Chesapeake Beats on Q1 Earnings and Revs - Analyst Blog

May 07 2014 - 2:00PM

Zacks

Chesapeake Energy

Corp. (CHK) reported adjusted first quarter 2014 earnings

of 59 cents per share, comfortably beating the Zacks Consensus

Estimate of 47 cents. Also, the reported figure improved from the

year-earlier profit of 30 cents a share.

Quarterly revenues improved to $5,046.0 million from $3,424.0

million a year ago. The top line also got the better of the Zacks

Consensus Estimate of $1,864.0 million.

Operational Performance

Chesapeake’s daily production for the reported quarter averaged

approximately 675,200 barrel of oil equivalent (Boe), an increase

of 11% from 2013 first quarter. Average daily production consisted

of approximately 109,500 barrels per day (Bbl/d) of oil, 84,200

Bbls of NGL and 2.9 billion cubic feet (Bcf) of natural gas.

Oil equivalent realized price in the reported quarter was $35.35

per boe, up from $26.71 in the year-earlier quarter. Average

realizations for natural gas were $3.27 per Mcf compared with $2.13

per Mcf in the year-earlier quarter. Oil was sold at $85.08 per

barrel, down from the year-ago price of $94.85 per barrel.

On the cost front, quarterly production expenses were $4.73 per

Boe, reflecting an increase of 2.4% sequentially.

Financials

At the end of the quarter, Chesapeake − the largest U.S. natural

gas producer after ExxonMobil Corporation (XOM) −

had a cash balance of $1,004.0 million. Long-term debt stood at

$12,653.0 million, representing a debt-to-capitalization ratio of

39.0%.

Guidance

The company raised its 2014 total production growth outlook on an

adjusted basis to 9–12% from 8–10%, to reflect higher-than-expected

natural gas liquids volumes. However as the company shifts its

focus to more liquid-rich plays, it expects liquids production to

increase approximately 25–29% in 2014. For 2014, Chesapeake expects

capital expenditure in the range of $5,200–$5,600 million.

Zacks Rank & Other Stocks

Chesapeake carries a Zacks Rank #3 (Hold) and is expected to

perform in line with the market in the next one to three months.

However, there are stocks in the oil and gas sector like,

Clayton Williams Energy, Inc. (CWEI) and

Matrix Service Company (MTRX), which hold a Zacks

Rank #1 (Strong Buy) and are expected to outperform the market.

CHESAPEAKE ENGY (CHK): Free Stock Analysis Report

WILLIAMS(C)ENGY (CWEI): Free Stock Analysis Report

MATRIX SERVICE (MTRX): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

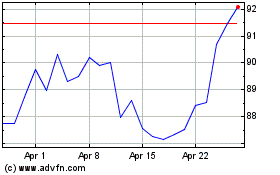

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

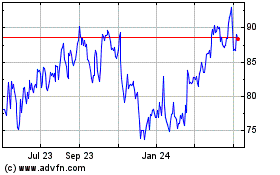

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024