Mutual Fund Summary Prospectus (497k)

March 13 2014 - 4:49PM

Edgar (US Regulatory)

J.P. Morgan U.S. Equity Funds

JPMorgan Equity Income Fund

JPMorgan Large Cap Growth Fund

JPMorgan Market Expansion Enhanced Index Fund

JPMorgan Mid Cap Growth Fund

(All Share Classes)

(each, a series of JPMorgan Trust II)

Supplement dated March 13, 2014

to the Summary Prospectuses dated November 1, 2013, as supplemented

At their February 2014

Board meeting, the Board of Trustees (“Board”) of JPMorgan Trust II (the “Trust”) approved a number of proposals concerning the Funds listed above related to changes in the Funds’ fundamental investment objectives. Each of

the proposals will require shareholder approval before it is implemented.

Shareholders of each Fund as of the record date will be asked to

approve the proposals for new fundamental investment objectives at a special meeting of shareholders to take place on or about June 10, 2014. If approved, the new investment objective for each Fund will go into effect on the date of the

shareholder meeting. If you own shares of a Fund as of the record date for the special meeting of shareholders, you will receive (i) a Proxy Statement describing in detail the proposal related to such Fund, and summarizing the Board’s

considerations in recommending that shareholders approve the proposal and (ii) a proxy card and instructions on how to submit your vote. If the proposal is not approved for a Fund, the new fundamental investment objective will not take effect

for that Fund.

Change in Investment Objective for JPMorgan Equity Income Fund

The Board approved, subject to shareholder approval, replacing the JPMorgan Equity Income Fund’s (the “Equity Income Fund”) fundamental investment objective with a new fundamental investment

objective.

If approved by the Equity Income Fund’s shareholders, pursuant to its new investment objective, the Equity Income Fund would seek

capital appreciation and current income. The new investment objective would replace the existing objective which seeks current income through regular payment of dividends with the secondary goal of achieving capital appreciation by investing

primarily in equity securities. The change in the investment objective of the Equity Income Fund was recommended by J.P. Morgan Investment Management Inc. (“JPMIM”), as investment adviser to the Fund, so that the Fund’s objective

would more closely match the portfolio managers’ investment process. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

Change in Investment Objective for JPMorgan Large Cap Growth Fund

The Board also approved, subject to shareholder approval, replacing the JPMorgan Large Cap Growth Fund’s (the “Large Cap Growth Fund”) fundamental investment objective with a new fundamental

investment objective.

If approved by the Large Cap Growth Fund’s shareholders, pursuant to its new investment objective, the Large Cap

Growth Fund would seek long-term capital appreciation. The new investment objective would replace the existing objective which seeks long-term capital appreciation and growth of income by investing primarily in equity securities. The change in the

investment objective of the Large Cap Growth Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new objective would provide portfolio management with more flexibility to seek attractive investment

opportunities that may offer greater potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

Change in Investment Objective for JPMorgan Market Expansion Enhanced Index Fund

The Board approved, subject to shareholder approval, replacing the JPMorgan Market Expansion Enhanced Index Fund’s (the “Market Expansion Enhanced Index Fund”) fundamental investment objective

with a new fundamental investment objective.

If approved by the Market Expansion Enhanced Index Fund’s shareholders, pursuant to its new

investment objective, the Market Expansion Enhanced Index Fund would seek to provide investment results that correspond to or incrementally exceed the total return performance of an index that tracks the performance of the small- and

SUP-SPRO-USEQ-314

mid-capitalization equity markets. The new investment objective would replace the existing objective which seeks to provide a return which substantially duplicates the price and yield performance

of domestically traded common stocks in the small- and mid-capitalization equity markets, as represented by a market capitalization weighted combination of the Standard & Poor’s SmallCap 600 Index (S&P SmallCap 600) and the

Standard & Poor’s MidCap 400 Index (S&P MidCap 400). The change in the investment objective of the Market Expansion Enhanced Index Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new

objective would provide the Fund with more flexibility to change its benchmark which may result in greater potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the

Fund is managed.

Change in Investment Objective for JPMorgan Mid Cap Growth Fund

The Board also approved, subject to shareholder approval, replacing the JPMorgan Mid Cap Growth Fund’s (the “Mid Cap Growth Fund”) fundamental investment objective with a new fundamental

investment objective.

If approved by the Mid Cap Growth Fund’s shareholders, pursuant to its new investment objective, the Mid Cap Growth

Fund would seek growth of capital. The new investment objective would replace the existing objective which seeks growth of capital and secondarily, current income by investing primarily in equity securities. The change in the investment objective of

the Mid Cap Growth Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new objective would provide portfolio management with more flexibility to seek attractive investment opportunities that may offer greater

potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

INVESTORS SHOULD RETAIN THIS SUPPLEMENT WITH THE

SUMMARY PROSPECTUS FOR FUTURE REFERENCE

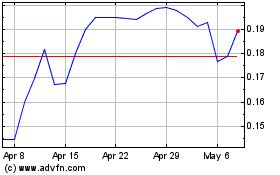

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

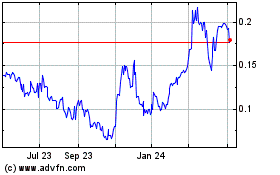

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024