Fortitude Group, Inc. Announces Purchase of Well-Known Financial Internet Property

May 01 2014 - 10:51AM

Marketwired

Fortitude Group, Inc. Announces Purchase of Well-Known Financial

Internet Property

ERIE, PA--(Marketwired - May 1, 2014) - Fortitude Group, Inc.

(OTC: FRTD) announced today that the company has completed the

acquisition of a prominent financial Internet property with over

1,600,000 qualified opt-in members.

Under the terms of the agreement, the name of the acquired

financial site will not be disclosed until the domain has been

successfully transferred to Fortitude. This transfer is

normally concluded in 2-4 weeks. Fortitude has acquired 100%

interest in the website, including the domain and associated

trademarks as well as the front-end website, the middleware data

and the back-end database management software.

According to the acquisition agreement, since its inception, the

acquired domain has amassed over 1,600,000 opt-in members, of which

over 300,000 are active micro-cap investors and just under 400,000

are accredited investors. Consideration for this acquisition was 25

million restricted shares of Fortitude common stock issued under

Rule 144.

According to the 2014 case study prepared by Subscription Site

Insider (CLICK HERE) entitled "Email List Valuations: What's Your

Opt-In Email List Worth as a Media Property on the M&A

Marketplace Today?" the author provides valuations on specific

opt-in data ranging from between $1 - $35 per name depending on

eight key factors. Based on these 8 factors, the acquired

domains membership database would be valued at the higher end

of the spectrum and should be valued between $20 and $25 per opt-in

name.

Thomas J. Parilla, CEO of Fortitude stated, "With the addition

of this well-known financial website to our portfolio, we are

poised to capture a large portion of the crowdfunding market share.

The laws surrounding crowdfunding are rapidly moving through the

regulatory approval process. We now manage a growing subscriber

base of active investors and can refine our current portfolio while

reshaping the criteria for our future investments. The SEC is in

its final stages of comments surrounding The Jobs Act Regulation A

(+) and it is an industry wide assumption that ultimately

Regulation A (+) will pass and become a viable tool that will allow

companies to publicly market new funding projects to qualified

investors. We are confident that now that we have completed

this acquisition, we have a foothold in an otherwise fragmented

industry that will allow us to aggressively communicate with our

members about investments and their potential participation."

About

Fortitude Group, Inc. is a diversified company with investments

in multiple sectors of the economy targeting joint ventures, wholly

owned subsidiaries and/or majority/minority positions that cross

various market segments with the goal of creating a quality company

that builds intrinsic value for its shareholders.

Forward Looking

Statements

This press release contains forward-looking statements. Such

forward-looking statements are subject to a number of risks,

assumptions and uncertainties that could cause the Company's actual

results to differ materially from those projected in such

statements. Forward-looking statements speak only as of the date

made and are not guarantees of future performance. We undertake no

obligation to publicly revise any forward-looking statements.

Contact Fortitude Group, Inc. Investor Relations Phone:

888-447-5501 Email: info@FRTDGroup.com

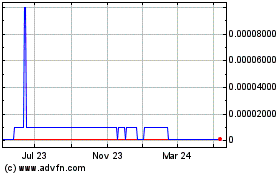

Fortitude (CE) (USOTC:FRTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

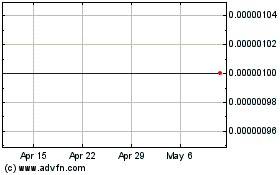

Fortitude (CE) (USOTC:FRTD)

Historical Stock Chart

From Apr 2023 to Apr 2024