Medinah Minerals Announces a Signed Offer Agreement on the Altos de Lipangue Project

April 25 2014 - 12:35PM

Business Wire

Medinah Minerals (Pink Sheets: MDMN) today

issued the following shareholder update concerning mining

developments at the Altos de Lipangue mining project.

Progress Update on the Altos de Lipangue

ProjectApril 25, 2014

We are pleased to announce that we have received a firm written

offer from a group of well-known and highly qualified Peruvian

mining experts to immediately commence development of the entire

Altos de Lipangue properties. Medinah has until June 9, 2014 to

accept or reject the terms of this agreement.

Additionally, there has been accelerated interest in the Altos

de Lipangue project with major and mid-tier mining companies

actively expanding their knowledge of the property, predominantly

in light of recent discoveries at the LDM/NUOCO mining projects.

These companies have requested and received signed confidentiality

documents and agreements that are on file. Therefore, Medinah

Mining Chile has allowed each of their crews access into the field

and visitation to the location of the stored core samples.

Medinah Mining Chile’s Board of Directors, after previous failed

attempts, came to the conclusion last July 2013, to hire a

professional team of consultants in order to review issues and

assist in presenting an industry-standard mining option Joint

Venture Agreement (JVA), or any other acceptable form of

association.

After full diagnostic review, the consultants determined that

the main concern to address in order to secure an industry standard

mining option was that Medinah Minerals, Inc. must take immediate

steps to consolidate all of its mining claims under one entity.

Over several months, all necessary acquisitions, full title

reviews, cessation of encumbrance endeavors and notarizations, the

tasks were completed and negotiations began with various mining

conglomerates. A company agent was enlisted to be the main

representative negotiator for the Altos de Lipangue (ADL)

project.

Management was later advised, by the representative agent, that

several complex legal issues were impeding potential transactions

and also needed to be resolved. These matters were handled and

formally notarized for presentation and ultimate approval by the

Chilean Ministry of Mines in December 2013. In January 2014,

Medinah Mining Chile was noticed that it had clear ownership of the

entire Altos de Lipangue group of properties. Medinah Minerals,

Inc. then legally acquired 100% ownership of all of the shares of

Medinah Mining Chile.

Over several months, various mining companies have sent

representatives consisting of geologists, mining engineers and

management teams to view the ADL. Documents and historical issues

were provided, as requested, to each of these entities. Further

verifications of core samples have been undertaken by several

potential partners. Each of the groups also visited the

privately-held LDM and NUOCO properties.

Medinah Mining Chile will thoroughly investigate every offer

presented by the team of consultants in order to capitalize on

increasing the value of the Altos plateau properties. These offers

are being reviewed by Management and the Directors of Medinah

Mining Chile, and Medinah Minerals, Inc.

Juan José Quijano FernándezChairman/President – Medinah

Minerals, Inc.

Cautionary Statement – Forward-Looking

Information

This news release may contain certain “forward-looking

statements” within the meaning of the United States Securities

Exchange Act of 1934, as amended. This forward-looking information

includes, or may be based upon estimates, forecasts and statements

of management’s expectations with respect to, among other things,

the completion of transactions, the issuance of permits, the size

and quality of mineral resources, future trends for the company,

progress in development of mineral properties, future production

and sales volumes, capital costs, mine production costs, demand and

market outlook for metals, future metal prices and treatment and

refining or milling charges, the outcome of legal proceedings, the

timing of exploration, development and mining activities,

acquisition of shares in other companies and the financial results

of the company. There can be no assurances that such statements

will prove to be accurate and actual results and future events

could differ materially and substantially from those anticipated in

such statements. Mineral resources that are not mineral reserves do

not have demonstrated economic viability. Inferred mineral

resources are considered too speculative geologically to have

economic considerations applied to them that would enable them to

be categorized as mineral reserves. There is no certainty that

mineral resources will be converted into mineral reserves.

South American Mining MediaRoberto de Silva,

702-727-8235Roberto@southamericanminingmedia.comhttp://www.medinah-minerals.com

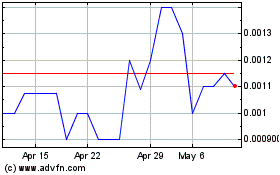

Medinah Mining (PK) (USOTC:MDMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

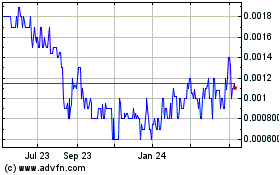

Medinah Mining (PK) (USOTC:MDMN)

Historical Stock Chart

From Apr 2023 to Apr 2024