Credit Suisse Settles FHFA Dispute - Analyst Blog

March 24 2014 - 11:00AM

Zacks

Reducing its litigation hassles to an extent, Zurich-based

Credit Suisse Group AG (CS) announced a settlement

with the Federal Housing Finance Agency (FHFA) – the conservator of

Government Sponsored Enterprises (GSEs) Freddie

Mac (FMCC) and Fannie Mae (FNMA). The

settlement is related to the fraudulent sale of mortgage backed

securities (MBS) to Freddie and Fannie.

Credit Suisse has to shell out a sum of $885 million for the

settlement of two lawsuits filed by the FHFA against the bank. The

settlement includes the resolution of all claims relating to

misrepresentation of loans underlying around $16.6 billion of

mortgage bonds sold by Credit Suisse to Freddie and Fannie between

2005 and 2007. Notably, the Swiss bank will pay $234 million to

Fannie and $651 million to Freddie.

As the settlement agreement has come up before Credit Suisse filing

its financial results for 2013, the company will adjust the

associated charge of 275 million Swiss francs ($312 million) with

the prior-year results. The bank will now report a net loss of 8

million francs for fourth-quarter 2013 and about 2.8 billion francs

for 2013. This compared unfavorably with previously reported profit

of 267 million francs for the fourth quarter and 3 billion francs

for the full year, respectively.

Credit Suisse is not the only major bank to be censured in the FHFA

lawsuit. The FHFA sued 18 international institutions for selling

faulty mortgages and securities to Fannie and Freddie in 2011.

After more than two years of filing lawsuits against 18 major

financial institutions, FHFA recovered approximately $10 billion

for taxpayers.

The financial institutions that have settled these charges include

JPMorgan Chase & Co. (JPM), General Electric

Company, Citigroup Inc., UBS AG, Deutsche Bank AG and Ally

Financial Inc. Of these, the biggest amount was recovered from

JPMorgan ($4.0 billion), followed by Deutsche Bank ($1.9 billion),

UBS ($885 million), Ally Financial ($475 million), Citigroup ($250

million) and General Electric ($6.3 million).

Additionally, Wells Fargo & Company, which was not part of the

above-mentioned litigation, agreed to settle similar charges for

$335.2 million in Nov 2013. Wells Fargo was able to evade the

lawsuit as its lawyers were already in negotiation with the FHFA

regarding a settlement.

Legal issues seem endless for Credit Suisse. To add to its woes, it

is likely that the Swiss bank will be sued by the U.S. Senate

committee for facilitating tax evasion by American clients.

Recently, the Senate committee alleged that Credit Suisse offered

banking services at the Zurich airport to customers’ accounts that

were hidden from the Internal Revenue Service (IRS). The bank also

resorted to carrying clients in a special elevator and fixing

appointments in locations outside its operating areas. We believe

that the U.S. Senate’s decision to crack the whip on Swiss banks

like Credit Suisse will be a step towards reducing the huge losses

incurred by the U.S. Treasury due to offshore tax evasion by

Americans.

This issue comes after the Swiss bank reached a settlement with the

SEC worth $196 million and accepted the charges related to

providing unregistered cross-border securities services to clients

in the U.S.

Such settlements by banks demonstrate their aim to resolve all

legal issues, thereby reducing costs over the upcoming period.

Moreover, such settlements are anticipated to aid in the further

revival of the economy. Alongside, these strategic decisions are

expected to bode well for banks and help gain investors’

confidence.

Though the bank is settling such litigation issues, stringent norms

and a sluggishly recovering economy will pose challenges to Credit

Suisse’s profitability going forward. At present, Credit Suisse has

a Zacks Rank #4 (Sell).

CREDIT SUISSE (CS): Free Stock Analysis Report

FREDDIE MAC (FMCC): Get Free Report

FANNIE MAE (FNMA): Get Free Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

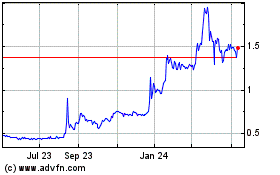

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

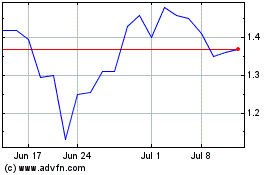

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024