Current Report Filing (8-k)

April 29 2014 - 10:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2014

————————————

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

————————————

|

| | |

Delaware | 0-22818 | 22-3240619 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Not Applicable

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events

On April 28, 2014, The Hain Celestial Group, Inc. (“Hain Celestial”) acquired Charter Baking Company, Inc. ("Charter") and its subsidiary Rudi's Organic Bakery, Inc. ("Rudi's") pursuant to an agreement and plan of merger among Hain Celestial, its wholly-owned subsidiary CBC Merger Sub, Inc., Charter, CBCSR, LLC, Charterhouse Equity Partners IV, L.P., Ares Capital Corporation and Strategic Partners III Investments, L.P. (the "Acquisition").

Rudi's, a leading organic and gluten-free company in the United States, offers a diversified line of bread and baked goods. In calendar year 2013, Rudi's generated approximately $60 million in net sales. The purchase price was approximately $61.3 million, consisting of $50 million in cash and shares of Hain Celestial common stock representing approximately $11.3 million. In connection with the closing of the Acquisition, on April 28, 2014 Hain Celestial issued 133,744 shares of Hain Celestial common stock, par value $0.01 per share, to Strategic Partners III Investments, L.P., Charter Organic Foods LLC and Ares Capital Corporation.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

5.1* | | Opinion of DLA Piper LLP (US) |

| | |

23.1* | | Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 29, 2014

|

| | |

| THE HAIN CELESTIAL GROUP, INC. (Registrant) |

| |

| By: | /s/ Stephen J. Smith |

| Title: | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

5.1* | | Opinion of DLA Piper LLC (US) |

| | |

23.1* | | Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

* Filed herewith

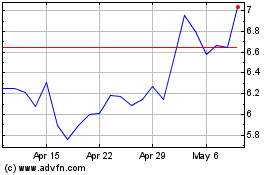

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

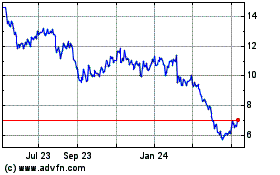

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024