Holmes Macro Trends Fund is Now MEGAX

March 20 2014 - 2:22PM

Business Wire

Fund Could Benefit from a Strong U.S.

Economy

U.S. Global Investors, Inc. (Nasdaq: GROW), a boutique

registered investment advisory firm specializing in natural

resources, emerging markets, domestic equities and municipal bonds,

changed the ticker of its Holmes Macro Trends Fund to MEGAX.

“The ticker MEGAX better reflects the big-picture approach of

the fund and its focus on long-term sector leadership trends,” says

Frank Holmes, U.S. Global Investors CEO. “Given the headwinds

facing Asia and Europe, the fund’s U.S.-based holdings could

benefit from a strong U.S. economy.”

The Holmes Macro Trends Fund seeks to own domestic growth

companies with robust fundamentals, including those growing

revenues at more than 10 percent and generating at least 20 percent

earnings growth, located in the strongest industries and sectors of

the market.

“Over the past year, shareholders have benefited from the fund’s

approach. As of the end of February, the fund outperformed the

benchmark S&P 1500 Composite index by almost 10 percent in one

year,” says Holmes.

As of February 28, the Holmes Macro Trends Fund grew 35.30

percent while the S&P 1500 Composite Index rose 25.71

percent.

To learn more about the fund and how it invests, investors can

download the fact sheet at U.S. Global’s website.

About U.S. Global Investors, Inc.

U.S. Global Investors, Inc. (www.usfunds.com) is a boutique

registered investment adviser specializing in actively managed

equity and bond strategies. The company has a longstanding history

as experts in gold and precious metals, natural resources and

emerging markets. Headquartered in San Antonio, Texas, the company

provides advisory and other services to U.S. Global Investors Funds

and other clients.

With an average of $1.11 billion in assets under management in

the quarter ended December 31, 2013, U.S. Global Investors manages

domestic and offshore funds offering a variety of investment

options, from emerging markets to fixed income.

Total Annualized Returns as of 12/31/13

One-Year Five-Year Ten-Year

Gross Expense Ratio Expense Ratio After Waivers Holmes Macro

Trends (MEGAX) 39.38% 15.69% 6.89% 1.86% NA S&P 1500 Composite

Index 32.79% 18.37% 7.77% NA NA

Expense ratios as stated in the most recent prospectus.

Performance data quoted above is historical. Past performance is no

guarantee of future results. Results reflect the reinvestment of

dividends and other earnings. For a portion of periods, the fund

had expense limitations, without which returns would have been

lower. Current performance may be higher or lower than the

performance data quoted. The principal value and investment return

of an investment will fluctuate so that your shares, when redeemed,

may be worth more or less than their original cost. Performance

does not include the effect of any direct fees described in the

fund’s prospectus (e.g., short-term trading fees of 0.05%) which,

if applicable, would lower your total returns. Performance quoted

for periods of one year or less is cumulative and not annualized.

Obtain performance data current to the most recent month-end at

www.usfunds.com or 1-800-US-FUNDS.

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a fund prospectus by visiting www.usfunds.com or by calling

1-800-US-FUNDS (1-800-873-8637). Read it carefully before

investing. Distributed by U.S. Global Brokerage, Inc.

The S&P 1500 Composite is a broad-based

capitalization-weighted index of 1500 U.S. companies and is

comprised of the S&P 400, S&P 500, and the S&P 600.

U.S. Global Investors, Inc.Susan Filyk, 210-308-1286Public

Relationssfilyk@usfunds.com

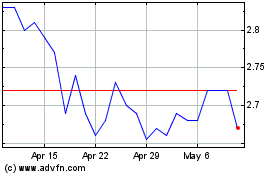

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

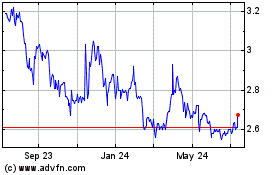

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Apr 2023 to Apr 2024