Freddie Mac's New Multi-Indicator Market Index Measures Stability of Metro, State and National Housing Markets

March 26 2014 - 10:00AM

Marketwired

Freddie Mac's New Multi-Indicator Market Index Measures Stability

of Metro, State and National Housing Markets

Draws From Multiple Data Sources to Measure Housing Market

Stability and Trends; Key Findings Show Many States, Metros Still

Outside Stable Range

MCLEAN, VA--(Marketwired - Mar 26, 2014) - Freddie Mac

(OTCQB: FMCC) today released its inaugural Freddie Mac

Multi-Indicator Market Index(SM) (MiMi(SM)). MiMi is a new

publicly-accessible tool that monitors and measures the stability

of the nation's housing market, as well as the housing markets of

all 50 states, the District of Columbia, and the top 50 metro

markets.

MiMi combines proprietary Freddie Mac data with current local

market data to calculate a range of equilibrium for each

single-family housing market covered. Monthly, MiMi uses this data

to show, at a glance, where each market stands relative to its own

stable range. MiMi also indicates how each market is trending --

whether it is moving closer to, or further away from, its stable

range. A market can fall outside its stable range by being too weak

to generate enough demand for a well-balanced housing market or by

overheating to an unsustainable level of activity.

For a more detailed description of MiMi, read the Executive

Perspective on MiMi by Freddie Mac Chief Economist Frank

Nothaft.

"MiMi is the right housing index at the right time as we once

again transition to a purchase-dominated housing market," said

Nothaft. "With recent history demonstrating that housing activity

differs substantially from market to market, MiMi offers a fresh

perspective on housing at the local level just as we are entering

this new purchase market landscape. MiMi helps to pinpoint each

market's 'sweet spot' by focusing on local housing differences

while also tracking the fundamentals necessary for a stable market.

MiMi draws from multiple data sources -- including Freddie Mac

proprietary data generated through our daily business with more

than 2,000 mortgage lenders across the country -- to create current

insights into how the housing market at the national, state, and

local level is trending."

News Facts:

In today's first release of MiMi, several key findings emerged

that highlight the current state of the nation's housing market as

of January 2014:

- The national MiMi value stands at -3.08 points indicating a

weak housing market overall. From December to January the national

MiMi improved by 0.03 points and by 0.81 points from one year ago.

The nation's housing market is improving based on its 3-month trend

of +0.17 points and moving closer to its stable and in range

status. The nation's all-time MiMi low of -4.49 was in November

2010 when the housing market was at its weakest.

- Eleven of the 50 states plus the District of Columbia are

stable and in range with North Dakota, the District of Columbia,

Wyoming, Alaska, and Louisiana ranking in the top five.

- Four of the 50 metros are stable and in range, San Antonio,

Houston, Austin and New Orleans.

- The five most improving states from December to January were

Florida (+0.11), Tennessee (+0.11), Michigan (+0.09), Louisiana

(+0.07), Nevada (+0.07), and Texas (+0.07). From one year ago the

most improving states were Florida (+2.12), Nevada (+1.84),

California (+1.26), Texas (+1.06) and D.C. (+1.05).

- The five most improving metros were Miami (+0.11), Detroit

(+0.10), Orlando (+0.09), San Antonio (+0.09), and Chicago (+0.08).

From one year ago the most improving metros were Miami (+2.54),

Orlando (+2.08), Riverside (+1.87), Las Vegas (+1.81), and Tampa

(+1.77).

- Overall, in January of 2014, 25 of the 50 states plus the

District of Columbia are improving based on their 3-month trend and

35 of the 50 metros are improving.

Quote attributable to Freddie Mac Deputy Chief Economist Len

Kiefer:

"With this month's MiMi release, we're seeing a few themes from

the nation's improving housing markets. In many markets a

better employment picture, along with some income growth, makes it

possible for more people who are considering buying a home to stay

within reasonable payment-to-income ratios on their monthly

mortgages. But some high cost markets are already starting to

feel an affordability pinch. At the same time, those markets with a

strong energy-related presence are posting solid house price gains

supported by employment and wage growth. Conversely, many markets

are still in recovery mode with ground to make up. Out of the 50

metro areas that MiMi tracks, only four are in range in January,

but 35 are improving. As we enter the spring homebuying season, we

hope to see recent trends continue with more markets moving closer

to their long-term stable range."

MiMi assesses where each market is relative to its own long-term

stable range by looking at home purchase applications,

payment-to-income ratios (changes in home purchasing power based on

house prices, mortgage rates and household income), proportion of

on time mortgage payments in each market, and the local employment

picture. The four indicators are combined to create a composite

MiMi value for each market. For more detail on MiMi see the FAQs.

MiMi is released at 10 a.m. EDT monthly. The most current version

can be found at FreddieMac.com/mimi.

Freddie Mac was established by Congress in 1970 to provide

liquidity, stability and affordability to the nation's residential

mortgage markets. Freddie Mac supports communities across the

nation by providing mortgage capital to lenders. Today Freddie Mac

is making home possible for one in four home borrowers and is one

of the largest sources of financing for multifamily housing.

Additional information is available at FreddieMac.com, Twitter

@FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

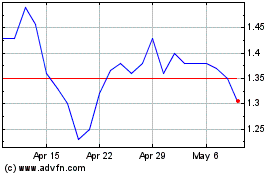

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024