Current Report Filing (8-k)

April 23 2014 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 23, 2014

Aastrom Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

000-22025 |

|

94-3096597 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

24 Frank Lloyd Wright Drive, Lobby K,

Ann Arbor, Michigan |

|

48105 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (734) 418-4400

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On April 19, 2014, Aastrom Biosciences, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”), by and between the Company and Sanofi, a Frenche société anonyme (“Seller”). Pursuant to the Stock Purchase Agreement, the Company has agreed to acquire certain assets, including all of the outstanding equity interests of Genzyme Biosurgery ApS, a wholly-owned subsidiary of Seller, and over 250 patents and patent applications, of Seller and certain of its Subsidiaries (together with the Seller, the “Selling Persons”) and assume certain liabilities of the Selling Persons for purposes of acquiring the portions of the cell therapy and regenerative medicine business of the Selling Persons (the “Business”) currently operated through Genzyme Biosurgery ApS, which researches, develops, manufactures, markets and sells the Carticel®, Epicel® and MACI® products (the “Transaction”). The Company will also acquire global manufacturing and production centers located in the United States and Denmark. As consideration for the Transaction and the other agreements of the Selling Persons contemplated by the Asset Purchase Agreement, the Company will, on the closing date of the Transaction (the “Closing Date”) pay to the Selling Person $6,500,000.00, subject to certain post-closing adjustments based upon working capital of Seller or Genzyme Biosurgery ApS on the Closing Date, of which $4,000,000.00 will be paid in cash and the remaining $2,500,000.00 will be payable in the form of a promissory note (the “Promissory Note”) to be held by the Seller. The Promissory Note will accrue interest at the short term applicable federal rate in effect on the Closing Date, be prepayable without prepayment penalty, and be due upon the earliest to occur of (i) July 12, 2014, (ii) a liquidation, dissolution or winding up of the Company, or a (iii) Liquidation Transaction (as defined in the Promissory Note). In connection with the sale of the Business, the Selling Persons intend to transfer substantially all of the Selling Person’s employees (the “Transferred Employees”) primarily engaged in the Business to the Company prior to or after the Closing Date.

The Asset Purchase Agreement contains customary representations and warranties and covenants by each party. The Asset Purchase Agreement contains customary indemnification provisions, subject to certain limitations, whereby the Company will indemnify the Selling Persons, and the Selling Persons will indemnify the Company, for losses arising following the closing of the Transaction out of (i) inaccuracies in or breaches of its representations and warranties and breaches or failures to perform its covenants under the Asset Purchase Agreement, and (ii) any liability retained by the Selling Persons in connection with the Transaction, among other matters.

Consummation of the Transactions contemplated by the Asset Purchase Agreement and the related ancillary agreements is subject to the satisfaction of customary closing conditions set forth therein, including the absence of a Material Adverse Effect (as defined in the Asset Purchase Agreement) on the Business, the absence of legal impediments to closing, the accuracy of the representations and warranties made by the parties, the receipt of certain regulatory permits and approvals and the execution of ancillary agreements. The Company expects that the transaction will close in May of 2014.

The Asset Purchase Agreement provides that until the third anniversary of the Closing Date, Seller and its Affiliates will not compete against the Business, and Seller and its Affiliates, for a period of 24 months following the Closing Date, will not solicit for employment any of the Transferred Employees or employees of the Company and its Affiliates with whom Seller and its Affiliates had contact, in each case in connection with the Transaction. In addition, in connection with the closing of the Transaction, the Company and the Selling Persons will enter into (i) certain IP assignment and license agreements to effect the transfer and license of the intellectual property related to the Business being assigned and/or licensed to the Company, (ii) certain assignment and assumption of lease agreements for each of the real property leases being assigned to the Company, (iii) a transition services agreement pursuant to which Seller will provide the Company with certain transition services in connection with the transition of the Business from the Selling Persons to the Company, and (iv) a transition supply agreement pursuant to which Seller will make available to the Company, as from the Closing Date, on a transitional basis the raw material to the same extent it was available to the Business prior to the closing.

The Asset Purchase Agreement also includes customary termination provisions, including that (i) if the other party has materially breached any representation, warranty, covenant obligation or agreement contained in the Asset Purchase Agreement, such that the condition would not be satisfied and such failure or breach with respect to any such representation, warranty or obligation cannot be cured or if curable, shall continue uncured until the Drop Dead Date), or each of the Company and Seller may terminate the Asset Purchase Agreement if the closing of the Transaction has not occurred on or prior to May 31, 2014 (the “Drop Dead Date”), provided, however, that the right to terminate the Asset Purchase Agreement under this clause will not be available to either party if a breach of the Asset Purchase Agreement by the party seeking to terminate the Asset Purchase Agreement is the cause of the failure of the closing to occur on or before such date.

2

The foregoing description of the Asset Purchase Agreement, the Promissory Note and the Transaction does not purport to be complete and is qualified in its entirety by reference to the full text of the Asset Purchase Agreement, a copy of which is attached hereto as Exhibit 2.1 and the Promissory Note which is attached as Exhibit 4.3.7 thereto, and is incorporated into this report by reference. The Asset Purchase Agreement contains representations and warranties by the Company, on the one hand, and by the Selling Persons, on the other hand, made solely for the benefit of the other. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules that the parties have exchanged in connection with signing the Asset Purchase Agreement. The disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Asset Purchase Agreement. Moreover, certain representations and warranties in the Asset Purchase Agreement were made as of a specified date, may be subject to a contractual standard of materiality different from what might be viewed as material to stockholders or may have been used for the purpose of allocating risk between the Company, on the one hand, and the Selling Persons, on the other hand. Accordingly, investors are not third-party beneficiaries under the Asset Purchase Agreement and should not rely on the representations and warranties in the Asset Purchase Agreement as characterizations of the actual state of facts about the Company or the Selling Person at the time they were made or otherwise.

Item 8.01 Other Events.

On April 21, 2014, the Company issued a press release announcing that it had entered into the Asset Purchase Agreement to effect the Transaction. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

|

(d) |

Exhibits. |

|

|

|

|

|

|

|

|

|

2.1 |

|

Asset Purchase Agreement, dated as of April 19, 2014, by and between the Company and Sanofi.* |

|

|

|

|

|

|

|

|

|

99.1 |

|

Press Release dated April 21, 2014. |

|

|

|

|

|

|

|

|

|

*Schedules omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish a supplemental copy of any omitted schedule to the Securities Exchange Commission upon request.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Aastrom Biosciences, Inc. |

|

|

|

|

|

Date: April 23, 2014 |

By: |

/s/ Dominick C. Colangelo |

|

|

|

|

|

|

Name: |

Dominick C. Colangelo |

|

|

|

Title: |

Chief Executive Officer and President |

4

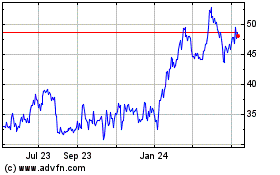

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024