J.P. Morgan U.S. Equity Funds

JPMorgan Equity Income Fund

JPMorgan Large Cap Growth Fund

JPMorgan Market Expansion Enhanced Index Fund

JPMorgan Mid Cap Growth Fund

(All Share Classes)

(each, a series of JPMorgan Trust II)

Supplement dated March 13, 2014

to the Summary Prospectuses dated November 1, 2013, as supplemented

At their February 2014

Board meeting, the Board of Trustees (“Board”) of JPMorgan Trust II (the “Trust”) approved a number of proposals concerning the Funds listed above related to changes in the Funds’ fundamental investment objectives. Each of

the proposals will require shareholder approval before it is implemented.

Shareholders of each Fund as of the record date will be asked to

approve the proposals for new fundamental investment objectives at a special meeting of shareholders to take place on or about June 10, 2014. If approved, the new investment objective for each Fund will go into effect on the date of the

shareholder meeting. If you own shares of a Fund as of the record date for the special meeting of shareholders, you will receive (i) a Proxy Statement describing in detail the proposal related to such Fund, and summarizing the Board’s

considerations in recommending that shareholders approve the proposal and (ii) a proxy card and instructions on how to submit your vote. If the proposal is not approved for a Fund, the new fundamental investment objective will not take effect

for that Fund.

Change in Investment Objective for JPMorgan Equity Income Fund

The Board approved, subject to shareholder approval, replacing the JPMorgan Equity Income Fund’s (the “Equity Income Fund”) fundamental investment objective with a new fundamental investment

objective.

If approved by the Equity Income Fund’s shareholders, pursuant to its new investment objective, the Equity Income Fund would seek

capital appreciation and current income. The new investment objective would replace the existing objective which seeks current income through regular payment of dividends with the secondary goal of achieving capital appreciation by investing

primarily in equity securities. The change in the investment objective of the Equity Income Fund was recommended by J.P. Morgan Investment Management Inc. (“JPMIM”), as investment adviser to the Fund, so that the Fund’s objective

would more closely match the portfolio managers’ investment process. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

Change in Investment Objective for JPMorgan Large Cap Growth Fund

The Board also approved, subject to shareholder approval, replacing the JPMorgan Large Cap Growth Fund’s (the “Large Cap Growth Fund”) fundamental investment objective with a new fundamental

investment objective.

If approved by the Large Cap Growth Fund’s shareholders, pursuant to its new investment objective, the Large Cap

Growth Fund would seek long-term capital appreciation. The new investment objective would replace the existing objective which seeks long-term capital appreciation and growth of income by investing primarily in equity securities. The change in the

investment objective of the Large Cap Growth Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new objective would provide portfolio management with more flexibility to seek attractive investment

opportunities that may offer greater potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

Change in Investment Objective for JPMorgan Market Expansion Enhanced Index Fund

The Board approved, subject to shareholder approval, replacing the JPMorgan Market Expansion Enhanced Index Fund’s (the “Market Expansion Enhanced Index Fund”) fundamental investment objective

with a new fundamental investment objective.

If approved by the Market Expansion Enhanced Index Fund’s shareholders, pursuant to its new

investment objective, the Market Expansion Enhanced Index Fund would seek to provide investment results that correspond to or incrementally exceed the total return performance of an index that tracks the performance of the small- and

SUP-SPRO-USEQ-314

mid-capitalization equity markets. The new investment objective would replace the existing objective which seeks to provide a return which substantially duplicates the price and yield performance

of domestically traded common stocks in the small- and mid-capitalization equity markets, as represented by a market capitalization weighted combination of the Standard & Poor’s SmallCap 600 Index (S&P SmallCap 600) and the

Standard & Poor’s MidCap 400 Index (S&P MidCap 400). The change in the investment objective of the Market Expansion Enhanced Index Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new

objective would provide the Fund with more flexibility to change its benchmark which may result in greater potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the

Fund is managed.

Change in Investment Objective for JPMorgan Mid Cap Growth Fund

The Board also approved, subject to shareholder approval, replacing the JPMorgan Mid Cap Growth Fund’s (the “Mid Cap Growth Fund”) fundamental investment objective with a new fundamental

investment objective.

If approved by the Mid Cap Growth Fund’s shareholders, pursuant to its new investment objective, the Mid Cap Growth

Fund would seek growth of capital. The new investment objective would replace the existing objective which seeks growth of capital and secondarily, current income by investing primarily in equity securities. The change in the investment objective of

the Mid Cap Growth Fund was recommended by JPMIM, as investment adviser to the Fund, because JPMIM believes the new objective would provide portfolio management with more flexibility to seek attractive investment opportunities that may offer greater

potential for improved performance. The new investment objective would not change the Fund’s investment strategies or the way that the Fund is managed.

INVESTORS SHOULD RETAIN THIS SUPPLEMENT WITH THE

SUMMARY PROSPECTUS FOR FUTURE REFERENCE

|

|

|

|

|

Summary Prospectus November 1, 2013, as supplemented March 13, 2014

|

|

|

JPMorgan Mid Cap Growth Fund

Class/Ticker: R2/JMGZX R5/JMGFX R6/JMGMX

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You

can find the Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information, online at www.jpmorganfunds.com/funddocuments. You can also get this information at no cost by calling 1-800-480-4111 or by

sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund. The Fund’s Prospectus and Statement of Additional Information, both dated November 1, 2013, as

supplemented, are incorporated by reference into this Summary Prospectus.

What is the goal of the Fund?

The Fund seeks growth of capital and secondarily, current income by investing primarily in equity securities.

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(Expenses that you pay each year as a percentage of the value

of your investment)

|

|

|

|

|

Class R2

|

|

|

Class R5

|

|

|

Class R6

|

|

|

Management Fees

|

|

|

0.65

|

%

|

|

|

0.65

|

%

|

|

|

0.65

|

%

|

|

Distribution (Rule 12b-1) Fees

|

|

|

0.50

|

|

|

|

NONE

|

|

|

|

NONE

|

|

|

Other Expenses

|

|

|

0.56

|

|

|

|

0.35

|

|

|

|

0.33

|

|

|

Shareholder Service Fees

|

|

|

0.25

|

|

|

|

0.05

|

|

|

|

NONE

|

|

|

Remainder of Other Expenses

|

|

|

0.31

|

|

|

|

0.30

|

|

|

|

0.33

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

1.71

|

|

|

|

1.00

|

|

|

|

0.98

|

|

|

Fee Waivers and Expense Reimbursements

1

|

|

|

(0.31

|

)

|

|

|

(0.21

|

)

|

|

|

(0.24

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursements

1

|

|

|

1.40

|

|

|

|

0.79

|

|

|

|

0.74

|

|

|

1

|

The Fund’s adviser, administrator and distributor (the Service Providers) have contractually agreed to waive fees and/or reimburse expenses to the extent Total Annual

Fund Operating Expenses of Class R2, Class R5 and Class R6 Shares (excluding acquired fund fees and expenses, dividend expenses relating to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary

expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 1.40%, 0.79% and 0.74%, respectively, of their average daily net assets. This contract cannot be terminated prior to 11/1/14 at which time the Service

Providers will determine whether or not to renew or revise it.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods

indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses are equal to the total annual fund operating expenses after fee waivers and expense reimbursements shown in the fee table

through 10/31/14 and total annual fund operating expenses thereafter. Your actual costs may be higher or lower.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHETHER OR NOT YOU SELL YOUR SHARES, YOUR

COST WOULD BE:

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

CLASS R2 SHARES ($)

|

|

|

143

|

|

|

|

509

|

|

|

|

899

|

|

|

|

1,994

|

|

|

CLASS R5 SHARES ($)

|

|

|

81

|

|

|

|

298

|

|

|

|

532

|

|

|

|

1,206

|

|

|

CLASS R6 SHARES ($)

|

|

|

76

|

|

|

|

288

|

|

|

|

518

|

|

|

|

1,180

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and

may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses, or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year,

the Fund’s portfolio turnover rate was 70% of the average value of its portfolio.

1

What are the Fund’s main investment strategies?

Under normal circumstances, at least 80% of the Fund’s Assets will be invested in equity securities of mid cap companies, including

common stocks and debt securities and preferred stocks that are convertible to common stocks. “Assets” means net assets, plus the amount of borrowings for investment purposes. In implementing its main strategies, the Fund invests primarily

in common stocks of mid cap companies which the Fund’s adviser believes are capable of achieving sustained growth. Mid cap companies are companies with market capitalizations similar to those within the universe of the Russell Midcap

®

Growth Index at the time of purchase. As of the last reconstitution of the Russell Midcap Growth Index on June 28,

2013, the market capitalizations of the companies in the index ranged from $526 million to $31 billion.

Derivatives, which are instruments that

have a value based on another instrument, exchange rate or index, may be used as substitutes for securities in which the Fund can invest. To the extent the Fund uses derivatives, the Fund will primarily use futures contracts to more effectively gain

targeted equity exposure from its cash positions.

Investment Process: In managing the Fund, the adviser employs a process that combines research,

valuation and stock selection to identify companies that have a history of above-average growth or which the adviser believes will achieve above-average growth in the future. Growth companies purchased for the Fund include those with leading

competitive positions, predictable and durable business models and management that can achieve sustained growth.

The adviser may sell a security

for several reasons. A security may be sold due to a change in the company’s fundamentals or if the adviser believes the security is no longer attractively valued. Investments may also be sold if the adviser identifies a stock that it believes

offers a better investment opportunity.

The Fund’s Main Investment Risks

The Fund is subject to management risk and may not achieve its objective if the adviser’s expectations regarding particular securities or markets are not met.

An investment in this Fund or any other fund may not provide a complete investment program. The suitability

of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this Prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial

goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Equity Market Risk.

The price of equity securities may rise or fall because of changes in the broad

market or changes in a company’s financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting individual companies, sectors or industries selected for the Fund’s portfolio or the

securities market as a whole, such as changes in economic or political conditions. When the value of the Fund’s securities goes down, your investment in the Fund decreases in value.

General Market Risk.

Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region

will adversely impact markets or issuers in other countries or regions.

Mid Cap Company Risk.

Investments in mid cap companies may be

riskier, more volatile and more vulnerable to economic, market and industry changes than investments in larger, more established companies. As a result, share price changes may be more sudden or erratic than the prices of other equity securities,

especially over the short term.

Growth Investing Risk.

Because investing attempts to identify companies that the adviser believes will

experience rapid earnings growth relative to value or other types of stocks, growth stocks may trade at higher multiples of current earnings compared to value or other stocks, leading to inflated prices and thus potentially greater declines in

value.

Derivative Risk.

Derivatives, including futures, may be riskier than other types of investments and may increase the volatility of

the Fund. Derivatives may be sensitive to changes in economic and market conditions and may create leverage, which could result in losses that significantly exceed the Fund’s original investment. Derivatives expose the Fund to counterparty

risk, which is the risk that the derivative counterparty will not fulfill its contractual obligations (and includes credit risk associated with the counterparty). Certain derivatives are synthetic instruments that attempt to replicate the

performance of certain reference assets. With regard to such derivatives, the Fund does not have a claim on the reference assets and is subject to enhanced counterparty risk. Derivatives may not perform as expected, so the Fund may not

realize the intended benefits. When used for hedging, the change in value of a derivative may not correlate as expected with the security or other risk being hedged. In addition, given their complexity, derivatives expose the Fund to risks of

mispricing or improper valuation.

Redemption Risk.

The Fund could experience a loss when selling securities to meet redemption requests by

shareholders. The risk of loss increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices.

2

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are

not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

You could lose money investing in the Fund.

The Fund’s Past Performance

This section provides some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund’s Class R2 Shares has varied from year to year for the past ten

calendar years. The table shows the average annual total returns over the past one year, five years and ten years. The table compares that performance to the Russell Midcap

®

Growth Index and the Lipper

Mid-Cap

Growth Funds Index, an index based on the total returns of certain mutual funds within the

Fund’s designated category as determined by Lipper. Unlike the other index, the Lipper index includes the expenses of the mutual funds included in the index. The performance of the Class R2, Class R5 and Class R6 Shares is based on the

performance of the Select Class Shares prior to their inception. The actual returns of Class R5 and Class R6 Shares would be different than those shown because Class R5 and Class R6 Shares have different expenses than Select Class Shares. Prior

class performance for Class R2 Shares has been adjusted to reflect differences in expenses between Class R2 and Select Class Shares. Past performance (before and after taxes) is not necessarily an indication of how any class of the Fund will perform

in the future.

Updated performance information is available by visiting www.jpmorganfunds.com or by calling

1-800-480-4111.

|

|

|

|

|

|

|

|

|

Best Quarter

|

|

1st quarter, 2012

|

|

|

18.06%

|

|

|

Worst Quarter

|

|

4th quarter, 2008

|

|

|

–27.10%

|

|

The Fund’s

year-to-date

total return

through 9/30/13 was 28.78%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURNS

(For periods ended December 31, 2012)

|

|

|

|

|

Past

1 Year

|

|

|

Past

5 Years

|

|

|

Past

10 Years

|

|

|

CLASS R6 SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

16.20

|

%

|

|

|

2.05

|

%

|

|

|

8.64

|

%

|

|

Return After Taxes on Distributions

|

|

|

15.43

|

|

|

|

1.53

|

|

|

|

7.64

|

|

Return After Taxes on Distributions

and Sale of Fund Shares

|

|

|

11.53

|

|

|

|

1.67

|

|

|

|

7.41

|

|

|

CLASS R5 SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

16.15

|

|

|

|

2.04

|

|

|

|

8.64

|

|

|

CLASS R2 SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

15.44

|

|

|

|

1.54

|

|

|

|

8.14

|

|

|

RUSSELL MIDCAP

®

GROWTH INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Fees, Expenses or Taxes)

|

|

|

15.81

|

|

|

|

3.23

|

|

|

|

10.32

|

|

|

LIPPER

MID-CAP

GROWTH FUNDS INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Taxes)

|

|

|

13.36

|

|

|

|

1.49

|

|

|

|

9.40

|

|

After-tax returns are shown only for the Class R6 Shares, and after tax returns for the other classes will vary. After-tax

returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. The

after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Management

J.P. Morgan Investment Management Inc.

|

|

|

|

|

|

|

Portfolio

Manager

|

|

Managed the

Fund

Since

|

|

Primary Title with

Investment Adviser

|

|

Timothy Parton

|

|

2004

|

|

Managing Director

|

Purchase and Sale of Fund Shares

There are no maximum or minimum purchase requirements with respect to Class R2 or Class R5 Shares.

Purchase Minimums

|

|

|

|

|

|

|

For Class R6 Shares

|

|

|

|

|

|

To establish an account

|

|

$

|

15,000,000 for Direct Investors

|

|

|

$5,000,000 for Discretionary Accounts

|

|

|

To add to an account

|

|

|

No minimum levels

|

|

There is no investment minimum for other Class R6 eligible investors.

3

In general, you may purchase or redeem shares on any business day

|

Ÿ

|

|

Through your Financial Intermediary or the eligible retirement plan or college savings plan through which you invest in the Fund

|

|

Ÿ

|

|

By writing to J.P. Morgan Funds Services, P.O. Box 8528, Boston, MA 02266-8528

|

|

Ÿ

|

|

After you open an account, by calling J.P. Morgan Funds Services at

1-800-480-4111

|

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income or capital gains, except when your investment is in a 401(k) plan or other

tax-advantaged

investment plan, in which case you may be subject to federal income tax upon withdrawal from the tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the

financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or financial intermediary and your salesperson to recommend the Fund over another investment.

Ask your salesperson or visit your financial intermediary’s website for more information.

SPRO-MCG-R2R5R6-1113-2

4

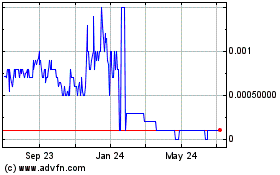

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

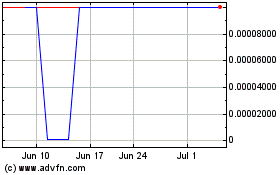

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024