- Total GAAP Revenue of $13.6 Million

with Medical Device Segment Revenue Increasing 8%

- GAAP EPS of $0.18 Includes One-time

$0.04 Non-cash Charge

- Pro Forma EPS Increases 10% to

$0.22

- Continued Pre Clinical Optimization

of Paclitaxel Drug Coated Balloon

- Full Year 2014 EPS Outlook Range

Affirmed and Revenue Outlook Range Adjusted to $56.0 Million to

$58.5 Million

SurModics, Inc. (Nasdaq:SRDX), a leading provider of surface

modification and in vitro diagnostic technologies to the healthcare

industries, today announced results for its fiscal 2014 second

quarter.

Commenting on the Company’s performance, SurModics’ President

and Chief Executive Officer Gary Maharaj said, “Our Medical Device

business unit delivered exceptional revenue growth and

much-improved operating income. Additionally, I am particularly

pleased that our pro forma earnings per share increased in the

light of headwinds in our In Vitro Diagnostics business unit and

continued investment in our drug coated balloon program.”

Second Quarter Revenue and Earnings Summary

GAAP revenue for the fiscal 2014 second quarter totaled $13.6

million, compared with $13.7 million in the fiscal 2013 second

quarter.

Diluted earnings per share from continuing operations in the

second quarter of fiscal 2014 totaled $0.18, compared with $0.23 in

the prior-year period. On a pro forma basis, earnings per share in

the fiscal 2014 second quarter were $0.22, excluding the previously

announced $0.04 per share one-time, non-cash charge related to

amendments to board of director equity compensation, compared with

$0.20 on a pro forma basis in the prior-year period. The year-ago

quarter included a $0.03 per share benefit from one-time discrete

income tax items.

Medical Device Summary

The Medical Device business unit accounts for approximately

three-quarters of the Company’s total revenue. This unit, which

includes hydrophilic coatings and device drug delivery

technologies, posted revenue of $10.5 million in the second quarter

of fiscal 2014, increasing 8% from the year-ago period. Second

quarter hydrophilic coating royalty revenue increased 3% to $7.1

million from the year-earlier period. Maharaj said, “Our team is

actively engaged with customers conducting feasibility trials with

our next generation Serene lubricity coating platform.”

Medical Device generated $5.3 million of operating income during

the second quarter, a 10% increase compared with the second quarter

of fiscal 2013, primarily reflecting increased revenue.

Additional highlights include:

- Three medical device customers launched

new products utilizing SurModics hydrophilic coatings;

- Second consecutive quarter of year over

year coronary sector revenue growth, up 3%; and

- Development work continued on the

Company’s high-priority drug coated balloon program.

In Vitro Diagnostics Summary

The In Vitro Diagnostics (IVD) business unit accounts for

approximately one-quarter of the Company’s total revenue. Revenue

for the second quarter of fiscal 2014 totaled $3.1 million,

down $0.8 million from the year-ago period. The decline in current

year revenue was primarily driven by a shift in order patterns by a

few key customers who initiated inventory rebalancing programs

related to SurModics’ stabilization and antigen products, combined

with lower sales of BioFx branded substrate products and a slowdown

in sales in Europe. The IVD business unit generated

$0.6 million of operating income in the second quarter of

fiscal 2014, compared with $1.3 million in the year ago period.

Maharaj said, “We expect improvement in the IVD business in the

second half of fiscal 2014.”

Balance Sheet and Cash Flow

As of March 31, 2014, the Company had $51.3 million of cash and

investments. SurModics generated cash from operating activities of

$5.9 million in the first six months of 2014, compared with $6.8

million in the same prior-year period. The Company repurchased

105,566 shares of common stock for $2.6 million in the second

quarter of fiscal 2014 under the July 2013 $20.0 million repurchase

authorization. This repurchase authorization was fully utilized in

January 2014.

Maharaj said, “We continue to focus on driving our core

business, developing our pipeline including the drug coated balloon

platform and seeking opportunities to leverage our balance sheet to

further enhance shareholder value.”

Fiscal 2014 Outlook

SurModics reaffirms its previously stated earnings per share

outlook for fiscal 2014. Including planned increase in research and

development spending primarily to support our drug coated balloon

program and the second quarter 2014 $0.04 per share one-time,

non-cash charge related to board of director equity compensation,

the Company continues to estimate diluted GAAP earnings to be in

the range of $0.85 to $0.97 per share. This range also assumes

research and development expense will increase in the range of 7%

to 9% in fiscal 2014, down from a 20% increase included in our

previous guidance. The Company is adjusting its full-year revenue

guidance to be in the range of $56.0 million to $58.5 million

to reflect the change in customer order patterns in the IVD

business unit. The previous guidance was for revenue in the range

of $58.0 million to $62.0 million. The Company also affirmed for

fiscal 2014 that cash flow from operating activities should range

from $17.6 million to $18.6 million and capital expenditures are

expected to range from $2.2 million to $2.5 million.

Live Webcast

SurModics will host a webcast at 4 p.m. CT (5 p.m. ET) today to

discuss second quarter results. To access the webcast, go to the

investor relations portion of the Company’s website at

www.surmodics.com and click on the webcast icon. A replay of the

second quarter conference call will be available by dialing

800-406-7325 and entering conference call ID passcode 4678793. The

audio replay will be available beginning at 7 p.m. CT on Thursday,

May 1, 2014, until 7 p.m. CT on Thursday, May 8,

2014.

About SurModics, Inc.

SurModics’ mission is to exceed our customers’ expectations and

enhance the well-being of patients by providing the world’s

foremost, innovative surface modification technologies and in vitro

diagnostic chemical components. The Company partners with the

world’s leading and emerging medical device, diagnostic and life

science companies to develop and commercialize innovative products

designed to improve patient diagnosis and treatment. Core offerings

include surface modification coating technologies that impart

lubricity, prohealing, and biocompatibility capabilities; and

components for in vitro diagnostic test kits and microarrays.

SurModics is headquartered in Eden Prairie, Minnesota. For more

information about the Company, visit www.surmodics.com. The content

of SurModics’ website is not part of this press release or part of

any filings that the Company makes with the SEC.

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements.

Statements that are not historical or current facts, including

statements about beliefs and expectations regarding our

expectations regarding the Company’s performance in the near- and

long-term, including our revenue, earnings and cash flow

expectations for fiscal 2014, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors could cause actual results to

differ materially from those anticipated, including (1) our

reliance on third parties (including our customers and licensees)

and their failure to successfully develop, obtain regulatory

approval for, market and sell products incorporating our

technologies; (2) our ability to realize the full potential of our

pipeline (including our drug-coated balloon initiatives); (3) our

ability to achieve our corporate goals; (4) possible adverse market

conditions and possible adverse impacts on our cash flows, and (5)

the factors identified under “Risk Factors” in Part I, Item 1A of

our Annual Report on Form 10-K for the fiscal year ended September

30, 2013, and updated in our subsequent reports filed with the SEC.

These reports are available in the Investors section of our website

at www.surmodics.com and at the SEC website at www.sec.gov.

Forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update them in light of new

information or future events.

Use of Non-GAAP Financial Information

In addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, SurModics is

reporting non-GAAP financial results including non-GAAP net income

and non-GAAP diluted net income per share. We believe that these

non-GAAP measures provide meaningful insight into our operating

performance excluding certain event-specific matters, and provide

an alternative perspective of our results of operations. We use

non-GAAP measures, including those set forth in this release, to

assess our operating performance and to determine payout under our

executive compensation programs. We believe that presentation of

certain non-GAAP measures allows investors to review our results of

operations from the same perspective as management and our board of

directors and facilitates comparisons of our current results of

operations. The method we use to produce non-GAAP results is not in

accordance with GAAP and may differ from the methods used by other

companies. Non-GAAP results should not be regarded as a substitute

for corresponding GAAP measures but instead should be utilized as a

supplemental measure of operating performance in evaluating our

business. Non-GAAP measures do have limitations in that they do not

reflect certain items that may have a material impact upon our

reported financial results. As such, these non-GAAP measures

presented should be viewed in conjunction with both our financial

statements prepared in accordance with GAAP and the reconciliation

of the supplemental non-GAAP financial measures to the comparable

GAAP results provided for the specific periods presented, which are

attached to this release.

SurModics, Inc. and

Subsidiaries

Condensed Consolidated Statements of

Income

(in thousands, except per share data)

Three Months Ended Six Months Ended

March 31, March 31, 2014 2013

2014 2013 (Unaudited) (Unaudited) Revenue:

Royalties and license fees $ 7,329 $ 6,951 $ 14,794 $ 14,467

Product sales 5,165 5,758 10,565 11,111 Research and development

1,110 986 2,128

1,968 Total revenue 13,604 13,695

27,487 27,546 Operating costs

and expenses: Product costs 1,696 1,945 3,700 3,904 Research and

development 4,134 3,774 7,833 7,136 Selling, general and

administrative 4,294 3,847 8,145

7,500 Total operating costs and expenses

10,124 9,566 19,678

18,540 Operating income from continuing operations

3,480 4,129 7,809

9,006 Other income (loss): Investment income, net 66 56 152

127 Impairment loss on strategic investments ― (129 ) ― (129 )

Other income, net 125 282 806

1,458 Other income, net 191

209 958 1,456 Income from

continuing operations before income taxes 3,671 4,338 8,767 10,462

Income tax provision (1,212 ) (918 ) (2,678 )

(2,794 ) Income from continuing operations 2,459 3,420 6,089

7,668 Income from discontinued operations, net of taxes ―

682 ― 682 Net income $ 2,459

$ 4,102 $ 6,089 $ 8,350 Basic

income per share: Continuing operations $ 0.18 $ 0.23 $ 0.45 $ 0.52

Discontinued operations 0.00 0.05 0.00 0.05 Net income $ 0.18 $

0.28 $ 0.45 $ 0.57 Diluted income per share: Continuing

operations $ 0.18 $ 0.23 $ 0.44 $ 0.52 Discontinued operations 0.00

0.05 0.00 0.05 Net income $ 0.18 $ 0.28 $ 0.44 $ 0.56

Weighted average number of shares outstanding: Basic 13,538 14,622

13,658 14,639 Diluted 13,824 14,914 13,925 14,871

SurModics, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(in thousands)

March 31, September 30, 2014

2013 (Unaudited) Assets Cash and short-term investments $

33,843 $ 25,707 Accounts receivable 5,610 5,332 Inventories 2,758

3,328 Other current assets 2,396 1,366 Current assets of

discontinued operations 46 46 Total current assets

44,653 35,779 Property and equipment, net 12,689 12,845

Long-term investments 17,420 32,397 Other assets 20,920

20,902 Total assets $ 95,682 $ 101,923 Liabilities

and Stockholders’ Equity Current liabilities $ 3,118 $ 5,837

Current liabilities of discontinued operations 126

139 Total current liabilities 3,244 5,976 Other liabilities

1,805 2,130 Total stockholders’ equity 90,633 93,817

Total liabilities and stockholders’ equity $ 95,682 $ 101,923

SurModics, Inc. and

Subsidiaries

Condensed Consolidated Statements of

Cash Flows

(in thousands)

Six Months Ended March 31, 2014

2013 (Unaudited) Operating Activities: Net income $ 6,089 $

8,350 Income from discontinued operations ― (682 ) Depreciation and

amortization 1,380 1,446 Stock-based compensation 2,462 1,238 Gain

on sales of available-for-sale securities and strategic investments

(806 ) (1,458 ) Net other operating activities (822 ) 492 Change in

operating assets and liabilities: Accounts receivable (279 ) 158

Accounts payable and accrued liabilities (1,770 ) (1,366 ) Income

taxes (559 ) (1,322 ) Net change in other operating assets and

liabilities 241 (31 ) Net cash provided by

operating activities from continuing operations 5,936

6,825 Investing Activities: Purchases of

property and equipment (798 ) (1,239 ) Cash transferred to

discontinued operations (13 ) (86 ) Net other investing activities

495 2,175 Net cash (used in) provided

by investing activities from continuing operations (316 )

850 Financing Activities: Repurchase of common

stock (12,544 ) (2,681 ) Purchases of common stock to pay employee

taxes (1,114 ) (39 ) Net other financing activities 987

42 Net cash used in financing activities from

continuing operations (12,671 ) (2,678 ) Net cash

(used in) provided by continuing operations (7,051 )

4,997 Discontinued operations: Net cash used in

operating activities (13 ) (86 ) Net cash provided by financing

activities 13 86 Net cash provided by

discontinued operations ― ― Net change in cash

and cash equivalents (7,051 ) 4,997 Cash and Cash Equivalents:

Beginning of period 15,495 15,540 End

of period $ 8,444 $ 20,537

SurModics, Inc. and

Subsidiaries

Supplemental Segment

Information

(in thousands)

(Unaudited)

Three Months Ended March 31, 2014

2013 % Change Revenue % of Total

% of Total Medical Device $ 10,482 77.0 % $ 9,735

71.1 % 7.7 % In Vitro Diagnostics 3,122 23.0

3,960 28.9 (21.2 ) Total revenue $ 13,604 100.0 % $ 13,695

100.0 % (0.7 )%

Six Months Ended March 31,

2014 2013 % Change Revenue % of

Total % of Total Medical Device $ 21,031 76.5 % $ 20,266

73.6 % 3.8 % In Vitro Diagnostics 6,456 23.5

7,280 26.4 (11.3 ) Total revenue $ 27,487 100.0 % $ 27,546

100.0 % (0.2 )%

Three Months Ended

Six Months Ended March 31, March 31,

2014 2013 2014 2013

Operating Income (Loss) Medical Device $ 5,282 $ 4,785 $

10,610 $ 10,625 In Vitro Diagnostics 633 1,267 1,303 2,018

Corporate (2,435 ) (1,923 ) (4,104 )

(3,637 ) Total operating income $ 3,480 $ 4,129 $

7,809 $ 9,006

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP

Information

For the Three Months Ended March 31,

2014

(In thousands, except per share data)

(Unaudited)

As Reported Adjusted

GAAP(1)

Adjustments

Non-GAAP(2)

Revenue Royalties and license fees $ 7,329 $ 7,329

Product sales 5,165 5,165 Research and development 1,110

1,110 Total revenue $ 13,604 $ 13,604

Operating

income $ 3,480 $ 914 (3) $ 4,394

Income from

continuing operations $ 2,459 $ 580 (4) $ 3,039

Diluted earnings per share from continuing operations(5) $

0.18 $ 0.22 (1) Reflects operating results in

accordance with U.S. generally accepted accounting principles

(GAAP). (2) Adjusted Non-GAAP amounts consider adjustments to

reflect a $914 reduction to operating expenses associated with

acceleration of Board of Director stock-based compensation awards

and related adjustment to the income tax provision utilizing a

36.5% incremental effective tax rate. (3) Reflects the pre-tax

impact of the operating expense adjustment noted in (2) above. (4)

Adjusted to reflect the adjustments noted in (2) above. (5) Diluted

earnings per share from continuing operations is calculated using

the diluted weighted average shares outstanding for the period

presented.

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP

Information

For the Three Months Ended March 31,

2013

(in thousands, except per share data)

(Unaudited)

As Reported Adjusted

GAAP(1)

Adjustments

Non-GAAP(2)

Revenue Royalties and license fees $ 6,951 $ 6,951

Product sales 5,758 5,758 Research and development 986

986 Total revenue $ 13,695 $ 13,695

Operating

income $ 4,129 $ 4,129 10 (3)

Income from continuing

operations $ 3,420 $ (412 ) (4) $ 3,018

Diluted

earnings per share from continuing operations(5) $ 0.23 $ 0.20

(1) Reflects operating results in accordance with

U.S. generally accepted accounting principles (GAAP). (2) Adjusted

Non-GAAP amounts consider adjustments to reduce net investment loss

associated with an impairment loss on the Company’s investment in

ViaCyte substantially offset by the gain on the sale of OctoPlus

shares and increase the income tax provision to reverse discrete

income tax benefits recognized for the period presented as noted in

detail in note (4) below. The adjustment to net investment loss did

not generate a tax expense as there was an offsetting reversal of a

capital loss valuation allowance. (3) Reflects the pre-tax impact

of the net investment loss adjustments noted in (2) above. The

adjustment to net investment loss did not generate a tax expense as

there was an offsetting reversal of a capital loss valuation

allowance. (4) Adjusted to remove discrete income tax benefits of

$261 associated with the realization of capital loss carrybacks and

$151 from the January 2013 signing of the American Taxpayer Relief

Act of 2012 which retroactively reinstated federal R&D tax

credits for calendar 2012. (5) Diluted earnings per share from

continuing operations is calculated using the diluted weighted

average shares outstanding for the period presented.

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP

Information

For the Six Months Ended March 31,

2014

(In thousands, except per share data)

(Unaudited)

As Reported Adjusted

GAAP(1)

Adjustments

Non-GAAP(2)

Revenue Royalties and license fees $ 14,794 $ 14,794

Product sales 10,565 10,565 Research and development 2,128

2,128 Total revenue $ 27,487 $ 27,487

Operating

income $ 7,809 $ 914 (3) $ 8,723

Income from

continuing operations $ 6,089 $ (101 ) (4) $ 5,988

Diluted earnings per share from continuing operations(5) $

0.44 $ 0.43 (1) Reflects operating results in

accordance with U.S. generally accepted accounting principles

(GAAP). (2) Adjusted Non-GAAP amounts consider adjustments to

reduce operating expenses by $914 associated with acceleration of

Board of Director stock-based compensation awards and a $681

reduction in net investment income associated with a contingent

milestone payment related to the sale of Vessix Vascular shares

which were sold in fiscal 2013. The income tax provision includes

an adjustment associated with the stock-based compensation awards

utilizing a 36.5% incremental effective tax rate. The adjustment to

reduce net investment income did not generate a tax benefit as

there was an offsetting establishment of a capital loss valuation

reserve allowance. (3) Reflects the pre-tax impact of the operating

expense adjustment noted in (2) above. (4) Adjusted to reflect the

adjustments noted in (2) above. (5) Diluted earnings per share from

continuing operations is calculated using the diluted weighted

average shares outstanding for the period presented.

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP

Information

For the Six Months Ended March 31,

2013

(In thousands, except per share data)

(Unaudited)

As Reported Adjusted GAAP(1)

Adjustments Non-GAAP(2) Revenue

Royalties and license fees $ 14,467 $ (570 ) (3) $ 13,897 Product

sales 11,111 11,111 Research and development 1,968

1,968 Total revenue $ 27,546 $ (570 ) (3) $ 26,976

Operating income $ 9,006 $ (570 ) (3) $ 8,436 $ (362

) (4) $ (1,164 ) (5)

Income from continuing operations $

7,668 $ (412 ) (6) $ 5,730

Diluted earnings per share

from continuing operations(7) $ 0.52 $ 0.39 (1)

Reflects operating results in accordance with U.S. generally

accepted accounting principles (GAAP). (2) Adjusted Non-GAAP

amounts consider adjustments to reduce royalty revenue associated

with a one-time $570 catch up payment received in the first quarter

of fiscal 2013, a reduction in net investment income of $1,164

associated with the sale of Vessix Vascular and OctoPlus shares

offset by an impairment loss on the Company’s investment in

ViaCyte, a $412 increase in the income tax provision to reverse

discrete income tax benefits recognized as noted in detail in note

(6) below and adjustment to the income tax provision for the

one-time royalty revenue utilizing a 36.5% incremental effective

tax rate. The adjustment to reduce net investment income did not

generate a tax benefit as there was an offsetting establishment of

a capital loss valuation reserve allowance. (3) Reflects the

pre-tax impact of the $570 one-time royalty catch up payment noted

in (2) above. (4) Reflects the after tax impact of the $570

one-time royalty catch up payment noted in (2) above utilizing a

36.5% incremental effective tax rate. (5) Reflects the pre-tax

impact of the net investment income adjustments noted in (2) above.

(6) Adjusted to remove discrete income tax benefits of $261

associated with the realization of capital loss carrybacks and $151

from the January 2013 signing of the American Taxpayer Relief Act

of 2012 which retroactively reinstated federal R&D tax credits

for calendar 2012. (7) Diluted earnings per share from continuing

operations is calculated using the diluted weighted average shares

outstanding for the period presented.

SurModics, Inc.Andy LaFrence, 952-500-7000Vice President of

Finance and Chief Financial Officer

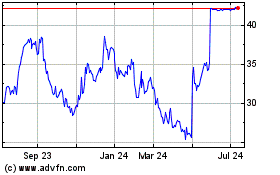

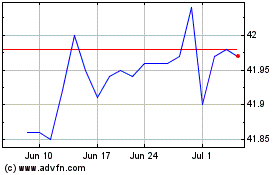

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024