Updated Research Report on General Motors - Analyst Blog

March 31 2014 - 10:20AM

Zacks

On Mar 2, 2014, we issued an updated research report on

General Motors Company (GM). General Motors

benefits from its focus on the emerging markets, investments in

North America and efforts to boost financial flexibility. We also

appreciate its focus on the fuel cell technology.

However, we are concerned about its significant exposure to

Europe, rising debt and declining free cash flow. Additionally,

high product recalls and the ongoing investigation regarding delay

in product recalls are reasons for concern.

General Motors recorded adjusted earnings of $1.1 billion or 67

cents per share in the fourth quarter of 2013, lagging the Zacks

Consensus Estimate of 88 cents per share. In comparison, the

company generated earnings of $0.8 billion or 48 cents per share in

the fourth quarter of 2012.

Revenues in the quarter grew 3.1% year over year to $40.5

billion, lagging the Zacks Consensus Estimate of $40.8 billion. In

2013, General Motors was the leading automaker with a 16.9% market

share in the U.S. GM is focusing on the emerging markets,

particularly Brazil, China and India, to recoup its global sales by

increasing capacity investment to meet the growing demand.

However, General Motors has been facing heat for delaying the

recall of 1.6 million vehicles with defective ignition switches

which can lead to shutting down of the engine and prevent

deployment of front air bags in the event of a crash.

GM’s total debt (Automotive and Financial) increased

significantly to $36.2 billion as of Dec 31, 2013 from $16.1

billion as of Dec 31, 2012. Consequently, debt-to-capitalization

ratio increased to 45.9% as of Dec 31, 2013 from 30.7% at the end

of 2012.

General Motors reported positive earnings surprises in 3 of the

trailing 4 quarters with an average beat of 2.95%. The Zacks

Consensus Estimate for the company’s 2014 earnings per share stands

at $3.77, up 18.52% from 2013.

General Motors currently holds a Zacks Rank #4 (Sell). Some

better-ranked automobile stocks worth considering are Tata

Motors Limited (TTM), Daimler AG (DDAIF)

and Tesla Motors, Inc. (TSLA). Tata Motors and

Dailmer sport a Zacks Rank #1 (Strong Buy), while Telsa carries a

Zacks Rank #2 (Buy).

DAIMLER AG (DDAIF): Get Free Report

GENERAL MOTORS (GM): Free Stock Analysis Report

TESLA MOTORS (TSLA): Free Stock Analysis Report

TATA MOTORS-ADR (TTM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

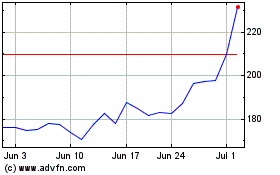

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024