UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1/A

AMENDMENT NO. 5 TO

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

THE ALKALINE WATER COMPANY

INC.

(Exact name of registrant as specified in its

charter)

Nevada

(State or other jurisdiction of

incorporation or organization)

2080

(Primary Standard Industrial

Classification Code Number)

99-0367049

(I.R.S. Employr

Identification Number)

7730 E Greenway Road Ste. 203

Scottsdale, AZ

85260

Telephone: (480) 656-2423

(Address,

including zip code, and telephone number,

including area code, of

registrant’s principal executive offices)

InCorp Services, Inc.

2360 Corporate Circle Ste.

400

Henderson, NV 89074-7722

Telephone: (702)

866-2500

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copy of Communications To:

Clark Wilson LLP

Suite 900 - 885 West Georgia Street

Vancouver, British

Columbia V6C 3H1, Canada

Telephone: (604) 687-5700

Attention: Mr. Virgil Z. Hlus

As soon as practicable

after the effective date of this registration statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. [

]

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated

filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated

filer [

]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

(Do not check if a smaller reporting company)

|

|

Calculation of Registration Fee

Title of Each Class

of Securities to be

Registered

|

Amount to be

Registered

(1)

|

Proposed Maximum

Offering Price

Per Share

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

|

Common stock

|

|

|

$10,000,000

(2)

|

$1,288.00

(6)

|

|

Warrants to purchase shares of common stock

|

|

Shares of common stock issuable upon exercise of the

warrants

|

|

|

$7,500,000

(2)

|

$966.00

(6)

|

|

Common stock to be offered for resale by selling

stockholders

|

5,488,375

(3)

|

$0.38

(4),(5)

|

$2,085,582.50

(4),(5)

|

$268.62

(5),(6)

|

|

Total

|

|

|

$19,585,582.50

|

$2,522.62

(6)

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933,

there is also being registered hereby such indeterminate number of

additional shares of common stock of The Alkaline Water Company Inc. as

may be issued or issuable because of stock splits, stock dividends, stock

distributions, and similar transactions.

|

|

|

|

|

(2)

|

Estimated solely for the purpose of calculating the

amount of the registration fee in accordance with Rule 457(o) under the

Securities Act of 1933.

|

|

|

|

|

(3)

|

Consists of (i) up to 2,000,002 shares of common stock

that may be issued upon conversion of shares of 10% Series B Convertible

Preferred Stock and (ii) up to 3,488,373 shares of common stock that may

be issued upon exercise of warrants.

|

|

|

|

|

(4)

|

Estimated solely for the purpose of calculating the

amount of the registration fee in accordance with Rule 457(c) under the

Securities Act of 1933.

|

|

|

|

|

(5)

|

Based on the closing price per share ($0.38) for The Alkaline Water Company Inc.’s common stock on November 26, 2013, as reported by Financial Industry Regulatory Authority’s OTC Bulletin Board.

|

|

|

|

|

(6)

|

Previously paid.

|

The registrant hereby amends this registration statement on

such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933 or until the

registration statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to said Section 8(a), may determine.

ii

Explanatory Note

This registration statement contains a prospectus to be used in

connection with the public offering of shares and warrants of The Alkaline Water

Company Inc. (the

“Public Offering Prospectus”

). In addition, The

Alkaline Water Company Inc. is contractually obligated to register for resale

the shares of its common stock that may be issued upon the conversion of

outstanding 10% Series B Convertible Preferred Stock and exercise of outstanding

Series A, B and C Common Stock Purchase Warrants) (the

“Registrable

Securities”

) held by selling stockholders. Consequently, this registration

statement contains a second prospectus to cover the resale of the Registrable

Securities (the

“Resale Prospectus”

) by the selling stockholders named in

the Resale Prospectus (the

“Selling Stockholders”

). The Public Offering

Prospectus and the Resale Prospectus are substantively identical, except for the

following principal differences:

-

they contain different outside and inside front covers;

-

they contain different The Offering sections in the Prospectus Summary

section;

-

the Risks Related to This Offering section is deleted from the Resale

Prospectus;

-

they contain different Use of Proceeds sections;

-

the Determination of Offering Price section is deleted from the Resale

Prospectus;

-

the Dilution section is deleted from the Resale Prospectus;

-

the Private Placement section is included in the Resale Prospectus;

-

the Selling Stockholder section is included in the Resale Prospectus;

-

they contain different Plan of Distribution sections; and

-

they contain different outside back covers.

The Alkaline Water Company Inc. has included in this

registration statement, after the outside back cover of the Public Offering

Prospectus, alternate sections to reflect the foregoing differences.

iii

|

The information in this prospectus is not complete and

may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective.

This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer

or sale is not permitted.

|

|

Subject to Completion, Dated April 3, 2014

|

|

Prospectus

|

|

The Alkaline Water Company Inc.

|

|

|

|

35,000,000 Shares of Common Stock

|

|

Warrants to Purchase up to 17,500,000 Shares of

Common Stock

|

|

|

|

17,500,000 Shares of Common Stock Underlying the

Warrants

|

|

_____________________________

|

We are offering up to 35,000,000 shares of our common stock and

warrants to purchase up to 17,500,000 shares of our common stock. Each share of

common stock we sell in the offering will be accompanied by a warrant to

purchase one-half of a share of common stock. Each share of common stock and

warrant will be sold at a price of $<>. The common stock and warrants are

immediately separable and will be issued separately. There is no minimum

offering amount required as a condition to closing in this offering, therefore

we are not required to sell any specific dollar amount or number of securities,

but will use our best efforts to sell all of the securities being offered. This

offering will terminate on <>, unless the offering is fully subscribed

before that date or we decide to terminate the offering prior to that date. The

offering price for the common stock and warrants and the exercise price of the

warrants will remain fixed for the duration of the offering.

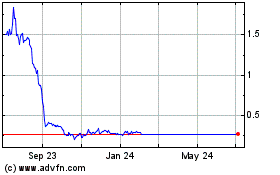

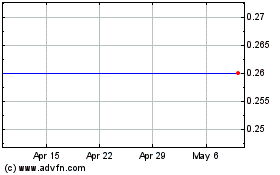

Our common stock is quoted on the OTC Bulletin Board under the

symbol “WTER”. We do not intend to apply for listing of the warrants on any

securities exchange and we do not expect that the warrants will be quoted on the

OTC Bulletin Board. On April 2, 2014, the closing price of our common

stock on the OTC Bulletin Board was $0.2844 per share.

|

|

|

Per Share

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

Offering Price

(1)

|

$

|

<>

|

|

$

|

<>

|

|

|

|

|

|

|

|

|

|

|

Placement Agent’s

Fees

(2)

|

$

|

<>

|

|

$

|

<>

|

|

|

|

|

|

|

|

|

|

|

Offering Proceeds, Before Expenses

|

$

|

<>

|

|

$

|

<>

|

|

|

(1)

|

Per share price represents the offering price for a share

of common stock and a warrant to purchase one-half of a share of common

stock.

|

|

(2)

|

In addition, we have agreed to issue to the placement agent warrants to purchase up to an aggregate of 5.5% of the aggregate number of shares of common stock sold in this offering (excluding any shares of common stock issuable upon exercise of the warrants) and a non-accountable expense allowance equal to the lesser of (i) 1% of the aggregate gross proceeds raised in the offering and (ii) $50,000.

|

H.C. Wainwright & Co., LLC has agreed to act as our exclusive placement agent in connection with this offering. The placement agent is not purchasing the securities offered by us, and is not required to sell any specific number or dollar amount of securities, but will use its reasonable best efforts to sell the securities offered. We have agreed to pay the placement agent a placement fee equal to 8% of the aggregate gross proceeds to us from the sale of common stock and warrants in this offering a and to issue warrants to the placement agent to purchase up to an aggregate of 5.5% of the aggregate number of shares of common stock sold in this offering (excluding any shares of common stock issuable upon exercise of the warrants), provided that, with respect to sales to certain investors in this offering which are identified in our engagement agreement with the placement agent, we shall pay to the placement agent a fee of 5% of the aggregate gross proceeds to us from the sale of common stock and warrants and shall issue warrants to purchase up to 5% of the aggregate number of shares of common stock sold to such investors. We estimate total expenses of this offering, excluding the placement agent fees and expenses, will be approximately $150,000. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. See “Plan of Distribution” beginning on page 15 of this prospectus for more information on this offering and the placement agent arrangements.

Investing in our common stock involves risks. See “Risk

Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

H.C. WAINWRIGHT & CO., LLC

The date of this prospectus is _____________, 2014.

Table of Contents

2

About This Prospectus

You should rely only on the information that we have provided

in this prospectus and any applicable prospectus supplement. We have not

authorized anyone to provide you with different information. No dealer,

salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus and any applicable

prospectus supplement. You must not rely on any unauthorized information or

representation. This prospectus is an offer to sell only the securities offered

hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. You should assume that the information in this prospectus and any

applicable prospectus supplement is accurate only as of the date on the front of

the document, regardless of the time of delivery of this prospectus, any

applicable prospectus supplement, or any sale of a security.

As used in this prospectus, the terms “we”, “us” “our” and

“Alkaline” refer to The Alkaline Water Company Inc., a Nevada corporation, and

its wholly-owned subsidiary, Alkaline Water Corp., and Alkaline Water Corp.’s

wholly-owned subsidiary, Alkaline 88, LLC (formerly Alkaline 84, LLC), unless

otherwise specified.

Prospectus Summary

The Offering

|

Securities offered

|

(i) Up to 35,000,000 shares of common stock;

|

|

|

(ii) Warrants to purchase up to 17,500,000 shares of common

stock; and

|

|

|

(iii) Up to 17,500,000 shares of common stock issuable upon

exercise of the warrants

|

|

|

|

|

Common stock outstanding prior to offering

|

81,602,175

(1)

|

|

|

|

|

Common stock to be outstanding after the offering

|

116,602,175

(2)

|

|

|

|

|

Use of proceeds

|

We expect to use the proceeds received from the offering

to fund the purchase of alkaline generating electrolysis system machines

to make our alkaline water, the purchase of a bottling plant, redemption

of preferred stock and for working capital and general corporate purposes.

See “Use of Proceeds” for more information.

|

|

|

|

|

OTCBB Symbol

|

“WTER”. There is no established trading market for the

warrants and we do not expect a market to develop.

|

|

|

|

|

Risk Factors

|

See “Risk Factors” beginning on page 5 and other

information in this prospectus for a discussion of the factors you should

consider before you decide to invest in our common stock and warrants.

|

|

(1)

|

Excludes (i) 19,485,000 shares of common stock reserved

for future issuance under our 2013 Equity Incentive Plan, (ii) 8,194,136

shares of common stock issuable upon the exercise of outstanding warrants

and (iii) 1,162,791 shares of common stock issuable upon the conversion of

outstanding shares of 10% Series B Convertible Preferred Stock. As of

April 3, 2014, there were (i) stock options to purchase up to

6,000,000 shares of our common stock outstanding under our 2013 Equity

Incentive Plan, with a weighted average exercise price of $0.605 per share

(ii) 8,194,136 shares of common stock issuable upon the exercise of

outstanding warrants with exercise prices ranging from $0.43 to $0.60 per

share, and (iii) 1,162,791 shares of common stock issuable upon the

conversion of the outstanding shares of 10% Series B Convertible Preferred

Stock with the conversion price of $0.43 per share.

|

|

|

|

|

(2)

|

Assumes the sale of all shares of common stock covered by

this prospectus. Excludes (i) up to 17,500,000 shares of common stock that

could be issued upon exercise of the warrants sold as part of this

offering and (ii) the shares of common stock underlying the warrants

issuable to the placement agent in connection with this

offering.

|

3

Our Business

Our company offers retail consumers bottled alkaline water in

three-liter and one-gallon volumes through our brand “Alkaline88”. Our product

is produced through an electrolysis process that uses specialized electronic

cells coated with a variety of rare earth minerals to produce our 8.8 pH

drinking water without the use of any chemicals. Our product also incorporates

84 trace Himalayan salts.

The main reason consumers drink our product is for the

perceived benefit that a proper pH balance helps fight disease and boosts the

immune system and the perception that alkaline water helps to maintain a proper

body pH and keeps cells young and hydrated.

Alkaline 88, LLC, our operating subsidiary, operates primarily

as a marketing and distribution company. Alkaline 88, LLC has entered into

exclusive arrangements with Water Engineering Solutions LLC, an entity that is

controlled and owned by our President, Chief Executive Officer, Director and

majority stockholder, Steven P. Nickolas, and our Vice-President, Secretary,

Treasurer and Director, Richard A. Wright, for the manufacture and production of

our alkaline generating electrolysis system machines. Alkaline 88, LLC has

entered into one-year agreement(s) with Arizona Bottled Water, LLC and White

Water, LLC to act as our initial co-packers. Our branding is being coordinated

through 602 Design, LLC and our component materials are readily available

through multiple vendors. Our principal suppliers are Plastipack Packaging and

Polyplastics Co.

Sample production and testing of our product began in late

2012. We have currently established initial contract manufacturing in Phoenix,

Arizona and plan to establish other key manufacturing facilities throughout the

United States to support the national distribution of our product.

Our product is currently at the introduction phase of its

lifecycle. In March 2012 Alkaline 88, LLC did market research on the demand for

a bulk alkaline product at the Natural Product Expo West in Anaheim, California.

In January 2013, we began the formal launching of our product in Southern

California and Arizona.

Our product is currently at the introduction phase of its lifecycle. In March 2012 Alkaline 88, LLC did market research on the demand for a bulk alkaline product at the Natural Product Expo West in Anaheim, California. In January 2013, we began the formal launching of our product in Southern California and Arizona. Since then, we have begun to deliver product through approximately 600 retail outlets throughout the United States, primarily in the Southwest and Texas, through large national distributors (UNFI and KeHe). Our current stores include convenience stores, natural food products stores, large ethnic markets and national retailers. Currently, we sell all of our products to our retailers through brokers and distributors. Our larger retail clients bring the water in through their own warehouse distribution network. Our current retail clients are made up of a variety of the following; convenience stores, including 7-11’s; large national retailers, including Albertson’s, Fry’s and Smith’s, (both Kroger companies) and regional grocery chains such as Bashas’, Bristol Farms, Vallarta, Superior Foods, Brookshire’s and other companies throughout the United States.

In order to continue our expansion, we anticipate that we will be required, in most cases, to continue to give promotional deals throughout 2014 and in subsequent years on a quarterly basis ranging from a 5%-15% discount similar to all other beverage company promotional programs. It has been our experience that most of the retailers have requested some type of promotional introductory program which has included either a $0.25-$0.50 per unit discount on an initial order; a buy one get one free program; or a free-fill program which includes 1-2 cases of free product per store location. Slotting has only been presented and negotiated in the larger national grocery chains and, in most cases, is offset by product sales. Our slotting fees with our current national retailers do not exceed $40,000 in the aggregate and are offset through product sales. In addition we participate in promotional activities of our distributors, these fees are not in excess of $100,000 and are offset through product sales.

We have not yet established an ongoing source of revenues sufficient to cover our operating costs and to support us to continue as a going concern. As of December 31, 2013, we had an accumulated deficit of $3,349,544. Our ability to continue as a going concern is dependent on our company obtaining adequate capital to fund operating losses until we become profitable. If we are unable to obtain adequate capital, we could be forced to significantly curtail or cease operations. In its report on the financial statements of Alkaline Water Corp., the predecessor of The Alkaline Water Company Inc., for the period from inception (June 19, 2012) to March 31, 2013, our independent registered public accounting firm included an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The principal offices of our company are located at 7730 E

Greenway Road, Ste. 203, Scottsdale, AZ 85260. Our telephone number is (480)

656-2423.

Summary of Financial Data

The following information represents selected audited financial

information for Alkaline Water Corp. for the period from inception on June 19,

2012 through March 31, 2013 and selected unaudited financial information for The

Alkaline Water Company Inc. for the three and nine month period ended December 31, 2013. The summarized financial information presented below is derived from

and should be read in conjunction with our audited and unaudited financial

statements, as applicable, including the notes to those financial statements

which are included elsewhere in this prospectus along with the section entitled

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” beginning on page 52 of this prospectus.

4

Statements of

Operations Data

|

For Three Month Period

Ended

December 31, 2013

|

For Nine Month Period

Ended

December 31, 2013

|

From Inception on June

19, 2012

to

March 31, 2013

|

|

Revenue

|

$171,137

|

$333,404

|

$15,110

|

|

Cost of Goods Sold

|

$102,609

|

$193,566

|

$8,026

|

|

Total Operating Expenses

|

$2,506,201

|

$3,242,285

|

$284,580

|

|

Net Loss

|

$(2,397,827)

|

$(3,066,156)

|

$(283,388)

|

|

Balance Sheets Data

|

As of December 31, 2013

|

As of March 31, 2013

|

|

Cash

|

$22,465

|

$64,607

|

|

Working Capital

|

$(282,396)

|

$(82,566)

|

|

Total Assets

|

$782,901

|

$140,373

|

|

Total Liabilities

|

$563,856

|

$169,856

|

|

Total Stockholders’ Equity (Deficit)

|

$178,588

|

$(29,483)

|

|

Accumulated Deficit

|

$(3,349,544)

|

$(283,388)

|

Risk Factors

An investment in our common stock involves a number of very

significant risks. You should carefully consider the following risks and

uncertainties in addition to other information in this prospectus in evaluating

our company and our business before purchasing our securities. Our business,

operating results and financial condition could be seriously harmed as a result

of the occurrence of any of the following risks. You could lose all or part of

your investment due to any of these risks. You should invest in our common stock

only if you can afford to lose your entire investment.

Risks Related to This Offering

You will experience immediate and substantial dilution as

a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial dilution as a result

of this offering. After giving effect to the sale by us of up to 35,000,000 shares

of common stock and warrants to purchase an additional 17,500,000 shares of our

common stock, and after deducting placement agent commissions and estimated

offering expenses payable by us, investors in this offering can expect an

immediate dilution of $<> per share, or <>%, at the offering price,

assuming no exercise of the warrants. To the extent any of the warrants we have

issued in this offering, or any other warrants or options that we have issued,

are exercised, you will sustain future dilution. We may also acquire other

assets or businesses by issuing equity, which may result in additional dilution

to our stockholders.

Upon completion of this offering, we are required to use 25% of the gross proceeds from this offering to redeem our 10% Series B Convertible Preferred Stock.

On November 7, 2013, we sold to certain institutional investors an aggregate of 500 shares of our 10% Series B Convertible Preferred Stock at a stated value of $1,000 per share of Series B Preferred Stock for gross proceeds of $500,000. Within three trading days from the closing of any subsequent financing by us, we must use 25% of the proceeds from such financing to redeem our 10% Series B Convertible Preferred Stock on a pro rata basis, until such time that all of our 10% Series B Convertible Preferred Stock then outstanding are redeemed in full. Accordingly, upon completion of this offering, we are required to use 25% of the gross proceeds from this offering to redeem our 10% Series B Convertible Preferred Stock ($500,000) and accrued but unpaid dividends and make-whole amount (approximately $50,000) and the redemption of these securities may have an adverse effect on our cash position.

We will have immediate and broad discretion over the use

of the net proceeds from this offering and we may use these proceeds in ways

with which you may not agree.

We have considerable discretion in the application of the

proceeds of this offering. We currently expect to use the net proceeds from this

offering for the purchase of alkaline generating electrolysis system machines to

make our alkaline water, the purchase of a bottling plant and for working

capital and general corporate purposes. However, there may be circumstances

where, for sound business reasons, a reallocation of funds may be necessary or

advisable. You must rely on our judgment regarding the application of the net

proceeds of this offering. Our judgment may not result in positive returns on

your investment and you will not have an opportunity to evaluate the economic,

financial, or other information upon which we base our decisions.

5

There is no public market for the warrants being offered

in this offering.

There is no established public trading market for the warrants

being offered in this offering, and we do not expect a trading market to

develop. In addition, we do not intend to apply for listing the warrants on any

securities exchange or expect the warrants to be quoted on the OTC Bulletin

Board. Without an active trading market, the liquidity of the warrants will be

limited.

Risks Related to Our Business

Because we have a limited operating history, our ability

to fully and successfully develop our business is unknown.

We were incorporated in June 6, 2011, and we have only recently

begun producing and distributing alkaline bottled water, and we have a limited

operating history from which investors can evaluate our business. Our ability to

successfully develop our products, and to realize consistent, meaningful

revenues and profit has not been established and cannot be assured. We have not

generated any significant revenues and do not expect to do so in near future.

For us to achieve success, our products must receive broad market acceptance by

consumers. Without this market acceptance, we will not be able to generate

sufficient revenue to continue our business operation. If our products are not

widely accepted by the market, our business may fail.

Our ability to achieve and maintain profitability and positive

cash flow is dependent upon our ability to generate revenues, manage development

costs and expenses, and compete successfully with our direct and indirect

competitors. We anticipate operating losses in upcoming future periods. This

will occur because there are expenses associated with the development,

production, marketing, and sales of our product. As a result, we may not

generate significant revenues in the future. Failure to generate significant

revenues in near future may cause us to suspend or cease activities.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. We have not yet established an ongoing source of revenues sufficient to cover our operating costs and to allow us to continue as a going concern. As of December 31, 2013, we had an accumulated deficit of $3,349,544. Our ability to continue as a going concern is dependent on our company obtaining adequate capital to fund operating losses until we become profitable. If we are unable to obtain adequate capital, we could be forced to significantly curtail or cease operations. In its report on the financial statements of Alkaline Water Corp., the predecessor of The Alkaline Water Company Inc., for the period from inception (June 19, 2012) to March 31, 2013, our independent registered public accounting firm included an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Alkaline Water Corp. did not assess its internal control

over financial reporting as of March 31, 2013.

6

Alkaline Water Corp., The Alkaline Water Company Inc.’s

predecessor, did not assess its internal control over financial reporting as of

March 31, 2013 because it was a private company at that time. If Alkaline Water

Corp. failed to maintain proper and effective internal control over financial

reporting as of March 31, 2013, the audited financial statements included in

this prospectus may not be accurate, which could adversely affect our business,

financial condition or results of operations.

We will need additional funds to produce, market, and

distribute our product.

We will have to spend additional funds to produce, market and

distribute our product. If we cannot raise sufficient capital, we may have to

cease operations and you could lose your investment. We will need additional

funds to produce our product for distribution to our target market. Even after

we have produced our product, we will have to spend substantial funds on

distribution, marketing and sales efforts before we will know if we have

commercially viable and marketable/sellable products.

There is no guarantee that sufficient sale levels will be

achieved.

There is no guarantee that the expenditure of money on

distribution and marketing efforts will translate into sufficient sales to cover

our expenses and result in profits. Consequently, there is a risk that you may

lose all of your investment.

Our development, marketing, and sales activities are

limited by our size.

Because we are small and do not have much capital, we must

limit our product development, marketing, and sales activities. As such we may

not be able to complete our production and business development program in a

manner that is as thorough as we would like. We may not ever generate sufficient

revenues to cover our operating and expansion costs and you may, therefore, lose

your entire investment.

Changes in the non-alcoholic beverage business

environment and retail landscape could adversely impact our financial results.

The non-alcoholic beverage business environment is rapidly

evolving as a result of, among other things, changes in consumer preferences,

including changes based on health and nutrition considerations and obesity

concerns; shifting consumer tastes and needs; changes in consumer lifestyles;

and competitive product and pricing pressures. In addition, the non-alcoholic

beverage retail landscape is very dynamic and constantly evolving, not only in

emerging and developing markets, where modern trade is growing at a faster pace

than traditional trade outlets, but also in developed markets, where discounters

and value stores, as well as the volume of transactions through e-commerce, are

growing at a rapid pace. If we are unable to successfully adapt to the rapidly

changing environment and retail landscape, our share of sales, volume growth and

overall financial results could be negatively affected.

Intense competition and increasing competition in the

commercial beverage market could hurt our business.

The commercial retail beverage industry, and in particular its

non-alcoholic beverage segment, is highly competitive. Market participants are

of various sizes, with various market shares and geographical reach, some of

whom have access to substantially more sources of capital.

We compete generally with all liquid refreshments, including

bottled water and numerous specialty beverages, such as: SoBe; Snapple; Arizona;

Vitamin Water; Gatorade; and Powerade.

We compete indirectly with major international beverage

companies including but not limited to: the Coca-Cola Company; PepsiCo, Inc.;

Nestlé; Dr Pepper Snapple Group; Groupe Danone; Kraft Foods Group, Inc.; and

Unilever. These companies have established market presence in the United States,

and offer a variety of beverages that are substitutes to our product. We face

potential direct competition from such companies, because they have the

financial resources, and access to manufacturing and distribution channels to

rapidly enter the alkaline water market.

We compete directly with other alkaline water producers and

brands focused on the emerging alkaline beverage market including: Eternal;

Essentia; Icelandic; Real Water; Aqua Hydrate; Mountain Valley; Qure; Penta; and

Alka Power. These companies could bolster their position in the

alkaline water market through additional expenditure and promotion.

7

As a result of both direct and indirect competition, our

ability to successfully distribute, market and sell our product, and to gain

sufficient market share in the United States to realize profits may be limited,

greatly diminished, or totally diminished, which may lead to partial or total

loss of your investments in our company.

Alternative non-commercial beverages or processes could

hurt our business.

The availability of non-commercial beverages, such as tap

water, and machines capable of producing alkaline water at the consumer’s home

or at store-fronts could hurt our business, market share, and profitability.

Expansion of the alkaline beverage market or sufficiency

of consumer demand in that market for operations to be profitable are not

guaranteed.

The alkaline water market is an emerging market and there is no

guarantee that this market will expand or that consumer demand will be

sufficiently high to allow our company to successfully market, distribute and

sell our product, or to successfully compete with current or future competition,

all of which may result in total loss of your investment.

Our growth and profitability depends on the performance

of third-parties and our relationship with them.

Our distribution network and its success depend on the

performance of third parties. Any non-performance or deficient performance by

such parties may undermine our operations, profitability, and result in total

loss to your investment. To distribute our product, we use a

broker-distributor-retailer network whereby brokers represent our products to

distributors and retailers who will in turn sell our product to consumers. The

success of this network will depend on the performance of the brokers,

distributors and retailers of this network. There is a risk that a broker,

distributor, or retailer may refuse to or cease to market or carry our product.

There is a risk that the mentioned entities may not adequately perform their

functions within the network by, without limitation, failing to distribute to

sufficient retailers or positioning our product in localities that may not be

receptive to our product. Furthermore, such third-parties’ financial position or

market share may deteriorate, which could adversely affect our distribution,

marketing and sale activities. We also need to maintain good commercial

relationships with third-party brokers, distributors and retails so that they

will promote and carry our product. Any adverse consequences resulting from the

performance of third-parties or our relationship with them could undermine our

operations, profitability and may result in total loss of your investment.

The loss of one or more of our major customers or a

decline in demand from one or more of these customers could harm our business.

We have 3 major customers that together account for 51% (25%, 14% and 12%, respectively) of accounts receivable at December 31, 2013, and 2 customers that together account for 28% (18% and 10%, respectively) of the total revenues earned for the nine month period ended December 31, 2013. There can be no assurance that such customers will continue to order our products in the same level or at all. A reduction or delay in orders from such customers, including reductions or delays due to market, economic or competitive conditions, could have a material adverse effect on our business, operating results and financial condition.

Health benefits of alkaline water is not guaranteed or

proven, rather it is perceived by consumers.

Health benefits of alkaline water are not guaranteed and have

not been proven. There is a consumer perception that drinking alkaline water has

beneficial health effects. Consequently, negative changes in consumers’

perception of the benefits of alkaline water or negative publicity surrounding

alkaline water may result in loss of market share or potential market share and

hence loss of your investment.

8

Water scarcity and poor quality could negatively impact

our production costs and capacity.

Water is the main ingredient in our product. It is also a

limited resource, facing unprecedented challenges from overexploitation,

increasing pollution, poor management, and climate change. As demand for water

continues to increase, as water becomes scarcer, and as the quality of available

water deteriorates, we may incur increasing production costs or face capacity

constraints that could adversely affect our profitability or net operating

revenues in the long run.

Increase in the cost, disruption of supply or shortage of

ingredients, other raw materials or packaging materials could harm our

business.

We and our bottlers will use water, 84 trace Himalayan salts,

packaging materials for bottles such as plastic and paper products. The prices

for these ingredients, other raw materials and packaging materials fluctuate

depending on market conditions. Substantial increases in the prices of our or

our bottlers’ ingredients, other raw materials and packaging materials, to the

extent they cannot be recouped through increases in the prices of finished

beverage products, would increase our operating costs and could reduce our

profitability. Increases in the prices of our finished products resulting from a

higher cost of ingredients, other raw materials and packaging materials could

affect the affordability of our product and reduce sales.

An increase in the cost, a sustained interruption in the

supply, or a shortage of some of these ingredients, other raw materials, or

packaging materials and containers that may be caused by a deterioration of our

or our bottlers’ relationships with suppliers; by supplier quality and

reliability issues; or by events such as natural disasters, power outages, labor

strikes, political uncertainties or governmental instability, or the like, could

negatively impact our net revenues and profits.

Changes in laws and regulations relating to beverage

containers and packaging could increase our costs and reduce demand for our

products.

We and our bottlers intend to offer our product in

nonrefillable, recyclable containers in the United States. Legal requirements

have been enacted in various jurisdictions in the United States requiring that

deposits or certain ecotaxes or fees be charged for the sale, marketing and use

of certain nonrefillable beverage containers. Other proposals relating to

beverage container deposits, recycling, ecotax and/or product stewardship have

been introduced in various jurisdictions in the United States and overseas, and

we anticipate that similar legislation or regulations may be proposed in the

future at local, state and federal levels in the United States. Consumers’

increased concerns and changing attitudes about solid waste streams and

environmental responsibility and the related publicity could result in the

adoption of such legislation or regulations. If these types of requirements are

adopted and implemented on a large scale in the geographical regions in which we

operate or intend to operate, they could affect our costs or require changes in

our distribution model, which could reduce our net operating revenues or

profitability.

Significant additional labeling or warning requirements

or limitations on the availability of our product may inhibit sales of affected

products.

Various jurisdictions may seek to adopt significant additional

product labeling or warning requirements or limitations on the availability of

our product relating to the content or perceived adverse health consequences of

our product. If these types of requirements become applicable to our product

under current or future environmental or health laws or regulations, they may

inhibit sales of our product.

9

Unfavorable general economic conditions in the United

States could negatively impact our financial performance.

Unfavorable general economic conditions, such as a recession or

economic slowdown, in the United States could negatively affect the

affordability of, and consumer demand for, our product in the United States.

Under difficult economic conditions, consumers may seek to reduce discretionary

spending by forgoing purchases of our products or by shifting away from our

beverages to lower-priced products offered by other companies, including

non-alkaline water. Consumers may also cease purchasing bottled water and

consume tap water. Lower consumer demand for our product in the United States

could reduce our profitability.

Adverse weather conditions could reduce the demand for

our products.

The sales of our products are influenced to some extent by

weather conditions in the markets in which we operate. Unusually cold or rainy

weather during the summer months may have a temporary effect on the demand for

our product and contribute to lower sales, which could have an adverse effect on

our results of operations for such periods.

Changes in, or failure to comply with, the laws and

regulations applicable to our products or our business operations could increase

our costs or reduce our net operating revenues.

The advertising, distribution, labeling, production, safety,

sale, and transportation in the United States of our product will be subject to:

the Federal Food, Drug, and Cosmetic Act; the Federal Trade Commission Act; the

Lanham Act; state consumer protection laws; competition laws; federal, state,

and local workplace health and safety laws, such as the Occupational Safety and

Health Act; various federal, state and local environmental protection laws; and

various other federal, state, and local statutes and regulations. Legal

requirements also apply in many jurisdictions in the United States requiring

that deposits or certain ecotaxes or fees be charged for the sale, marketing,

and use of certain non-refillable beverage containers. The precise requirements

imposed by these measures vary. Other types of statutes and regulations relating

to beverage container deposits, recycling, ecotaxes and/or product stewardship

also apply in various jurisdictions in the United States. We anticipate that

additional, similar legal requirements may be proposed or enacted in the future

at the local, state and federal levels in the United States. Changes to such

laws and regulations could increase our costs or reduce or net operating

revenues.

In addition, failure to comply with environmental, health or

safety requirements and other applicable laws or regulations could result in the

assessment of damages, the imposition of penalties, suspension of production,

changes to equipment or processes, or a cessation of operations at our or our

bottlers’ facilities, as well as damage to our image and reputation, all of

which could harm our profitability.

Our products are considered premium and healthy beverages

and are being sold at premium prices compared to our competitors; we cannot

provide any assurances as to consumers’ continued market acceptance of our

current and future products.

We will compete directly with other alkaline water producers

and brands focused on the emerging alkaline beverage market including Eternal,

Essentia, Icelandic, Real Water, Aqua Hydrate, Mountain Valley, Qure, Penta, and

Alka Power. Products offered by our direct competitors are sold in various

volumes and prices with prices ranging from approximately $1.39 for a half-liter

bottle to approximately $2.99 for a one-liter bottle, and volumes ranging from

half-liter bottles to one-and-a half liter bottles. We currently offer our

product in a three-liter bottle for a suggested retail price (SRP) of $3.99 and

one-gallon bottle for an SRP of $4.99. Our competitors may introduce larger

sizes and offer them at an SRP that is lower than our product. We can provide no

assurances that consumers will continue to purchase our product or that they

will not prefer to purchase a competitive product.

We rely on key executive officers, and their knowledge of

our business would be difficult to replace.

We are highly dependent on our two executive officers, Steven

P. Nickolas and Richard A. Wright. We do not have “key person” life insurance

policies for any of our officers. The loss of management and industry expertise

of any of our key executive officers could result in delays in product

development, loss of any future customers and sales and diversion of management

resources, which could adversely affect our operating results.

10

Our executive officers are not subject to supervision or

review by an independent board or audit committee.

Our board of directors consists of Steven P. Nickolas and

Richard A. Wright, our executive officers. Accordingly, we do not have any

independent directors. Also we do not have an independent audit committee. As a

result, the activities of our executive officers are not subject to the review

and scrutiny of an independent board of directors or audit committee.

Risk Related to Our Stock

Because Steven P. Nickolas controls a large percentage of

our voting stock, he has the ability to influence matters affecting our

stockholders.

Steven P. Nickolas, our President, Chief Executive Officer and

Director, exercises voting and dispositive power with respect to 43,000,000

shares of our common stock, which are beneficially owned by WiN Investments, LLC

and Lifewater Industries, LLC, and owns 10,000,000 shares of Series A Preferred

Stock, which has 10 votes per share upon any matter submitted to our

stockholders for a vote. Accordingly, he controls a majority of the votes

attached to our outstanding voting securities. As a result, he has the ability

to influence matters affecting our stockholders, including the election of our

directors, the acquisition or disposition of our assets, and the future issuance

of our securities. Because he controls such majority of votes, investors may

find it difficult to replace our management if they disagree with the way our

business is being operated. Because the influence by Mr. Nickolas could result

in management making decisions that are in the best interest of Mr. Nickolas and

not in the best interest of the investors, you may lose some or all of the value

of your investment in our common stock.

Because we can issue additional shares of common stock,

our stockholders may experience dilution in the future.

We are authorized to issue up to 1,125,000,000 shares of common stock and 100,000,000 shares of preferred stock, of which 81,602,175 shares of common stock are issued and outstanding, 20,000,000 shares of Series A Preferred Stock are issued and outstanding and 500 shares of 10% Series B Convertible Preferred Stock are issued and outstanding as of April 3, 2014. Our board of directors has the authority to cause us to issue additional shares of common stock and preferred stock, and to determine the rights, preferences and privileges of shares of our preferred stock, without consent of our stockholders. Consequently, the stockholders may experience more dilution in their ownership of our stock in the future.

Because we became public by means of a reverse takeover

transaction, we may not be able to attract the attention of major brokerage

firms.

Additional risks may exist since we became public through a

“reverse takeover” with a shell company. Security analysts of major brokerage

firms and securities institutions may not cover us since there are no

broker-dealers who sold our stock in a public offering who would have an

incentive to follow or recommend the purchase of our common stock. No assurance

can be given that established brokerage firms will want to conduct any

financings for us in the future.

Trading on the OTC Bulletin Board may be volatile and

sporadic, which could depress the market price of our common stock and make it

difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board. Trading

in stock quoted on the OTC Bulletin Board is often thin and characterized by

wide fluctuations in trading prices, due to many factors that may have little to

do with our operations or business prospects. This volatility could depress the

market price of our common stock for reasons unrelated to operating performance.

Moreover, the OTC Bulletin Board is not a stock exchange, and trading of

securities on the OTC Bulletin Board is often more sporadic than the trading of

securities listed on a national securities exchange like the NASDAQ or the NYSE.

Accordingly, stockholders may have difficulty reselling any of our shares.

11

A decline in the price of our common stock could affect

our ability to raise further working capital, it may adversely impact our

ability to continue operations and we may go out of business.

A prolonged decline in the price of our common stock could

result in a reduction in the liquidity of our common stock and a reduction in

our ability to raise capital. Because we plan to acquire a significant portion

of the funds we need in order to conduct our planned operations through the sale

of equity securities, a decline in the price of our common stock could be

detrimental to our liquidity and our operations because the decline may cause

investors not to choose to invest in our stock. If we are unable to raise the

funds we require for all our planned operations, we may be forced to reallocate

funds from other planned uses and may suffer a significant negative effect on

our business plan and operations, including our ability to develop new products

and continue our current operations. As a result, our business may suffer, and

not be successful and we may go out of business. We also might not be able to

meet our financial obligations if we cannot raise enough funds through the sale

of our equity securities and we may be forced to go out of business.

Because we do not intend to pay any cash dividends on our

shares of common stock in the near future, our stockholders will not be able to

receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the

development and expansion of our business. We do not anticipate paying any cash

dividends on our common stock in the near future. The declaration, payment and

amount of any future dividends will be made at the discretion of the board of

directors, and will depend upon, among other things, the results of operations,

cash flows and financial condition, operating and capital requirements, and

other factors as the board of directors considers relevant. There is no

assurance that future dividends will be paid, and if dividends are paid, there

is no assurance with respect to the amount of any such dividend. Unless we pay

dividends, our stockholders will not be able to receive a return on their shares

unless they sell them.

Our stock is a penny stock. Trading of our stock may be

restricted by the SEC’s penny stock regulations, which may limit a stockholder’s

ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange

Commission (“SEC”) has adopted Rule 15g-9 which generally defines “penny stock”

to be any equity security that has a market price (as defined in Rule 15g-9)

less than $5.00 per share or an exercise price of less than $5.00 per share,

subject to certain exceptions. Our securities are covered by the penny stock

rules, which impose additional sales practice requirements on broker-dealers who

sell to persons other than established customers and “accredited investors”. The

term “accredited investor” refers generally to institutions with assets in

excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or

annual income exceeding $200,000 or $300,000 jointly with their spouse. The

penny stock rules require a broker-dealer, prior to a transaction in a penny

stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document in a form prepared by the SEC, which provides information

about penny stocks and the nature and level of risks in the penny stock market.

The broker-dealer also must provide the customer with current bid and offer

quotations for the penny stock, the compensation of the broker-dealer and its

salesperson in the transaction and monthly account statements showing the market

value of each penny stock held in the customer’s account. The bid and offer

quotations, and the broker-dealer and salesperson compensation information, must

be given to the customer orally or in writing prior to effecting the transaction

and must be given to the customer in writing before or with the customer’s

confirmation. In addition, the penny stock rules require that prior to a

transaction in a penny stock not otherwise exempt from these rules; the

broker-dealer must make a special written determination that the penny stock is

a suitable investment for the purchaser and receive the purchaser’s written

agreement to the transaction. These disclosure requirements may have the effect

of reducing the level of trading activity in the secondary market for the stock

that is subject to these penny stock rules. Consequently, these penny stock

rules may affect the ability of broker-dealers to trade our securities. We

believe that the penny stock rules discourage investor interest in and limit the

marketability of our common stock.

FINRA sales practice requirements may also limit a

stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the SEC,

the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that

require that in recommending an investment to a customer, a broker-dealer must

have reasonable grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax

status, investment objectives and other information. Under interpretations of

these rules, the FINRA believes that there is a high probability that

speculative low priced securities will not be suitable for at least some

customers. The FINRA requirements make it more difficult for broker-dealers to

recommend that their customers buy our common stock, which may limit your

ability to buy and sell our stock.

12

Forward-Looking Statements

This prospectus contains forward-looking statements.

Forward-looking statements are projections in respect of future events or our

future financial performance. In some cases, you can identify forward-looking

statements by terminology such as “may”, “should”, “intend”, “expect”, “plan”,

“anticipate”, “believe”, “estimate”, “predict”, “potential”, or “continue” or

the negative of these terms or other comparable terminology. These statements

are only predictions and involve known and unknown risks, including the risks in

the section entitled “Risk Factors”, uncertainties and other factors, which may

cause our company’s or our industry’s actual results, levels of activity or

performance to be materially different from any future results, levels of

activity or performance expressed or implied by these forward-looking

statements. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity or performance. Except as required by applicable law,

including the securities laws of the United States, we do not intend to update

any of the forward-looking statements to conform these statements to actual

results.

Use of Proceeds

We expect to receive up to $9 million in net proceeds from the

sale of the securities in this offering, based on a price of $<> per share

of common stock and corresponding warrant and after deducting placement agent

fees and expenses and estimated offering expenses payable by us and assuming the

sale of all of the securities offered in this offering. However, this is a best

efforts offering with no minimum, and we may not sell all or any of the

securities; as a result, we may receive significantly less in net proceeds, and

the net proceeds received may not be sufficient to continue to operate our

business.

We currently expect to use the net proceeds from this offering

as specified in the following table, and we have ordered the specific uses of

proceeds in order of priority. We do not expect that our priorities for fund

allocation would change if the amount we raise in this offering is less than the

maximum proceeds to be potentially raised in this offering. The data in the

table set forth below excludes any proceeds we could receive from the exercise

of the warrants to be issued in this offering.

Description of

Use

|

|

25% of

Maximum

Proceeds

Obtained

|

|

|

50% of

Maximum

Proceeds

Obtained

|

|

|

75% of

Maximum

Proceeds

Obtained

|

|

|

100% of

Maximum

Proceeds

Obtained

|

|

|

Purchase of alkaline generating

electrolysis system machines

(1)

|

$

|

1,380,000

|

|

$

|

1,840,000

|

|

$

|

2,760,000

|

|

$

|

3,450,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase bottling plant

(2)

|

|

-

|

|

|

-

|

|

$

|

1,700,000

|

|

$

|

1,700,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption of preferred stock

(3)

|

$

|

550,000

|

|

$

|

550,000

|

|

$

|

550,000

|

|

$

|

550,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital including legal, audit,

accounting, investor relations & corporate communications, and

financing-related expenses

|

$

|

320,000

|

|

$

|

2,110,000

|

|

$

|

1,740,000

|

|

$

|

3,300,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

$

|

2,250,000

|

|

$

|

4,500,000

|

|

$

|

6,750,000

|

|

$

|

9,000,000

|

|

Notes

|

(1)

|

Each machine costs approximately $230,000, including

shipping and installation, and is purchased from Water Engineering

Solutions, LLC (

“WES”

), an entity that is controlled and owned by

our President, Chief Executive Officer, Director and majority

stockholder, Steven P. Nickolas, and our Vice-President, Secretary,

Treasurer and Director, Richard A. Wright. Per the agreement with WES, the

machine will be manufactured and sold to us at a price that will allow WES

a 40% gross profit margin on all components and an $85.00/hour/man hour

spent on production and installation of each machine. The 40% gross profit

margin represents a 10% reduction from WES’s standard margin. In addition,

we must provide a purchase order to WES with a 50% deposit for each

machine, an additional 40% upon WES’s receipt of the electrolysis cells

and the balance of 10% due upon delivery. We also agreed with WES to

purchase a minimum of 3 machines in the first 12 month period; 4 machines

in the next 12 month period; and 6 machines in the third 12 month period.

WES agreed to provide maintenance and service on all the machines at a

rate of $200 per day for a mechanic, $350 per day for a skilled mechanic,

and $500 per day for WES’ engineer.

|

13

|

(2)

|

If we obtain at least 75% of the maximum proceeds from

this offering, we plan to acquire the North Cove Bottling Plant in North

Carolina, which has an estimated purchase price of $1,700,000. If

consummated, this acquisition is expected to provide us with a calculated

logistical advantage given the plant’s strategic location and production

capacity. The plant was built in the mid-1990s and was designed for

high-speed manufacturing. Currently, the plant has no employees, no

customers and is not in operations. In addition, in order to bring the

plant online, we need to obtain certain licenses and re-certifications and

need to complete repairs and facility improvements. If all of these are

completed, we may be able to begin production as early as the second quarter of 2014.

|

|

|

|

|

(3)

|

On November 7, 2013, we sold to certain institutional

investors an aggregate of 500 shares of our 10% Series B Convertible

Preferred Stock (

“Series B Preferred Stock”

) at a stated value of

$1,000 per share of Series B Preferred Stock for gross proceeds of

$500,000. Upon completion of this offering, we are required to use 25% of

the gross proceeds from this offering to redeem the Series B Preferred

Stock, including accrued but unpaid dividends and make-whole

amount.

|

The (i) projected amount of proceeds to be spent on each

purpose set forth in the table above and (ii) the projected net proceeds to us

after deducting for applicable costs and expenses, are in each case estimates

based on our current expectations. Those estimates may prove to be wrong, and we

could require additional funding for any one of the purposes set forth in the

table above, which could consequently reduce the expenditures we use for another

purpose or be a lesser percentage of the total funds required for the particular

purpose.

If a warrant holder elects to exercise the warrants issued in

this offering, we may also receive proceeds from the exercise of the warrants.

We cannot predict when or if the warrants will be exercised. It is possible that

the warrants may expire and may never be exercised.

Determination of Offering Price

In determining the offering price of the common stock and the

warrants and the exercise price of the warrants, we will consider a number of

factors including, but not limited to, the current market price of our common

stock, trading prices of our common stock over time, the illiquidity and

volatility of our common stock, our current financial condition and the

prospects for our future cash flows and earnings, and market and economic

conditions at the time of the offering. Once the offering price is determined,

the offering price for the common stock and the warrants and the exercise price

of the warrants will remain fixed for the duration of the offering.

Our common stock is traded on the OTC Bulletin Board under the symbol “WTER”. On April 2, 2014, the closing price for one share of our common stock was $0.2844.

Dilution

If you invest in the securities offered in this offering, and

assuming no value is attributed to the warrants, your interest will be diluted

immediately to the extent of the difference between the offering price per share

of our common stock and the pro forma net tangible book value per share of our

common stock after this offering. As of December 31, 2013, our net tangible

book value was $149,166, or $0.002 per share of common stock. Our net tangible book value per share is equal to total assets less

intangible assets and total liabilities, divided by the number of shares of our

outstanding common stock.

14

Net tangible book value dilution per share represents the

difference between the amount per share of common stock paid by the new

investors who purchase securities in this offering and the pro forma net

tangible book value per share in common stock immediately after completion of

this offering, assuming no value is attributed to the warrants. After giving

effect to our sale of up to 35,000,000 shares of common stock at an offering price

of $<> per share, and after deducting placement agent fees and expenses

and estimated offering expenses payable by us, our pro forma net tangible book

value as of December 31, 2013 would have been $<>, or $<> per

share. This represents an immediate increase of net tangible book value of

$<> per share to our existing stockholders and an immediate dilution in

net tangible book value of $<> per share to purchasers of securities in

this offering. The following table illustrates this per share dilution:

|

Offering price per share

|

$

|

<>

|

|

|

|

|

|

|

|

Net tangible book value per share as of

December 31, 2013

|

$

|

0.002

|

|

|

|

|

|

|

|

Increase in net tangible book value per

share attributable to this offering

|

$

|

<>

|

|

|

|

|

|

|

|

Pro forma net tangible book value per share

after this offering

|

$

|

<>

|

|

|

|

|

|

|

|

Dilution in net tangible book value per

share to new investors

|

$

|

<>

|

|

|

|

|

|

|

|

The above discussion and table do not

include the following:

|

|

|

|

-

19,485,000 shares of common stock reserved for future issuance under our

2013 Equity Incentive Plan. As of April 3, 2014, there were stock

options to purchase up to 6,000,000 shares of our common stock outstanding

under our 2013 Equity Incentive Plan with a weighted average exercise price of

$0.605 per share;

-

8,194,136 shares of common stock issuable upon the exercise of outstanding

warrants as of April 3, 2014, with exercise prices ranging from

$0.43 to $0.60 per share;

-

1,162,791 shares of common stock issuable upon the conversion of 10% Series

B Convertible Preferred Stock with the conversion price of $0.43 per share;

and

-

Up to 17,500,000 shares of common stock issuable upon exercise of warrants at

an exercise price of $<> per share sold as part of this offering.

Plan of Distribution

We are offering up to 35,000,000 shares of our common stock and

warrants to purchase up to 10,000,000 shares of our common for an offering price

of $<>per combination of one share of common stock and a warrant to

purchase one-half of a share of common stock with an exercise price of $<>

per share, with aggregate gross proceeds of up to $17,500,000. The common stock

and warrants are immediately separable and will be issued separately. However,

there is no minimum offering amount required as a condition to closing and we

may sell significantly fewer shares of common stock and warrants in the

offering.

H.C. Wainwright & Co., LLC, referred to as the placement

agent or Wainwright, has entered into an engagement agreement with us in which

it has agreed to act as the exclusive placement agent in connection with the

offering. The placement agent has no obligation to buy any of the securities

from us nor is it required to arrange the purchase or sale of any specific

number or dollar amount of the securities, but has agreed to use its reasonable

best efforts to arrange for the sale of all of the securities. The placement agent may engage one or more sub-placement agents or selected dealers to assist with the offering. Subject to the

terms and conditions contained in the engagement agreement, the placement agent is using its reasonable best

efforts to introduce us to selected institutional investors who will purchase

the securities. We will enter into purchase agreements directly with the

investors in this offering.

15

We have agreed to pay Wainwright a placement fee equal to 8% of the aggregate gross proceeds to us from the sale of common stock and warrants in this offering, provided that, with respect to certain investors in this offering which are set forth in our engagement agreement with the placement agent, we shall pay to the placement agent a fee of 5% of the gross proceeds to us from such investors from the sale of common stock and warrants. In addition, subject to FINRA Rule 5110(f)(2)(D), we have agreed to pay a non-accountable expense allowance equal to the lesser of (i) 1% of the aggregate gross proceeds raised in the offering and (ii) $50,000. We estimate total expenses of this offering, excluding the placement agent fees and expenses, will be approximately $150,000. The following table shows the per security and total fees we will pay to the placement agent assuming the sale of all of the securities offered pursuant to this prospectus, excluding any proceeds that we may receive upon exercise of the warrants issued in this offering.

|

Per security

|

$ <>

|

|

|

|

|

Total

|

$<>

|