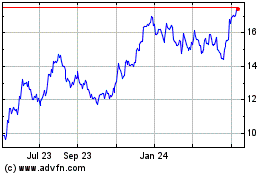

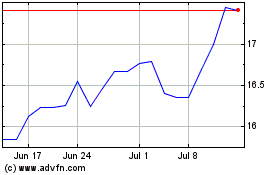

Fulton Financial Reports First Quarter Earnings of $0.22 per Share

LANCASTER, PA--(Marketwired - Apr 22, 2014) - Fulton Financial

Corporation (NASDAQ: FULT)

- Diluted earnings per share for the first quarter of 2014 was 22

cents, unchanged from the fourth quarter of 2013 and a 10.0 percent

increase from the first quarter of 2013.

- Net interest income for the first quarter of 2014 decreased

$3.4 million, or 2.5 percent, compared to the fourth quarter of

2013. The net interest margin for the first quarter of 2014

decreased one basis point, to 3.47 percent, compared to the fourth

quarter of 2013.

- Average interest-earning assets decreased $77.9 million, or 0.5

percent, compared to the fourth quarter of 2013, with average loans

decreasing $30.2 million, or 0.2 percent.

- Non-interest income, excluding investment securities gains,

decreased $2.2 million, or 5.4 percent, in comparison to the fourth

quarter of 2013, while non-interest expense decreased $7.2 million,

or 6.2 percent.

- During the first quarter of 2014, the Corporation implemented a

number of its previously disclosed cost savings initiatives,

including the consolidation of 13 branches, subsidiary bank

management restructurings and changes to certain benefit plans.

These initiatives resulted in implementation expenses, net of

associated gains, of approximately $1.0 million and expense

reductions of approximately $1.0 million during the first quarter

of 2014. Annualized expense reductions from these cost savings

initiatives are expected to be approximately $8.0 million.

- The provision for credit losses was $2.5 million for the first

quarter of 2014, unchanged from the fourth quarter of 2013 and a

$12.5 million, or 83.3 percent, decrease from the first quarter of

2013. Non-performing loans increased $653,000, or 0.4 percent, in

comparison to December 31, 2013 and decreased $53.7 million, or

25.7 percent, in comparison to March 31, 2013.

- During the first quarter of 2014, the Corporation repurchased

4.0 million shares of common stock, completing its outstanding

share repurchase program.

Fulton Financial Corporation (NASDAQ: FULT) reported net income

of $41.8 million, or 22 cents per diluted share, for the first

quarter of 2014, compared to $42.1 million, or 22 cents per diluted

share, for the fourth quarter of 2013.

"We were pleased to report another quarter of solid earnings and

good returns on assets and equity," said E. Philip Wenger,

Chairman, CEO and President. "Asset quality remained strong this

quarter. We also saw a significant reduction in operating expenses

that contributed to improved efficiency. During the quarter, we

completed our previously announced four million share repurchase

program."

Net Interest Income and

Margin Net interest income for the first quarter of 2014

decreased $3.4 million, or 2.5 percent, from the fourth quarter of

2013. The net interest margin decreased one basis point, or 0.3

percent, to 3.47 percent, in the first quarter of 2014 from 3.48

percent in the fourth quarter of 2013. Average yields on

interest-earning assets decreased one basis point, while the

average cost of interest-bearing liabilities increased one basis

point.

Average Balance

Sheet Total average assets for the first quarter of 2014

were $16.9 billion, a decrease of $60.2 million, or 0.4 percent,

from the fourth quarter of 2013. Average loans, net of unearned

income, decreased $30.2 million, or 0.2 percent, in comparison to

the fourth quarter of 2013.

| |

|

|

|

|

|

|

| |

|

Quarter Ended |

|

|

Increase (decrease) |

|

| |

|

March 31, 2014 |

|

|

December 31, 2013 |

|

|

in Balance |

|

| |

|

Balance |

|

Yield (1) |

|

|

Balance |

|

Yield (1) |

|

|

$ |

|

|

% |

|

| |

|

(dollars in thousands) |

|

| Average Loans, net of unearned income, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate - commercial mortgage |

|

$ |

5,085,128 |

|

4.44 |

% |

|

$ |

5,065,963 |

|

4.49 |

% |

|

$ |

19,165 |

|

|

0.4 |

% |

|

|

Commercial - industrial, financial and agricultural |

|

|

3,637,075 |

|

4.03 |

% |

|

|

3,639,690 |

|

4.03 |

% |

|

|

(2,615 |

) |

|

(0.1 |

%) |

|

|

Real estate - home equity |

|

|

1,755,346 |

|

4.18 |

% |

|

|

1,774,919 |

|

4.18 |

% |

|

|

(19,573 |

) |

|

(1.1 |

%) |

|

|

Real estate - residential mortgage |

|

|

1,336,323 |

|

3.99 |

% |

|

|

1,331,987 |

|

4.04 |

% |

|

|

4,336 |

|

|

0.3 |

% |

|

|

Real estate - construction |

|

|

576,346 |

|

4.08 |

% |

|

|

581,306 |

|

4.15 |

% |

|

|

(4,960 |

) |

|

(0.9 |

%) |

|

|

Consumer |

|

|

274,910 |

|

4.82 |

% |

|

|

287,245 |

|

4.85 |

% |

|

|

(12,335 |

) |

|

(4.3 |

%) |

|

|

Leasing and other |

|

|

97,229 |

|

9.79 |

% |

|

|

111,456 |

|

8.01 |

% |

|

|

(14,227 |

) |

|

(12.8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Average Loans, net of unearned income |

|

$ |

12,762,357 |

|

4.28 |

% |

|

$ |

12,792,566 |

|

4.29 |

% |

|

$ |

(30,209 |

) |

|

(0.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

Presented on a tax-equivalent basis using a 35% Federal tax rate

and statutory interest expense disallowances. |

| |

|

|

Total average liabilities decreased $72.3 million, or 0.5

percent, from the fourth quarter of 2013, due to a $187.7 million

decrease in average deposits, partially offset by a $109.2 million,

or 9.9 percent, increase short-term borrowings.

| |

|

|

|

|

|

|

| |

|

Quarter Ended |

|

|

Increase (decrease) |

|

| |

|

March 31, 2014 |

|

|

December 31, 2013 |

|

|

in Balance |

|

| |

|

Balance |

|

Rate |

|

|

Balance |

|

Rate |

|

|

$ |

|

|

% |

|

| |

|

(dollars in thousands) |

|

|

|

|

| Average Deposits, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest-bearing demand |

|

$ |

3,243,424 |

|

- |

% |

|

$ |

3,318,073 |

|

- |

% |

|

$ |

(74,649 |

) |

|

(2.2 |

%) |

| |

Interest-bearing demand |

|

|

2,945,211 |

|

0.13 |

% |

|

|

2,966,994 |

|

0.13 |

% |

|

|

(21,783 |

) |

|

(0.7 |

%) |

| |

Savings deposits |

|

|

3,351,871 |

|

0.13 |

% |

|

|

3,410,030 |

|

0.12 |

% |

|

|

(58,159 |

) |

|

(1.7 |

%) |

| Total average demand and savings |

|

|

9,540,506 |

|

0.08 |

% |

|

|

9,695,097 |

|

0.08 |

% |

|

|

(154,591 |

) |

|

(1.6 |

%) |

| |

Time

deposits |

|

|

2,932,456 |

|

0.82 |

% |

|

|

2,965,604 |

|

0.82 |

% |

|

|

(33,148 |

) |

|

(1.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Average Deposits |

|

$ |

12,472,962 |

|

0.26 |

% |

|

$ |

12,660,701 |

|

0.25 |

% |

|

$ |

(187,739 |

) |

|

(1.5 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality

Non-performing assets were $170.2 million, or 1.01 percent of total

assets, at March 31, 2014, compared to $169.3 million, or 1.00

percent of total assets, at December 31, 2013 and $232.5 million,

or 1.39 percent of total assets, at March 31, 2013. The $901,000,

or 0.5 percent, increase in non-performing assets in comparison to

the fourth quarter of 2013 was primarily due to an increase in

non-performing commercial mortgages and commercial loans, partially

offset by a decrease in non-performing residential mortgages.

Annualized net charge-offs for the quarter ended March 31, 2014

were 0.26 percent of average total loans, compared to 0.33 percent

for the quarter ended December 31, 2013 and 0.62 percent for the

quarter ended March 31, 2013. The allowance for credit losses as a

percentage of non-performing loans was 128.5 percent at March 31,

2014, as compared to 132.8 percent at December 31, 2013 and 106.2

percent at March 31, 2013.

Non-interest

Income Non-interest income, excluding investment

securities gains, decreased $2.2 million, or 5.4 percent, in

comparison to the fourth quarter of 2013. Service charges on

deposit accounts decreased $1.1 million, or 8.3 percent, including

a $649,000 decrease in overdraft fees. Mortgage banking income

decreased $758,000, including a $715,000 decrease in gains on sales

of mortgage loans, as both volumes and spreads decreased.

Non-interest

Expense Non-interest expense decreased $7.2 million, or 6.2

percent, in the first quarter of 2014 compared to the fourth

quarter of 2013. Salaries and employee benefits decreased $5.6

million, or 8.6 percent, due primarily to decreases in incentive

compensation and health insurance expense, in addition to a $1.5

million gain recognized as a result of an amendment of the

Corporation's postretirement health plan. These decreases were

partially offset by a seasonal increase in payroll taxes and an

increase in severance costs. A $1.5 million increase in net

occupancy expense was mainly a result of increased snow removal

costs. Other outside services declined $1.8 million due to the

timing of consulting arrangements related to risk management and

compliance initiatives.

About Fulton

Financial Fulton Financial Corporation is a Lancaster,

Pennsylvania-based financial holding company that has banking

offices in Pennsylvania, Maryland, Delaware, New Jersey and

Virginia through the following affiliates, headquartered as

indicated: Fulton Bank, N.A., Lancaster, PA; Swineford National

Bank, Middleburg, PA; Lafayette Ambassador Bank, Easton, PA; FNB

Bank, N.A., Danville, PA; Fulton Bank of New Jersey, Mt. Laurel,

NJ; and The Columbia Bank, Columbia, MD.

The Corporation's investment management and trust services are

offered at all banks through Fulton Financial Advisors, a division

of Fulton Bank, N.A. Residential mortgage lending is offered by all

banks under the Fulton Mortgage Company brand.

Additional information on Fulton Financial Corporation is

available on the Internet at www.fult.com.

Safe Harbor

Statement This news release may contain forward-looking

statements with respect to the Corporation's financial condition,

results of operations and business. Do not unduly rely on

forward-looking statements. Forward-looking statements can be

identified by the use of words such as "may," "should," "will,"

"could," "estimates," "predicts," "potential," "continue,"

"anticipates," "believes," "plans," "expects," "future," "intends"

and similar expressions which are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to risks and

uncertainties, some of which are beyond the Corporation's control

and ability to predict, that could cause actual results to differ

materially from those expressed in the forward-looking

statements.

A discussion of certain risks and uncertainties affecting the

Corporation, and some of the factors that could cause the

Corporation's actual results to differ materially from those

described in the forward-looking statements, can be found in the

sections entitled "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in the

Corporation's Annual Report on Form 10-K for the year ended

December 31, 2013, which has been filed with the Securities and

Exchange Commission and is available in the Investor Relations

section of the Corporation's website (www.fult.com) and on the

Securities and Exchange Commission's website (www.sec.gov). The

Corporation undertakes no obligation, other than as required by

law, to update or revise any forward-looking statements, whether as

a result of new information, future events or otherwise.

Non-GAAP Financial

Measures The Corporation uses certain non-GAAP financial

measures in this earnings release. These non-GAAP financial

measures are reconciled to the most comparable GAAP measures in

tables at the end of this release.

| |

|

|

|

|

|

| |

|

|

|

|

|

| FULTON FINANCIAL CORPORATION |

|

|

|

|

|

| CONDENSED CONSOLIDATED ENDING BALANCE SHEETS

(UNAUDITED) |

|

|

|

|

|

| dollars in thousands |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

% Change from |

|

| |

|

March 31 |

|

March 31 |

|

December 31 |

|

March 31 |

|

December 31 |

|

| |

|

2014 |

|

2013 |

|

2013 |

|

2013 |

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash and due from banks |

|

$ |

260,389 |

|

$ |

174,479 |

|

$ |

218,540 |

|

49.2 |

% |

19.1 |

% |

| |

Other interest-earning assets |

|

|

307,062 |

|

|

171,684 |

|

|

248,161 |

|

78.9 |

% |

23.7 |

% |

| |

Loans held for sale |

|

|

24,417 |

|

|

63,045 |

|

|

21,351 |

|

(61.3 |

%) |

14.4 |

% |

| |

Investment securities |

|

|

2,501,198 |

|

|

2,736,269 |

|

|

2,568,434 |

|

(8.6 |

%) |

(2.6 |

%) |

| |

Loans, net of unearned income |

|

|

12,733,792 |

|

|

12,377,288 |

|

|

12,782,220 |

|

2.9 |

% |

(0.4 |

%) |

| |

Allowance for loan losses |

|

|

(197,089 |

) |

|

(220,041 |

) |

|

(202,780 |

) |

(10.4 |

%) |

(2.8 |

%) |

| |

|

Net loans |

|

|

12,536,703 |

|

|

12,157,247 |

|

|

12,579,440 |

|

3.1 |

% |

(0.3 |

%) |

| |

Premises and equipment |

|

|

225,647 |

|

|

226,754 |

|

|

226,021 |

|

(0.5 |

%) |

(0.2 |

%) |

| |

Accrued interest receivable |

|

|

43,376 |

|

|

47,485 |

|

|

44,037 |

|

(8.7 |

%) |

(1.5 |

%) |

| |

Goodwill and intangible assets |

|

|

532,747 |

|

|

534,987 |

|

|

533,076 |

|

(0.4 |

%) |

(0.1 |

%) |

| |

Other assets |

|

|

480,350 |

|

|

570,787 |

|

|

495,574 |

|

(15.8 |

%) |

(3.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

Assets |

|

$ |

16,911,889 |

|

$ |

16,682,737 |

|

$ |

16,934,634 |

|

1.4 |

% |

(0.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Deposits |

|

$ |

12,669,917 |

|

$ |

12,388,460 |

|

$ |

12,491,186 |

|

2.3 |

% |

1.4 |

% |

| |

Short-term borrowings |

|

|

1,069,684 |

|

|

1,126,966 |

|

|

1,258,629 |

|

(5.1 |

%) |

(15.0 |

%) |

| |

Other liabilities |

|

|

230,108 |

|

|

216,337 |

|

|

238,048 |

|

6.4 |

% |

(3.3 |

%) |

| |

FHLB advances and long-term debt |

|

|

883,461 |

|

|

889,211 |

|

|

883,584 |

|

(0.6 |

%) |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total Liabilities |

|

|

14,853,170 |

|

|

14,620,974 |

|

|

14,871,447 |

|

1.6 |

% |

(0.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

|

|

2,058,719 |

|

|

2,061,763 |

|

|

2,063,187 |

|

(0.1 |

%) |

(0.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Total

Liabilities and Shareholders' Equity |

|

$ |

16,911,889 |

|

$ |

16,682,737 |

|

$ |

16,934,634 |

|

1.4 |

% |

(0.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS, DEPOSITS AND SHORT-TERM BORROWINGS DETAIL: |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Real estate - commercial mortgage |

|

$ |

5,137,454 |

|

$ |

4,729,930 |

|

$ |

5,101,922 |

|

8.6 |

% |

0.7 |

% |

| |

Commercial - industrial, financial and

agricultural |

|

|

3,574,130 |

|

|

3,658,483 |

|

|

3,628,420 |

|

(2.3 |

%) |

(1.5 |

%) |

| |

Real estate - home equity |

|

|

1,740,496 |

|

|

1,689,446 |

|

|

1,764,197 |

|

3.0 |

% |

(1.3 |

%) |

| |

Real estate - residential mortgage |

|

|

1,331,465 |

|

|

1,303,454 |

|

|

1,337,380 |

|

2.1 |

% |

(0.4 |

%) |

| |

Real estate - construction |

|

|

584,217 |

|

|

597,597 |

|

|

573,672 |

|

(2.2 |

%) |

1.8 |

% |

| |

Consumer |

|

|

270,021 |

|

|

309,138 |

|

|

283,124 |

|

(12.7 |

%) |

(4.6 |

%) |

| |

Leasing and other |

|

|

96,009 |

|

|

89,240 |

|

|

93,505 |

|

7.6 |

% |

2.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Loans, net of unearned income |

|

$ |

12,733,792 |

|

$ |

12,377,288 |

|

$ |

12,782,220 |

|

2.9 |

% |

(0.4 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest-bearing demand |

|

$ |

3,359,900 |

|

$ |

3,075,511 |

|

$ |

3,283,172 |

|

9.2 |

% |

2.3 |

% |

| |

Interest-bearing demand |

|

|

2,960,577 |

|

|

2,698,811 |

|

|

2,945,210 |

|

9.7 |

% |

0.5 |

% |

| |

Savings deposits |

|

|

3,346,880 |

|

|

3,345,842 |

|

|

3,344,882 |

|

- |

|

0.1 |

% |

| |

Time deposits |

|

|

3,002,560 |

|

|

3,268,296 |

|

|

2,917,922 |

|

(8.1 |

%) |

2.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Deposits |

|

$ |

12,669,917 |

|

$ |

12,388,460 |

|

$ |

12,491,186 |

|

2.3 |

% |

1.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Customer repurchase agreements |

|

$ |

220,426 |

|

$ |

158,214 |

|

$ |

175,621 |

|

39.3 |

% |

25.5 |

% |

| |

Customer short-term promissory notes |

|

|

88,160 |

|

|

114,231 |

|

|

100,572 |

|

(22.8 |

%) |

(12.3 |

%) |

| |

Federal funds purchased |

|

|

361,098 |

|

|

729,521 |

|

|

582,436 |

|

(50.5 |

%) |

(38.0 |

%) |

| |

Short-term FHLB advances |

|

|

400,000 |

|

|

125,000 |

|

|

400,000 |

|

220.0 |

% |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Short-term Borrowings |

|

$ |

1,069,684 |

|

$ |

1,126,966 |

|

$ |

1,258,629 |

|

(5.1 |

%) |

(15.0 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FULTON FINANCIAL

CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) |

| in thousands, except per-share data and

percentages |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

|

% Change from |

|

| |

|

Mar 31 |

|

|

Mar 31 |

|

|

Dec 31 |

|

|

Mar 31 |

|

|

Dec 31 |

|

| |

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2013 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

|

$ |

148,792 |

|

|

$ |

151,322 |

|

|

$ |

152,457 |

|

|

(1.7 |

%) |

|

(2.4 |

%) |

| |

Interest expense |

|

|

19,227 |

|

|

|

21,678 |

|

|

|

19,505 |

|

|

(11.3 |

%) |

|

(1.4 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Interest Income |

|

|

129,565 |

|

|

|

129,644 |

|

|

|

132,952 |

|

|

(0.1 |

%) |

|

(2.5 |

%) |

| |

Provision for credit losses |

|

|

2,500 |

|

|

|

15,000 |

|

|

|

2,500 |

|

|

(83.3 |

%) |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Interest Income after Provision |

|

|

127,065 |

|

|

|

114,644 |

|

|

|

130,452 |

|

|

10.8 |

% |

|

(2.6 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposit accounts |

|

|

11,711 |

|

|

|

14,111 |

|

|

|

12,770 |

|

|

(17.0 |

%) |

|

(8.3 |

%) |

| |

Investment management and trust services |

|

|

10,958 |

|

|

|

10,096 |

|

|

|

10,589 |

|

|

8.5 |

% |

|

3.5 |

% |

| |

Other service charges and fees |

|

|

8,927 |

|

|

|

8,510 |

|

|

|

9,421 |

|

|

4.9 |

% |

|

(5.2 |

%) |

| |

Mortgage banking income |

|

|

3,605 |

|

|

|

8,173 |

|

|

|

4,363 |

|

|

(55.9 |

%) |

|

(17.4 |

%) |

| |

Investment securities gains |

|

|

- |

|

|

|

2,473 |

|

|

|

33 |

|

|

(100.0 |

%) |

|

(100.0 |

%) |

| |

Other |

|

|

3,305 |

|

|

|

3,896 |

|

|

|

3,556 |

|

|

(15.2 |

%) |

|

(7.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Non-Interest Income |

|

|

38,506 |

|

|

|

47,259 |

|

|

|

40,732 |

|

|

(18.5 |

%) |

|

(5.5 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and employee benefits |

|

|

59,566 |

|

|

|

61,212 |

|

|

|

65,194 |

|

|

(2.7 |

%) |

|

(8.6 |

%) |

| |

Net occupancy expense |

|

|

13,603 |

|

|

|

11,844 |

|

|

|

12,134 |

|

|

14.9 |

% |

|

12.1 |

% |

| |

Other outside services |

|

|

3,812 |

|

|

|

2,860 |

|

|

|

5,633 |

|

|

33.3 |

% |

|

(32.3 |

%) |

| |

Data processing |

|

|

3,796 |

|

|

|

3,903 |

|

|

|

3,386 |

|

|

(2.7 |

%) |

|

12.1 |

% |

| |

Equipment expense |

|

|

3,602 |

|

|

|

3,908 |

|

|

|

3,972 |

|

|

(7.8 |

%) |

|

(9.3 |

%) |

| |

Software |

|

|

2,925 |

|

|

|

2,748 |

|

|

|

2,450 |

|

|

6.4 |

% |

|

19.4 |

% |

| |

Professional fees |

|

|

2,904 |

|

|

|

3,047 |

|

|

|

3,379 |

|

|

(4.7 |

%) |

|

(14.1 |

%) |

| |

FDIC insurance expense |

|

|

2,689 |

|

|

|

2,847 |

|

|

|

2,839 |

|

|

(5.5 |

%) |

|

(5.3 |

%) |

| |

Operating risk loss |

|

|

1,828 |

|

|

|

1,766 |

|

|

|

2,367 |

|

|

3.5 |

% |

|

(22.8 |

%) |

| |

Marketing |

|

|

1,584 |

|

|

|

1,872 |

|

|

|

1,660 |

|

|

(15.4 |

%) |

|

(4.6 |

%) |

| |

Other real estate owned and repossession expense |

|

|

983 |

|

|

|

2,854 |

|

|

|

1,116 |

|

|

(65.6 |

%) |

|

(11.9 |

%) |

| |

Intangible amortization |

|

|

315 |

|

|

|

534 |

|

|

|

834 |

|

|

(41.0 |

%) |

|

(62.2 |

%) |

| |

Other |

|

|

11,947 |

|

|

|

11,541 |

|

|

|

11,798 |

|

|

3.5 |

% |

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

Non-Interest Expense |

|

|

109,554 |

|

|

|

110,936 |

|

|

|

116,762 |

|

|

(1.2 |

%) |

|

(6.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Income Before Income Taxes |

|

|

56,017 |

|

|

|

50,967 |

|

|

|

54,422 |

|

|

9.9 |

% |

|

2.9 |

% |

| |

Income tax expense |

|

|

14,234 |

|

|

|

11,740 |

|

|

|

12,339 |

|

|

21.2 |

% |

|

15.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net

Income |

|

$ |

41,783 |

|

|

$ |

39,227 |

|

|

$ |

42,083 |

|

|

6.5 |

% |

|

(0.7 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Basic |

|

$ |

0.22 |

|

|

$ |

0.20 |

|

|

$ |

0.22 |

|

|

10.0 |

% |

|

- |

|

| |

|

Diluted |

|

|

0.22 |

|

|

|

0.20 |

|

|

|

0.22 |

|

|

10.0 |

% |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash dividends |

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

- |

|

|

- |

|

| |

Shareholders' equity |

|

|

10.90 |

|

|

|

10.56 |

|

|

|

10.71 |

|

|

3.2 |

% |

|

1.8 |

% |

| |

Shareholders' equity (tangible) |

|

|

8.08 |

|

|

|

7.82 |

|

|

|

7.94 |

|

|

3.3 |

% |

|

1.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average shares (basic) |

|

|

189,467 |

|

|

|

196,299 |

|

|

|

191,577 |

|

|

(3.5 |

%) |

|

(1.1 |

%) |

| |

Weighted average shares (diluted) |

|

|

190,489 |

|

|

|

197,217 |

|

|

|

192,658 |

|

|

(3.4 |

%) |

|

(1.1 |

%) |

| |

Shares outstanding, end of period |

|

|

188,850 |

|

|

|

195,276 |

|

|

|

192,652 |

|

|

(3.3 |

%) |

|

(2.0 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED FINANCIAL RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average assets |

|

|

1.01 |

% |

|

|

0.96 |

% |

|

|

0.99 |

% |

|

|

|

|

|

|

| |

Return on average shareholders' equity |

|

|

8.21 |

% |

|

|

7.67 |

% |

|

|

8.14 |

% |

|

|

|

|

|

|

| |

Return on average shareholders' equity (tangible) |

|

|

11.13 |

% |

|

|

10.43 |

% |

|

|

11.15 |

% |

|

|

|

|

|

|

| |

Net interest margin |

|

|

3.47 |

% |

|

|

3.55 |

% |

|

|

3.48 |

% |

|

|

|

|

|

|

| |

Efficiency ratio |

|

|

63.38 |

% |

|

|

61.78 |

% |

|

|

65.14 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FULTON FINANCIAL CORPORATION |

|

| CONDENSED CONSOLIDATED AVERAGE BALANCE SHEET ANALYSIS

(UNAUDITED) |

|

| dollars in thousands |

|

| |

|

| |

Quarter Ended |

|

| |

March 31, 2014 |

|

|

March 31, 2013 |

|

|

December 31, 2013 |

|

| |

Average Balance |

|

Interest (1) |

|

|

Yield/ Rate |

|

|

Average Balance |

|

|

Interest (1) |

|

|

Yield/ Rate |

|

|

Average Balance |

|

|

Interest (1) |

|

|

Yield/ Rate |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans,

net of unearned income |

$ |

12,762,357 |

|

$ |

134,749 |

|

|

4.28 |

% |

|

$ |

12,257,280 |

|

|

$ |

136,948 |

|

|

4.53 |

% |

|

$ |

12,792,566 |

|

|

$ |

138,336 |

|

|

4.29 |

% |

| |

Taxable investment securities |

|

2,257,773 |

|

|

13,266 |

|

|

2.35 |

% |

|

|

2,421,178 |

|

|

|

13,397 |

|

|

2.22 |

% |

|

|

2,289,672 |

|

|

|

13,431 |

|

|

2.35 |

% |

| |

Tax-exempt investment securities |

|

279,278 |

|

|

3,613 |

|

|

5.17 |

% |

|

|

292,118 |

|

|

|

3,814 |

|

|

5.22 |

% |

|

|

283,799 |

|

|

|

3,574 |

|

|

5.04 |

% |

| |

Equity

securities |

|

33,922 |

|

|

429 |

|

|

5.11 |

% |

|

|

44,371 |

|

|

|

510 |

|

|

4.64 |

% |

|

|

33,887 |

|

|

|

413 |

|

|

4.83 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Investment Securities |

|

2,570,973 |

|

|

17,308 |

|

|

2.70 |

% |

|

|

2,757,667 |

|

|

|

17,721 |

|

|

2.57 |

% |

|

|

2,607,358 |

|

|

|

17,418 |

|

|

2.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans

held for sale |

|

13,426 |

|

|

134 |

|

|

4.00 |

% |

|

|

47,885 |

|

|

|

495 |

|

|

4.14 |

% |

|

|

20,059 |

|

|

|

290 |

|

|

5.78 |

% |

| |

Other

interest-earning assets |

|

258,803 |

|

|

882 |

|

|

1.36 |

% |

|

|

190,576 |

|

|

|

429 |

|

|

0.90 |

% |

|

|

263,478 |

|

|

|

737 |

|

|

1.12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Interest-earning Assets |

|

15,605,559 |

|

|

153,073 |

|

|

3.97 |

% |

|

|

15,253,408 |

|

|

|

155,593 |

|

|

4.13 |

% |

|

|

15,683,461 |

|

|

|

156,781 |

|

|

3.98 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash

and due from banks |

|

199,641 |

|

|

|

|

|

|

|

|

|

202,507 |

|

|

|

|

|

|

|

|

|

|

212,463 |

|

|

|

|

|

|

|

|

| |

Premises and equipment |

|

226,295 |

|

|

|

|

|

|

|

|

|

226,466 |

|

|

|

|

|

|

|

|

|

|

226,955 |

|

|

|

|

|

|

|

|

| |

Other

assets |

|

1,032,071 |

|

|

|

|

|

|

|

|

|

1,071,440 |

|

|

|

|

|

|

|

|

|

|

1,008,304 |

|

|

|

|

|

|

|

|

| |

Less:

allowance for loan losses |

|

(203,201) |

|

|

|

|

|

|

|

|

|

(227,858 |

) |

|

|

|

|

|

|

|

|

|

(210,636 |

) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Assets |

$ |

16,860,365 |

|

|

|

|

|

|

|

|

$ |

16,525,963 |

|

|

|

|

|

|

|

|

|

$ |

16,920,547 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Demand

deposits |

$ |

2,945,211 |

|

$ |

909 |

|

|

0.13 |

% |

|

$ |

2,705,835 |

|

|

$ |

877 |

|

|

0.13 |

% |

|

$ |

2,966,994 |

|

|

$ |

969 |

|

|

0.13 |

% |

| |

Savings deposits |

|

3,351,871 |

|

|

1,035 |

|

|

0.13 |

% |

|

|

3,334,305 |

|

|

|

1,023 |

|

|

0.12 |

% |

|

|

3,410,030 |

|

|

|

1,042 |

|

|

0.12 |

% |

| |

Time

deposits |

|

2,932,456 |

|

|

5,952 |

|

|

0.82 |

% |

|

|

3,321,309 |

|

|

|

8,501 |

|

|

1.04 |

% |

|

|

2,965,604 |

|

|

|

6,117 |

|

|

0.82 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Interest-bearing Deposits |

|

9,229,538 |

|

|

7,896 |

|

|

0.35 |

% |

|

|

9,361,449 |

|

|

|

10,401 |

|

|

0.45 |

% |

|

|

9,342,628 |

|

|

|

8,128 |

|

|

0.35 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Short-term borrowings |

|

1,208,953 |

|

|

633 |

|

|

0.21 |

% |

|

|

1,032,122 |

|

|

|

509 |

|

|

0.20 |

% |

|

|

1,099,709 |

|

|

|

520 |

|

|

0.19 |

% |

| |

FHLB

advances and long-term debt |

|

883,532 |

|

|

10,698 |

|

|

4.88 |

% |

|

|

891,173 |

|

|

|

10,768 |

|

|

4.87 |

% |

|

|

888,378 |

|

|

|

10,857 |

|

|

4.87 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Interest-bearing Liabilities |

|

11,322,023 |

|

|

19,227 |

|

|

0.69 |

% |

|

|

11,284,744 |

|

|

|

21,678 |

|

|

0.78 |

% |

|

|

11,330,715 |

|

|

|

19,505 |

|

|

0.68 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Demand

deposits |

|

|

3,243,424 |

|

|

|

|

|

|

|

|

|

2,968,777 |

|

|

|

|

|

|

|

|

|

|

3,318,073 |

|

|

|

|

|

|

|

|

| |

Other |

|

|

232,004 |

|

|

|

|

|

|

|

|

|

198,944 |

|

|

|

|

|

|

|

|

|

|

221,010 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Liabilities |

|

|

14,797,451 |

|

|

|

|

|

|

|

|

|

14,452,465 |

|

|

|

|

|

|

|

|

|

|

14,869,798 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

|

|

2,062,914 |

|

|

|

|

|

|

|

|

|

2,073,498 |

|

|

|

|

|

|

|

|

|

|

2,050,749 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Liabilities and Shareholders' Equity |

$ |

|

16,860,365 |

|

|

|

|

|

|

|

|

$ |

16,525,963 |

|

|

|

|

|

|

|

|

|

$ |

16,920,547 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest income/net interest margin (fully taxable

equivalent) |

|

|

|

|

|

133,846 |

|

|

3.47 |

% |

|

|

|

|

|

|

133,915 |

|

|

3.55 |

% |

|

|

|

|

|

|

137,276 |

|

|

3.48 |

% |

| |

Tax

equivalent adjustment |

|

|

|

|

|

(4,281 |

) |

|

|

|

|

|

|

|

|

|

(4,271 |

) |

|

|

|

|

|

|

|

|

|

(4,324 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net

interest income |

|

|

|

|

$ |

129,565 |

|

|

|

|

|

|

|

|

|

$ |

129,644 |

|

|

|

|

|

|

|

|

|

$ |

132,952 |

|

|

|

|

| |

|

(1) Presented on a tax-equivalent basis using a 35%

Federal tax rate and statutory interest expense

disallowances. |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE LOANS, DEPOSITS AND SHORT-TERM BORROWINGS

DETAIL: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Quarter Ended |

|

% Change from |

|

| |

|

|

March 31 |

|

|

March 31 |

|

|

December 31 |

|

March 31 |

|

|

December 31 |

|

| |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

2013 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

| Loans, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Real

estate - commercial mortgage |

|

$ |

5,085,128 |

|

$ |

4,666,494 |

|

$ |

5,065,963 |

|

9.0 |

% |

|

0.4 |

% |

| |

Commercial - industrial, financial and agricultural |

|

|

3,637,075 |

|

|

3,662,566 |

|

|

3,639,690 |

|

(0.7 |

%) |

|

(0.1 |

%) |

| |

Real

estate - home equity |

|

|

1,755,346 |

|

|

1,662,173 |

|

|

1,774,919 |

|

5.6 |

% |

|

(1.1 |

%) |

| |

Real

estate - residential mortgage |

|

|

1,336,323 |

|

|

1,283,168 |

|

|

1,331,987 |

|

4.1 |

% |

|

0.3 |

% |

| |

Real

estate - construction |

|

|

576,346 |

|

|

591,338 |

|

|

581,306 |

|

(2.5 |

%) |

|

(0.9 |

%) |

| |

Consumer |

|

|

274,910 |

|

|

305,480 |

|

|

287,245 |

|

(10.0 |

%) |

|

(4.3 |

%) |

| |

Leasing and other |

|

|

97,229 |

|

|

86,061 |

|

|

111,456 |

|

13.0 |

% |

|

(12.8 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Loans, net of unearned income |

|

$ |

12,762,357 |

|

$ |

12,257,280 |

|

$ |

12,792,566 |

|

4.1 |

% |

|

(0.2 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest-bearing demand |

|

$ |

3,243,424 |

|

$ |

2,968,777 |

|

$ |

3,318,073 |

|

9.3 |

% |

|

(2.2 |

%) |

| |

Interest-bearing demand |

|

|

2,945,211 |

|

|

2,705,835 |

|

|

2,966,994 |

|

8.8 |

% |

|

(0.7 |

%) |

| |

Savings deposits |

|

|

3,351,871 |

|

|

3,334,305 |

|

|

3,410,030 |

|

0.5 |

% |

|

(1.7 |

%) |

| |

Time

deposits |

|

|

2,932,456 |

|

|

3,321,309 |

|

|

2,965,604 |

|

(11.7 |

%) |

|

(1.1 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Deposits |

|

$ |

12,472,962 |

|

$ |

12,330,226 |

|

$ |

12,660,701 |

|

1.2 |

% |

|

(1.5 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings, by type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Customer repurchase agreements |

|

$ |

187,362 |

|

$ |

165,109 |

|

$ |

196,997 |

|

13.5 |

% |

|

(4.9 |

%) |

| |

Customer short-term promissory notes |

|

|

102,000 |

|

|

112,041 |

|

|

93,986 |

|

(9.0 |

%) |

|

8.5 |

% |

| |

Federal funds purchased |

|

|

416,230 |

|

|

709,779 |

|

|

408,726 |

|

(41.4 |

%) |

|

1.8 |

% |

| |

Short-term FHLB advances and other borrowings |

|

|

503,361 |

|

|

45,193 |

|

|

400,000 |

|

N/M |

|

|

25.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total

Short-term Borrowings |

|

$ |

1,208,953 |

|

$ |

1,032,122 |

|

$ |

1,099,709 |

|

17.1 |

% |

|

9.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| N/M - Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

| FULTON FINANCIAL CORPORATION |

| ASSET QUALITY INFORMATION (UNAUDITED) |

| dollars in thousands |

| |

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

| |

|

Mar 31 |

|

|

Mar 31 |

|

|

Dec 31 |

| |

|

2014 |

|

|

2013 |

|

|

2013 |

| ALLOWANCE FOR CREDIT LOSSES: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Balance at beginning of period |

|

$ |

204,917 |

|

|

$ |

225,439 |

|

|

$

212,838 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Loans charged off: |

|

|

|

|

|

|

|

|

|

|

| |

|

Commercial - industrial, financial and agricultural |

|

|

(5,125 |

) |

|

|

(9,502 |

) |

|

(5,527) |

| |

|

Consumer and home equity |

|

|

(2,402 |

) |

|

|

(2,954 |

) |

|

(1,879) |

| |

|

Real

estate - commercial mortgage |

|

|

(1,386 |

) |

|

|

(4,133 |

) |

|

(7,779) |

| |

|

Real

estate - residential mortgage |

|

|

(846 |

) |

|

|

(3,050 |

) |

|

(1,423) |

| |

|

Real

estate - construction |

|

|

(214 |

) |

|

|

(1,986 |

) |

|

(1,391) |

| |

|

Leasing and other |

|

|

(295 |

) |

|

|

(481 |

) |

|

(616) |

| |

|

Total

loans charged off |

|

|

(10,268 |

) |

|

|

(22,106 |

) |

|

(18,615) |

| |

Recoveries of loans previously charged off: |

|

|

|

|

|

|

|

|

|

|

| |

|

Commercial - industrial, financial and agricultural |

|

|

744 |

|

|

|

379 |

|

|

5,851 |

| |

|

Consumer and home equity |

|

|

565 |

|

|

|

837 |

|

|

451 |

| |

|

Real

estate - commercial mortgage |

|

|

44 |

|

|

|

1,064 |

|

|

740 |

| |

|

Real

estate - residential mortgage |

|

|

116 |

|

|

|

81 |

|

|

106 |

| |

|

Real

estate - construction |

|

|

224 |

|

|

|

671 |

|

|

888 |

| |

|

Leasing and other |

|

|

164 |

|

|

|

162 |

|

|

158 |

| |

|

Recoveries of loans previously charged off |

|

|

1,857 |

|

|

|

3,194 |

|

|

8,194 |

| |

Net loans charged off |

|

|

(8,411 |

) |

|

|

(18,912 |

) |

|

(10,421) |

| |

Provision for credit losses |

|

|

2,500 |

|

|

|

15,000 |

|

|

2,500 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Balance at end of period |

|

$ |

199,006 |

|

|

$ |

221,527 |

|

|

$ 204,917 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Net charge-offs to average loans (annualized) |

|

|

0.26 |

% |

|

|

0.62 |

% |

|

0.33% |

| |

|

|

|

|

|

|

|

|

|

|

| NON-PERFORMING ASSETS: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Non-accrual loans |

|

$ |

133,705 |

|

|

$ |

179,334 |

|

|

$

133,753 |

| |

Loans 90 days past due and accruing |

|

|

21,225 |

|

|

|

29,325 |

|

|

20,524 |

| |

|

Total

non-performing loans |

|

|

154,930 |

|

|

|

208,659 |

|

|

154,277 |

| |

Other real estate owned |

|

|

15,300 |

|

|

|

23,820 |

|

|

15,052 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total non-performing assets |

|

$ |

170,230 |

|

|

$ |

232,479 |

|

|

$ 169,329 |

| |

|

|

|

|

|

|

|

|

|

|

| NON-PERFORMING LOANS, BY TYPE: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Real estate - commercial mortgage |

|

$ |

45,876 |

|

|

$ |

58,805 |

|

|

$

44,068 |

| |

Commercial - industrial, financial and

agricultural |

|

|

38,830 |

|

|

|

61,113 |

|

|

38,021 |

| |

Real estate - residential mortgage |

|

|

29,305 |

|

|

|

36,361 |

|

|

31,347 |

| |

Real estate - construction |

|

|

20,758 |

|

|

|

31,919 |

|

|

21,267 |

| |

Consumer and home equity |

|

|

20,087 |

|

|

|

20,250 |

|

|

19,526 |

| |

Leasing |

|

|

74 |

|

|

|

211 |

|

|

48 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total non-performing loans |

|

$ |

154,930 |

|

|

$ |

208,659 |

|

|

$ 154,277 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| TROUBLED DEBT RESTRUCTURINGS (TDRs), BY TYPE: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Real-estate - residential mortgage |

|

$ |

30,363 |

|

|

$ |

33,095 |

|

|

$

28,815 |

| |

Real-estate - commercial mortgage |

|

|

19,514 |

|

|

|

28,421 |

|

|

19,758 |

| |

Real estate - construction |

|

|

8,430 |

|

|

|

11,125 |

|

|

10,117 |

| |

Commercial - industrial, financial and

agricultural |

|

|

6,755 |

|

|

|

9,031 |

|

|

8,045 |

| |

Consumer and home equity |

|

|

2,622 |

|

|

|

1,549 |

|

|

1,376 |

| |

Total accruing TDRs |

|

|

67,684 |

|

|

|

83,221 |

|

|

68,111 |

| |

Non-accrual TDRs (1) |

|

|

27,487 |

|

|

|

33,215 |

|

|

30,209 |

| |

Total TDRs |

|

$ |

95,171 |

|

|

$ |

116,436 |

|

|

$ 98,320 |

| |

|

|

|

|

|

|

|

|

|

|

| (1) Included within non-accrual loans above. |

| |

| DELINQUENCY RATES, BY TYPE: |

| |

| |

|

March 31, 2014 |

|

March 31, 2013 |

|

December 31, 2013 |

| |

|

31-89 Days |

|

> than or = to 90 Days (2) |

|

Total |

|

31-89 Days |

|

> than or = to 90 Days (2) |

|

Total |

|

31-89 Days |

|

> than or = to 90 Days (2) |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Real estate - commercial mortgage |

|

0.35% |

|

0.89% |

|

1.24% |

|

0.39% |

|

1.25% |

|

1.64% |

|

0.38% |

|

0.87% |

|

1.25% |

| |

Commercial - industrial, financial and agricultural |

|

0.33% |

|

1.09% |

|

1.42% |

|

0.35% |

|

1.67% |

|

2.02% |

|

0.30% |

|

1.04% |

|

1.34% |

| |

Real estate - construction |

|

0.43% |

|

3.55% |

|

3.98% |

|

0.17% |

|

5.34% |

|

5.51% |

|

0.11% |

|

3.71% |

|

3.82% |

| |

Real estate - residential mortgage |

|

1.53% |

|

2.20% |

|

3.73% |

|

2.07% |

|

2.79% |

|

4.86% |

|

1.74% |

|

2.34% |

|

4.08% |

| |

Consumer, home equity, leasing and other |

|

0.89% |

|

0.96% |

|

1.85% |

|

0.82% |

|

0.98% |

|

1.80% |

|

1.10% |

|

0.91% |

|

2.01% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

|

0.56% |

|

1.22% |

|

1.78% |

|

0.62% |

|

1.68% |

|

2.30% |

|

0.61% |

|

1.20% |