Earnings Outlook is the Key Factor - Ahead of Wall Street

April 15 2014 - 10:00AM

Zacks

Tuesday, April 15,

2014

The benign inflation reading and a soft Empire State manufacturing

survey are the only notable economic reports today. But the focus

remains on the Q1 earnings season and on that front the market will

likely find today’s positive-looking Coca Cola

(KO) and Johnson & Johnson (JNJ) reports as

reassuring enough.

Both Coca Cola and Johnson & Johnson were able to come ahead of

top-line expectations, even though Coke was barely able to meet

lowered EPS expectations. Including this morning’s reports, we now

have Q1 results from 35 S&P 500 members that combined account

for 10.8% of the index’s total market capitalization. The scorecard

at this stage shows total earnings growth +3.1% on +1.4% higher

revenues, with 60% beating EPS expectations and 40% coming ahead of

top-line expectations.

Hard to draw any conclusions at this early stage, but except for

the earnings beat ratio, performance on the other three metrics is

weaker than what we have seen thus far from the same group of

companies. The modestly improved earnings beat ratio at this

admittedly earlier stage could mean that the lowered estimates have

provided an easy-to-beat hurdle rate, as we saw with the Coke

report this morning. Intel (INTC),

Yahoo (YHOO) and CSX Corp (CSX)

will report after the close today.

We saw more negative estimates revisions ahead of the start of the

Q1 earnings season than was typically the case in other recent

quarters. As with economic data, weather was likely a factor in the

greater magnitude of estimate cuts. The flip side of lowered

estimates is that it sets us up for more frequent positive

surprises this quarter.

But beat ratios have far less

informational value than forward guidance. It will be instructive

if we will see any change in the persistently negative guidance

trend of the last many quarters this time around. My sense is that

it will be very hard for the stock market to get its mojo back

unless the earnings outlook improves.

Sheraz Mian

Director of Research

CSX CORP (CSX): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

COCA COLA CO (KO): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

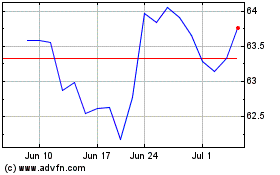

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024