Eco-Tek Worldwide CEO Speaks About the Company's Future Plans

April 28 2014 - 1:00PM

Marketwired

Eco-Tek Worldwide CEO Speaks About the Company's Future Plans

TORONTO, ONTARIO--(Marketwired - Apr 28, 2014) -

(OTCQB:ETEK)

I came to join Eco-Tek in June of 2013 and immediately recognized

that it was a great little Company with truly fantastic products

but, with the passing of its founder more than a year earlier, it

had lost its direction. Even best lubricant in the world and the

best oil cleaning system won't sell themselves.

Job one was to get more customers. A new team of seasoned

professionals joined the Company, most them on performance based

renumeration, and they had kicked up our sales. We have been

achieving a 50% growth in sales per quarter and we are convinced

that we can sustain this kind of growth in revenue for the

foreseeable future. Next we had to increase our margins. Working

with our suppliers and using smart cost controls we have brought

our margins from low 30s to high 40s. Our distribution partners in

North America were focused on smaller customers and our

international success with larger customers in the mining,

construction and transport sectors showed us that we should change

up our distribution in North America. In April we started that

process with North Dakota and we will add about 10 more

distribution partners in North America over the next year. Overall

Eco-Tek expects to have revenue of $2.2 million to $2.8 million in

2014.

Before I joined the Company, it became a public Company by way of

an RTO. The group that arranged this fairly expensive process

funded the Company by Convertible Promissory Notes and Promissory

Notes. The Company borrowed about $900,000 over the course of last

year to pay for its costs associated with filing, legal, accounting

and audit work with regards to being a public Company. This group

ceased to provide funds in August of 2013 and Eco-Tek has gone to

the financial markets to obtain financing since that time. A large

portion of the outstanding debt from the period up to August 2013

could have been converted into huge numbers of shares and the

Company has taken steps to minimize the impact of this issue by

changing out the notes that could have converted for many hundreds

of millions of shares for ones that convert for only millions of

shares. These conversions have occurred between December 2013 and

March 2014 with little or no impact on our shares. The Company has

also made arrangements with other note holders to convert their

notes into preferred shares that will not impact the common share

dilution. The Company also has about $475,000 in debt to the

original founding shareholders and they have also agreed to convert

to preferred shares. This action plan will take about three more

months to complete and it has has two major benefits. One: it

significantly reduces the potential dilution. While the total

conversion number would vary with share market price, we believe

that the overall impact of our action plan will have reduced

dilution by about 1.3 billion shares. Two: it almost eliminates the

Company debt, new debt excluded. We expect the fully diluted share

number to be between 650 million and 750 million plus new shares

attributable to stock options.

I and many of our senior staff are taking the major portion of our

pay as stock options. This action has two large benefits for the

Company. First it conserves cash, which is always a valuable

commodity for a growing Company, and second its aligns the

interests of our team with our shareholders. I like to have

everybody in the canoe paddling with the Company.

The Company plans two more action items with regards to our share

structure. First, in the next short while, we will file for a

change in the Authorized Shares from 7 billion to 1 billion, and

second, once we have completed the conversions and debt elimination

as outlined above, we will commence a buyback program to reduce the

total outstanding issued shares by about 250 million. We expect

this program to take about a year.

Eco-Tek is a great little Company about to get much bigger. We were

six hard working people in June of 2013 and we are now a strong

team of twenty-seven that grows every month. We will still have our

ups and downs but we are inspired by our recent successes and

excited by our prospects. We expect to have bright future, make

good money and have some fun. We invite you come along and help us

on our journey.

Eco-Tek Group Inc. (OTCQB:ETEK)

About Eco-Tek Group Inc.:

Eco-Tek Group Inc., based in Toronto, Ontario was founded in 2009.

Dedicated to the development and marketing innovative and cost

effective "green" lubrication products for the transportation,

industrial and marine industries and development by their

experienced chemists and engineers with extensive knowledge in the

science of lubrication and related studies. Eco-Tek Group Inc. is

dedicated to formulating cutting edge products that make a

significant contribution to the reduction of fossil fuel

consumption while enhancing quality and performance.

Eco-Tek Group Inc. has marketed the company's products in Ontario

for the past number of years and has established a solid base of

highly satisfied customers. Recently Eco-Tek has established

distributors in South America, and Europe and is now expanding its

operations across North America and around the world.

Submitted on behalf of its board

Safe Harbor:

This press release may contain forward-looking statements with

respect to business conducted by Eco-Tek Group Inc. By their

nature, forward-looking statements and forecasts involve risks and

uncertainties because they relate to events and depend on

circumstances that will occur in the future. Such forward-looking

statements include those that express plan, anticipation, intent,

contingency, goals, targets, or future developments and/or

otherwise are not statements of historical fact. The words

"potentially", "anticipate", "could", "calls for", and similar

expressions also identify forward-looking statements. The Company

does not undertake to update any forward-looking statements.

Factors that could affect actual results include, without

limitation, risks associated with: the Company's ability to

successfully obtain patents for its technology and the adequacy of

such patents; the introduction of competitive technology; the

Company's ability to develop, manufacture, license, or sell its

products or product candidates; the Company's ability to enter into

and successfully execute any license and collaborative agreements;

the adequacy of the Company's capital resources and cash flow

projections, the Company's ability to obtain sufficient financing

to maintain the Company's planned operations, or the risk of

bankruptcy; other risks that may be described under Certain Risks

and Uncertainties Related to the Company's Business, as contained

in the forthcoming Company's Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q.F.

Eco-Tek Group Inc.Stephen TunksPresident1-888-970-3265

TOLL-FREEInfo@ecotekworldwide.comwww.ecotekworldwide.com

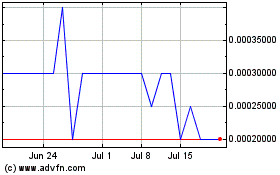

Eco Tek (PK) (USOTC:ETEK)

Historical Stock Chart

From Mar 2024 to Apr 2024

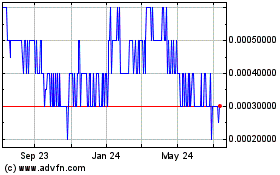

Eco Tek (PK) (USOTC:ETEK)

Historical Stock Chart

From Apr 2023 to Apr 2024