Proxy Statement (definitive) (def 14a)

April 28 2014 - 9:01AM

Edgar (US Regulatory)

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934 (Amendment No. )

|

Filed by the Registrant

[X]

|

|

|

Filed by a Party other than

the Registrant [ ]

|

|

|

|

|

|

|

|

Check the appropriate

box:

|

|

|

|

[ ]

|

|

Preliminary Proxy

Statement

|

[ ]

|

Soliciting Material Under Rule

14a-12

|

|

[ ]

|

|

Confidential, For Use of

the

Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

|

[X]

|

|

Definitive Proxy

Statement

|

|

|

[ ]

|

|

Definitive Additional

Materials

|

|

|

|

Siebert Financial Corp.

|

|

|

|

(Name of Registrant as

Specified In Its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant)

|

|

|

Payment of Filing Fee (Check

the appropriate box):

|

|

[X]

|

|

No fee required.

|

|

[

]

|

|

Fee computed on

table below per Exchange Act Rules 14a-6(i)(4) and

0-11.

|

|

|

|

1)

|

|

Title of each class of

securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

2)

|

|

Aggregate number of

securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

3)

|

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

|

|

|

|

|

|

|

4)

|

|

Proposed maximum

aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

5)

|

|

Total fee

paid:

|

|

|

|

|

|

|

|

[

]

|

|

Fee paid previously

with preliminary materials:

|

|

[

]

|

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its

filing.

|

|

|

|

1)

|

|

Amount previously

paid:

|

|

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration

Statement No.:

|

|

|

|

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

4)

|

|

Date Filed:

|

|

|

|

|

|

|

SIEBERT FINANCIAL CORP.

885 Third Avenue, Suite 3100

New York, New York 10022

(212)

644-2400

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

TO BE HELD ON JUNE 9, 2014

Dear

Shareholders:

Notice is hereby given of the Annual Meeting of Shareholders of Siebert

Financial Corp., a New York corporation, at The Harmonie Club, 4 East 60th

Street, New York, NY, on Monday, June 9, 2014 at 10:00 a.m., local time. The

meeting’s purpose is to:

1.

Elect four directors.

2.

Consider any other matters that are properly presented at the Annual Meeting and

any adjournment thereof.

You may vote at the Annual Meeting if you were one of our shareholders of record

at the close of business on Thursday, April 17, 2014.

Along with the attached Proxy Statement, we are also enclosing a copy of our

Annual Report to Shareholders, which includes our financial

statements.

To

assure your representation at the meeting, please vote by Internet or telephone

or sign and mail the enclosed proxy as soon as possible. We have enclosed a

return envelope, which requires no postage if mailed in the United States. Your

proxy is being solicited by the Board of Directors. Shareholders who attend the

meeting may revoke their proxy and vote their shares in person.

PLEASE VOTE—YOUR VOTE IS IMPORTANT

|

|

Joseph M. Ramos, Jr.

|

|

|

Secretary

|

New York, New York

April 28, 2014

|

IMPORTANT NOTICE

REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL

MEETING:

This Notice and Proxy Statement, our

Proxy Card and our Annual Report also are available at www.proxyvote.com

by entering the control number found on the enclosed Proxy

Card

|

SIEBERT FINANCIAL CORP.

885 Third Avenue, Suite 3100

New York, New York 10022

(212)

644-2400

PROXY STATEMENT FOR THE

2014 ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD ON JUNE 9,

2014

INFORMATION ABOUT THE

ANNUAL MEETING AND VOTING

|

Annual

Meeting:

|

|

June 9, 2014

|

|

The

Harmonie Club

|

|

|

|

10:00 a.m., local time

|

|

4 East 60th

Street

|

|

|

|

|

|

New York,

New York

|

|

|

|

|

|

|

|

Record

Date:

|

|

Close of business on

Thursday, April 17, 2014. If you were a shareholder at that time, you may

vote at the meeting. Each share is entitled to one vote. On the record

date, we had 22,085,126 shares of our common stock outstanding and

entitled to vote. Of those shares, 19,878,700 shares were beneficially

owned or controlled by the Estate of Muriel F. Siebert, our former

Chairwoman, President and Chief Executive Officer. This proxy statement

and form of proxy were first mailed to shareholders on or about April 28,

2014.

|

|

|

|

|

|

|

|

Quorum:

|

|

The holders of a majority of

the outstanding shares of our common stock, present in person or by proxy

and entitled to vote, will constitute a quorum at the meeting. Abstentions

and broker non-votes will be counted for purposes of determining the

presence or absence of a quorum.

|

|

|

|

|

|

|

|

Agenda:

|

|

1.

|

Elect four directors.

|

|

|

|

|

|

|

|

2.

|

Any other proper business.

However, we currently are not aware of any other matters that will come

before the meeting.

|

|

|

|

|

|

Vote

Required:

|

|

In the case of the

proposal to elect directors, the four nominees for director who receive

the most votes will be elected. If you withhold authority to vote for any

nominee on your proxy card, your vote will not count either for or against

the nominee.

|

|

Broker

Non-votes:

|

|

“Broker non-votes”

are shares held by brokers or nominees which are present in person or

represented by proxy, but which are not voted on a particular matter

because instructions have not been received from the beneficial owner.

Under the rules of the Financial Industry Regulatory Authority, member

brokers generally may not vote shares held by them in street name for

customers unless they are permitted to do so under the rules of any

national securities exchange of which they are a member. Under the rules

of the New York Stock Exchange, New York Stock Exchange-member brokers who

hold shares of our common stock in street name for their customers and

have transmitted our proxy solicitation materials to their customers, but

do not receive voting instructions from such customers, are not permitted

to vote on non-routine matters.

Broker non-votes

count for quorum purposes, but we do not count broker non-votes as votes

for or against any non-routine proposal. Under the New York Stock Exchange

rules, the proposal relating to the election of directors and the advisory

proposals relating to executive compensation are deemed to be a

non-routine matters with respect to which brokers and nominees may not

exercise their voting discretion without receiving instructions from the

beneficial owner of the shares.

|

|

|

|

|

|

|

|

Proxies:

|

|

Please vote; your

vote is important. Prompt return of your proxy will help avoid the costs

of re-solicitation. Unless you tell us on the proxy card to vote

differently, we will vote signed returned proxies “FOR” each of the Board

of Directors’ nominees for director.

If any nominee cannot

or will not serve as a director, your proxy will vote in accordance with

his or her best judgment. At the time we began printing this proxy

statement, we did not know of any matters that needed to be acted upon at

the meeting other than those discussed in this proxy statement. However,

if any additional matters are presented to the shareholders for action at

the meeting, your proxy will vote in accordance with his or her best

judgment.

|

|

|

|

|

|

Proxies Solicited

By:

|

|

The Board of

Directors.

|

|

|

|

|

|

Revoking Your

Proxy:

|

|

You may revoke your

proxy before it is voted at the meeting. Proxies may be revoked if

you:

|

|

|

|

|

|

|

|

1.

|

deliver a

signed, written revocation letter, dated later than the proxy, to Joseph

M. Ramos, Jr., Secretary, Siebert Financial Corp., 885 Third Avenue, Suite

3100, New York, New York 10022;

|

|

|

|

|

|

|

|

|

2.

|

deliver a

signed proxy, dated later than the first proxy, to Mr. Ramos at the

address above; or

|

|

|

|

|

|

|

|

|

3.

|

attend the Annual Meeting and vote in person or by proxy. Attending

the meeting without doing more will not revoke your proxy.

|

2

|

Cost of

Solicitation:

|

|

We will pay all costs

of soliciting these proxies, estimated at approximately $6,000 in the

aggregate. Although we are mailing these proxy materials, our directors,

officers and employees may also solicit proxies by telephone, facsimile,

mail or personal contact. These persons will receive no compensation for

their services, but we may reimburse them for reasonable out-of-pocket

expenses. We will also furnish copies of solicitation materials to

fiduciaries, custodians, nominees and brokerage houses for forwarding to

beneficial owners of our shares of common stock held in their names, and

we will reimburse them for reasonable out-of-pocket expenses. Broadridge

Financial Solutions, Inc. is assisting us in the solicitation of proxies

for the meeting for no additional fee.

|

|

|

|

|

|

|

|

Your

Comments:

|

|

Your comments about

any aspects of our business are welcome. Although we may not respond on an

individual basis, your comments help us to measure your satisfaction, and

we may benefit from your suggestions.

|

3

PROPOSAL

ELECTION OF

DIRECTORS

|

Generally:

|

|

Our Board of

Directors nominated four directors for election at the annual meeting. All

the nominees for election as director are currently serving as our

directors. All the nominees have consented to be named and have indicated

their intent to serve if elected. If elected, each director will hold

office until the next annual meeting or until the director’s successor has

been duly elected. All our directors other than Jane Macon are

“independent directors” within the meaning of Rule 5605(a)(2) of The

Nasdaq Stock Market.

|

|

|

|

|

|

Nominees:

|

|

PATRICIA L. FRANCY

Age 68

|

|

Patricia Francy

retired as Special Advisor for Alumni Relations and Treasurer &

Controller, Columbia University, December 31, 2005. Ms. Francy is a

director of Old Westbury Funds, Inc., the Matheson Foundation, the Guttman

Foundation, the Muriel F. Siebert Foundation and the Respect for Law and

Alliance. Ms. Francy became a director on March 11, 1997. Ms. Francy is

one of two executors of the Estate of Muriel F. Siebert, our former

Chairwoman, President and Chief Executive Officer, although she does not

possess the power in that capacity to control the voting of the shares of

our common stock held by the Estate.

Specific

experience, qualifications, attributes or skills:

Ms. Francy served as

Treasurer and Controller of Columbia University from 1989 until 2003. She

had been affiliated with Columbia University since 1968, and has served as

a Director of Finance and Director of Budget Operations. Ms. Francy was

Governor of the Columbia University Club of New York, and a former

director for the Children’s Tumor Foundation and the Metropolitan New York

Library Council. She serves on the Outward Bound Advisory Board. Ms.

Francy participates as director emeritus of Junior Achievement Worldwide,

and is a member of the Economic Club of New York and the International

Women’s Forum. Ms. Francy provides expertise on financial

matters.

|

4

|

|

|

NANCY

PETERSON HEARN

Age

80

|

|

Nancy Peterson Hearn

is Chairman of Peterson Tool Company, Inc. and was its President/CEO from

1979 until 2012. Ms. Hearn became a director on June 4, 2001.

Specific

experience, qualifications, attributes or skills:

A nationally

recognized business entrepreneur, Nancy Peterson Hearn is chairman of

Peterson Tool Company, Inc. Under her leadership, the company has made

exponential gains in sales, production and reputation, and is ranked among

the world’s premier designers and manufacturers of custom insert tooling.

Peterson Tool successfully received ISO 9001 certification, and has earned

numerous quality and certification awards including General Motors’

Targets for Excellence Award and Caterpillar’s coveted Certified Supplier

of Quality Materials awards.

She was the first

American to earn the prestigious Veuve Clicquot Business Woman of the Year

Award (1990). Ms. Hearn has a distinguished leadership record that

includes roles on some of the most prestigious boards in the nation. She

has served as Vice Chair of the Foundation, Southeast Region Chair and

Membership Chair for Committee of 200 (“C200”), an international

organization of businesswomen, which has established the Nancy Sanders

Peterson Scholars Award in her honor. She chaired the C200 Auction from

2000 to 2008, and her efforts helped raise several millions of dollars for

the C200 Foundation. She has also served on the boards of The Society of

International Business Fellows, the Aquinas College Board of Governors,

the Mississippi University for Women’s National Board of Distinguished

Women, Nashville Symphony, Cheekwood Museum and Botanical Gardens and

Nashville Ballet.

|

5

|

|

|

|

|

Most recently, she

received the Golden Micrometer Award from Precision Machine Producers

Association for 40 Years of service in the metal working

industry.

Ms. Hearn has a

longstanding record of community activism that includes roles in

Leadership Nashville, the Tennessee Workforce Development Board, the

Tennessee Council on Vocational Education, and has been recognized by The

National Federation of Parents for Drug Free Youth. As a spokesperson for

private industry, she champions the advancement of sound economic policies

and professional healthcare standards.

Ms. Hearn is the

mother of six adult children, two of whom are actively involved in

Peterson Tool Company, Inc. She is married to Billy Ray Hearn and lives in

Nashville, Tennessee.

|

|

|

|

|

|

|

|

|

|

JANE H.

MACON

Age

67

|

|

Jane Macon is a Partner with the law firm of

Bracewell & Giuliani, LLP. Prior to joining the Bracewell firm in

October 2013, she was a Partner in the law firm of Fulbright &

Jaworski L.L.P., San Antonio, Texas for nearly 30 years. Fulbright &

Jaworski L.L.P. and Bracewell & Giuliani, LLP continue to provide

legal services to Siebert Financial Corporation. Ms. Macon became a

director on November 8, 1996 and was named Chairwoman in August 2013. Ms.

Macon is one of two executors of the Estate of Muriel F. Siebert, our

former Chairwoman, President and Chief Executive Officer and, in that

capacity, she possesses the power to control the voting and disposition of

the shares of our common stock held by the Estate.

Specific

experience, qualifications, attributes or

skills:

|

6

|

|

|

|

|

Ms. Macon centers her

legal practice on public finance and administrative law, public and

private partnerships, real estate, zoning, platting, condemnation and

municipal bonds. Prior to joining Fulbright & Jaworski L.L.P. in 1983,

Ms. Macon served as the first female city attorney of the City of San

Antonio where she served in that position from 1977 to 1983. Active in

professional organizations, Ms. Macon is a past president of the

International Women’s Forum, the Women Lawyers of Texas and the San

Antonio Young Lawyers Association. She presently serves as the program

chair of the San Antonio Bar Association. She has served as a member of

the Boards of Directors for the following national boards: NOW Legal

Defense Fund, Child Care Action Campaign, Center for Democracy, National

Women’s Political Caucus, National Nurses League and National Civic League

(formerly National Municipal League). Ms. Macon is also a member of the

San Antonio and American Bar Associations and the State Bar of Texas. She

has received both awards as Outstanding Young Lawyer of Texas and the

Outstanding Young Lawyer of San Antonio and is listed in Who’s Who in

America. Ms. Macon was recently awarded the Prevent Blindness Texas Person

of Vision Award signed by Gov. Rick Perry and the Hope Award by the WOW

(Women’s Opportunity Week by the Greater San Antonio Chamber of Commerce).

Ms. Macon provides expertise on legal

matters.

|

7

|

|

|

ROBERT P.

MAZZARELLA

Age

67

|

|

Robert Mazzarella

serves as a director and as a member of the audit and compensation

committees of Placemark Investments, Inc., a registered investment adviser

in Wellesley, Massachusetts and Investors Capital Holdings Ltd., in

Lynfield Massachusetts. Mr. Mazzarella also acts as a consultant to a

number of major financial services firms and venture capital firms. Mr.

Mazzarella became a director on March 1, 2004.

Specific

experience, qualifications, attributes or skills:

Mr. Mazzarella

retired from Fidelity Investments Brokerage Services LLC in January 2002,

at which time he served as its president. The Board of Directors has

determined that Mr. Mazzarella qualifies as an “audit committee financial

expert” under the applicable rules of the Securities and Exchange

Commission. Mr. Mazzarella provides expertise on financial and brokerage

matters.

|

|

|

|

|

|

|

|

Vote

Required:

|

|

The four nominees for

director who receive the most votes will be elected. The enclosed proxy

allows you to vote for the election of all the nominees listed, to

withhold authority to vote for one or more of the nominees or to withhold

authority to vote for all the nominees. If you withhold authority to vote

for any nominee on your proxy card, your vote will not count either for or

against the nominee.

The persons named in

the enclosed proxy intend to vote “FOR” the election of all the nominees.

Each of the nominees currently serves as a director and has consented to

be nominated. We do not foresee that any of the nominees will be unable or

unwilling to serve, but if such a situation should arise, your proxy will

vote in accordance with his or her best

judgment.

|

THE BOARD OF DIRECTORS DEEMS THIS PROPOSAL TO BE IN THE BEST INTEREST OF SIEBERT

FINANCIAL CORP. AND ITS SHAREHOLDERS AND RECOMMENDS THAT YOU VOTE “FOR” THE

ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR.

8

CORPORATE

GOVERNANCE

|

Board

Meetings:

|

|

The Board of

Directors held twelve meetings during 2013. Each incumbent director

attended at least 75% of his or her Board of Directors meetings and all of

his or her committee meetings.

|

|

|

|

|

|

Controlled

Company:

|

|

We are a “Controlled

Company” as defined in Rule 5615(c)(1) of The Nasdaq Stock Market because

the Estate of Muriel F. Siebert, our former Chairwoman, President and

Chief Executive Officer, holds more than 50% of our voting power for the

election of directors. As a “Controlled Company” we are not required to

have a majority of our Board of Directors comprised of independent

directors, a compensation committee comprised solely of independent

directors or a nominating committee comprised solely of independent

directors.

|

|

|

|

|

|

Audit Committee of

the

Board of Directors:

|

|

The Audit Committee

of our Board of Directors currently consists of Ms. Francy, Chairwoman,

Ms. Hearn and Mr. Mazzarella. The Board of Directors has determined that

Ms. Francy, Ms. Hearn and Mr. Mazzarella is each an “independent director”

within the meaning of Rule 5605(a)(2) of The Nasdaq Stock Market and

within the meaning of the applicable rules and regulations of the

Securities and Exchange Commission. The Audit Committee held five meetings

during 2013.

The Board of

Directors has determined that Mr. Mazzarella qualifies as an “audit

committee financial expert” under the applicable rules of the Securities

and Exchange Commission.

The Audit Committee

was established to (i) assist the Board of Directors in its oversight

responsibilities regarding the integrity of our financial statements, our

compliance with legal and regulatory requirements and our auditor’s

qualifications and independence, (ii) prepare the report of the Audit

Committee contained herein, (iii) retain, consider the continued retention

and terminate our independent auditors, (iv) approve audit and non-audit

services performed by our independent auditors and (v) perform any other

functions from time to time delegated by the Board of Directors. The Board

of Directors has adopted a written charter for the Audit Committee, which

is available on the website of Muriel Siebert & Co., Inc. at

https://www.siebertnet.com/html/StartAboutAuditCommittee.aspx.

|

9

|

Compensation

Committee of

the Board

of Directors:

|

|

The Compensation

Committee of our Board of Directors currently consists of Ms. Macon,

Chairwoman, Ms. Francy and Mr. Mazzarella. The Compensation Committee

reviews and determines all forms of compensation provided to our executive

officers and directors. The Compensation Committee also administers our

stock option and other employee benefit plans. The Compensation Committee

does not function pursuant to a formal written charter and as a

“Controlled Company” we are not required to comply with The Nasdaq Stock

Market’s independence requirements. The Compensation Committee held zero

meeting during 2013.

The Compensation

Committee evaluates the performance of the Chief Executive Officer in

terms of our operating results and financial performance and determines

her compensation in connection therewith. For the 2013 fiscal year, our

Chief Executive Officer requested that her cash compensation be limited to

$150,000. The Compensation Committee determined that the cash compensation

for the Chief Executive Officer be $150,000 for the 2012 fiscal year. This

amount was unchanged from 2012. However, Ms. Siebert passed away on August

24, 2013, as a result her compensation was $112,500 in 2013.

In accordance with

general practice in the securities industry, our executive compensation

includes base salaries, an annual discretionary cash bonus, and stock

options and other equity incentives that are intended to align the

financial interests of our executives with the returns to our

shareholders. The Compensation Committee determines compensation of our

executive officers (other than the Chief Executive Officer) after

carefully reviewing self-evaluations completed by the executive officers,

each executive officer’s business responsibilities, current compensation,

the recommendation of our Chief Executive Officer and our financial

performance. We did not change the 2013 base salaries of any of our

executive officers from the levels in effect at the end of 2012. After

evaluating our financial performance in 2013, our Compensation Committee

did not award our executive officers or any other employees of the Company

bonuses in 2013. In addition, we did not award any stock options or other

equity incentives to our executive officers in 2013

.

|

10

|

|

|

As part of its

oversight of the Company’s executive compensation, the Compensation

Committee considers the impact of the Company’s executive compensation,

and the incentives created by the compensation awards that it administers,

on the Company’s risk profile. In addition, the Company reviews all of its

compensation policies and procedures, including the incentives that they

create and factors that may reduce the likelihood of excessive risk

taking, to determine whether they present a significant risk to the

Company. The review found that there were no excessive risks encouraged by

the Company’s rewards programs and the rewards programs do not produce

payments that have a material impact on the financial performance of the

Company.

|

|

|

|

|

|

Nominating

Committee

of the Board of

Directors:

|

|

The Nominating

Committee of the Board of Directors currently consists of Ms. Hearn,

Chairwoman, Ms. Francy and Ms. Macon. The Nominating Committee does not

function pursuant to a formal written charter and as a “Controlled

Company” we are not required to comply with The Nasdaq Stock Market’s

independence requirements. The Nominating Committee did not meet in 2013,

but acted in 2014 with respect to the recommendation to the Board of

Directors of the nomination of each of the directors for re-election at

the 2014 Annual Meeting of Shareholders.

The purpose of the

Nominating Committee is to identify individuals qualified to become

members of our Board of Directors and to recommend to the Board of

Directors or the shareholders that such individuals be selected for

directorship. In identifying and evaluating nominees for director, the

Nominating Committee considers each candidate’s experience, integrity,

background and skills as well as other qualities that the candidate may

possess and factors that the candidate may be able to bring to the Board

of Directors. We do not have a formal policy with regard to the

consideration of diversity in identifying director nominees. However, the

Board of Directors believes that it is essential that its members

represent diverse viewpoints, with a broad array of experiences,

professions, skills, geographic representation and backgrounds that, when

considered as a group, provide a sufficient mix of perspectives to allow

the Board of Directors to best fulfill its responsibilities to the

long-term interests of our shareholders.

|

11

|

|

|

The Nominating

Committee will consider shareholder nominees for election to our Board of

Directors. In evaluating such nominees, the Nominating Committee will use

the same selection criteria the Nominating Committee uses to evaluate

other potential nominees. Any shareholder wishing to recommend a director

candidate for consideration by, the Nominating Committee must do so by

sending written notice to our Secretary, Joseph M. Ramos, Jr. at 885 Third

Avenue, Suite 3100, New York, New York 10022, no later than January 6,

2015. Such notice must include the recommended candidate’s name,

experience, qualifications and biographical data, as well as information

as to whether such candidate would qualify as an “independent director”

within the meaning of Rule 5605(a)(2) of The Nasdaq Stock Market and the

applicable rules and regulations of the Securities and Exchange Commission

or as an “audit committee financial expert” under applicable rules and

regulations of the Securities and Exchange Commission. The submission must

be accompanied by a written consent by the nominee to stand for election

if nominated by the Board of Directors and to serve if elected by the

shareholders and a representation that the information with respect to

such nominee is truthful and accurate.

|

|

|

|

|

|

Indemnification of

Officers and Directors:

|

|

We indemnify our

executive officers and directors to the extent permitted by applicable law

against liabilities incurred as a result of their service to us and

against liabilities incurred as a result of their service as directors of

other corporations when serving at our request. We have a director’s and

officer’s liability insurance policy, underwritten by Illinois National

Insurance Company, a member of the American International Group, Inc., in

the annual aggregate amount of $10 million. As to reimbursements by the

insurer of our indemnification expenses, the policy has a $250,000

deductible; there is no deductible for covered liabilities of individual

directors and officers.

|

|

|

|

|

|

Annual

Shareholders

Meeting Attendance

Policy:

|

|

It is the policy of

our Board of Directors that all of our directors are strongly encouraged

to attend each annual shareholders meeting. All of our directors attended

the 2013 annual meeting of shareholders.

|

|

|

|

|

|

Code of

Ethics:

|

|

We have adopted a

Code of Ethics for Senior Financial Officers applicable to our chief

executive officer, chief financial officer, treasurer, controller,

principal accounting officer, and any of our other employees performing

similar functions. A copy of the Code of Ethics for Senior Financial

Officers is available on our website at

https://www.siebertnet.com/html/StartAboutGovernance.aspx.

|

12

|

Board Leadership

Structure and Board of

Directors:

|

|

Jane Macon is the

Chairwoman of our Board of directors. The Board of Directors does not have

a lead independent director. The Company believes this structure allows

all of the directors to participate in the full range of the Board’s

responsibilities with respect to its oversight of the Company’s

management. The Board of Directors has determined that this leadership

structure is appropriate given the size of the Company, the number of

directors overseeing the Company and the Board of Directors’ oversight

responsibilities.

The Board of

Directors holds four to seven regular meetings each year to consider and

address matters involving the Company. The Board of Directors also may

hold special meetings to address matters arising between regular meetings.

These meetings may take place in person or by telephone. The independent

directors also regularly meet in executive sessions outside the presence

of management. The Board of Directors has access to legal counsel for

consultation concerning any issues that may occur during or between

regularly scheduled Board meetings. As discussed above, the Board has

established an Audit Committee, a Compensation Committee and a Nominating

Committee to assist the Board in performing its oversight

responsibilities.

|

|

|

|

|

|

The Board of

Directors’

Role in Risk Oversight:

|

|

Consistent with its

responsibility for oversight of the Company, the Board of Directors, among

other things, oversees risk management of the Company’s business affairs

directly and through the committee structure that it has established. The

principal risks associated with the Company are risks related to

securities market volatility and the securities industry, lower price

levels in the securities markets, intense competition in the brokerage

industry, extensive government regulation, net capital requirements,

customers’ failure to pay, investment banking activities, an increase in

volume on our systems or other events which could cause them to

malfunction, reliance on information processing and communications

systems, continuing changes in technology, dependence on the ability to

attract and retain key personnel, the ability of our principal shareholder

to control many key decisions and there may be no public market for our

common stock.

The Board of

Directors’ role in the Company’s risk oversight process includes regular

reports from senior management on areas of material risk to the Company,

including operational, financial, legal, regulatory, strategic and

reputational risks. The full Board of Directors (or the appropriate

committee) receives these reports from management to identify and discuss

such risks.

|

13

|

|

|

The Board of

Directors periodically reviews with management its strategies, techniques,

policies and procedures designed to manage these risks. Under the overall

supervision of the Board of Directors, management has implemented a

variety of processes, procedures and controls to address these

risks.

The Board of

Directors requires management to report to the full Board of Directors on

a variety of matters at regular meetings of the Board of Directors and on

an as-needed basis, including the performance and operations of the

Company and other matters relating to risk management. The Audit Committee

also receives regular reports from the Company’s independent registered

public accounting firm on internal control and financial reporting

matters. These reviews are conducted in conjunction with the Board of

Directors’ risk oversight function and enable the Board of Directors to

review and assess any material risks facing the

Company.

|

14

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

Management

Ownership:

|

|

The following table lists share ownership of our common stock as of

April 2, 2014. The information includes beneficial ownership by each of

our directors, the persons named in the Summary Compensation Table, all

directors and executive officers as a group and beneficial owners known by

our management to hold at least 5% of our common stock. To our knowledge,

each person named in the table has sole voting and investment power with

respect to all shares of common stock shown as beneficially owned by such

person. No persons or groups filed statements with the Securities and

Exchange Commission during 2013 disclosing that they held more than 5% of

our common stock.

|

|

Name of

Beneficial Owner

(1)

|

|

Shares of Common

Stock

|

|

Percent of

Class

|

|

The Estate of Muriel F. Siebert

|

|

19,878,700

|

|

|

89.9

|

%

|

|

|

Suzanne Shank

|

|

36,000

|

|

|

*

|

|

|

|

Joseph M. Ramos, Jr.

|

|

25,000

|

(2)

|

|

*

|

|

|

|

Patricia L. Francy

|

|

61,000

|

(3)

|

|

*

|

|

|

|

Nancy Peterson Hearn

|

|

60,000

|

(2)

|

|

*

|

|

|

|

Jane

H. Macon

|

|

61,000

|

(3)

|

|

*

|

|

|

|

Robert P. Mazzarella

|

|

60,000

|

(2)

|

|

*

|

|

|

|

Directors and current executive officers as a group (6

persons)

|

|

303,000

|

(4)

|

|

1.4

|

%

|

|

____________________

|

*

|

|

Less than 1%

|

|

|

|

|

|

(1)

|

|

The address for each person named in the table is c/o Siebert

Financial Corp., 885 Third Avenue, Suite 3100, New York, New York

10022.

|

|

|

|

|

|

(2)

|

|

Represents options to purchase shares of our common stock which are

currently exercisable.

|

|

|

|

|

|

(3)

|

|

Includes options to purchase 60,000 shares of our common stock

which are currently exercisable.

|

|

|

|

|

|

(4)

|

|

Includes options to purchase an aggregate of 265,000 shares of our

common stock described above which are currently

exercisable.

|

15

EXECUTIVE

COMPENSATION

Summary Compensation

Table

The following table shows, during the years ended December 31, 2013 and 2012,

the annual compensation paid to or earned by (1) our former Chief Executive

Officer, (2) Acting Chief Executive Officer and (3) each of the four most highly

compensated individuals who served as our executive officers in 2013

(collectively, the “Named Executive Officers”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-qualified

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

Deferred

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock

|

|

Option

|

|

Incentive Plan

|

|

Compensation

|

|

All Other

(7)

|

|

|

|

Name and principal

|

|

|

|

Salary

|

|

Bonus

|

|

Awards

|

|

Awards

|

|

Compensation

|

|

Earnings

|

|

Compensation

|

|

Total

|

|

position

|

|

Year

|

|

($)

|

|

($)

|

|

($)

|

|

($)

(1)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

Muriel F. Siebert

(4)

|

|

2013

|

|

112,500

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

112,500

|

|

Chairwoman and President

|

|

2012

|

|

150,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

150,000

|

|

|

|

Suzanne Shank

(5)

|

|

2013

|

|

52,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

52,000

|

|

Acting Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph M. Ramos, Jr.

(2)

(3)

|

|

2013

|

|

285,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

285,000

|

|

Executive Vice President,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Operating Officer and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

2012

|

|

285,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

285,000

|

|

|

|

Ameen Esmail

(6)

|

|

2013

|

|

154,167

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

30,833

|

|

185,000

|

|

Executive Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Director of Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Development

|

|

2012

|

|

185,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

185,000

|

|

|

|

Jeanne M. Rosendale

(6)

|

|

2013

|

|

250,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

50,000

|

|

300,000

|

|

Executive Vice President and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Counsel

|

|

2012

|

|

300,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

300,000

|

|

|

|

Timothy O’Leary

(6)

|

|

2013

|

|

166,669

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

33,000

|

|

200,000

|

|

Executive Vice President

|

|

2012

|

|

200,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

200,000

|

____________________

|

(1)

|

|

Represents

the dollar amount recognized for financial statement reporting in

accordance with ASC Topic 718.

|

|

|

|

(2)

|

|

Mr. Ramos

also serves as Chief Financial Officer of Siebert, Brandford, Shank &

Co., L.L.C. and is separately compensated by Siebert Brandford Shank for

such services.

|

|

|

|

(3)

|

|

Mr. Ramos

was named to the additional position of Chief Operating Officer effective

June 17, 2013.

|

|

|

|

(4)

|

|

Ms.

Siebert passed away on August 24, 2013.

|

|

|

|

(5)

|

|

Ms. Shank

was named Active Chief Executive Officer effective September 16, 2013 at a

salary of $250,000 annually.

|

|

|

|

(6)

|

|

Terminated

on October 29, 2013.

|

|

|

|

(7)

|

|

Represents

severance payments.

|

16

Grants of Plan-Based

Awards

Our Compensation Committee did not approve grants of options to purchase our

common stock or other equity awards under our 2007 Long-Term Incentive Plan to

any of our Named Executive Officers in 2013.

Outstanding Equity Awards

at December 31, 2013

The following table sets forth the outstanding equity award holdings of our

Named Executive Officers at December 31, 2013.

|

|

|

OPTION

AWARDS

|

|

|

|

|

|

|

|

STOCK

AWARDS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

Incentive

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive

|

|

Plan

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

Plan

|

|

Awards:

|

|

|

|

|

|

|

|

|

Incentive

|

|

|

|

|

|

|

|

|

|

|

|

Awards:

|

|

Market or

|

|

|

|

|

|

|

|

|

Plan

|

|

|

|

|

|

|

|

|

|

|

|

Number of

|

|

Payout Value

|

|

|

|

|

|

|

|

|

Awards:

|

|

|

|

|

|

|

|

|

|

Market

|

|

Unearned

|

|

of Unearned

|

|

|

|

Number of

|

|

Number of

|

|

Number of

|

|

|

|

|

|

|

|

Number

|

|

Value of

|

|

Shares,

|

|

Shares,

|

|

|

|

Securities

|

|

Securities

|

|

Securities

|

|

|

|

|

|

|

|

of Shares

|

|

Shares or

|

|

Units or

|

|

Units or

|

|

|

|

Underlying

|

|

Underlying

|

|

Underlying

|

|

|

|

|

|

|

|

or Units of

|

|

Units of

|

|

Other

|

|

Other

|

|

|

|

Unexercised

|

|

Unexercised

|

|

Unexercised

|

|

Option

|

|

Option

|

|

Stock That

|

|

Stock That

|

|

Rights That

|

|

Rights That

|

|

|

|

Options (#)

|

|

Options (#)

|

|

Unearned

|

|

Exercise

|

|

Expiration

|

|

Have Not

|

|

Have Not

|

|

Have Not

|

|

Have Not

|

|

Name

|

|

Exercisable

|

|

Unexercisable

|

|

Options

(#)

|

|

Price

($)

|

|

Date

|

|

Vested (#)

|

|

Vested

($)

|

|

Vested (#)

|

|

Vested

(#)

|

|

Suzanne Shank

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

|

—

|

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Joseph M. Ramos, Jr.

|

|

25,000

|

|

|

—

|

|

—

|

|

2.75

|

|

|

8/17/2016

|

|

|

—

|

|

—

|

|

—

|

|

—

|

____________________

17

Termination of

Employment and Change-in-Control Arrangements

Employment Agreements.

We are not a party to an employment agreement with

any Named Executive Officer. All of our Named Executive Officers are employees

at will.

Option Agreements.

The Option Agreements we entered into with our

Named Executive Officers provide that in the event of a Change in Control (as

defined below) of our Company, the options shall immediately become fully

exercisable. A Change in Control means the occurrence of (i) any consolidation

or merger in which we are not the continuing or surviving entity or pursuant to

which shares of our common stock are converted into cash, securities or other

property, other than a consolidation or merger in which the holders of our

common stock immediately prior to such consolidation or merger own not less than

50% of the total voting power of the surviving entity immediately after the

consolidation or merger, (ii) any sale, lease, exchange or other transfer of all

or substantially all of our assets, (iii) the approval by our shareholders of

any plan or proposal for our complete liquidation or dissolution or (iv) any

person or entity becoming the owner of 50% or more of our common stock. All

options to purchase our common stock issued to Mr. Ramos have vested and are

fully exercisable.

Compensation of

Directors

In September 2013, our

non-employee directors fees were increased annually to $60,000 from $40,000 for

service on our Board of Directors. We do not compensate our employees or

employees of our subsidiaries for service as directors.

|

Director Compensation

|

|

|

|

|

|

Fees

|

|

|

|

|

|

Non-Equity

|

|

Nonqualified

|

|

|

|

|

|

|

|

Earned

|

|

|

|

|

|

Incentive

|

|

Deferred

|

|

|

|

|

|

|

|

or Paid

|

|

Stock

|

|

Option

|

|

Plan

|

|

Compensation

|

|

All Other

|

|

|

|

|

|

in

|

|

Awards

|

|

Awards

|

|

Compensation

|

|

Earnings

|

|

Compensation

|

|

Total

|

|

Name

|

|

Cash ($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

Patricia L. Francy

(1)

|

|

45,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

45,000

|

|

Nancy Peterson Hearn

(2)

|

|

45,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

45,000

|

|

Jane H. Macon

(3)

|

|

45,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

45,000

|

|

Robert P. Mazzarella

(4)

|

|

45,000

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

45,000

|

____________________

|

(1)

|

|

Ms. Francy

is the Chairwoman of the Audit Committee.

|

|

|

|

(2)

|

|

Ms. Hearn

is the Chairwoman of the Nominating Committee.

|

|

|

|

(3)

|

|

Ms. Macon

is the Chairwoman of the Board and Compensation Committee.

|

|

|

|

(4)

|

|

Mr.

Mazzarella is the Audit Committee Financial

Expert.

|

18

Audit Committee

Report to

Shareholders:

|

|

The Audit Committee

has reviewed and discussed with management the audited financial

statements for the fiscal year ended December 31, 2013. The Audit

Committee has also discussed with our independent registered public

accounting firm the matters required to be discussed by Auditing Standards

No. 16, adopted by the Public Company Accounting Oversight Board (United

States) regarding, “Communications with Audit Committees,” including our

critical accounting policies and our interests, if any, in “off balance

sheet” entities. Additionally, the Audit Committee has received the

written disclosures and representations from the independent registered

public accounting firm required by applicable requirements of the Public

Company Accounting Oversight Board (United States) regarding

“Communication with Audit Committees concerning Independence” and has

discussed with the independent registered public accounting firm the

independent registered public accounting firm’s independence.

Based on the review

and discussions referred to within this report, the Audit Committee

recommended to the Board of Directors that the audited financial

statements for the fiscal year ended December 31, 2013 be included in

Siebert Financial Corp.’s Annual Report on Form 10-K for filing with the

Securities and Exchange Commission.

Audit

Committee,

Patricia L.

Francy,

Chairwoman

Nancy Peterson Hearn

Robert P. Mazzarella

|

|

|

|

|

|

Section 16(a)

Beneficial Ownership

Reporting

Compliance:

|

|

Section 16(a) of the

Exchange Act requires our executive officers and directors and persons who

beneficially own more than 10% of our common stock to file initial reports

of ownership and reports of changes in ownership with the Securities and

Exchange Commission.

These executive

officers, directors and shareholders are required by the Securities and

Exchange Commission to furnish us with copies of all forms they file

pursuant to Section 16(a).

No forms were filed

under Section 16(a) or were furnished to us during fiscal 2013. Based

solely upon this review, we believe that during fiscal 2013 all Section

16(a) filing requirements applicable to our executive officers, directors

and greater than 10% beneficial owners were complied with on a timely

basis.

|

|

|

|

|

|

Householding:

|

|

If you share an

address with another shareholder, only one copy of our Annual Report and

proxy statement is being delivered unless we have received contrary

instructions from you. We will promptly deliver a separate copy of either

document to, any shareholder upon written or oral request to our

Secretary, Joseph M. Ramos, Jr., at Siebert Financial Corp., 885 Third

Avenue, Suite 3100, New York, New York 10022, telephone (212) 644-2400. If

you share an address with another shareholder and (i) would like to

receive multiple copies of the proxy statement or Annual Report to

Shareholders in the future, or (ii) if you are receiving multiple copies

and would like to receive only one copy per household in the future,

please contact your bank, broker, or other nominee record holder, or you

may contact us at the above address and phone

number.

|

19

RELATIONSHIP WITH

INDEPENDENT AUDITORS

EisnerAmper LLP currently serves as our independent registered public accounting

firm. A representative of EisnerAmper LLP will be present at the Annual Meeting

and will have an opportunity to make a statement if he or she desires to do so,

and will respond to appropriate questions from shareholders.

Audit

Fees

Audit Fees.

The aggregate fees billed by EisnerAmper LLP for professional services rendered

for the audit of our annual financial statements and reviews of our quarterly

financial statements were $206,000 for the year ended December 31, 2013 and

$196,000 for the year ended December 31, 2012.

Audit-Related Fees.

EisnerAmper LLP did not perform any audit-related services during the

years ended December 31, 2013 and December 31, 2012.

Tax Fees.

The aggregate fees billed by EisnerAmper LLP during the years ended

December 31, 2013 and December 31, 2012 for tax compliance services totaled

$50,000 and $66,000, respectively.

All Other Fees.

The aggregate fees billed by EisnerAmper LLP during the years ended

December 31, 2013 and December 31, 2012 for other products and services totaled

$22,000 for each year, respectively. Other fees during the years ended December

31, 2013 and December 31, 2012 related to the audit of our 401(k)

Plan.

Our Audit Committee has determined that the services described above that were

rendered by EisnerAmper LLP are compatible with the maintenance of EisnerAmper

LLP’s independence from our management.

Pre-Approval

Policy

The Audit Committee pre-approves all audit and non-audit services provided by

our independent auditors prior to the engagement of the independent auditors

with respect to such services. With respect to audit services and permissible

non-audit services not previously approved, the Audit Committee has authorized

the Chairwoman of the Audit Committee to approve such audit services and

permissible non-audit services, provided the Chairwoman informs the Audit

Committee of such approval at the next regularly scheduled meeting. All “Audit

Fees”, “Tax Fees” and “All Other Fees” set forth above were pre-approved by the

Audit Committee in accordance with its pre-approval policy.

20

CERTAIN RELATIONSHIPS AND

RELATED TRANSACTIONS

Review and Approval of

Related Party Transactions

As

set forth in our Amended and Restated Audit Committee Charter, the Audit

Committee is responsible for reviewing and approving all related party

transactions.

Our Code of Ethics for Senior Financial Officers, applicable to our chief

executive officer, chief financial officer, controller, treasurer, principal

accounting officer and other employees performing similar functions, provides

that our Senior Financial Officers should endeavor to avoid any actual or

potential conflict of interest between their personal and professional

relationships and requires them to promptly report and disclose all material

facts relating to any such relationships or financial interests which give rise,

directly or indirectly, to an actual or potential conflict of interest to the

Audit Committee. The Code of Ethics also provides that no Senior Financial

Officer should knowingly become involved in any actual or potential conflict of

interest without the relationship or financial interest having been approved by

the Audit Committee. Our Code of Ethics does not specify the standards that the

Audit Committee would apply to a request for a waiver of this policy.

21

SHAREHOLDER PROPOSALS FOR

THE

2015 ANNUAL MEETING AND COMMUNICATIONS

If

you wish to submit proposals to be presented at the 2015 Annual Meeting of

Shareholders, the proposals must be received by us no later than December 30,

2014 to be included in our proxy materials for that meeting.

The Board of Directors maintains a process for shareholders to communicate with

the Board of Directors or individual directors as follows. Shareholders who wish

to communicate with the Board of Directors or an individual director should

direct written correspondence to our Secretary, Joseph M. Ramos, Jr., at our

principal office at 885 Third Avenue, Suite 3100, New York, New York 10022. Any

such communication must contain (i) a representation that the shareholder is a

holder of record of our common stock, (ii) the name and address, as they appear

on our books, of the shareholder sending such communication and (iii) the number

of shares of our common stock that are beneficially owned by such shareholder.

The Secretary will forward such communications to the Board of Directors or a

specified individual director to whom the communication is directed unless such

communication is unduly hostile, threatening, illegal or similarly

inappropriate, in which case the Secretary has the authority to discard the

communication or take appropriate legal action regarding such

communication.

OTHER

MATTERS

The Board does not know of any other matters to be presented at the meeting. If

any additional matters are properly presented to the shareholders for action at

the meeting, the persons named in the enclosed proxies and acting thereunder

will have discretion to vote on these matters in accordance with their best

judgment.

YOU MAY OBTAIN A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL

YEAR ENDED DECEMBER 31, 2013 FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

WITHOUT CHARGE BY WRITING TO: JOSEPH M. RAMOS, JR., SECRETARY, SIEBERT FINANCIAL

CORP., 885 THIRD AVENUE, SUITE 3100, NEW YORK, NEW YORK 10022 OR CALLING

800-872-0711.

|

|

By

Order of the Board of Directors

|

|

|

|

|

|

|

|

|

Joseph M. Ramos, Jr.

|

|

|

Secretary

|

Dated: April 28,

2014

PLEASE VOTE BY INTERNET

OR TELEPHONE OR COMPLETE,

DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT

PROMPTLY

IN THE ENCLOSED

ENVELOPE.

PLEASE VOTE—YOUR VOTE IS

IMPORTANT

22

SIEBERT FINANCIAL CORP.

6201 15TH AVENUE

C/O AMERICAN STOCK

TRANSFER

BROOKLYN, NY 11219

VOTE BY INTERNET -

www.proxyvote.com

Use the Internet to

transmit your voting instructions and for electronic delivery of information up

until 11:59 P.M. Eastern Time the day before the meeting date. Have your proxy

card in hand when you access the web site and follow the instructions to obtain

your records and to create an electronic voting instruction

form.

VOTE BY PHONE -

1-800-690-6903

Use any touch-tone

telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time

the day before the meeting date. Have your proxy card in hand when you call and

then follow the instructions.

VOTE BY

MAIL

Mark, sign and date your proxy card

and return it in the postage-paid envelope we have provided or return it to Vote

Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY

11717.

|

TO

VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

|

|

|

|

KEEP THIS PORTION FOR YOUR

RECORDS

|

|

|

DETACH AND RETURN THIS PORTION ONLY

|

|

THIS PROXY CARD IS VALID ONLY WHEN SIGNED

AND DATED.

|

|

|

|

For

|

Withhold

|

For

All

|

|

|

|

|

All

|

All

|

Except

|

|

|

The Board of

Directors recommends you vote FOR the entire slate of Director Nominees

listed below.

|

|

|

|

|

|

|

1.

|

|

Election

of Directors

|

|

o

|

o

|

o

|

|

|

|

|

Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To withhold authority to

vote for any individual nominee(s), mark “For All Except” and write the

number(s) of the nominee(s) on the line below.

|

|

|

|

|

|

|

|

|

01

|

Patricia L. Francy

|

02

|

Nancy Peterson Hearn

|

03

|

Jane H. Macon

|

04

|

Robert P. Mazzarella

|

|

|

|

|

|

NOTE:

The

undersigned's votes will be cast in the discretion of the Board of

Directors on any other business which may properly come before the meeting

or any adjournments

thereof.

|

|

|

|

|

For address change/comments,

mark here.

|

o

|

|

|

(see reverse for

instructions)

|

Yes

|

|

No

|

|

|

|

|

|

|

|

|

|

|

Please

indicate if you plan to attend this meeting

|

o

|

|

o

|

|

|

|

|

|

|

|

|

|

|

Please sign exactly

as your name(s) appear(s) hereon. When signing as attorney, executor,

administrator, or other fiduciary, please give full title as such. Joint

owners should each sign personally. All holders must sign. If a

corporation or partnership, please sign in full corporate or partnership

name, by authorized officer.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature [PLEASE SIGN

WITHIN BOX]

|

Date

|

|

|

Signature (Joint

Owners)

|

Date

|

|

ANNUAL MEETING OF SHAREHOLDERS

OF

SIEBERT FINANCIAL CORP.

June 9,

2014

The meeting will be held at 10:00

A.M., eastern daylight time, at

The Harmonie Club, 4 East 60th Street, New

York, NY.

Important Notice Regarding the

Availability of Proxy Materials for the Annual Meeting:

The Notice & Proxy Statement, Annual Report is/are

available at

www.proxyvote.com

.

SIEBERT FINANCIAL

CORP.

PROXY FOR THE ANNUAL MEETING OF

SHAREHOLDERS

TO BE HELD JUNE 9,

2014

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS

The undersigned hereby appoints Joseph M.

Ramos, Jr. and Patricia L. Francy, and each of them, the proxies of the

undersigned, with power of substitution to each of them to vote all shares of

Siebert Financial Corp. which the undersigned is entitled to vote at the Annual

Meeting of Shareholders of Siebert Financial Corp. to be held Monday, June 9,

2014, at 10:00 A.M., eastern daylight time, and at any adjournments thereof.

Please call 212-355-7400 to obtain directions to the Annual Meeting to vote in

person. Any and all proxies heretofore given are hereby revoked.

UNLESS OTHERWISE SPECIFIED IN THE

SPACES PROVIDED, THE UNDERSIGNED'S VOTE WILL BE CAST FOR ALL NOMINEES LISTED IN

ITEM (1).

(If you noted any Address

Changes and/or Comments above, please mark corresponding box on the reverse

side.)

Continued and to be

signed on reverse side

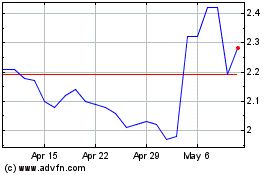

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

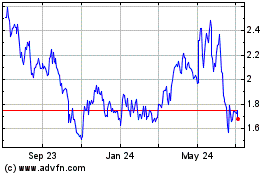

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024