can create substantial environmental liabilities,

gold, silver and other metals are commodities which have

substantial price fluctuations, a drop in prices could adversely

affect future profitability and capital raising efforts, and mining

can be dangerous and present operational hazards for employees and

contractors. Readers are cautioned not to place undue reliance

on these forward-looking statements. Tonogold does not

undertake any obligation to republish revised forward-looking

statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events.

CONTACT: For further information please contact:

Mark Ashley (mjashley3@gmail.com)

T: 858 456 1273

www.tonogold.com

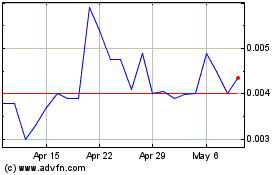

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tonogold Resources (PK) (USOTC:TNGL)

Historical Stock Chart

From Apr 2023 to Apr 2024