Current Report Filing (8-k)

April 22 2014 - 11:54AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 18, 2014

LAMAR ADVERTISING COMPANY

LAMAR MEDIA CORP.

(Exact name of registrants as specified in their charters)

|

|

|

|

|

| Delaware |

|

0-30242 |

|

72-1449411 |

| Delaware |

|

1-12407 |

|

72-1205791 |

| (States or other jurisdictions

of incorporation) |

|

(Commission

File Numbers) |

|

(IRS Employer

Identification Nos.) |

5321 Corporate Boulevard, Baton Rouge, Louisiana 70808

(Address of principal executive offices and zip code)

(225) 926-1000

(Registrants’ telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On April 18, 2014, Lamar Media Corp. (“Lamar Media”), a wholly owned subsidiary of Lamar Advertising Company (“Lamar Advertising” or

the “Company”), entered into Amendment No. 1 to the Second Amended and Restated Credit Agreement (the “Amendment”) with Lamar Advertising, certain of Lamar Media’s subsidiaries as Guarantors, JPMorgan Chase Bank, N.A.

as Administrative Agent and the Lenders named therein under which the parties agreed to amend Lamar Media’s existing senior credit facility on the terms set forth in the Amendment. The Amendment creates a new $300 million Term A Loan facility

(the “Term A Loans”) and certain other amendments to the senior credit agreement. The Term A Loans are not incremental loans and do not reduce the existing $500 million Incremental Loan facility. Lamar Media borrowed all $300 million in

Term A Loans on April 18, 2014. The net loan proceeds, together with borrowings under the revolving portion of the senior credit facility and cash on hand, were used to fund the redemption of all $400 million in aggregate principal amount of

Lamar Media’s 7 7/8% Senior Subordinated Notes due 2018 on April 21, 2014.

The Term A Loans mature on February 2, 2019 and will begin

amortizing on June 30, 2014 in quarterly installments paid on such date and on each September 30, December 31, March 31 and June 30 thereafter, as follows:

|

|

|

|

|

| Principal Payment Date |

|

Principal Amount |

|

| June 30, 2014- March 31, 2016 |

|

$ |

3,750,000 |

|

| June 30, 2016- March 31, 2017 |

|

$ |

5,625,000 |

|

| June 30, 2017- December 31, 2018 |

|

$ |

11,250,000 |

|

| Term A Loan Maturity Date |

|

$ |

168,750,000 |

|

The Term A Loans shall bear interest at rates based on the Adjusted LIBO Rate (“Eurodollar Term A Loans”) or the

Adjusted Base Rate (“Base Rate Term A Loans”), at Lamar Media’s option. Eurodollar Term A Loans shall bear interest at a rate per annum equal to the Adjusted LIBO Rate plus 2.00% (or the Adjusted LIBO Rate plus 1.75% at any time

the Total Debt Ratio is less than or equal to 3.00 to 1). Base Rate Term A Loans shall bear interest at a rate per annum equal to the Adjusted Base Rate plus 1.00% (or the Adjusted Base Rate plus 0.75% at any time the Total Debt Ratio is less

than or equal to 3.00 to 1). The guarantees, covenants, events of default and other terms of the Second Amended and Restated Credit Agreement apply to the Term A Loans.

The foregoing description of the Amendment is qualified in its entirety by reference to the complete text of the Amendment, which is filed as Exhibit 10.1 to

this report and incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

Please refer to the discussion under Item 1.01 above, which is incorporated under this Item 2.03 by

reference.

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Amendment No. 1 dated April 18, 2014 to the Second Restatement Agreement, as amended and restated as of February 3, 2014 and as further amended on April 18, 2014, by and among Lamar Media Corp., Lamar Advertising Company, the

Subsidiary Guarantors named therein, the Lenders named therein, and JPMorgan Chase Bank, N.A., as Administrative Agent (including the Second Amended and Restated Credit Agreement as amended through April 18, 2014 as Exhibit A

thereto). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: April 22, 2014 |

|

|

|

LAMAR ADVERTISING COMPANY |

|

|

|

|

|

|

|

|

By: |

|

/s/ Keith A. Istre |

|

|

|

|

|

|

Keith A. Istre |

|

|

|

|

|

|

Treasurer and Chief Financial Officer |

|

|

|

| Date: April 22, 2014 |

|

|

|

LAMAR MEDIA CORP. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Keith A. Istre |

|

|

|

|

|

|

Keith A. Istre |

|

|

|

|

|

|

Treasurer and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Amendment No. 1 dated April 18, 2014 to the Second Restatement Agreement, as amended and restated as of February 3, 2014 and as further amended on April 18, 2014, by and among Lamar Media Corp., Lamar Advertising Company, the

Subsidiary Guarantors named therein, the Lenders named therein, and JPMorgan Chase Bank, N.A., as Administrative Agent (including the Second Amended and Restated Credit Agreement as amended through April 18, 2014 as Exhibit A

thereto). |

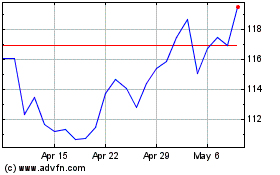

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

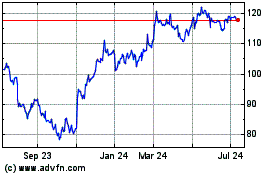

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Apr 2023 to Apr 2024