Arrow Beats on Q1 Earnings, Misses Rev - Analyst Blog

May 07 2014 - 9:00AM

Zacks

Arrow Electronics

Inc. (ARW) reported first-quarter 2014 adjusted earnings

(excluding the effect of restructuring and amortization) per share

of $1.22, which beat the Zacks Consensus Estimate by a penny. On a

year-over-year basis, earnings increased 27.9%, primarily due to

growth across its business segments. Reported earnings also came

within management’s guided range of $1.14 and $1.26 per share.

Quarter Details

Arrow’s revenues on a reported basis came in at $5.08 billion,

which increased 4.8% from the year-ago quarter. On an adjusted

basis, revenues decreased 1.4% from the year-ago quarter and also

came in at $5.08 billion, which missed the Zacks Consensus Estimate

of $5.32 billion. The company’s book-to-bill ratio was 1.04.

On a segmental basis, revenues from Global components increased

7.2% on a year-over-year basis to $3.42 billion. Adjusted revenues

increased 4.4% from the year-ago quarter and also came in at $3.42

billion. Revenues from America increased 1.0% while Asia-Pacific

revenues increased 12.0%, primarily due to strong growth in China.

European revenues, on an adjusted basis, increased 7.0% on a

year-over-year basis, which boosted segment revenues.

Revenues from Global enterprise computing solutions (ECS) came in

at $1.66 billion, up a marginal 0.2% on a year-over-year basis,

primarily due to increased demand for software and security-related

solutions, partially offset by a tepid hardware business. Adjusted

revenues decreased 11.4% from the year-ago-quarter. Revenues were

impacted by low demand in Arrow’s storage and servers business

globally. Revenues from America declined 10.0% while revenues from

Europe declined 11.0% on an adjusted basis. However, sales from

Europe on a reported basis were up 15.0% year over year, primarily

due to the Computerlinks acquisition.

Arrow reported adjusted operating margin of 3.9%, which was up 47

basis points (bps) from the year-ago quarter primarily due to

growth across its businesses. Adjusted operating expenses increased

6.2% from the year-ago quarter to $503.5 million and were up 14 bps

as a percentage of revenues for the same period of time.

Arrow’s adjusted net income (excluding the effect of restructuring

and amortization) came in at $124.0 million or $1.22 per share

compared with $103.1 million or 96 cents in the year-ago

quarter.

Arrow ended the quarter with cash and cash equivalents of $258.3

million, down from $390.6 million at the end of the previous

quarter. Long-term debt was $2.14 billion, down from $2.23 billion

at the end of the previous quarter. During the quarter, the company

generated $124.0 million in cash from operations. During the

quarter, Arrow repurchased shares worth $70.0 million.

Guidance

For the second quarter of 2014, Arrow expects sales to range

between $5.45 billion and $5.85 billion (mid pint $5.65 billion),

reflecting a sequential increase in revenues. The Zacks Consensus

Estimate is pegged at $5.72 billion.

Global components sales are projected between $3.45 billion and

$3.65 billion. Global enterprise computing solutions sales are

estimated between $2.0 billion and $2.2 billion. The company

expects non-GAAP earnings to range between $1.35 and $1.47, up

sequentially. The Zacks Consensus Estimate of $1.41 per share is

line with the mid-point of the guided range.

Management expects its enterprise computing solutions business to

boost revenues. Moreover, the company expects its global components

business to remain at par on a sequential basis in the second

quarter.

Our Take

Electronic component distributor Arrow posted mixed first-quarter

results, with the bottom line surpassing the Zacks Consensus

Estimate but revenues missing the same. Year-over-year comparisons

were modestly up and Arrow had a favorable book to bill ratio.

Moreover, positive commentary about enhanced productivity, annual

cost savings, and continued higher contributions from Europe are

encouraging. Moreover, incremental sales from strategic

acquisitions such as that of Computerlinks are expected to boost

Arrow’s top line going forward.

We believe that Arrow’s core strength of providing best-in-class

services and easy-to-acquire technologies are expected to bolster

its growth in the future.

However, uncertain economic conditions and competition from

Avnet (AVT) and Ingram Micro (IM)

are concerns, going forward.

Currently, Arrow has a Zacks Rank #2 (Buy). Investors can also

consider Rambus Inc. (RMBS) which has a Zacks Rank

#1 (Strong Buy) and is worth buying.

ARROW ELECTRONI (ARW): Free Stock Analysis Report

AVNET (AVT): Free Stock Analysis Report

INGRAM MICRO (IM): Free Stock Analysis Report

RAMBUS INC (RMBS): Free Stock Analysis Report

To read this article on Zacks.com click here.

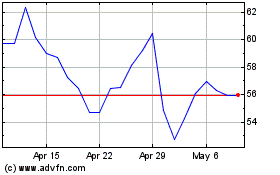

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

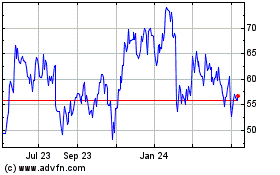

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024