Lundin Mining Corporation (TSX:LUN)(OMX:LUMI) ("Lundin Mining" or the "Company")

today reported net earnings of $13.3 million ($0.02 per share) for the quarter

ended March 31, 2014. Cash flows of $27.5 million were generated from operations

in the quarter, not including the Company's attributable cash flows from Tenke

Fungurume.

Paul Conibear, President and CEO commented, "This year remains an exciting year

for the Company as we prepare to bring the high grade Eagle nickel/copper mine

into production. We are pleased that Eagle continues to remain on time and

budget with first saleable concentrate expected in the fourth quarter of 2014.

During the first quarter, production at our operations was generally in-line

with expectations, however unit costs in some areas were higher than our annual

average cost guidance. Mine performance improved as the quarter advanced and we

maintain our annual production and cost guidance."

Summary financial results for the quarter:

----------------------------------------------------------------------------

Three months ended

March 31

US$ Millions (except per share amounts) 2014 2013

----------------------------------------------------------------------------

Sales 149.9 188.2

Operating earnings(1) 43.1 68.1

Net earnings 13.3 50.1

Basic earnings per share 0.02 0.09

Cash flow from operations 27.5 45.8

Ending net (debt) / cash position (148.3) 199.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operational Highlights

Wholly-owned operations: Copper, nickel, and lead production all exceeded

expectations, while zinc production was in-line with targeted production. Higher

throughput at Neves-Corvo and Aguablanca resulted in better than expected copper

and nickel production, respectively, while significantly higher lead grades at

Zinkgruvan resulted in lead production exceeding expectations.

-- Neves-Corvo produced 12,765 tonnes of copper and 14,228 tonnes of zinc

in the first quarter of 2014. Production from the Lombador ore body

resulted in a 39% increase in zinc production over the comparable period

in the prior year. Higher copper ore throughput was more than offset by

lower head grades and recoveries resulting in lower copper production

compared with the first quarter of 2013, but was in-line with the mine

plan for the first quarter of 2014. Copper cash costs(2) of $2.10/lb for

the quarter were higher than guidance ($1.90/lb) due primarily to

unfavourable foreign exchange rates and secondarily due to lower grades

and recoveries than we expect as yearly averages.

-- Zinc production of 19,239 tonnes at Zinkgruvan met expectations and was

23% higher than the comparable period in 2013, largely as a result of

increased levels of mining and milling of zinc ore and improved head

grades. Lead production of 9,133 tonnes exceeded expectations and

presents an increase of 39% over the comparable period in 2013. Cash

costs for zinc of $0.45/lb were higher than guidance ($0.35/lb) mostly

due to higher levels of by-product inventory at period-end.

-- Aguablanca continued to display strong operational performance, with

current quarter production of 1,980 tonnes of nickel and 1,652 tonnes of

copper. This exceeded both expectations for the first quarter of 2014

and production levels of the prior year comparable period. Lower mining

costs resulted in cash costs of $2.98/lb of nickel for the quarter, also

below both guidance of $4.50/lb and the prior year quarter ($4.66/lb).

(1) Operating earnings is a non-GAAP measure defined as sales, less operating

costs (excluding depreciation) and general and administrative costs.

(2) Cash cost/lb of copper, zinc or nickel are non-GAAP measures defined as all

cash costs directly attributable to mining operating, less royalties and

by-product credits.

Tenke: Tenke operations continue to perform well.

-- Lundin's attributable share of first quarter production included 11,871

tonnes of copper cathode and 713 tonnes of cobalt in hydroxide. The

Company's attributable share of Tenke's sales included 9,168 tonnes of

copper at an average realized price of $3.07/lb and 872 tonnes of cobalt

at an average realized price of $9.21/lb.

-- Attributable operating cash flow from Tenke for the first quarter of

2014 was $27.7 million. Cash distributions received by Lundin Mining in

the quarter were $16.7 million, lower than expected due to timing of

shipments and lower copper price.

-- Operating cash costs for the first quarter of 2014 were $0.89/lb of

copper sold, better than the revised full year guidance of $1.22/lb and

prior year's cost of $1.23/lb for the first quarter of 2013.

Eagle Nickel/Copper Project: advancing on time, on budget.

-- There are approximately 700 people currently working at the mine and

mill, including contractors. All of the major equipment has been

delivered and is in an advanced stage of installation. As of March 31,

2014, construction is progressing as planned at 79% project completion.

-- Capital costs are on budget, expecting to come in at the original

forecast of $400 million from the date of acquisition. $160 million has

been spent since that time, of which $62 million was spent in the first

quarter of 2014. The majority of remaining costs to complete

construction are within fixed price contracts.

-- Operations hiring is well advanced with all key positions filled.

-- Mine area facility commissioning has started and mill commissioning is

expected to start in the third quarter of 2014. Eagle is on track to

ship first saleable copper and nickel concentrates in the fourth quarter

of 2014. Ore processing and concentrate production are expected to reach

full design rates in the second quarter of 2015.

Financial Performance

-- Operating earnings for the first quarter of 2014 were $43.1 million, a

decrease of $25.0 million from the $68.1 million reported in the

comparable quarter of 2013. The decrease was primarily attributable to

lower realized metal prices ($14.8 million) and lower sales volumes at

Neves-Corvo and Aguablanca ($10.0 million).

-- For the quarter ended March 31, 2014, sales of $149.9 million decreased

by $38.3 million from the first quarter of the prior year ($188.2

million) mainly due to lower realized metal prices and lower nickel and

copper sales than in the prior year first quarter. Increased zinc and

lead volumes were not enough to offset the decrease in nickel and copper

sales volumes.

-- Average London Metal Exchange ("LME") metal prices for copper, lead and

nickel for the quarter ended March 31, 2014 were lower (11%, 8% and 15%,

respectively) than that of the comparable quarter in the prior year,

while zinc prices remained flat.

-- Operating costs (excluding depreciation) of $100.2 million in the

current quarter were lower than the prior year comparative quarter

($113.5 million) primarily as a result of decreased sales volumes at

Neves-Corvo and Aguablanca, partially offset by increased sales volumes

at Zinkgruvan and unfavourable foreign exchange rates.

-- Net earnings of $13.3 million ($0.02 per share) for the three months

ended March 31, 2014 were $36.8 million lower than the $50.1 million

($0.09 per share) reported for corresponding quarter in the prior year.

Earnings were impacted by:

-- lower operating earnings primarily due to lower realized metal

prices and lower sales volumes ($25.0 million);

-- lower income from equity investment in Tenke Fungurume ($12.9

million); and

-- no contribution from insurance proceeds as compared to the $15.1

million in insurance proceeds for business interruption at the

Aguablanca mine received in the first quarter of 2013; partially

offset by

-- higher net tax recovery ($12.5 million), primarily as a result of

lower taxable income

-- Cash flow from operations for the current quarter was $27.5 million

compared to $45.8 million in the first quarter of 2013. The comparative

decrease in the cash flow is attributable to lower operating earnings in

the current quarter.

Financial Position and Financing

-- Net debt position at March 31, 2014 was $148.3 million compared to

$112.1 million at December 31, 2013.

-- The $36.2 million increase in net debt during the quarter was

attributable to investments in mineral properties, plant and equipment

of $92.4 million, primarily the development of the Eagle project,

partially offset by operating cash flows of $27.5 million, distributions

from Tenke of $16.7 million and $10.8 million reduction in restricted

funds.

-- The Company has corporate term and revolving debt facilities available

for borrowing up to $600 million. At March 31, 2014 the Company had

$262.3 million committed against these facilities, leaving debt capacity

of $337.7 million available for future drawdowns.

Outlook

2014 Production and Cost Guidance

-- 2014 production and cash cost guidance for wholly-owned operations

remains unchanged from that provided on February 20, 2014 in the

Company's annual MD&A. Freeport-McMoRan Copper & Gold Inc.'s

("Freeport", or "FCX") forecast copper production at Tenke of 47,900

tonnes is down slightly from the 48,400 tonnes previously guided.

Tenke's full year cash cost is expected to be lower than guided earlier

(now $1.22/lb versus previous guidance of $1.28/lb of copper), largely

as a result of higher realized cobalt prices. Given its performance

year-to-date, Aguablanca's nickel and copper production are expected to

be at the top end of the guidance range. Aguablanca's production and

cash cost guidance will be re-assessed mid-year.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(contained tonnes) Tonnes Cash Costs(a)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Copper Neves-Corvo 50,000 - 55,000 $1.90/lb

Zinkgruvan 3,000 - 4,000

Aguablanca 5,000 - 6,000

Eagle 2,000 - 3,000

----------------------------------------------------------------

Wholly-owned 60,000 - 68,000

Tenke(@24%)(b) 47,900 $1.22/lb

----------------------------------------------------------------

Total attributable 107,900 - 115,900

Zinc Neves-Corvo 60,000 - 65,000

Zinkgruvan 75,000 - 80,000 $0.35/lb

----------------------------------------------------------------

Total 135,000 - 145,000

Lead Neves-Corvo 2,000 - 2,500

Zinkgruvan 27,000 - 30,000

----------------------------------------------------------------

Total 29,000 - 32,500

Nickel Aguablanca 6,000 - 7,000 $4.50/lb

Eagle 2,000 - 3,000

----------------------------------------------------------------

Total 8,000 - 10,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(a) Cash costs remain dependent upon exchange rates (forecast at

EUR/USD:1.35, USD/SEK:6.50) and metal prices (forecast at Cu: $3.15/lb,

Zn: $0.90/lb, Pb: $0.95/lb, Ni: $6.50/lb, Co: $12.00/lb). Prior

guidance forecast EUR/USD at 1.30, Zn at $0.87/lb and Pb at $1.00/lb.

(b) Freeport has provided updated 2014 sales and cash costs guidance.

Tenke's 2014 production is assumed to approximate Freeport's sales

guidance.

2014 Capital Expenditure Guidance

Capital expenditures for 2014 are expected to be $440 million (including Eagle,

but excluding Tenke), a $20 million reduction from previous guidance. Major

capital investments for 2014 are as follows:

-- Sustaining capital in European operations - $100 million, consisting of

approximately $55 million for Neves-Corvo, $40 million for Zinkgruvan

and $5 million across other sites.

-- New investment capital in European operations - $40 million (previous

guidance - $60 million), consisting of:

-- Lombador - $25 million (previous guidance - $44 million): For

underground vertical and horizontal development and associated mine

infrastructure related to the development of the upper Lombador ore

bodies for future high grade zinc and copper production. Redesign

and optimization of development has allowed for a combination of

cost savings and the deferral of certain expenditures into 2015.

-- Neves-Corvo zinc plant debottlenecking and zinc expansion studies -

$5 million: For the installation of a zinc tailings recovery

circuit, zinc expansion feasibility studies and Santa Barbara

hoisting shaft capacity increase design work.

-- Aguablanca underground mining project - $10 million: For ramp and

initial ore body development and the installation of associated mine

infrastructure.

-- New investment in Eagle project - $300 million, to complete construction

of the Humboldt mill and Eagle mine.

-- New investment in Tenke - $50 million, estimated by the Company as its

share of the remaining Phase II expansion costs, other expansion related

initiatives and sustaining capital funding for 2014. All of the capital

expenditures are expected to be self-funded by cash flow from Tenke

operations.

The Company believes it is reasonable to expect Lundin's attributable

cash distributions from Tenke to be in the range of $100 to $130 million

in 2014, below previous guidance due to lower copper prices. Guidance

will be updated again at the end of the second quarter reflecting copper

price trends and expectations for the balance of the year.

2014 Exploration Guidance

-- Total exploration expenses for 2014 (excluding Tenke) are estimated to

be $35 million, $5 million less than prior guidance. These expenditures

will be principally directed towards underground and surface mine

exploration at Neves-Corvo, Zinkgruvan and Eagle, select greenfield

exploration programs and new business development activities in South

America and Eastern Europe.

About Lundin Mining

Lundin Mining Corporation is a diversified Canadian base metals mining company

with operations and development projects in Portugal, Sweden and Spain and the

USA, producing copper, zinc, lead and nickel. In addition, Lundin Mining holds a

24% equity stake in the world-class Tenke Fungurume copper/cobalt mine in the

Democratic Republic of Congo and in the Freeport Cobalt Oy business, which

includes a cobalt refinery located in Kokkola, Finland.

On Behalf of the Board,

Paul Conibear, President and CEO

Forward Looking Statements

Certain of the statements made and information contained herein is

"forward-looking information" within the meaning of the Ontario Securities Act.

This report includes, but is not limited to, forward looking statements with

respect to the Company's estimated full year metal production, cash costs,

exploration expenditures, and capital expenditures, as noted in the Outlook

section and elsewhere in this document. These estimates and other

forward-looking statements are based on a number of assumptions and are subject

to a variety of risks and uncertainties which could cause actual events or

results to differ from those reflected in the forward-looking statements,

including, without limitation, risks and uncertainties relating to the estimated

cash costs, timing and amount of production from the Eagle project, cost

estimates for the Eagle project, foreign currency fluctuations; risks inherent

in mining including environmental hazards, industrial accidents, unusual or

unexpected geological formations, ground control problems and flooding; risks

associated with the estimation of mineral resources and reserves and the

geology, grade and continuity of mineral deposits; the possibility that future

exploration, development or mining results will not be consistent with the

Company's expectations; the potential for and effects of labour disputes or

other unanticipated difficulties with or shortages of labour or interruptions in

production; actual ore mined varying from estimates of grade, tonnage, dilution

and metallurgical and other characteristics; the inherent uncertainty of

production and cost estimates and the potential for unexpected costs and

expenses, commodity price fluctuations; uncertain political and economic

environments; changes in laws or policies, foreign taxation, delays or the

inability to obtain necessary governmental permits; litigation risks; and other

risks and uncertainties, including those described in the Risk and Uncertainties

section of the Company's Annual Information Form and in each Management's

Discussion and Analysis. Forward-looking information may also be based on other

various assumptions including, without limitation, the expectations and beliefs

of management, the assumed long term price of copper, zinc, lead and nickel;

that the Company can access financing, appropriate equipment and sufficient

labour and that the political environment where the Company operates will

continue to support the development and operation of mining projects. Should one

or more of these risks and uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially from those

described in the forward-looking statements. Accordingly, readers are advised

not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lundin Mining Corporation

Sophia Shane

Investor Relations North America

+1-604-689-7842

Lundin Mining Corporation

John Miniotis

Senior Manager, Corporate Development and Investor Relations

+1-416-342-5565

Lundin Mining Corporation

Robert Eriksson

Investor Relations Sweden

+46 8 545 015 50

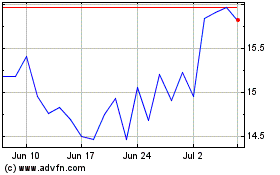

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

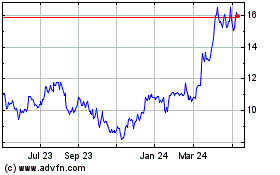

Lundin Mining (TSX:LUN)

Historical Stock Chart

From Apr 2023 to Apr 2024