DuPont Highlights Growth Drivers for Seed Biz - Analyst Blog

March 13 2014 - 3:00PM

Zacks

Chemical giant

DuPont (DD) has divulged its growth strategies for

its seed business. At the Eighteenth Annual Goldman Sachs

Agribusiness Conference, Paul E. Schickler – president of DuPont

Pioneer – highlighted opportunities in major global agricultural

markets and the roll out of the Encirca services platform for

farmers in the U.S.

Schickler, at the meet, emphasized the need for science-based,

sustainable solutions for U.S. growers as an expected rise in

population, urbanization and a fast emerging middle-class will

require increased productivity.

Schickler added that, over the next five years, around half of the

company’s growth in the Agriculture segment is expected to come

from outside of North America, mostly in major markets such as

Latin America, Eastern Europe, India and China where DuPont has a

strong foothold and looking for continued growth.

DuPont Pioneer, the seed business of DuPont, plays a major role in

the company’s focus on expanding its leadership in the

science-driven segments of the agriculture-to-food value chains. It

has been a leader in developing innovative decision services over

the past ten years. DuPont Pioneer, over the past decade, has

mapped over 20 million grower acres and helped customers implement

variable rate seeding prescriptions on more than 1.5 million acres

during the 2013 growing season.

The recent launch of the Encirca services platform, which

represents a key part of DuPont Pioneers’ growth strategy, marks an

expansion to DuPont’s whole-farm decision services offerings geared

to help farmers boost their productivity and profitability. The

company retains a differentiated approach to its whole-farm

decision services as it offers farmers tailor-made services and

personalized advice.

Encirca services will assist farmers in making planting decisions

as well as more informed management decisions regarding

nitrogen/fertility, irrigation and grain marketing throughout the

year. These services have been developed through internal

investment, strategic acquisitions and collaborations with leading

innovators in agriculture.

Encirca services have been projected to deliver peak revenues of

more than $500 million annually for DuPont Pioneer over the next

decade. The company expects to launch additional services under the

Encirca services moniker in 2015 and beyond. DuPont sees

significant potential for these services in helping corn and

soybean farmers in North America beef up productivity and further

extend to a vast spectrum of crops and markets globally.

DuPont is witnessing strong momentum in its agriculture business,

reflected by higher corn seeds and crop protection sales. Despite

unfavorable currency impact, the Agriculture segment saw

double-digit rise in sales in the fourth quarter of 2013 boosted by

healthy insecticide sales in Latin America and earlier seed

shipments, aided by the company’s acquisition of a majority stake

in Pannar Seed (Pty) Limited.

DuPont is seeing healthy demand for its corn hybrids and expects

continued strong growth in crop protection driven by new products.

The company has numerous new products in its pipeline that are

expected to create value for its customers.

DuPont launched 1,753 new products in 2013 and its key products

including Optimum AQUAmax corn products and Optimum AcreMax insect

control products are gaining significant market traction. The

company gained more than a point in the North American corn market

share last year driven by strong performance in its Pioneer seed

business.

DuPont is a Zacks Rank #3 (Hold) stock.

Other companies in the chemical industry with a favorable Zacks

Rank are The Dow Chemical Company (DOW),

LyondellBasell Industries NV (LYB) and PPG

Industries Inc. (PPG), all with a Zacks Rank #2 (Buy).

DU PONT (EI) DE (DD): Free Stock Analysis Report

DOW CHEMICAL (DOW): Free Stock Analysis Report

LYONDELLBASEL-A (LYB): Free Stock Analysis Report

PPG INDS INC (PPG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

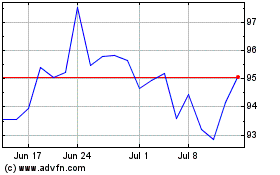

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

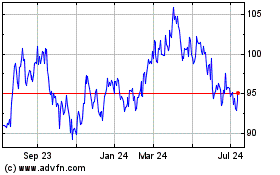

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024