-- Revenues increase 1% in U.S. dollars and

3% in local currency to $7.13 billion --

-- EPS are $1.03; operating income is $951

million, with operating margin of 13.3% --

-- Record new bookings of $10.1 billion

include consulting bookings of $4.6 billion and outsourcing

bookings of $5.5 billion --

-- Company declares semi-annual cash

dividend of $0.93 per share --

-- Company updates business outlook for

fiscal 2014 --

Accenture (NYSE:ACN) reported financial results for the second

quarter of fiscal 2014, ended Feb. 28, 2014, with net revenues of

$7.13 billion, an increase of 1 percent in U.S. dollars

and 3 percent in local currency over the same period last year,

within the company’s guided range.

Diluted earnings per share were $1.03, compared with $1.65 for

the second quarter last year, which included benefits of $243

million, or $0.34 per share, from final determinations of

prior-year U.S. federal tax liabilities and $224 million, or $0.31

per share, from a reduction in reorganization liabilities.

Excluding these benefits, diluted EPS for the second quarter last

year were $1.00.

Operating income for the quarter was $951 million, or

13.3 percent of net revenues, compared with $1.16 billion, or

16.5 percent of net revenues, for the second quarter last

year, which included the benefit of $224 million from the reduction

in reorganization liabilities. Excluding the benefit, operating

income for the second quarter of fiscal 2013 was $940 million, or

13.3 percent of net revenues.

New bookings for the quarter were a record $10.1 billion, with

consulting bookings of $4.6 billion and outsourcing bookings

of $5.5 billion.

Pierre Nanterme, Accenture’s chairman and CEO, said, “In the

second quarter, we delivered revenues within our guided range,

reported solid earnings per share and returned substantial cash to

shareholders. We continued to see very strong demand for our

services, with $10.1 billion in new bookings, including record

consulting and record outsourcing bookings.

“Looking ahead, we are well-positioned to deliver our business

outlook for the year, given our outstanding year-to-date bookings

of $18.8 billion as well as the activity and client interest we see

in the marketplace. We remain focused on the successful execution

of our growth strategy, and are confident in our ability to deliver

value to our clients and our shareholders.”

Financial Review

Revenues before reimbursements (“net revenues”) for the second

quarter of fiscal 2014 were $7.13 billion, compared with

$7.06 billion for the second quarter of fiscal 2013, an

increase of 1 percent in U.S. dollars and 3 percent in

local currency, and within the company’s guided range of $6.95

billion to $7.25 billion. The foreign-exchange impact for the

quarter was approximately negative 1.5 percent, consistent with the

assumption provided in the company’s first-quarter earnings

release.

- Consulting net revenues for the quarter

were $3.70 billion, a decrease of 1 percent in U.S. dollars

and flat in local currency compared with the second quarter of

fiscal 2013.

- Outsourcing net revenues were

$3.43 billion, an increase of 4 percent in U.S. dollars

and 5 percent in local currency over the second quarter of

fiscal 2013.

Diluted EPS for the quarter were $1.03, compared with $1.65 for

the second quarter last year, which included $0.65 in benefits from

final determinations of prior-year tax liabilities and reductions

in reorganization liabilities. Excluding these benefits, EPS for

the second quarter last year were $1.00. The $0.03 increase from

adjusted EPS last year reflects:

- $0.01 from higher revenue and

operating results;

- $0.01 from a lower effective tax rate

excluding the impact last year of final determinations of

prior-year tax liabilities and the reduction in reorganization

liabilities; and

- $0.03 from a lower share count

partially offset by:

- $0.02 from lower non-operating

income.

Gross margin (gross profit as a percentage of net revenues) for

the quarter was 31.3 percent, compared with 31.6 percent for

the second quarter last year. Selling, general and administrative

(SG&A) expenses for the quarter were $1.28 billion, or

17.9 percent of net revenues, compared with $1.29 billion, or

18.3 percent of net revenues, for the second quarter last

year.

Operating results for the quarter reflect lower contract

profitability, primarily due to pricing pressures and higher

payroll costs and, to a lesser extent, lower margins in the early

stages of a few large contracts. Operating results also reflect a

higher level of investment in the quarter to build new capabilities

including strategic acquisitions to enhance the company’s

capabilities in key growth areas. These factors were offset by a

reduction in variable compensation expense compared to the second

quarter of fiscal 2013.

Operating income for the quarter was $951 million, or 13.3

percent of net revenues, compared with $1.16 billion, or 16.5

percent of net revenues, for the second quarter last year, which

included the $224 million reorganization benefit. Excluding the

reorganization benefit, operating income for the second quarter

last year was $940 million, or 13.3 percent of net revenues.

The company’s effective tax rate for the quarter was

24.0 percent, compared with negative 0.5 percent for the

second quarter last year. Excluding benefits from the final

determinations of prior-year U.S. federal tax liabilities and the

reduction in reorganization liabilities, the effective tax rate for

the second quarter last year was 24.8 percent.

Net income for the quarter was $722 million, compared with

$1.19 billion for the second quarter last year, which included the

favorable impact of both the $224 million reorganization benefit

and the $243 million from final determinations of prior-year tax

liabilities.

Operating cash flow for the quarter was $292 million, and

property and equipment additions were $76 million. Free cash

flow, defined as operating cash flow net of property and equipment

additions, was $216 million. For the same period last year,

operating cash flow was $634 million; property and equipment

additions were $90 million; and free cash flow was

$544 million.

Days services outstanding, or DSOs, were 33 days, compared with

31 days at Aug. 31, 2013 and 31 days at Feb. 28, 2013.

Accenture’s total cash balance at Feb. 28, 2014 was

$3.7 billion, compared with $5.6 billion at Aug. 31,

2013. The lower cash balance at Feb. 28, 2014 was principally due

to share repurchases and cash dividend payments, as well as funds

used for business acquisitions.

Utilization for the quarter was 87 percent, compared with

87 percent for the first quarter of fiscal 2014 and 88 percent

for the second quarter of fiscal 2013. Attrition for the second

quarter of fiscal 2014 was 12 percent, compared with 11

percent for both the first quarter of fiscal 2014 and the second

quarter of fiscal 2013.

New Bookings

New bookings for the second quarter were $10.1 billion and

reflect a negative 2 percent foreign-currency impact compared

with new bookings in the second quarter last year.

- Consulting new bookings were

$4.6 billion, or 46 percent of total new bookings.

- Outsourcing new bookings were

$5.5 billion, or 54 percent of total new bookings.

Net Revenues by Operating Group

Net revenues by operating group were as follows:

- Communications, Media & Technology:

$1.41 billion, compared with $1.41 billion for the second

quarter of fiscal 2013, flat in U.S. dollars and an increase of

2 percent in local currency.

- Financial Services: $1.56 billion,

compared with $1.51 billion for the second quarter of fiscal

2013, an increase of 4 percent in U.S. dollars and

5 percent in local currency.

- Health & Public Service: $1.18

billion, compared with $1.19 billion for the second quarter of

fiscal 2013, a decrease of 1 percent in U.S. dollars and an

increase of 1 percent in local currency.

- Products: $1.75 billion, compared

with $1.68 billion for the second quarter of fiscal 2013, an

increase of 4 percent in U.S. dollars and 5 percent in local

currency.

- Resources: $1.22 billion, compared

with $1.25 billion for the second quarter of fiscal 2013, a

decrease of 2 percent in U.S. dollars and flat in local

currency.

Net Revenues by Geographic Region

Net revenues by geographic region were as follows:

- Americas: $3.36 billion, compared

with $3.28 billion for the second quarter of fiscal 2013, an

increase of 2 percent in U.S. dollars and 4 percent in

local currency.

- Europe, Middle East and Africa (EMEA):

$2.86 billion, compared with $2.80 billion for the second

quarter of fiscal 2013, an increase of 2 percent in U.S.

dollars and flat in local currency.

- Asia Pacific: $908 million,

compared with $978 million for the second quarter of fiscal 2013, a

decrease of 7 percent in U.S. dollars and an increase of

4 percent in local currency.

Returning Cash to

Shareholders

Accenture continues to return cash to shareholders through cash

dividends and share repurchases.

Dividend

Accenture plc has declared a semi-annual cash dividend of $0.93

per share on Accenture plc Class A ordinary shares for shareholders

of record at the close of business on April 11, 2014, and Accenture

SCA will declare a semi-annual cash dividend of $0.93 per share on

Accenture SCA Class I common shares for shareholders of record at

the close of business on April 8, 2014. These dividends are

both payable on May 15, 2014.

Combined with the semi-annual cash dividend of $0.93 per share

paid on Nov. 15, 2013, this will bring the total dividend payments

for the fiscal year to $1.86 per share, for total projected cash

dividend payments of approximately $1.3 billion.

Share Repurchase Activity

During the second quarter of fiscal 2014, Accenture repurchased

or redeemed 9.2 million shares, including approximately 6.5

million shares repurchased in the open market, for a total of

$739 million. This brings Accenture’s total share repurchases

and redemptions for the first half of fiscal 2014 to 18.9 million

shares, including 14.5 million shares repurchased in the open

market, for a total of $1.46 billion.

Accenture’s total remaining share repurchase authority at Feb.

28, 2014 was approximately $5.8 billion.

At Feb. 28, 2014, Accenture had approximately 673 million

total shares outstanding, including 633 million Accenture plc

Class A ordinary shares and 40 million Accenture SCA Class I

common shares and Accenture Canada Holdings Inc. exchangeable

shares.

Business Outlook

Third Quarter Fiscal 2014

Accenture expects net revenues for the third quarter of fiscal

2014 to be in the range of $7.40 billion to

$7.65 billion. This range assumes a foreign-exchange impact of

zero percent compared with the third quarter of fiscal

2013.

Full Fiscal Year 2014

For fiscal 2014, the company now expects net revenue growth to

be in the range of 3 percent to 6 percent in local

currency, compared with 2 percent to 6 percent previously.

Accenture’s business outlook for the full 2014 fiscal year

continues to assume a foreign-exchange impact of

negative 0.5 percent compared with fiscal 2013.

The company now expects diluted EPS to be in the range of $4.50

to $4.62, compared with $4.44 to $4.56 previously.

Accenture continues to expect operating margin for the full

fiscal year to be in the range of 14.3 percent to 14.5

percent. This compares with 15.2 percent in fiscal 2013 on a GAAP

basis, which included a positive impact of 100 basis points from

reductions in reorganization liabilities. Accenture continues to

expect its operating margin for fiscal 2014 to expand 10 to

30 basis points from the adjusted Non-GAAP operating margin of

14.2 percent for fiscal 2013.

For fiscal 2014, the company now expects operating cash flow to

be in the range of $3.3 billion to $3.6 billion, compared

with $3.6 billion to $3.9 billion previously; continues

to expect property and equipment additions to be $400 million;

and now expects free cash flow to be in the range of $2.9 billion

to $3.2 billion, compared with $3.2 billion to

$3.5 billion previously.

The company continues to expect to return at least

$3.7 billion to its shareholders in fiscal 2014 through

dividends and share repurchases.

The company now expects its annual effective tax rate to be in

the range of 25.5 percent to 26.5 percent, compared with

26.5 percent to 27.5 percent previously.

Accenture now expects new bookings for fiscal 2014 in the range

of $33 billion to $36 billion, compared with $32 billion

to $35 billion previously.

Conference Call and Webcast

Details

Accenture will host a conference call at 8:00 a.m. EDT today to

discuss its second-quarter fiscal 2014 financial results. To

participate, please dial +1 (800) 230-1074 [+1 (612) 234-9959

outside the United States, Puerto Rico and Canada] approximately 15

minutes before the scheduled start of the call. The conference call

will also be accessible live on the Investor Relations section of

the Accenture Web site at www.accenture.com.

A replay of the conference call will be available online at

www.accenture.com beginning at 10:00 a.m. EDT today, Thursday,

Mar. 27, and continuing until Thursday, June 26, 2014. A podcast of

the conference call will be available online at www.accenture.com

beginning approximately 24 hours after the call and continuing

until Thursday, June 26, 2014. The replay will also be available

via telephone by dialing +1 (800) 475-6701 [+1 (320) 365-3844

outside the United States, Puerto Rico and Canada] and entering

access code 320421 from 10:00 a.m. EDT Thursday, Mar. 27

through Thursday, June 26, 2014.

About Accenture

Accenture is a global management consulting, technology services

and outsourcing company, with approximately 289,000 people serving

clients in more than 120 countries. Combining unparalleled

experience, comprehensive capabilities across all industries and

business functions, and extensive research on the world’s most

successful companies, Accenture collaborates with clients to help

them become high-performance businesses and governments. The

company generated net revenues of US$28.6 billion for the fiscal

year ended Aug. 31, 2013. Its home page is www.accenture.com.

Non-GAAP Financial

Information

This news release includes certain non-GAAP financial

information as defined by Securities and Exchange Commission

Regulation G. Pursuant to the requirements of this regulation,

reconciliations of this non-GAAP financial information to

Accenture’s financial statements as prepared under generally

accepted accounting principles (GAAP) are included in this press

release. Financial results “in local currency” are calculated by

restating current-period activity into U.S. dollars using the

comparable prior-year period’s foreign-currency exchange rates.

Accenture’s management believes providing investors with this

information gives additional insights into Accenture’s results of

operations. While Accenture’s management believes that the non-GAAP

financial measures herein are useful in evaluating Accenture’s

operations, this information should be considered as supplemental

in nature and not as a substitute for the related financial

information prepared in accordance with GAAP.

Forward-Looking

Statements

Except for the historical information and discussions contained

herein, statements in this news release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Words such as “may,”

“will,” “should,” “likely,” “anticipates,” “expects,” “intends,”

“plans,” “projects,” “believes,” “estimates,” “positioned,”

“outlook” and similar expressions are used to identify these

forward-looking statements. These statements involve a number of

risks, uncertainties and other factors that could cause actual

results to differ materially from those expressed or implied. These

include, without limitation, risks that: the company’s results of

operations could be adversely affected by volatile, negative or

uncertain economic conditions and the effects of these conditions

on the company’s clients’ businesses and levels of business

activity; the company’s business depends on generating and

maintaining ongoing, profitable client demand for the company’s

services and solutions, and a significant reduction in such demand

could materially affect the company’s results of operations; if the

company is unable to keep its supply of skills and resources in

balance with client demand around the world and attract and retain

professionals with strong leadership skills, the company’s

business, the utilization rate of the company’s professionals and

the company’s results of operations may be materially adversely

affected; the markets in which the company competes are highly

competitive, and the company might not be able to compete

effectively; the company’s profitability could suffer if its

cost-management strategies are unsuccessful, and the company may

not be able to improve its profitability through improvements to

cost-management to the degree it has done in the past; the

company’s results of operations could materially suffer if the

company is not able to obtain sufficient pricing to enable it to

meet its profitability expectations; if the company’s pricing

estimates do not accurately anticipate the cost, risk and

complexity of the company performing its work or third parties upon

whom it relies do not meet their commitments, then the company’s

contracts could have delivery inefficiencies and be unprofitable;

the company could have liability or the company’s reputation could

be damaged if the company fails to protect client and/or company

data or information systems as obligated by law or contract or if

the company’s information systems are breached; the company’s

results of operations and ability to grow could be materially

negatively affected if the company cannot adapt and expand its

services and solutions in response to ongoing changes in technology

and offerings by new entrants; as a result of the company’s

geographically diverse operations and its growth strategy to

continue geographic expansion, the company is more susceptible to

certain risks; the company’s Global Delivery Network is

increasingly concentrated in India and the Philippines, which may

expose it to operational risks; the company might not be successful

at identifying, acquiring or integrating businesses or entering

into joint ventures; the company’s work with government clients

exposes the company to additional risks inherent in the government

contracting environment; the company’s business could be materially

adversely affected if the company incurs legal liability; the

company’s results of operations could be materially adversely

affected by fluctuations in foreign currency exchange rates; the

company’s alliance relationships may not be successful or may

change, which could adversely affect the company’s results of

operations; outsourcing services and the continued expansion of the

company’s other services and solutions into new areas subject the

company to different operational risks than its consulting and

systems integration services; the company’s services or solutions

could infringe upon the intellectual property rights of others or

the company might lose its ability to utilize the intellectual

property of others; if the company is unable to protect its

intellectual property rights from unauthorized use or infringement

by third parties, its business could be adversely affected; the

company’s ability to attract and retain business and employees may

depend on its reputation in the marketplace; many of the company’s

contracts include payments that link some of its fees to the

attainment of performance or business targets and/or require the

company to meet specific service levels, which could increase the

variability of the company’s revenues and impact its margins;

changes in the company’s level of taxes, and audits, investigations

and tax proceedings, or changes in the company’s treatment as an

Irish company, could have a material adverse effect on the

company’s results of operations and financial condition; if the

company is unable to manage the organizational challenges

associated with its size, the company might be unable to achieve

its business objectives; if the company is unable to collect its

receivables or unbilled services, the company’s results of

operations, financial condition and cash flows could be adversely

affected; the company’s share price and results of operations could

fluctuate and be difficult to predict; the company’s results of

operations and share price could be adversely affected if it is

unable to maintain effective internal controls; any changes to the

estimates and assumptions that the company makes in connection with

the preparation of its consolidated financial statements could

adversely affect its financial results; the company may be subject

to criticism and negative publicity related to its incorporation in

Ireland; as well as the risks, uncertainties and other factors

discussed under the “Risk Factors” heading in Accenture plc’s most

recent annual report on Form 10-K and other documents filed with or

furnished to the Securities and Exchange Commission. Statements in

this news release speak only as of the date they were made, and

Accenture undertakes no duty to update any forward-looking

statements made in this news release or to conform such statements

to actual results or changes in Accenture’s expectations.

ACCENTURE PLC

CONSOLIDATED INCOME

STATEMENTS (In thousands of U.S. dollars, except share and

per share amounts) (Unaudited) Three Months

Ended February 28, Six Months Ended February 28,

2014 % of Net Revenues 2013

% of Net Revenues 2014 % of

Net Revenues 2013 % of Net Revenues

REVENUES: Revenues before reimbursements (“Net revenues”) $

7,130,667 100 % $ 7,058,042 100 % $ 14,489,416 100 % $ 14,278,003

100 % Reimbursements 436,816 435,278

877,763 883,353 Revenues 7,567,483

7,493,320 15,367,179 15,161,356

OPERATING EXPENSES:

Cost of services: Cost of services before reimbursable expenses

4,900,525 68.7 % 4,827,679 68.4 % 9,809,927 67.7 % 9,681,447 67.8 %

Reimbursable expenses 436,816 435,278

877,763 883,353 Cost of services

5,337,341 5,262,957 10,687,690 10,564,800 Sales and marketing

837,255 11.7 % 834,047 11.8 % 1,765,465 12.2 % 1,702,249 11.9 %

General and administrative costs 441,605 6.2 % 455,551 6.5 %

889,658 6.1 % 904,403 6.3 % Reorganization benefits, net

—

—

%

(223,767 ) (3.2 %) (18,015 ) (0.1 %) (223,302

) (1.6 %) Total operating expenses 6,616,201

6,328,788 13,324,798

12,948,150

OPERATING INCOME 951,282

13.3 % 1,164,532 16.5 % 2,042,381 14.1 % 2,213,206 15.5 %

Interest income 7,960 9,859 14,716 18,626 Interest expense (4,348 )

(3,641 ) (8,006 ) (8,190 ) Other (expense) income, net

(4,766 ) 10,599 (15,386 ) 4,163

INCOME BEFORE INCOME TAXES 950,128 13.3 % 1,181,349 16.7 %

2,033,705 14.0 % 2,227,805 15.6 % Provision for (benefit

from) income taxes 227,797 (5,749 )

499,728 274,676

NET INCOME 722,331 10.1

% 1,187,098 16.8 % 1,533,977 10.6 % 1,953,129 13.7 % Net

income attributable to noncontrolling interests in Accenture SCA

and Accenture Canada Holdings Inc.

(42,849 ) (78,363 ) (91,947 ) (137,318 ) Net income attributable to

noncontrolling interests – other (1) (8,182 ) (6,933

) (18,884 ) (15,192 )

NET INCOME

ATTRIBUTABLE TO ACCENTURE PLC $ 671,300 9.4 % $

1,101,802 15.6 % $ 1,423,146 9.8 % $ 1,800,619

12.6 %

CALCULATION OF EARNINGS PER SHARE: Net income

attributable to Accenture plc $ 671,300 $ 1,101,802 $ 1,423,146 $

1,800,619 Net income attributable to noncontrolling interests in

Accenture SCA

and Accenture Canada Holdings Inc. (2)

42,849 78,363 91,947

137,318 Net income for diluted earnings per share

calculation $ 714,149 $ 1,180,165 $ 1,515,093

$ 1,937,937

EARNINGS PER SHARE: -Basic $ 1.06 $ 1.70

$ 2.24 $ 2.79 -Diluted (3) $ 1.03 $ 1.65 $ 2.18 $ 2.71

WEIGHTED

AVERAGE SHARES: -Basic 635,929,351 649,520,337 636,314,554

644,608,780 -Diluted (3) 693,209,942 715,464,436 695,508,819

715,567,376 Cash dividends per share $

—

$

—

$ 0.93 $ 0.81

__________________ (1) Comprised primarily of noncontrolling

interest attributable to the noncontrolling shareholders of

Avanade, Inc. (2) Diluted earnings per share assumes the redemption

of all Accenture SCA Class I common shares owned by holders of

noncontrolling interests and the exchange of all Accenture Canada

Holdings Inc. exchangeable shares for Accenture plc Class A

ordinary shares on a one-for-one basis. (3) Diluted weighted

average Accenture plc Class A ordinary shares and earnings per

share amounts in fiscal 2013 have been restated to reflect

additional restricted share units issued to holders of restricted

share units in connection with the fiscal 2014 payment of cash

dividends.

ACCENTURE PLC

SUMMARY OF REVENUES

(In thousands of U.S. dollars) (Unaudited)

Three Months Ended February 28,

Percent

Increase

(Decrease)

Percent

Increase

(Decrease)

Local

2014

2013

U.S. dollars

Currency

OPERATING GROUPS Communications, Media & Technology $

1,408,616 $ 1,411,489 —% 2% Financial

Services 1,563,655 1,508,865 4

5

Health & Public Service 1,183,728 1,192,698 (1) 1 Products

1,745,515 1,680,719 4 5 Resources

1,224,897 1,251,874 (2) — Other 4,256

12,397 n/m n/m

TOTAL Net Revenues 7,130,667

7,058,042 1% 3% Reimbursements 436,816

435,278 — TOTAL REVENUES $ 7,567,483 $

7,493,320 1%

GEOGRAPHY Americas $ 3,361,579 $

3,279,776 2% 4% EMEA 2,861,214 2,800,359 2 — Asia Pacific

907,874 977,907 (7) 4

TOTAL

Net Revenues $ 7,130,667 $

7,058,042 1% 3%

TYPE OF WORK Consulting $ 3,696,916 $

3,752,965 (1)% —% Outsourcing 3,433,751

3,305,077 4 5

TOTAL Net Revenues $

7,130,667 $ 7,058,042 1% 3%

Six Months Ended February 28,

Percent

Increase

(Decrease)

Percent

Increase

(Decrease)

Local

2014 2013

U.S. dollars

Currency

OPERATING GROUPS Communications, Media & Technology $

2,819,599 $ 2,870,275 (2)%

—%

Financial Services 3,161,621 3,071,807 3 4 Health & Public

Service 2,413,802 2,367,408 2 4 Products 3,546,577 3,379,262 5

6

Resources 2,539,904 2,573,339 (1) — Other

7,913 15,912 n/m n/m

TOTAL Net Revenues

14,489,416 14,278,003 1% 3% Reimbursements

877,763 883,353 (1) TOTAL REVENUES $

15,367,179 $ 15,161,356 1%

GEOGRAPHY

Americas $ 6,795,333 $ 6,612,896 3% 4% EMEA 5,783,355 5,625,255 3 —

Asia Pacific 1,910,728

2,039,852 (6) 4

TOTAL Net Revenues $

14,489,416 $ 14,278,003 1% 3%

TYPE OF WORK

Consulting $ 7,634,583 $ 7,713,641 (1)% —% Outsourcing

6,854,833 6,564,362 4 6

TOTAL

Net Revenues $ 14,489,416 $

14,278,003 1% 3%

__________________ n/m = not

meaningful

ACCENTURE PLC For the Three

Months Ended February 28, 2014 and 2013 (In thousands of

U.S. dollars) (Unaudited) OPERATING INCOME BY

OPERATING GROUP

Operating Income as Reported (GAAP) Three

Months Ended February 28, 2014

2013 Operating

Income

Operating

Margin

Operating

Income

Operating

Margin

Communications, Media & Technology $ 181,815 13 %

$ 225,744 16 % Financial Services 209,138 13

244,158 16 Health & Public Service 145,614 12 188,218 16

Products 205,526 12 264,234 16 Resources

209,189 17 242,178 19 Total $

951,282 13.3 % $ 1,164,532 16.5 %

Three Months

Ended February 28, 2014 2013 Operating

Income and

Operating Margin as

Reported (GAAP)

Operating Income and Operating Margin

Excluding Reorganization

Benefits

(Non-GAAP)

Operating

Income

Operating

Margin

Operating

Income

(GAAP)

Reorganization

Benefits (1)

Operating

Income (2)

Operating

Margin (2)

Increase

(Decrease)

Communications, Media & Technology $ 181,815 13 % $

225,744 $ 43,304 $ 182,440 13 % $ (625

) Financial Services 209,138 13 244,158 48,170 195,988 13 13,150

Health & Public Service 145,614 12 188,218 39,446 148,772 12

(3,158 ) Products 205,526 12 264,234 52,924 211,310 13 (5,784 )

Resources 209,189 17 242,178

40,411 201,767 16 7,422

Total $ 951,282 13.3 % $ 1,164,532 $ 224,255 $

940,277 13.3 % $ 11,005

RECONCILIATION OF NET INCOME AND

DILUTED EARNINGS PER SHARE, AS REPORTED (GAAP), TO NET INCOME AND

DILUTED

EARNINGS PER SHARE, AS ADJUSTED

(NON-GAAP)

Three Months Ended February 28, 2014

2013 Net Income

Diluted

Earnings

Per Share

Net Income

Diluted

Earnings

Per Share

As reported (GAAP) $ 722,331 $ 1.03 $

1,187,098 $ 1.65 Less impact of

reorganization benefits (1)(2) — — (224,255 ) (0.31 ) Less benefit

from final determinations of U.S. federal tax liabilities

— —

(242,938 ) (0.34 ) As adjusted (Non-GAAP) $

722,331 $ 1.03 $ 719,905

$ 1.00

__________________

(1)

Represents reorganization benefits related

to final determinations of certain reorganization liabilities

established in connection with our transition to a corporate

structure during 2001.

(2)

Reorganization benefits had the effect of

increasing income before income taxes without any increase in

income tax expense.

ACCENTURE PLC For the Six Months

Ended February 28, 2014 and 2013 (In thousands of U.S.

dollars) (Unaudited)

OPERATING INCOME BY OPERATING GROUP Operating

Income as Reported (GAAP) Six Months Ended February 28,

2014 2013 Operating

Income

Operating

Margin

Operating

Income

Operating

Margin

Communications, Media & Technology $ 335,183 12 %

$ 408,792 14 % Financial Services 472,706 15 485,256

16 Health & Public Service 324,919 13 331,677 14 Products

452,913 13 499,926 15 Resources 456,660 18

487,555 19 Total $ 2,042,381

14.1 % $ 2,213,206 15.5 %

Six Months Ended

February 28, 2014 2013

Operating Income and

Operating Margin as

Reported (GAAP)

Operating Income and Operating Margin

Excluding Reorganization

Benefits

(Non-GAAP)

Operating

Income

Operating

Margin

Operating

Income

(GAAP)

Reorganization

Benefits (1)

Operating

Income (2)

Operating

Margin (2)

Increase

(Decrease)

Communications, Media & Technology $ 335,183 12 % $

408,792 $ 43,304 $ 365,488 13 % $

(30,305 ) Financial Services 472,706 15 485,256 48,170 437,086 14

35,620 Health & Public Service 324,919 13 331,677 39,446

292,231 12 32,688 Products 452,913 13 499,926 52,924 447,002 13

5,911 Resources 456,660 18 487,555

40,411 447,144 17 9,516

Total $ 2,042,381 14.1 % $ 2,213,206 $

224,255 $ 1,988,951 13.9 % $ 53,430

RECONCILIATION OF NET INCOME AND DILUTED EARNINGS PER

SHARE, AS REPORTED (GAAP), TO NET INCOME AND DILUTED

EARNINGS PER SHARE, AS ADJUSTED

(NON-GAAP)

Six Months Ended February 28, 2014

2013 Net Income

Diluted

Earnings

Per Share

Net Income

Diluted

Earnings

Per Share

As reported (GAAP) $ 1,533,977 $ 2.18 $

1,953,129 $ 2.71 Less impact of

reorganization benefits (1)(2) — — (224,255 ) (0.31 ) Less benefit

from final determinations of U.S. federal tax liabilities

— —

(242,938 ) (0.34 ) As adjusted (Non-GAAP) $

1,533,977 $ 2.18 $

1,485,936 $ 2.06

__________________

(1)

Represents reorganization benefits related

to final determinations of certain reorganization liabilities

established in connection with our transition to a corporate

structure during 2001.

(2)

Reorganization benefits had the effect of

increasing income before income taxes without any increase in

income tax expense.

ACCENTURE PLC CONSOLIDATED

BALANCE SHEETS (In thousands of U.S. dollars)

February 28, 2014 August 31, 2013 (Unaudited)

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 3,680,274 $ 5,631,885

Short-term investments 2,706 2,525 Receivables from clients, net

3,588,189 3,333,126 Unbilled services, net 1,730,495 1,513,448

Other current assets 1,632,216

1,363,194 Total current assets

10,633,880 11,844,178

NON-CURRENT

ASSETS: Unbilled services, net 30,947 18,447 Investments 43,350

43,631 Property and equipment, net 783,961 779,675 Other

non-current assets 4,865,071

4,181,118 Total non-current assets

5,723,329 5,022,871

TOTAL ASSETS $

16,357,209 $ 16,867,049

LIABILITIES

AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES:

Current portion of long-term debt and bank borrowings $ 167 $ -

Accounts payable 936,315 961,851 Deferred revenues 2,438,786

2,230,615 Accrued payroll and related benefits 2,711,689 3,460,393

Other accrued liabilities 1,201,401

1,508,131 Total current liabilities

7,288,358 8,160,990

NON-CURRENT

LIABILITIES: Long-term debt 26,322 25,600 Other non-current

liabilities 3,255,842

3,252,630 Total non-current liabilities

3,282,164 3,278,230

TOTAL ACCENTURE PLC

SHAREHOLDERS’ EQUITY 5,272,315 4,960,186

NONCONTROLLING

INTERESTS 514,372

467,643

TOTAL SHAREHOLDERS’ EQUITY

5,786,687 5,427,829

TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY $ 16,357,209 $

16,867,049

ACCENTURE PLC CONSOLIDATED CASH FLOWS

STATEMENTS (In thousands of U.S. dollars)

(Unaudited) Three Months Ended February 28,

Six Months Ended February 28, 2014 2013

2014 2013 CASH FLOWS FROM OPERATING

ACTIVITIES: Net income $ 722,331 $

1,187,098 $ 1,533,977 $ 1,953,129

Depreciation, amortization and asset impairments 149,140 157,266

294,467 297,190 Reorganization benefits, net - (223,767 ) (18,015 )

(223,302 ) Share-based compensation expense 206,780 184,434 333,686

298,604 Change in assets and liabilities/other, net

(785,871 ) (670,807 )

(1,670,502 ) (1,800,212 ) Net cash

provided by operating activities 292,380

634,224

473,613 525,409

CASH FLOWS

FROM INVESTING ACTIVITIES: Purchases of property and equipment

(76,167 ) (90,241 ) (135,126 ) (176,788 ) Purchases of businesses

and investments, net of cash acquired (472,202 ) (88,011 ) (609,589

) (297,963 ) Other investing, net 710

1,589 1,504

2,351 Net cash used in investing

activities (547,659 )

(176,663 ) (743,211 )

(472,400 )

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds

from issuance of ordinary shares 112,587 112,239 292,820 276,845

Purchases of shares (739,238 ) (608,958 ) (1,460,752 ) (829,789 )

Cash dividends paid - - (630,234 ) (560,135 ) Other financing, net

50,572 31,295

83,571

69,993 Net cash used in financing activities

(576,079 ) (465,424 )

(1,714,595 ) (1,043,086 ) Effect of

exchange rate changes on cash and cash equivalents

(15,566 ) (34,943 )

32,582 (14,363 )

NET DECREASE

IN CASH AND CASH EQUIVALENTS (846,924 ) (42,806 ) (1,951,611 )

(1,004,440 )

CASH AND CASH EQUIVALENTS, beginning of period

4,527,198

5,678,892 5,631,885

6,640,526

CASH AND CASH EQUIVALENTS,

end of period $ 3,680,274 $

5,636,086 $ 3,680,274 $

5,636,086

AccentureRoxanne Taylor,

+1-917-452-5106roxanne.taylor@accenture.com

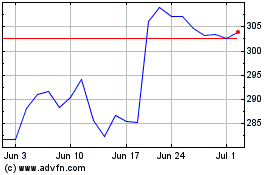

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024