Filed Pursuant to Rule 424(b)(5)

Registration No. 333-186103

PROSPECTUS SUPPLEMENT

To Prospectus dated December 17, 2013

CEL-SCI CORPORATION

500,000 Shares of Common Stock

By means of this prospectus supplement, we are offering shares of our

common stock to the holders of the Series M warrants who elect to exercise the

warrants. The Series M warrants may be exercised at any time prior to April 20,

2014 at a price of $1.00 per share.

Our common stock is currently traded on the NYSE MKT (formerly known as

the NYSE Amex) under the symbol "CVM." On March 13, 2014, the closing price of

our common stock on the NYSE MKT was $1.27 per share. For a more detailed

description of our common stock and warrants, see the section entitled

"Description of Securities" beginning on page 13 of this Prospectus Supplement.

Investing in our common stock involves a high degree of risk. See "Risk

Factors" beginning on page 10 of this prospectus supplement and page 11 of the

accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March 14, 2014

1

TABLE OF CONTENTS

Prospectus Supplement

Page

About this Prospectus Supplement 3

Forward-Looking Statements 4

Prospectus Supplement Summary 4

The Offering 9

Risk Factors 10

Use of Proceeds 11

Dilution 12

Description of Securities 12

Legal Matters 13

Where You Can Find More Information 13

Incorporation of Documents by Reference 14

|

2

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus

supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying

prospectus, including the documents incorporated by reference, provides more

general information. Generally, when we refer to this prospectus, we are

referring to both parts of this document combined. We urge you to carefully read

this prospectus supplement and the accompanying prospectus, and the documents

incorporated herein and therein, before buying any of the securities being

offered by this prospectus supplement. This prospectus supplement may add,

update or change information contained in the accompanying prospectus. To the

extent that any statement that we make in this prospectus supplement is

inconsistent with statements made in the accompanying prospectus or any

documents incorporated by reference therein, the statements made in this

prospectus supplement will be deemed to modify or supersede those made in the

accompanying prospectus and such documents incorporated by reference therein.

You should rely only on the information contained or incorporated herein

by reference in this prospectus supplement and contained or incorporated therein

by reference in the accompanying prospectus. We have not authorized anyone to

provide you with different or additional information. We have not authorized

anyone to give any information other than that contained in the prospectus, this

prospectus supplement, and any free writing prospectus prepared by us or on our

behalf. If anyone provides you with different, additional or inconsistent

information, you should not rely on it. You should assume that the information

in this prospectus supplement and the accompanying prospectus is accurate only

as of the date on the front of the applicable document and that any information

we have incorporated by reference is accurate only as of the date of the

document incorporated by reference, regardless of the time of delivery of this

prospectus supplement or the accompanying prospectus, or any sale of a security.

Our business, financial condition, results of operations and prospects may have

changed since those dates. You should read this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference in this

prospectus supplement and the accompanying prospectus when making your

investment decision. You should also read and consider the information in the

documents we have referred you to in the section of this prospectus entitled

"Additional Information."

We are offering to sell, and are seeking offers to buy, the securities

only in jurisdictions where such offers and sales are permitted. The

distribution of this prospectus supplement and the accompanying prospectus and

the offering of the securities in certain jurisdictions or to certain persons

within such jurisdictions may be restricted by law. Persons outside the United

States who come into possession of this prospectus supplement and the

accompanying prospectus must inform themselves about and observe any

restrictions relating to the offering of the securities and the distribution of

this prospectus supplement and the accompanying prospectus outside the United

States. This prospectus supplement and the accompanying prospectus do not

constitute, and may not be used in connection with, an offer to sell, or a

solicitation of an offer to buy, any securities offered by this prospectus

supplement and the accompanying prospectus by any person in any jurisdiction in

which it is unlawful for such person to make such an offer or solicitation.

This prospectus supplement, the accompanying prospectus, and the

information incorporated herein and therein by reference may include trademarks,

3

service marks and trade names owned by us or other companies. All trademarks,

service marks and trade names included or incorporated by reference into this

prospectus supplement or the accompanying prospectus are the property of their

respective owners.

In this prospectus, unless otherwise specified or the context requires

otherwise, we use the terms "CEL-SCI," the "Company," "we," "us" and "our" to

refer to CEL-SCI Corporation. Our fiscal year ends on September 30.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the

documents incorporated by reference herein and therein contain forward-looking

statements. These statements relate to future events and involve known and

unknown risks, uncertainties and other factors which may cause our actual

results, performance or achievements to be materially different from any future

results, performances or achievements expressed or implied by the

forward-looking statements.

Factors that might affect our forward-looking statements include those

disclosed in this prospectus and the accompanying prospectus.

In some cases, you can identify forward-looking statements by terms

such as "may," "will," "should," "could," "would," "expects," "plans,"

"anticipates," "believes," "estimates," "projects," "predicts," "potential" and

similar expressions intended to identify forward-looking statements. These

statements reflect our current views with respect to future events and are based

on assumptions and subject to risks and uncertainties. Given these

uncertainties, you should not place undue reliance on these forward-looking

statements. We discuss many of these risks in greater detail under the heading

"Risk Factors" herein and in the documents incorporated by reference herein.

Also, these forward-looking statements represent our estimates and assumptions

only as of the date of the document containing the applicable statement.

Unless required by law, we undertake no obligation to update or revise

any forward-looking statements to reflect new information or future events or

developments. Thus, you should not assume that our silence over time means that

actual events are bearing out as expressed or implied in such forward-looking

statements. Before deciding to purchase our securities, you should carefully

consider the risk factors incorporated by reference and set forth herein, in

addition to the other information set forth in this prospectus supplement, the

accompanying prospectus and in the documents incorporated by reference herein

and therein.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and

information appearing elsewhere in this prospectus supplement, in the

accompanying prospectus and in the documents we incorporate by reference. This

summary is not complete and does not contain all of the information that you

should consider before investing in our securities. To fully understand this

offering and its consequences to you, you should read this entire prospectus

supplement and the accompanying prospectus carefully, including the information

referred to under the heading "Risk Factors" in the accompanying prospectus and

4

set forth herein, the financial statements and other information incorporated by

reference in this prospectus supplement and the accompanying prospectus when

making an investment decision.

About CEL-SCI Corporation

We were formed as a Colorado corporation in 1983. Our principal office

is located at 8229 Boone Boulevard, Suite 802, Vienna, VA 22182. Our telephone

number is 703-506-9460 and our web site is www.cel-sci.com.

Our business consists of the following:

1) Multikine(R) (Leukocyte Interleukin, Injection) investigational

immunotherapy against cancer and Human Papilloma Virus (HPV);

2) LEAPS technology, with two investigational therapies,

LEAPS-H1N1-DC pandemic flu treatment for hospitalized patients

and CEL-2000, a rheumatoid arthritis treatment vaccine.

MULTIKINE

Our lead investigational therapy, Multikine, is currently being

developed as a potential therapeutic agent directed at using the immune system

to produce an anti-tumor immune response. Data from Phase I and Phase II

clinical trials suggest that Multikine simulates the activities of a healthy

person's immune system, enabling it to use the body's own anti-tumor immune

response. Multikine (Leukocyte Interleukin, Injection) is the full name of this

investigational therapy, which, for simplicity, is referred to in the remainder

of this document as Multikine. Multikine is the trademark that we have

registered for this investigational therapy, and this proprietary name is

subject to FDA review in connection with our future anticipated regulatory

submission for approval. Multikine has not been licensed or approved for sale,

barter or exchange by the FDA or any other regulatory agency. Neither has its

safety or efficacy been established for any use.

Multikine has been cleared by the regulators in ten countries around

the world, including the U.S. FDA, for a global Phase III clinical trial in

advanced primary (not yet treated) head and neck cancer patients. The trial is

currently under the management of two new clinical research organizations (CROs)

who are adding 60-80 clinical centers in existing and new countries to increase

the speed of patient enrollment.

The trial will test the hypothesis that Multikine treatment

administered prior to the current standard therapy for head and neck cancer

patients (surgical resection of the tumor and involved lymph nodes followed by

radiotherapy or radiotherapy and concurrent chemotherapy) will extend the

overall survival, enhance the local/regional control of the disease and reduce

the rate of disease progression in patients with advanced oral squamous cell

carcinoma.

The primary clinical endpoint in CEL-SCI's ongoing Phase III clinical trial

is that a 10% improvement in overall survival in the Multikine treatment arm,

plus the current standard of care (SOC - consisting of surgery + radiotherapy or

surgery + radiochemotherapy), over that which can be achieved in the SOC arm

alone (in the well-controlled Phase III clinical trial currently ongoing) must

be achieved. Based on what is presently known about the current survival

statistics for this population, CEL-SCI believes that achievement of this

endpoint should enable CEL-SCI, subject to further consultations with FDA, to

move forward, prepare and submit a Biologic License Application to FDA for

Multikine.

The clinical trial is giving immunotherapy to cancer patients, i.e.,

prior to their receiving any conventional treatment for cancer, including

surgery, radiation and/or chemotherapy. This could be shown to be important

because conventional therapy may weaken the immune system, and may compromise

the potential effect of immunotherapy. Because Multikine is given before

conventional cancer therapy, when the immune system may be more intact, we

5

believe the possibility exists for it to have a greater likelihood of activating

an anti-tumor immune response under these conditions. This likelihood is one of

the clinical aspects being evaluated in the ongoing global Phase III clinical

trial.

Multikine is a different kind of investigational therapy in the fight

against cancer. Multikine is a defined mixture of cytokines. It is a combination

immunotherapy, possessing both active and passive properties.

In October 2012 and again in November 2013, in an interim review of the

safety data from the Phase III study, an Independent Data Monitoring Committee

(IDMC) raised no safety concerns. The IDMC also indicated that no safety signals

were found that would call into question the benefit/risk of continuing the

study. CEL-SCI considers the results of the IDMC review to be important since

studies have shown that up to 30% of Phase III trials fail due to safety

considerations and the IDMC's safety findings from this interim review were

similar to those reported by investigators during CEL-SCI's Phase I-II trials.

Ultimately, the decision as to whether a drug is safe is made by the FDA based

on an assessment of all of the data from a trial.

On October 7, 2013, CEL-SCI announced a Cooperative Research and

Development Agreement with the U.S. Naval Medical Center, San Diego. Pursuant to

this agreement, the Naval Medical Center will conduct Human Subjects

Institutional Review Board approved Phase I study of CEL-SCI's investigational

immunotherapy, Multikine, in HIV/HPV co-infected men and women with peri-anal

warts. Anal and genital warts are commonly associated with the Human Papilloma

Virus, the most common sexually transmitted disease. Men and women with a

history of anogenital warts have a 30 fold increased risk of anal cancer.

Persistent HPV infection in the anal region is thought to be responsible for up

to 80% of anal cancers. HPV is a significant health problem in the HIV infected

population as individuals are living longer as a result of greatly improved HIV

medications.

The purpose of this study is to evaluate the safety and clinical impact

of Multikine as a treatment of peri-anal warts and assess its effect on anal

intraepithelial dysplasia (AIN) in HIV/HPV co-infected men and women.

CEL-SCI will contribute the investigational study drug Multikine, will

retain all rights to any currently owned technology, and will have the right to

exclusively license any new technology developed from the collaboration.

Multikine is being given to the HIV/HPV co-infected patients with peri-anal

warts since promising early results were seen in another Institutional Review

Board approved Multikine Phase I study conducted at the University of Maryland.

6

In this study, investigational therapy Multikine was given to HIV/HPV

co-infected women with cervical dysplasia resulting in visual and histological

evidence of clearance of lesions. Furthermore, elimination of a number of HPV

strains was determined by in situ polymerase chain reaction (PCR) performed on

tissue biopsy collected before and after Multikine treatment. As reported by the

investigators in the earlier study, the study volunteers all appeared to

tolerate the treatment with no reported serious adverse events.

The treatment regimen for the study of up to 15 HIV/HPV co-infected

patient volunteers with peri-anal warts to be conducted by the Naval Medical

Center will be identical to the regimen that was used in the earlier Multikine

cervical study in HIV/HPV co-infected patients.

In October 2013, CEL-SCI entered into a co-development and profit

sharing agreement with Ergomed for Multikine in HIV/HPV co-infected men and

women with peri-anal warts. This agreement will initially be in support of the

development with the US Navy. Ergomed will assume up to $3 million in clinical

and regulatory costs.

Also in October 2013, CEL-SCI entered into a co-development and profit

sharing agreement with Ergomed for Multikine in HIV/HPV co-infected women with

cervical dysplasia. Human Papilloma Virus (HPV) is the most common sexually

transmitted disease. HPV is a significant health problem in the HIV infected

population as individuals are living longer as a result of greatly improved HIV

medications. People living with HIV and others with compromised immunity are

more at risk for HPV-related complications. Persistent HPV infection can also be

a precursor to cervical cancer. Ergomed will assume up to $3 million in clinical

and regulatory costs.

CEL-SCI's focus in HPV is not the development of an antiviral against

HPV in the general population. Instead it is the development of an immunotherapy

to be used in patients who are immune suppressed by diseases such as HIV and are

therefore less able or unable to control HPV and its resultant diseases. This

group of patients has no good treatments available to them and there are, to the

Company's knowledge, no competitors at the current time. HPV is also relevant to

the head and neck cancer Phase III study since it is now known that HPV is a

cause of head and neck cancer. Multikine was shown to kill HPV in an earlier

study of HIV infected women with cervical dysplasia.

LEAPS

CEL-SCI's patented T-cell Modulation Process, referred to as LEAPS

(Ligand Epitope Antigen Presentation System), uses "heteroconjugates" to direct

the body to choose a specific immune response. LEAPS is designed to stimulate

the human immune system to more effectively fight bacterial, viral and parasitic

infections as well as autoimmune, allergies, transplantation rejection and

cancer, when it cannot do so on its own. Administered like a vaccine, LEAPS

combines T-cell binding ligands with small, disease associated, peptide antigens

and may provide a new method to treat and prevent certain diseases.

The ability to generate a specific immune response is important because

many diseases are often not combated effectively due to the body's selection of

the "inappropriate" immune response. The capability to specifically reprogram an

immune response may offer a more effective approach than existing vaccines and

drugs in attacking an underlying disease.

7

Using the LEAPS technology, we have created a potential peptide treatment

for H1N1 (swine flu) hospitalized patients. This LEAPS flu treatment is designed

to focus on the conserved, non-changing epitopes of the different strains of

Type A Influenza viruses (H1N1, H5N1, H3N1, etc.), including "swine", "avian or

bird", and "Spanish Influenza", in order to minimize the chance of viral "escape

by mutations" from immune recognition. Therefore one should think of this

treatment not really as an H1N1 treatment, but as a pandemic flu treatment.

CEL-SCI's LEAPS flu treatment contains epitopes known to be associated with

immune protection against influenza in animal models.

Additional work on this treatment for the pandemic flu work is being

pursued in collaboration with the National Institute of Allergy and Infectious

Diseases (NIAID), part of the National Institutes of Health, USA. In May 2011

NIAID scientists presented data at the Keystone Conference on "Pathogenesis of

Influenza: Virus-Host Interactions" in Hong Kong, China, showing the positive

results of efficacy studies in mice of L.E.A.P.S. H1N1 activated dendritic cells

(DCs) to treat the H1N1 virus. Scientists at the NIAID found that H1N1-infected

mice treated with LEAPS-H1N1 DCs showed a survival advantage over mice treated

with control DCs. The work was performed in collaboration with scientists led by

Kanta Subbarao, M.D., Chief of the Emerging Respiratory Diseases Section in

NIAID's Division of Intramural Research, part of the National Institutes of

Health, USA.

In July 2013, CEL-SCI announced the publication of the results of

additional influenza studies by researchers from the NIAID in the Journal of

Clinical Investigation (www.jci.org/articles/view/67550). The studies described

in the publication show that when CEL-SCI's investigational J-LEAPS Influenza

Virus treatments were used "in vitro" to activate immune cells called dendritic

cells (DCs), these activated dendritic cells, when injected into influenza

infected mice, arrested the progression of lethal influenza virus infection in

these mice. The work was performed in the laboratory of Dr. Subbarao.

With our LEAPS technology, we have also developed a second peptide

named CEL-2000, a potential rheumatoid arthritis vaccine. The data from animal

studies of rheumatoid arthritis using the CEL-2000 treatment vaccine

demonstrated that CEL-2000 is an effective treatment against arthritis with

fewer administrations than those required by other anti-rheumatoid arthritis

treatments, including Enbrel(R). CEL-2000 is also potentially a more disease

type-specific therapy, is calculated to be significantly less expensive and may

be useful in patients unable to tolerate or who may not be responsive to

existing anti-arthritis therapies.

RECENT FINANCING

On December 19, 2013, we, Laidlaw & Company (UK) Ltd. and Dawson James

Securities, Inc. (the "Underwriters"), entered into an underwriting agreement

(the "Underwriting Agreement") to issue and sell 4,761,905 shares of our common

stock, as well as warrants to purchase an additional 4,761,905 shares of common

stock. Each share of common stock is being sold together with a warrant to

purchase one share for the combined purchase price of $0.63, minus underwriting

discounts and commissions. We granted the Underwriters an option to purchase up

to 476,190 additional shares of common stock and/or warrants to purchase up to

476,190 additional shares of common stock, for the combined purchase price of

$0.63 for one share and one warrant, minus underwriting discounts and

8

commissions, or the separate purchase prices per share or warrant, as

applicable, set forth in the Underwriting Agreement. The option was exercisable,

in whole or in part, for a period of 45 days after December 19, 2013.

On December 23, 2013, the Underwriters exercised their over-allotment

option to purchase shares of common stock and 476,190 warrants. The offering of

the 5,238,095 shares and the 5,238,095 warrants, which includes the 476,190

shares and warrants sold as a result of the exercise of the Underwriter's

over-allotment option, closed on December 24, 2013. The net proceeds to us from

the sale of the shares, warrants and over-allotment shares and warrants was

approximately $2,989,000, after deducting the underwriting discount.

The shares and warrants were offered and sold pursuant to our existing

shelf registration statement on Form S-3 (333-186103) that was declared

effective by the Securities and Exchange Commission on February 28, 2013, a

Prospectus dated December 17, 2013 and a Prospectus Supplement dated December

19, 2013.

THE OFFERING

Common stock offered By means of this prospectus supplement we are offering

500,000 shares of our common stock to the holders of

the Series M warrants. The Series M warrants may be

exercised at any time prior to April 20, 2014 at a

price of $1.00 per share.

Use of proceeds We estimate that our net proceeds from this offering,

assuming all 500,000 Series M warrants are exercised,

will be approximately $490,000 after deducting

estimated offering expenses.

We intend to use the net proceeds from this offering

primarily for our Phase III clinical trial, other

research and development, and general and

administrative expenses.

Risk factors You should carefully read and consider the information

beginning on page 10 of this prospectus supplement and

page 11 of the accompanying prospectus set forth under

the headings "Risk Factors" and all other information

set forth in this prospectus supplement, the

accompanying prospectus, and the documents incorporated

herein and therein by reference before deciding to

invest in our common stock.

Trading symbols:

Common Stock - NYSE MKT CVM

Series S Warrants -

NYSE MKT CVM WS

|

Unless we indicate otherwise, the number of shares to be outstanding after

this offering is based on 55,988,015 shares of our common stock

9

outstanding as of March 10, 2014, but excludes approximately 43,617,000 shares

which may be issued upon the exercise of outstanding options and warrants or the

conversion of a note.

RISK FACTORS

Investing in our common stock involves significant risks. You should

carefully consider the "Risk Factors" included and incorporated by reference in

the accompanying prospectus, this prospectus supplement and any other applicable

prospectus supplement, including the risk factors incorporated by reference from

our most recent Annual Report on Form 10-K for the fiscal year ended September

30, 2013, filed with the SEC on December 27, 2013, as updated by our Quarterly

Reports on Form 10-Q and our other filings with the SEC, filed after the Annual

Report. The risks and uncertainties we described are not the only ones facing

us. Additional risks not presently known to us, or that we currently deem

immaterial, may also impair our business operations. If any of these risks were

to occur, our business, financial condition, or result of operations would

likely suffer. In that event, the trading price of our common stock would

decline, and you could lose all or part of your investment.

Risks related to this Offering

Management will have broad discretion as to the use of the proceeds of this

offering.

We currently intend to use the net proceeds from this offering for our

Phase III clinical trial, other research and development, and general and

administrative expenses. We have not designated the amount of net proceeds we

will receive from this offering for any particular purpose. Accordingly, our

management will have broad discretion as to the application of these net

proceeds and could use them for purposes other than those contemplated at the

time of this offering. You will be relying on the judgment of our management

with regard to the use of these net proceeds, and you will not have the

opportunity, as part of your investment decision, to assess whether the net

proceeds are being used appropriately. It is possible that the net proceeds will

be invested in a way that does not yield a favorable, or any, return for us. The

failure of our management to use such funds effectively could have a material

adverse effect on our business, financial condition, operating results and cash

flow.

You will experience immediate and substantial dilution.

Since the exercise price of the Series M warrants offered pursuant to this

prospectus supplement and the accompanying prospectus is higher than the net

tangible book value per share of our common stock, you will suffer substantial

dilution in the net tangible book value of the common stock you purchase in this

offering. After giving effect to the sale of 500,000 shares of common stock upon

the exercise of our Series M Warrants, at a price of $1.00 per share, if you

purchase securities in this offering, you will suffer immediate and substantial

dilution share in the net tangible book value of the common stock you acquire.

See the "Dilution" section of this prospectus supplement for a more detailed

discussion of the dilution you will incur if you purchase securities in this

offering.

10

You may experience future dilution as a result of future equity offerings or

other equity issuances.

We expect that significant additional capital will be needed in the

future to continue our planned operations. To raise additional capital, we may

in the future offer additional shares of our common stock or other securities

convertible into or exchangeable for our common stock. We cannot assure you that

we will be able to sell shares or other securities in any other offering at a

price per share that is equal to or greater than the price per share paid by

investors in this offering. The price per share at which we sell additional

shares of our common stock or other securities convertible into or exchangeable

for our common stock in future transactions may be higher or lower than the

price per share in this offering. To the extent we raise additional capital by

issuing equity securities, our stockholders may experience substantial dilution.

If we sell common stock, convertible securities or other equity securities, your

investment in our common stock will be diluted. These sales may also result in

material dilution to our existing shareholders, and new investors could gain

rights superior to our existing shareholders.

Our outstanding options and warrants may adversely affect the trading price of

our common stock.

As of March 10, 2014, there were outstanding options which allows the

holders to purchase approximately 6,000,000 shares of our common stock, at

prices ranging between $0.68 and $20.00 per share, outstanding warrants which

allow the holders to purchase approximately 37,341,000 shares of our common

stock, at prices ranging between $0.53 and $17.50 per share, and a convertible

note which allows the holder to acquire approximately 276,000 shares of our

common stock at a conversion price of $4.00. The outstanding options and

warrants could adversely affect our ability to obtain future financing or engage

in certain mergers or other transactions, since the holders of options and

warrants can be expected to exercise them at a time when we may be able to

obtain additional capital through a new offering of securities on terms more

favorable to us than the terms of the outstanding options and warrants. For the

life of the options, warrants and the convertible note, the holders have the

opportunity to profit from a rise in the market price of our common stock

without assuming the risk of ownership. The issuance of shares upon the exercise

of outstanding options and warrants, or the conversion of the note, will also

dilute the ownership interests of our existing stockholders.

USE OF PROCEEDS

We intend to use the net proceeds from this offering primarily for our

Phase III clinical trial, other research and development, and general and

administrative expenses. We have not yet determined the amount of net proceeds

to be used specifically for any of the foregoing purposes. The net proceeds from

this offering will not be sufficient to complete clinical trials and other

studies required for the approval of any product by the FDA, and we will need

significant additional funds in the future.

Our management will have broad discretion in the application of the

net proceeds from this offering, and investors will be relying on the judgment

of our management with regard to the use of these net proceeds. Pending the use

of the net proceeds from this offering as described above, we intend to invest

the net proceeds in short-term, investment-grade, interest-bearing instruments.

11

DILUTION

If you exercise your Series M warrants, your interest will be diluted to

the extent of the difference between the exercise price of the Series M Warrants

($1.00) and the net tangible book value per share of our common stock at the

time you sell your warrants.

The net tangible book value of our common stock on December 31, 2013 was

approximately $0.27 per share, based on 55,852,991 shares of our common stock

outstanding as of December 31, 2013. Net tangible book value per share

represents the amount of our total tangible assets, less our total liabilities,

divided by the total number of shares of our common stock outstanding. Dilution

in net tangible book value per share to new investors represents the difference

between the amount per share paid by purchasers for shares in this offering and

the net tangible book value per share of our common stock immediately

afterwards.

Assuming all 500,000 Series M Warrants are exercised (of which there is no

assurance), our as-adjusted net tangible book value as of December 31, 2013

would have been approximately $15,603,000, (unaudited) or $0.28 per share. This

represents an immediate increase in the net tangible book value of $0.01 per

share to existing stockholders and the immediate dilution in the net tangible

book value of $0.72 per share to investors purchasing our shares in this

offering.

The following table illustrates this per share dilution. All amounts in the

table are unaudited.

Exercise price of Series M warrants $1.00

Net tangible book value per share as of December 31, 2013 $0.27

As-adjusted net tangible book value per share as of

December 31, 2013, after giving effect to this offering $0.28

Increase in net tangible book value per share attributable

to this offering $0.01

Dilution per share to investors in this offering $0.72

|

The above discussion and table assume all Series M warrants are exercised,

and are based on 55,852,992 shares of our common stock outstanding as of

December 31, 2013 and excludes approximately 43,497,542 shares of common stock

issuable upon the full exercise of outstanding options and warrants or the

conversion of a note.

DESCRIPTION OF SECURITIES

In this offering, we are offering 500,000 shares of common stock issuable

upon the exercise of our Series M warrants. The Series M warrants have an

exercise price of $1.00 per share and expire on April 20, 2014.

12

Common stock

The material terms and provisions of our common stock are described

under the caption "Description of Securities" in the accompanying prospectus.

Our common stock is listed on the NYSE MKT under the symbol "CVM".

Options/Warrants/Convertible Note

See the "Comparative Share Date" section of our prospectus dated

December 17, 2013 for information concerning the terms of our outstanding

options, warrants and a convertible note.

Rights Agreement

In November 2007 we declared a dividend of one Series A Right and one

Series B Right for each share of our common stock which was outstanding on

November 9, 2007. When the Rights become exercisable, each Series A Right will

entitle the registered holder, subject to the terms of a Rights Agreement, to

purchase from us one share of our common stock at a price equal to 20% of the

market price of our common stock on the exercise date, although the price may be

adjusted pursuant to the terms of the Rights Agreement. If after a person or

group of affiliated persons has acquired 15% or more of our common stock or

following the commencement of, a tender offer for 15% or more of our outstanding

common stock (i) we are acquired in a merger or other business combination and

we are not the surviving corporation, (ii) any person consolidates or merges

with us and all or part of our common shares are converted or exchanged for

securities, cash or property of any other person, or (iii) 50% or more of our

consolidated assets or earning power are sold, proper provision will be made so

that each holder of a Series B Right will thereafter have the right to receive,

upon payment of the exercise price of $100 (subject to adjustment), that number

of shares of common stock of the acquiring company which at the time of such

transaction has a market value that is twice the exercise price of the Series B

Right.

LEGAL MATTERS

The validity of the issuance of the securities offered hereby will be

passed upon for us by Hart & Hart LLC, Denver, Colorado.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of the

registration statement on Form S-3 we filed with the Securities and Exchange

Commission, or SEC, under the Securities Act, and do not contain all the

information set forth in the registration statement. Whenever a reference is

made in this prospectus supplement or the accompanying prospectus to any of our

contracts, agreements or other documents, the reference may not be complete, and

you should refer to the exhibits that are a part of the registration statement

or the exhibits to the reports or other documents incorporated by reference into

this prospectus supplement and the accompanying prospectus for a copy of such

contract, agreement or other document. You may inspect a copy of the

registration statement, including the exhibits and schedules, without charge, at

the SEC's public reference room mentioned below, or obtain a copy from the SEC

upon payment of the fees prescribed by the SEC.

13

We are subject to the requirements of the Securities Exchange Act of l934

and are required to file reports, proxy statements and other information with

the Securities and Exchange Commission. Copies of any such reports, proxy

statements and other information filed by us can be read and copied at the

Commission's Public Reference Room at 100 F. Street, N.E., Washington, D.C.

20549. The public may obtain information on the operation of the Public

Reference Room by calling the Commission at 1-800-SEC-0330. The Commission

maintains an Internet site that contains reports, proxy and information

statements, and other information regarding us. The address of that site is

http://www.sec.gov.

You can find information about the Company on our website at

http://www.cel-sci.com. Information found on our website is not part of this

prospectus.

INCORPORATION OF DOCUMENTS BY REFERENCE

We incorporate by reference the filed documents listed below, except as

superseded, supplemented or modified by this prospectus, and any future filings

we will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the

Exchange Act (unless otherwise noted, the SEC file number for each of the

documents listed below is 001-11889):

o Annual Report on Form 10-K for the fiscal year ended September 30,

2013.

o Report on Form10-Q for the three months ended December 31, 2013.

o Current Reports on Form 8-K, which were filed with the SEC on, October

10, 2013, October 11, 2013, November 1, 2013, December 19, 2013 and

December 24, 2013.

All documents filed with the Commission by us pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this

prospectus and prior to the termination of this offering shall be deemed to be

incorporated by reference into this prospectus and to be a part of this

prospectus from the date of the filing of such documents. Any statement

contained in a document incorporated or deemed to be incorporated by reference

shall be deemed to be modified or superseded for the purposes of this prospectus

to the extent that a statement contained in this prospectus or in any

subsequently filed document which also is or is deemed to be incorporated by

reference in this prospectus modifies or supersedes such statement. Such

statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

14

We will provide, without charge, to each person to whom a copy of this

prospectus is delivered, including any beneficial owner, upon the written or

oral request of such person, a copy of any or all of the documents incorporated

by reference below (other than exhibits to these documents, unless the exhibits

are specifically incorporated by reference into this prospectus). Requests

should be directed to:

CEL-SCI Corporation

8229 Boone Blvd., #802

Vienna, Virginia 22182

(703) 506-9460

15

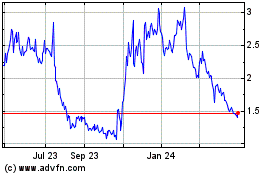

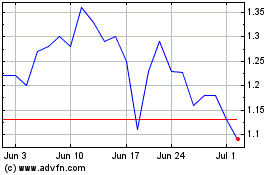

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cel Sci (AMEX:CVM)

Historical Stock Chart

From Apr 2023 to Apr 2024