Optimizing utilization and cash flows of

Luverne plant by producing both isobutanol and ethanol

- Reports EPS of ($0.35)

- Ended the fourth quarter with cash and cash equivalents of

$24.6 million

- Transitioning Luverne plant to the production of both

isobutanol and ethanol

- Produced isobutanol from mash using our yeast biocatalyst and

GIFT®

- Signed licensing LOI with Porta Hnos S.A. to become exclusive

licensee in Argentina

- Began selling bio-isooctane for high performance fuel

applications

Gevo, Inc. (Nasdaq:GEVO) today announced its financial results for

the three months ended December 31, 2013 and provided an update on

recent corporate highlights.

Gevo also announced that it is transitioning the Luverne plant

to the production of both isobutanol and ethanol. Gevo's decision

to transition to the simultaneous production of both products is a

direct result of (1) the steady progress made in executing Gevo's

flexible production technology strategy and (2) today's high

ethanol margin environment. Producing both ethanol and isobutanol

allows Gevo to fully utilize the Luverne plant and increase cash

flow as Gevo continues to commercialize its isobutanol production

capabilities.

Luverne Update

The Company has successfully demonstrated its two key

technologies (its yeast biocatalyst and its GIFT system) at

commercial scale using full corn mash to produce isobutanol,

although the process is still being optimized. The enhanced plant

configuration permits the Company to scale-up the isobutanol

production process while taking advantage of high ethanol margins.

The expected benefits of this integrated production configuration

include:

- Producing ethanol improves Luverne's operating environment for

the optimization of isobutanol production by creating a continuous,

stable mash flow and consistent recycle of water back to the

fermenters.

- Increases available cash flow to the Company, as Gevo optimizes

its isobutanol production technology.

- Broadens the potential market to license, as partners

increasingly see the benefit of co-producing isobutanol and ethanol

at a single site, the "side-by-side" model.

"This has been a very focused quarter for the Company.

Fundamentally, our technology works at scale with corn mash as a

feedstock. As we have advanced on our isobutanol learning curve, we

have demonstrated that the isobutanol technology not only works,

but can work concurrently with ethanol production, giving our plant

more earning power and flexibility. We are learning how to optimize

our procedures, processes, and equipment, effectively writing the

"owners manual" making it possible for us to confidently produce

isobutanol on a continuous basis. Our original vision was to focus

our efforts on one product; however we now are confident that we

can leverage the flexibility of our technology and more fully

utilize all the operating units in the plant to produce ethanol

simultaneously with isobutanol. Needless to say, the expected

additional cash flow is a benefit as we work to maximize the

learning per dollar as we scale up our technology. Therefore, we

plan to run three of our fermenters to produce ethanol, while the

fourth fermenter will remain dedicated to isobutanol

production. We are calling this configuration "side by side",

meaning both ethanol and isobutanol could be produced

concurrently.

"Regarding the isobutanol production process, we've made a lot

of progress on learning how to run isobutanol at scale. In

particular, we have:

- Commissioned our proprietary system to sterilize corn

mash.

- Proven that our two key technologies, our isobutanol producing

yeast and our GIFT system, work at commercial scale utilizing full

corn mash to produce isobutanol.

- Achieved up to 71% of our targeted gallons per batch

goal.

- Produced isobutanol that met quality targets.

- Demonstrated that we can manage infections during fermentation,

achieving over 100% of our goal, although not with the consistency

or reliability that we need.

- Operated all of the fermenters and GIFT systems and they

performed as expected.

- Begun the integration of the water recycle streams, and have

achieved greater that 90% water recycle in fermentation.

Learning to run a 'new-to-the-world' process at the scale of our

Luverne plant with 1 million liter fermenters requires a lot of

work. Working through the issues that arise creates the crucial

know-how needed for steady full scale production, expansion, and

licensing," said Dr. Gruber.

Other Recent Highlights

On March 6, 2014, Gevo announced that Porta Hnos S.A. ("Porta")

has signed a letter of intent to become the exclusive licensee of

GIFT in Argentina to produce renewable isobutanol. Porta is a

131 year old family owned company in Argentina that produces

liquor, vinegars and has a 120 m3/day corn ethanol plant

(approximately 12mgpy). In addition, Porta has designed and

built two 250 m3/day ethanol plants for others and they are working

on two more ethanol plants for 2014. Half of all current

ethanol plants in Argentina were designed by Porta, and they have a

joint venture with Alpha Laval to provide separation and

evaporation expertise.

In the fourth quarter of 2013, Gevo began selling bio-isooctane

for specialty fuel applications such as racing fuel. Gevo's

renewable isobutanol from Luverne, Minn. is being converted into

bio-isooctane at its biorefinery at South Hampton Resources.

Initial volumes are being used for testing purposes with the goal

of approving its use in racing competitions, amongst other

applications.

On December 23, 2013, Gevo announced that the U.S. Army has

successfully flown the Sikorsky UH-60 Black Hawk helicopter on a

50/50 blend of Gevo's ATJ-8 (Alcohol-to-Jet). Alcohol-to-Jet is a

renewable, drop in alternative fuel for JP8 that addresses the Army

Energy Security Strategy and Plans' mandate that the Army certify

100% of its air platforms on alternative/renewable fuels by 2016.

This flight marks the first ever Army Aircraft to fly on the

isobutanol ATJ blend. This testing is being performed as part of

the previously announced contract with Gevo to supply more than

16,000 gallons to the U.S. Army. Gevo's patented ATJ fuel is

designed to be the same as petroleum jet fuel, and to be fully

compliant with aviation fuel specifications and provide equal

performance, including fit-for-purpose properties.

On December 23, 2013, Gevo announced that Underwriter

Laboratories (UL) has approved the use of up to 16% isobutanol in

UL 87A pumps, providing all of the service stations across the

country with the assurance that isobutanol blended gasoline will

work in their current gasoline pumps without the need to purchase

new equipment. Every gasoline pump across the country is

required by law to meet the UL specifications. Gevo has been

working with UL for many years to approve the use of isobutanol in

UL 87A pumps. Gevo sponsored a research study with UL to

confirm the suitability of using isobutanol in UL pumps and based

on the results of that study and other resources, UL has approved

the use of up to 16% isobutanol in UL 87A pumps.

Financial Highlights

Revenues for the fourth quarter of 2013 were $1.7 million

compared to $1.9 million in the same period in 2012. Revenues in

the fourth quarter included proceeds from sales of production from

Gevo's hydrocarbons demonstration facility of $0.9 million,

including sales of biobased jet fuel to the U.S. Air Force and the

U.S. Army and initial sales of isooctane for specialty fuel

applications, revenue under Gevo's agreement with The Coca-Cola

Company, and revenue from ongoing research agreements. In 2012,

fourth quarter revenues benefited from the sale of excess corn

inventory of $1.0 million.

Research and development expense was $3.9 million in the fourth

quarter of 2013, compared to $4.4 million in the comparable period

in 2012. During the fourth quarter of 2013, Gevo's development

efforts were focused on startup operations for the production of

isobutanol at its Luverne facility, optimization of specific parts

of its isobutanol production technology to further enhance

isobutanol production rates, production of bio-jet fuel to the USAF

and production of bio-para-xylene at the Silsbee demonstration

plant. Research and development expense decreased $0.5 million in

the fourth quarter of 2013 compared with the same period in 2012,

primarily resulting from lower compensation-related expenses and

consulting and license fee expenses. These decreases partially

were offset by production costs of bio-jet fuel and

bio-para-xylene.

Selling, general and administrative expense decreased to $5.8

million in the fourth quarter of 2013 from $7.8 million for the

fourth quarter of 2012. This reflected lower compensation and

operating expenses, including cost saving benefits resulting from

actions taken during 2012 to focus Gevo's operations, as well as

lower litigation-related costs.

Interest expense for the fourth quarter of 2013 was $2.0 million

compared to $2.2 million for the same period in 2012. The decrease

primarily resulted from a decline in the outstanding principal

balance of our convertible notes as holders elected to convert

their note holdings into shares of Gevo common stock and a decline

in the outstanding principal balance of our debt with TriplePoint

Capital LLC primarily due to scheduled payments on our principal

balance.

The company reported a non-cash loss of $2.4 million during the

fourth quarter of 2013 related to changes in the fair value of

derivative warrant liability and embedded derivatives contained in

the convertible notes. We reported a $2.0 million gain during the

fourth quarter of 2012 associated with the changes in the fair

value of the embedded derivatives contained in the convertible

notes. These derivatives result from the rights that holders of the

convertible notes have upon conversion, and under certain

circumstances, will result in non-cash amounts being recorded in

the company's statement of operations in each reporting period

while the convertible notes remain outstanding. The company did not

have any holders of convertible debt opt to convert their note

holdings into shares of Gevo common stock during the three months

ended December 31, 2013.

The net loss for the fourth quarter of 2013 was $17.3 million

compared to $13.2 million during the same period in 2012.

In December 2013, we raised gross proceeds of $28.8 million

associated with the issuance of 21,303,750 common stock

units. During the fourth quarter of 2013, we used $7.8 million

of cash to repay principal on our secured debt with TriplePoint

Capital ("TriplePoint"), including $5.1 million associated with the

restructuring of the TriplePoint facility that was done in

conjunction with the December common stock unit issuance. As

part of that restructuring, TriplePoint agreed to, among other

things, waive Gevo's obligation to make principal payments on the

secured debt through December 31, 2014.

Webcast and Conference Call Information

Hosting today's conference call at 4:30 p.m. EDT (2:30 p.m. MDT)

will be Dr. Patrick Gruber, Chief Executive Officer, and Mike

Willis, Chief Financial Officer. They will review the company's

financial results for the three months ended December 31, 2013 and

provide an update on recent corporate highlights.

To participate in the conference call, please dial 1 (800)

708-4540 (inside the U.S.) or 1 (847) 619-6397 (outside the U.S.)

and reference the access code 36623383. The presentation will be

available via a live webcast

at: http://edge.media-server.com/m/p/kwstnb72/lan/en.

A replay of the call will be available two hours after the

conference call ends on March 25, 2014 until Midnight EDT on April

24, 2014. To access the replay, please dial 1-888-843-7419 (inside

the U.S.) or 1-630-652-3042 (outside the U.S) and reference the

access code 36623383#. The archived webcast will be available for

30 days in the Investor Relations section of Gevo's website at

www.gevo.com.

About Gevo

Gevo is a leading renewable chemicals and next-generation

biofuels company. Gevo's patent-protected, capital-light business

model converts existing ethanol plants into bio-refineries to make

isobutanol. This versatile chemical can be directly integrated into

existing chemical and fuel products to deliver environmental and

economic benefits. Gevo has executed initial commercial-scale

production runs at its isobutanol facility in Luverne, Minn.,

constructed in conjunction with ICM, a leading provider of

proprietary ethanol process technology, and has a marquee list of

partners including The Coca-Cola Company, Sasol Chemical

Industries, and LANXESS, Inc., an affiliate of LANXESS Corporation,

among others. Gevo is committed to a sustainable bio-based economy

that meets society's needs for plentiful food and clean air and

water. For more information, visit www.gevo.com.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include statements that are not purely statements of

historical fact, and can sometimes be identified by our use of

terms such as "intend," "expect," "plan," "estimate," "future,"

"strive" and similar words. These forward-looking statements are

made on the basis of the current beliefs, expectations and

assumptions of the management of Gevo and are subject to

significant risks and uncertainty. Investors are cautioned not to

place undue reliance on any such forward-looking statements. All

such forward-looking statements speak only as of the date they are

made, and the company undertakes no obligation to update or revise

these statements, whether as a result of new information, future

events or otherwise. Although the company believes that the

expectations reflected in these forward-looking statements are

reasonable, these statements involve many risks and uncertainties

that may cause actual results to differ materially from what may be

expressed or implied in these forward-looking statements. For a

further discussion of risks and uncertainties that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

business of Gevo in general, see the risk disclosures in the Annual

Report on Form 10-K of Gevo for the year ended December 31, 2012,

as amended, and in subsequent reports on Form 8-K and other filings

made with the SEC by Gevo.

Non-GAAP Financial Information

Consolidated financial information has been presented in

accordance with GAAP as well as on a non-GAAP basis. On a non-GAAP

basis, financial measures exclude non-cash items such as

stock-based compensation. Management believes that it is useful to

supplement its GAAP financial statements with this non-GAAP

information because management uses such information internally for

its operating, budgeting and financial planning purposes. These

non-GAAP financial measures also facilitate management's internal

comparisons to Gevo's historical performance as well as comparisons

to the operating results of other companies. In addition, Gevo

believes these non-GAAP financial measures are useful to investors

because they allow for greater transparency into the indicators

used by management as a basis for its financial and operational

decision making. Non-GAAP information is not prepared under a

comprehensive set of accounting rules and therefore, should only be

read in conjunction with financial information reported under U.S.

GAAP when understanding Gevo's operating performance. A

reconciliation between GAAP and non-GAAP financial information is

provided in the financial statement tables below.

| Gevo, Inc. |

| Condensed Consolidated

Statements of Operations Information |

| (Unaudited, in thousands,

except share and per share amounts) |

| |

|

|

|

|

| |

|

|

Three Months

Ended |

| |

Year Ended

December 31, |

December

31, |

| |

2013 |

2012 |

2013 |

2012 |

| Revenue and cost of goods

sold |

|

|

|

|

| Ethanol sales and related

products, net |

$ -- |

$ 19,908 |

$ -- |

$ -- |

| Grant revenue, research and

development program revenue and corn sales |

8,224 |

4,477 |

1,695 |

1,924 |

| Total revenues |

8,224 |

24,385 |

1,695 |

1,924 |

| |

|

|

|

|

| Cost of goods sold |

17,913 |

32,410 |

5,048 |

2,811 |

| |

|

|

|

|

| Gross loss |

(9,689) |

(8,025) |

(3,353) |

(887) |

| |

|

|

|

|

| Operating expenses |

|

|

|

|

| Research and development |

20,179 |

19,431 |

3,899 |

4,352 |

| Selling, general and

administrative |

25,647 |

43,981 |

5,750 |

7,806 |

| Total operating expenses |

45,826 |

63,412 |

9,649 |

12,158 |

| |

|

|

|

|

| Loss from operations |

(55,515) |

(71,437) |

(13,002) |

(13,045) |

| |

|

|

|

|

| Other income (expense) |

|

|

|

|

| Interest expense |

(9,301) |

(6,338) |

(1,980) |

(2,177) |

| (Loss) gain from change in fair

value of derivatives |

(81) |

17,000 |

(2,361) |

2,000 |

| Loss on conversion of debt |

(2,038) |

-- |

-- |

-- |

| Other income |

129 |

63 |

14 |

45 |

| Total other expense |

(11,291) |

10,725 |

(4,327) |

(132) |

| |

|

|

|

|

| Net loss |

$ (66,806) |

$ (60,712) |

$ (17,329) |

$ (13,177) |

| |

|

|

|

|

| Net loss per share attributable to Gevo, Inc.

common stockholders - basic and diluted |

$ (1.48) |

$ (1.86) |

$ (0.35) |

$ (0.34) |

| Weighted-average number of common shares

outstanding - basic and diluted |

45,071,618 |

32,619,091 |

49,758,100 |

39,300,054 |

| |

| Gevo, Inc. |

| Condensed Consolidated

Balance Sheet Information |

| (Unaudited, in

thousands) |

| |

|

|

| |

December

31, |

| |

2013 |

2012 |

| Assets |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 24,625 |

$ 66,744 |

| Accounts receivable |

1,358 |

698 |

| Inventories |

3,581 |

6,659 |

| Prepaid expenses and other

current assets |

1,163 |

1,779 |

| Total current assets |

30,727 |

75,880 |

| |

|

|

| Property, plant and equipment, net |

83,475 |

77,093 |

| Deposits and other assets |

2,153 |

3,138 |

| Total assets |

$ 116,355 |

$ 156,111 |

| |

|

|

| Liabilities |

|

|

| Current liabilities: |

|

|

| Accounts payable, accrued

liabilities and other current liabilities |

$ 13,030 |

$ 8,256 |

| Derivative warrant

liability |

7,243 |

-- |

| Current portion of secured

debt, net |

788 |

8,513 |

| Total current liabilities |

21,061 |

16,769 |

| Long-term portion secured debt, net |

9,339 |

15,445 |

| Convertible notes, net |

14,501 |

25,554 |

| Other long-term liabilities |

479 |

512 |

| Total liabilities |

45,380 |

58,280 |

| |

|

|

| Total stockholders'

equity |

70,975 |

97,831 |

| Total liabilities and

stockholders' equity |

$ 116,355 |

$ 156,111 |

| |

| Gevo, Inc. |

| Condensed Consolidated

Cash Flow Information |

| (Unaudited, in

thousands) |

| |

|

|

|

|

| |

|

|

Three Months

Ended |

| |

Year Ended

December 31, |

December

31, |

| |

2013 |

2012 |

2013 |

2012 |

| Operating Activities |

|

|

|

|

| Net loss |

$ (66,806) |

$ (60,712) |

$ (17,329) |

$ (13,177) |

| Adjustments to reconcile net loss to net cash

used in operating activities: |

|

|

|

|

| Non-cash expenses |

13,273 |

13,554 |

3,061 |

2,734 |

| Loss (gain) from change in fair

value of derivatives |

81 |

(17,000) |

2,361 |

(2,000) |

| Loss on conversion of debt |

2,038 |

-- |

-- |

-- |

| Changes from working

capital |

4,366 |

(3,900) |

(3,421) |

(8,303) |

| Net cash used in operating

activities |

(47,048) |

(68,058) |

(15,328) |

(20,746) |

| |

|

|

|

|

| Investing Activities |

|

|

|

|

| Acquisitions of property, plant

and equipment, net |

(7,800) |

(52,432) |

(5,172) |

(1,496) |

| Other |

125 |

(607) |

125 |

-- |

| Net cash used in investing

activities |

(7,675) |

(53,039) |

(5,047) |

(1,496) |

| |

|

|

|

|

| Financing Activities |

|

|

|

|

| Proceeds from issuance of

common stock |

28,761 |

61,875 |

28,761 |

-- |

| Payments on secured debt |

(14,529) |

(10,406) |

(7,814) |

(3,139) |

| Proceeds from issuance of

convertible debt |

-- |

42,300 |

-- |

-- |

| Proceeds from issuance of

secured debt |

-- |

5,000 |

-- |

-- |

| Other financing activities |

(1,628) |

(5,153) |

(1,608) |

128 |

| Net cash provided by (used in)

financing activities |

12,604 |

93,616 |

19,339 |

(3,011) |

| |

|

|

|

|

| Net decrease in cash and cash

equivalents |

(42,119) |

(27,481) |

(1,036) |

(25,253) |

| |

|

|

|

|

| Cash and cash equivalents |

|

|

|

|

| Beginning of period |

66,744 |

94,225 |

25,661 |

91,997 |

| End of period |

$ 24,625 |

$ 66,744 |

$ 24,625 |

$ 66,744 |

| |

| Gevo, Inc. |

| Non-GAAP Financial

Information |

| (Unaudited, in

thousands) |

| |

|

|

|

|

| |

Year

Ended |

Three Months

Ended |

| |

December

31, |

December

31, |

| |

2013 |

2012 |

2013 |

2012 |

| Gevo Development, LLC / Agri-Energy, LLC |

|

|

|

|

| Loss from operations |

$ (15,770) |

$ (12,600) |

$ (5,485) |

$ (2,056) |

| Depreciation and

amortization |

2,233 |

2,113 |

582 |

532 |

| Non-cash stock-based

compensation |

160 |

216 |

30 |

52 |

| Non-GAAP loss from operations |

$ (13,377) |

$ (10,271) |

$ (4,873) |

$ (1,472) |

| |

|

|

|

|

| Gevo, Inc. |

|

|

|

|

| Loss from operations |

$ (39,745) |

$ (58,837) |

$ (7,517) |

$ (10,989) |

| Depreciation and

amortization |

1,160 |

1,200 |

253 |

244 |

| Non-cash stock-based

compensation |

3,751 |

7,763 |

798 |

937 |

| Non-GAAP loss from operations |

$ (34,834) |

$ (49,874) |

$ (6,466) |

$ (9,808) |

| |

|

|

|

|

| Gevo Consolidated |

|

|

|

|

| Loss from operations |

$ (55,515) |

$ (71,437) |

$ (13,002) |

$ (13,045) |

| Depreciation and

amortization |

3,393 |

3,313 |

835 |

776 |

| Non-cash stock-based

compensation |

3,911 |

7,979 |

828 |

989 |

| Non-GAAP loss from operations |

$ (48,211) |

$ (60,145) |

$ (11,339) |

$ (11,280) |

CONTACT: Media Contact:

Robin Peak

Gevo, Inc.

T: (720) 267-8632

rpeak@gevo.com

Investor Contact:

Mike Willis

Gevo, Inc.

T: (720) 267-8636

mwillis@gevo.com

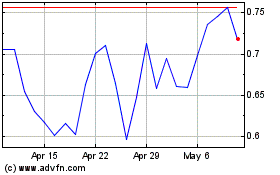

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

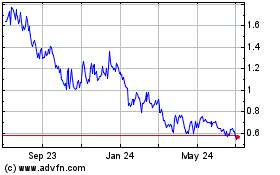

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024