Falco Pacific Files NI 43-101 Technical Report on Horne 5 Deposit

April 18 2014 - 1:41AM

Marketwired Canada

Falco Pacific Resource Group Inc. ("Falco Pacific" or the "Company") (TSX

VENTURE:FPC) is pleased to announce that it has filed a technical report in

accordance with National Instrument 43-101, entitled, "Technical Report and

Mineral Resource Estimate for the Horne 5 Deposit" (the "Technical Report") with

Canadian securities regulators, pursuant to the Company's news release dated

March 4, 2014. The report documents an initial mineral resource estimate for the

upper portion of the Company's 100% owned Horne 5 deposit in Rouyn-Noranda,

Quebec. The Technical Report is available at www.sedar.com and on the Company's

website.

About Falco Pacific Resource Group

Founded in 2012 with the acquisition of the 728 square kilometre Rouyn Noranda

Project in Quebec, Falco Pacific is led by a veteran exploration team and is

uniquely positioned as it prepares to move from compilation to active

exploration and optimization of its extensive and very well positioned asset

basket.

For more information, please go to www.falcopacific.com.

On behalf of the Board of Directors of

FALCO PACIFIC RESOURCE GROUP

"Michael Byron"

Vice President, Exploration

Cautionary Notes

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking

information (together, "forward-looking statements") within the meaning of

applicable securities laws and the United States Private Securities Litigation

Reform Act of 1995. All statements, other than statements of historical fact,

included herein including, without limitation, statements regarding the

anticipated content, commencement and cost of exploration programs and work with

respect to the historical data on the Horne 5 deposit, anticipated exploration

program results, the discovery and delineation of mineral

deposits/resources/reserves, metal price assumptions, the ability of the Company

to optimize the value of the Horne 5 deposit and to outline the economic

parameters for any potential development of Horne 5 and several nearby deposits,

the ability of the Company to add other nearby unmined and remnant deposits to

the Company's current model, the ability of the Company to continue low cost,

high impact growth, the potential for any production decision to be made in

respect of the Horne 5 deposit, the potential for any mining at or mineral

production from Horne 5 or any surrounding deposits, the potential for the

identification of multiple deposits surrounding Horne 5, business and financing

plans and business trends. Information concerning mineral resource estimates may

also be deemed to be forward-looking statements in that it reflects a prediction

of the mineralization that would be encountered, and the results of mining it,

if a mineral deposit were developed and mined. Generally, forward-looking

information can be identified by the use of terminology such as "plans",

"expects", "estimates", "intends", "anticipates", "believes" or variations of

such words, or statements that certain actions, events or results "may",

"could", "would", "might", "will be taken", "occur" or "be achieved".

Forward-looking statements involve risks, uncertainties and other factors that

could cause actual results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially from these

forward-looking statements include those risks set out in the Company's public

documents filed on SEDAR at www.sedar.com. Although the Company believes that

the assumptions and factors used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these statements, which only

apply as of the date of this news release, and no assurance can be given that

such events will occur in the disclosed times frames or at all. Except where

required by law, the Company disclaims any intention or obligation to update or

revise any forward-looking statement, whether as a result of new information,

future events or otherwise.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI

43-101") is a rule developed by the Canadian Securities Administrators which

establishes standards for all public disclosure an issuer makes of scientific

and technical information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by reference in

this press release have been prepared in accordance with NI 43-101 and the

guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum

(the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the

CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology

of NI 43-101 and the CIM Standards differ significantly from the requirements

and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC

Industry Guide 7"). Accordingly, the Company's disclosures regarding

mineralization may not be comparable to similar information disclosed by

companies subject to SEC Industry Guide 7. Without limiting the foregoing, while

the terms "mineral resources", "inferred mineral resources", "indicated mineral

resources" and "measured mineral resources" are recognized and required by NI

43-101 and the CIM Standards, they are not recognized by the SEC and are not

permitted to be used in documents filed with the SEC by companies subject to SEC

Industry Guide 7. Mineral resources which are not mineral reserves do not have

demonstrated economic viability, and US investors are cautioned not to assume

that all or any part of a mineral resource will ever be converted into reserves.

Further, inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or economically. It cannot

be assumed that all or any part of the inferred resources will ever be upgraded

to a higher resource category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of a feasibility study or

prefeasibility study, except in rare cases. The SEC normally only permits

issuers to report mineralization that does not constitute SEC Industry Guide 7

compliant "reserves" as in-place tonnage and grade without reference to unit

amounts. The term "contained ounces" is not permitted under the rules of SEC

Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a

"reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry

Guide 7, a mineral reserve is defined as a part of a mineral deposit which could

be economically and legally extracted or produced at the time the mineral

reserve determination is made, and a "final" or "bankable" feasibility study is

required to report reserves, the three-year historical price is used in any

reserve or cash flow analysis of designated reserves and the primary

environmental analysis or report must be filed with the appropriate governmental

authority.

Caution Regarding Adjacent or Similar Mineral Properties

This news release contains information with respect to adjacent or similar

mineral properties in respect of which the Company has no interest or rights to

explore or mine. The Company advises US investors that the mining guidelines of

the US Securities and Exchange Commission (the "SEC") set forth in the SEC's

Industry Guide 7 ("SEC Industry Guide 7") strictly prohibit information of this

type in documents filed with the SEC. Readers are cautioned that the Company has

no interest in or right to acquire any interest in any such properties, and that

mineral deposits on adjacent or similar properties, and any production therefrom

or economics with respect thereto, are not indicative of mineral deposits on the

Company's properties or the potential production from, or cost or economics of,

any future mining of any of the Company's mineral properties.

This press release is not, and is not to be construed in any way as, an offer to

buy or sell securities in the United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mr. Dean Linden

Business Development

Falco Pacific Resource Group

Ph: 1.425.449.9442

info@falcopacific.com

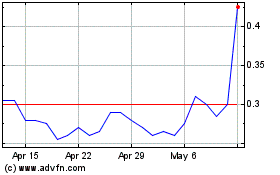

Falco Resources (TSXV:FPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

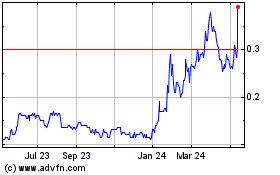

Falco Resources (TSXV:FPC)

Historical Stock Chart

From Apr 2023 to Apr 2024