GOL Reports Q4 Loss, Misses Ests (Revised) - Analyst Blog

March 27 2014 - 9:00AM

Zacks

GOL Linhas Aereas

Inteligentes S.A. (GOL) reported fourth-quarter 2013 net

loss per share of R$0.07 or approximately 3 cents, which compared

unfavorably with the Zacks Consensus Estimate of a break-even. The

results, however, improved from the year-ago loss of R$1.66 (or

approximately 81 cents). The quarter’s results were hurt by a

decline in domestic supply, record jet fuel prices and depreciation

of Brazilian real against the dollar.

The company reported fourth-quarter

net loss of R$19.3 million (approximately $8.49 million), better

than the year-ago net loss of R$447.1 million (approximately $217.2

million).

For full-year 2013, the company

reported loss per share of R$2.62 (approximately $1.22), 53.2%

lower than the year-ago loss of R$5.61 (approximately $2.88).

For the year, net loss stood at

R$724.6 million (approximately $337.15 million), 52.1% narrower

than the year-ago loss of R$1,512.9 million (approximately $777.78

million).

Revenue

Net revenue increased 28.7% year

over year to R$2,728.2 million (approximately $1199.87 million) in

the reported quarter. The top line was way ahead of the Zacks

Consensus Estimate of $961.0 million. Net revenue for full-year

2013 was up 10.5% year over year to R$8,956.2 million

(approximately $4167.3 million).

The domestic market generated

revenues of R$2,494.6 million ($1,097.12 million), while

international market revenues totaled R$233.6 million ($102.73

million).

Operational

Statistics

Revenue passenger kilometers or RPK

– implying revenue generated per kilometer per passenger – for the

quarter improved 10.1% from the year-ago quarter to 9,484.4

million. International RPK improved 44.4% while domestic RPK rose

7.3%.

Available Seat kilometers (ASK) –

that measures an airline's passenger carrying capacity – inched up

2.6% year over year to 12,667.4 million. ASK in the domestic market

improved 0.3% against a substantial 26.2% in the international

front.

During the quarter, the company’s

total load factor stood at 74.8%, up 510 basis points (bps) from

the year-ago quarter. Domestically, load factor moved up 490 bps

and internationally, it rose 860 bps.

Margins

Operating costs and expenses, in

the reported quarter, remained flat with the year-ago figure of

R$2,565.35 million (approximately $1,128.24 million).

Fourth-quarter operating income

(EBIT) came in at R$162.86 million (approximately $71.62 million)

compared with an operating loss of R$357.57 million (approximately

$173.7 million) in the year-earlier quarter.

Financials

Exiting 2013, GOL Linhas' cash and

cash equivalents increased to R$1,635.64 million (approximately

$761.1 million) from R$775.51 million (approximately $367.7

million) in the corresponding year-ago quarter. Long-term debt

increased to R$5,148.7 million (approximately $2,395.7 million)

from R$3,471.55 million (approximately $1,690.0 million) in

2012.

Outlook

For 2014, the company is expecting

a negative 3–1% variation in domestic capacity, while growth in

international market is projected at around 8%. GOL expects

increased profits on improved yield management, supply flexibility

and increased load factor. The company expects RASK (revenue per

available seat kilometer) growth of above 10% and a CASK (cost of

available seat kilometer), excluding fuel growth, of around 10% or

below. In keeping with these views, GOL expects EBIT margin of 3–6%

in 2014.

Our Take

Persistent weakness in Brazilian

currency, which contributed to the 8% increase in fuel prices

offsetting some of the positives of the quarter, is likely to pose

considerable obstruction to GOL’s 2014 growth strategies. Other

risks, such as competition, subdued global economy, increased

aircraft maintenance costs and high debt, remain concerns.

However, Brazil will host the 2014

football world cup and 2016 summer Olympics, two of the biggest

sporting extravaganzas. The country is expected to get around

600,000 international and 3 million domestic visitors this year,

presenting a big opportunity for passenger carriers like GOL.

GOL – which operates with other

industry players like Copa Holdings S.A. (CPA) –

has a Zacks Rank #4 (Sell).

Other Stocks

Better-ranked stocks within this

sector include Southwest Airlines Co. (LUV) and

American Airlines Group Inc. (AAL). Both the

stocks sport a Zacks Rank #1 (Strong Buy).

(We have revised this article to correct a mistake. The

previous version, published earlier, should not be relied

upon.)

AMER AIRLINES (AAL): Free Stock Analysis Report

COPA HLDGS SA-A (CPA): Free Stock Analysis Report

GOL LINHAS-ADR (GOL): Free Stock Analysis Report

SOUTHWEST AIR (LUV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

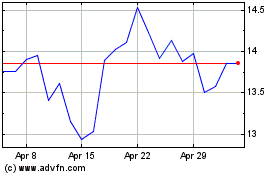

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

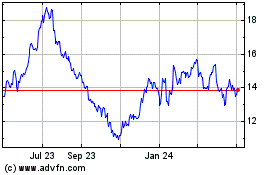

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024