Securities Act Registration No. 333-181176

Investment Company Act Registration No. 811-22696

As filed with the Securities and Exchange Commission on March

31,

2014

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ý

¨

Pre-Effective Amendment No.

ý

Post-Effective Amendment No.

20

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

ý

ý

Amendment No.

23

(Check appropriate box or boxes.)

Compass EMP Funds Trust

(Exact Name of Registrant as Specified in Charter)

17605 Wright Street, Omaha, NE 68130

(Address of Principal Executive Offices)(Zip Code)

Registrant’s Telephone Number, including Area Code:

(402) 895-1600

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and Address of Agent for Service)

With copy to:

|

|

JoAnn M. Strasser, Thompson Hine LLP

41 South High Street, 17th Floor

Columbus, Ohio 43215

614-469-3265 (phone)

614-469-3361 (fax)

|

Approximate date of proposed public offering: As soon as practicable after the effective date of the Registration Statement.

It is proposed that this filing will become effective:

¨

Immediately upon filing pursuant to paragraph (b)

X

On (

April 1, 2014

) pursuant to paragraph (b)

¨

60 days after filing pursuant to paragraph (a)(1)

¨

On (date) pursuant to paragraph (a)(1)

¨

75 days after filing pursuant to paragraph (a)(2)

¨

On (date) pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

¨

This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

![[PROSPECTUS001.JPG]](http://content.edgar-online.com/edgar_conv_img/2014/03/31/0000910472-14-001417_PROSPECTUS001.JPG)

April

1,

2014

Prospectus

Compass EMP Multi-Asset Balanced Fund

Class A: CTMAX Class C: CTMCX Class T: CTMTX

Compass EMP Multi-Asset Growth Fund

Class A: LTGAX Class C: LTGCX Class T: LTGTX

Compass EMP Alternative Strategies Fund

Class A: CAIAX Class C: CAICX Class T: CAITX

This Prospectus provides important information about the Funds that you should know before investing. Please Read it carefully and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

Prospectus –

|

|

|

FUND SUMMARY-COMPASS EMP MULTI-ASSET BALANCED FUND

|

1

|

|

FUND SUMMARY-COMPASS EMP MULTI-ASSET GROWTH FUND

|

7

|

|

FUND SUMMARY-COMPASS EMP ALTERNATIVE STRATEGIES FUND

|

13

|

|

ADDITIONAL INFORMATION ABOUT PRINCIPAL INVESTMENT STRATEGIES AND RELATED RISKS

|

18

|

|

MANAGEMENT

|

27

|

|

HOW SHARES ARE PRICED

|

28

|

|

HOW TO PURCHASE SHARES

|

29

|

|

HOW TO REDEEM SHARES

|

34

|

|

FREQUENT PURCHASES AND REDEMPTIONS OF FUND SHARES

|

36

|

|

TAX STATUS, DIVIDENDS AND DISTRIBUTIONS

|

37

|

|

DISTRIBUTION OF SHARES

|

37

|

|

FINANCIAL HIGHLIGHTS

|

38

|

|

PRIVACY NOTICE

|

48

|

FUND SUMMARY-COMPASS EMP MULTI-ASSET BALANCED FUND

Investment Objectives:

The Compass EMP Multi-Asset Balanced Fund's (the “Balanced Fund” or the “Fund”) primary objective is total return, which the Balanced Fund considers to be a combination of interest, capital gains, dividends and distributions.

Fees and Expenses of the Fund:

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A and Class T shares if you and your family invest, or agree to invest in the future, at least $50,000 in the Compass EMP Funds. More information about these and other discounts is available from your financial professional and in

How to Purchase Shares

on page

29

of the Fund's Prospectus

and

Purchase

and Redemption of

Shares

on page

38

of the Statement of Additional Information.

|

|

|

|

|

Shareholder Fees

(fees paid directly from your investment)

|

Class A

|

Class T

|

Class C

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

5.75%

|

3.50%

|

None

|

|

Wire Redemption Fee (per wire redemption; deducted directly from account)

|

$15.00

|

$15.00

|

$15.00

|

|

Annual Fund Operating Expenses

|

|

|

|

|

(expenses that you pay each year as a

percentage of the value of your investment)

|

|

|

|

|

Management Fees

(1)

|

0.00%

|

0.00%

|

0.00%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.50%

|

1.00%

|

|

Other Expenses

(1)

|

0.29%

|

0.29%

|

0.29%

|

|

Acquired Fund Fees and Expenses

(2)

|

0.92%

|

0.92%

|

0.92%

|

|

Total Annual Fund Operating Expenses

|

1.46%

|

1.71%

|

2.21%

|

|

Fee Waivers and Expense Reimbursement

(3)

|

(0.04)%

|

(0.04)%

|

(0.04)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers

|

1.42%

|

1.67%

|

2.17%

|

1

The Management Fee and Other Expenses are restated to reflect current contractual fees.

2

Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies and are estimated for the current fiscal year. The operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies.

3

Compass Efficient Model Portfolios, LLC (the “Advisor”) has contractually agreed through July 31,

2015

to

reimburse expenses, but only to the extent necessary to maintain the Funds’ total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds; 12b-1 fees and extraordinary expenses) at 0.25% for the Fund. This agreement may only be terminated by the Fund's Board of Trustees on 60 days' written notice to the Advisor.

Example

:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1

|

|

|

|

|

|

Class

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A

|

$711

|

$1,006

|

$1,323

|

$2,218

|

|

Class T

|

$514

|

$866

|

$1,242

|

$2,296

|

|

Class C

|

$220

|

$687

|

$1,181

|

$2,541

|

Portfolio Turnover

:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the portfolio turnover rate of the

Fund

was

111%

of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objectives by investing in affiliated underlying funds (the “Compass Funds”) advised by the Fund’s investment adviser, Compass Efficient Model Portfolios, LLC (the “Advisor”). These Compass Funds invest in a portfolio of equities (including common stock), fixed income securities and futures contracts (including commodity, currency and financial futures). The Advisor will select the appropriate investment vehicle based on the strategy of the particular asset class within the investment portfolio. The Fund may also invest in these asset classes directly or through exchange traded funds (“ETFs”). The Fund invests primarily in fixed income, equity and alternative (including commodity, currency, hedging and real estate) securities. Under normal market conditions, the Balanced Fund invests at least 25% of its net assets in equity securities and at least 25% of its assets in fixed income securities.

The Fund uses a proprietary volatility weighted global asset allocation model that seeks to produce lower correlation and volatility with a similar or greater return over a full market cycle compared to traditional market indexes. The rules-based asset allocation methodology used to manage the Fund's portfolio consists of restrictions, constraints and criteria for the purchase or sale of each individual asset class, security or strategy. Because the Fund follows a rules-based asset allocation strategy, the performance of the Fund is not intended to track or correlate the performance of any particular securities index.

The Advisor selects securities and strategies that invest across a broad range of global asset classes including, but not limited to, U.S., international and emerging markets stocks, including small, mid and large capitalization companies, U.S. and international bonds, U.S. and international real estate, commodities and currencies. Although the Advisor selects securities from a broad range of asset classes, the market capitalization of the equity securities in which the Fund may invest are not a factor considered by the Advisor in making investment decisions for the Fund. In considering fixed income securities in which the Fund may invest, directly or indirectly, the credit rating for these securities will generally be investment grade (which the Advisor defines as having a rating of BBB and above), but up to 20% of the Fund’s assets invested in fixed income may be invested in junk bonds. The Advisor will focus on fixed income securities with an intermediate average maturity (defined as between 2 and 10 years), although the Fund may invest in fixed income securities with any credit rating or maturity.

The Fund may invest up to 25% of its total assets in a wholly-owned and controlled subsidiary (the "Subsidiary"). The Subsidiary may invest primarily in (long and short) commodity, currency and financial futures, as well as fixed income securities and other investments intended to serve as margin or collateral for the Subsidiary's derivative positions. When viewed on a consolidated basis, the Subsidiary is subject to the same investment restrictions as the Fund.

Principal Risks of Investing in the Fund

As with any mutual fund, there is no guarantee that the Fund will achieve its goal. The Fund's returns will vary and you could lose money on your investment in the Fund.

2

·

Commodity Risk.

Commodity-related risks include production risks caused by unfavorable weather, animal and plant disease, geologic and environmental factors. Commodity-related risks also include unfavorable changes in government regulation such as tariffs, embargoes or burdensome production rules and restrictions. The Fund is also subject to commodity concentration risk because it normally invests over 25% of its assets in the commodities industries.

·

Conflict of Interest Risk.

The Fund invests in affiliated underlying funds (the Compass Funds), unaffiliated underlying funds, or a combination of both. The Advisor, therefore, is subject to conflicts of interest in allocating the Fund’s assets among the underlying funds. The Advisor will receive more revenue to the extent it selects a Compass Fund rather than an unaffiliated fund for inclusion in the Fund’s portfolio. In addition, the Advisor may have an incentive to allocate the Fund’s assets to those Compass Funds for which the net advisory fees payable to the Advisor are higher than the fees payable by other Compass Funds.

·

Currency Risk.

The Fund's net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. Additionally, certain foreign countries may impose restrictions on the ability of issuers of foreign securities to make payment of principal and interest to investors located outside the country, due to blockage of foreign currency exchanges or otherwise.

·

Emerging Market Risk.

Emerging market countries may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights. Emerging market economies may be based on only a few industries and security issuers may be more susceptible to economic weakness and more likely to default. Emerging market securities also tend to be less liquid.

·

Fixed Income Risk.

The value of the Fund's direct or indirect investments in fixed income securities will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. On the other hand, if rates fall, the value of the fixed income securities generally increases. The value of fixed income securities typically falls when an issuer's credit quality declines and may even become worthless if an issuer defaults.

·

Foreign Exposure Risk.

Special risks associated with investments in foreign markets may include less liquidity, greater volatility, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.

·

Futures Risk.

The Fund's use of futures contracts exposes the Fund to leverage and tracking risks because a small investment in futures contracts may produce large losses and futures contracts may not be perfect substitutes for securities.

·

Junk Bond Risk.

Lower-quality fixed income securities, known as "high yield" or "junk" bonds, present greater risk than bonds of higher quality, including an increased risk of default. These securities are considered speculative.

·

Liquidity Risks.

Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

·

Management Risk

. The Advisor's asset selection methodology may produce incorrect judgments about the value a particular asset and may not produce the desired results.

·

Preferred Stock Risk.

The value of preferred stocks will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of preferred stock. Preferred stocks are also subject to credit risk, which is the possibility that an issuer of preferred stock will fail to make its dividend payments.

3

·

Real Estate Risk.

The value of real estate investments are subject to the risks of the real estate market as a whole, such as taxation, regulations and economic and political factors that negatively impact the real estate market. These may include decreases in real estate values, overbuilding, increases in operating costs, interest rates and property taxes.

·

Sector Risk.

The Fund may be subject to the risk that its assets are invested in a particular sector or group of sectors in the economy and as a result, the value of the Fund may be adversely impacted by events or developments in a sector or group of sectors.

·

Small and Mid-Capitalization Stock Risk.

The earnings and prospects of smaller-sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Smaller-sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience.

·

Stock Market Risk.

Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels and political events affect the securities markets.

·

Tax Risk.

The Fund may not be able to meet the conditions to qualify as a "Regulated Investment Company" or "RIC" and be eligible for the favorable tax provisions under the Internal Revenue Code that apply to RICs. If the Fund does not qualify as a RIC, it will be subject to Fund-level taxation, which will reduce the Fund's net asset value by taxes paid on net income and net capital gains. In the alternative, the Fund may be required to pay a tax penalty that could be significant to maintain its RIC status.

·

Tracking Risks.

ETFs in which the Fund invests may not be able to replicate exactly the performance of the indices or sectors they track because transaction costs incurred by the ETF in adjusting the actual balance of the securities.

·

Turnover Risk:

The Fund may have portfolio turnover rates significantly in excess of 100%. Increased portfolio turnover causes the Fund to incur higher brokerage costs, which may adversely affect the Fund's performance and may produce increased taxable distributions.

·

Underlying Funds Risk.

Investment companies, including ETFs and mutual funds, are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in investment companies and also may be higher than other mutual funds that invest directly in securities. Investment companies are subject to specific risks, depending on the nature of the fund.

·

Wholly-Owned Subsidiary Risk.

The Subsidiary will not be registered under the Investment Company Act of 1940 ("1940 Act") and, unless otherwise noted in this Prospectus, will not be subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary, respectively, are organized, could result in the inability of the Fund and/or Subsidiary to operate as described in this Prospectus and could negatively affect the Fund and its shareholders. Your cost of investing in the Fund will be higher because you indirectly bear the expenses of the Subsidiary.

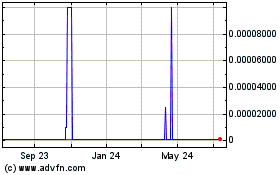

Performance:

The bar chart and accompanying table shown below provide an indication of the risks of investing in the Fund by showing the total return of its Class A shares for each full calendar year, and by showing how its average annual returns compare over time with those of a broad measure of market performance and a supplemental index. The Fund was reorganized on March 29, 2013 from a series of Mutual Fund Series Trust, an Ohio statutory trust, (the “Predecessor Fund”) to a series of Compass EMP Funds Trust, a Delaware statutory trust (the “Reorganization”). The Fund is a continuation of the

4

Predecessor Fund and, therefore, the performance information includes performance of the Predecessor Fund. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how it will perform in the future. Although Class C and Class T shares would have similar annual returns to Class A shares because the classes are invested in the same portfolio of securities, the returns for Class C and Class T shares would be different from Class A shares because Class C and Class T shares have different expenses than Class A shares. Updated performance information is available by calling 1-888-944-4367.

Calendar Year Returns as of December 31

![[PROSPECTUS003.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/31/0000910472-14-001417_PROSPECTUS003.GIF)

|

|

|

|

Best Quarter:

|

6/30/09

|

12.71%

|

|

Worst Quarter:

|

6/30/10

|

(3.26)%

|

Performance Table

Average Annual Total Returns

(For periods ended December 31,

2013)

|

|

|

|

Class A Shares

|

One Year

|

Since

Inception

(1)

|

|

Return before taxes

|

1.31%

|

6.34%

|

|

Return after taxes on distributions

|

(1.77)%

|

4.98%

|

|

Return after taxes on distributions and sale of Fund shares

|

1.25%

|

4.50%

|

|

Class C Shares

|

|

Return before taxes

|

6.63%

|

6.81%

|

|

Class T Shares

|

|

Return before taxes

|

3.36%

|

2.77%

|

|

S&P 500 Total Return Index (reflects no deduction for fees, expenses or taxes)

|

32.39%

|

17.94%

|

|

Barclays Hedge Fund of Funds Index

|

8.84%

|

4.32%

|

1

The inception date of the Fund’s Class A and Class C shares is December 31, 2008. The inception date of the Fund’s

Class T shares is December 30, 2009.

After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns are only shown for Class A shares. After-tax returns for Class C and Class T shares will vary.

5

The Barclay Hedge Fund of Funds Index is a measure of the average return of all hedge fund of funds in the Barclay database, which as of

December 31,

2013

included more than

1,197

hedge funds.

The Barclay Hedge Fund of Funds Index shows how the Fund’s performance compares with the returns of funds investing in a broad range of asset classes.

Advisor:

Compass Efficient Model Portfolios, LLC, also known as Compass EMP, is the Fund's investment advisor.

Portfolio Manager:

Stephen Hammers, managing partner, co-founder and chief investment officer of the Advisor, serves as the Fund's Portfolio Manager. He has served the Fund in this capacity since the Fund commenced operations.

Purchase and Sale of Fund Shares:

The minimum initial investment in Class A, C and T shares the Fund is $2,500 for a regular account, $2,500 for an IRA account, or $100 for an automatic investment plan account. The minimum subsequent investment in the Fund is $50. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange is open. Redemptions requests may be made in writing, by telephone or through a financial intermediary and will be paid by check of wire transfer.

Tax Information:

Dividends and capital gain distributions you receive from the Fund, whether you reinvest your distributions in additional Fund shares or receive them in cash, are taxable to you at either ordinary income or capital gains tax rates unless you are investing through a tax-deferred plan such as an IRA a 401(k) plan. If you are investing in a tax-free plan, distributions may be taxable upon withdrawal from the plan.

Payments to Broker-Dealers and Other Financial Intermediaries:

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

6

FUND SUMMARY-COMPASS EMP MULTI-ASSET GROWTH FUND

Investment Objective:

The Compass EMP Multi-Asset Growth Fund's (the “Growth Fund” or the “Fund”) objective is to achieve long-term capital appreciation.

Fees and Expenses of the Fund:

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A and Class T shares if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund. More information about these and other discounts is available from your financial professional and in

How to Purchase Shares

on page

29

of the Fund's Prospectus

and

Purchase and Redemption of Shares

on page

38

of the Statement of Additional Information.

|

|

|

|

|

Shareholder Fees

(fees paid directly from your investment)

|

Class A

|

Class T

|

Class C

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

5.75%

|

3.50%

|

None

|

|

Wire Redemption Fee (per wire redemption; deducted directly from account)

|

$15.00

|

$15.00

|

$15.00

|

|

Annual Fund Operating Expenses

|

|

|

|

|

(expenses that you pay each year as a

percentage of the value of your investment)

|

|

|

|

|

Management Fees

(1)

|

0.00%

|

0.00%

|

0.00%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.50%

|

1.00%

|

|

Other Expenses

(1)

|

0.31%

|

0.31%

|

0.31%

|

|

Acquired Fund Fees and Expenses

(2)

|

1.25%

|

1.25%

|

1.25%

|

|

Total Annual Fund Operating Expenses

|

1.81%

|

2.06%

|

2.56%

|

|

Fee Waivers and Expense Reimbursement

(3)

|

(0.06)%

|

(0.06)%

|

(0.06)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursement

|

1.75%

|

2.00%

|

2.50%

|

1

The Management Fee and Other Expenses are restated to reflect current contractual fees.

2

Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies and are estimated for the current fiscal year. The operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies.

3

Compass Efficient Model Portfolios, LLC (the “Advisor”) has contractually agreed through July 31,

2015

to

reimburse expenses, but only to the extent necessary to maintain the Funds’ total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds; 12b-1 fees and extraordinary expenses) at 0.25% for the Fund. This agreement may only be terminated by the Fund's Board of Trustees on 60 days' written notice to the Advisor.

Example

:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that each Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

Class

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A

|

$743

|

$1,106

|

$1,493

|

$2,575

|

|

Class T

|

$546

|

$968

|

$1,414

|

$2,

651

|

|

Class C

|

$253

|

$791

|

$1,355

|

$2,891

|

7

Portfolio Turnover

:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the portfolio turnover rate of the

Fund

was

151%

of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing in affiliated underlying funds (the “Compass Funds”) advised by the Fund’s investment adviser, Compass Efficient Model Portfolios, LLC (the “Advisor”). These Compass Funds invest in a portfolio of equities (including common stocks), fixed income securities (of any credit quality or maturity) and futures contracts (including commodity, currency and financial futures). The Advisor will select the appropriate investment vehicle based on the strategy of the particular asset class within the investment portfolio.

The Fund may also invest in these asset classes directly or through exchange traded funds (“ETFs”). The Fund invests primarily in fixed income, equity and alternative (including commodity, currency, hedging and real estate) securities.

The Fund uses a proprietary volatility weighted global asset allocation model that seeks to produce lower correlation and volatility with a similar or greater return over a full market cycle compared to traditional market indexes. The rules-based asset allocation methodology used to manage the Fund's portfolio consists of restrictions, constraints and criteria for the purchase or sale of each individual asset class, security or strategy. Because the Fund follows a rules-based asset allocation strategy, the performance of the Fund is not intended to track or correlate the performance of any particular securities index.

The Advisor selects securities and strategies that invest across a broad range of global asset classes including, but not limited to, U.S., international and emerging markets stocks, including small, mid and large capitalization companies, U.S. and international bonds, U.S. and international real estate, commodities and currencies. Although the Advisor selects securities from a broad range of asset classes, the market capitalization of the equity securities in which the Fund may invest are not a factor considered by the Advisor in making investment decisions for the Fund.

The Fund may invest up to 25% of its total assets in a wholly-owned and controlled subsidiary (the "Subsidiary"). The Subsidiary may invest primarily in (long and short) commodity, currency and financial futures, as well as fixed income securities and other investments intended to serve as margin or collateral for the Subsidiary's derivative positions. When viewed on a consolidated basis, the Subsidiary is subject to the same investment restrictions as the Fund.

Principal Risks of Investing in the Fund

As with any mutual fund, there is no guarantee that a Fund will achieve its goal. The Fund's returns will vary and you could lose money on your investment in the Fund.

·

Commodity Risk.

Commodity-related risks include production risks caused by unfavorable weather, animal and plant disease, geologic and environmental factors. Commodity-related risks also include unfavorable changes in government regulation such as tariffs, embargoes or burdensome production rules and restrictions. The Fund is also subject to commodity concentration risk because it normally invests over 25% of its assets in the commodities industries.

·

Conflict of Interest Risk.

The Fund invests in affiliated underlying funds (the Compass Funds), unaffiliated underlying funds, or a combination of both. The Advisor, therefore, is subject to conflicts of interest in allocating the Fund’s assets among the underlying funds. The Advisor will receive more revenue to the extent it selects a Compass Fund rather than an unaffiliated fund for inclusion in the Fund’s portfolio. In addition, the Advisor may have an incentive to allocate the Fund’s assets to those

8

Compass Funds for which the net advisory fees payable to the Advisor are higher than the fees payable by other Compass Funds.

·

Currency Risk.

The Fund's net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. Additionally, certain foreign countries may impose restrictions on the ability of issuers of foreign securities to make payment of principal and interest to investors located outside the country, due to blockage of foreign currency exchanges or otherwise.

·

Emerging Market Risk.

Emerging market countries may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights. Emerging market economies may be based on only a few industries and security issuers may be more susceptible to economic weakness and more likely to default. Emerging market securities also tend to be less liquid.

·

Fixed Income Risk.

The value of the Fund's direct or indirect investments in fixed income securities will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. On the other hand, if rates fall, the value of the fixed income securities generally increases. The value of fixed income securities typically falls when an issuer's credit quality declines and may even become worthless if an issuer defaults.

·

Foreign Exposure Risk.

Special risks associated with investments in foreign markets may include less liquidity, greater volatility, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.

·

Futures Risk.

The Fund's use of futures contracts exposes the Fund to leverage and tracking risks because a small investment in futures contracts may produce large losses and futures contracts may not be perfect substitutes for securities.

·

Junk Bond Risk.

Lower-quality fixed income securities, known as "high yield" or "junk" bonds, present greater risk than bonds of higher quality, including an increased risk of default. These securities are considered speculative.

·

Liquidity Risks.

Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

·

Management Risk.

The Advisor's asset selection methodology may produce incorrect judgments about the value a particular asset and may not produce the desired results.

·

Preferred Stock Risk.

The value of preferred stocks will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of preferred stock. Preferred stocks are also subject to credit risk, which is the possibility that an issuer of preferred stock will fail to make its dividend payments.

·

Real Estate Risk.

The value of real estate investments are subject to the risks of the real estate market as a whole, such as taxation, regulations and economic and political factors that negatively impact the real estate market. These may include decreases in real estate values, overbuilding, increases in operating costs, interest rates and property taxes.

·

Sector Risk.

The Fund may be subject to the risk that its assets are invested in a particular sector or group of sectors in the economy and as a result, the value of the Fund may be adversely impacted by events or developments in a sector or group of sectors.

9

·

Small and Mid-Capitalization Stock Risk.

The earnings and prospects of smaller-sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Smaller-sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience.

·

Stock Market Risk.

Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels and political events affect the securities markets.

·

Tax Risk.

The Fund may not be able to meet the conditions to qualify as a "Regulated Investment Company" or "RIC" and be eligible for the favorable tax provisions under the Internal Revenue Code that apply to RICs. If the Fund does not qualify as a RIC, it will be subject to Fund-level taxation, which will reduce the Fund's net asset value by taxes paid on net income and net capital gains. In the alternative, the Fund may be required to pay a tax penalty that could be significant to maintain its RIC status.

·

Tracking Risks.

ETFs in which the Fund invests may not be able to replicate exactly the performance of the indices or sectors they track because transaction costs incurred by the ETF in adjusting the actual balance of the securities.

·

Turnover Risk.

The Fund may have portfolio turnover rates significantly in excess of 100%. Increased portfolio turnover causes the Fund to incur higher brokerage costs, which may adversely affect the Fund's performance and may produce increased taxable distributions.

·

Underlying Funds Risk.

Investment companies, including ETFs and mutual funds, are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in investment companies and also may be higher than other mutual funds that invest directly in securities. Investment companies are subject to specific risks, depending on the nature of the fund.

·

Wholly-Owned Subsidiary Risk.

The Subsidiary will not be registered under the Investment Company Act of 1940 ("1940 Act") and, unless otherwise noted in this Prospectus, will not be subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary, respectively, are organized, could result in the inability of the Fund and/or Subsidiary to operate as described in this Prospectus and could negatively affect the Fund and its shareholders. Your cost of investing in the Fund will be higher because you indirectly bear the expenses of the Subsidiary.

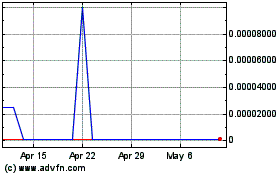

Performance:

The bar chart and accompanying table shown below provide an indication of the risks of investing in the Fund by showing the total return of its Class A shares for each full calendar year, and by showing how its average annual returns compare over time with those of a broad measure of market performance and a supplemental index. The Fund was reorganized on March 29, 2013 from a series of Mutual Fund Series Trust, an Ohio statutory trust, (the “Predecessor Fund”) to a series of Compass EMP Funds Trust, a Delaware statutory trust (the “Reorganization”). The Fund is a continuation of the Predecessor Fund and, therefore, the performance information includes performance of the Predecessor Fund. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how it will perform in the future. Although Class C and Class T shares would have similar annual returns to Class A shares because the classes are invested in the same portfolio of securities, the returns for Class C and Class T shares would be different from Class A shares because Class C and Class T shares have different expenses than Class A shares. Updated performance information is available by calling 1-888-944-4367.

10

Calendar Year Returns as of December 31

![[PROSPECTUS007.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/31/0000910472-14-001417_PROSPECTUS007.GIF)

|

|

|

|

Best Quarter:

|

6/30/09

|

18.04%

|

|

Worst Quarter:

|

3/31/09

|

(10.21)%

|

Performance Table

Average Annual Total Returns

(For periods ended December 31,

2013)

|

|

|

|

Class A Shares

|

One Year

|

Since

Inception

(1)

|

|

Return before taxes

|

13.33%

|

7.65%

|

|

Return after taxes on distributions

|

5.94%

|

5.75%

|

|

Return after taxes on distributions and sale of Fund shares

|

8.22%

|

5.27%

|

|

Class C Shares

|

|

Return before taxes

|

19.32%

|

8.07%

|

|

Class T Shares

|

|

Return before taxes

|

15.74%

|

3.99%

|

|

S&P 500 Total Return Index (reflects no deduction for fees,

expenses or taxes)

|

32.39%

|

17.94%

|

|

Barclays Hedge Fund Index

|

11.12%

|

9.30%

|

|

Barclays Hedge Fund of Funds Index

|

8.84%

|

4.32%

|

1

The inception date of the Fund’s Class A and Class C shares is December 31, 2008. The inception date of the Fund’s

Class T shares is December 30, 2009.

After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns are only shown for Class A shares. After-tax returns for Class C and Class T shares will vary.

The Barclay Hedge Fund Index is a measure of the average return of all hedge funds (excepting Funds of Funds) in the Barclay database, which as of

December 31,

2013

included more than

5,064

hedge funds.

The Barclay Hedge Fund of Funds Index is a measure of the average return of all hedge fund of funds in the Barclay database, which as of

December 31,

2013

included more than

1,197

hedge funds.

The Barclay Hedge Fund Index and Barclay Hedge Fund of Funds Index show how the Fund’s performance compares with the returns of funds investing in a broad range of asset classes.

11

Advisor:

Compass Efficient Model Portfolios, LLC, also known as Compass EMP, is the Fund's investment advisor.

Portfolio Manager:

Stephen Hammers, managing partner, co-founder and chief investment officer of the Advisor, serves as the Fund's Portfolio Manager. He has served the Fund in this capacity since the Fund commenced operations.

Purchase and Sale of Fund Shares:

The minimum initial investment in Class A, C and T shares the Fund is $2,500 for a regular account, $2,500 for an IRA account, or $100 for an automatic investment plan account. The minimum subsequent investment in the Fund is $50. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange is open. Redemptions requests may be made in writing, by telephone or through a financial intermediary and will be paid by check of wire transfer.

Tax Information:

Dividends and capital gain distributions you receive from the Fund, whether you reinvest your distributions in additional Fund shares or receive them in cash, are taxable to you at either ordinary income or capital gains tax rates unless you are investing through a tax-deferred plan such as an IRA a 401(k) plan. If you are investing in a tax-free plan, distributions may be taxable upon withdrawal from the plan.

Payments to Broker-Dealers and Other Financial Intermediaries:

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

12

FUND SUMMARY-COMPASS EMP ALTERNATIVE STRATEGIES FUND

Investment Objectives:

The Compass EMP Alternative Strategies Fund's (the "Alternative Fund" or the “Fund”) objective is long-term capital appreciation.

Fees and Expenses of the Fund:

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 in the Compass EMP Funds. More information about these and other discounts is available from your financial professional and in

How to Purchase Shares

on page

29

of the Fund's Prospectus

and

Purchase

and

Redemption of Shares

on page

38

of the Statement of Additional Information.

|

|

|

|

|

Shareholder Fees

(fees paid directly from your investment)

|

Class A

|

Class T

|

Class C

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

5.75%

|

3.50%

|

None

|

|

Wire Redemption Fee (per wire redemption; deducted directly from account)

|

$15.00

|

$15.00

|

$15.00

|

|

Annual Fund Operating Expenses

|

|

|

|

|

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

Management Fees

(1)

|

0.00%

|

0.00%

|

0.00%

|

|

Distribution and/or Service (12b-1) Fees

|

0.25%

|

0.50%

|

1.00%

|

|

Other Expenses

(1) (4)

|

0.77%

|

0.77%

|

0.77%

|

|

Acquired Fund Fees and Expenses

(2)

|

0.48%

|

0.48%

|

0.48%

|

|

Total Annual Fund Operating Expenses

|

1.50%

|

1.75%

|

2.25%

|

|

Fee Waivers and Expense Reimbursement

(3)

|

20)%

(0.

|

(0.20)%

|

(0.20)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers

|

1.30%

|

1.55%

|

2.05%

|

1

The Management Fee and Other Expenses are restated to reflect current contractual fees.

2

Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies and are estimated for the current fiscal year. The operating expenses in this fee table will not correlate to the expense ratio in the Fund's financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies.

3

Compass Efficient Model Portfolios, LLC (the “Advisor”) has contractually agreed through July 31,

2015

to

reimburse expenses, but only to the extent necessary to maintain the Funds’ total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds; 12b-1 fees and extraordinary expenses) at 0.25% for the Fund. This agreement may only be terminated by the Fund's Board of Trustees on 60 days' written notice to the Advisor.

4

During the year ended November 30, 2013, the Alternative Fund acquired and maintained a controlling interest in each of the Compass EMP Long/Short Strategies Fund, Compass EMP Commodity Strategies Enhanced Volatility Weighted Fund (formerly known as Compass EMP Commodity Long/Short Strategies Fund) and the Compass EMP Commodity Strategies Volatility Weighted Fund. The Other Expenses of the Alternative Fund include the activity of its wholly owned CFC, the activity of the Compass EMP Commodity Strategies Volatility Weighted Fund for the period July 26, 2013 through November 30, 2013, and the activity of Compass EMP Commodity Strategies Enhanced Volatility Weighted Fund

(and its wholly owned CFC) and Compass EMP Commodity Strategies Volatility Weighted Fund (and its wholly owned CFC) for the period April 11, 2013 through November 30, 2013.

Example

:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

13

|

|

|

|

|

|

Class

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Class A

|

$700

|

$1,003

|

$1,329

|

$2,246

|

|

Class T

|

$502

|

$863

|

$1,248

|

$2,324

|

|

Class C

|

$208

|

$684

|

$1,187

|

$2,569

|

Portfolio Turnover

:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the portfolio turnover rate of the

Fund

was

153%

of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objectives by investing in affiliated underlying funds (the “Compass Funds”) advised by the Fund’s investment adviser, Compass Efficient Model Portfolios, LLC (the “Advisor”). These Compass Funds invest in a portfolio of equities (including common stock), fixed income securities and futures contracts (including commodity, currency and financial futures). The Advisor will select the appropriate investment vehicle based on the strategy of the particular asset class within the investment portfolio. The Fund may also invest in these asset classes directly or through exchange traded funds (“ETFs”). The Fund invests primarily in fixed income, equity and alternative securities, with an emphasis on alternatives (including commodity, currency, hedging and real estate). The Fund’s strategy generally focuses on investments that have the potential to provide capital appreciation.

The Fund uses a proprietary volatility weighted global asset allocation model that seeks to produce lower correlation and volatility with a similar or greater return over a full market cycle compared to traditional market indexes. The rules-based asset allocation methodology used to manage the Fund's portfolio consists of restrictions, constraints and criteria for the purchase or sale of each individual asset class, security or strategy. Because the Fund follows a rules-based asset allocation strategy, the performance of the Fund is not intended to track or correlate the performance of any particular securities index.

The Advisor selects securities and strategies that invest across a broad range of global asset classes including, but not limited to, U.S., international and emerging markets stocks, including small, mid and large capitalization companies, U.S. and international bonds, U.S. and international real estate, commodities and currencies. Although the Advisor selects securities from a broad range of asset classes, the market capitalization of the equity securities in which the Fund may invest are not a factor considered by the Advisor in making investment decisions for the Fund. In considering fixed income securities in which the Fund may invest, directly or indirectly, the credit rating for these securities will generally be investment grade (which the Advisor defines as having a rating of BBB and above), but up to 20% of the Fund’s assets invested in fixed income may be invested in junk bonds. The Advisor will focus on fixed income securities with an intermediate average maturity (defined as between 2 and 10 years), although the Fund may invest in fixed income securities with any average credit rating or maturity.

The Fund may invest up to 25% of its total assets in a wholly-owned and controlled subsidiary (the "Subsidiary"). The Subsidiary may invest primarily in (long and short) commodity, currency and financial futures, as well as fixed income securities and other investments intended to serve as margin or collateral for the Subsidiary's derivative positions. When viewed on a consolidated basis, the Subsidiary is subject to the same investment restrictions as the Fund.

Principal Risks of Investing in the Fund

As with any mutual fund, there is no guarantee that the Fund will achieve its goal. The Fund's returns will vary and you could lose money on your investment in the Fund.

·

Commodity Risk.

Commodity-related risks include production risks caused by unfavorable weather, animal and plant disease, geologic and environmental factors. Commodity-related risks also

include unfavorable changes in government regulation such as tariffs, embargoes

or burdensome production

14

rules and restrictions. The Fund is also subject to commodity concentration risk because it normally invests over 25% of its assets in the commodities industries.

·

Conflict of Interest Risk.

The Fund invests in affiliated underlying funds (the Compass Funds), unaffiliated underlying funds, or a combination of both. The Advisor, therefore, is subject to conflicts of interest in allocating the Fund’s assets among the underlying funds. The Advisor will receive more revenue to the extent it selects a Compass Fund rather than an unaffiliated fund for inclusion in the Fund’s portfolio. In addition, the Advisor may have an incentive to allocate the Fund’s assets to those Compass Funds for which the net advisory fees payable to the Advisor are higher than the fees payable by other Compass Funds.

·

Currency Risk.

The Fund's net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. Additionally, certain foreign countries may impose restrictions on the ability of issuers of foreign securities to make payment of principal and interest to investors located outside the country, due to blockage of foreign currency exchanges or otherwise.

·

Emerging Market Risk.

Emerging market countries may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights. Emerging market economies may be based on only a few industries and security issuers may be more susceptible to economic weakness and more likely to default. Emerging market securities also tend to be less liquid.

·

Fixed Income Risk.

The value of the Fund's direct or indirect investments in fixed income securities will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. On the other hand, if rates fall, the value of the fixed income securities generally increases. The value of fixed income securities typically falls when an issuer's credit quality declines and may even become worthless if an issuer defaults.

·

Foreign Exposure Risk.

Special risks associated with investments in foreign markets may include less liquidity, greater volatility, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.

·

Futures Risk.

The Fund's use of futures contracts exposes the Fund to leverage and tracking risks because a small investment in futures contracts may produce large losses and futures contracts may not be perfect substitutes for securities.

·

Junk Bond Risk.

Lower-quality fixed income securities, known as "high yield" or "junk" bonds, present greater risk than bonds of higher quality, including an increased risk of default. These securities are considered speculative.

·

Liquidity Risks.

Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

·

Management Risk.

The Advisor's asset selection methodology may produce incorrect judgments about the value a particular asset and may not produce the desired results.

·

Preferred Stock Risk.

The value of preferred stocks will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of preferred stock. Preferred stocks are also subject to credit risk, which is the possibility that an issuer of preferred stock will fail to make its dividend payments.

·

Real Estate Risk.

The

value of real estate investments are subject to the risks of the real estate

market as a whole, such as taxation, regulations and economic and political

factors that negatively

15

impact the real estate market. These may include decreases in real estate values, overbuilding, increases in operating costs, interest rates and property taxes.

·

Sector Risk.

The Fund may be subject to the risk that its assets are invested in a particular sector or group of sectors in the economy and as a result, the value of the Fund may be adversely impacted by events or developments in a sector or group of sectors.

·

Small and Mid-Capitalization Stock Risk.

The earnings and prospects of smaller-sized companies are more volatile than larger companies and may experience higher failure rates than larger companies. Smaller-sized companies normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience.

·

Stock Market Risk.

Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels and political events affect the securities markets.

·

Underlying Funds Risk.

Investment companies, including ETFs and mutual funds, are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in investment companies and also may be higher than other mutual funds that invest directly in securities. Investment companies are subject to specific risks, depending on the nature of the fund.

·

Tracking Risks.

ETFs in which the Fund invests may not be able to replicate exactly the performance of the indices or sectors they track because transaction costs incurred by the ETF in adjusting the actual balance of the securities.

·

Tax Risk.

The Fund may not be able to meet the conditions to qualify as a "Regulated Investment Company" or "RIC" and be eligible for the favorable tax provisions under the Internal Revenue Code that apply to RICs. If the Fund does not qualify as a RIC, it will be subject to Fund-level taxation, which will reduce the Fund's net asset value by taxes paid on net income and net capital gains. In the alternative, the Fund may be required to pay a tax penalty that could be significant to maintain its RIC status.

·

Wholly-Owned Subsidiary Risk.

The Subsidiary will not be registered under the Investment Company Act of 1940 ("1940 Act") and, unless otherwise noted in this Prospectus, will not be subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary, respectively, are organized, could result in the inability of the Fund and/or Subsidiary to operate as described in this Prospectus and could negatively affect the Fund and its shareholders. Your cost of investing in the Fund will be higher because you indirectly bear the expenses of the Subsidiary.

·

Turnover Risk.

The Fund may have portfolio turnover rates significantly in excess of 100%. Increased portfolio turnover causes the Fund to incur higher brokerage costs, which may adversely affect the Fund's performance and may produce increased taxable distributions.

Performance:

The bar chart and accompanying table shown below provide an indication of the risks of investing in the Fund by showing the total return of its Class A shares for each full calendar year, and by showing how its average annual returns compare over time with those of a broad measure of market performance and a supplemental index. The Fund was reorganized on March 29, 2013 from a series of Mutual Fund Series Trust, an Ohio statutory trust, (the “Predecessor Fund”) to a series of Compass EMP Funds Trust, a Delaware statutory trust (the “Reorganization”). The Fund is a continuation of the

Predecessor Fund and, therefore, the performance information includes

performance of the Predecessor Fund. How the Fund has performed in the past

(before and after taxes) is not necessarily an indication of how it will perform

in the future. Although Class C and Class T shares would have similar annual

returns to

16

Class A shares because the classes are invested in the same portfolio of securities, the returns for Class C and Class T shares would be different from Class A shares because Class C and Class T shares have different expenses than Class A shares. Updated performance information is available by calling 1-888-944-4367.

Calendar Year Returns as of December 31

![[PROSPECTUS010.GIF]](http://content.edgar-online.com/edgar_conv_img/2014/03/31/0000910472-14-001417_PROSPECTUS010.GIF)

|

|

|

|

Best Quarter:

|

9/30/10

|

8.77%

|

|

Worst Quarter:

|

6/30/10

|

(6.34)%

|

Performance Table

Average Annual Total Returns

(For periods ended December 31,

2013)

|

|

|

|

Class A Shares

|

One Year

|

Since

Inception (12/30/2009)

|

|

Return before taxes

|

(1.56)%

|

(1.04)%

|

|

Return after taxes on distributions

|

(1.56)%

|

(1.13)%

|

|

Return after taxes on distributions and sale of Fund shares

|

(0.89)%

|

(0.81)%

|

|

Class C Shares

|

|

Return before taxes

|

3.59%

|

(0.36)%

|

|

Class T Shares

|

|

Return before taxes

|

(0.40)%

|

(0.73)%

|

|

S&P 500 Total Return Index (reflects no deduction for fees, expenses or taxes)

|

32.39

%

|

15.60

%

|

|

Barclays Hedge Fund Index

|

11.12%

|

5.96%

|

|

Barclays Hedge Fund of Funds Index

|

8.84%

|

2.89%

|

After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns are only shown for Class A shares. After-tax returns for Class C and Class T shares will vary.

The Barclay Hedge Fund Index is a measure of the average return of all hedge funds (excepting Funds of Funds) in the Barclay database, which as of

December 31,

2013

included more than

5,064

hedge funds

. The Barclay Hedge Fund of Funds Index is a measure of the average return of all hedge fund of funds in the Barclay database, which as of

December 31,

2013

included more than

1,197

hedge funds.

The Barclay Hedge Fund Index and Barclay Hedge Fund of Funds Index show how

the Fund’s performance compares with the returns of funds investing in a broad

range of asset classes

17

Advisor:

Compass Efficient Model Portfolios, LLC, also known as Compass EMP, is the Fund's investment advisor.

Portfolio Manager:

Stephen Hammers, managing partner, co-founder and chief investment officer of the Advisor, serves as the Fund's Portfolio Manager. He has served the Fund in this capacity since the Fund commenced operations.

Purchase and Sale of Fund Shares:

The minimum initial investment in Class A, C and T shares the Fund is $2,500 for a regular account, $2,500

for an IRA account, or $100 for an automatic investment plan account. The minimum subsequent investment in the Fund is $50. You may purchase and redeem shares of the Fund on any day that the New York Stock Exchange is open. Redemptions requests may be made in writing, by telephone or through a financial intermediary and will be paid by check of wire transfer.

Tax Information:

Dividends and capital gain distributions you receive from the Fund, whether you reinvest your distributions in additional Fund shares or receive them in cash, are taxable to you at either ordinary income or capital gains tax rates unless you are investing through a tax-deferred plan such as an IRA a 401(k) plan. If you are investing in a tax-free plan, distributions may be taxable upon withdrawal from the plan.

Payments to Broker-Dealers and Other Financial Intermediaries:

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

ADDITIONAL INFORMATION ABOUT PRINCIPAL INVESTMENT STRATEGIES AND RELATED RISKS

INVESTMENT OBJECTIVES

|

|

|

Fund

|

Investment Objective

|

|

Balanced Fund

|

The Fund's objective is total return.

|

|

Growth Fund

|

The Fund's objective is long-term capital appreciation.

|

|

Alternative Fund

|

The Fund's objective is long-term capital appreciation.

|

The investment objectives of each Fund are non-fundamental and may be changed by the Board of Trustees without shareholder approval. If the Board decides to change a Fund's investment objectives, or the Balanced Fund's policy to invest at least 25% of its total assets in equities and 25% in fixed income securities, shareholders will be given 60 days' advance notice.

PRINCIPAL INVESTMENT STRATEGIES

Balanced Fund

The Fund seeks to achieve its investment objectives by investing

in affiliated underlying funds (the “Compass Funds”) advised by the Fund’s investment adviser. These Compass Funds invest in a portfolio of equities, fixed income securities and futures contracts. The Advisor will select the appropriate investment vehicle based on the strategy of the particular asset class within the investment portfolio. The Fund may also invest in these asset classes directly or through exchange traded funds (“ETFs”). The Fund invests primarily in fixed income, equity and alternative (including commodity, currency, hedging and real estate) securities, with an emphasis on fixed income. Under normal market conditions, the Balanced Fund invests at least 25% of its net assets in equity securities and at least 25% of its assets in fixed income securities.

An ETF is an investment company that offers investors a proportionate share in a portfolio of stocks, bonds, or other securities. Like individual equity securities, ETFs are traded on a stock exchange and can be bought and sold throughout the day. Traditional ETFs

attempt to achieve the same investment return as that of a particular

18

market index, such as the Standard & Poor's 500 Index. To mirror the performance of a market index, an ETF invests either in all of the securities in the index or a representative sample of securities in the index. Unlike traditional indexes, which generally weight their holdings based on relative size (market capitalization), enhanced indexes use weighting structures that include other criteria such as earnings, sales, growth, liquidity, book value or dividends.

The Fund uses a proprietary volatility weighted global asset allocation model that seeks to produce lower correlation and volatility with a similar or greater return over a full market cycle compared to traditional market indexes. The rules-based asset allocation methodology used to manage the Fund's portfolio consists of restrictions, constraints and criteria for the purchase or sale of each individual asset class, security or strategy. Because the Fund follows a rules-based asset allocation strategy, the performance of the Fund is not intended to track or correlate the performance of any particular securities index.

The Advisor selects securities and strategies that invest across a broad range of global asset classes including, but not limited to, U.S., international and emerging markets stocks, including small, mid and large capitalization companies, U.S. and international bonds, U.S. and international real estate, commodities and currencies. Although the Advisor selects securities from a broad range of asset classes, the market capitalization of the equity securities in which the Fund may invest are not a factor considered by the Advisor in making investment decisions for the Fund. In considering fixed income securities in which the Fund may invest, directly or indirectly, the credit rating for these securities will generally be investment grade (which the Advisor defines as having a rating of BBB and above),

but up to 20% of the Fund’s assets invested in fixed income may be invested in junk bonds. The Advisor will focus on fixed income securities with an intermediate average maturity (defined as between 2 and 10 years), although the Fund may invest in fixed income securities with any credit rating or maturity. Following is a summary of the methodology used to manage the Fund's portfolio:

Following is a summary of the asset allocation methodology used to manage the Fund's portfolio. The summary below consists of restrictions, constraints and criteria for the purchase or sale of each individual asset class, security or strategy:

·

Utilize core, liquid markets and asset classes;

·

Weight individual asset classes based on their volatility in attempt to avoid opinion, market and asset class risk;

·

Weight individual positions on their volatility in an attempt to avoid opinion and security risk;

·

Rebalance asset classes based on upside and downside performance forcing a buy-low/sell-high strategy.

Subsidiary

The Fund may execute the commodity, currency and financial futures portion of its investment strategy, primarily, by investing up to 25% of its total assets (measured at the time of purchase) in a wholly-owned and controlled Subsidiary. The Subsidiary may invest primarily in (long and short) commodity, currency and financial futures, as well as fixed income securities and other investments intended to serve as margin or collateral for the Subsidiary's derivative positions. However, the Fund may also make futures investments outside of the Subsidiary. The Subsidiary is subject to the same investment restrictions as the Fund, when viewed on a consolidated basis. The principal investment strategies and principal investment risks of the Subsidiary are also principal investment strategies and principal risks of the Fund and are reflected in this Prospectus. By investing in commodities indirectly through the Subsidiary, the Fund will obtain exposure to the commodities markets within the federal tax requirements that apply to the Fund. Specifically, the Subsidiary is expected to provide the Fund with exposure to the commodities markets within the limitations of the federal tax requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"). Sub-chapter M requires, among other things, that at least 90% of the Fund's income be derived from securities or derived

with respect to its business of investing in securities (typically referred to

as "qualifying income"). The Fund may also make investments in certain

commodity-linked securities through the Subsidiary because income

19

from these securities is not treated as "qualifying income" for purposes of the 90% income requirement if the Fund invests in the security directly.

The Internal Revenue Service has issued a number of private letter rulings to other mutual funds (unrelated to the Fund), which indicate that certain income from a fund's investment in a wholly-owned foreign subsidiary will constitute "qualifying income" for purposes of Subchapter M. The Fund does not have a private letter ruling, but fully intends to comply with the IRS' rules if the IRS were to change its position. To satisfy the 90% income requirement, the Subsidiary will, no less than annually, declare and distribute a dividend to the Fund, as the sole shareholder of the Subsidiary, in an amount approximately equal to the total amount of "Subpart F" income (as defined in Section 951 of the Code) generated by or expected to be generated by the Subsidiary's investments during the fiscal year. Such dividend distributions are "qualifying income" pursuant to Subchapter M (Section 851(b)) of the Code.

Because the Fund may invest a substantial portion of its assets in the Subsidiary, which may hold some of the investments described in this Prospectus, the Fund may be considered to be investing indirectly in some of those investments through its Subsidiary. For that reason, references to the Fund may also include the Subsidiary.

When viewed on a consolidated basis, the Subsidiary will be subject to the same investment restrictions and limitations, and follow the same compliance policies and procedures, as the Fund.