IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS. This proxy statement and the enclosed proxy card are first being mailed or furnished to our shareholders on or about April 2, 2014. This proxy statement and our Annual Report on Form 10-K for the year ended

December 31, 2013

are available to holders of

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 2

record of our common stock at

www.envisionreports.com/vrtx

and to beneficial holders of our common stock at

www.edocumentview.com/vrtx.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 3

To assist you in reviewing the proposals to be acted upon, we call your attention to the following business and compensation highlights. The following description is only a summary. For more complete information on these topics, please review our Annual Report on Form 10-K for the year ended

December 31, 2013

, or 2013 Annual Report, and this proxy statement in full.

2013 was a very successful year for us. Since the end of 2012, we:

|

|

|

|

•

|

Increased our net product revenues from KALYDECO (ivacaftor) by 116% from $171.6 million in 2012 to $371.3 million in 2013. Most patients with cystic fibrosis, or CF, who have the G551D mutation in their cystic fibrosis transmembrane conductance regulator, or

CFTR

, gene in the United States and Europe have started treatment with KALYDECO.

|

|

|

|

|

•

|

Completed enrollment in two Phase 3 clinical trials in which we are evaluating lumacaftor in combination with ivacaftor as a potential treatment for patients with CF who have two copies (homozygous) of the F508del mutation in their

CFTR

gene with data expected in mid-2014. The F508del mutation is the most prevalent genetic mutation that causes CF.

|

|

|

|

|

•

|

Obtained approval to market KALYDECO for the treatment of patients with CF six years of age and older who have eight other mutations in their

CFTR

gene based on a supplemental New Drug Application, or sNDA, submitted in the United States in September 2013; and submitted in October 2013 our first Marketing Authorization Application, or MAA, variation for ivacaftor in the European Union.

|

|

|

|

|

•

|

Completed a Phase 3 clinical trial of ivacaftor in patients with CF who have the R117H mutation in their

CFTR

gene. Although this clinical trial did not meet its primary endpoint, we believe a pre-specified subgroup analysis demonstrated a clinical benefit in patients with CF 18 years of age and older who have the R117H mutation on at least one allele.

|

|

|

|

|

•

|

Completed enrollment in a Phase 3 clinical trial to evaluate ivacaftor as a treatment for children with CF two to five years of age with specific mutations in their

CFTR

gene, including the G551D mutation, and a Phase 2 proof-of-concept clinical trial in patients with CF who have clinical evidence of residual CFTR function.

|

|

|

|

|

•

|

Completed a Phase 2 clinical trial that demonstrated a clinical benefit of ivacaftor in combination with VX-661 in patients with CF who have two copies (homozygous) of the F508del mutation in their

CFTR

|

gene.

|

|

|

|

•

|

Received Breakthrough Therapy designation for the combination regimen of ivacaftor and VX-661.

|

|

|

|

|

•

|

Conducted Phase 2a clinical trials evaluating VX-135 and a Phase 2b clinical trial evaluating VX-509.

|

|

|

|

|

•

|

Maintained high research productivity:

|

|

|

|

|

◦

|

Advanced our CF research program to identify next-generation corrector compounds that could be included in future dual and/or triple combination treatment regimens.

|

|

|

|

|

◦

|

Progressed multiple other research and early-stage development programs, including programs in the areas of oncology, multiple sclerosis and other serious and rare diseases.

|

|

|

|

|

•

|

Strengthened our balance sheet:

|

|

|

|

|

◦

|

Ended 2013 with approximately $1.47 billion in cash, cash equivalents and marketable securities, which was an increase of approximately $143.9 million compared to the end of 2012.

|

|

|

|

|

◦

|

Eliminated $400 million in convertible debt.

|

|

|

|

|

•

|

Focused our research and development investment on our CF programs and our other research and early-stage development programs, and reduced our sales, general and administrative expenses to appropriately balance investment against revenues.

|

|

|

|

|

•

|

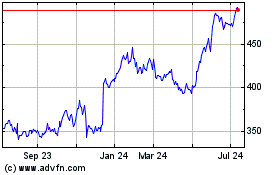

Increased our market capitalization from approximately $9.1 billion at the end of 2012 to approximately $17.4 billion at the end of 2013. The following chart sets forth the price of our common stock on December 31, 2011, 2012 and 2013.

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 4

|

|

|

|

|

SUMMARY INFORMATION

(continued)

|

Our compensation program is structured to attract, retain and motivate talented and experienced individuals across all areas of our business and align the interests of our executive officers with the interests of our shareholders as we seek to create value through the discovery, development and commercialization of transformative medicines. 2013 was a very successful year for Vertex, and our 2013 executive compensation decisions were made by applying our pay-for-performance compensation philosophy and principles, as follows:

|

|

|

|

|

|

• Our executive officers’ total compensation is comprised of a mix of base salary, annual cash bonus and long-term incentive awards that include both time-based stock options and performance-based restricted stock awards, and reflects a balance of elements so that a significant portion is performance-contingent, to better align our executives’ financial interests with the interests of our shareholders.

|

|

|

•

92% of the total compensation in 2013 for Dr. Jeffrey M. Leiden, our chairman, chief executive officer and president, was incentive-based in the form of annual cash bonus and equity compensation.

|

|

• We awarded our eligible officers annual cash bonuses and long-term equity grants at above-target levels to reward them for the company’s and their individual 2013 successes.

|

Our compensation for our named executive officers was supported by 78% of the “Say-on-Pay” advisory votes cast by our shareholders in 2013. In 2013, we continued our discussions with a number of our shareholders regarding, among other matters, our executive compensation program and dilution caused by our broad-based equity compensation program. During these discussions we listened to their perspectives and gained insight into how we could further align the interests of our company with the interests of our shareholders.

Our board of directors and management development and compensation committee reviewed our compensation programs and governance practices in light of our evolving business and implemented several changes in 2013 and early 2014, including:

|

|

|

|

◦

|

Implementing a modification to our equity compensation programs that resulted in a 20% decrease in the number of options that we granted in 2013 as compared to 2012 and a 5% decrease in the number of shares of restricted stock that we granted in 2013 as compared to 2012;

|

|

|

|

|

◦

|

Adopting stock ownership guidelines for all of our named executive officers, including our CEO; and

|

|

|

|

|

◦

|

Amending our by-laws to provide for a majority vote standard for uncontested elections of our directors.

|

The total compensation for 2013 for our named executive officers is set forth in the following table under the caption “Total Compensation.” To supplement this information, we have included a column entitled “Total Realized Compensation,” which subtracts the grant-date fair value of equity awards granted in 2013 and substitutes the actual value realized on the exercise of stock options and the vesting of restricted stock awards during 2013. Executives with a longer tenure had higher total realized compensation in 2013 because they exercised long-term incentive stock options that had increased in value over time as our stock price increased, which is consistent with the objectives of our compensation program.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officer

|

Title

|

Executive Since

|

Salary

|

Annual

Cash Bonus

|

Grant-Date Fair

Value of 2013

Equity Awards

|

Total

Compensation

|

|

|

Total Realized

Compensation

|

|

Jeffrey M. Leiden

|

Chairman, CEO and President

|

2011

|

$

|

1,038,462

|

|

$

|

2,772,000

|

|

$

|

9,303,337

|

|

$

|

13,126,474

|

|

|

|

$

|

8,112,903

|

|

|

Ian F. Smith

|

EVP & CFO

|

2001

|

$

|

582,959

|

|

$

|

682,500

|

|

$

|

2,906,628

|

|

$

|

4,184,762

|

|

|

$

|

36,597,952

|

|

|

Stuart A. Arbuckle

|

EVP & CCO

|

2012

|

$

|

553,846

|

|

$

|

630,000

|

|

$

|

3,622,501

|

|

$

|

4,819,022

|

|

|

$

|

2,534,960

|

|

|

Kenneth L. Horton

|

EVP & CLO

|

2012

|

$

|

465,000

|

|

$

|

439,425

|

|

$

|

3,622,501

|

|

$

|

4,539,551

|

|

|

$

|

1,505,376

|

|

|

Peter Mueller

|

EVP, Global R&D & CSO

|

2003

|

$

|

619,846

|

|

$

|

637,000

|

|

$

|

2,906,628

|

|

$

|

4,176,149

|

|

|

$

|

9,996,495

|

|

For information regarding our named executive officers’ compensation, as calculated under Securities and Exchange Commission, or SEC, rules, see the narrative and notes accompanying the

Summary Compensation Table

set forth beginning on page 49. For more information regarding the calculation of “Total Realized Compensation” see the narrative accompanying the

Total Realized Compensation Table

on page 51.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 5

|

|

|

|

|

SUMMARY INFORMATION

(continued)

|

Our board of directors recommends that our shareholders vote FOR the director nominees and FOR each of

the proposals.

ELECTION OF DIRECTORS (Item 1 – Page 9)

Margaret G. McGlynn and Wayne J. Riley have been nominated for re-election and William D. Young has been nominated for election at the

2014

annual meeting of shareholders. You will find important information about the qualifications and experience of each of our director nominees and each of our continuing directors in the section of this proxy statement captioned “Item 1: Election of Directors.”

APPROVAL OF AN AMENDMENT TO OUR 2013 STOCK AND OPTION PLAN (Item 2 – Page 23)

We are asking our shareholders to approve an amendment to our 2013 Stock and Option Plan, or 2013 Plan, that increases the number of shares authorized for issuance pursuant to the 2013 Plan by 9.5 million shares. We have adopted, subject to shareholder approval, the amendment to the 2013 Plan. The 2013 Plan utilizes a “fungible share” concept, in conjunction with our decision implemented in 2013 to shift our overall compensation balance toward more cash and less equity. The fungible share approach allows us to issue a higher percentage of restricted shares relative to options than was permitted under our 2006 Stock and Option Plan, which is intended to reduce dilution and result in the issuance of a lower number of overall shares. This shift resulted in us granting 20% fewer options and 5% fewer shares of restricted stock in 2013 as compared to 2012. The 2013 Plan has a pool of shares of our common stock eligible for issuance, with each share of issued restricted stock reducing the pool by 1.66 shares.

We believe that our equity compensation program has been fundamental to our success, and that the requested additional 9.5 million shares are necessary in order to continue to attract, incent and retain the right employees to achieve our short- and long-term business objectives.

We expect to continue to review our compensation programs in future periods in light of the market for talented employees in our industry and our business and financial profile.

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Item 3 – Page 30)

We are asking our shareholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for

2014

.

“SAY-ON-PAY” ADVISORY VOTE (Item 4 – Page 33)

We are asking our shareholders to approve, on an advisory basis, the compensation program for our named executive officers. We believe that our compensation program has been and will continue to be successful in attracting, retaining and motivating the right executive team to lead our company. After consideration of the evolution of our business and the views expressed by our shareholders, under a program we implemented in 2013 we changed the amounts payable under our incentive compensation programs, and modified certain of our compensation and equity related policies. For a further discussion of these actions see “Item 4: Advisory Vote to Approve Named Executive Officer Compensation.”

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 6

|

|

|

|

|

|

|

|

|

Frequently Asked Questions Regarding the Annual

|

|

|

Compensation Discussion and Analysis

|

34

|

|

Meeting

|

7

|

|

Executive Summary

|

34

|

|

Item 1: Election of Directors

|

9

|

|

Detailed Discussion and Analysis

|

36

|

|

Board Structure and Composition

|

9

|

|

Management Development and Compensation

|

|

|

Shareholder-Recommended Director Candidates

|

10

|

|

Committee Report

|

48

|

|

Majority Vote Standard

|

10

|

|

Compensation and Equity Tables

|

49

|

|

Director Nominees

|

11

|

|

Summary Compensation Table

|

49

|

|

Continuing Directors

|

13

|

|

Option Exercises and Stock Vested for 2013

|

50

|

|

Corporate Governance and Risk Management

|

17

|

|

Total Realized Compensation Table

|

51

|

|

Independence, Chair and Co-Lead Independent

|

|

|

Grants of Plan-Based Awards During 2013

|

52

|

|

Directors

|

17

|

|

Outstanding Equity Awards at Fiscal Year-End

|

|

|

Board Committees

|

17

|

|

for 2013

|

53

|

|

Risk Management

|

18

|

|

Summary of Termination and Change of Control

|

|

|

Code of Conduct

|

18

|

|

Benefits

|

56

|

|

Board Attendance, Committee Meetings and

|

|

|

Employment Contracts and Change of Control

|

|

|

Committee Membership

|

19

|

|

Arrangements

|

57

|

|

Audit and Finance Committee

|

19

|

|

Security Ownership of Certain Beneficial

|

|

|

Corporate Governance and Nominating

|

|

|

Owners and Management

|

66

|

|

Committee

|

19

|

|

Section 16(a) Beneficial Ownership Reporting

|

|

|

Management Development and Compensation

|

|

|

Compliance

|

67

|

|

Committee

|

20

|

|

Other Information

|

68

|

|

Compensation Committee Interlocks and

|

|

|

Other Matters

|

68

|

|

Insider Participation

|

20

|

|

Shareholder Proposals for the 2015 Annual

|

|

|

Science and Technology Committee

|

20

|

|

Meeting and Nominations for Director

|

68

|

|

Director Compensation

|

21

|

|

Shareholder Communications to the Board

|

68

|

|

Item 2: Approval of Amendment to 2013 Stock and

|

|

|

Householding of Annual Meeting Materials

|

68

|

|

Option Plan

|

23

|

|

Solicitation

|

68

|

|

Summary of 2013 Stock and Option Plan

|

25

|

|

Availability of Materials

|

69

|

|

Equity Compensation Plan Information

|

29

|

|

Appendix A: 2013 Stock and Option Plan

|

A-1

|

|

Item 3: Ratification of the Appointment of

|

|

|

|

|

|

Independent Registered Public Accounting Firm

|

30

|

|

|

|

|

Audit and Finance Committee Report

|

32

|

|

|

|

|

Item 4: Advisory Vote to Approve Named

|

|

|

|

|

|

Executive Officer Compensation

|

33

|

|

|

|

PROXY STATEMENT

This proxy statement, with the enclosed proxy card, is being furnished to shareholders of Vertex Pharmaceuticals Incorporated in connection with the solicitation by our board of directors of proxies to be voted at our

2014

annual meeting of shareholders and at any postponements or adjournments thereof. The annual meeting will be held on

Wednesday, May 7, 2014

, at 9:30 a.m. at our headquarters, which are located at 50 Northern Avenue, Boston, Massachusetts.

This proxy statement and the enclosed proxy card are first being mailed or otherwise furnished to our shareholders on or about

April 2, 2014

. Our

2013

Annual Report on Form 10-K and other materials regarding our company are being mailed to the shareholders with this proxy statement, but are not part of the proxy statement.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 7

|

|

|

|

|

FREQUENTLY ASKED QUESTIONS REGARDING THE ANNUAL MEETING

|

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the annual meeting, shareholders will act upon the matters outlined in the Notice of Annual Meeting of Shareholders. These include the election of directors, the approval of an amendment to our 2013 Stock and Option Plan, which authorizes for issuance 9.5 million additional shares of our common stock, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm and the approval on an advisory basis of the compensation program for our named executive officers. Management, chairs of each committee of our board and representatives of Ernst & Young LLP are expected to attend the annual meeting and be available to respond to questions from shareholders.

WHAT IS A PROXY?

It is your legal designation of another person to vote the stock you own in the manner you direct. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. We have designated Jeffrey M. Leiden, Ian F. Smith and Kenneth L. Horton to serve as proxies at the annual meeting.

WHAT IS A PROXY STATEMENT?

It is a document that provides certain information about a company and matters to be voted upon at a meeting of shareholders. The SEC requires us to give you, as a shareholder, the information in this proxy statement and certain other information when we are soliciting your vote.

WHAT IS THE DIFFERENCE BETWEEN A SHAREHOLDER OF RECORD AND A SHAREHOLDER WHO HOLDS STOCK IN STREET NAME?

Shareholders of Record.

If your shares are registered in your name with our transfer agent, Computershare, you are a shareholder of record with respect to those shares, and these proxy materials were sent directly to you by Computershare.

Street Name Holders.

If you hold your shares in an account at a bank or broker, then you are the beneficial owner of shares held in “street name.” The proxy materials were forwarded to you by your bank or broker, who is considered the shareholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your bank or broker how to vote the shares held in your account.

HOW MANY SHARES MUST BE REPRESENTED IN ORDER TO HOLD THE ANNUAL MEETING?

In order for us to conduct the annual meeting, holders of a majority of the shares entitled to vote as of the close of business on the record date must be present in person or by proxy. This constitutes a quorum. If you are a shareholder of record, your shares are counted as present if you properly return a proxy card or voting instruction form by mail or if you attend the annual meeting and vote in person. If you are the beneficial owner of shares held in “street name” you must follow the instructions of your bank or broker in order to direct them how to vote the shares held in your account. Abstentions and broker non-votes will be counted as present for purposes of establishing a quorum. If a quorum is not present, we will adjourn the annual meeting until a quorum is obtained.

HOW CAN I VOTE AT THE ANNUAL MEETING IF I OWN SHARES IN STREET NAME?

If you are a street name holder, you may not vote your shares at the annual meeting unless you obtain a legal proxy from your bank or broker. A legal proxy is a bank’s or broker’s authorization for you to vote the shares it holds in its name on your behalf.

WHAT IS THE RECORD DATE AND WHAT DOES IT MEAN?

The record date for the annual meeting is

March 10, 2014

and was established by our board of directors. On the record date, there were

236,112,597

shares of our common stock entitled to vote. Owners of record of common stock at the close of business on the record date are entitled to:

|

|

|

|

•

|

receive notice of the annual meeting; and

|

|

|

|

|

•

|

vote at the annual meeting and any adjournment or postponement of the annual meeting.

|

IF I SUBMIT A PROXY, MAY I LATER REVOKE IT AND/OR CHANGE MY VOTE?

Shareholders may revoke a proxy and/or change their vote prior to the completion of voting at the annual meeting by:

|

|

|

|

•

|

signing another proxy card with a later date and delivering it to our Secretary, Kenneth L. Horton, 50 Northern Avenue, Boston, Massachusetts 02210, before the annual meeting; or

|

|

|

|

|

•

|

voting at the annual meeting, if you are a shareholder of record or hold your shares in street name and have obtained a legal proxy from your bank or broker.

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 8

|

|

|

|

|

FREQUENTLY ASKED QUESTIONS REGARDING THE ANNUAL MEETING

(continued)

|

WHAT IF I DO NOT SPECIFY A CHOICE FOR A MATTER WHEN RETURNING A PROXY?

Shareholders should specify their choice for each matter following the directions described on their proxy card. If no specific instructions are given, proxies that are signed and returned will be voted:

|

|

|

|

•

|

FOR the election of all director nominees;

|

|

|

|

|

•

|

FOR approval of the amendment to our 2013 Stock and Option Plan;

|

|

|

|

|

•

|

FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31,

2014

; and

|

|

|

|

|

•

|

FOR our executive compensation program.

|

ARE MY SHARES VOTED IF I DO NOT PROVIDE A PROXY?

If you are a shareholder of record and do not provide a proxy, you must attend the annual meeting in order to vote. If you hold shares through an account with a bank or broker, your shares may be voted by the bank or broker if you do not provide voting instructions. Banks and brokers have the authority under applicable rules to vote shares on routine matters for which their customers do not provide voting instructions. The ratification of Ernst & Young LLP as our independent registered public accounting firm is considered a routine matter. The election of directors, the approval of the amendment to our 2013 Stock and Option Plan and the advisory vote with respect to our executive compensation program are not considered routine, and banks and brokers cannot vote shares without instruction on those matters. Shares that banks and brokers are not authorized to vote on those matters are counted as “broker non-votes” and will have no effect on the results of those votes.

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL AND HOW ARE VOTES COUNTED?

Item 1: Election of Directors

The nominees for director in an uncontested election who receive a majority of the votes from shareholders present in person or represented by proxy at the annual meeting (more votes cast “FOR” such director than “WITHHELD” from such director) will be elected. Abstentions are not counted for purposes of electing directors. You may vote either FOR or WITHHOLD your vote from any one or more of the nominees.

Item 2: Approval of the Amendment to our 2013 Stock and Option Plan

To be approved, this proposal must receive an affirmative vote from shareholders present in person or represented by proxy at the annual meeting representing a majority of the votes cast on the proposal. Abstentions will have no effect on the results of this vote.

Item 3: Ratification of the Appointment of Independent Registered Public Accounting Firm

To be approved, this proposal must receive an affirmative vote from shareholders present in person or represented by proxy at the annual meeting representing a majority of the votes cast on the proposal. Abstentions will have no effect on the results of this vote.

Item 4: Advisory Vote to Approve Named Executive Officer Compensation

To be approved, this proposal must receive an affirmative vote from shareholders present in person or represented by proxy at the annual meeting representing a majority of the votes cast on the proposal. Abstentions will have no effect on the results of this vote.

WHERE CAN I FIND MORE INFORMATION ABOUT MY VOTING RIGHTS AS A SHAREHOLDER?

The SEC has an informational website that provides shareholders with general information about how to cast their vote and why voting should be an important consideration for shareholders. You may access that website at sec.gov/spotlight/proxymatters.shtml.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 9

|

|

|

|

|

ITEM 1 - ELECTION OF DIRECTORS

|

Our board of directors has nominated Margaret G. McGlynn and Wayne J. Riley for re-election and William D. Young for election at our

2014

annual meeting of shareholders to hold office until our

2017

annual meeting of shareholders.

Our board of directors is our company’s ultimate decision-making body except with respect to those matters reserved to the shareholders. Our board selects our senior management team, who in turn are responsible for the day-to-day operations of our company. Our board acts as an advisor and counselor to senior management and oversees its performance.

Our board consists of directors divided into three classes, with each class holding office for a three-year term. Margaret G. McGlynn and Wayne J. Riley, current Class I Directors, and William D. Young, who would join our board as a Class I Director upon election by our shareholders, have been nominated by our board for election at the

2014

annual meeting of shareholders for a three-year term that will expire at the

2017

annual meeting of shareholders. Each of the nominees has agreed to be named in this proxy statement and to serve if elected. We believe that all of the nominees will be able and willing to serve if elected. However, if any nominee should become unable for any reason or unwilling to serve, proxies may be voted for another person nominated as a substitute by our board of directors, or our board may reduce the number of directors.

BOARD STRUCTURE AND COMPOSITION

The corporate governance and nominating committee of our board of directors is responsible for recommending the composition and structure of our board and for developing criteria for board membership. This committee regularly reviews director competencies, qualities and experiences, with the goal of ensuring that our board is comprised of an effective team of directors who function collegially and who are able to apply their experience toward meaningful contributions to general corporate strategy and oversight of corporate performance, risk management, organizational development and succession planning.

Our by-laws provide that the size of our board may range between three and eleven members. We currently have nine members on our board of directors. We have nominated William D. Young, who was recommended by our corporate governance and nominating committee, for election at the 2014 annual meeting of shareholders to fill the vacant tenth seat on our board of directors. Our corporate governance and nominating committee may seek one additional director candidate who meets the criteria below in order to complement the qualifications and experience of our existing board members. Our corporate governance and nominating committee may engage a search firm to recommend candidates who satisfy the criteria.

Director Criteria, Qualifications and Experience; Diversity.

The corporate governance and nominating committee seeks to recommend for nomination directors of stature who have a substantive knowledge of our business and industry or who can bring to the board specific and valuable strategic or management capabilities acquired in other industries. The committee expects each of our directors to have proven leadership, sound judgment, integrity and a commitment to the success of our company. We also seek personal qualities that foster a respectful environment in which our directors listen to one another and are engaged and constructive. These goals for our board composition presuppose a diverse range of viewpoints, experiences and specific expertise. The corporate governance and nominating committee considers a nominee’s personal characteristics and business experience relative to those of our existing board members, including the type of prior management experience, levels of expertise relevant to our business and its growth stage, prior board service, reputation in the business community, personal characteristics such as gender and race and other factors that the committee believe to be important at the specific point in time when choices for board membership are being made. At this time, our commitment to racial and gender diversity is demonstrated by the make-up of our board, which includes two members who are women and one member who is African-American.

The key experience, qualifications, attributes and skills brought by our directors to our board that are important to our business include:

|

|

|

|

•

|

Corporate leadership experience.

We believe that directors who have held significant corporate leadership positions over extended periods of time provide our company with special insights. These people generally have a practical understanding of organizational processes and strategy that is valuable during periods of organizational change and growth.

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 10

|

|

|

|

|

ITEM 1 - ELECTION OF DIRECTORS

(continued)

|

|

|

|

|

•

|

Industry knowledge.

We seek directors with substantive knowledge of the biotechnology, pharmaceutical or related industries. We believe that having a substantial portion of our board of directors comprised of individuals with experience as executives or directors in these industries provides our board with the background necessary to counsel our management regarding the issues facing our company.

|

|

|

|

|

•

|

Financial expertise.

We believe that an understanding of finance is important for our board of directors, and our budgeting processes and financial and strategic transactions require our directors to be financially knowledgeable. In addition, we seek to have a number of directors qualified to serve on our audit and finance committee and at least one director with in-depth knowledge of financial statements and financial reporting processes sufficient to qualify as an audit committee financial expert under applicable regulatory standards.

|

|

|

|

|

•

|

Scientific experience.

As a biopharmaceutical company that seeks to develop transformative medicines for patients with serious diseases, we look for directors with backgrounds in science and technology and in particular the research and development of pharmaceutical products.

|

|

|

|

|

•

|

Commitment to company values and goals.

We seek directors who are committed to our company and its values and goals and who value the contributions that can be provided by individuals who believe in our company and its prospects for success.

|

SHAREHOLDER-RECOMMENDED DIRECTOR CANDIDATES

The corporate governance and nominating committee will consider director candidates recommended by shareholders in accordance with the criteria for director selection described above under

Director Criteria, Qualifications and Experience; Diversity

. Shareholders recommending candidates for consideration should submit any pertinent information regarding the candidate, including biographical information and a statement by the proposed candidate that he or she is willing to serve if nominated and elected, by mail to our corporate secretary at our offices at 50 Northern Avenue, Boston, Massachusetts 02210. If a shareholder wishes to nominate a candidate to be considered for election as a director at the

2015

annual meeting of shareholders using the procedures set forth in our by-laws, the shareholder must follow the procedures described in

Other Information—Shareholder Proposals for the

2015

Annual Meeting and Nominations for Director

on page 68 of this proxy statement.

MAJORITY VOTE STANDARD

In 2014, following discussions with our shareholders, we amended our by-laws to provide for a majority vote standard for uncontested elections of our directors. Under our by-laws as amended, director nominees in an uncontested election who receive more votes cast “for” such director nominees than “withheld” from such director nominees are elected. Our board’s policy is that any nominee for director in an uncontested election who receives a greater number of votes “withheld” than votes “for” the nominee’s election shall promptly tender his or her resignation to the chair of our board following certification of the shareholder vote. Our corporate governance and nominating committee will promptly consider the tendered resignation. Based on all factors it deems in its discretion to be relevant, the committee will recommend that our board either accept or reject the resignation and may recommend that the board adopt measures designed to address any issues perceived to underlie the election results. Our board will then act on the corporate governance and nominating committee’s recommendation. We will promptly disclose our board’s decision, including, if applicable, the reasons for rejecting the tendered resignation. Any director whose resignation is being considered under this policy will not participate in the corporate governance and nominating committee or board considerations, recommendations or actions with respect to the tendered resignation.

|

|

|

|

|

OUR BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR EACH OF THE NOMINEES.

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 11

|

|

|

|

|

ITEM 1 - DIRECTOR NOMINEES

|

In each of the director nominee and continuing director biographies that follow, we highlight the specific experience, qualifications, attributes and skills that led the board of directors to conclude that the director nominee or continuing director should serve on our board of directors at this time.

DIRECTOR NOMINEES

CLASS I DIRECTORS—PRESENT TERMS EXPIRING IN

2014

AND PROPOSED TERMS TO EXPIRE IN

2017

|

|

|

|

|

|

Margaret G. McGlynn

|

|

|

Age:

54

|

Member – Management Development and Compensation

|

|

Director Since:

2011

|

Committee

|

Ms. McGlynn has served as the President and Chief Executive Officer of the International AIDS Vaccine Initiative, a global not-for-profit organization whose mission is to ensure the development of safe, effective and accessible HIV vaccines for use throughout the world, since July 2011. Ms. McGlynn served as President, Vaccines and Infectious Diseases of Merck & Co., Inc. from 2005 until 2009. Ms. McGlynn joined Merck in 1983 and served in a variety of marketing, sales and managed care roles. Currently, Ms. McGlynn serves as a member of the Board of Directors of Air Products and Chemicals, Inc., a company specializing in gases and chemicals for industrial uses, and Amicus Therapeutics, Inc., a biopharmaceutical company. She is a member of the National Industrial Advisory Committee at the University at Buffalo School of Pharmacy and Pharmaceutical Sciences. Ms. McGlynn holds a B.S. in pharmacy and an M.B.A. in marketing from the State University of New York at Buffalo.

Skills and Qualifications:

Ms. McGlynn’s corporate leadership experience and industry knowledge make her a valuable contributor to our board. Her service as an executive at Merck and her service on the board of Amicus Therapeutics and the board and audit committee of Air Products and Chemicals, Inc. give her a practical understanding of organizational practices valuable to a company at our stage of growth. Her experience in the development of treatments for infectious diseases provides her with a valuable understanding of the scientific issues we face in the drug development process.

|

|

|

|

|

|

Wayne J. Riley, M.D.

|

|

|

Age:

54

|

Member – Corporate Governance and Nominating Committee

|

|

Director Since:

2010

|

Member – Science and Technology Committee

|

Dr. Riley is Clinical Professor of Medicine, Vanderbilt University School of Medicine and Adjunct Professor of Healthcare Management, Owen Graduate School of Management at Vanderbilt University. From January 2007 until July 2013, Dr. Riley was President and Chief Executive Officer of Meharry Medical College. At Meharry he held the rank of tenured Professor of Internal Medicine and was a Senior Health Policy Associate at the Robert Wood Johnson Center for Health Policy at Meharry. From May 2004 to December 2006, Dr. Riley served as a corporate officer and member of the executive management team as Vice President and Vice Dean for Health Affairs and Governmental Relations and Associate Professor of Medicine at Baylor College of Medicine, and Assistant Chief of Medicine at Ben Taub General Hospital. Dr. Riley is a member of the Board of Directors of HCA Holdings, Inc., the parent company of Hospital Corporation of America, a leading operator of hospitals and health facilities. Dr. Riley formerly served as a Director of Pinnacle Financial Partners and of the Nashville Branch Board of the Federal Reserve Bank of Atlanta. Dr. Riley earned a B.A. from Yale University, an M.P.H. in health systems management from Tulane University School of Public Health & Tropical Medicine, an M.D. from the Morehouse School of Medicine and an M.B.A. from Rice University’s Jones Graduate School of Management.

Skills and Qualifications:

Dr. Riley is a valuable contributor to our board due to the corporate leadership skills he has acquired through his experience as the President and CEO of Meharry Medical College and executive positions at Baylor College of Medicine and Ben Taub General Hospital. As a physician, executive, clinician educator, and public health and health policy expert, he brings a unique perspective on the scientific and medical issues we face in pharmaceutical development and commercialization.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 12

|

|

|

|

|

ITEM 1 - DIRECTOR NOMINEES

(continued)

|

DIRECTOR NOMINEE—PROPOSED TERM AS CLASS I DIRECTOR TO EXPIRE IN

2017

Mr. Young is a Venture Partner at Clarus Ventures, a life sciences venture capital firm, which he joined in 2010. Prior to Clarus Ventures, Mr. Young served from 1999 until June 2009 as the Chairman and Chief Executive Officer of Monogram Biosciences, Inc., a biotechnology company acquired by Laboratory Corporation of America in June 2009. From 1980 to 1999, Mr. Young was employed at Genentech, Inc. in positions of increasing responsibility, including as Chief Operating Officer from 1997 to 1999, where he was responsible for all product development, manufacturing and commercial functions. Prior to joining Genentech, Mr. Young was with Eli Lilly & Co. for 14 years. Mr. Young currently serves at the Chairman of the Boards of Directors of Biogen Idec and NanoString Technologies, Inc., and as a member of the Boards of Directors of Theravance, Inc. and Biomarin Pharmaceutical Inc. Mr. Young is retiring from Biogen Idec’s Board of Directors when his term concludes in June 2014. Mr. Young holds a B.S. in Chemical Engineering from Purdue University, an M.B.A. from Indiana University and an Honorary Doctorate in Engineering from Purdue University. Mr. Young was elected to the National Academy of Engineering in 1993 for his contributions to biotechnology.

Skills and Qualifications:

Mr. Young will be a valuable contributor to our board due to the in-depth knowledge of the pharmaceuticals industry that he acquired through his extensive experience as both a CEO and board member at numerous pharmaceutical and biotechnology organizations and as a venture capitalist focused on the life sciences industry. Mr. Young’s strong leadership qualities, global industry knowledge and financial expertise provide him with the background to work collaboratively with both management and fellow board members in order to address issues facing our company.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 13

|

|

|

|

|

ITEM 1 - CONTINUING DIRECTORS

|

CONTINUING DIRECTORS

CLASS II DIRECTORS—TERMS EXPIRING IN 2015

|

|

|

|

|

|

David Altshuler, M.D., Ph.D.

|

|

|

Age:

49

|

Member – Corporate Governance and Nominating Committee

|

|

Director Since:

2012

|

Member – Science and Technology Committee

|

Dr. Altshuler is the Director of the Program in Medical and Population Genetics at the Broad Institute of Harvard University and the Massachusetts Institute of Technology, a position he has held since 2003. He has served as the Institute’s Deputy Director and Chief Academic Officer since 2009. He is one of four founding members of the Broad Institute, a research collaboration of Harvard, MIT, The Whitehead Institute and the Harvard Hospitals. Dr. Altshuler joined the faculty at Harvard Medical School and the Massachusetts General Hospital in 2000 and has held the academic rank of Professor of Genetics and Medicine since 2008. He has served as Adjunct Professor of Biology at MIT since 2012. Dr. Altshuler earned a B.S. from MIT, a Ph.D. from Harvard University and an M.D. from Harvard Medical School. Dr. Altshuler completed his clinical training in Internal Medicine, and in Endocrinology, Diabetes and Metabolism, at the Massachusetts General Hospital.

Skills and Qualifications:

Dr. Altshuler is a leading academic physician-scientist who brings an in-depth understanding of biology and human genetics and the use of advanced technologies in medical research to our board. In addition to his industry knowledge and scientific expertise, Dr. Altshuler’s experience as a founding member of an innovative, collaborative research institute provides him with valuable leadership experience.

|

|

|

|

|

|

Jeffrey M. Leiden, M.D., Ph.D.

|

Chairman, Chief Executive Officer and President

|

|

Age:

58

|

|

|

Director Since:

2009

|

|

Dr. Leiden has held the positions of Chief Executive Officer and President since February 2012 after joining us as CEO Designee in December 2011. He has been the Chairman of our Board of Directors since May 2012, and served as our lead independent director from October 2010 through December 2011. Dr. Leiden was a Managing Director at Clarus Ventures, a life sciences venture capital firm, from 2006 through January 2012. Dr. Leiden was President and Chief Operating Officer of Abbott Laboratories, Pharmaceuticals Products Group, and a member of the Board of Directors of Abbott Laboratories from 2001 to 2006. From 1987 to 2000, Dr. Leiden held several academic appointments, including the Rawson Professor of Medicine and Pathology and Chief of Cardiology and Director of the Cardiovascular Research Institute at the University of Chicago, the Elkan R. Blout Professor of Biological Sciences at the Harvard School of Public Health, and Professor of Medicine at Harvard Medical School. He is an elected member of both the American Academy of Arts and Sciences, and the Institute of Medicine of the National Academy of Sciences. Dr. Leiden is a senior advisor to Clarus Ventures. Dr. Leiden was a director and the non-executive Vice Chairman of the Board of Directors of Shire plc, a specialty biopharmaceutical company, from 2006 to January 2012, and was also a member of the Board of Directors of Millennium Pharmaceuticals, Inc. from October 2007 until it was acquired in June 2008. Dr. Leiden received his M.D., Ph.D. and B.A. degrees from the University of Chicago.

Skills and Qualifications:

Dr. Leiden possesses strong leadership qualities, demonstrated through his service as an executive in the pharmaceutical industry and as a life sciences venture capitalist, and has extensive knowledge of the science underlying drug discovery and development through his experiences as a distinguished physician, scientist and teacher. He also provides our board with in-depth knowledge of our company through the day-to-day leadership of our executives.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 14

|

|

|

|

|

ITEM 1 - CONTINUING DIRECTORS

(continued)

|

|

|

|

|

|

|

Bruce I. Sachs

|

Co-lead Independent Director

|

|

Age:

54

|

Chair – Management Development and Compensation Committee

|

|

Director Since:

1998

|

Member – Audit and Finance Committee

|

Mr. Sachs is a General Partner at Charles River Ventures, a venture capital firm he joined in 1999. From 1998 to 1999, he served as Executive Vice President and General Manager of Ascend Communications, Inc. From 1997 until 1998, Mr. Sachs served as President and Chief Executive Officer of Stratus Computer, Inc. From 1995 to 1997, he served as Executive Vice President and General Manager of the Internet Telecom Business Group at Bay Networks, Inc. From 1993 to 1995, he served as President and Chief Executive Officer at Xylogics, Inc. Mr. Sachs was a director of BigBand Networks, Inc., a network-based platform company, from 2005 through June 2009. Mr. Sachs holds a B.S.E.E. in electrical engineering from Bucknell University, an M.E.E. in electrical engineering from Cornell University and an M.B.A. from Northeastern University.

Skills and Qualifications:

Mr. Sachs brings strong business judgment and financial analytical skills, honed through his experience developing business strategy at a senior management level and his success in building companies and in venture capital, to the board. In addition, Mr. Sachs has extensive business leadership experience, including service as a CEO at a technology company, as well as financial expertise.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 15

|

|

|

|

|

ITEM 1 - CONTINUING DIRECTORS

(continued)

|

CLASS III DIRECTORS—TERMS EXPIRING IN 2016

|

|

|

|

|

|

|

Joshua Boger, Ph.D.

|

|

|

Age:

62

|

Chair – Science and Technology Committee

|

|

Director Since:

1989

|

|

Dr. Boger is the founder of Vertex. He was our Chief Executive Officer from 1992 through May 2009. He was Chairman of our Board from 1997 until May 2006 and our President from our inception until December 2000, and from 2005 through February 2009. He was our Chief Scientific Officer from 1989 until May 1992. Prior to founding Vertex in 1989, Dr. Boger held the position of Senior Director of Basic Chemistry at Merck Sharp & Dohme Research Laboratories in Rahway, New Jersey, where he headed both the Department of Medicinal Chemistry of Immunology & Inflammation and the Department of Biophysical Chemistry. Dr. Boger holds a B.A. in chemistry and philosophy from Wesleyan University and M.S. and Ph.D. degrees in chemistry from Harvard University.

Skills and Qualifications:

Dr. Boger’s qualifications for our board include his extensive industry knowledge and leadership experience. Dr. Boger brings an in-depth knowledge of issues facing our company and our industry as a result of his experience founding and leading Vertex and his distinguished career as a scientist.

|

|

|

|

|

|

Terrence C. Kearney

|

|

|

Age:

59

|

Chair – Audit and Finance Committee

|

|

Director Since:

2011

|

Member – Management Development and Compensation Committee

|

Mr. Kearney served as the Chief Operating Officer of Hospira, Inc., a specialty pharmaceutical and medication delivery company, from April 2006 to January 2011. From April 2004 to April 2006, he served as Hospira’s Senior Vice President, Finance, and Chief Financial Officer, and he served as Acting Chief Financial Officer through August 2006. Mr. Kearney served as Vice President and Treasurer of Abbott Laboratories from 2001 to April 2004. From 1996 to 2001, Mr. Kearney was Divisional Vice President and Controller for Abbott’s International Division. He received his B.S. in biology from the University of Illinois and his M.B.A. from the University of Denver.

Skills and Qualifications:

Mr. Kearney’s corporate leadership experience, industry knowledge and financial expertise make him a valuable contributor to our board. He has a practical perspective on the management of global pharmaceutical operations, including commercial, manufacturing and research and development activities, and financial management strategies. He is an “audit committee financial expert” as defined in SEC regulations, with particular experience in matters faced by the audit committee of a company with pharmaceutical product revenues and related expenses.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 16

|

|

|

|

|

ITEM 1 - CONTINUING DIRECTORS

(continued)

|

|

|

|

|

|

|

Yuchun Lee

|

|

|

Age:

48

|

Member – Audit and Finance Committee

|

|

Director Since:

2012

|

Member – Science and Technology Committee

|

Mr. Lee has served as an Executive in Residence (XIR) and Partner of General Catalyst Partners, a venture capital firm, since April 2013. Mr. Lee was the Vice President of IBM’s Enterprise Marketing Management Group from November 2010 through January 2013. Mr. Lee co-founded Unica Corporation, a provider of software and services used to automate marketing processes, in 1992, and was Unica’s President and/or Chief Executive Officer from 1992 through November 2010, when Unica was acquired by IBM. From 1989 to 1992, Mr. Lee was a senior consultant at Digital Equipment Corporation, a supplier of general computing technology and consulting services. Mr. Lee holds B.S. and M.S. degrees in electrical engineering and computer science from the Massachusetts Institute of Technology and an M.B.A. from Babson College.

Skills and Qualifications:

Mr. Lee’s expertise in marketing processes, customer engagement and business and financial expertise make him a valuable contributor to our board. Mr. Lee is an innovator who founded and managed the growth of a successful technology company and gained further leadership experience while serving as an executive at IBM. Mr. Lee’s experiences outside of the biopharmaceutical sector provide the board with a fresh perspective on the issues facing the company.

|

|

|

|

|

|

Elaine S. Ullian

|

Co-lead Independent Director

|

|

Age:

66

|

Chair – Corporate Governance and Nominating Committee

|

|

Director Since:

1997

|

Member – Audit and Finance Committee

|

From 1996 through January 2010, Ms. Ullian served as President and Chief Executive Officer of Boston Medical Center, a private, not-for-profit, 626-bed, academic medical center with a community-based focus. From 1994 to 1996, she served as President and Chief Executive Officer of Boston University Medical Center Hospital. From 1987 to 1994, Ms. Ullian served as President and Chief Executive Officer of Faulkner Hospital. She also serves as a director of Thermo Fisher Scientific Inc. and Hologic, Inc. Ms. Ullian holds a B.A. in political science from Tufts University and an M.P.H. from the University of Michigan.

Skills and Qualifications:

Ms. Ullian brings significant leadership experience acquired as the CEO of large health care providers to our board. The knowledge she obtained serving as an executive, together with her extensive experience serving on the boards of directors of multiple public companies in the healthcare field, provide her with the expertise required to serve as one of our co-lead independent directors and as the chair of our corporate governance and nominating committee. She also provides the board with the perspective of providers, payors and patients, for whom our products are intended.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 17

|

|

|

|

|

CORPORATE GOVERNANCE AND RISK MANAGEMENT

|

We are committed to good corporate governance and integrity in our business dealings. Our governance practices are documented in our Statement of Corporate Governance Principles, which addresses the role and composition of our board and the functioning of the board and its committees. You can find our governance documents, including our Statement of Corporate Governance Principles, charters for each committee of the board and our Code of Conduct, on our website www.vrtx.com under “Investors—Corporate Governance—Governance Documents.”

INDEPENDENCE, CHAIR AND CO-LEAD INDEPENDENT DIRECTORS

Our board has determined that seven of our nine directors qualify as “independent” under the definition of that term adopted by The Nasdaq Stock Market LLC, or Nasdaq. These directors are Dr. Altshuler, Mr. Kearney, Mr. Lee, Ms. McGlynn, Dr. Riley, Mr. Sachs and Ms. Ullian. Our independent directors generally meet in executive session at each regularly scheduled board meeting.

Dr. Leiden, our president and chief executive officer, serves as the chairman of our board. Our employment agreement with Dr. Leiden provides that he will serve as the chairman of our board through January 31, 2016. In addition, we have two co-lead independent directors who are elected by the independent directors. Each of the board committees (other than the science and technology committee) is chaired by one of our independent directors.

Our board believes that strong, independent board leadership is a critical aspect of effective corporate governance, and our corporate governance principles require that if the chair is not an independent director, that the independent directors elect a lead independent director. Since December 2011, Mr. Sachs and Ms. Ullian have served as our co-lead independent directors. We believe this structure provides our board independent leadership, while providing the benefit of having our chief executive officer, the individual with primary responsibility for managing our day-to-day operations, chair regular board meetings as we discuss key business and strategic issues. Combined with the co-lead independent directors and experienced and independent committee chairs, this structure provides strong independent oversight of management.

Our co-lead independent directors’ responsibilities include:

|

|

|

|

•

|

calling and leading regular and special meetings of the independent directors;

|

|

|

|

|

•

|

serving as a liaison between our executive leaders and the independent directors;

|

|

|

|

|

•

|

reviewing the planned dates for regularly scheduled board meetings and the primary agenda items for each meeting; and

|

|

|

|

|

•

|

reviewing with the chair of each board committee agenda items that fall within the scope of the responsibilities of that committee.

|

BOARD COMMITTEES

Our board has established various committees to assist in discharging its duties: the audit and finance committee, the corporate governance and nominating committee, the management development and compensation committee, or MDCC, and the science and technology committee. Each member of the audit and finance committee, corporate governance and nominating committee and MDCC is an independent director as that term is defined by the SEC and Nasdaq. The primary responsibilities of each of the committees are set forth below, and the committee memberships are provided in the table appearing on page 19.

Each of the committees has the authority, as its members deem appropriate, to engage legal counsel or other experts or consultants in order to assist the committee in carrying out its responsibilities.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 18

|

|

|

|

|

CORPORATE GOVERNANCE AND RISK MANAGEMENT

(continued)

|

RISK MANAGEMENT

Our board of directors discharges its overall responsibility to oversee risk management with a focus on our most significant risks. We face considerable risk related to the commercialization of our approved products, including regulatory risk with respect to our promotional activities and competition from approved drugs and investigational drug candidates that may have product profiles superior to our approved products. We continue to invest significant resources in research programs and clinical development programs as part of our strategy to develop transformative medicines for patients with serious diseases. With respect to each of our drug development and commercialization programs, we face considerable risk that the program will not ultimately result in a commercially successful pharmaceutical product. Our board and its committees monitor and manage the strategic, compliance and operational risks related to KALYDECO (ivacaftor) and INCIVEK (telaprevir) and our research and development programs through regular board and committee discussions that include presentations to the board and its committees by our executive officers as well as during in-depth short- and long-term strategic reviews held at least annually.

For certain specific risk types, our board of directors has delegated oversight responsibility to board committees as follows:

|

|

|

|

•

|

Our audit and finance committee oversees our risk management programs and policies related to our financial and accounting systems, accounting policies and investment strategies, information technology systems and steps our management has taken to monitor, mitigate and report on those exposures. The audit and finance committee also is responsible for addressing risks arising from related party transactions.

|

|

|

|

|

•

|

Our MDCC oversees risks associated with our compensation policies, management resources and structure, succession planning, and management development and selection processes.

|

|

|

|

|

•

|

Our corporate governance and nominating committee oversees risks related to the company’s governance structure and litigation exposure, and reviews our enterprise risk management programs.

|

|

|

|

|

•

|

Our science and technology committee oversees risks related to our research and development investments.

|

CODE OF CONDUCT

We have adopted a Code of Conduct that applies to all of our directors and employees, including our chief executive officer and chief financial and accounting officers. Our Code of Conduct is available on our website www.vrtx.com under “Investors—Corporate Governance—Governance Documents.” Disclosure regarding any amendments to, or waivers from, provisions of the Code of Conduct that apply to our directors or principal executive, financial or accounting officers will be posted on our website or included in a Current Report on Form 8-K within four business days following the date of the amendment or waiver.

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 19

|

|

|

|

|

CORPORATE GOVERNANCE AND RISK MANAGEMENT

(continued)

|

BOARD ATTENDANCE, COMMITTEE MEETINGS AND COMMITTEE MEMBERSHIP

|

|

|

|

|

|

|

|

|

|

|

|

Director (1)

|

Independence

|

Board

|

Audit

and

Finance

|

Corporate

Governance and

Nominating

|

Management

Development and

Compensation

|

Science

and

Technology

|

2013

Attendance at

Meetings (2)

|

|

David Altshuler

|

X

|

●

|

|

●

|

|

●

|

95%

|

|

Joshua Boger

|

|

●

|

|

|

|

Chair

|

100%

|

|

Terrence C. Kearney

|

X

|

●

|

Chair

|

|

●

|

|

100%

|

|

Yuchun Lee

|

X

|

●

|

●

|

|

|

●

|

100%

|

|

Jeffrey M. Leiden

|

|

Chair

|

|

|

|

|

100%

|

|

Margaret G. McGlynn

|

X

|

●

|

|

|

●

|

|

95%

|

|

Wayne J. Riley

|

X

|

●

|

|

●

|

|

●

|

100%

|

|

Bruce I. Sachs

|

X

|

Co-lead

|

●

|

|

Chair

|

|

97%

|

|

Elaine S. Ullian

|

X

|

Co-lead

|

●

|

Chair

|

|

|

100%

|

|

2013 Meetings

|

|

10

|

10

|

5

|

11

|

4

|

|

|

|

|

|

(1)

|

Each of our directors is encouraged to attend each meeting of shareholders. Each of our directors attended our 2013 annual meeting of shareholders.

|

|

|

|

|

(2)

|

Includes meetings of the board of directors and meetings of each committee of the board of directors while the director served on such committee.

|

Audit and Finance Committee

The primary purposes of the audit and finance committee are to:

|

|

|

|

•

|

appoint, oversee and replace, if necessary, our independent registered public accounting firm;

|

|

|

|

|

•

|

assist our board in fulfilling its responsibility for oversight of our accounting and financial reporting processes; and

|

|

|

|

|

•

|

review and make recommendations to our board concerning our financial structure and financing strategy.

|

Our independent registered public accounting firm reports directly to, and is held accountable by, our audit and finance committee in connection with the audit of our annual financial statements and related services.

Mr. Kearney, the chair of our audit and finance committee, is an “audit committee financial expert” as that term is defined in applicable regulations of the SEC.

The report of the audit and finance committee appears on page 32

of this proxy statement.

Our audit and finance committee reviews and, if appropriate, recommends for approval or ratification by our board of directors, all transactions with related persons that are required to be disclosed by us pursuant to Item 404(a) of Regulation S-K, except for transactions, if any, related to the employment of executive officers, which would be recommended for approval by the MDCC. Our policies and procedures with respect to

transactions with related persons are governed by our written Related Party Transaction Policy. Pursuant to this policy, related party transactions include transactions, arrangements or relationships in which our company is a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% shareholders or their immediate family members, who we refer to as related persons, has a direct or indirect material interest, except where disclosure of such transaction would not be required pursuant to Item 404(a) of Regulation S-K. As appropriate for the circumstances, our audit and finance committee will review and consider the related person’s interest in the related party transaction and such other factors as it deems appropriate. Since January 1, 2013, we have not entered into any transactions disclosable pursuant to Item 404(a) of Regulation S-K.

Corporate Governance and Nominating Committee

The corporate governance and nominating committee:

|

|

|

|

•

|

assists our board of directors in developing and implementing our corporate governance principles;

|

|

|

|

|

•

|

recommends the size and composition of our board and its committees;

|

|

|

|

|

•

|

develops and recommends to our board an annual self-evaluation process to assess the effectiveness of our board and oversees this process;

|

|

|

|

|

•

|

reviews and recommends director compensation;

|

|

|

|

|

•

|

identifies qualified individuals to become members of our board;

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 20

|

|

|

|

|

CORPORATE GOVERNANCE AND RISK MANAGEMENT

(continued)

|

|

|

|

|

•

|

recommends director nominations to the full board; and

|

|

|

|

|

•

|

assists the board in recruiting and evaluating potential candidates for the CEO position.

|

Management Development and Compensation Committee

The primary purposes of the MDCC are to oversee the discharge of our board’s responsibilities relating to:

|

|

|

|

•

|

compensation of our executives;

|

|

|

|

|

•

|

review and approval of our benefit and equity compensation plans; and

|

|

|

|

|

•

|

planning for the succession of our executives, including our chief executive officer.

|

The MDCC has the authority to delegate any of its responsibilities to individual members of the MDCC to the extent deemed appropriate by the MDCC in its sole discretion, but subject always to the general oversight of the board of directors.

See

Compensation Discussion and Analysis—Detailed Discussion

below for a discussion of the MDCC’s role in overseeing executive compensation.

The report of the MDCC appears at page 48 of this proxy statement.

Compensation Committee Interlocks and Insider Participation.

Mr. Kearney, Ms. McGlynn and Mr. Sachs served on the MDCC during 2013. Each member of the MDCC was an independent director while serving on the MDCC. No member of our board of directors who was a member of our MDCC at any time during 2013 has ever been one of our employees or officers. No member of our board of directors who was a member of our MDCC at any time during 2013 has ever been a party to a transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K prior to becoming a member of our MDCC. During 2013, none of our executive officers served as a member of the board of directors or compensation committee of the board of directors, or performed the equivalent functions, of any entity that has one or more executive officers serving as a member of our board or the MDCC.

Science and Technology Committee

Our science and technology committee discharges our board’s responsibilities relating to the oversight of our investment in pharmaceutical research and development. In furtherance of that oversight function, the science and technology committee:

|

|

|

|

•

|

reviews and assesses our current and planned research and development programs and technology initiatives from a scientific perspective;

|

|

|

|

|

•

|

assesses the capabilities of our key scientific personnel and the depth and breadth of our scientific resources;

|

|

|

|

|

•

|

provides strategic advice to our board regarding emerging science and technology issues and trends; and

|

|

|

|

|

•

|

periodically reviews our patent portfolio and strategy.

|

Notice of Annual Meeting of Shareholders

and 2014 Proxy Statement | 21

We have designed and implemented our compensation program for our non-employee directors to attract, motivate and retain individuals who are committed to our values and goals and who have the expertise and experience that we need to achieve those goals.

Compensation Program

Our compensation program for our non-employee directors is set forth in the following table:

|

|

|

|

|

|

|

Compensation Element

|

|

|

Cash

|

|

|

|

Annual Cash Retainer

|

|

$50,000

|

|

Annual Committee Chair Retainer

|

Audit and Finance Committee

|

$25,000

|

|

|

Corporate Governance and Nominating Committee

|

$20,000

|

|

|

Management Development and Compensation Committee

|

$20,000

|

|

|

Science and Technology Committee

|

$12,500

|

|

Annual Committee Retainer (non-Chair)

|

|

$5,000

|

|

Annual Lead Independent Director Retainer (for each Co-lead)

|

|

$25,000

|

|

|

|

|

|

Equity

|

|

|

|

Initial Equity Grant

|

Option to purchase 30,000 shares of common stock. These options vests quarterly over a four-year period from the date of grant.

|

|

Annual Equity Retainer

|

Option to purchase 20,000 shares of common stock granted on June 1 of each year. These options are fully-vested upon the date of grant.

|

|

Co-lead Independent Director Annual Grant

|

Option to purchase 2,500 shares of common stock granted on June 1 of each year. These options are fully-vested upon the date of grant.

|

We periodically review and may adjust our non-employee director compensation program in the future.

Non-Employee Director Compensation and Equity Information

The following tables provide summary information regarding our non-employee directors.

Summary

2013

Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

Fees Earned or

Paid in Cash

|

Option

Awards (1)

|

Total

|

|

David Altshuler

|

|

$

|

60,000

|

|

|

$

|

728,422

|

|

|

$

|

788,422

|

|

|

Joshua Boger

|

|

$

|

62,500

|

|

|

$

|

728,422

|

|

|

$

|

790,922

|

|

|

Matthew W. Emmens (Director until May 8, 2013)

|

|

$

|

22,917

|

|

|

$

|

—

|

|

|

$

|

22,917

|

|

|

Terrence C. Kearney

|

|

$

|

80,000

|

|

|

$

|

728,422

|

|

|

$

|

808,422

|

|

|

Yuchun Lee

|

|

$

|

60,000

|

|

|

$

|

728,422

|

|

|

$

|

788,422

|

|

|

Margaret G. McGlynn

|

|

$

|

55,000

|

|

|

$

|

728,422

|

|

|

$

|

783,422

|

|

|

Wayne J. Riley

|

|

$

|

60,000

|

|

|

$

|

728,422

|

|

|

$