Current Report Filing (8-k)

April 02 2014 - 7:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

April 1, 2014

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

000-51446

|

|

02-0636095

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(IRS employer identification no.)

|

|

121 South 17th Street

|

|

|

|

Mattoon, Illinois

|

|

61938-3987

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (217) 235-3311

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On April 1, 2014, Consolidated Communications Holdings, Inc. (the “Company”) entered into a Third Supplemental Indenture among the Company, its wholly owned subsidiary Consolidated Communications, Inc. (“CCI”), each of its other subsidiaries listed on the signature page thereto and Wells Fargo Bank, National Association, as trustee (the “Supplemental Indenture”). The Supplemental Indenture amends the Indenture dated as of May 30, 2012 (as previously supplemented by a First Supplemental Indenture dated as of July 2, 2012 and a Second Supplemental Indenture dated as of August 3, 2012, the “Indenture”) that governs CCI’s 10.875% Senior Notes due 2020 (the “Notes”).

The Supplemental Indenture was entered into in connection with CCI’s previously announced solicitation of consents from the holders of the Notes (the “Consent Solicitation”), which CCI commenced on March 19, 2014.

The Supplemental Indenture, which became effective upon its execution, amends the Indenture so that CCI and its restricted subsidiaries are permitted to (a) make Restricted Payments (as defined in the Indenture) otherwise available under the consolidated cash flow builder basket described in Section 4.07(a) of the Indenture if, after giving effect to such transaction on a pro forma basis, CCI’s Consolidated Leverage Ratio (as defined in the Indenture) would be less than 4.50 to 1.0, in each instance of a Restricted Payment, rather than 4.25 to 1.0 and (b) incur liens securing Indebtedness (as defined in the Indenture) in an amount not to exceed the greater of (i) the amount of Indebtedness incurred or that could be incurred under the permitted credit facilities basket in the debt covenant and (ii) 2.75 (rather than 2.50) times CCI’s Consolidated Cash Flow (as defined and calculated in the Indenture). Except as amended by the Supplemental Indenture, all terms and conditions set forth in the Indenture remain in full force and effect. This summary of the terms of the Supplemental Indenture is qualified in its entirety by reference to the Supplemental Indenture, a copy of which is attached as Exhibit 4.1 to this Current Report on Form 8-K and is hereby incorporated by reference.

Item 3.03. Regulation FD Disclosure.

The information set forth under “Item 1.01. Entry into a Material Definitive Agreement” of this Current Report on Form 8-K with respect to the Company’s entry into the Supplemental Indenture is hereby incorporated into this Item 3.03 by reference.

Item 7.01. Regulation FD Disclosure.

On April 2, 2014, the Company announced that CCI successfully completed its Consent Solicitation in connection with the Supplemental Indenture. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Item 9.01. Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

| |

|

|

Exhibit No.

|

|

Description

|

|

4.1

|

|

Third Supplemental Indenture, dated as of April 1, 2014, among the Company, CCI, each of the subsidiaries listed on the signature page thereto and Wells Fargo Bank, National Association

|

|

99.1

|

|

Press Release dated April 2, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: April 2, 2014

|

|

|

| |

Consolidated Communications Holdings, Inc.

|

| |

|

|

| |

By:

|

/s/ Steven L. Childers

Name: Steven L. Childers

Title: Chief Financial Officer

|

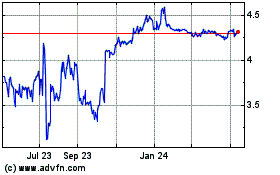

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

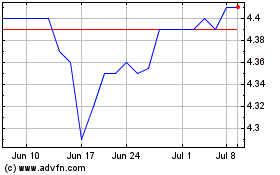

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024