NRG Energy Hits 52-Week High - Analyst Blog

March 20 2014 - 5:00PM

Zacks

On March 19, 2014, share prices of

NRG Energy, Inc. (NRG) touched a 52-week high of

$30.64, finally closing at $29.79 with a pretty good trade volume

of approximately 3.5 million, up 66.4% from the previous day.

The Driving Force

The market reacted positively after it was announced yesterday that

NRG Energy has received approval from the Federal Energy Regulatory

Commission for the entire transfer of Edison Mission Energy (EME)

assets to the company. The EME asset transfer – an Edison

International (EIX) unit – was previously announced in the

fourth quarter of 2013.

The addition of EME assets will add 8,000 megawatts (MW) to NRG’s

generation portfolio and fetch long-term synergies. Edison

Mission’s asset base includes 10 gas-fired plants in California, 4

coal-fired plants in Illinois and more than 30 wind projects in

various states.

NRG Energy has been actively engaged in acquisition and expansion

initiatives since the start of the year. The company

announced the acquisition of Dominion Resources

Inc.’s (D) retail electric segment for an undisclosed

amount. This acquisition will entitle NRG to an additional 600,000

new customer accounts and lucrative prospects in the Northeast and

Texas regions.

In addition, the company started constructing Guam’s first solar

power plant, Dangan, together with The Boeing

Company (BA) and its subsidiary NRG Solar LLC. This

renewable project is expected to substitute roughly 2 million

barrels of fuel oil and diesel consumption and generate 25 MW of

electricity.

With efforts in place for clean energy production, NRG Energy and

Virgin Limited Edition have entered into an agreement to provide

renewable power to Necker Island. Under this agreement, NRG will

produce power for the micro-grid in the island, 75% of which will

come from solar, wind and energy storage technologies.

NRG Energy, a Zacks Rank #3 (Hold) company, is focused on a

sustainable and cleaner way of power generation and emphasizes upon

the reduction of carbon base-load. With the renewable market

dynamics becoming more favorable in the U.S., NRG Energy’s pursuit

to increase its renewable portfolio will definitely prove to be a

key growth driver.

BOEING CO (BA): Free Stock Analysis Report

DOMINION RES VA (D): Free Stock Analysis Report

EDISON INTL (EIX): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

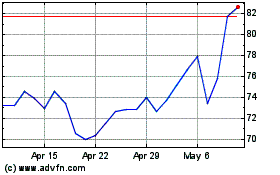

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

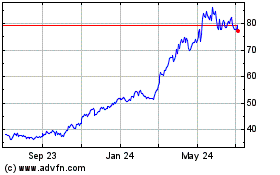

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024