AGCO Shows Stability on Fundamentals - Analyst Blog

April 08 2014 - 9:50AM

Zacks

On Apr 3, 2014, we issued an updated research report on

AGCO Corporation (AGCO). This manufacturer of

agricultural equipment reported fourth-quarter 2013 adjusted

earnings of $1.40 per share, which improved 41% year over year and

came ahead of the Zacks Consensus Estimate.

The company remains committed to its plans of expanding in the

Commonwealth of Independent States (CIS), China and Africa. Last

year, AGCO entered into a 50-50 joint venture (JV) with Russian

Machines to manufacture and distribute agricultural equipment and

replacement parts in Russia.

Further, the company plans to invest in production facilities in

China over the next 15 years. AGCO intends to widen its presence in

Africa and has $100 million of investment in pipeline for the

coming years.

Additionally, the company’s efforts to enhance shareholders’ value

was evident when a 10% hike in the quarterly payout was announced

in Jan 2014. Moreover, AGCO increased its share repurchase program

to $500 million, which will likely be complete over the next 18

months. The company will continue investing for driving growth and

profitability with additional investments in plants and new

products. It will also target another strong year of solid free

cash flow for 2014.

For 2014, AGCO expects GSI sales to be up 10%–15% from 2013, with

most of the growth occurring outside the U.S. The countercyclical

nature of the protein production sector supports more stable

earnings in GSI. In the long term, an increase in the world’s

population and change in diet are expected to create demand for

additional grain storage and protein production capacity.

However, AGCO reiterated its full-year 2014 earnings per share

guidance of $6.00, which reflects a 0.2% year-over-year dip. The

company also cautioned that a fall in commodity prices in 2014 as

compared to 2013 will lead to reduced farm income and softer

industry demand across the developed agricultural equipment

markets. AGCO is projecting net sales in the range of $10.8 billion

to $11.0 billion for 2014, relatively flat as compared with 2013.

The guidance includes the impact of softer market conditions.

In addition, product demand is expected to fall in the near term

due to decrease in farm income and crop prices as well as a less

favorable renewable fuel standard (RFS). Notably, the RFS is likely

to drag the demand for corn, thereby lowering the need for

agricultural equipment as well. The company also anticipates rise

in market development expenses and engineering expenditures (for

meeting Tier 4 final emission requirements) to continue weighing on

margins.

Furthermore, the absence of an extension of current depreciation

tax benefits beyond 2013 (in the U.S.) and potential FINAME

borrowing cost increases (in Brazil) could pressure AGCO’s

earnings.

AGCO currently carries a Zacks Rank #4 (Sell).

Other Stocks to Consider

Some better-ranked machinery makers worth consideration include

Alamo Group, Inc. (ALG), Broadwind Energy,

Inc. (BWEN) and Altra Industrial Motion

Corp. (AIMC). All of these have a Zacks Rank #2 (Buy).

AGCO CORP (AGCO): Free Stock Analysis Report

ALTRA HOLDINGS (AIMC): Free Stock Analysis Report

ALAMO GROUP INC (ALG): Free Stock Analysis Report

BROADWIND ENRGY (BWEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

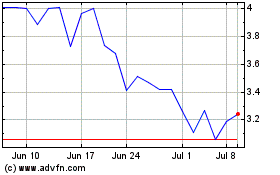

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

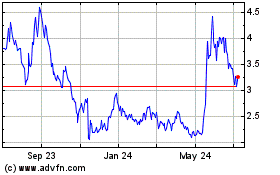

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024